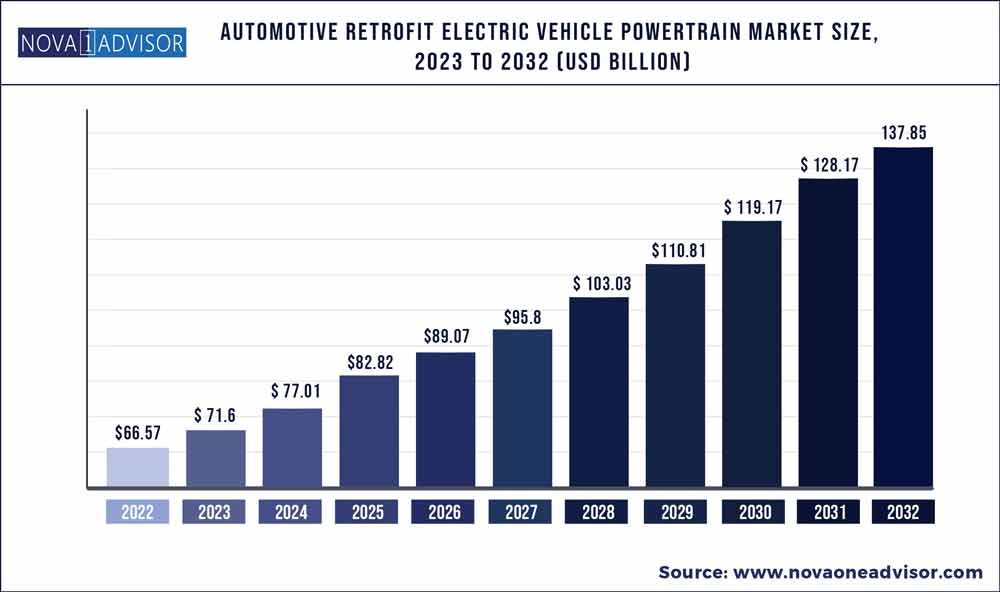

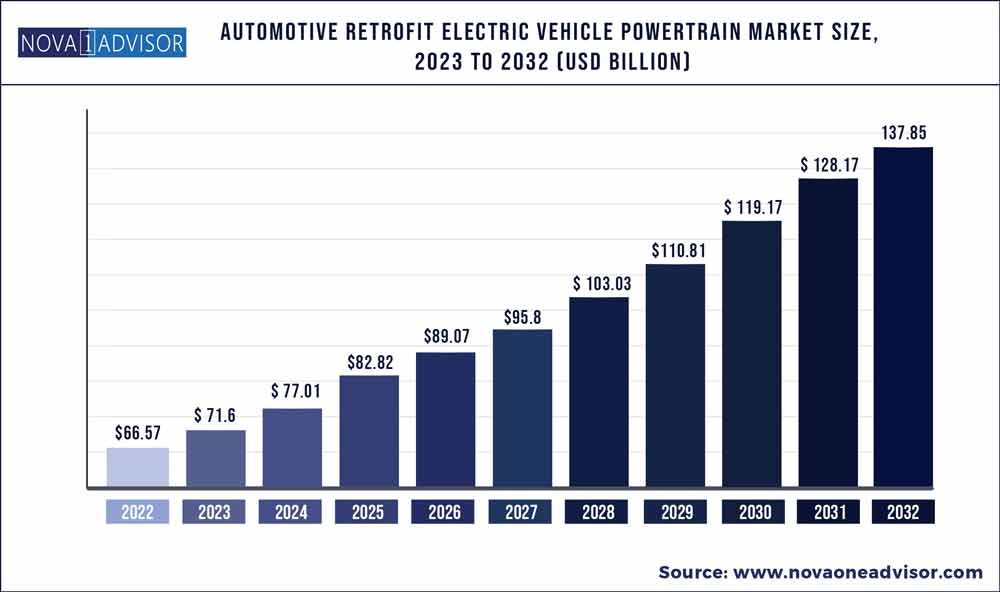

The global automotive retrofit electric vehicle powertrain market size was exhibited at USD 66.57 billion in 2022 and is projected to hit around USD 137.85 billion by 2032, growing at a CAGR of 7.55% during the forecast period 2023 to 2032.

Key Pointers:

- By vehicle type, the commercial vehicle segment has dominated the market with 49.8% market share in 2022.

- The passenger vehicle segment growing at a CAGR of 7.37% from 2023 to 2032.

- The Asia Pacific has held market share of 66.2% in 2022.

- North America and Europe are also large markets for automotive retrofit electric vehicle powertrains, and held value shares of 11.69% and 18.19%, respectively, of the global market in 2022.

Automotive Retrofit Electric Vehicle Powertrain Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 71.6 Billion

|

|

Market Size by 2032

|

USD 137.85 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 7.55%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Component Type, Vehicle Type, Electric Vehicle Type

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

ALTIGREEN, BHARAT MOBI, Continental AG, Delphi Technologies, ETrio, EV Europe, Folks Motor, Hitachi Astemo Ltd., Johnson Electric Holdings Ltd, Loop Moto, Magna International Inc., Mando Corporation, Mitsubishi Electric, Rexnamo Electro Pvt Ltd., Robert Bosch GmbH, Transition One, VerdeMobility, XL Fleet

|

Growing Need of Electrification of Vehicles in Developed and Developing Countries Fueling Demand for Inclusive Kits

The global inclusive kit market is estimated to reach a valuation of US$ 23.7 Bn by end of 2022, attributed to the high demand from automobile owners who are keen to retrofit their existing conventional vehicles to electric vehicles instead of buying new electric vehicles to save on costs. Inclusive kit is a highly versatile product, since it contains all the essential components for retrofitting such as electric battery, charger, controllers, axles, and converters in one single kit.

Inclusive kits help save time, money, and efforts of vehicle owners that is needed in individually finding each and every component required for converting a vehicle into an electric vehicle. Furthermore, they are witnessing a high demand from the developed markets such as North America and Europe for retrofitting the classic vehicles from 70s, 80s, and 90s. All these factors are propelling their demand for their application as preferred type of automotive retrofit electric vehicle powertrains in the retrofitting of conventional vehicles.

In most cases, especially in developing countries, vehicle owners are increasingly looking to adopt electric mobility; however, prohibitive initial purchasing prices of electric vehicles even after factoring in the government subsidies prevents them from buying new electric vehicles. Thus, the sales of electric vehicle retrofit powertrains in markets such as Asia Pacific are continuously rising. Inclusive kits are widely used even in retrofitting of small cars. This is also proving to be a major factor in the rising demand for inclusive kits.

Inclusive kits are also used widely in retrofitting commercial vehicles. Hence, increasing retrofitting of commercial vehicles is also contributing to the growing demand for inclusive kits.

In addition, the growing demand for electrification of vehicles in developed as well as developing countries is a key factor boosting the demand and production for inclusive kits and therefore the automotive retrofit electric vehicle powertrain market.

Government Incentives on Electric Vehicles to Boost Demand for Automotive Retrofit Electric Vehicle Powertrains

Various government incentives are provided for the adoption of electric vehicles, worldwide. Some of these include free parking in central business areas of major cities, waving of road taxes and registration fees, free road usage by charging no road tolls and preferential road pricing, and direct subsidies and cashbacks provided during purchasing of electric vehicles. Many owners want to avail these benefits by switching to electric vehicles. Retrofitting is a very cost effective way for them to switch to electric mobility and enjoy these benefits. This is also boosting the global automotive retrofit electric vehicle powertrain market.

Consistent rise in fuel prices, which have significantly increased the operating costs of IC engine vehicles is propelling the automotive retrofit electric vehicle powertrain market. Furthermore, introduction of new retrofitting services such as converting the conventional vehicles to hybrid vehicles by retaining their IC engines to reduce the impact of factors including range anxiety in the minds of automobile buyers is expected to automotive retrofit electric vehicle powertrain industry.

Inclination for Full Electric Conversions to Reduce Operating Costs to Fuel Automotive Retrofit Electric Vehicle Powertrain Market Growth

In terms of electric vehicle type, the global automotive retrofit electric vehicle powertrain market has been segmented into all electric vehicle, plug-in hybrid vehicle, and hybrid vehicle. The all electric vehicle segment of the automotive retrofit electric vehicle powertrain market held a major share of 39.63% in 2021, and will maintain the status quo with a growth rate of more than 7% during the forecast period. The preference for all electric vehicles in automotive retrofit electric vehicle powertrain is mainly due to the inclination of vehicle buyers to opt for full electric conversions to reduce their operating costs, significantly. They also are eligible for incentives on electric vehicles. This has resulted into all electric vehicle being the dominant segment by electric vehicle type in automotive retrofit electric vehicle powertrain market.

Trend of Retrofitting Commercial Vehicles with Electric Powertrains to Dominate Global Market

Automotive retrofit electric vehicle powertrain market has been classified into two wheeler, passenger vehicle, and commercial vehicle, in terms of vehicle type. The commercial vehicle category dominated the global automotive retrofit electric vehicle powertrain market in 2021 with a market share of 47%. Furthermore, this segment is expected to register an impressive CAGR of 7.06% during the forecast period. Prices of new electric commercial vehicles are very high and fuel costs make up the largest share of the operating costs of fleet owners. Thus, there is a rising trend to retrofit old fleets with electric vehicle powertrains to control their ever increasing operating costs. This leads to commercial vehicle category being the largest one by vehicle type segment. Passenger vehicle was the fastest growing segment with a CAGR of 7.31% due to the growing trend of electrification of automobiles.

Regional Outlook in Global Automotive Retrofit Electric Vehicle Powertrain Market

Asia Pacific held the largest volume share of 66.2% of the global automotive retrofit electric vehicle powertrain market in 2022. Growth was mainly attributed to key presence of developed countries that are home to advanced research and development as well as manufacturing facilities for automotive retrofit manufactures such as China, Japan, India, and South Korea. The region is home to global headquarters of major automotive retrofit electric powertrain manufacturers including Hitachi Astemo Ltd., Mitsubishi Electric Corporation, and Mando Corporation. Many new startups such as Altigreen, BharatMobi, Folks Motor, and Loop Moto are entering this market in countries including India.

China dominates the automotive retrofit electric vehicle powertrain market in Asia Pacific. India and China contributed 11.61% and 27.41% shares, respectively, to the overall Asia Pacific market. China accounts for almost one-third of the total automotive retrofit electric vehicle powertrain market in the Asia Pacific. The country is a key automotive hub across the globe.

In addition, government incentives on electric vehicles, announcements of baseline years to stop the sales of new IC engine vehicles, rising fuel prices, high taxation on automotive fuels, and growing environmental consciousness in Japan, South Korea, and China primarily propel the market in the region. The market is also driven by increasing conversion of old vehicles to electric vehicles in countries such as China, Japan, India, and South Korea, which is also estimated to boost the automotive retrofit electric vehicle powertrain market in Asia Pacific during the forecast period.

North America and Europe are also large markets for automotive retrofit electric vehicle powertrains, and held value shares of 11.69% and 18.19%, respectively, of the global market in 2022. These markets are primarily driven by retrofitting of old classic vehicles. Electric motors and chargers were the most demanded type of components for automotive retrofit electric vehicle powertrains in these regions.

The South America region is a larger market for automotive retrofit electric vehicle powertrains compared to the Middle East & Africa region; this market in South America is likely to grow at a faster rate compared to the Middle East & Africa region.

Some of the prominent players in the Automotive Retrofit Electric Vehicle Powertrain Market include:

- ALTIGREEN,

- BHARAT MOBI,

- Continental AG,

- Delphi Technologies,

- ETrio,

- EV Europe,

- Folks Motor,

- Hitachi Astemo Ltd.,

- Johnson Electric Holdings Ltd,

- Loop Moto,

- Magna International Inc.,

- Mando Corporation,

- Mitsubishi Electric,

- Rexnamo Electro Pvt Ltd.,

- Robert Bosch GmbH,

- Transition One,

- VerdeMobility,

-

- XL Fleet

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Automotive Retrofit Electric Vehicle Powertrain market.

By Component Type

- Inclusive Conversion Kit

- Electric Motor

- Battery

- Controller

- Charger

- Others (Axle, Converter, etc.)

By Vehicle Type

- Two Wheelers

- Passenger Vehicle (Hatchback, Sedan and Utility Vehicle)

- Commercial Vehicle (Light Commercial Vehicle and Heavy Commercial Vehicle)

By Electric Vehicle Type

- All Electric Vehicle Battery

- Plug-in Hybrid Vehicle

- Hybrid Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)