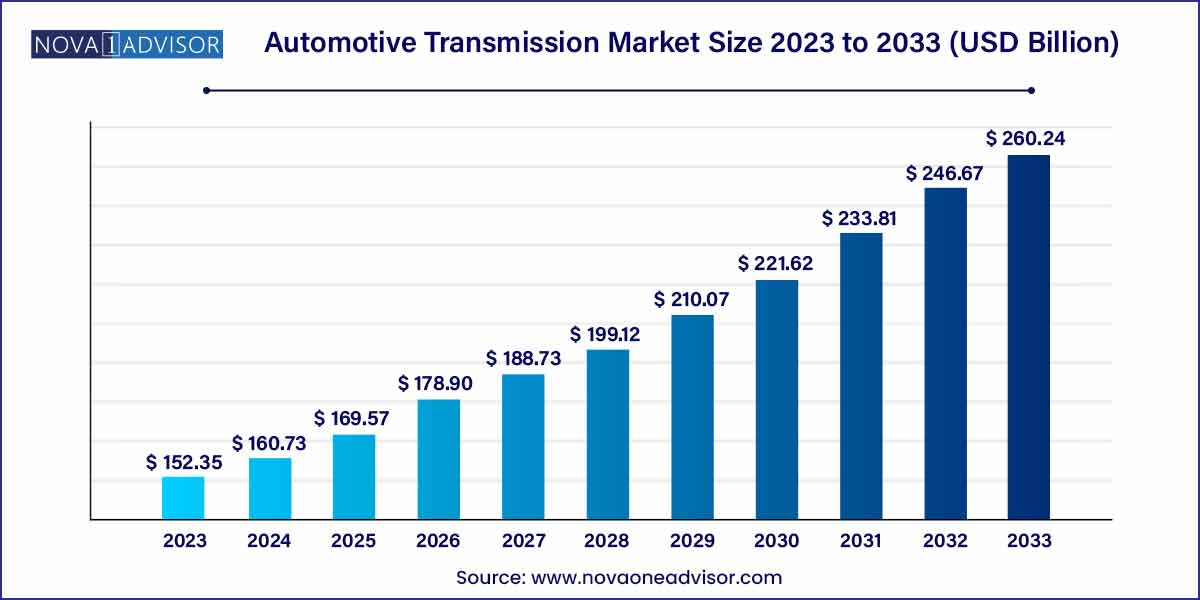

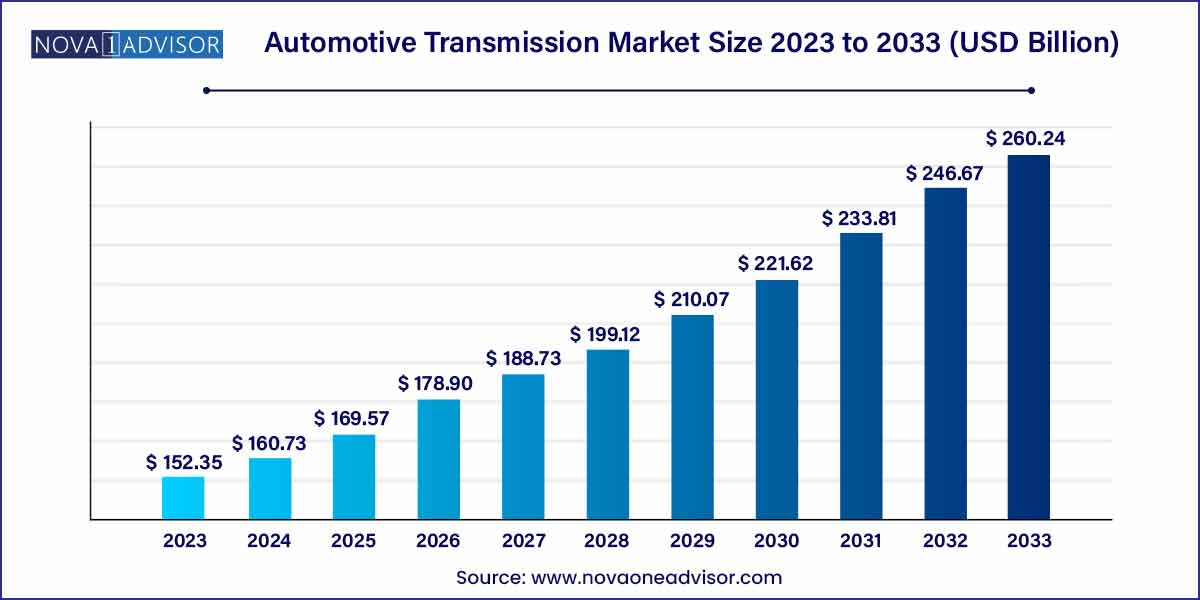

The global automotive transmission market size was exhibited at USD 152.35 billion in 2023 and is projected to hit around USD 260.24 billion by 2033, growing at a CAGR of 5.5% during the forecast period of 2024 to 2033.

Key Takeaways:

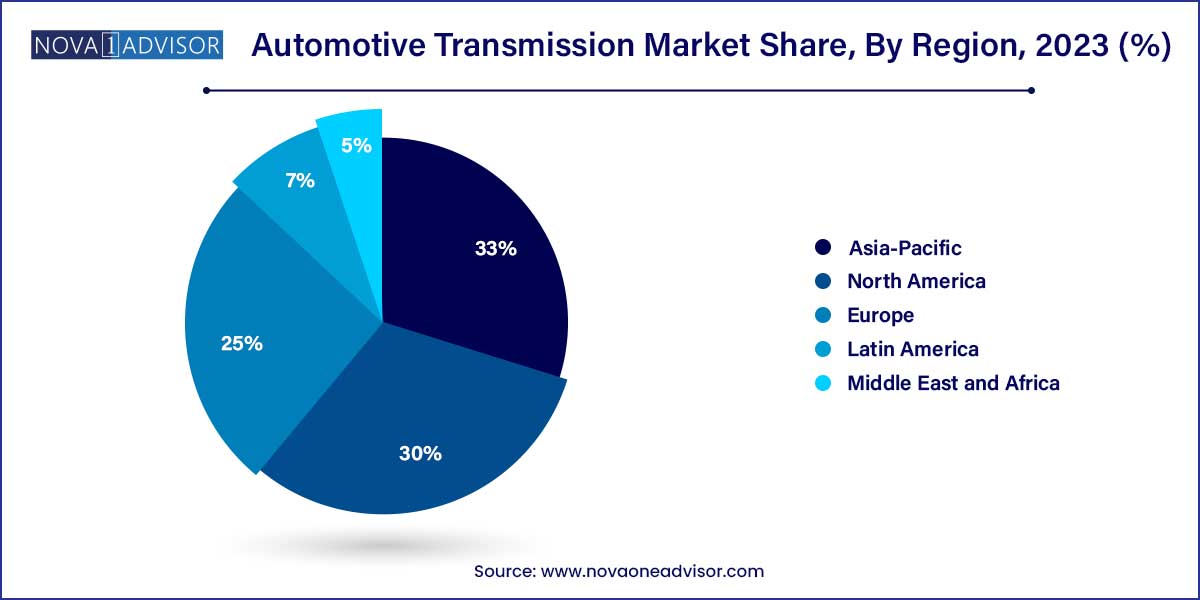

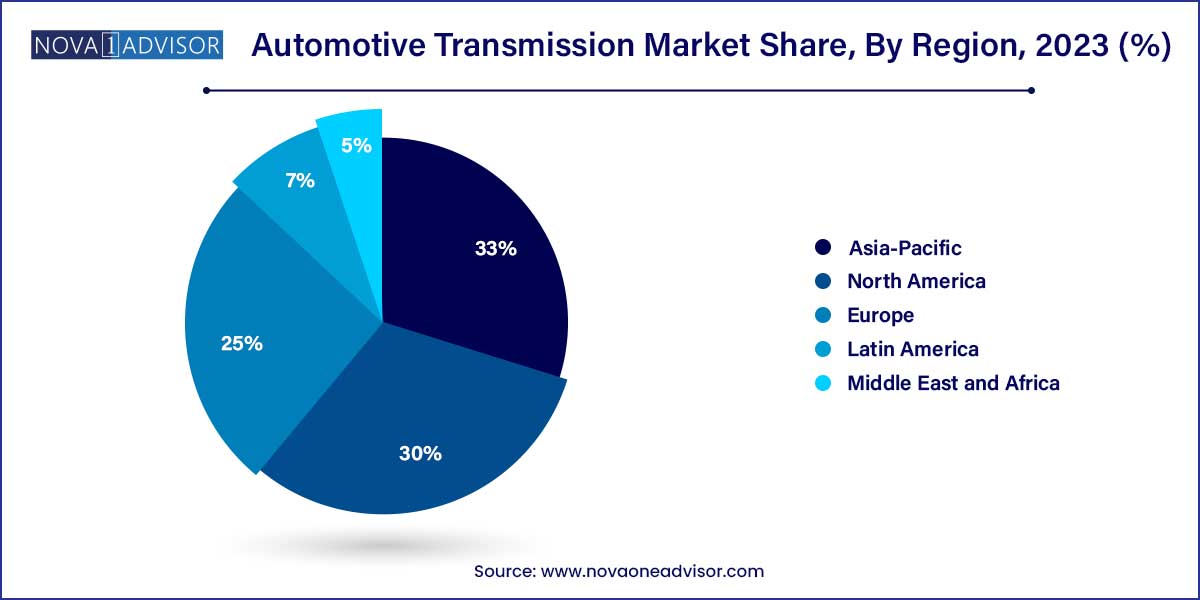

- Asia Pacific accounted for the largest revenue share of more than 33% in 2023

- The manual-type segment accounted for the largest revenue share of more than 50% in 2023.

- The gasoline segment accounted for the largest revenue share of more than 55% in 2023.

- The passenger cars segment accounted for the largest revenue share of over 70% in 2023.

Automotive Transmission Market: Overview

The automotive transmission market plays a pivotal role in the global automotive industry, serving as the critical link between an engine and the wheels. This overview aims to delve into the current landscape of the automotive transmission market, highlighting key trends, challenges, and opportunities shaping its trajectory.

Automotive Transmission Market Growth

The growth of the automotive transmission market is fueled by various factors. Firstly, the increasing demand for electric vehicles (EVs) is driving the development of efficient transmission systems tailored to electric powertrains. Technological advancements, such as dual-clutch transmissions and continuously variable transmissions (CVTs), are enhancing fuel efficiency and performance, contributing to market expansion. Additionally, the integration of connectivity and automation features in vehicles is influencing transmission design, with smart transmission systems gaining traction for their enhanced reliability and performance. Furthermore, the expansion of emerging markets, focus on lightweight materials, and collaborative partnerships among industry stakeholders present lucrative growth opportunities for automotive transmission manufacturers.

Automotive Transmission Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 152.35 Billion |

| Market Size by 2033 |

USD 260.24 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Transmission Type, Fuel Type, Vehicle Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Aisin Seiki Co., Ltd.; Allison Transmission, Inc.; BorgWarner Inc.; Continental AG; Eaton Corporation PLC; Getrag; GKN PLC; Jatco Ltd.; Magna International, Inc.; ZF Friedrichshafen AG. |

Automotive Transmission Market Dynamics

- Technological Advancements:

The automotive transmission market is characterized by continuous technological advancements aimed at improving performance, fuel efficiency, and overall driving experience. Innovations such as dual-clutch transmissions, continuously variable transmissions (CVTs), and automated manual transmissions (AMTs) have revolutionized transmission systems, offering smoother gear shifts, better fuel economy, and enhanced driving dynamics. Moreover, the integration of connectivity and automation features in vehicles is reshaping transmission design, with smart transmission systems incorporating predictive analytics and adaptive control algorithms gaining prominence.

- Regulatory Pressures and Emission Standards:

Stringent emissions regulations worldwide are compelling automakers to develop transmission solutions that optimize fuel efficiency and reduce greenhouse gas emissions. Government mandates and environmental concerns are pushing for the adoption of cleaner and more efficient transmission technologies. As a result, automotive transmission manufacturers are investing in research and development to design transmission systems that meet or exceed regulatory requirements while maintaining cost-effectiveness. Additionally, the shift towards electric vehicles (EVs) is accelerating, prompting transmission suppliers to develop specialized transmission solutions tailored to electric powertrains.

Automotive Transmission Market Restraint

- Supply Chain Disruptions:

The automotive transmission market faces challenges stemming from supply chain disruptions caused by various factors such as geopolitical tensions, natural disasters, and global pandemics like the COVID-19 crisis. These disruptions disrupt the flow of critical components and materials required for manufacturing transmission systems, leading to production delays, increased costs, and supply shortages. The complexity of global supply chains makes them susceptible to disruptions, impacting the ability of automotive transmission manufacturers to meet demand and fulfill orders in a timely manner.

- Shift in Consumer Preferences:

Changing consumer preferences and purchasing behaviors pose a significant restraint on the automotive transmission market. There has been a notable shift in consumer demand towards sport utility vehicles (SUVs), crossovers, and electric vehicles (EVs), which offer different transmission requirements compared to traditional passenger cars. This shift requires automotive transmission manufacturers to adapt their product offerings to cater to diverse vehicle segments and transmission technologies. Failure to anticipate and respond to changing consumer preferences can result in market share erosion and reduced profitability for transmission suppliers.

Automotive Transmission Market Opportunity

- Expansion in Emerging Markets:

Emerging economies present lucrative opportunities for growth in the automotive transmission market. Rapid urbanization, rising disposable incomes, and increasing vehicle ownership rates in countries such as China, India, Brazil, and Mexico are driving demand for automobiles, including passenger cars and commercial vehicles. Moreover, infrastructure development initiatives and government incentives to promote automotive manufacturing further stimulate market growth in these regions.

- Focus on Lightweight Materials:

The automotive industry's growing emphasis on fuel efficiency and emissions reduction is creating opportunities for innovation in lightweight transmission materials. Lightweight materials such as aluminum alloys, magnesium alloys, and advanced composites offer significant weight savings compared to traditional materials like cast iron and steel. By incorporating lightweight materials into transmission components such as casings, gears, and shafts, automotive transmission manufacturers can improve fuel efficiency, reduce vehicle emissions, and enhance overall performance. Furthermore, lightweight materials contribute to vehicle electrification efforts by optimizing the efficiency of electric powertrains and extending battery range.

Automotive Transmission Market Challenges

- Regulatory Compliance and Emission Standards:

One of the primary challenges confronting the automotive transmission market is the need to comply with stringent regulatory requirements and emission standards. Governments worldwide are imposing increasingly strict regulations aimed at reducing greenhouse gas emissions and improving fuel efficiency in vehicles. These regulations drive automakers and transmission manufacturers to invest heavily in research and development to develop transmission systems that meet or exceed these standards. However, achieving compliance while maintaining cost-effectiveness poses a significant challenge, particularly as regulations continue to evolve and become more stringent over time.

- Rapid Technological Advancements:

The automotive industry is undergoing rapid technological advancements, particularly in areas such as electrification, connectivity, and autonomous driving. These advancements bring both opportunities and challenges for automotive transmission manufacturers. On one hand, technological innovations such as dual-clutch transmissions, continuously variable transmissions (CVTs), and automated manual transmissions (AMTs) offer improved performance, fuel efficiency, and driving dynamics. On the other hand, keeping pace with these advancements and incorporating new technologies into transmission systems requires significant investments in research, development, and manufacturing capabilities.

Segments Insights:

Transmission Type Insights

Manual transmission dominated the automotive transmission market in 2024, primarily because of its cost-effectiveness, mechanical simplicity, and popularity in emerging economies. Manual gearboxes offer better fuel economy and greater control, which many drivers in markets like India, Brazil, and Southeast Asia still prefer. Manufacturers like Suzuki, Hyundai, and Volkswagen continue to offer manual transmission options across their model ranges to cater to these demographics.

Conversely, automatic transmission is the fastest-growing segment, fueled by changing consumer preferences and urbanization. The convenience, reduced driver fatigue, and advances in technology have made ATs more accessible and efficient. Regions such as North America, Europe, and increasingly Asia-Pacific are witnessing robust demand for vehicles equipped with automatic and semi-automatic transmissions. OEMs are rolling out more models with AT options, even in traditionally manual-dominated segments, to capture this shift.

Fuel Type Insights

Gasoline vehicles dominated the automotive transmission market, accounting for the largest share due to their global prevalence, especially in passenger vehicles. Gasoline engines, typically lighter and more efficient for urban commuting, remain the preferred choice for a wide range of vehicle types. The demand for gasoline-powered SUVs, crossovers, and compact cars, especially in markets like the U.S. and China, reinforces the dominance of this segment.

However, the "others" segment, comprising hybrid and electric vehicles, is the fastest-growing category. As governments introduce stricter emission norms and offer incentives for low-emission vehicles, consumers are increasingly shifting towards electric and hybrid options. Transmission solutions for hybrids, in particular, such as e-CVTs, are witnessing surging demand. Leading manufacturers are investing in research and development to innovate transmission systems specifically designed for electrified powertrains.

Vehicle Type Insights

Passenger cars dominated the automotive transmission market, driven by their sheer volume of production and sales worldwide. Compact cars, sedans, hatchbacks, and increasingly, crossovers and SUVs, form the backbone of transmission system demand. Innovations in gearboxes such as 6-speed and 8-speed transmissions are enhancing fuel efficiency and driving performance in this segment, making it the largest contributor to overall market revenue.

On the other hand, light commercial vehicles (LCVs) are the fastest-growing segment, boosted by the rapid rise of e-commerce, last-mile delivery services, and urban logistics. LCVs require robust, durable, and efficient transmission systems that can handle stop-and-go traffic and heavy loads. Automotive OEMs are increasingly focusing on offering automatic variants for commercial applications, further accelerating growth in this segment.

Regional Insights

Asia-Pacific dominated the automotive transmission market in 2024, owing to the presence of major automotive manufacturing hubs like China, Japan, India, and South Korea. High vehicle production volumes, rising disposable incomes, and growing urbanization support strong demand for both manual and automatic transmission systems. Additionally, supportive government policies in India and China promoting vehicle electrification are creating future opportunities for transmission innovations specific to EVs and hybrids.

North America is the fastest-growing region, characterized by high automatic transmission penetration and a rapidly increasing shift toward SUVs, pickup trucks, and electric vehicles. The U.S. market, in particular, has seen robust adoption of automatic and CVT systems, while Canada and Mexico are experiencing growing investments in automotive production and drivetrain technologies. This regional dynamism ensures a strong outlook for transmission manufacturers catering to North American demand.

Some of the prominent players in the automotive transmission market include:

- Aisin Seiki Co., Ltd.

- Allison Transmission, Inc.

- BorgWarner Inc.

- Continental AG

- Eaton Corporation PLC

- Getrag

- GKN PLC

- Jatco Ltd.

- Magna International, Inc.

- ZF Friedrichshafen AG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive transmission market.

Transmission Type

Fuel Type

Vehicle Type

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)