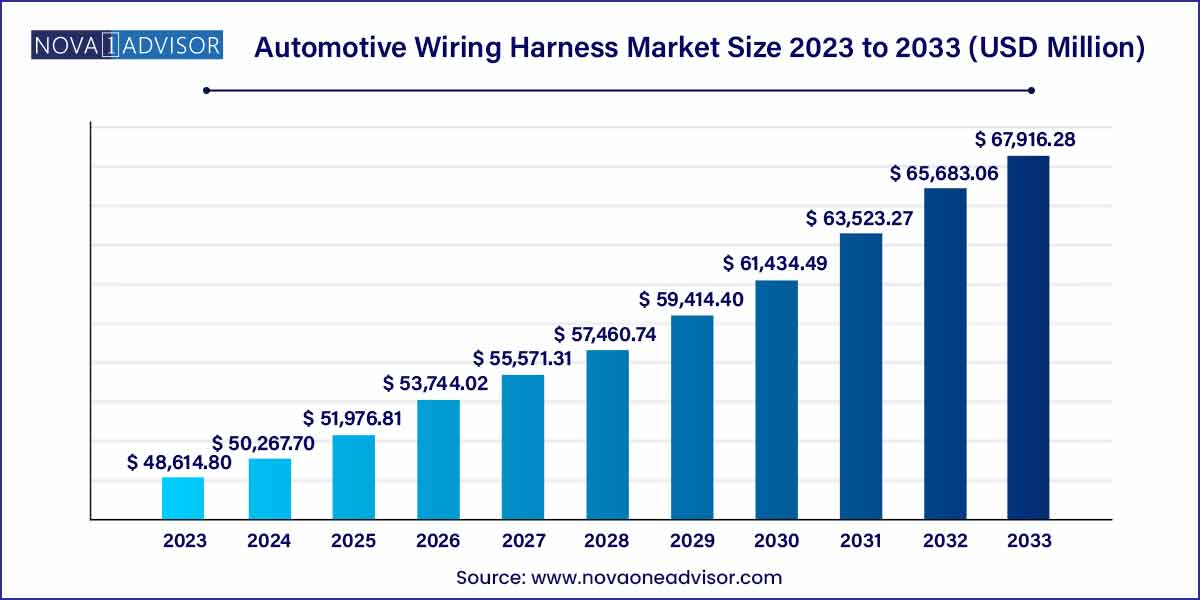

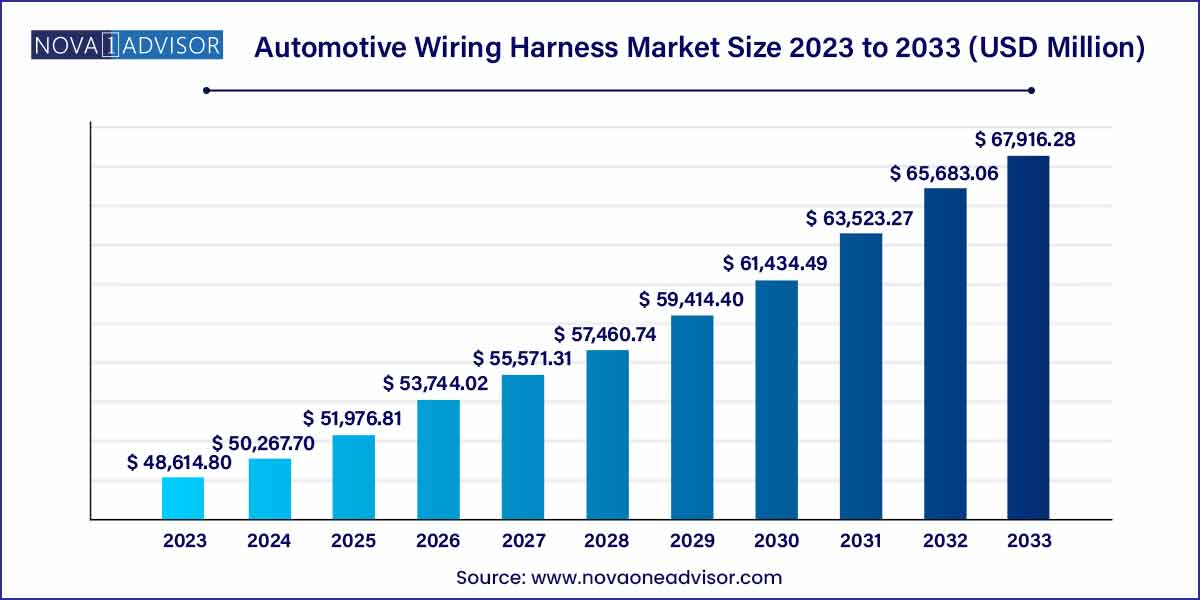

The global automotive wiring harness market size was exhibited at USD 48,614.8 million in 2023 and is projected to hit around USD 67,916.28 million by 2033, growing at a CAGR of 3.4% during the forecast period of 2024 to 2033.

Key Takeaways:

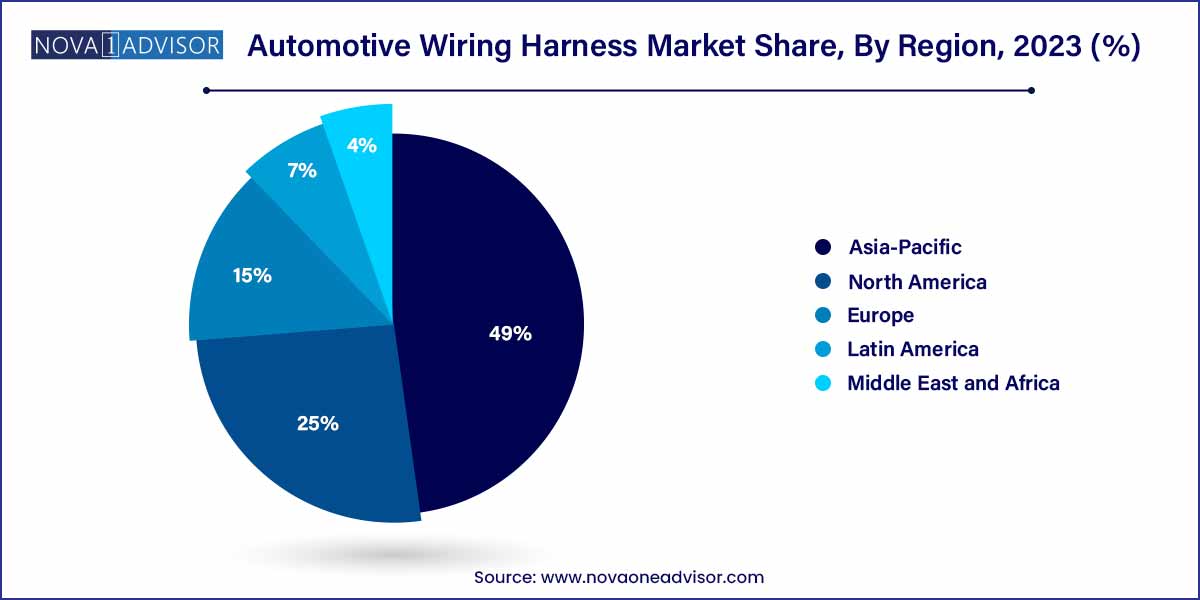

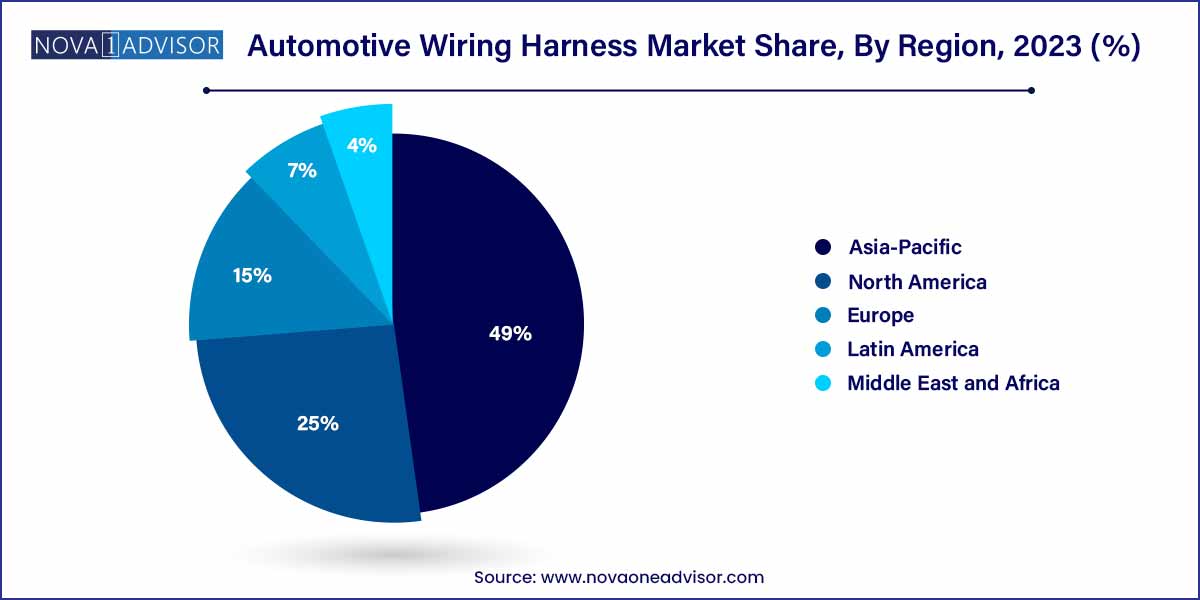

- The Asia-Pacific region dominated the automotive wiring harness market and accounted for the largest revenue share of 49.0% in 2023.

- The battery electric vehicle (BEV) is expected to accumulate the largest market share and is projected to expand at the highest CAGR within the forecast period.

- The terminal segment dominated the market and is anticipated to hold the majority of the market share in 2022.

- Light vehicles dominated the market and accounted for the largest revenue share of over 90% in 2022.

- The chassis segment dominated the market and accounted for the largest revenue share of over 34% in 2022.

Automotive Wiring Harness Market: Overview

The Automotive Wiring Harness Market forms an essential backbone of the automotive industry, connecting a vehicle’s various components, sensors, and control units to facilitate the seamless flow of electrical power and data. A wiring harness is a systematic and integrated arrangement of wires, terminals, and connectors that run throughout a vehicle, ensuring reliable performance of critical systems, including engine management, lighting, infotainment, and safety features.

The growing complexity of automotive electronics, the rapid rise of electric and hybrid vehicles, and increasing adoption of advanced driver-assistance systems (ADAS) are driving the demand for sophisticated and durable wiring harness solutions. Lightweight, compact, and energy-efficient wiring harnesses are gaining prominence as OEMs strive to improve fuel efficiency and vehicle performance.

Major players like Yazaki Corporation, Sumitomo Electric Industries, and Aptiv PLC are investing heavily in the development of next-generation wiring solutions, such as aluminum harnesses and high-voltage architectures for electric vehicles. Innovations aimed at modularization, smart harness integration, and automated production processes are shaping the future of the industry.

Automotive Wiring Harness Market Growth

The automotive wiring harness market is experiencing robust growth attributed to several key factors. The surge in demand for electric vehicles (EVs) and the integration of advanced technologies such as advanced driver-assistance systems (ADAS) and infotainment systems are driving the need for sophisticated wiring solutions. Additionally, the industry's focus on lightweight and efficient designs, coupled with the shift towards modular vehicle architectures, is spurring innovation in wiring harness development. Safety and reliability remain paramount, leading to investments in rigorous testing and validation processes. As automakers prioritize innovation, efficiency, and sustainability, the automotive wiring harness market is poised for continued expansion, presenting significant opportunities for market players across the value chain.

Automotive Wiring Harness Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 48,614.8 Million |

| Market Size by 2033 |

USD 67,916.28 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 3.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Application, Electric Vehicle, Vehicle, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Delphi Technologies PLC (Aptiv PLC); Sumitomo Electric Industries, Ltd.; Yazaki Corporation; Leoni AG; Lear Corporation; Furukawa Electric Co., Ltd. |

Automotive Wiring Harness Market Dynamics

- Electrification Drive and Advanced Technology Integration:

The automotive industry is undergoing a significant transformation with the rapid adoption of electric vehicles (EVs) and the integration of advanced technologies into vehicles. This shift towards electrification is fueled by environmental concerns, regulatory mandates, and the increasing consumer demand for sustainable transportation options. As a result, there is a growing need for specialized wiring harnesses designed to support electric drivetrains, battery management systems, and other electrification components. Additionally, the proliferation of advanced driver-assistance systems (ADAS), infotainment systems, connectivity features, and autonomous driving capabilities necessitates complex wiring solutions to facilitate seamless communication and operation.

- Lightweight Design and Modular Architectures:

In response to stringent fuel efficiency regulations and consumer demand for environmentally-friendly vehicles, automotive manufacturers are increasingly focusing on lightweight design solutions across all vehicle components, including wiring harnesses. Lightweight wiring harnesses not only contribute to improved fuel economy but also enhance overall vehicle performance and handling. Furthermore, the adoption of modular vehicle platforms and flexible architectures enables automakers to streamline production processes and accommodate diverse vehicle configurations more efficiently. This trend towards modularization necessitates adaptable wiring harness solutions that can be easily customized and integrated into different vehicle models.

Automotive Wiring Harness Market Restraint

- Complexity and Cost Challenges:

The increasing complexity of automotive wiring harnesses, driven by the integration of advanced technologies and the proliferation of electronic components, poses significant challenges for manufacturers. As vehicles become more technologically advanced, the number of wires, connectors, and modules within wiring harnesses continues to grow, resulting in larger and more intricate harness designs. This complexity not only increases manufacturing and assembly costs but also complicates troubleshooting, maintenance, and repair processes for automotive technicians. Additionally, the demand for high-quality materials, stringent regulatory requirements, and the need for rigorous testing further contribute to the overall cost burden associated with automotive wiring harnesses.

- Supply Chain Disruptions and Component Shortages:

The automotive industry is susceptible to supply chain disruptions and component shortages, which can significantly impact the production and availability of wiring harnesses. Factors such as geopolitical tensions, natural disasters, trade disputes, and global pandemics can disrupt the supply of raw materials, components, and finished products, leading to delays in manufacturing and delivery schedules. Moreover, the increasing demand for electronic components and semiconductors, driven by the electrification and digitization of vehicles, has exacerbated supply chain challenges, resulting in shortages and price fluctuations. These supply chain disruptions not only disrupt production processes but also increase costs and lead times for automotive wiring harness manufacturers.

Automotive Wiring Harness Market Opportunity

- Expansion of Electric Vehicle (EV) Market:

The rapid expansion of the electric vehicle (EV) market presents a significant opportunity for growth in the automotive wiring harness industry. With governments worldwide implementing stringent emissions regulations and offering incentives to promote electric vehicle adoption, the demand for EVs is expected to surge in the coming years. Electric vehicles require specialized wiring harnesses to accommodate the unique requirements of electric drivetrains, battery management systems, and charging infrastructure. As a result, automotive wiring harness manufacturers have the opportunity to capitalize on the growing demand for EV components by developing innovative wiring solutions tailored to electric vehicles.

- Integration of Advanced Connectivity and Autonomous Driving Technologies:

The integration of advanced connectivity and autonomous driving technologies into vehicles represents a significant opportunity for innovation and growth in the automotive wiring harness market. As vehicles become more connected and autonomous, the demand for sophisticated wiring harnesses capable of supporting high-speed data transmission, sensor integration, and real-time communication is expected to increase. Advanced driver-assistance systems (ADAS), in-vehicle infotainment systems, vehicle-to-everything (V2X) communication, and autonomous driving features require robust wiring solutions to facilitate seamless integration and operation. Automotive wiring harness manufacturers have the opportunity to develop specialized wiring solutions tailored to the unique requirements of connected and autonomous vehicles, including high-bandwidth data cables, sensor harnesses, and power distribution systems.

Automotive Wiring Harness Market Challenges

- Integration of Advanced Technologies and Electronics:

One of the major challenges in the automotive wiring harness market is the integration of increasingly complex and advanced technologies into vehicles. With the rise of electric vehicles (EVs), advanced driver-assistance systems (ADAS), infotainment systems, and other electronic features, there is a growing demand for wiring harnesses capable of supporting these sophisticated systems. However, integrating a multitude of sensors, cameras, processors, and communication modules into vehicles requires wiring harnesses with higher pin counts, greater flexibility, and increased reliability. Moreover, the rapid pace of technological innovation and the emergence of new vehicle architectures further complicate the design and development of wiring harnesses, as manufacturers must constantly adapt to evolving requirements and standards. This challenge is exacerbated by the need to ensure compatibility and interoperability between different electronic components and systems, as well as compliance with stringent safety and regulatory requirements.

- Supply Chain Disruptions and Component Shortages:

Another key challenge in the automotive wiring harness market is the risk of supply chain disruptions and component shortages. The automotive industry relies on a complex global supply chain involving numerous suppliers, subcontractors, and logistics providers to source raw materials, components, and finished products. However, this interconnected network is susceptible to various external factors, including geopolitical tensions, natural disasters, trade disputes, and global pandemics, which can disrupt production and distribution channels. In recent years, the automotive industry has faced shortages and price fluctuations for critical components such as semiconductors, connectors, and wire harnesses, leading to production delays and increased costs for manufacturers. Moreover, the increasing demand for electronic components and the growing competition for limited resources further exacerbate supply chain challenges, making it difficult for automotive wiring harness manufacturers to secure a stable and reliable supply of materials and components.

Segments Insights:

Electric Vehicle Insights

Battery Electric Vehicles (BEVs) dominated the EV segment in 2024. BEVs rely entirely on electric propulsion, necessitating extensive wiring for battery systems, power distribution units, and electronic control modules. With global BEV sales breaking records year-on-year, demand for specialized wiring harnesses designed for high-voltage and lightweight efficiency remains robust.

Plug-in Hybrid Electric Vehicles (PHEVs) are growing rapidly. PHEVs combine conventional engines with electric drive systems, requiring complex dual wiring architectures. As transitional solutions for consumers hesitant to fully shift to BEVs, PHEVs are experiencing rising adoption, particularly in markets like Europe and North America, driving wiring harness demand.

Component Insights

Electric Wires dominated the component segment in 2024. Electric wires form the fundamental medium through which electrical signals and power are transmitted across various vehicle subsystems. With the increasing electrification of powertrains, entertainment systems, and safety mechanisms, the demand for high-quality, durable, and heat-resistant wires has surged. Companies are focusing on developing lightweight and low-resistance wires to meet stringent energy efficiency norms.

Connectors are the fastest-growing component. As modularity becomes a priority, connectors facilitate easier assembly, maintenance, and upgrades. The growing complexity of ADAS and infotainment systems, combined with the push for flexible architectures in EVs, is driving rapid growth in the automotive connectors market. In March 2024, TE Connectivity launched its new line of high-voltage connectors designed specifically for ultra-fast EV charging applications, indicating strong growth momentum.

Vehicle Insights

Light Vehicles dominated the vehicle type segment. Passenger cars, including sedans, SUVs, and crossovers, account for the majority of automotive production and thus demand for wiring harnesses. Technological upgrades in infotainment, safety, and comfort features are further adding to wiring complexity in this segment.

Heavy Vehicles are witnessing faster growth. The electrification of commercial trucks, buses, and construction vehicles, alongside the expansion of autonomous vehicle initiatives, is significantly boosting wiring harness requirements. In January 2024, Volvo Trucks announced plans to double its electric heavy truck production, illustrating the rapid growth of heavy vehicle electrification.

Application Insights

Body applications dominated the application segment. Wiring harnesses for body applications include door locks, mirrors, interior lighting, window controls, and seating systems. The surge in demand for luxury features, personalized ambient lighting, and power-operated vehicle components has reinforced the dominance of this segment.

Sensor applications are the fastest-growing. With the rise of autonomous driving and vehicle safety mandates, the number of sensors integrated into vehicles has increased dramatically. Each sensor requires reliable and protected wiring to ensure continuous data transmission to the control units. In February 2024, Bosch reported a 25% increase in sensor deployment across new vehicle platforms, underscoring the growing wiring needs in this application.

Regional Insights

Asia-Pacific dominated the global automotive wiring harness market in 2024. The region benefits from a strong automotive manufacturing base, led by countries like China, Japan, South Korea, and India. China’s aggressive EV push, coupled with Japan's expertise in advanced electronics and South Korea's focus on autonomous vehicle development, are major contributors. In March 2024, China's Ministry of Industry and Information Technology launched a new program supporting local harness manufacturers, solidifying APAC’s leadership.

Europe is the fastest-growing region. Stringent emission regulations, strong EV adoption, and massive investments in ADAS and connected vehicle technologies are fueling wiring harness demand. Germany, France, and the UK are particularly active in deploying smart automotive technologies. In April 2024, the European Union introduced new safety standards mandating additional sensor-based features in all vehicles sold from 2026, driving up the need for complex wiring architectures.

Some of the prominent players in the automotive wiring harness market include:

- Delphi Technologies PLC (Aptiv PLC)

- Furukawa Electric Co., Ltd.

- Kromberg & Schubert GmbH Cable & Wire

- LEONI AG

- Lear Corporation

- PKC Group

- Sumitomo Electric Industries, Ltd.

- Spark Minda, Ashok Minda Group

- China Auto Electronics Group Limited (THB Group)

- Yazaki Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive wiring harness market.

Component

- Electric Wires

- Connectors

- Terminals

- Others

Application

- Body

- Chassis

- Engine

- HVAC

- Sensors

Electric Vehicle

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Vehicle

- Light Vehicles

- Heavy Vehicles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)