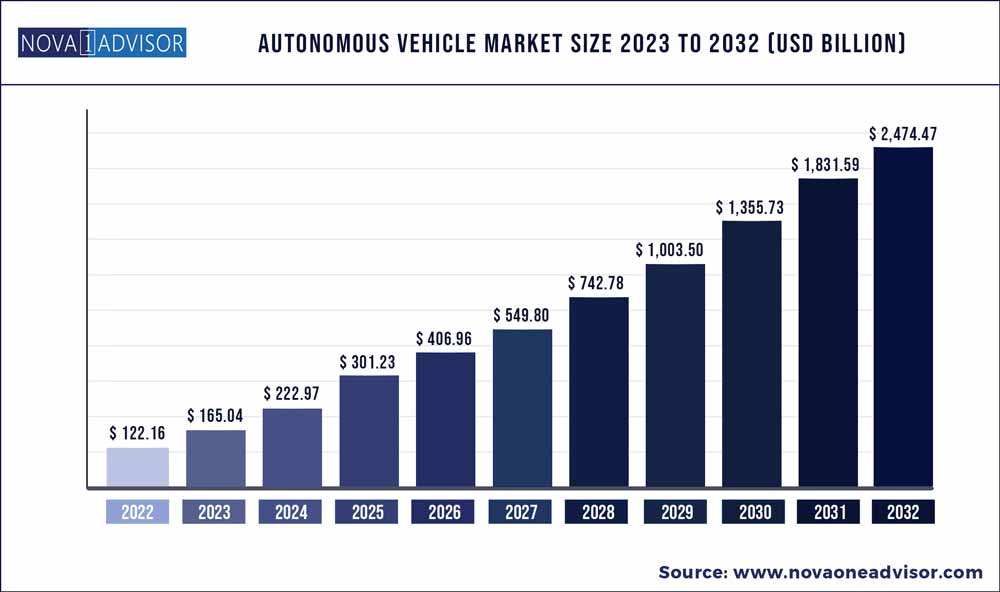

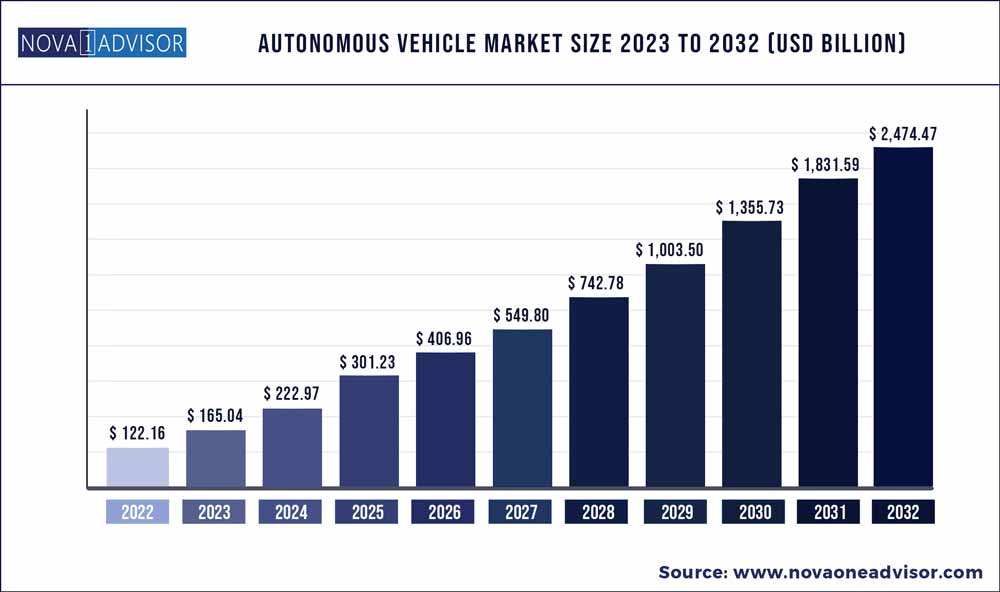

The global autonomous vehicle market size was estimated at USD 122.16 billion in 2022 and is expected to surpass around USD 2,474.47 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 35.1% during the forecast period 2023 to 2032.

Key Takeaways:

- North America accounted for the largest market share of 46.5% in 2022.

- The Asia-Pacific region is expected to hit at a CAGR of 35.6% from 2023 to 2032.

- Application, the transportation segment accounted largest revenue share of 93.75% in 2022.

- The defense segment is expected to grow at the fastest CAGR of 65.1% during the forecast period.

- By vehicle type, the passenger segment accounted for 74.19% of revenue share in 2022.

- By propulsion type, the semi-autonomous vehicle segment accounted for 95.09% of revenue share in 2022.

Autonomous Vehicle Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 165.04 Billion |

| Market Size by 2032 |

USD 2,474.47 Billion |

| Growth Rate From |

CAGR of 35.1% |

| Base Year 2022 |

2023 to 2032 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Application, Level of Automation, Propulsion, Vehicle, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BMW AG, Audi AG, Ford Motor Company, Daimler AG, Google LLC, General Motors Company, Nissan Motor Company, Honda Motor Co., Ltd., Toyota Motor Corporation, Tesla, Volvo Car Corporation, Uber Technologies, Inc., and Volkswagen AG |

Self-drive cars, also known as autonomous vehicles, are a key innovation in the automotive industry, with high growth potential, and act as a catalyst in the technological development of automobiles. Developing a supportive regulatory framework, government funding, and investment in digital infrastructure are expected to play a key role in positively affecting market growth during the forecast period.

The improvements in technology, such as adaptive algorithms, sensor processing, high-definition mapping, and enhanced infrastructure, are prompting various companies to expand the production of autonomous vehicles. The market has a wide range of products and systems that comprise the autonomous vehicle infrastructure. Autonomous cars enable independent mobility for non-drivers and people suffering from certain disabilities. It allows travelers to travel with more comfort and flexibility to read, rest, or even work while traveling, increasing their efficiency. It will also reduce paid drivers' costs for commercial vehicles and taxis. Other benefits, such as increased safety with reduced crash risks and increased road capacity with reduced costs, will significantly increase the adoption of these vehicles in the market.

Various leading players are working towards enhancing the experience of using autonomous vehicles with the help of new technologies. For instance, in 2019, the leading automobile company Volkswagen announced its collaboration with Ford to invest in AI vendor Argo AI. The partnership aimed to introduce autonomous vehicle technology in Europe and the US. The company decided to invest more than 4 billion USD through 2023 to develop and enhance its autonomous or self-driving services.

The autonomous car comprises numerous sensors, such as LiDAR and RADAR systems, working concurrently to carry out operations automatically without the help of drivers. By performing situational analysis, motion planning, and trajectory control, these sensors help in navigation. The rising safety concerns and advancements in automotive technologies have led governments of various countries to penetrate and accept autonomous vehicles, such as the U.S., Germany, China, and Japan. Such factors are anticipated to drive market growth in the forecast period.

Many government entities are taking various initiatives to launch autonomous vehicles in their countries. Additionally, the government has taken multiple initiatives to ensure the safety of autonomous vehicles. For instance, in February 2018, the European Union (EU), the ENSEMBLE consortium, and the Netherlands scientific research organization TNO announced the implementation plan for multi-brand truck platooning on European roads. Multi-brand truck platooning will enable a single truck to connect with other trucks.

Such initiatives will improve the fuel economy, increase traffic capacity, and reduce the carbon-dioxide emissions in the EU. Moreover, the National Highway Traffic Safety Administration (NHTSA) has announced several measures and guidelines to ensure safety. In 2021, NHTSA issued a standard general order under which the manufacturers and the operators of autonomous vehicles will have to report any crashes they face to the agency.

Market Drivers

RISING NEED FOR ROAD SAFETY

The number of road accidents are increasing day by day. According to the Association for Safe International Road Travel (ASIRT), more than one million people die in road accidents each year. The primary cause of accidents is human error that occurs in an uncertainty of events, for instance, head-on collisions due to misinterpretation of the driver. Accidents may also occur due to machine or parts failure, such as the failure of brakes or breakage of axles. The governments of many nations are strengthening the regulations that can resolve road safety concerns.

Autonomous vehicles are safer than traditional vehicles as they are technologically advanced vehicles with various driving assisting systems, such as navigation systems, lane management systems, anti-collision systems, among others, and are connected to a central processing and decision-making system.

According to Automotive World Ltd., a leader in automotive industry information, there would be more than 2 billion cars across the globe in 2050. Thus, with a large number of cars, there would be a high concern for traffic congestion. Autonomous vehicles could assist in resolving traffic congestion issues. Autonomous cars can communicate with other cars and thus avoid traffic congestions. Also, with rising sharing economy self-driving cars can provide the travelers with an easy and convenient point to point travel with optimal efficiency and minimum traffic congestion.

GROWING R&D SPENDING IN AUTONOMOUS VEHICLE DEVELOPMENT

An autonomous vehicle is a combination of various sensors and networking system that assist the computer in driving the vehicle. In 2018, BMW Group is expected to spend the largest share of its revenue in research and development operations. The usual amount spent by the company is in the range of 5 to 5.5% of the sales, but in the recent annual report, the company has stated that it would spend 6.5 to 7% of its sales toward the development of technology. It is mainly focusing on the development of autonomous and electric vehicles. For better and rapid development of autonomous technology in vehicles, several companies such as Audi and Tesla Motors collaborate with technology developers. For instance, collaboration companies such as Nvidia will assist automobile manufacturers in developing object recognition.

Also, auto manufacturers such as Waymo have partnered with Intel Corporation to enhance automobile infotainment systems. In addition, several other competitors conduct in-house research for developing cutting edge technologies for autonomous vehicles. In the luxury car segment, Tesla and Mercedes are investing more than 60% in internal research. Many OEMs in Japan, such as Toyota, have also initiated in- house research that enhances the technological capabilities of the companies.

ENVIRONMENTAL IMPACT DUE TO TRADITIONAL VEHICLES

The rising environmental impact of the pollution caused by traditional vehicles has increased the global temperature as well as health hazards to humans. According to Environmental Protection Agency (EPA), in the U.S. more than 75% of the carbon monoxide is emitted by motor vehicles. It causes various respiratory and cardiovascular diseases such as asthma. Thus, with the rise of autonomous vehicles, the percentage of pollution caused by cars and trucks is expected to reduce owing to optimum usage of fuel by vehicles and the growing implementation of ecofriendly automotive solutions such as electric cars.

Furthermore, the growth of the sharing economy would act as a catalyst in the rise of autonomous vehicles. As the cars would be self-driven, they could be shared, thus decreasing the impact on the environment. For instance, Uber, a company that provides ride sharing and food delivery, has initiated the development and testing of autonomous vehicles in Arizona, U.S. Moreover, other ride sharing companies such as Lyft and Gett have started collaborating with OEMs that develop autonomous vehicles.

INCREASED ENERGY SAVINGS BY AUTONOMOUS VEHICLES

The rising development of autonomous cars that are integrated with artificial intelligence would increase the efficiency of the car as compared to human drivers. Autonomous vehicles can increase the efficiency of the vehicle as they would have real-time traffic updates, enhanced telematics and connected cars, the self-driving vehicle would change the routes accordingly. Thus, the vehicles would be more efficient as they would not result in the wastage of fuel at traffic jams.

Autonomous vehicles have enhanced fuel efficiency since they use proper acceleration and gear shifts as compared to human drivers who tend to accelerate or deaccelerate the vehicle aggressively and ending up wasting more fuel. Platooning of vehicles is possible with autonomous vehicles. This would also assist in increasing the efficiency of the vehicle, owing to reduced aerodynamic drag caused by the platooning. The rise of hybrid technologies used in traditional cars and trucks currently, along with the use of pure electric and hybrid electric technologies in future autonomous cars and trucks, would together assist in saving energy and increasing the efficiency of the drive. The sharing economy would also increase energy savings with the use of autonomous cars and trucks.

Market Opportunities

Increasing Focus on Vehicle Platooning

Vehicle platoon comprises group of vehicles equipped with advanced technology, running together in a row from nose-to-tail at a high speed. A lead vehicle is followed by the other vehicle at a same speed and maneuvers to the lead the vehicle. Each vehicle communicates with lead vehicle, which controls

the speed and direction of the other vehicles. Additionally, vehicle platooning is a result of one the technological advancement in the automotive industry, which aims to enhance vehicle & passenger safety, improve fuel efficiency and decreases time travel. Numerous vehicle manufacturers and

government bodies are investing huge amount in R&D to develop vehicle platooning technology. For instance, in February 2018, the Europe government launched “ENSEMBLE”, an EU funded project for truck platooning. DAF, Daimler, Iveco, MAN, Scania, and Volvo are the partner of this program. The ENSEMBLE consortium will develop autonomous trucks for vehicle platooning and will demonstrate multi brand truck platooning over the period of next three years. Additionally, in January 2018, after the successful test of truck platooning in Europe, Daimler AG is testing truck platooning in Japan through its subsidiary “Fuso”. Moreover, rising implementation of vehicle platooning is expected to boost the demand for autonomous vehicle.

INCREASED TECHNOLOGICAL ADVANCEMENTS BY OEMS FOR THE DEVELOPMENT OF AUTONOMOUS VEHICLES

The driver assistance technology offers adaptive headlights, passive cruise control, lane departure warning, night vision, blind spot detection, and self-parking features. The security features entail remote keyless entry and passive car entry. Autonomous cars enhance comfort by integrating air conditioning, LED lighting, electric windows, rain sensitive wipers, electric seats, power sliding doors, and electric roof. The electrical suspension offers an active as well as passive suspension. The power train features offer engine management, electrical power steering, electro-hydraulic power steering, automatic gearbox, and steer-by-wire. Instrumentation offers head-up displays. Braking advancements offer ABS without as well as with electronic stability. The safety features incorporate airbags and occupant detection.

NEW BUSINESS MODEL FOR INSURANCE COMPANIES

The rising emergence of autonomous vehicles is expected to innovate automobile insurance. Traditional automobile insurance is secured by the owner of the vehicle. For instance, car owners must insure their vehicle as a preventive measure against accidents. More than 90% of the accidents are caused due to human error. Thus, considering such accidents, insurance companies provide aid in terms of monetary benefits. However, with autonomous vehicles on the roads, the rate of accidents is expected to reduce as it would be driven by robotic drivers.

Self-driving cars would be less susceptible to accidents and also the ownership of the vehicles would shift to automakers as they can boost the sharing economy by providing autonomous vehicles as per requirements 24/7. With the less individual ownership of vehicles, auto insurance is expected to experience a decline. Moreover, along with the rise of autonomous vehicles, innovative insurances such as enhanced cyber-security insurance, sensor insurance/algorithm insurance, and insurance against bad infrastructure. Thus, insurance would be provided for services instead of physical products. Furthermore, autonomous vehicles are expected to increase automobile insurance exponentially over the forecast period.

Below mentioned are the benefits of vehicle platooning

- Lower fuel consumption

- Reduce CO2 emissions by up to 10%

- Reduction in road congestion

- Reduction in traffic accident

- Optimises transportation system by using roads more effectively

- Reduce up to 30% of total operating costs of a truck

Transition from Car ownership to Mobility-as-a-Service (MaaS)

With the changing landscape of how passengers commute on daily basis, the demand for an integrated mobility service platform which combines various modes of transportation such as public transit, private vehicle, and bikes, among others in a compact service package has increased in the recent years.

According to the United Nations, the total population living in urban areas is estimated to reach 68% by 2050 from 55% in 2018 and along with this rapidly rising urban population, the demand for sustainable transportation system which consumes less time, is affordable and reduces hassle is expected to grow as well. As MaaS helps in decongestion of traffic, cost reduction, and efficient travel, the future of mobility services is expected to change rapidly. As the platform is flexible to integrate new modes or products without interfering with the existing service operations, integration of autonomous vehicle is expected to be adopted on a commercial scale thereby increasing car-pooling services; reducing the use of privately-owned cars autonomous cars. As the Mobility-as-a-Service becomes sustainable in the future, it is expected reduce the travel costs such as fuel costs and toll cost by reducing traffic congestions.

Most of services for MaaS will be delivered by the robo-taxi or self-driving taxi, a Level 4 or Level 5 autonomous cars operated for on-demand mobility services such as ride haling and ride sharing. Additionally, autonomous driving technology providers such as Waymo, Uber, and Zoox, among others are spending a humongous amount in R&D to develop Level 4 or Level 5 robo-taxis. For instance, Uber invests $125 million to $200 million in a quarter for self-driving vehicle projects. Additionally, autonomous technology providers are collaborating with automotive OEMs and tier 1 component providers to develop advanced autonomous vehicles. For instance, in August 2018, Uber partnered with Toyota and as per the partnership agreement Toyota invested $500 million in Uber and both companies will work jointly for the development of self-driving cars. The combined self-driving technology will be integrated with Toyota Sienna minivans and will be deployed on Uber ride-hailing networks starting from 2021. All these factors are anticipated to create immense opportunities for the market growth.

Wide Ranging Opportunities for Luxury Cars (Level 1 and Level 2) in Emerging Economies

The demand for luxury cars is on a rise, automotive OEMs such as Volvo, BMW, Audi, Mercedes- Benz, among others are developing luxury vehicles, which are level 1 and level 2 autonomous vehicles. In the recent years, the automotive sector has witnessed unprecedented growth in emerging economies such as China, India, Vietnam, Malaysia, and Indonesia, which are also becoming major manufacturing hubs for global automotive players. In order to efficiently make use of rising consumer automobile preferences, leading global automotive OEMs are entering into new and emerging markets for business expansion in terms of product launches, acquisitions/partnerships. For instance, BMW will launch X7, X4 in India in 2019. BMW X7 comprises ADAS features such as adaptive cruise control, lane departure warning, blind spot detection, and speed limit information, among others. This form of expansion will further strengthen the company’s position in emerging countries and enhance its market share.

Additionally, leading automotive OEMs are expanding their geographical footprint in emerging countries by increasing manufacturing capacity in an order to fulfil the gap between the demand and supply of the vehicles. For instance, in July 2018, BMW and its Chinese partner “Brilliance Automotive Group Holdings” signed an agreement to expand their Chinese joint venture “BMW Brilliance Automotive”. This expansion will help the company to boost its production capacity to 520,000 cars in 2019.

Market Restraint

VEHICLE SAFETY AND CYBERSECURITY CONCERNS

Autonomous vehicles are a cyber-physical system as they have elements of both physical and virtual worlds. The physical system comprises the car and all the mechanical components, while the virtual system comprises the AI-based driving assisting systems, such as car-to-car communication, navigation, and cloud connectivity. Thus, Connectivity also poses a threat to the security of the autonomous car. Autonomous vehicles can be hacked by traditional hackers for personal data, such as behavior patterns. Moreover, autonomous vehicles can be infected by ransomware that can cause accidents while also increasing the chances of vehicle theft. In 2015, Jeep Cherokee was hacked by researchers from IOActive, Inc., a company that provides cybersecurity solutions. The car was hacked using the entertainment system that was connected to the cloud through the internet. Thus, the hackers were successful in taking control of the car.

The LiDAR and image recognition system can also be tricked by portraying false images and road signs. Also, Lidar is unable to sense glass while radar can mainly sense metal objects only. Thus, it poses a threat to the passengers travelling in autonomous cars. The malfunctioning of autonomous cars can be fatal, which emerges as the biggest social perception inhibiting their espousal. Extensive and scrupulous testing is indispensable, as is redundancy in autonomous systems. In case something miscarries, there are alternatives or back-ups in place, which permit the continued safe operation of these cars. However, this would further increase the cost of autonomous cars. Moreover, people are highly concerned about the cars’ performance in different driving conditions as regards weather and traffic. Functional safety is another key concern that hampers the adoption of autonomous cars. It is referred to as the absence of unreasonable risks that occur due to hazards caused by the malfunctioning of electronic systems. Moreover, random failures are unpredictable.

NON-AVAILABILITY OF INFRASTRUCTURE IN DEVELOPING COUNTRIES

The main pillars of autonomous vehicles are policies and regulations, technological innovation, infrastructure, and adoption by customers. The self-driving vehicle is dependent on factors such as continuously maintained road infrastructure, road signs, and updated maps or navigation systems. In many developing countries such as India, Mexico, and Brazil, the road infrastructure is not as developed as compared to developed countries such as the U.S., Singapore, and Sweden. Thus, it would cause a hindrance in the development of autonomous vehicles.

The networking and development of roads also plays an important role in enhancing the adoption of self-diving vehicles. For instance, in 2017, according to the World Economic Forum, Brazil was ranked 107th out of 144 countries in infrastructure development. Thus, such issues in developing nations would act as a restraint in the development of autonomous vehicles. The investments in developing the infrastructure would play a vital role in the adoption and growth of autonomous vehicles. Also, upgrading the existing infrastructures and building new ones would act as a restraint in the development of autonomous vehicles in the growing economies.

Market Challenge

SYSTEM RELIABILITY AND UNCERTAINTY IN USER ACCEPTANCE

The surging technological advancements aiming at offering enhanced features while reducing the social perception pertaining to the adoption of driverless cars is a key concern. Moreover, people would prefer to spend a little more on their current cars and equip them with features such as crash avoidance and lane keeping systems, which form the basis of autonomous cars. Furthermore, several social equity concerns associated with driverless cars may hinder their adoption as these cars may have unfair impacts.

In addition, autonomous cars would affect business activity as well. There would be a decline in the demand for car repairs owing to reduced crash rates, thereby impacting the maintenance & repair department revenue. Moreover, if the frequency of accidents drops then a complete “crash economy” of insurance firms, chiropractors, automotive body-shops, and others will be disrupted. The adoption of autonomous cars is emphasized due to the increased safety that it offers in driving as compared to humans. A computers faulty reading from a sensor or miscalculation may trigger a car to perform unsuitable tasks, which could catch the driver off-guard. This may possibly result in uncommon and highly complex types of accidents that are difficult to predict.

Application Insights

The transportation segment held the largest market share of 93.75% in 2022, due to the rising adoption of AVs in transportation. For instance, in December 2019, Baidu, a provider of Internet-related products and services, announced that it had secured 40 licenses that would enable the company to test driverless cars. In the transportation type segment, the industrial segment is estimated to grow at a high CAGR in the forecast period. This is due to technological advances and the rising acceptance of autonomous vehicles by various governments across the globe.

Furthermore, the enhanced technology offered by various companies also attracts customers to adopt autonomous vehicles for commercial use. Different leading companies are collaborating to provide hi-tech autonomous driving experiences. For instance, in March 2020, Toyota announced that it is working with TomTom and Denso to demonstrate fast, high-definition map-building methods for the road that will help improve autonomous vehicle driving and provide a safer experience.

The defense segment is expected to grow at the fastest CAGR of 65.1% during the forecast period. This is due to the rising number of initiatives across various regions, such as North America. For instance, in March 2020, Sikorsky and the U.S. Defense Advanced Research Projects Agency (DARPA) announced testing autonomous flight software on S-70 Black Hawk and S-76 commercial helicopters. Based on application, autonomous vehicles are categorized into transportation and defense.

Regional Insights

North America accounted for the largest market share of 46.5% in 2022. The growth across the mobility as a service sector is anticipated to provide impetus to the autonomous car market. North America is expected to witness significant growth owing to amendments in traffic regulations in the U.S. to incorporate autonomous cars on public roads. The regulation is slowly being adopted across all the states of the U.S. to make transportation fully autonomous.

For instance, the National Highway Traffic Safety Association (NHTSA), a traffic regulations body in the U.S., under its policy in 2013, allowed self-driving car testing in several states, including Nevada, California, Florida, Michigan, and Washington D.C.

On the other hand, South America is projected to demonstrate growth at the fastest CAGR of 75.3% over the forecast period. The region is witnessing significant advancements in autonomous vehicle technology. Key players in the automotive and technology sectors invest in research and development to bring autonomous vehicles to the market. These investments contribute to the market's growth by fueling technological innovations and improving the capabilities and safety of autonomous systems.

Europe is expected to emerge as a potentially lucrative market for adopting autonomous cars due to the growing consumer preference for using technologically advanced products. In addition to this, the government is taking various initiatives to enhance autonomous vehicles.

For instance, in August 2020 in the U.K., The Department of Transport (DFT) announced the launch of the Automated Lane-Keeping System (ALKS), which can automatically take control of vehicles running at low speeds. This technology will enable the driver to delegate driving to the vehicles, and the system will keep the vehicle moving along its lane. The U.K. government plans for self-driving vehicles to be in use by 2021 in the country, and it also has further plans to make the required changes to the regulations that can support the development of autonomous vehicles in the region.

Recent Developments

- In May 2023, Uber Technologies Inc. and Waymo LLC, the autonomous driving technology company Alphabet owns, entered a partnership. This alliance aims to bring self-driving vehicles into Uber's service offerings, with the potential to commence as early as this year. As part of the collaboration, a designated fleet of Waymo's vehicles will be seamlessly integrated into Uber's ride-hailing and food delivery operations within the Phoenix metropolitan area. This strategic partnership marks a significant milestone in integrating autonomous driving technology, offering promising prospects for both companies in the evolving mobility landscape.

- In April 2023, Tesla revealed that the electric vehicle (EV) company is expected to introduce its highly anticipated Full Self-Driving (FSD) technology later this year. This advancement will enhance Tesla's product offerings and generate substantial profits. Furthermore, implementing FSD is anticipated to help counterbalance the margin pressure from aggressive price reductions.

- In January 2023, NVIDIA Corporation and Foxconn, a Taiwanese technology company, partnered to collaborate on developing automated and autonomous vehicle platforms. As part of the agreement, Foxconn will manufacture electronic control units (ECUs) utilizing Nvidia's advanced Drive Orin system-on-a-chip (SOC) technology. These ECUs are intended for use in the worldwide automotive market.

- In December 2022, TOYOTA MOTOR CORPORATION launched an operating system, Arene, by 2025. Arene is designed to facilitate autonomous driving by monitoring safety systems, and traffic information and controlling essential car components such as the steering wheel and brakes. Toyota aims to position Arene as a comprehensive solution for autonomous driving, streamlining the integration of various systems and ensuring efficient and safe operations. The operating system will be crucial in managing and coordinating the complex technologies required for autonomous vehicles.

Key Companies & Market Share Insights

The global autonomous vehicle market is highly competitive and dominated by the presence of major automotive giants. Leading market players are significantly focused towards inorganic growth strategies such as collaboration, partnership, merger & acquisition, and regional expansion. In August 2017, Intel Corporation, BMW AG, Fiat Chrysler Automobiles (FCA), and Mobileye, affiliated business of Intel Corporation contracted a memo of understanding for Fiat Chrysler Automobiles to link companies for the development of autonomous vehicle driving platform. The memorandum aimed at collaborating capabilities, resources, and strengths of all the companies to reduce the product launch time, in addition, also enhances the development efficiency and platform technology.

Moreover, industry participants also invest significantly for the product development as autonomous vehicles require high-end electronic devices for advanced automotive features. Rapidly changing consumer preference and increasing awareness among the people for environment-friendly vehicles motivate the market players to incorporate such features in their vehicles. These market players tie up with the electronic hardware manufacturing companies to meet the consumer demand.

Some of the prominent players in the autonomous vehicle market include:

- BMW AG

- Audi AG

- Ford Motor Company

- Daimler AG

- Google LLC

- General Motors Company

- Nissan Motor Company

- Honda Motor Co., Ltd.

- Toyota Motor Corporation

- Tesla

- Volvo Car Corporation

- Uber Technologies, Inc.

- Volkswagen AG

Segments Covered in the Report

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2020 to 2032. This report includes market segmentation and its revenue estimation by classifying it on the basis of application, and region:

By Application

- Defense

- Transportation

- Commercial transportation

- Industrial transportation

By Level of Automation

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

By Propulsion Type

- Semi-autonomous

- Fully Autonomous

By Vehicle Type

- Passenger Car

- Commercial Vehicle

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)