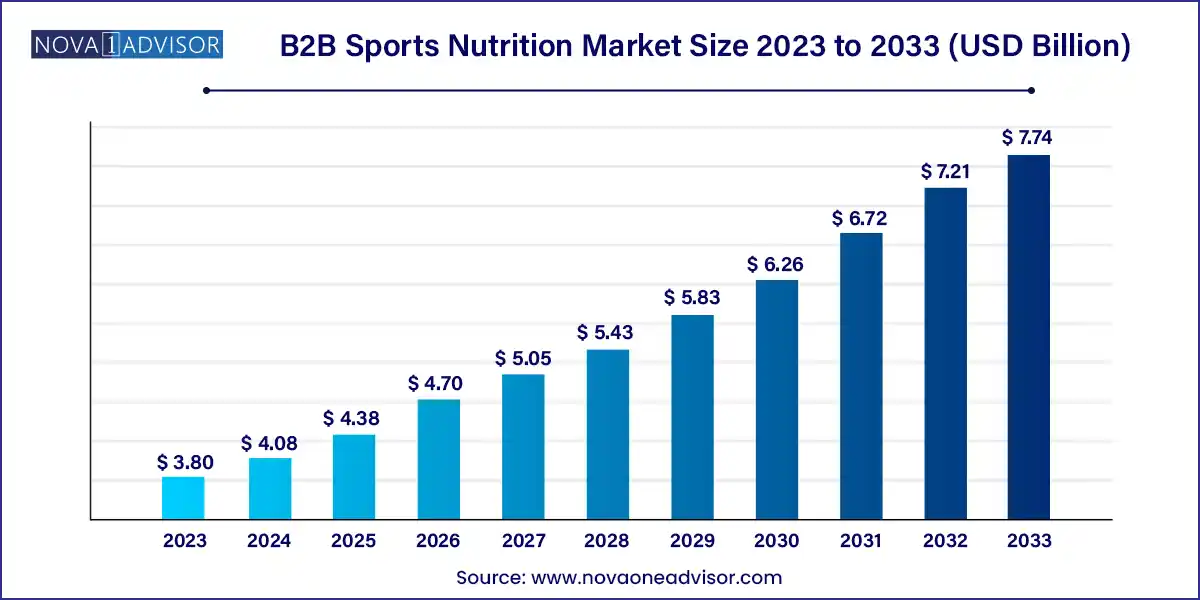

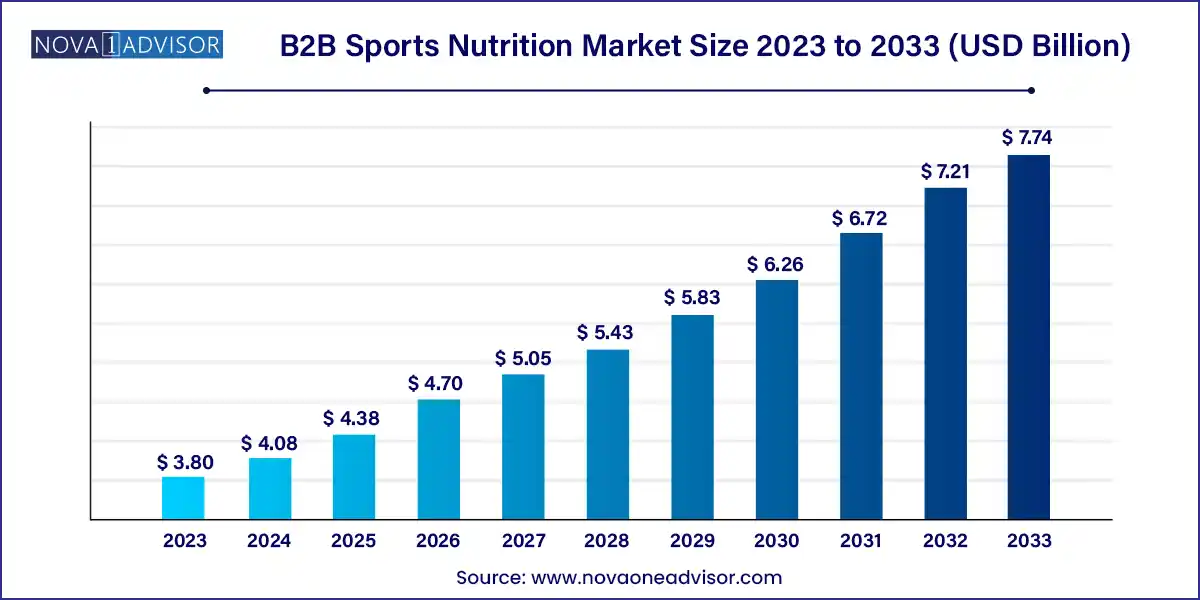

The global B2B sports nutrition market size was exhibited at USD 3.80 billion in 2023 and is projected to hit around USD 7.74 billion by 2033, growing at a CAGR of 7.38% during the forecast period 2024 to 2033.

Key Takeaways:

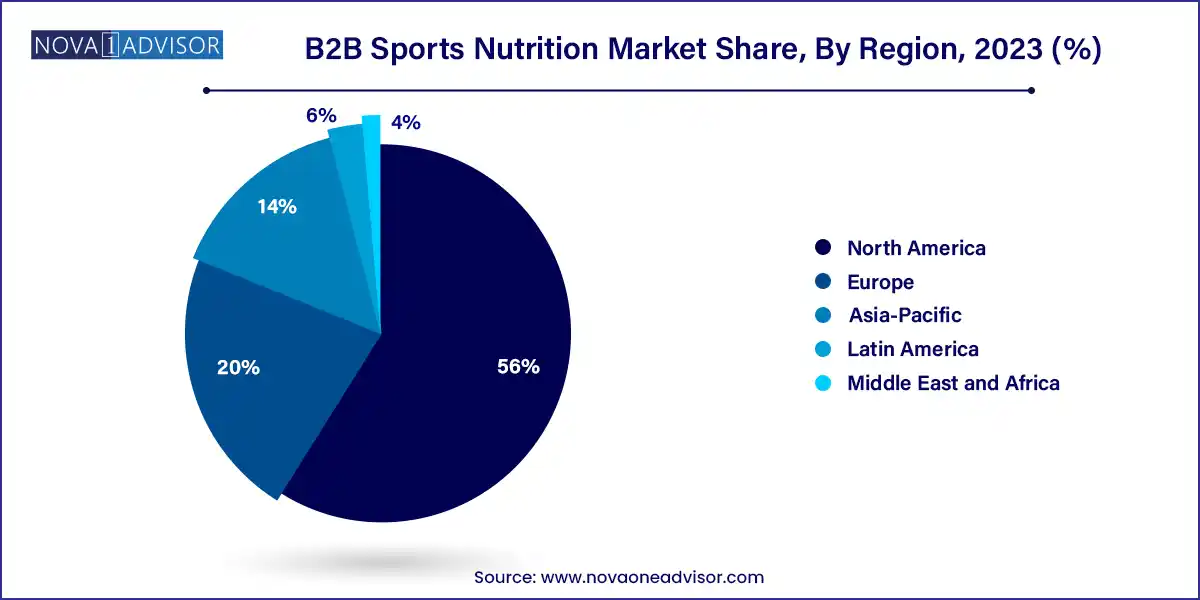

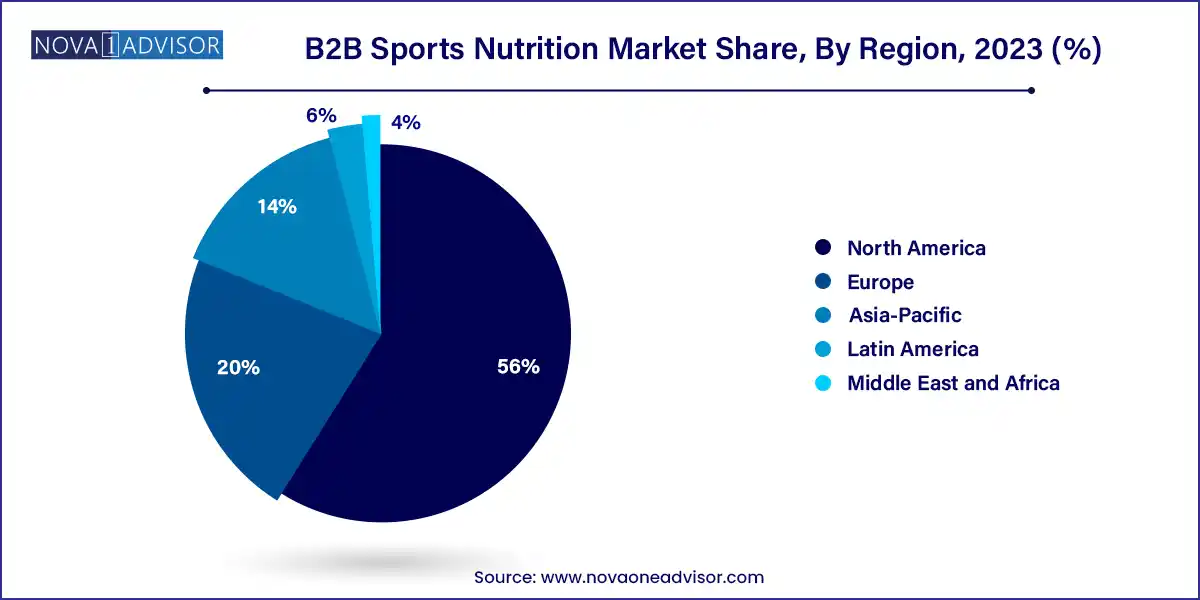

- North America generated more than 63% of the revenue share in 2023.

- Europe region is expected to grow at the fastest CAGR from 2023 to 2032.

- By application, the recovery segment led the market and captured the largest revenue share of around 25% in 2023.

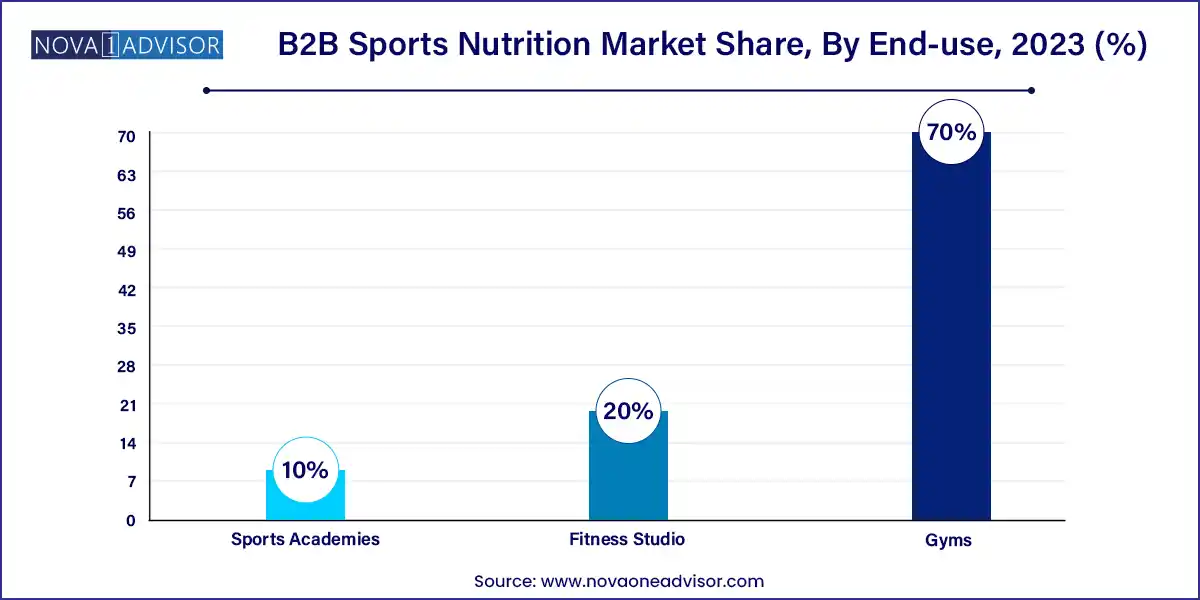

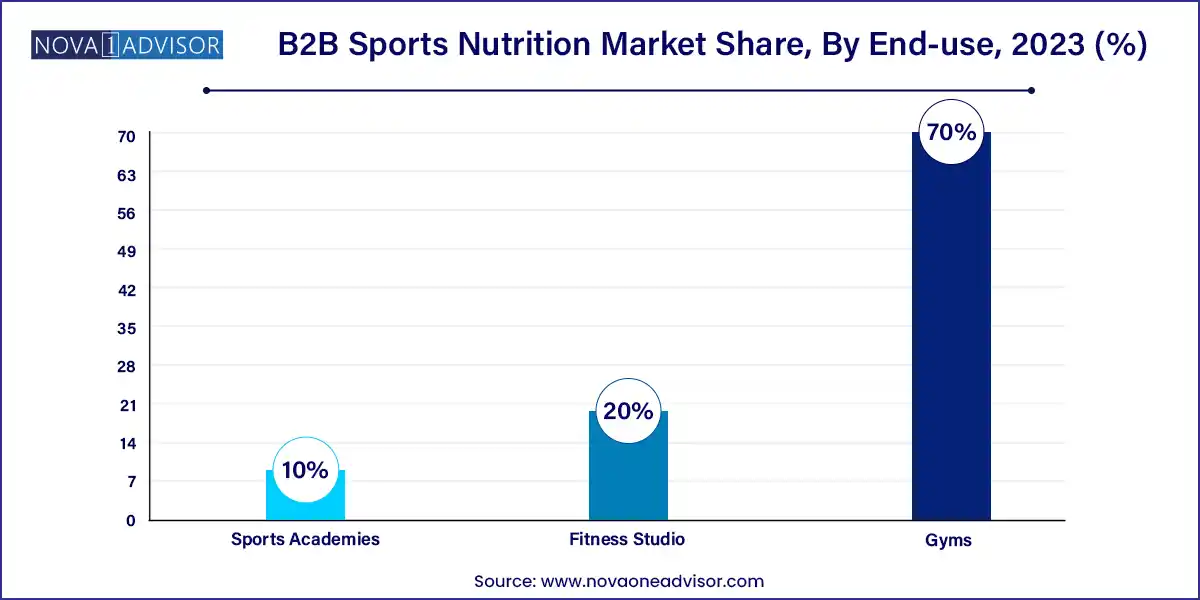

- By distribution channel, the gym segment generated for a maximum market share of around 70% in 2023.

B2B Sports Nutrition Market Overview:

Sports Nutrition refers to consuming nutrients such as proteins, minerals, amino acids, vitamins, and carbohydrates to increase power and stamina and improve athletic performance. It helps to increase muscle mass, speed up muscle recovery, and give the body the fuel for high-intensity activities requiring sufficient energy and stamina. Sports nutrition includes post-workout supplements used for muscle growth and healing and pre-workout nutraceuticals used to boost energy levels and hydration and increase muscle strength. Protein supplements lead the market, with a share of 70% in overall consumption.

Sports nutrition companies see this as an opportunity to bridge the gap and capitalize on the growing demand. They ensure that the products are approved by the food safety and standards authority of India (the regulatory body for food products) and adhere to the guidelines of the Indian Council of Medical Research (ICMR) and the World Health Organisation’s good manufacturing practices (GMP).

Nutrition influences athletes’ performance, but various individuals react differently to the same meals, nutrients, and supplements. The government has created more facilities for sportspersons through professional sporting leagues, which provide services for more athletes to take up sports as a profession.

Growth Factors

The requirement for diverse types of protein bars, energy drinks, dietary & health supplements, and among sportspersons and bodybuilders has accelerated the market expansion. Various natural components are used to build sports nutrients derived from vegetable starch, sugars, milk, fiber, egg protein, herbs, vitamins, and minerals. The most popular sports supplementation are energy amplifiers, recovery strengths, and performance enhancers sportsperson performance improvement, weight loss maintenance, health, and well-being.

The sports nutrition industry has seen massive growth, mainly using supplements, which have been tied to steroids. Growing sports engagement and concern about physical well-being amongst youth drive the need for sports nourishment commodities and serve the market expansion.

The government brought consciousness about the significance of health in daily life- Khelo India and Fit India. Campaigns have stimulated the country's renewal of sports culture and increased investment in sports infrastructure in recent years. The outbreak has put preventative healthcare in the center. Doctors advised wellness Nutritional Supplements during the pandemic, ensuing in higher consciousness and acceptance.

They help them to fulfill their body requirement and enhance performance and recovery ratios by nourishing them with essential vitamins, proteins, minerals, fats, and carbohydrates. The notable elements fostering market advancement are the growing popularity of organic food, drink, protein, and nutritional bars, ascending expenditure, evolving lifestyle, and emerging globalization.

B2B Sports Nutrition Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.08 Billion |

| Market Size by 2033 |

USD 7.74 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.38% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Application and By Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Glanbia Plc., Abbott, PepsiCo, The Hut Group, Cardiff B2B Sports Nutrition Limited, Iovate Health Sciences, MUSCLEPHARM, General Nutrition Centers, Inc., The Bountiful Company, Post Holdings, Inc., Herbalife International of America, Inc., The Bountiful Company, Clif Bar & Company, Science in Sport and Others. |

B2B Sports Nutrition Market Dynamics:

Driver

The fast pace of urbanization, non-traditional consumer growth, and increased health clubs and fitness centers are the dominating driving factors for the change throughout the forecasting market. Different innovations in the sports nutrition market for making the products safer and more effective to consume are expected to boost the need for sports fitness nutrition in the forthcoming years. Performance-improving supplements like creatine and protein powders have risen by about 80% over the past five years. Even probiotics and botanical extracts are predicted to have a greater need from athletes to improve their gut health.

Restraints

Awareness about diseases, high commodity prices, low economic conditions, and shortage of suitable insurance methods limits the adoption of B2B sports nutrition products across developing regions of the globe. Therefore, announcing new products with low prices and growing efforts for market perforation in these regions can offer profitable growing facilities for the B2B sports nutrition players.

Opportunities

The regular rise in adolescence selecting sports as their career is also vital for the market's expansion. The increasing awareness of diseases, increased risk of damage, absorbing high-fiber nutritious food, and development of e-commerce bases also hit the market growth of sports nutrition—proficiency in R&D, mainly in developing nations that encourage sports nutrition and sports in general. Peoples are more deliberate about physically fit because of greater realization and literacy. Social media thrive with pictures of celebrities and youth posting images of their carved and toned bodies.

Impact of COVID-19

The onset of the Covid-19 outbreak devastated our lives, but it benefitted the expansion of the international market. It transitioned and changed people's mindsets to familiarize themselves and live healthy lives. According to a report, 51% of people and consumers worldwide were concerned and anxious about quickly gaining weight from the pandemic due to laziness, less activity, and replacing nutritious food with junk food.

Thereby, it elevated multiple health issues among people, which led to the intake of several dietary supplements that enabled them to abolish and overcome their unhealthy lifestyles, driving a market expansion.

However, intake was negligible at the onset of the pandemic as all the yoga centers, fitness clubs, and gyms were closed. Eventually, people embarked on taking a withstand for their health, which gradually impacted them. Our post-covid living habits are more health driven, leading to a vast increase in the global client base and need for nutrition. Be it sports persons, athletes, bodybuilders, or people from anywhere who strive to live a healthy life have been involved heavily in strengthening the idea of healthy living by raising the market size and growth of the nutrition industry.

People's option has transformed into an active lifestyle, with more stress on health and fitness, which is crucial in driving the market growth. Consumer rise in sports nutrition is also estimated to expedite with the steady increase in the acceptance of health and protein supplements by youthful and middle-aged people. The magnifying request for plant-based and immunity-enhancing nutritional goods and accessories also adds to the sports nutrition market growth. The persistently increasing rate of obese people has elevated awareness about healthy food and fitness, contributing to the advancement of the sports nutrition market.

Segments Insights:

By Application Insights

Muscle growth dominates the market, as strength training and hypertrophy-focused fitness programs continue to be a major pillar across gyms and sports academies. Products under this segment typically include high-protein formulations, creatine blends, and BCAAs (Branched Chain Amino Acids). Fitness centers use these offerings to improve recovery time and lean mass development, especially in clientele involved in weightlifting or resistance training.

Cognitive repairment and immunity enhancement are the fastest-growing applications, driven by increasing awareness around mental focus, neuroplasticity, and holistic performance. Products in this segment often include adaptogens like ashwagandha, ginseng, and rhodiola, alongside immunity boosters like vitamin C, zinc, and medicinal mushrooms. These blends are now popular not only in endurance sports but also among esports players, students, and executives.

By Distribution Channel Insights

Gyms remain the largest distribution channel, particularly large franchises and national chains that maintain in-house nutrition bars or branded supplement lines. These entities procure directly from B2B manufacturers, ensuring consistency, margin control, and brand alignment. Bulk contracts and exclusive distribution rights are common, supporting long-term vendor relationships.

Sports academies represent the fastest-growing channel, especially in regions like Asia-Pacific and Latin America. Governments and private organizations are heavily investing in athlete development at the youth level. Sports nutrition in these environments is not a retail transaction but a developmental necessity leading to high-volume, long-term, and performance-backed procurement practices.

By Regional Insights

North America dominates the global B2B sports nutrition market, attributed to a mature fitness industry, strong supplement manufacturing capabilities, and widespread acceptance of sports nutrition products in training environments. The U.S. and Canada are home to several top-tier manufacturers with established supply chains and regulatory compliance teams. Moreover, collegiate and professional sports in the U.S. form a robust B2B clientele.

Asia-Pacific is the fastest-growing region, particularly led by emerging health consciousness in India, China, and Southeast Asia. A growing middle class, fitness influencer culture, and rising disposable incomes are making sports nutrition mainstream. Government-led sports programs and increasing gym memberships are translating to B2B procurement opportunities, especially when combined with the region’s strong nutraceutical production ecosystem.

By Recent Developments

-

Glanbia Performance Nutrition (April 2025): Launched a B2B-specific e-commerce portal allowing gyms to customize pre- and post-workout stacks under their branding.

-

NOW Sports (March 2025): Announced a strategic partnership with a chain of boutique fitness studios in Canada to supply immunity-focused protein powders and adaptogenic drinks.

-

NutraBio Labs (February 2025): Rolled out a customizable B2B subscription model for small gyms, offering volume-based pricing and quarterly innovation kits.

-

Myprotein (January 2025): Entered the Asia-Pacific B2B space via a partnership with an Indian fitness chain to offer private-labeled recovery supplements.

-

MuscleTech (December 2024): Invested in an AI-driven logistics system to predict order frequency from B2B customers and reduce delivery lags.

Some of the prominent players in the B2B sports nutrition market include:

- Glanbia Plc.

- Abbott

- PepsiCo

- The Hut Group

- Cardiff B2B Sports Nutrition Limited

- Iovate Health Sciences

- MUSCLEPHARM

- General Nutrition Centers, Inc.

- The Bountiful Company

- Post Holdings, Inc.

- Herbalife International of America, Inc.

- The Bountiful Company

- Clif Bar & Company

- Science in Sport

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global B2B sports nutrition market.

By Application

- Endurance

- Strength Training

- Muscle Growth

- Recovery

- Energy

- Weight Management

- Immunity Enhancement

- Cognitive Repairment

By Distribution Channel

- Gyms

- Fitness Studio

- Sports Academies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)