Big Data Security Market Size and Trends

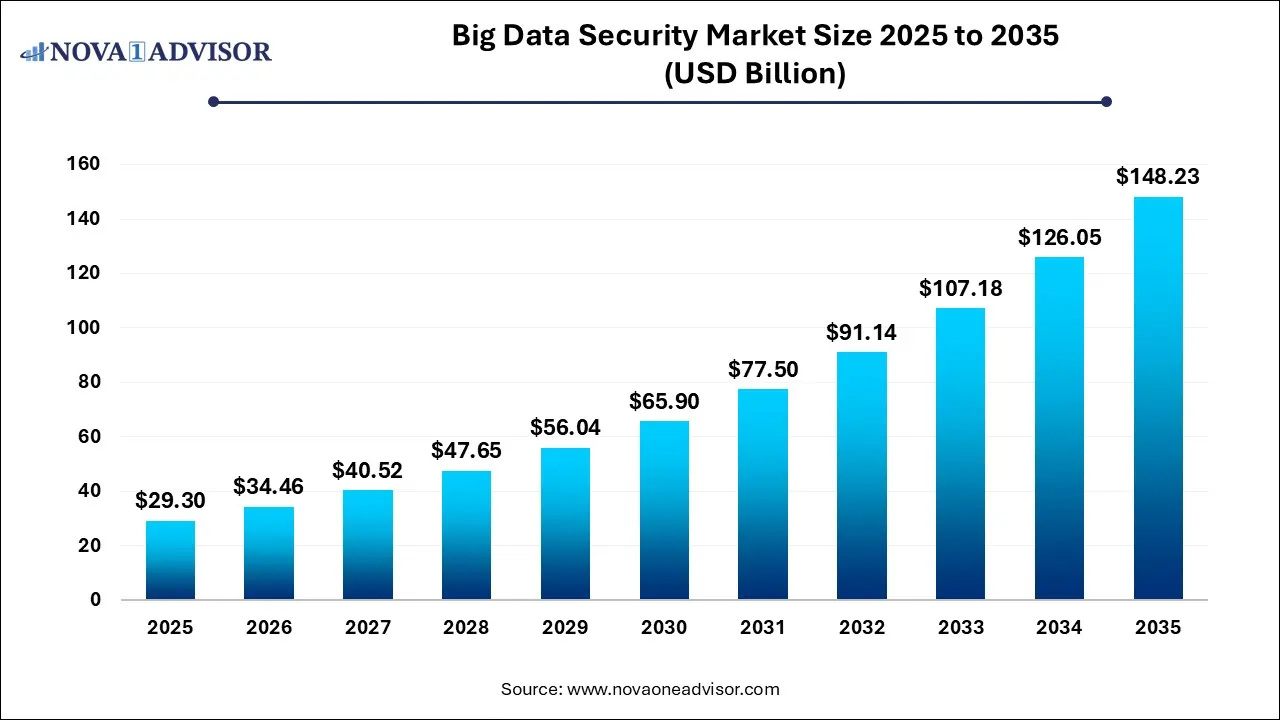

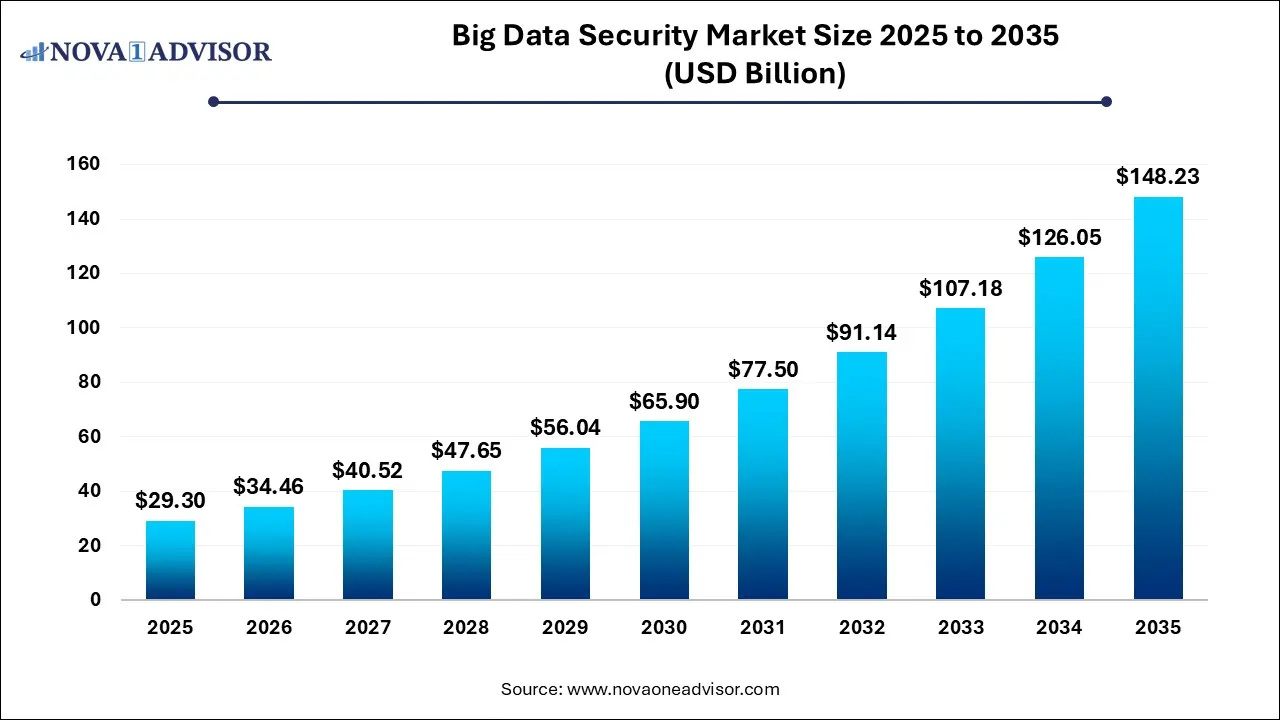

The big data security market size was exhibited at USD 29.30 billion in 2025 and is projected to hit around USD 148.23 billion by 2035, growing at a CAGR of 17.6% during the forecast period 2026 to 2035.

Big Data Security Market Key Takeaways:

- The software segment accounted for the largest market share, over 78%, in the big data security market in 2025.

- The services segment is anticipated to grow at the fastest CAGR over the forecast period.

- The cloud segment accounted for the largest market share in 2025.

- The on-premises segment is anticipated to expand at a compound annual growth rate of over 16% during the forecast period.

- The large enterprises segment accounted for the largest market share of over 72% in 2025.

- The small & medium enterprises (SMEs) segment is anticipated to expand at the fastest CAGR during the forecast period.

- The BFSI segment accounted for the largest market share of over 29.0% in 2025 in the big data security market.

- The IT & ITES segment is anticipated to grow at the highest CAGR during the forecast period.

- North America held the major share of over 43.0% of the big data security market in 2025.

Market Overview

The Big Data Security Market is rapidly evolving as organizations across industries grapple with the exponential growth of data and increasingly sophisticated cyber threats. Big data, characterized by its volume, velocity, and variety, presents unique challenges when it comes to securing sensitive information. Traditional security mechanisms are no longer sufficient to protect the dynamic and distributed nature of modern data ecosystems, especially in hybrid cloud environments.

Organizations are now investing in advanced big data security frameworks that integrate threat intelligence, access control, encryption, anomaly detection, and real-time monitoring to protect data across endpoints, databases, and cloud platforms. With industries like BFSI, healthcare, and telecom relying heavily on large-scale analytics, the emphasis on securing structured and unstructured data has never been greater. Regulatory frameworks such as GDPR, HIPAA, and CCPA have further propelled the adoption of big data security solutions to ensure compliance and minimize the risk of data breaches.

The rise of remote work, IoT devices, and AI-powered analytics is expanding the attack surface, making data-centric security a top enterprise priority. Vendors are responding with scalable solutions that integrate with existing big data platforms such as Hadoop, Spark, and NoSQL databases while offering visibility, auditability, and control across distributed data landscapes.

Major Trends in the Market

-

Shift Toward Unified Data Security Platforms: Enterprises are consolidating multiple security tools into integrated platforms to manage complex big data environments.

-

Adoption of AI and ML in Threat Detection: Artificial intelligence and machine learning are enhancing the speed and accuracy of anomaly and threat detection.

-

Data Security for Hybrid and Multi-Cloud Environments: As data moves across public, private, and hybrid clouds, companies are investing in cloud-native security tools.

-

Zero Trust Architecture: Increasing implementation of zero trust principles to protect data at every level—users, devices, and applications.

-

Data Security Automation: Organizations are automating data classification, tokenization, and compliance checks to improve efficiency and reduce human error.

-

Growth of Data Privacy Regulations: Evolving regulatory landscapes are compelling companies to adopt proactive data protection strategies.

-

Expansion of Managed Security Services: Enterprises are outsourcing big data security operations to MSSPs for cost-efficiency and round-the-clock monitoring.

Report Scope of Big Data Security Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 34.46 Billion |

| Market Size by 2035 |

USD 148.23 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 17.6% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Component, Deployment, Enterprise Size, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Amazon Web Services Inc.; Broadcom; IBM; McAfee LLC; Microsoft; Oracle; Palo Alto Networks; SAS Institute Inc.; Splunk Inc.; Trend Micro Incorporated |

Market Driver: Rising Frequency and Complexity of Data Breaches

The increasing frequency and sophistication of data breaches is a major driver of the big data security market. Cyberattacks targeting sensitive customer and financial data have escalated, with threat actors exploiting vulnerabilities in big data platforms, cloud infrastructure, and distributed networks. For example, high-profile breaches at major financial institutions and healthcare providers have exposed millions of personal records, resulting in significant reputational and financial damage.

In response, organizations are strengthening their security posture by adopting solutions that protect the confidentiality, integrity, and availability of data at rest, in motion, and in use. Encryption, access controls, behavioral analytics, and automated response mechanisms are now being integrated into big data ecosystems to address real-time threats. The need for proactive detection and protection of massive, fast-moving data flows is pushing companies to deploy end-to-end security frameworks designed specifically for big data environments.

Market Restraint: High Implementation and Integration Complexity

A notable restraint in the big data security market is the complexity and cost of implementation and integration. Big data environments are inherently heterogeneous, involving multiple storage formats, distributed processing frameworks, cloud infrastructures, and user roles. Integrating security tools across this complex landscape while maintaining performance and compliance—can be resource-intensive and technically challenging.

Moreover, legacy IT systems may not be compatible with modern security protocols or big data platforms, leading to data silos and visibility gaps. Smaller organizations, in particular, face budget constraints and skill shortages, which can delay or complicate deployment. As a result, many enterprises struggle to implement holistic big data security strategies without affecting system performance or introducing operational friction.

Market Opportunity: Rising Demand for Data Security in AI-Driven Analytics

An emerging opportunity lies in securing AI and ML workloads that depend on vast volumes of sensitive data for training and inference. As AI becomes more integrated into decision-making and operations particularly in industries like healthcare, finance, and smart cities—the need to safeguard the underlying data becomes paramount.

Securing AI pipelines involves not only protecting datasets but also securing training environments, model integrity, and inference outputs. The use of synthetic data, homomorphic encryption, federated learning, and confidential computing are opening new avenues for data security in AI workflows. Vendors that can deliver robust security solutions for AI-driven big data analytics—while maintaining scalability and performance—stand to capture significant market share.

Big Data Security Market By Component Insights

Software solutions dominate the market, particularly those focused on encryption, access control, monitoring, and compliance. Within this segment, data encryption, tokenization, and masking are widely deployed to protect sensitive data in transit and at rest. Data security analytics is another rapidly expanding category, offering advanced insights into user behavior, policy violations, and intrusion attempts using machine learning.

Services are the fastest-growing component, with managed services leading the way. Organizations are increasingly outsourcing complex security tasks such as monitoring, patch management, threat detection, and compliance audits to third-party specialists. Professional services, including risk assessments, security architecture design, and policy development, are also in high demand, especially among enterprises undergoing digital transformation.

Big Data Security Market By Deployment Insights

On-premises deployment dominates, especially among large enterprises and highly regulated industries such as BFSI and government. These sectors prioritize data sovereignty, internal control, and legacy system integration, making on-prem solutions preferable. On-prem deployments offer better performance and customized security controls but come with higher CapEx.

Cloud deployment is the fastest-growing, fueled by the rapid adoption of cloud-native applications and storage. Cloud-based big data platforms such as AWS, Azure, and Google Cloud have become mainstream, necessitating robust cloud-native security frameworks. These solutions offer scalability, flexibility, and faster time-to-market, especially for SMEs and digital-native companies.

Big Data Security Market By Enterprise Size Insights

Large enterprises hold the largest market share, owing to their extensive data infrastructures, regulatory responsibilities, and budgetary capacity. These organizations deploy multi-layered security architectures and often lead in adopting emerging technologies like AI-driven analytics and quantum encryption.

SMEs represent the fastest-growing segment, as they embrace big data analytics for competitive advantage. Cloud-based security tools, SaaS offerings, and managed services have made it more accessible for SMEs to adopt enterprise-grade protection without heavy upfront investments.

Big Data Security Market By End-use Insights

BFSI is the dominant industry vertical, due to the sector’s strict compliance requirements and high sensitivity of financial data. With increasing digitization of banking, insurance, and financial trading platforms, security tools such as real-time monitoring, data masking, and encryption are standard in modern BFSI infrastructure.

Healthcare & Life Sciences is the fastest-growing end-use sector, driven by the digitization of health records, remote care, and genomics research. The surge in telehealth and wearable devices has expanded the attack surface, necessitating robust data privacy solutions to meet HIPAA and other international standards. Real-time security analytics and data classification tools are gaining traction in this domain.

Big Data Security Market By Regional Insights

North America leads the big data security market, owing to its advanced IT infrastructure, high concentration of data-intensive enterprises, and stringent regulatory landscape. The U.S. hosts several major cybersecurity and cloud service providers, including IBM, Microsoft, Palo Alto Networks, and AWS, which actively innovate in big data protection.

Enterprises in the region are early adopters of AI, blockchain, and advanced analytics, further expanding the need for robust security. U.S. financial institutions, healthcare providers, and federal agencies prioritize security investments, particularly following high-profile breaches like the SolarWinds and Colonial Pipeline incidents. The region’s combination of innovation, regulation, and threat exposure underpins its dominant market position.

Asia Pacific is the fastest-growing region, driven by rapid digitalization, urbanization, and the expansion of cloud computing across economies like China, India, Singapore, and Australia. As businesses shift to cloud-based operations and digital payments, cybersecurity threats have surged, prompting increased investment in data-centric security tools.

Governments across the region are strengthening data protection laws—such as India’s DPDP Act and China’s PIPL—thereby pushing enterprises to prioritize compliance-driven security. Tech startups, e-commerce platforms, and telecom providers in Asia Pacific are particularly aggressive in adopting encryption, access management, and behavior analytics tools to protect vast customer datasets.

Some of the prominent players in the big data security market include:

Recent Developments

-

March 2025: Microsoft Azure launched a new suite of AI-powered big data security analytics tools, integrated with Sentinel, to detect anomalous behavior in real-time across hybrid environments.

-

February 2025: IBM Security unveiled enhanced data masking and quantum-safe encryption modules for hybrid cloud deployments, aimed at the BFSI and healthcare sectors.

-

January 2025: McAfee Enterprise announced a strategic partnership with AWS to offer a unified security management dashboard for big data workloads hosted in the cloud.

-

December 2024: Palo Alto Networks expanded its Cortex XSOAR platform with automated big data threat detection workflows tailored for telecom and ITES enterprises.

-

November 2024: Symantec (Broadcom) rolled out a data loss prevention (DLP) engine specifically designed to secure unstructured data in Hadoop and NoSQL environments.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the big data security market

By Component

-

- Data Authorization & Access

- Data Discovery & Classification

- Data Encryption, Tokenization, and Masking

- Data Governance & Compliance

- Data Auditing & Monitoring

- Data Backup & Recovery

- Data Security Analytics

-

- Managed Services

- Professional Services

- Training, Support, and Maintenance

By Deployment

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-use

- BFSI

- Utilities

- IT & ITES

- Healthcare & Life Sciences

- Retail & Ecommerce

- Telecom

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)