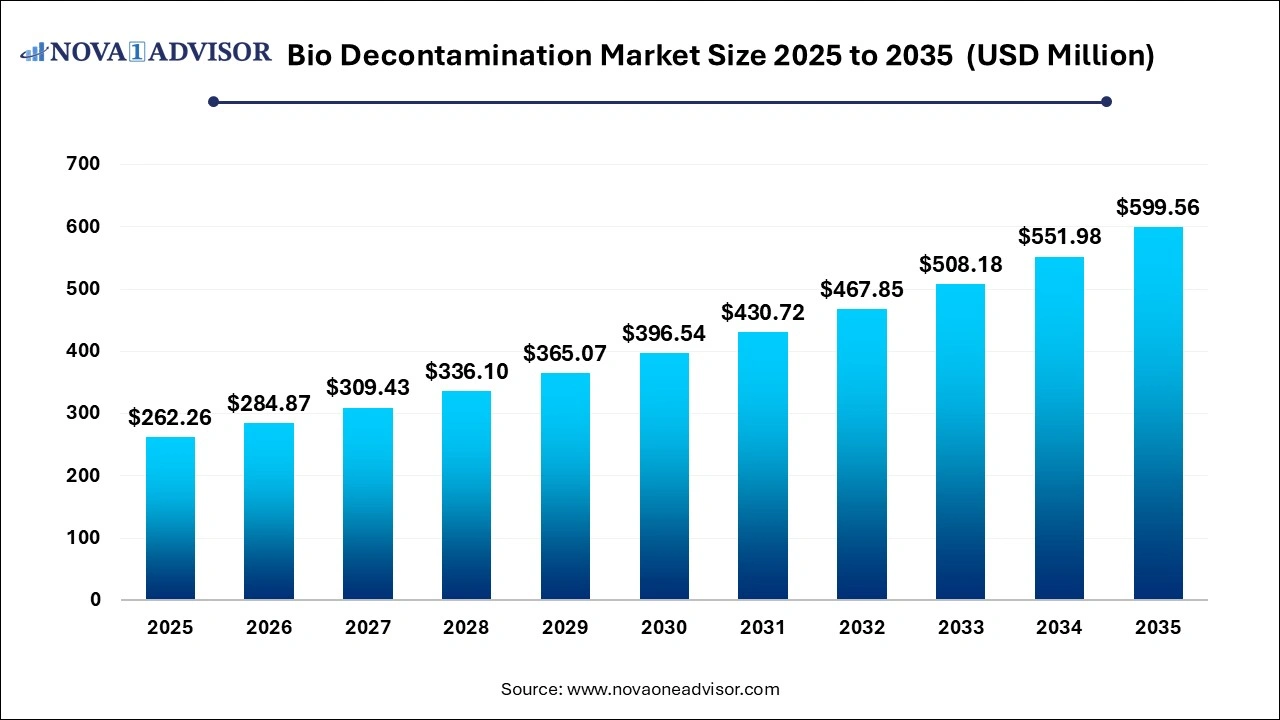

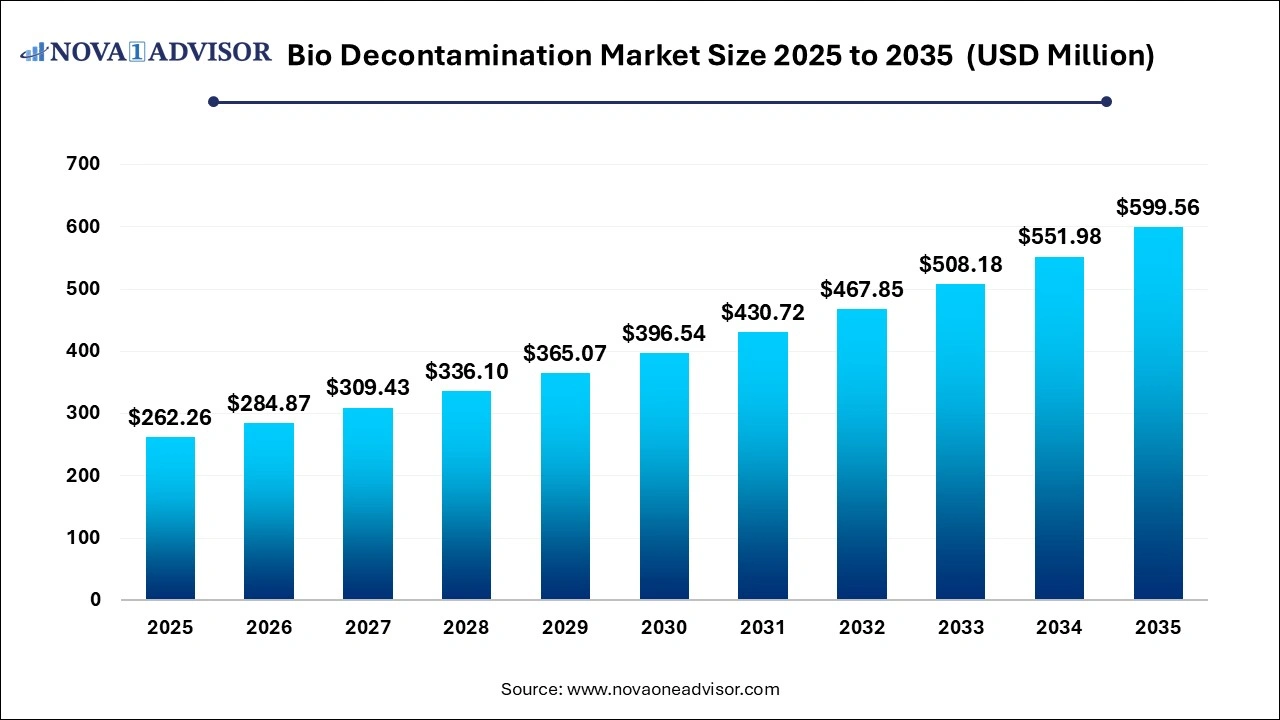

Bio Decontamination Market Size, Growth and Trends 2026 to 2035

The global Bio Decontamination market size was estimated at USD 262.26 million in 2025 and is expected to surpass around USD 599.56 million by 2035 and poised to grow at a compound annual growth rate (CAGR) of 8.62% during the forecast period 2026 to 2035.

Bio Decontamination Market Outlook

- Market Growth Overview: The bio decontamination market is expected to grow significantly between 2026 and 2035, driven by the rising surgical procedures, advancement in technology, and rising surgical procedures.

- Sustainability Trends: Sustainability trends involve green agent and sustainable agents, energy efficient technology, and reduced waste and efficiency.

- Major Investors: Major investors in the market include Ecolab Inc., STERIS plc, and TOMI Environmental Solutions, Inc.

Report Scope of the Bio Decontamination Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 284.87 Million |

| Market Size by 2035 |

USD 599.56 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 8.62% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By Agent Type, By Type, By End User |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

STERIS PLC:, Ecolab, TOMI Environmental Solutions, Inc, Technology (BIT) |

COVID-19 Impact

Factors such as the increasing demand for hospital beds and ICUs, the proliferation of isolation facilities, and the increasing awareness among consumers on bio decontamination products & services for medical devices and healthcare facilities have boosted the demand for bio decontamination products and services.

Further, in 2021, bio decontamination services were used by hospitals to convert COVID-19 wards to normal wards. For instance, Bioquell’s rapid bio decontamination service (RBDS) aided in returning the emergency COVID-19 ward to general use.

Also, COVID-19 has also impacted companies’ revenue in 2020 operating in the bio decontamination market. For instance, sales of Bioquell Global Healthcare & Life Sciences increased by 22% in 2020 due to strong demand for bio decontamination products. However, the segmental revenue declined by 4% in 2021 due to the decreased severity of COVID-19.

Bio Decontamination Market Dynamics

Driver

Growth in pharmaceutical & biotechnology industries

Bio decontamination equipment, services, consumables, and accessories are widely used in pharmaceutical companies, especially in parenteral (injectable) manufacturing. According to the European Federation of Pharmaceutical Industries & Associations (EFPIA), the global pharmaceuticals were USD 1,077,856 in 2020. Furthermore, according to the Pharmaceutical Executive, the top 15 pharmaceutical companies invested USD 133 billion in 2021 in R&D expenditure. With the rising R&D expenditure and the increasing focus on the development of new therapeutic and diagnostic products, the demand for state-of-the-art facilities equipped with modern machines & instruments and a properly decontaminated environment (for efficient & effective research and manufacturing) is expected to increase in the coming years. This is considered a positive indicator for the growth of the bio decontamination market during the forecast period.

Opportunity

Growing healthcare sector and increasing outsourcing in emerging economies

Emerging markets, such as India and China, are considered cost-saving hubs by developed countries. During the last decade, businesses in developed markets, such as the US and Europe, have outsourced their manufacturing and packaging operations to China, South Korea, Taiwan, and India to leverage the lower labor costs and less-stringent government regulations in these countries. As these countries are becoming major manufacturing hubs, there is a greater focus on quality parameters and the adoption of technologically advanced products to cater to customer requirements. Consequently, the adoption of bio decontamination products & services is growing across many industries in these countries

Restraint

Presence of manual bio decontamination methods and budgetary constraints in healthcare facilities

Some of the common manual bio decontamination processes include spraying, manual cleaning with bleach or formaldehyde, and wiping with a suitable agent. Even though these methods have disadvantages, such as difficulties in the removal of residuals and difficulty in ensuring coverage over the entire area (particularly in rooms), they are still being used in various developing countries owing to their cost advantages. Also, hospitals and healthcare facilities in some developing and underdeveloped countries still have a low priority level for bio decontamination, as the healthcare infrastructure development in these countries focuses more on capital investments in medical devices and facility expansion. This is one of the major factors restraining the growth of the bio decontamination market in these countries.

Bio Decontamination Market Segmental Insights

By Product Insights

How did the Equipment Segment Dominate the Bio Decontamination Market?

The equipment segment is driven by the high capital investment required for automated, high-efficiency systems like vapor generators and isolators. Stringent regulatory standards in pharmaceutical manufacturing mandate these advanced technologies to ensure sterile production and compliance with GMP requirements. The rising hospital-acquired infection rates are driving significant investment in rapid-response hardware for operating rooms and cleanrooms.

How did the Consumables Segment Expect to Hold the Fastest-Growing Bio Decontamination Market in the Coming Years?

The consumables segment is driven by the expansion of cell and gene therapy manufacturing necessitates intense, ongoing protocols, ensuring a constant and accelerating need for high-quality decontamination supplies. Stringent regulatory pressure for validated 6-log bioburden reduction is also shifting the market toward specialized, single-use sterile barriers and rapid-result biological indicators.

By Agent Type Insights

How did the Hydrogen Peroxide Segment Account for the Largest Share in the Bio Decontamination Market?

The hydrogen peroxide segment is driven by its high antimicrobial efficacy and unique ability to decompose into non-toxic water and oxygen. The widespread adoption of vaporized hydrogen peroxide (VHP) systems has revolutionized the sterilization of delicate instruments and cleanrooms through efficient, low-temperature automation. Increasing regulatory stringency in pharmaceutical and healthcare sectors further mandates the use of such safe, residue-free agents for high-level disinfection.

How did the Chlorine Dioxide Segment Expect to Hold the Fastest-Growing Bio Decontamination Market in the Ccoming Years?

The chlorine dioxide segment is driven by its high-water solubility and superior efficacy make it ideal for preventing mold and biofilm in diverse industrial environments. Increasing demand for advanced water treatment in the pharmaceutical and food and beverage sectors is significantly boosting its market adoption. Supported by EPA and ECHA regulations, it is being positioned as a safer, more effective alternative to traditional disinfectants for large-scale decontamination.

By Type Insights

How did the Chamber Decontamination Sgment Account for the Notable Share in the Bio Decontamination Market?

The chamber decontamination segment is driven by the strict validation and consistency required by pharmaceutical and biotech companies for aseptic manufacturing. These automated systems significantly enhance operational efficiency by enabling rapid, repeatable sterilization of complex equipment, far outpacing traditional manual methods. The surge in drug development is driving sustained investment in vaporised hydrogen peroxide (VHP) generators and specialized research chambers.

By End User Insights

How did the Pharmaceutical and Medical Device Manufacturing Companies Segment Account for the Largest Share in the Bio Decontamination Market?

The pharmaceutical & medical device manufacturing companies segment is driven by the absolute necessity of good manufacturing practices (GMP) and validated sterility in biopharma production. The rise of personalized medicine and biologics has mandated heavy investment in integrated room decontamination and automated hydrogen peroxide vapor (HPV) systems for cleanrooms and isolators. With growing allocated to R&D, these firms maintain high-volume expenditure on the continuous validation and decontamination of sophisticated laboratory equipment.

How did the Life Sciences & Biotechnology Research Organizations Segment Account for the Fastest CAGR in the Bio Decontamination Market?

The life sciences & biotechnology research organizations segment is driven by the expansion of advanced therapies necessitates continuous, high-level sterilization to ensure product purity and patient safety. The industry is shifting toward automated vaporized hydrogen peroxide (VHP) systems, which provide the validated, residue-free decontamination required for complex cleanroom and isolator environments. The advancement in cell and gene therapy R&D reinforces the critical need for advanced bio-decontamination as a fundamental component of modern manufacturing excellence.

Bio Decontamination Market Regional Insights

In 2025, North America accounted for the largest share of the bio decontamination market

The global bio decontamination market is segmented into four major regions namely, North America, Europe, the Asia Pacific, and Rest of the World. North America accounted for the largest share of the bio decontamination market in 2021. Factors such as the increasing incidence of HAIs, presence of key players, and the rising number of surgical procedures are contributing to the large share of this regional segment.

Some of the prominent players in the Bio Decontamination Market include: Steris PLC (US), Ecolab (US), TOMI Environmental Solutions, Inc (US), JCE Biotechnology (France), Fedegari Autoclavi SpA (Italy), Zhejiang TAILIN Bioengineering Co., LTD (US), Howorth Air Technology Ltd. (UK), Solidfog Technologies (Belgium), ClorDiSys Solutions, Inc. (US), Amira SRL (Italy), Noxilizer, Inc. (US), Tecomak (UK), DIOP GmbH & Co. KG (Germany), AM Instruments srl (Italy), Allen & Company Environmental Services (US), Sychem Limited (UK), Controlled Contamination Services (US), Klenzaids (India), Curis Decontamination (US), IHSS Ltd (UK), METALL+PLASTIC GmbH (Germany), Bio Decontamination Ltd (UK), Syntegon Technology GmbH (Germany), The Ecosense Company (US), Reatorg (Russia),and CLEAMIX (Finland).

Key Players in the Bio Decontamination Market

- STERIS PLC: STERIS is a global leader in infection prevention, offering a broad portfolio of Vaporized Hydrogen Peroxide (VHP) generators, equipment, and services that provide high-level decontamination for pharmaceutical, biotechnology, and research facilities.

- Ecolab: As a market leader, Ecolab utilizes its Bioquell technology to offer automated, high-log, residue-free vaporized hydrogen peroxide decontamination services and equipment for cleanrooms, isolators, and pharmaceutical manufacturing lines.

- TOMI Environmental Solutions, Inc.: TOMI specializes in rapid, cost-effective surface and airborne decontamination through its patented Binary Ionization Technology (BIT) platform, which utilizes ionized hydrogen peroxide (iHP) to eradicate bacteria, viruses, and fungi.

- JCE Biotechnology: JCE Biotechnology designs and manufactures specialized, high-level surface bio-decontamination systems specifically for cleanrooms, isolators, and transfer airlocks in pharmaceutical and laboratory environments.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the global Bio Decontamination market

By Product

- Equipment

- Services

- Consumables

By Agent Type

- Hydrogen Peroxide

- Chlorine Dioxide

- Peracetic Acid

- Nitrogen Dioxide

By Type

- Chamber Decontamination

- Room Decontamination

By End User

- Pharmaceutical & Medical Device Manufacturing Companies

- Life Sciences & Biotechnology Research Organizations

- Hospitals & Healthcare Facilities

By Region

- North America

- Europe

- Germany

- France

- United Kingdom

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa