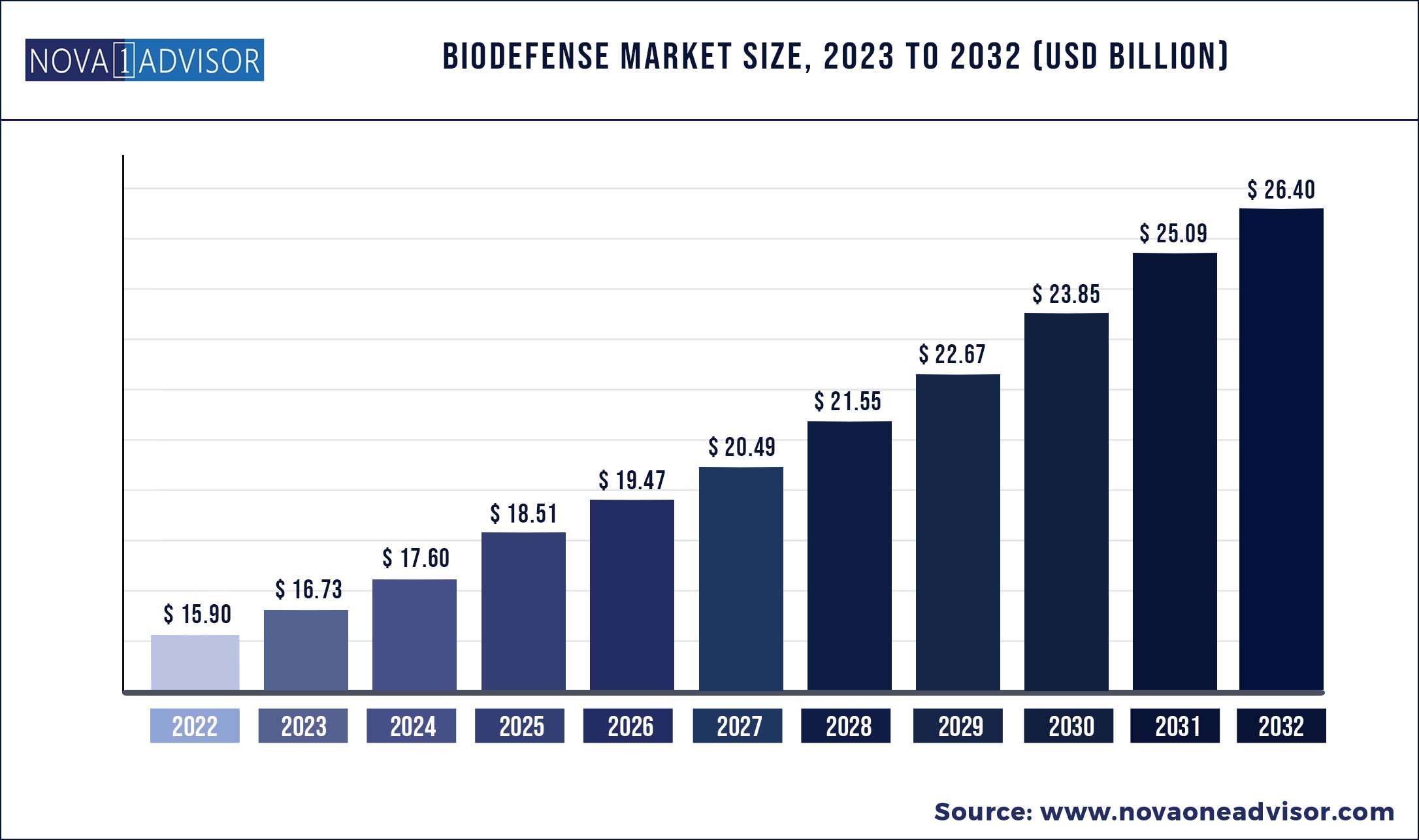

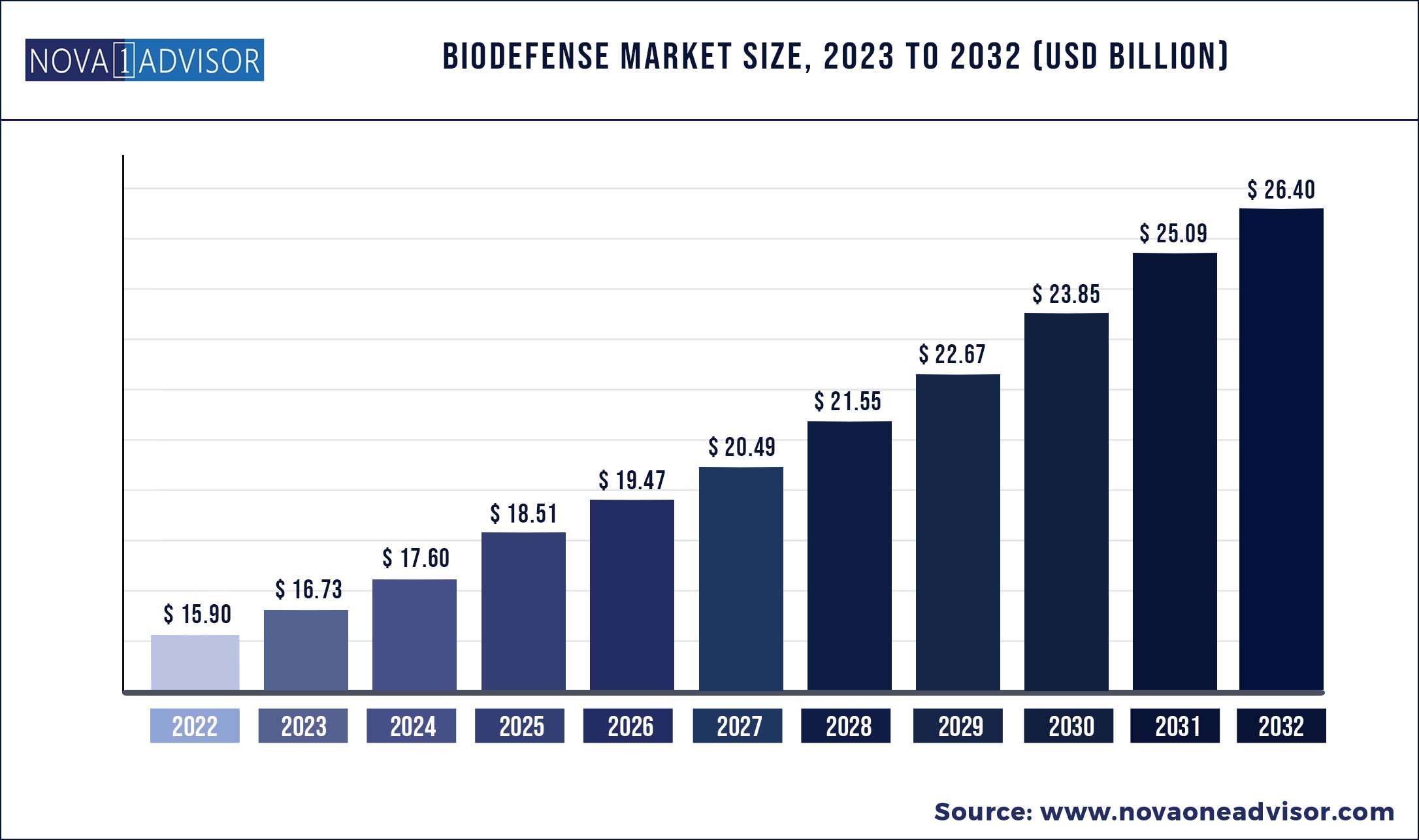

The global biodefense market size was exhibited at USD 15.9 billion in 2022 and is projected to hit around USD 26.40 billion by 2032, growing at a CAGR of 5.2% during the forecast period 2023 to 2032.

Key Pointers:

- The anthrax segment held the largest market share of 28.9% in 2022 and is expected to grow at a significant CAGR over the forecast period.

- The other product segment is expected to be the fastest-growing segment with a 6.3% CAGR over the forecast

- North America dominated the Biodefense market capturing an 86.9% market share in 2022

- This percentage of funding to DoD is proposed to increase to 48.11% in 2019.

- Asia Pacific is expected to witness the highest CAGR of 9.2% over the forecast period

Biodefense Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 16.73 Billion

|

|

Market Size by 2032

|

USD 26.40 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 5.2%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Product

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

XOMA corporation; Altimmune Inc. Emergent Biosolutions Inc.; Dynavax Technologies Corporation; SIGA Technologies; Elusys Therapeutics Inc.; Ichor Medical Systems; Dynport Vaccine Company; Cleveland Biolabs; Bavarian Nordic; Ology Bioservices; Alnylam Pharmaceuticals Inc.

|

Biodefense is a set of medical or military measures. These are taken in response to the demand for restoring the biosecurity of a country against biological toxins or infectious agents. The agents can be used with the intent to kill or infect humans, animals, or the environment and to instigate biological warfare. Biological agents used during bioterrorism are usually living organisms. These can include bacteria, viruses, fungi, or toxins that are deliberately used to sicken and kill creating social and economic turmoil. Factors such as the presence of favorable government initiatives in the U.S., growing investment from private players, increased government focus and funding towards biodefense strategies, and the growing prevalence of various agents such as the Ebola virus, Zika virus, and flu are driving the overall market growth.

The advent of technological advancements in the field of genetic engineering and biotechnology in the last decades has offered ease in modification of these fatal, and naturally occurring viruses which can be re-engineered to cause devastation. Moreover, these organisms can be easily obtained which makes biodefense a crucial aspect for countries around the world. Biological agents that have been used as a carrier for bioterrorism in the past include anthrax, botulism, and chemical & nuclear agent. This led to serious economic loss.

These instances drove governments around the world to engage in biodefense acts, treaties, and policies to counter biological threats, reduce risks, and prepare for, respond to, and recover from bioterrorism incidents. Since the anthrax bio-terrorism act that was carried out in 2001 through the mail, the National Institute of Infectious disease has played a vital role in developing medical products and strategies to counter bioterrorism and emerging and re-emerging infectious diseases by carrying out continuous research to diagnose, treat, and prevent them, whether deliberate or naturally occurring.

Governments of many countries remain committed to collaboration with several international partners to support response activities and increase preparedness. For instance, an experimental single-dose Ebola vaccine manufactured by Merck [rVSV-ZEBOV-GP] has been authorized for safe use by the World Health Organization and DRC MoH. As of November 17, 2019, approximately 250,000 persons at risk for Ebola have been vaccinated.

Developed economies are sending aid to countries with weak medical infra and low research capabilities many companies like Bavarian Nordic and Ology Bioservices are researching Ebola and Zika virus. The introduction of the Project BioShield Act was a strategic decision to increase funding for procuring, developing, and utilizing medical countermeasures against biological, chemical, radiological, and nuclear (CBRN) warfare agents. These above-mentioned factors and the rising risk of prevalence of the infectious disease is expected to boost the market growth.

Some of the prominent players in the Biodefense Market include:

- XOMA corporation

- Altimmune Inc.

- Emergent Biosolutions Inc.

- Dynavax Technologies Corporation.

- SIGA Technologies.

- Elusys Therapeutics Inc.

- Ichor Medical Systems.

- Dynport Vaccine Company.

- Cleveland Biolabs.

- Bavarian Nordic.

- Ology Bioservices.

- Alnylam Pharmaceuticals Inc

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Biodefense market.

By Product

- Anthrax

- Smallpox

- Botulism

- Radiation/Nuclear

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)