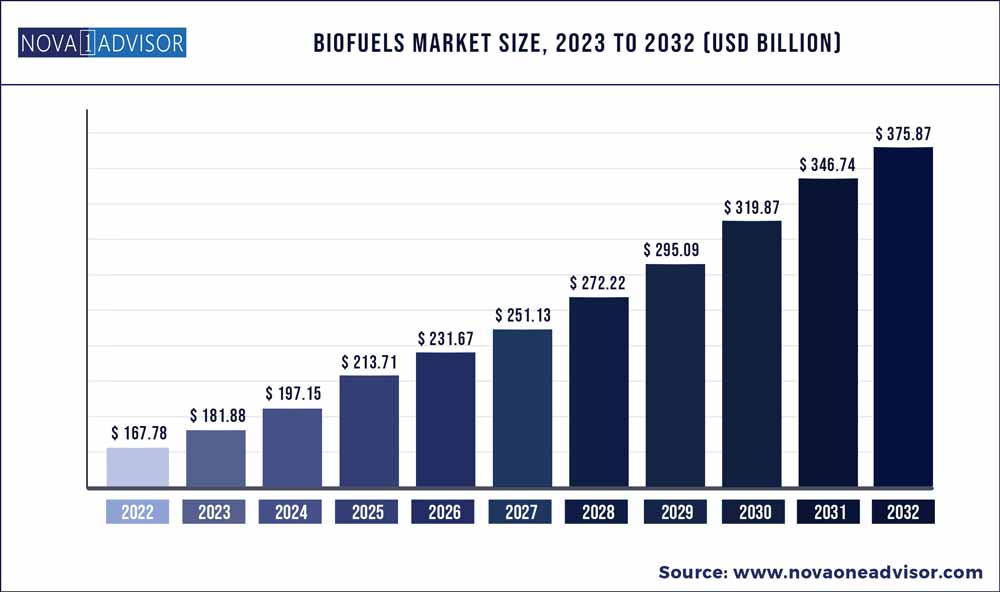

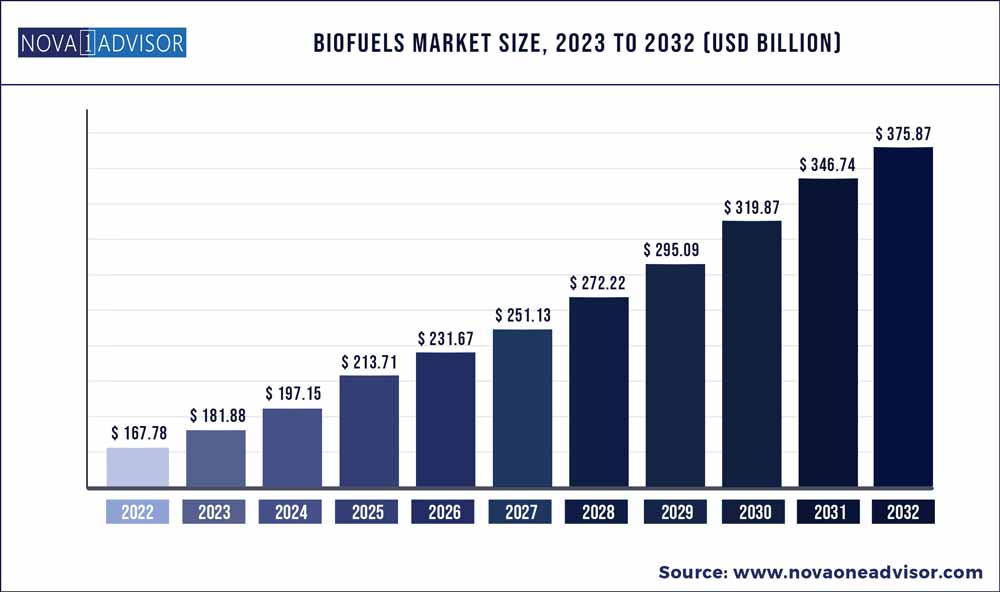

The global Biofuel market size was exhibited at USD 167.78 billion in 2022 and is projected to hit around USD 375.87 billion by 2032, growing at a CAGR of 8.4% during the forecast period 2023 to 2032.

Key Pointers:

- The biofuel market, the bioethanol segment held major share of 68.9% in 2022.

- The vegetable oil segment dominated the global biofuel market and accounted for 29.19% share in 2022.

- North America accounted for prominent share of 39.1% of the global market in 2022.

- These regions held 27.3% and 9.5 % share of the global market, respectively, in 2022.

Biofuel is derived from organic matter such as plants, algae, and animal waste. It plays an important role in reducing carbon dioxide emissions. Biofuels are renewable alternatives to conventional fuels such as gasoline, diesel, and kerosene. They can be used in passenger vehicles, trucks, ships, and airplanes. Currently, ethanol and biodiesel are the two common types of liquid biofuels. Ethanol is produced from corn and cellulosic feedstock such as crop residues and wood. Algae biofuels are an alternative to commonly known biofuel sources, such as corn and sugarcane. Vegetable oils, yellow grease, used cooking oils, or animal fats are used in the production of renewable diesel.

Biofuel Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 181.88 Billion

|

|

Market Size by 2032

|

USD 375.87 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 8.4%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Type, Feedstock, End-use

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

Dow, Cargill, Inc., Archer-Daniels-Midland Company, BTG International Ltd., Renewable Energy Group, Inc., Enerkem, Drax Group, EnviTec Biogas AG, Green Plains, AR Energy Group, Abengoa Bioenergy SA, and VERBIO Vereinigte BioEnergie AG

|

Rise in Adoption of Renewable Energy Augmenting Market Demand for Biofuel

Biofuels can be used to limit greenhouse gas (GHG) and CO2 emissions. Fossil fuels are the main source of global warming. Adoption of biofuels can lead to lower GHG emissions, depending on the source and its circumstances. Thus, liquid biofuels help improve local air quality, reduce bio-waste, and protect ecosystems. Regulatory policies such as the Renewable Fuel Standard, a federal program that requires transportation fuel sold in the U.S. to contain a minimum volume of renewable fuels, encourage the adoption of biofuels. The EU Renewable Energy Directive (RED) stipulates that biofuels should have at least 50% lower emissions than their fossil fuel alternatives for installations in operation before October 2015, and 60% for installations starting after this date, rising to 65% lower for biofuel plants commencing operation after 1 January 2022.

Increase in the R&D of biofuels is expected to augment the global market during the forecast period. In October 2022, a study ‘Efficient process for xylitol production from nitric acid pretreated rice straw derived pentosans by Candida tropicalis GS18’, published in the Biomass and Bioenergy Journal identified a potential Candida tropicalis strain for efficient xylitol production. Xylitol is a natural sugar alcohol. Rye straw can be converted into fuel and xylitol.

Supply Security and Risk Abatement of Conventional Oil

Crude oil reserves are mostly concentrated in Middle East & Africa, the Americas, and Asia Pacific. However, reserves in these regions are witnessing high pressure due to rise in demand for fuel worldwide. This could be a basis for future conflicts between oil-producing nations aiming to secure remaining reserves for themselves. Thus, diversification of energy sources is a robust solution for risk abatement in this situation. South America, Russia, and Sub-Saharan Africa are some of the largest producers of biomass. Of these regions, only Russia has major fossil fuel deposits. Crude oil prices are volatile as natural and manmade events can potentially disrupt the supply of oil & gas. These include geopolitical risks, sanctions, crude inventory draws, and speculative positioning by oil producers. Therefore, other regions and countries are significantly investing in renewable energy to reduce their dependency on oil reserves.

Increase in Adoption of Bioethanol in Vehicles

In terms of type, the global biofuel market has been segregated into biodiesel, bioethanol, bio-heavy oil, and others. According to recent trends in the biofuel market, the bioethanol segment held major share of 68.9% in 2022. It is estimated to dominate the market during the forecast period. Bioethanol is a renewable fuel produced from various plant materials. It is used as a blending agent with gasoline to increase octane and cut down carbon monoxide and other smog-causing emissions. E10 is the most common blend of ethanol and is approved for use in most conventional gasoline-powered vehicles. Bioethanol is made from plant starches and sugars, particularly corn starch.

Rise in Production of Biofuel from Vegetable Oils

Based on feedstock, the global biofuel market has been classified into corn, sugarcane, vegetable oil, palm oil, and others. The vegetable oil segment dominated the global biofuel market and accounted for 29.19% share in 2022. Biodiesel can be produced from vegetable oils such as sunflower, soybean, rapeseed, and castor oil. Biodiesel production from vegetable oils is eco-friendly, as it recycles waste cooking oil and provides renewable energy with lower pollution.

Global Biofuel Market Regional Outlook

North America accounted for prominent share of 39.1% of the global market in 2022. Implementation of stringent regulations is expected to boost adoption of biofuels in the region in the next few years. Under the Energy Independence and Security Act of 2007 of the U.S., the Renewable Fuel Standard mandates that 36 billion gallons per year (bg/y) of biofuels need to be produced by 2023.

Future of the biofuel market in Asia Pacific and Europe is promising with the rise in production of liquid biofuels in Southeast Asia and increase in launch of ethanol-powered vehicles. These regions held 27.3% and 9.5 % share of the global market, respectively, in 2022. Middle East & Africa and Latin America are relatively minor markets for biofuel compared to other regions.

Key Developments in Global Biofuel Market

- In May 2019, United Airlines strengthened its reputation as the world's most environmentally conscious airline by renewing its contract with the U.S.-based World Energy. United Airlines agreed to purchase up to 10 million gallons of cost-competitive, commercial-scale, sustainable aviation biofuel over the next two years.

- In January 2019, ExxonMobil Corporation and Renewable Energy Group (REG) announced the signing of a joint research agreement with Clariant to evaluate the potential use of cellulosic sugars from sources such as residues and agricultural waste to produce biofuel

Key players have been profiled in the biofuel market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Some of the prominent players in the Biofuel Market include:

- Dow

- Cargill, Inc.

- Archer-Daniels-Midland Company

- BTG International Ltd.,

- Renewable Energy Group, Inc.

- Enerkem

- Drax Group PLC

- EnviTec Biogas AG

- Green Plains

- AR Energy Group

- Abengoa Bioenergy SA

- VERBIO Vereinigte BioEnergie AG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Biofuel market.

By Type

- Biodiesel

- Bioethanol

- Bio-heavy Oil

- Others

By Feedstock

- Corn

- Sugarcane

- Vegetable Oil

- Palm Oil

- Others

By End-use

- Transport

- Heat

- Electricity

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)