The global biofuels market size was exhibited at USD 99.54 billion in 2023 and is projected to hit around USD 292.99 billion by 2033, growing at a CAGR of 11.4% during the forecast period of 2024 to 2033.

.jpg)

Key Takeaways:

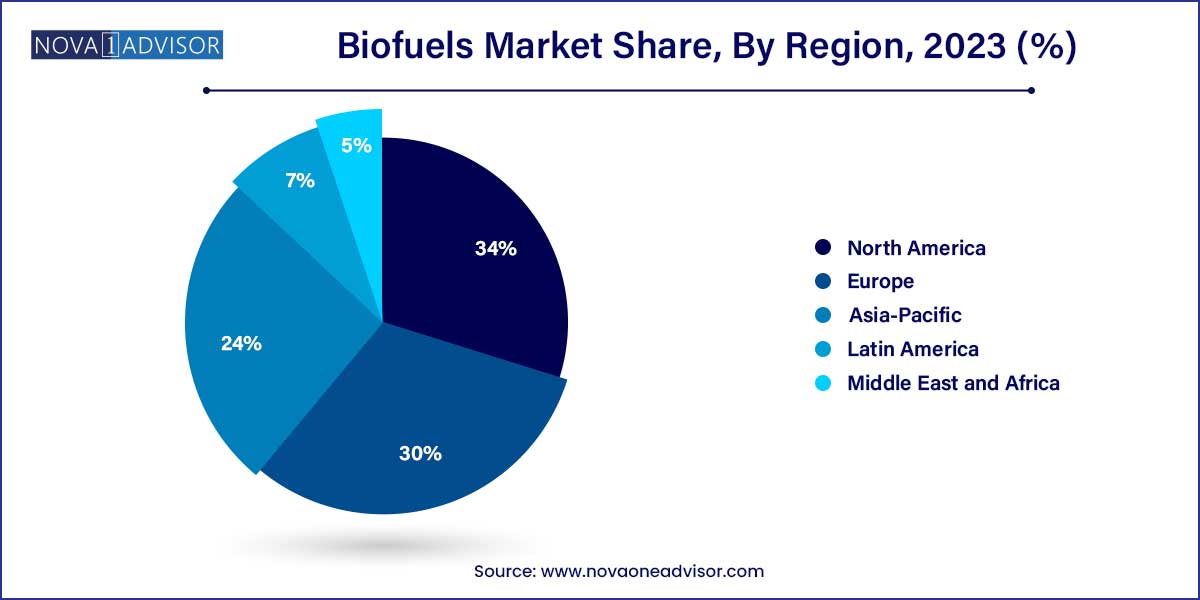

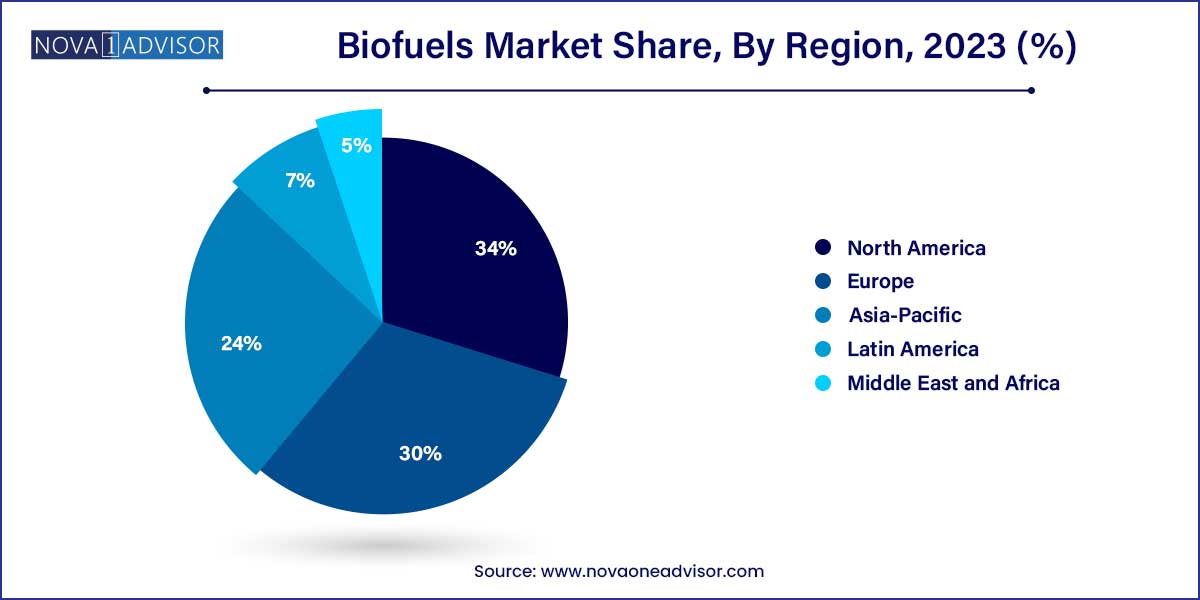

- North America emerged as the largest region, with a revenue share of more than 33.0% in 2023

- Ethanol was the leading segment, with nearly a quarter of the market share in 2023.

- Based on form, liquid biofuel emerged as the largest segment with a revenue share of over 44.0% in 2023

- First generation (conventional) biofuels held close to 84% of the global biofuels market share in 2023.

- The other segment dominated the global market with a maximum revenue share of more than 47.0% in 2023.

- The transportation segment dominated the market with a maximum revenue share of over 71.0% in 2023.

Biofuels Market: Overview

In an era marked by growing environmental consciousness and the need for sustainable energy solutions, the biofuels market stands as a beacon of innovation and opportunity. This comprehensive overview delves into the multifaceted landscape of biofuels, examining its evolution, current trends, challenges, and future prospects.

Biofuels Market Growth

The growth of the biofuels market is fueled by several key factors. Firstly, escalating environmental concerns and the imperative to reduce greenhouse gas emissions drive demand for sustainable energy alternatives like biofuels. Secondly, supportive government policies, including mandates, subsidies, and tax incentives, play a pivotal role in fostering market expansion by incentivizing investment and adoption. Additionally, advancements in technology and process optimization enhance the efficiency and cost-effectiveness of biofuel production, making them increasingly competitive with traditional fossil fuels. Moreover, growing concerns about energy security and the volatility of oil prices underscore the importance of diversifying the energy mix through the utilization of renewable resources like biofuels. Lastly, shifting consumer preferences towards eco-friendly products further drive the demand for biofuels, as individuals seek to align their purchasing decisions with sustainability goals.

Biofuels Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 99.54 Billion |

| Market Size by 2033 |

USD 292.99 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Feedstock, Form, Generation, Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Archer Daniels Midland Company; Green Plains Inc.; Petrobras; Valero Energy Corp.; Alto Ingredients Inc.; Gevo; Butamax Advanced Biofuels LLC; Wilmar International Ltd.; Renewable Energy Group, Inc.; Bunge North America, Inc.; Royal Dutch Shell Plc; CropEnergies AG; Air Liquide; Scandinavian Biogas Fuels International AB; Abengoa. |

Biofuels Market Dynamics

- Environmental Concerns and Regulatory Support:

The biofuels market is profoundly influenced by escalating environmental concerns and stringent regulatory measures aimed at curbing greenhouse gas emissions. With increasing awareness of climate change and air pollution, there is a growing preference for low-carbon alternatives like biofuels, which offer significant reductions in carbon dioxide emissions compared to fossil fuels. Government policies, such as renewable fuel standards and carbon pricing mechanisms, further bolster market growth by incentivizing the production and consumption of biofuels.

- Technological Innovations and Research Efforts:

Another critical dynamic shaping the biofuels market is the continuous pursuit of technological innovations and research efforts to enhance production efficiency, feedstock diversity, and sustainability. Advancements in biofuel production technologies, such as cellulosic ethanol and algae-based biofuels, hold the promise of overcoming traditional limitations associated with feedstock availability and land use conflicts. Additionally, ongoing research focuses on improving the yield and conversion efficiency of biofuel feedstocks, optimizing fermentation processes, and exploring novel pathways for biofuel synthesis.

Biofuels Market Restraint

- Competition with Food Production and Land Use Conflicts:

One of the primary restraints hindering the biofuels market is the competition between biofuel feedstock production and food production, leading to land use conflicts and concerns about food security. The utilization of food crops, such as corn and sugarcane, for biofuel production diverts agricultural resources away from food production, potentially exacerbating food scarcity and driving up prices. This competition for arable land can also result in deforestation, habitat destruction, and loss of biodiversity, further exacerbating environmental concerns. Additionally, the reliance on food-based feedstocks raises ethical questions regarding equitable access to resources and the potential for social inequities in regions heavily dependent on agriculture for food security.

- Feedstock Availability and Supply Chain Vulnerabilities:

Another significant restraint facing the biofuels market is the limited availability and reliability of feedstock supplies, leading to supply chain vulnerabilities and price volatility. Many biofuel feedstocks, such as corn, soybeans, and palm oil, are subject to seasonal fluctuations in yield, weather-related risks, and market demand pressures. Dependence on a narrow range of feedstock sources further amplifies supply chain risks, as disruptions in production or distribution can lead to shortages and price spikes. Moreover, competition for feedstocks from other industries, such as animal feed, food processing, and bio-based chemicals, further exacerbates supply constraints and price instability in the biofuels market.

Biofuels Market Opportunity

- Advancements in Advanced Biofuels Technology:

The biofuels market presents a compelling opportunity for advancements in advanced biofuels technology, particularly in the development and commercialization of next-generation biofuels derived from non-food feedstocks and waste materials. Advanced biofuels, such as cellulosic ethanol, biohydrogen, and algae-based biofuels, offer several advantages over traditional biofuels, including higher energy yields, reduced greenhouse gas emissions, and enhanced sustainability. By harnessing innovative technologies, such as enzymatic hydrolysis, thermochemical conversion, and synthetic biology, researchers and industry stakeholders can unlock the potential of diverse feedstock sources, such as agricultural residues, forestry waste, and municipal solid waste, to produce renewable fuels at scale.

- Integration with Circular Economy Principles:

Another significant opportunity within the biofuels market lies in the integration of circular economy principles to enhance sustainability and resource efficiency throughout the biofuel value chain. By adopting a holistic approach to resource management and waste valorization, biofuel producers can create synergies between biofuel production, waste management, and the production of value-added co-products. For example, biorefinery concepts enable the co-production of biofuels, biogas, biochemicals, and bio-based materials from a variety of feedstock inputs, maximizing resource utilization and minimizing waste generation. Additionally, by leveraging waste streams and by-products from other industries, such as agriculture, forestry, and food processing, biofuel producers can enhance feedstock diversity, reduce production costs, and improve overall environmental performance.

Biofuels Market Challenges

- Competition with Food Production and Land Use Conflicts:

A primary challenge confronting the biofuels market is the competition between biofuel feedstock production and food production, leading to land use conflicts and concerns about food security. The utilization of food crops, such as corn and sugarcane, for biofuel production diverts agricultural resources away from food production, potentially exacerbating food scarcity and driving up prices. This competition for arable land can also result in deforestation, habitat destruction, and loss of biodiversity, further exacerbating environmental concerns.

- Technological and Economic Barriers to Advanced Biofuels:

Another significant challenge facing the biofuels market is the technological and economic barriers associated with the commercialization of advanced biofuels derived from non-food feedstocks and waste materials. While advanced biofuels, such as cellulosic ethanol, biohydrogen, and algae-based biofuels, offer several advantages over traditional biofuels, including higher energy yields and reduced environmental impacts, scaling up production remains a formidable challenge. Technical hurdles, such as inefficient biomass conversion processes, high production costs, and limited infrastructure, inhibit the widespread adoption of advanced biofuels. Additionally, uncertainties surrounding feedstock availability, market demand, and policy support further complicate investment decisions and impede the development of a robust advanced biofuels industry.

Segments Insights:

Product Insights

Ethanol dominated the biofuels product segment.

Ethanol remains the cornerstone of the biofuels industry, accounting for the majority of global biofuel consumption. It is primarily used as a transportation fuel additive to reduce emissions and enhance octane ratings. Countries such as the U.S. and Brazil have well-established ethanol industries supported by favorable regulations and infrastructure. Flexible-fuel vehicles (FFVs) that can run on high ethanol blends are common in Brazil, showcasing ethanol's central role.

However, aviation biofuels are witnessing the fastest growth.

The aviation sector is aggressively pursuing sustainable aviation fuels (SAFs) to meet carbon reduction goals. Airlines like United, Delta, and British Airways are investing in aviation biofuels, while Airbus and Boeing are adapting aircraft to be SAF-ready. In 2025, the International Air Transport Association (IATA) announced that SAF production reached a new milestone, and the industry plans to significantly scale production by 2030. Bio-jet fuel initiatives are crucial for meeting international aviation carbon-neutral targets.

Liquid biofuels dominated the biofuels market by form.

Liquid biofuels such as ethanol, biodiesel, and aviation biofuel hold the largest share of the biofuels market. Their compatibility with existing fuel infrastructure (engines, pipelines, and refineries) makes them attractive for rapid deployment. Ethanol and biodiesel can be easily blended with gasoline and diesel, facilitating compliance with regulatory mandates without major technological overhauls. Countries like Brazil have built their entire transportation systems around high ethanol blends, highlighting the critical role of liquid biofuels in energy transitions.

Meanwhile, gaseous biofuels are the fastest-growing segment.

Gaseous biofuels like biomethane, biogas, and syngas are gaining traction as cleaner alternatives for both transportation and energy generation. The adoption of biomethane in compressed natural gas (CNG) vehicles and its use in decentralized energy systems is growing rapidly. European nations, particularly Germany, are investing heavily in biomethane plants. Biogas upgrading technologies that purify biogas into pipeline-quality renewable natural gas (RNG) are opening new markets for gaseous biofuels.

Generation Insights

First-generation biofuels dominated the market due to established production and infrastructure.

First-generation biofuels, derived from food crops, continue to dominate primarily because of the maturity of their production processes and widespread agricultural supply chains. Ethanol produced from corn and sugarcane, and biodiesel from vegetable oils, form the backbone of current biofuel consumption globally. Regulatory frameworks like the U.S. RFS and Brazil’s RenovaBio have ensured strong demand for these conventional biofuels.

In contrast, second-generation biofuels are the fastest-growing generation segment.

Second-generation biofuels use non-food feedstocks like lignocellulosic biomass, agricultural residues, and municipal solid waste. These fuels offer significant environmental benefits, reducing greenhouse gas emissions substantially more than first-generation alternatives. Companies like POET-DSM and Beta Renewables are pioneering commercial-scale production of cellulosic ethanol. As regulatory standards increasingly favor "advanced biofuels" and investments in biorefineries rise, second-generation biofuels are set for accelerated growth.

Feedstock Insights

Corn dominated the biofuels market feedstock segment in 2024.

Corn is the primary feedstock for ethanol production, especially in countries like the United States, which leads global ethanol output. The ease of processing, high starch content, and existing agricultural infrastructure have made corn the preferred choice for first-generation biofuels. The Renewable Fuel Standard (RFS) program in the U.S. mandates significant volumes of biofuels, predominantly corn-based ethanol, to be blended into the fuel supply, ensuring sustained demand. Corn-based biofuels have played a critical role in reducing petroleum dependence and supporting rural economies.

Meanwhile, vegetable oils are emerging as the fastest-growing feedstock.

Vegetable oils such as soybean, rapeseed, and palm oil are increasingly being used for biodiesel and green diesel production. The versatility of vegetable oils allows for their conversion into high-quality diesel substitutes through processes like transesterification and hydroprocessing. With Europe mandating higher biodiesel blends under its Renewable Energy Directive (RED II), the demand for vegetable oil-based biofuels is surging. Additionally, technological advancements are enabling the use of used cooking oils and non-edible oils, aligning with sustainability goals.

Application Insights

Transportation dominated the biofuels application segment.

Transportation is the largest application for biofuels, encompassing road vehicles, marine, and rail transport. Bioethanol and biodiesel are extensively blended with conventional fuels to reduce emissions from internal combustion engines. Mandates such as the European Union’s RED II and California’s Low Carbon Fuel Standard (LCFS) reinforce the dominance of transportation as the primary application sector.

Meanwhile, aviation applications are growing fastest.

Driven by the urgent need for greener alternatives in aviation, bio-based aviation fuels are capturing growing interest. Initiatives such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) are pushing airlines to adopt SAFs. Pilot projects and commercial flights powered by bio-jet fuels are becoming more common, signaling a strong upward trajectory for this application segment.

Regional Insights

North America, led by the United States and Canada, holds the largest share in the global biofuels market. The U.S. is a pioneer in biofuel policies with its Renewable Fuel Standard (RFS), while Canada’s Clean Fuel Standard (CFS) sets ambitious targets for biofuel blending. Abundant agricultural resources, strong government support, and advanced technology adoption have cemented North America's leadership in both ethanol and biodiesel production. Companies like POET, Renewable Energy Group (REG), and Archer Daniels Midland (ADM) have established expansive production and distribution networks.

Asia-Pacific countries such as China, India, Indonesia, and Thailand are rapidly expanding their biofuel production capacities to reduce import dependence and tackle environmental issues. Government mandates like India’s Ethanol Blending Program and Indonesia’s B30 biodiesel mandate are propelling market growth. Significant investments in research, infrastructure, and feedstock diversification are expected to make Asia-Pacific a formidable player in the biofuels arena over the coming decade.

Recent Developments

- In July 2023, Petrobras announced to begin testing the performance of a B24 bio bunker fuel blend. This fuel blend is being used to fuel a ship, located at the Rio Grande (RS) Terminal and chartered by Transpetro with 573,000 litres of fuel to be filled in the vessel.

- In July 2023, Equilon Enterprises LLC, a subsidiary of Shell plc and Green Plains Inc. entered into a technological collaboration to use Shell Fiber Conversion Technology (SFCT) with Fluid Quip Technologies’ precision separation and processing technology. This strategic partnership is expected to add significant value to Green Plains Inc.'s biorefinery platform.

- In April 2023, Lanzajet announced construction milestone completion of their production plant in Soperton, Georgia. The facility is the world’s first ethanol-based alcohol-to-jet sustainable aviation fuel production plant and is poised to being commercial operations in 2024.

- In January 2023, Green Plains Inc., United Airlines, and Tallgrass entered into a joint venture to form Blue Blade Energy, to develop Sustainable Aviation Fuel (SAF) technology that uses ethanol as its feedstock. The technology is in trial stages and upon successful results the joint venture project is expected to proceed with the construction of a pilot facility in 2024, followed by a full-scale facility that could begin commercial operations by 2028.

Some of the prominent players in the biofuel market include:

- Air Liquide

- Archer Daniels Midland Company

- Bunge North America, Inc.

- Butamax Advanced Biofuels LLC

- Green Plains Inc.

- Petrobras

- Renewable Energy Group, Inc.

- Royal Dutch Shell Plc

- Scandinavian Biogas Fuels International AB

- Wilmar International Ltd.

- LanzaJet, Inc

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global biofuels market.

Feedstock

- Corn

- Sugarcane

- Vegetables Oils

- Others

Form

- Solid Biofuels

- Liquid Biofuels

- Gaseous Biofuels

Generation

- First Generation Biofuels (Conventional Biofuels)

- Second Generation Biofuels (Advanced Biofuels)

- Third Generation Biofuels (Algae Fuels)

Product

- Biodiesel

- Green Diesel

- Ethanol

- Wood Pellets

- Aviation Biofuel (Bio-jet Fuel)

- Biomethane

- Syngas

- Green Hydrogen

- Others (Biogasoline, Biomethanol, Biobutanol, Bioethers)

Application

- Transportation

- Aviation

- Energy Generation

- Heating

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)