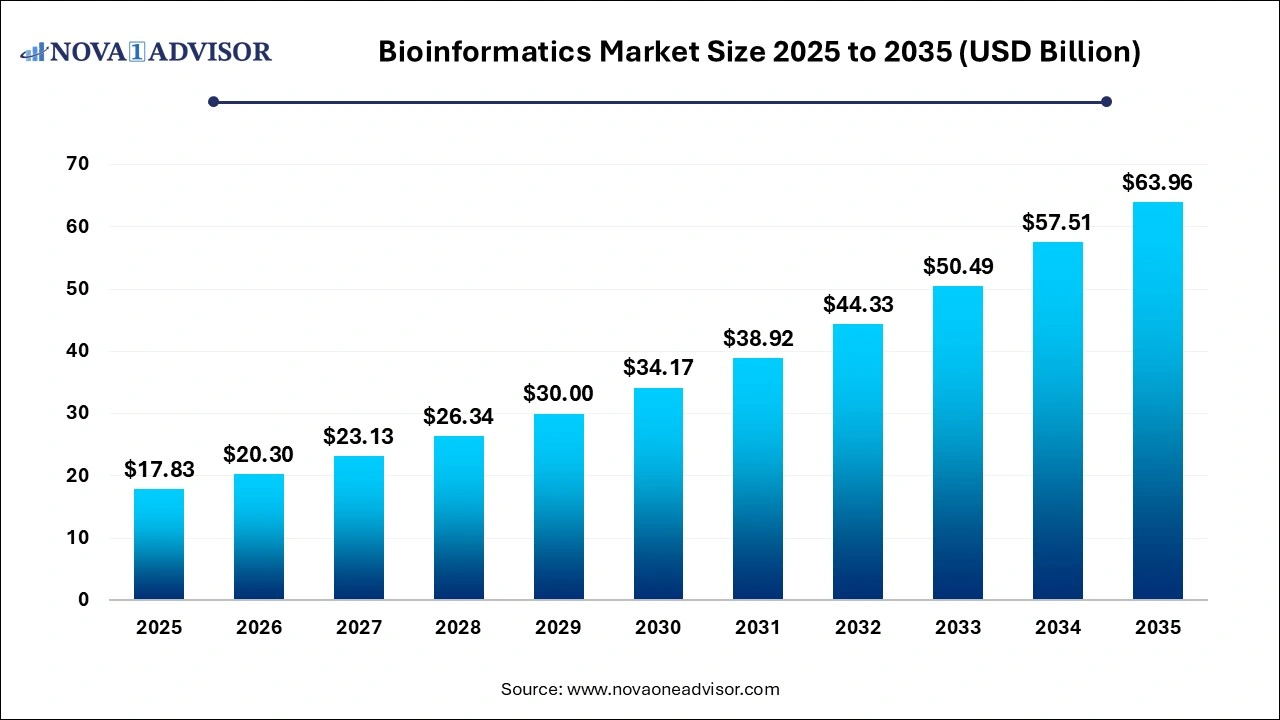

The global bioinformatics market size was estimated at USD 17.83 billion in 2025 and is projected to hit around USD 63.96 billion by 2035, growing at a CAGR of 13.63% during the forecast period from 2026 to 2035.

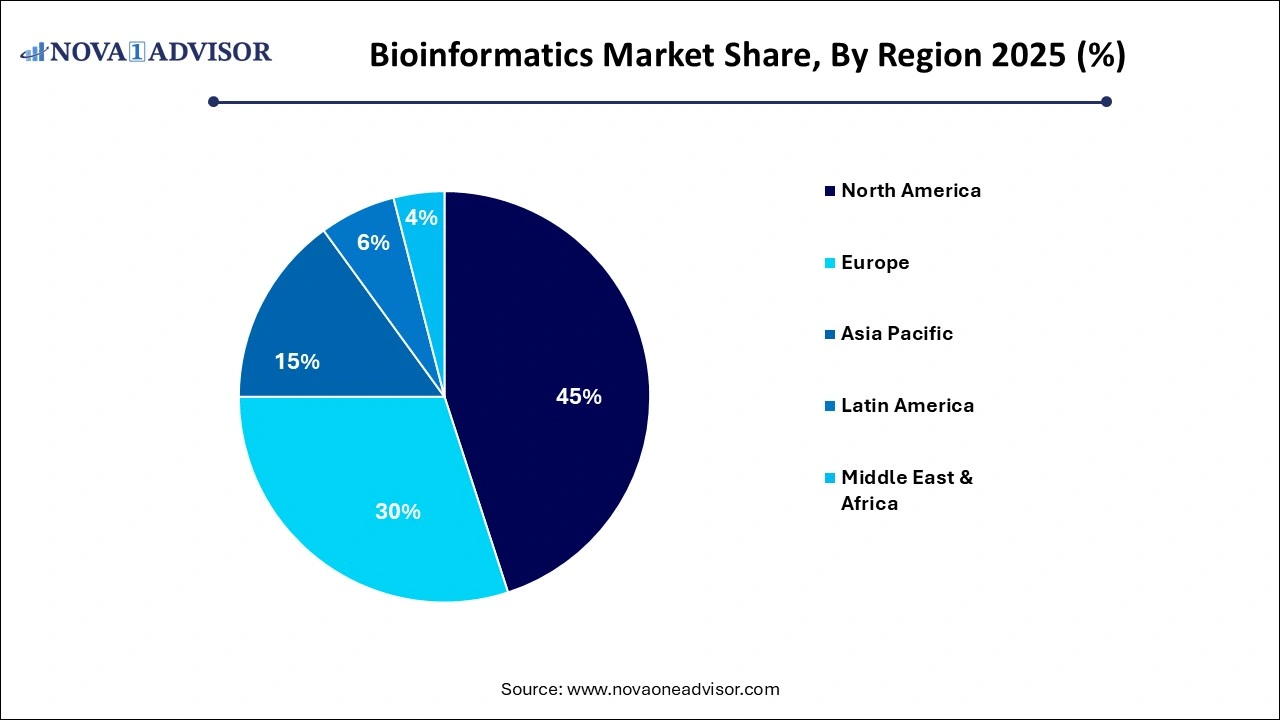

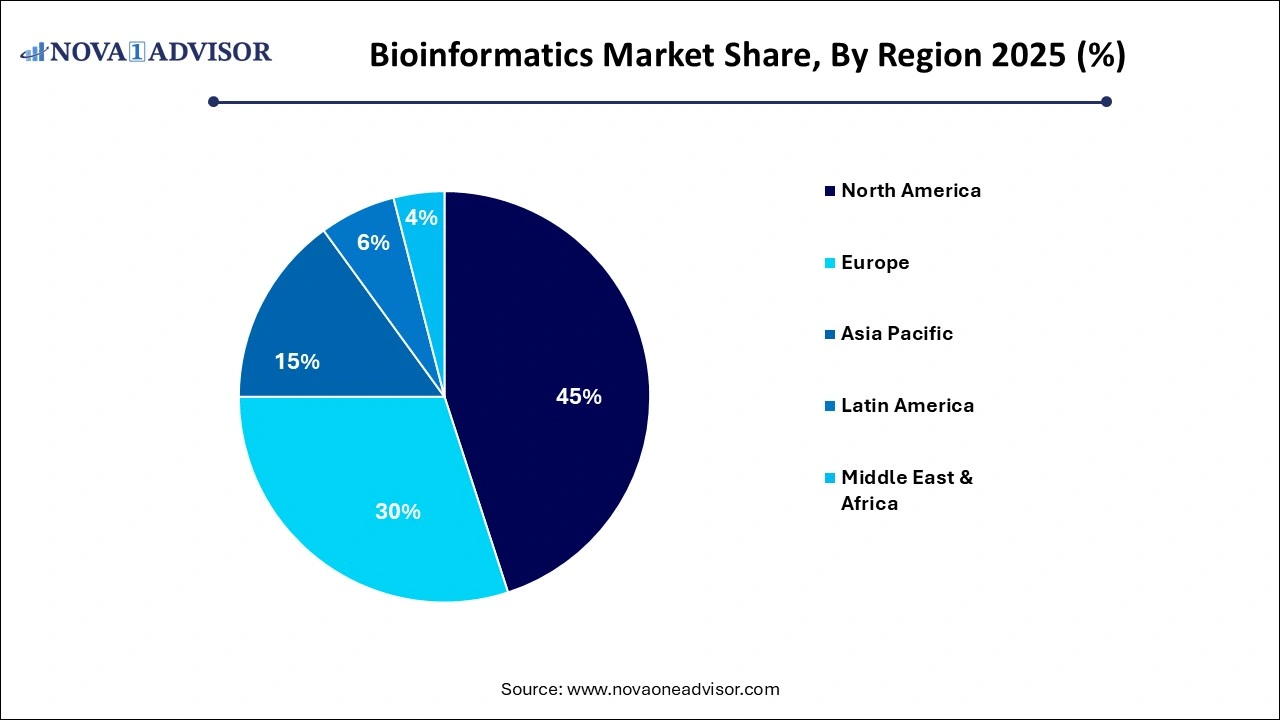

- North America dominated the market and accounted for a revenue share of 45% in 2025.

- Asia Pacific is poised to be the fastest-growing regional market with a CAGR of 18.4% during the projection period.

- The genomics application segment accounted for a significant revenue share in 2025.

- The cheminformatics segment is expected to expand substantially during the forecast period.

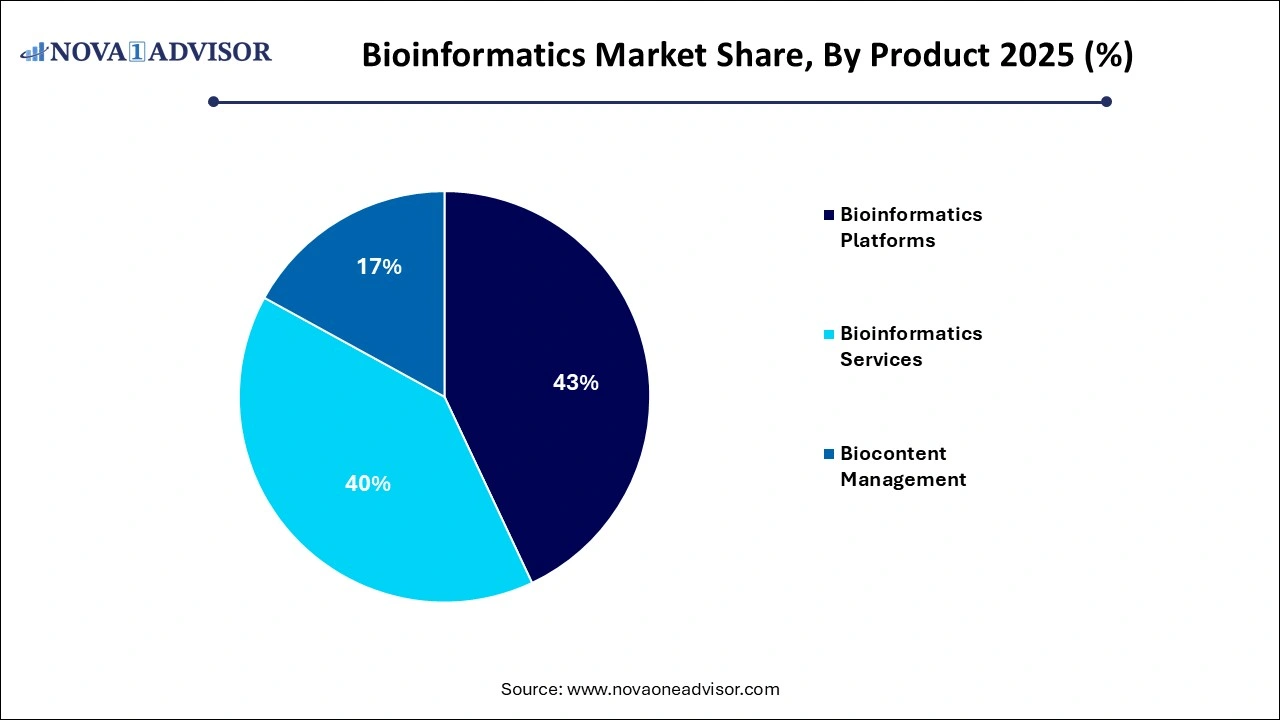

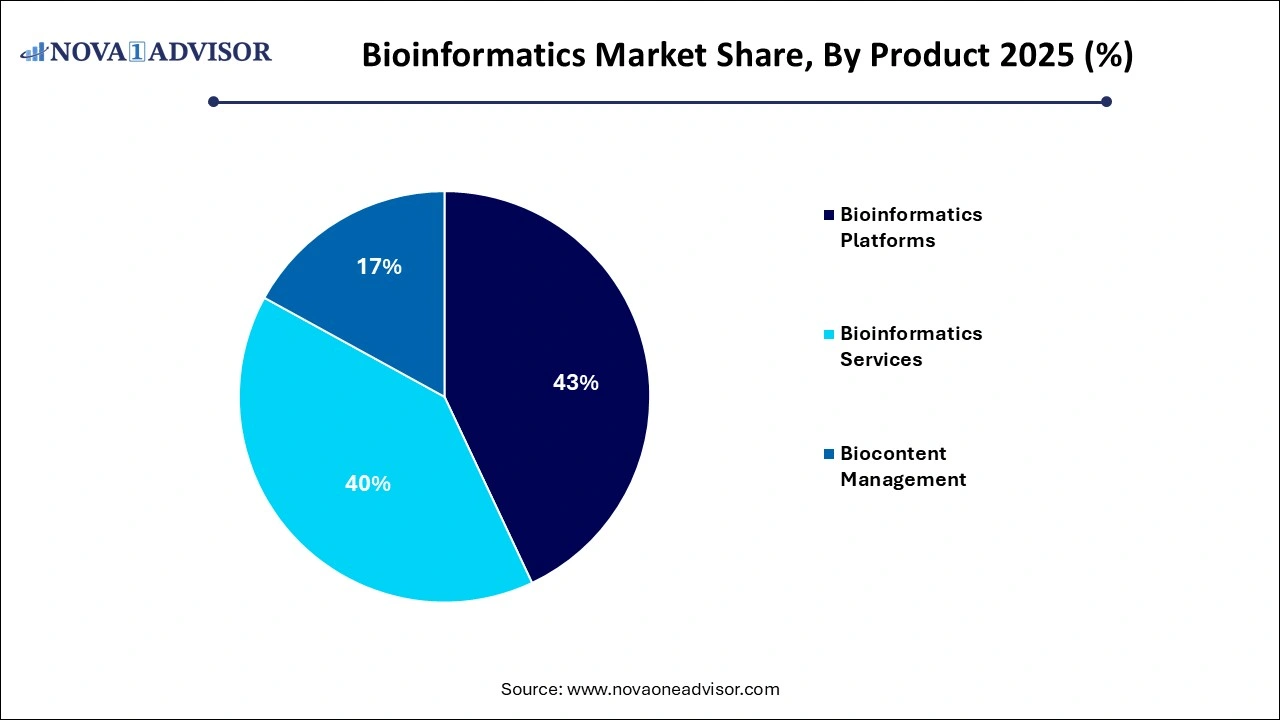

- The bio-content management segment led the market with a revenue share of 43.0% in 2025.

- The bioinformatics services segment is expected to expand at the fastest rate of 14.6% CAGR during the forecast period.

- The bioinformatics platforms segment is expected to grow significantly during the forecast period.

- The introduction of new and advanced technologies is expected to boost market growth over the forecast period.

Growing demand in the process of novel drug R&D and private and public funding initiatives to support R&D activities are expected to be the key factors driving the market during the forecast period. Furthermore, the introduction of user-friendly and readily available bioinformatics software such as RasMol, AUTODOCK, BALL, and Bioclipse, and growing market usage of these tools for the accurate and effective analysis of biomarkers discovery programs that assist in toxicity detection during the initial stage of the drug development process are expected to drive industry growth over the forecast period.

Bioinformatics software and tools are being used as integrated solutions that provide algorithms and statistical methodologies for data analysis and help integrate data management and analysis for applications such as next-generation sequencing, genomic and proteomic structuring, modeling, and three-dimensional drug designing. Increasing R&D initiatives in the proteomics and genomics market, including other related ‘-omics’ fields, are further expected to support market growth to meet data storage and analysis demands.

According to an article published by Stanford Medicine in January 2023, research conducted by Stanford scientists showed that a DNA sequencing technique could sequence a human genome in about 8 hours. Such developments can boost demand for genomics and, consequently, the bioinformatics sector. Bioinformatics data storage and analysis applications are capable of storing a large amount of genomic and proteomic information to facilitate research activities in fields ranging from aging and carcinogenesis to preventive therapy for genetic diseases. This factor is also expected to significantly contribute to the growth of this industry over the forecast period.

The COVID-19 pandemic has significantly impacted the bioinformatics market. Researchers and physicians resorted to bioinformatics to help them comprehend the virus and create diagnostic tests and cures. As a result, the demand for bioinformatics tools and services showed a noticeable surge during this period.

-

Integration of AI and Machine Learning in Genomics: Automated pattern recognition is accelerating discoveries in variant calling, gene annotation, and mutation analysis.

-

Cloud-Based Bioinformatics Solutions: Cloud platforms are enabling scalable, real-time data processing while reducing infrastructure overhead.

-

Rise of Precision Medicine and Personalized Genomics: Increasing focus on tailoring treatment based on genetic profiles is expanding bioinformatics usage in clinical workflows.

-

Expansion in Agricultural Bioinformatics: Genomic tools are being applied to crop breeding, trait selection, and livestock optimization.

-

Interoperable Data Formats and Open-Source Tools: The trend toward open-source bioinformatics pipelines and common data formats is fostering greater collaboration across research institutions.

-

Growing Use of Multi-omics Approaches: Integrative analysis of genomics, proteomics, metabolomics, and transcriptomics is becoming the norm in systems biology research.

-

Development of Clinical Grade Bioinformatics Tools: Regulatory-grade software is being developed to comply with standards for diagnostic applications, particularly in oncology and rare disease diagnostics.

-

Academic-Industry Partnerships: Universities and research institutes are increasingly collaborating with biotech firms to commercialize bioinformatics solutions.

| Report Attribute |

Details |

| Market Size in 2026 |

USD 20.3 Billion |

| Market Size by 2035 |

USD 63.96 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 13.63% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

DNAnexus Inc.; Seven Bridges Genomics; BGI Group; Partek Inc.; Thermo Fisher Scientific; Qiagen; Agilent Technologies; Illumina; PerkinElmer |

By Application Insights

Genomics remains the leading application of bioinformatics, with widespread use in variant detection, gene expression analysis, genome assembly, and functional annotation. The declining cost of sequencing and rise of large-scale population genomics studies have solidified genomics as the most data-intensive and high-impact bioinformatics domain. It plays a central role in disease gene discovery, pharmacogenomics, evolutionary biology, and plant breeding. Software platforms capable of handling terabytes of sequencing data and producing actionable insights are critical assets in this space.

Proteomics is the fastest-growing application area, driven by the increasing use of mass spectrometry-based protein identification and quantification techniques. Proteomics offers insight into post-translational modifications, protein–protein interactions, and dynamic biological responses, complementing genomic insights. As the field moves toward integrating multi-omics data, the need for platforms that can correlate gene expression with protein abundance is increasing. Companies are investing in AI-driven proteomics tools to support biomarker discovery, drug development, and disease classification, especially in oncology and neurodegenerative disorders.

By Product Insights

Bioinformatics platforms currently dominate the product segment, particularly sequence analysis and alignment platforms. These tools are essential for primary data processing from NGS outputs, allowing researchers to align reads to reference genomes, identify variants, and annotate gene functions. Tools such as BLAST, BWA, and Bowtie remain foundational, while commercial platforms from companies like Illumina, Thermo Fisher, and Qiagen offer more user-friendly, integrated solutions tailored for clinical or research settings.

Bioinformatics services are the fastest-growing segment, propelled by demand for outsourced data analysis and custom bioinformatics pipelines. Companies, especially startups and smaller research institutions, increasingly rely on service providers for processing complex datasets without investing in expensive infrastructure or hiring specialized personnel. Services such as cloud-based sequencing analysis, database curation, and statistical modeling are now often bundled into R&D contracts or collaborative studies. Growth in the services segment is further supported by increasing use of bioinformatics in diagnostics and personalized medicine, where timely and accurate interpretation of data is critical.

North America is the undisputed leader in the global bioinformatics market, accounting for the largest share due to advanced research infrastructure, strong government funding, and the presence of leading technology and biotechnology firms. The U.S. is home to key players such as Illumina, Thermo Fisher Scientific, and PerkinElmer, as well as top academic institutions driving bioinformatics innovation.

Programs such as the NIH’s All of Us initiative and private ventures like 23andMe and Verily are contributing to the surge in population genomics and personalized health, demanding robust bioinformatics infrastructure. Moreover, North America has pioneered the use of bioinformatics in clinical diagnostics, with regulatory pathways already in place for genomic interpretation software.

Asia-Pacific is the fastest-growing region, fueled by increasing investment in life sciences, a rising number of genome sequencing initiatives, and improving digital health ecosystems. Countries such as China, India, Japan, and South Korea are at the forefront of bioinformatics capacity building, supported by strong government support, emerging biotech sectors, and a growing pool of trained professionals.

India’s GenomeIndia Project and China’s BGI (Beijing Genomics Institute) are leading large-scale sequencing efforts that generate massive amounts of data requiring advanced analytics. APAC-based startups are also emerging as strong players in AI-driven diagnostics and agricultural genomics. Moreover, the affordability and scalability of bioinformatics services in the region are attracting global collaborations, reinforcing its role as a high-growth market.

Key Companies & Market Share Insights

Recent Developments

-

March 2025: Illumina launched the NovaCloud Bioinformatics Suite, an end-to-end, cloud-based analysis platform integrated with real-time clinical interpretation tools.

-

January 2025: QIAGEN and Google Cloud expanded their partnership to deliver next-gen bioinformatics workflows using scalable AI and machine learning tools tailored for cancer genomics.

-

November 2024: Thermo Fisher Scientific acquired a UK-based bioinformatics startup specializing in structural variant detection for rare diseases.

-

September 2024: Benchling, a biotech software company, raised $150 million to scale its bioinformatics cloud platform, which is increasingly used in gene editing and synthetic biology applications.

-

June 2024: DNAnexus partnered with the UK Biobank to offer secure data analysis tools for one of the largest genomic datasets globally, focusing on multi-omics integration.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the Bioinformatics market.

By Product

- Bioinformatics Platforms

- Sequence Analysis Platforms

- Sequence Manipulation Platforms

- Sequence Alignment Platforms

- Structural and Functional Analysis Platforms

- Others

- Bioinformatics Services

- Sequencing

- Database Management

- Data Analysis

- Others

- Biocontent Management

- Generalized Biocontent

- Specialized Biocontent

By Application

- Genomics

- Molecular Phylogenetics

- Metabolomics

- Proteomics

- Transcriptomics

- Cheminformatics and drug designing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)