Biologic Drugs Market Size and Forecast 2025 to 2034

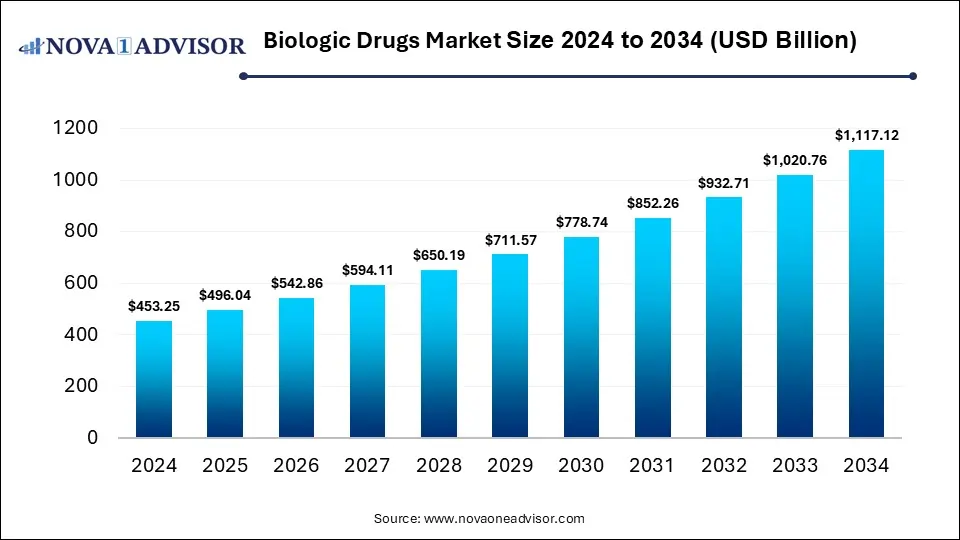

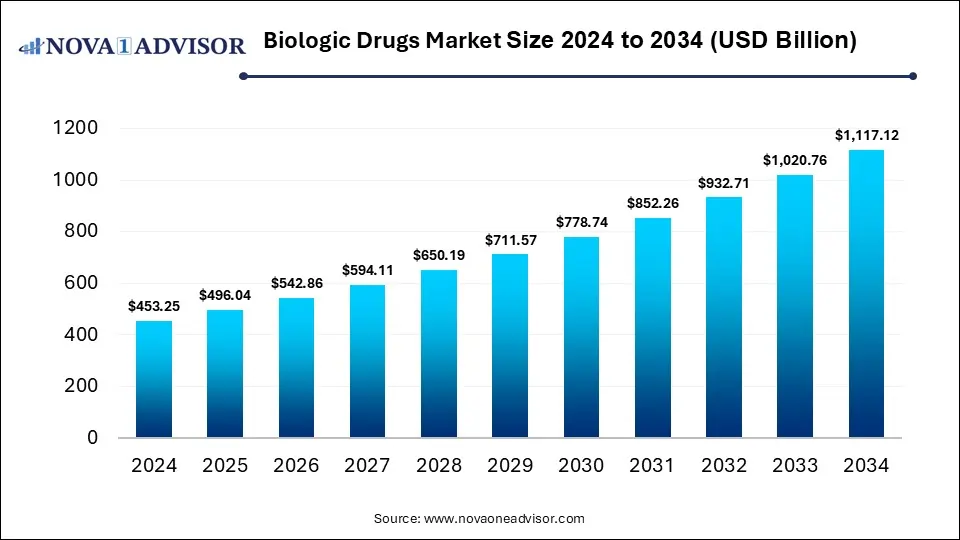

The global biologic drugs market size is calculated at USD 453.25 billion in 2024, grows to USD 496.04 billion in 2025, and is projected to reach around USD 1,117.12 billion by 2034, growing at a CAGR of 9.44% during the forecast period from 2025 to 2034. The market is growing due to rising demand for targeted therapies in chronic and rare diseases. Advancements in biotechnology and increasing FDA/EMA approvals further drive market expansion.

Biologic Drugs Market Key Takeaways

- North America dominated the biologic drugs market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product type, the monoclonal antibodies (mAbs) segment held the largest market share in 2024.

- By product type, the gene therapy segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By source, the mammalian segment led the market with the largest revenue share in 2024.

- By manufacturing type, the in-house manufacturing segment held the highest market share.

- By manufacturing type, the contract manufacturing organizations (CMO) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the oncology segment held the highest revenue shares in 2024.

- By application, the ophthalmology segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By distribution channel, the hospital pharmacies segment held the largest market share in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at the fastest CAGR in the market during the forecast period.

How is Innovation Impacting the Biologic Drugs Market?

Biologic drugs are advanced medicines made from living cells or organisms, designed to target specific proteins, genes, or pathways to treat complex diseases like cancer, autoimmune disorders, and rare conditions. Innovation is fueling the biologic drugs market by improving manufacturing efficiency, stability, and scalability of complex biologics. Breakthroughs in bioprocessing technologies, such as single-use systems and continuous manufacturing, are reducing production costs and time. Advancements in formulation science are enhancing drug delivery methods, including long-acting injectables and oral biologics, improving patient convenience and adherence. Moreover, integration of advanced analytics and automation in biologics and quality control is further accelerating market expansion globally.

What are the Key trends in the Biologic Drugs Market in 2024?

- In September 2023, Samsung Biologics invested in South Korea–based AimedBio, a company focused on using artificial intelligence (AI) to analyze patient data for advancing healthcare solutions.(Source:https://samsungbiologics.com/)

- In September 2023, Waters Corporation, a U.S.-based brand, introduced new solutions designed to streamline the preparation and analysis of biological samples, with the goal of speeding up bioprocess development.(Source:https://www.technologynetworks.com/)

How Can AI Affect the Biologic Drugs Market?

AI is reshaping the market by advancing protein structure prediction, enabling more effective biologic design, and supporting novel drug delivery systems. It helps in optimizing bioprocessing by predicting yield and stability issues early, reducing development risks. AI also assists in real-time monitoring of biologic production, ensuring consistent quality. Furthermore, its integration in supply chain management improves demand forecasting and distribution efficiency. These innovations collectively enhance the scalability, reliability, and accessibility of biologic therapies worldwide.

Report Scope of Biologic Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 496.04 Billion |

| Market Size by 2034 |

USD 1,117.12 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.44% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product Type, By Source, By Manufacturing Type, By Application (Therapeutic Area), By Distribution Channel, By Regional |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Eli Lilly, AbbVie, GSK plc, Novartis AG, Celltrion, Gilead Sciences, Johnson & Johnson, Amgen Inc |

Market Dynamics

Driver

Expansion of Biosimilars

The growth of biosimilars is propelling the drugs market by strengthening healthcare sustainability and reducing dependency on high-cost branded biologics. Their entry encourages healthcare providers to integrate biologic treatments into standard care pathways more widely. Additionally, biosimilars foster collaborations between global and regional manufacturers, boosting production capacity and market reach. With increasing physician confidence and regulatory support, biosimilars are accelerating the shift towards cost-effective biologic therapies, ultimately expanding patient access and fueling long-term market expansion.

- For Instance, In May 2024, the US FDA approved Bkemv (eculizumab-aeeb), an interchangeable biosimilar to Soliris (eculizumab) for treating rare blood disorders, including PNH and aHUS, offering patients a lower-cost alternative. (Source: https://www.fda.gov/)

Restraint

High Development and Manufacturing Cost

High development and manufacturing costs hinder the biologic drugs market because they create significant financial risks for companies, especially smaller biotech firms. The need for skilled labor, cold-chain logistics, and complex storage conditions adds to operational expenses. Additionally, scaling up biologic production is often unpredictable, leading to delays and cost overruns. These challenges discourage broader investment and slow down commercialization, ultimately restricting the availability of biologics in both developed and emerging healthcare systems.

Opportunity

Integration of Personalized Medicine and Precision Therapies

The rise of personalized medicine and precision therapies creates future opportunities in the biologic drugs market by opening new avenues for rare and underserved conditions where standard treatments are ineffective. These approaches allow for niche drug development, enabling companies to address smaller patient populations while still achieving strong market potential. Integration with digital health and real-world data further supports targeted biologic use, paving the way for innovative treatment models that improve healthcare efficiency and drive long-term market growth.

Segmental Insights

What made the Monoclonal Antibodies (mAbs) Segment Dominant in the Biologic Drugs Market in 2024?

In 2024, the monoclonal antibodies (mAbs) segment dominated the market because of their proven clinical efficacy and versatility across multiple therapeutic areas. Their ability to be engineered for enhanced stability, reduced immunogenicity, and improved delivery has increased adoption. The growing pipeline of biosimilar mAbs also expanded accessibility and market penetration. Combined with strong manufacturing capabilities, strategic partnerships, and rare diseases, mAbs maintained their leading position among biologic products globally.

The gene therapy segment is projected to grow rapidly because it addresses unmet medical needs by targeting the most common causes of diseases at the genetic level. Technological advancements in vector design, genome editing, and scalable manufacturing are reducing development challenges. Collaborations between biotech firms and research institutions are accelerating pipeline progression. Additionally, increasing government incentives and funding, and commercialization prospects are making gene therapy one of the fastest-growing segments in the biologic drug market.

Biologic Drugs Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Monoclonal Antibodies (mAbs) |

172.24 |

186.01 |

200.86 |

216.85 |

234.07 |

252.61 |

272.56 |

294.03 |

317.12 |

341.95 |

368.65 |

| Vaccines |

81.59 |

88.29 |

95.54 |

103.37 |

111.83 |

120.97 |

130.83 |

141.47 |

152.96 |

165.36 |

178.74 |

| Recombinant Hormones |

31.73 |

33.73 |

35.83 |

38.02 |

40.31 |

42.69 |

45.17 |

47.73 |

50.37 |

53.08 |

55.86 |

| Therapeutic Proteins |

54.39 |

58.53 |

62.97 |

67.73 |

72.82 |

78.27 |

84.10 |

90.34 |

97.00 |

104.12 |

111.71 |

| Cell Therapy |

45.33 |

52.58 |

60.80 |

70.10 |

80.62 |

92.50 |

105.91 |

121.02 |

138.04 |

157.20 |

178.74 |

| Gene Therapy |

36.26 |

42.16 |

48.86 |

56.44 |

65.02 |

74.71 |

85.66 |

98.01 |

111.93 |

127.59 |

145.23 |

| Antisense & RNAi Therapies |

31.73 |

34.72 |

38.00 |

41.59 |

45.51 |

49.81 |

54.51 |

59.66 |

65.29 |

71.45 |

78.20 |

How did the Mammalian Segment Dominate the Biologic Drugs Market in 2024?

In 2024, the mammalian segment dominated the market because mammalian cell systems offer superior yield scalability and consistency for producing complex biologics. Their ability to support post-translational modifications essential for drug stability and activity makes them preferred over alternative sources. Increasing demand for high-quality therapeutic proteins, coupled with ongoing investments in advanced bioreactor technologies and process optimization, further strengthened the segment's market position, leading to the highest revenue generation among all source types.

Biologic Drugs Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Microbial |

99.72 |

108.14 |

117.26 |

127.14 |

137.84 |

149.43 |

161.98 |

175.56 |

190.27 |

206.19 |

223.42 |

| Mammalian |

317.28 |

346.23 |

377.83 |

412.31 |

449.93 |

490.98 |

535.78 |

584.65 |

637.97 |

696.16 |

759.64 |

| Others (Yeast, Transgenic animals/plants) |

36.26 |

41.67 |

47.77 |

54.66 |

62.42 |

71.16 |

80.99 |

92.04 |

104.46 |

118.41 |

134.05 |

How did the in-house Manufacturing Segment Dominate the Market?

The in-house manufacturing segment led the biologic drugs market because companies can closely monitor production timelines, reduce risks associated with third-party delays, and protect proprietary formulations. Owning manufacturing facilities enables integration of advanced technologies, such as continuous processing and real-time quality monitoring, improving efficiency and reducing long-term costs. This control also facilities rapid scale-up for high-demand biologics and supports compliance with production a preferred choice for sustaining making in-house production a preferred choice for sustaining revenue and market leadership in the biologic drug industry.

The contract manufacturing organizations (CMO) segment is projected to grow rapidly as small and mid-sized biotech companies increasingly rely on external partners to access cutting-edge manufacturing technologies without large infrastructure investments. CMO provides flexibility to scale production based on demand and handle regulatory compliance across multiple regions. Their ability to accelerate time-to-market for complex biologics, manage supply chain challenges, and offer specialized services such as fill-finish and formulation support makes them an attractive option, fueling the segment's fastest CAGR in the biologic drugs market.

Biologic Drugs Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| In-house Manufacturing |

262.89 |

283.73 |

306.17 |

330.32 |

356.31 |

384.25 |

414.29 |

446.58 |

481.28 |

518.54 |

558.56 |

| Contract Manufacturing Organizations (CMOs) |

190.37 |

212.30 |

236.69 |

263.78 |

293.89 |

327.32 |

364.45 |

405.67 |

451.43 |

502.21 |

558.56 |

Why the Oncology Segment Dominated the Biologic Drugs Market in 2024?

In 2024, the oncology segment le the market due to increasing adoption of personalized cancer therapies and immune-oncology of personalized cancer therapies and immune-oncology treatments. Advancements in tumor-targeted biologics, such as bispecific antibodies and antibody-drug conjugates, have expanded therapeutic options and improved patient outcomes. Additionally, growing awareness of early cancer detection, rising healthcare expenditure, and strong collaborations between pharmaceutical companies and research institutions boosted the development and use of biologics in oncology, making it the highest revenue-generating application segment.

The ophthalmology segment is projected to grow rapidly as innovations in gene and cell therapies targeted previously untreatable ion disorders. Rising geriatric populations and lifestyle-related eye conditions are increasing demand for advanced biologics. Moreover, regulatory approvals of novel ocular biologics and collaborations between biotech firms and eye care specialists are accelerating market penetration. Enhanced patient access through specialized clinics and improved affordability of therapies are further boosting adoption, making ophthalmology the fastest-growing application segment in the biologic drugs market during the forecast period.

Biologic Drugs Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Oncology |

145.04 |

159.72 |

175.89 |

193.68 |

213.26 |

234.82 |

258.54 |

284.65 |

313.39 |

345.02 |

379.82 |

| Autoimmune Diseases |

81.59 |

88.79 |

96.63 |

105.16 |

114.43 |

124.52 |

135.50 |

147.44 |

160.43 |

174.55 |

189.91 |

| Infectious Diseases |

72.52 |

78.37 |

84.69 |

91.49 |

98.83 |

106.74 |

115.25 |

124.43 |

134.31 |

144.95 |

156.40 |

| Neurology |

45.33 |

50.10 |

55.37 |

61.19 |

67.62 |

74.71 |

82.55 |

91.19 |

100.73 |

111.26 |

122.88 |

| Cardiovascular |

40.79 |

44.15 |

47.77 |

51.69 |

55.92 |

60.48 |

65.41 |

70.74 |

76.48 |

82.68 |

89.37 |

| Metabolic Disorders |

40.79 |

44.64 |

48.86 |

53.47 |

58.52 |

64.04 |

70.09 |

76.70 |

83.94 |

91.87 |

100.54 |

| Ophthalmology |

27.20 |

30.26 |

33.66 |

37.43 |

41.61 |

46.25 |

51.40 |

57.10 |

63.42 |

70.43 |

78.20 |

How does the Hospital Pharmacies Segment dominate the Market in 2024?

In 2024, hospital pharmacies held the largest market share because they provide direct access to patients requiring complex biologic therapies, such as monoclonal antibodies and gene treatments. Hospitals offer one-site administrations, trained healthcare staff, and necessary storage facilities for sensitive biologics, ensuring safety and efficacy. Additionally, increasing hospital-based treatment programs, rising inpatient visits, and integration of specialty care services have strengthened the role of hospital pharmacies as primary distribution points, making them the dominant channel in the biologic drugs market.

The online pharmacy segment is projected to grow rapidly as patients seek faster access to high-cost biologics without frequent hospital visits. E-commerce platforms offer streamlined ordering, secure cold-chain delivery, and digital support for therapy adherence. Partnerships between pharmaceutical companies and online pharmacies are expanding the availability of specialty biologics, while mobile apps and subscription models enhance convenience. Rising awareness of telehealth services and increasing healthcare digitization are driving adoption, positioning online pharmacies as the fastest-growing distribution channel in the biologic drugs market.

Biologic Drugs Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospital Pharmacies |

249.29 |

270.34 |

293.15 |

317.85 |

344.60 |

373.57 |

404.95 |

438.91 |

475.68 |

515.48 |

558.56 |

| Retail Pharmacies |

135.98 |

147.32 |

159.60 |

172.89 |

187.26 |

202.80 |

219.61 |

237.78 |

257.43 |

278.67 |

301.62 |

| Online Pharmacies |

67.99 |

78.37 |

90.12 |

103.37 |

118.34 |

135.20 |

154.19 |

175.56 |

199.60 |

226.61 |

256.94 |

Regional Insights

How is North America Contributing to the Biologic Drugs Market?

North America led the market in 2024 because of the rapid integration of cutting-edge technologies, including gene and cell therapies, into clinical practice. Strong collaborations between research institutions, biotech startups, and major pharmaceutical companies accelerated biologic innovation. Supportive regulatory frameworks, robust patent protections, and early adoption of specialty biologics enhanced market penetration. Additionally, a high prevalence of lifestyle-related and autoimmune diseases, along with increasing patient access to advanced healthcare services, reinforced the region’s position as the largest revenue contributor.

How is Asia-Pacific Accelerating the Biologic Drugs Market?

Asia-Pacific is projected to register the fastest growth due to a large patient population, increasing demand for affordable and innovative biologic therapies, and expansion of local biotech manufacturing capabilities. Rising collaborations between multinational pharmaceutical companies and regional players, along with favorable regulatory reforms, are facilitating faster approvals and market entry. Additionally, greater urbanization, improved healthcare access in emerging economies, and growing digital health adoption are driving the rapid uptake of biologics, positioning Asia-Pacific as the fastest-growing market during the forecast period.

Biologic Drugs Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

185.8 |

201.9 |

219.3 |

238.2 |

258.8 |

281.1 |

305.3 |

331.5 |

360.0 |

391.0 |

424.5 |

| Europe |

122.4 |

132.9 |

144.4 |

156.8 |

170.4 |

185.0 |

200.9 |

218.2 |

236.9 |

257.2 |

279.3 |

| Asia Pacific |

108.8 |

121.5 |

135.7 |

151.5 |

169.1 |

188.6 |

210.3 |

234.4 |

261.2 |

290.9 |

324.0 |

| Latin America |

22.7 |

25.0 |

27.7 |

30.6 |

33.8 |

37.4 |

41.3 |

45.6 |

50.4 |

55.6 |

61.4 |

| Middle East and Africa (MEA) |

13.6 |

14.6 |

15.7 |

16.9 |

18.2 |

19.6 |

21.0 |

22.6 |

24.3 |

26.0 |

27.9 |

Top Companies in the Biologic Drugs Market

Recent Developments in the Biologic Drugs Market

- In 2024, the U.S. biosimilars market introduced five new products. Simlandi® (Humira®) and Hercessi™ (Herceptin®) entered already competitive “first-wave” biosimilar markets, while Tofidence™ and Tyenne® (Actemra®) and Pavblu® (Eylea®) became the first commercially available biosimilars for their respective reference therapies. These launches highlight ongoing market expansion, increasing treatment options, and enhanced patient access to cost-effective biologic alternatives. (Source: https://www.fr.com/)

- In July 2023, South Korea’s Lotte Biologics partnered with KANAPH Therapeutics to collaborate on developing an Antibody-Drug Conjugate (ADC) technology platform, aiming to advance innovative targeted cancer therapies. (Source: https://www.lottebiologics.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the biologic drugs market.

By Product Type

- Monoclonal Antibodies (mAbs)

- Vaccines

- Recombinant Hormones

- Therapeutic Proteins

- Cell Therapy

- Gene Therapy

- Antisense & RNAi Therapies

By Source

- Microbial

- Mammalian

- Others (Yeast, Transgenic animals/plants)

By Manufacturing Type

- In-house Manufacturing

- Contract Manufacturing Organizations (CMOs)

By Application (Therapeutic Area)

- Oncology

- Autoimmune Diseases

- Infectious Diseases

- Neurology

- Cardiovascular

- Metabolic Disorders

- Ophthalmology

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)