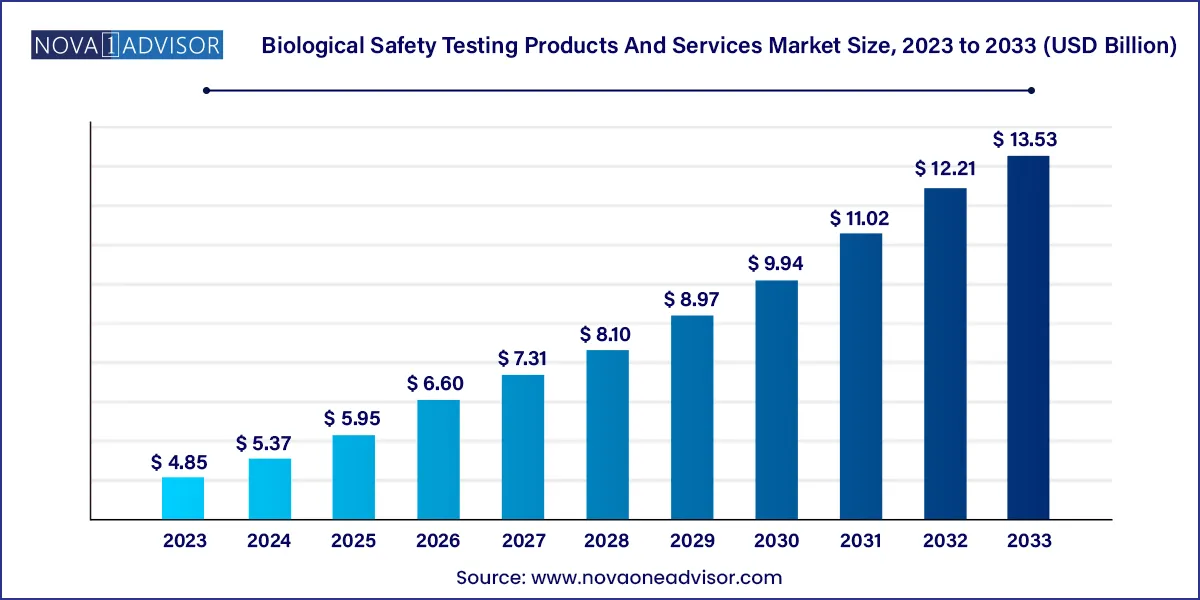

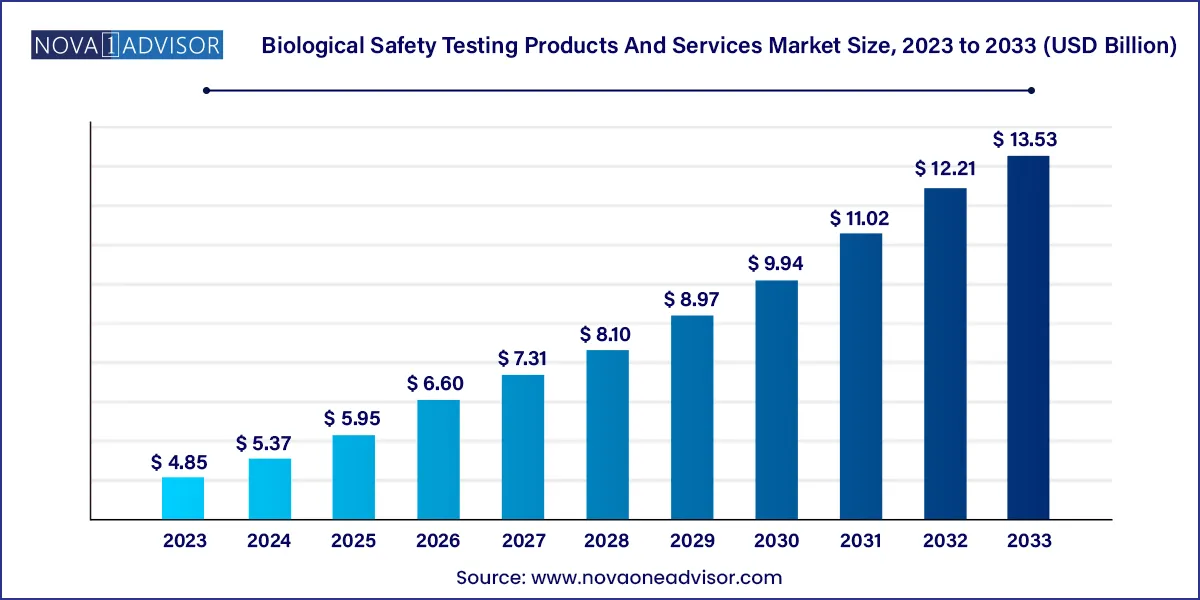

The global biological safety testing products and services market size was estimated at USD 4.85 billion in 2023 and is projected to hit around USD 13.53 billion by 2033, growing at a CAGR of 10.8% during the forecast period from 2024 to 2033.

Key Takeaways:

- North America dominated the overall market with a revenue share of 35.19% in 2023.

- The U.S. held the largest share in the North American market in 2023

- The Asia Pacific region is anticipated to grow at the fastest CAGR during the forecast period.

- the Asia Pacific region, Japan held the largest market share in 2023.

- The reagents and kits segment held a leading revenue share of over 39.19% in 2023.

- The vaccines & therapeutics segment accounted for the largest revenue share in 2023.

- The gene therapy segment is estimated to register the fastest CAGR through 2033

- The endotoxin tests segment dominated the market in 2023 with a significant revenue share.

- The bioburden tests segment has been anticipated to show lucrative growth over the forecast period.

Market Overview

The Biological Safety Testing Products and Services Market plays a vital role in safeguarding human health by ensuring that biological materials used in therapeutics, vaccines, gene therapies, and regenerative medicine are free from contamination, toxins, and other biological hazards. As life sciences industries evolve and biologics become more prominent, the need for rigorous testing standards has never been more critical.

Biological safety testing involves identifying and eliminating biological impurities such as bacteria, fungi, viruses, mycoplasma, and endotoxins in biopharmaceutical products. It is a mandatory regulatory requirement across the development and manufacturing stages to comply with global standards set by agencies like the FDA, EMA, and WHO. The market encompasses a broad range of offerings including reagents, kits, instruments, and outsourced services that support sterility, bioburden, endotoxin, and adventitious agent detection testing.

With the rising complexity of biologics such as monoclonal antibodies, cell therapies, and gene-modified products, ensuring the integrity and safety of biological raw materials and final formulations is paramount. This has triggered a surge in demand for both in-house testing tools and third-party service providers. Additionally, the expansion of biosimilars, growth in cell and gene therapy pipelines, and increasing biomanufacturing capacity globally are further driving this market.

Technological advancements, regulatory stringency, and pandemic-induced biopharma investment have positioned biological safety testing as a cornerstone of modern drug development. Whether it's in process development, batch release testing, or clinical trial material validation, the sector is embedded across the biopharmaceutical value chain.

Major Trends in the Market

-

Rising Adoption of Outsourced Testing Services: Biotech and pharma companies are increasingly outsourcing safety testing to specialized CROs to reduce time, cost, and regulatory burden.

-

Automation and Digitization in Testing Platforms: Laboratories are deploying robotic systems and digital data capture tools for enhanced reproducibility and faster throughput.

-

Increased Focus on Gene and Cell Therapy Safety: Novel therapies require advanced biosafety protocols, especially in stem cell-based and viral vector applications.

-

Integration of Rapid Microbiology Methods (RMM): These methods enable faster detection of contaminants, supporting real-time release testing (RTRT).

-

Stringent Regulatory Oversight: Regulatory bodies are enhancing GMP guidelines and encouraging early incorporation of safety testing protocols during development.

-

Growth in Companion Diagnostics and Personalized Medicine: The expansion of personalized biologics increases the need for customized safety assessments.

-

Advent of Multiplex Assay Platforms: New kits and instruments are being developed to simultaneously detect multiple contaminants in a single assay run.

Biological Safety Testing Products And Services Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 5.37 Billion |

| Market Size by 2033 |

USD 13.53 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.8% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, application, test type, region

|

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Charles River Laboratories; BSL Bioservice; Merck KGaA (MilliporeSigma); Samsung Biologics; Sartorius AG; Eurofins Scientific; SGS Société Générale de Surveillance SA; Thermo Fisher Scientific Inc.; BIOMÉRIEUX; Lonza |

Key Market Driver: Rising Global Production of Biologics

A major driver of the biological safety testing market is the surge in the global production and approval of biologics, including monoclonal antibodies, recombinant proteins, vaccines, and gene therapies. Biologics are inherently more complex and sensitive than small-molecule drugs, requiring more rigorous and frequent safety testing throughout the production lifecycle.

In 2024 alone, the FDA approved over 20 biologics, including first-in-class therapies and biosimilars. Each of these products must undergo stringent biosafety evaluations such as sterility, mycoplasma, and endotoxin testing. Moreover, biologics manufacturing often involves living cells and genetically modified organisms, which increases the risk of adventitious agent contamination—necessitating robust biosafety frameworks.

The expansion of manufacturing capacity, especially in North America and Asia, is fueling demand for biological testing solutions. Biopharma facilities operating under GMP conditions are heavily reliant on validated testing services and tools to meet regulatory expectations for safe production and batch release.

Key Market Restraint: High Cost and Technical Complexity

One of the key challenges restraining market growth is the high cost and technical complexity associated with biosafety testing, especially for new market entrants and smaller biotech firms. Sophisticated tests—such as cell line authentication, adventitious virus detection, or nucleic acid-based assays often require expensive instruments, skilled personnel, and time-consuming protocols.

For instance, establishing a compliant sterility testing lab requires Class 100 cleanrooms, biosafety cabinets, validated autoclaves, and trained microbiologists. These infrastructure and operational costs can be prohibitive, leading smaller players to delay or under-prioritize safety testing. Additionally, meeting international regulatory standards requires exhaustive documentation, validation, and calibration procedures, adding further burden.

Furthermore, variability in test results due to operator skill or environmental conditions can impact the reproducibility of tests, requiring redundant testing and re-validation. This drives up costs and timelines, especially during high-stakes clinical development stages.

Key Market Opportunity: Expansion of Gene and Cell Therapy Pipelines

A promising growth opportunity in this market lies in the rapid expansion of gene and cell therapy pipelines, which require next-generation biological safety testing solutions. These therapies involve using living cells, viral vectors, or genetically engineered components—all of which pose unique biosafety challenges.

For example, viral vector-based gene therapies must be rigorously tested for replication-competent viruses, endotoxins, and residual host cell proteins. Similarly, cell therapies must undergo mycoplasma testing, adventitious agent detection, and sterility testing before patient administration. This is particularly critical in autologous (patient-specific) therapies where production timelines are tight, and contamination can lead to devastating outcomes.

The FDA has created a specialized regulatory framework for gene therapy products, emphasizing the importance of robust quality control and biosafety validation. As more biotech companies enter this space, the need for customized testing services and scalable testing platforms will continue to grow, providing ample opportunities for toolmakers and CROs alike.

Segmental Analysis

By Product

Reagents & Kits dominated the U.S. biological safety testing market by product. This segment includes consumables used in assays such as endotoxin tests (LAL kits), bioburden testing, PCR kits for contamination detection, and sterility media. The demand is high due to the repeated, high-volume nature of testing across different production stages. Kits for qPCR-based detection of mycoplasma or adventitious agents are particularly favored due to their speed and reliability. Suppliers like Lonza, Merck KGaA, and Thermo Fisher dominate this segment with validated, GMP-grade kits.

Services represent the fastest-growing product segment, fueled by outsourcing trends in biologics manufacturing and clinical development. Contract testing organizations (CTOs) and CROs offer turnkey services for sterility, viral clearance, endotoxin, and contamination testing, reducing the burden on in-house teams. Startups and even large pharma companies are leveraging service providers for flexible, high-throughput, and regulatory-compliant biosafety solutions, especially during scale-up or tech transfer phases.

By Application

Vaccines & Therapeutics dominated the application landscape. The COVID-19 pandemic has cemented the role of vaccines as critical healthcare infrastructure, resulting in expanded production pipelines for both prophylactic and therapeutic vaccines. All these products undergo rigorous testing to eliminate microbial, viral, and endotoxin risks. Additionally, monoclonal antibodies and recombinant proteins form the backbone of modern therapeutics—requiring extensive bioburden, residual host protein, and identity testing.

Gene therapy is the fastest-growing application segment, given the surge in clinical trials and commercial approvals for inherited genetic disorders, cancers, and neurological diseases. The nature of gene therapies—often delivered via viral vectors or lipid nanoparticles demands enhanced biosafety assessments. Regulatory guidance around cell line origin, replication competency, and residual DNA levels is leading to an expanded role for advanced biosafety tests, including those powered by NGS or ddPCR.

By Test Type

Endotoxin testing was the most widely performed test type. This test is mandated for all injectable drugs and biologics to ensure the absence of bacterial endotoxins that can cause severe reactions in patients. LAL (Limulus Amebocyte Lysate) tests are the most common method, available in gel-clot, turbidimetric, and chromogenic formats. Their popularity stems from their high sensitivity, regulatory acceptance, and standardized workflows.

Adventitious agent detection is the fastest-growing testing type, especially in viral vector and cell therapy products. These tests use PCR, ELISA, or next-gen sequencing methods to identify hidden viral or microbial contamination that may not show up in conventional sterility tests. Companies are developing multiplexed assays that can detect a range of potential contaminants in a single workflow, enhancing efficiency and compliance.

Regional Insights

The U.S. leads the biological safety testing market, driven by a mature biopharmaceutical ecosystem, stringent regulatory standards, and strong government support. Organizations like the FDA, USP, and NIH have been instrumental in defining biosafety guidelines and enforcing quality compliance. The U.S. hosts some of the largest biologics production facilities in the world, with companies such as Pfizer, Amgen, and Genentech performing extensive biosafety validations during preclinical, clinical, and commercial stages.

Moreover, the region is home to leading CROs and biosafety service providers like Charles River, Eurofins, and BioReliance, which offer end-to-end testing services. Academic institutions and government labs also contribute significantly to test method development and validation studies. Recent pandemic preparedness efforts and the launch of several cell and gene therapy manufacturing hubs in Boston, North Carolina, and California have further strengthened market demand.

Asia-Pacific is the fastest-growing region.

Asia-Pacific is rapidly emerging as a manufacturing and R&D hub for biologics, biosimilars, and vaccines. Countries such as China, India, South Korea, and Singapore are investing in biopharma infrastructure and regulatory modernization, which is boosting demand for biosafety testing. China’s updated pharmacopoeia and the CFDA’s stricter biologics guidelines now mandate several biosafety tests at different production stages.

Additionally, domestic CDMOs and CROs in India and China are scaling up service offerings to cater to U.S. and EU-bound clients. Japan and South Korea are also leaders in regenerative medicine, particularly in stem cell therapies, which require intensive biosafety oversight. The rise of local reagent and instrument suppliers in these countries is also expected to improve access and affordability of testing solutions.

Recent Developments

-

March 2025: Charles River Laboratories announced the expansion of its viral clearance and mycoplasma testing capabilities in Pennsylvania to support increasing demand for gene therapy and mRNA vaccine development.

-

February 2025: Thermo Fisher Scientific launched a new rapid microbial detection platform designed to deliver sterility test results within 24 hours, compared to the traditional 14-day methods.

-

January 2025: Merck KGaA (MilliporeSigma) acquired a biosafety testing startup specializing in AI-powered contamination prediction tools, enhancing its digital testing portfolio.

-

December 2024: Eurofins Scientific opened a new biologics safety testing facility in North Carolina, increasing its U.S. footprint and high-throughput capacity for endotoxin, sterility, and virus testing.

-

November 2024: SGS Life Sciences introduced a new suite of PCR-based adventitious agent detection kits tailored for ATMPs (Advanced Therapy Medicinal Products), expanding its services for gene and cell therapies.

Key Biological Safety Testing Products And Services Companies:

- Charles River Laboratories

- BSL Bioservice

- Merck KGaA

- Samsung Biologics

- Sartorius AG

- Eurofins Scientific

- SGS Société Générale de Surveillance SA

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Lonza

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Biological Safety Testing Products And Services market.

By Product

- Reagents & Kits

- Instruments

- Services

By Application

- Vaccines & Therapeutics

- Vaccines

- Monoclonal Antibodies

- Recombinant Protein

- Blood & Blood-based Products

- Gene Therapy

- Tissue & Tissue-based Products

- Stem Cell

By Test Type

- Endotoxin Tests

- Sterility Tests

- Cell Line Authentication & Characterization Tests

- Bioburden Tests

- Adventitious Agent Detection Tests

- Residual Host Contamination Detection Tests

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)