Biologics CDMO Market Size Trends Analysis and Forecast till 2034

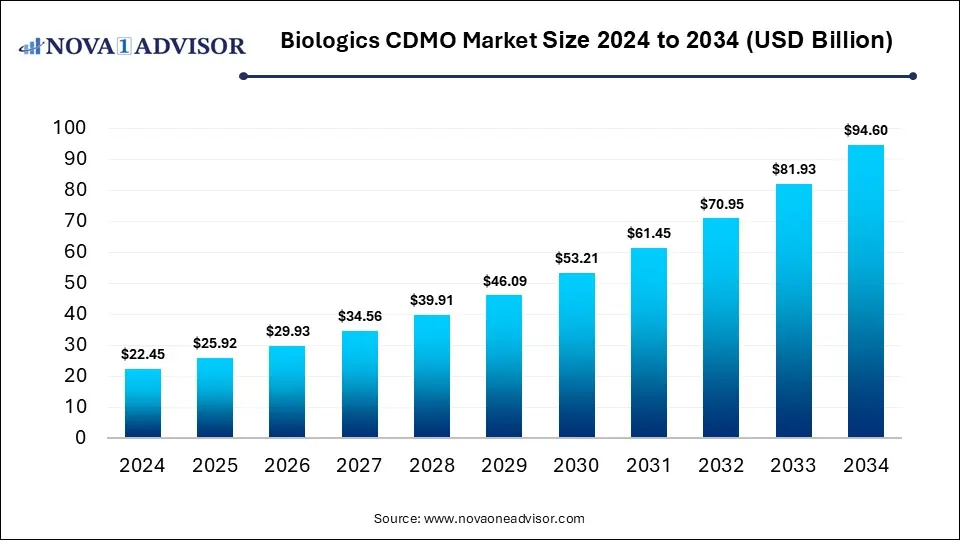

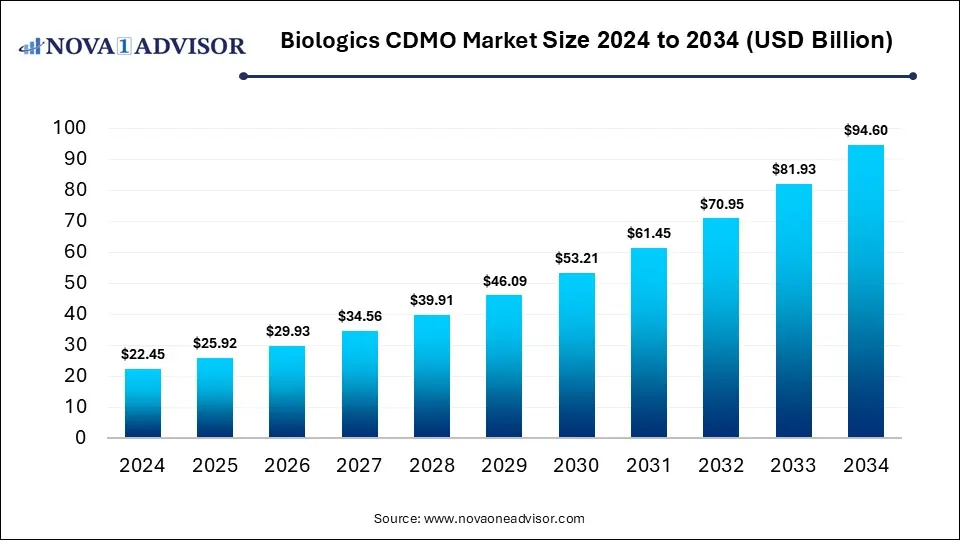

The global biologics CDMO market size is calculated at USD 22.45 billion in 2024, grows to USD 25.92 billion in 2025, and is projected to reach around USD 94.60 billion by 2034, growing at a solid CAGR of 15.47% from 2025 to 2034. The market is growing due to rising demand for complex biologics, biosimilars, and cell & gene therapies. Additionally, pharma companies increasingly outsource to CDMOs for cost efficiency, advanced technology, and faster time-to-market.

Biologics CDMO Market Key Takeaways

- North America dominated the biologics CDMO market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By type, the mammalian segment held the largest market share in 2024.

- By type, the microbial segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By molecule type, the monoclonal antibodies segment led the market with the largest revenue share in 2024.

- By molecule type, the recombinant protein segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By product type, the biologics segment is expected to grow at a significant rate in the market during the forecast period.

- By indication, the oncology segment held the highest market share in 2024.

- By indication, the auto-immune diseases segment is expected to grow at a notable rate in the market during the forecast period.

Why Biologics CDMO Market Evolving?

A biologics CDMO is a third-party partner that offers end-to-end solutions for biologics medicine, handling activities like process development, formulation, analytical testing, and large-scale manufacturing to help companies accelerate product commercialization. The biologics CDMO market is evolving because of the rising trend of small and mid-sized biotech firms that lack manufacturing capabilities, pushing them to depend on outsourcing partners. Increasing focus on personalized medicine and niche therapies also requires flexible, specialized facilities that CDMO can provide. Moreover, technological advancements such as single-use bioreactors and continuous bioprocessing are reshaping production methods, enabling faster and more efficient development, which further drives the shift towards CDMO collaboration.

What are the Key trends in the Biologics CDMO Market in 2024?

- In November 2024, GHO Capital Partners and Ampersand Capital Partners acquired Avid Bioservices, a biologics CDMO, in a deal valued at $1.1 billion, which equated to nearly 6.3 times its projected fiscal 2025 revenue. (Source: https://www.globenewswire.com/)

- In April 2024, Curida Holding AS, a CDMO for small molecules and biologics, received private equity funding from Signet Healthcare Partners to boost innovation, improve productivity, expand facility capabilities, and strengthen its market presence. (Source: https://www.businesswire.com/)

How Can AI Affect the Biologics CDMO Market?

AI can influence the market by enabling advanced digital twins for process simulation, allowing real-time monitoring and predictive maintenance of equipment. It can support personalized medicine by tailoring biologics production to patient-specific needs and improve batch consistency through automated decision-making. Moreover, AI-powered demand forecasting helps CDMOs manage capacity planning more effectively, reducing delays and optimizing resource utilization, ultimately strengthening competitiveness and responsiveness in a rapidly growing biologics landscape.

Report Scope of Biologics CDMO Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 25.92 Billion |

| Market Size by 2034 |

USD 94.60 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.47% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Molecule Type, Product Type, and Regions |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Driver

Rising Demand for Monoclonal Antibodies, Vaccines, and Biosimilars

The increasing demand for monoclonal antibodies, vaccines, and biosimilars is fueling the biologics CDMO market as it pushes the need for flexible production models and faster turnaround times. These biologics often targeted chronic and rare diseases, requiring tailored processes and large-scale availability. CDMO provides the agility to adapt to varying batch sizes and evolving formulations, ensuring timely market supply. This trend positions CDMOs as essential in meeting patient needs while supporting pharmaceutical companies' global expansion strategies.

- For Instance, In October 2024, Samsung Biologics signed a contract worth about USD 1.24 billion with an unnamed Asia-based pharma company. The deal, effective through December 2037, covers biopharma manufacturing at Samsung’s Songdo facility, pushing Samsung’s total contract value for 2024 past USD 3.3 billion. (Source: https://samsungbiologics.com/)

Restraint

High Cost and Complexity of Biologics Manufacturing

The high cost and complexity of biologics manufacturing restrain the CDMO market as they create a barrier to expanding capacity and adopting innovative technologies. Many CDMOs struggle with long lead times for facility upgrades, expensive raw materials, and limited availability of specialized equipment. These challenges can delay project execution and discourage smaller players from entering the market. Consequently, the overall outsourcing ecosystem faces constraints in meeting the growing global demand for biologics efficiently.

Opportunity

Growing Adoption of Personalized Medicine and Precision Biologics

The increasing focus on personalized medicine and precision biologics offers growth potential for CDMO because it drives demand for specialized manufacturing capabilities, such as adaptable production lines and innovative formulation technologies. As therapies become more patient-specific, pharmaceutical companies require external partners to handle complex development and small-scale production efficiently. This trend allows CDMOs to diversify their services, invest in advanced technologies, and establish long-term collaborations, ultimately expanding their role in the next-generation biologics market.

- For Instance, In March 2025, Syngene International acquired Emergent’s U.S. biologics facility for $36.5 M to boost large-molecule and personalized biologics manufacturing. (Source: https://www.reuters.com/)

Segmental Insights

How does the Mammalian Segment dominate the Biologics CDMO Market in 2024?

In 2024, the mammalian segment held the largest share of the market because mammalian cells are essential for producing complex biologics like monoclonal antibodies, recombinant proteins, and vaccines with proper folding, post-translational modification, and high bioactivity. Their ability to mimic human biological processes ensures therapeutic efficacy to mimis human biological processes ensures therapeutic efficacy and safety. Additionally, increasing demand for biologics targeting chronic and rare diseases, combined with established mammalian cell platforms, reinforced their dominance over microbial and other expression systems in the biologics CDMO market.

The microbial segment is projected to grow fastest because it enables flexible, scalable, and faster manufacturing of biologics, especially for biosimilars and recombinant proteins. Microbial systems require less stringent culture conditions, shorter production cycles, and simpler purification processes, reducing overall time-to-market. Additionally, technological advancements in synthetic biology and strain optimization are expanding the range of biologics that can be produced microbially, making this segment increasingly attractive for CDMOs looking to meet rising global demand efficiently.

Why Did the Monoclonal Antibodies Segment Dominate the Market in 2024?

The monoclonal antibody segment dominated the 2024 biologics CDMO market because of its critical role in next-generation therapies and personalized treatments. Growing partnerships between biotech firms and CDMOs to accelerate mAb production, coupled with increasing demand for antibody-based diagnostics and therapeutics, fueled revenue growth. Additionally, the scalability of mAb manufacturing and expanding global adoption in emerging markets strengthened the segment’s market position, making it the top revenue contributor among all molecule types during the year.

- For Instance, In October 2023, Tanvex BioPharma USA Inc. launched Tanvex CDMO, a full-service biologics contract development and manufacturing platform, aimed at leveraging its biopharmaceutical expertise to support the industry. (Source: https://www.tanvex.com/)

The recombinant protein segment is projected to grow fastest because of its expanding applications in rare disease treatments, immunotherapies, and vaccine development. Innovations in cell-free expression systems and high-throughput screening are enabling quicker, more flexible production. Moreover, pharmaceutical companies are increasingly outsourcing recombinant protein manufacturing to CDMOs to reduce operational costs and accelerate time-to-market. This growing reliance on external partners for specialized, high-quality protein production is driving the segment’s rapid growth throughout the forecast period.

How does the Biologics Segment Expand Notably in the Biologics CDMO Market?

The biologic segment is projected to grow significantly due to the expanding pipeline of innovative therapies and personalized treatments. Growing investment in research and development, along with the increasing adoption of outsourcing by biotech and pharma companies, is driving demand for CDMO services. Advanced manufacturing technologies and scalable production capabilities allow CDMOs to efficiently produce complex biologics, supporting faster commercialization and contributing to the segment’s significant growth during the forecast period.

Biologics CDMO Market By Product Type, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Biologics |

17.51 |

19.91 |

22.63 |

25.72 |

29.21 |

33.18 |

37.68 |

42.77 |

48.53 |

55.06 |

62.44 |

| Biosimilars |

4.94 |

6.01 |

7.30 |

8.85 |

10.70 |

12.90 |

15.54 |

18.68 |

22.42 |

26.87 |

32.17 |

What made the Oncology Segment Dominant in the Market in 2024?

The oncology segment dominated the 2024 market because cancer treatments increasingly rely on complex biologics, driving demand for specialized contract manufacturing. Rising global cancer incidence, coupled with expanded research in immuno-oncology and targeted therapies, has led companies to outsource production to CDMOs with advanced capabilities. The need for scalable, high-quality manufacturing to meet clinical and commercial supply requirements further strengthened the segment’s market share, making oncology the top indication in terms of revenue.

The auto-immune disease segment is projected to grow rapidly as demand rises for innovative biologics and biosimilars that treat chronic immune-related disorders. Increasing research into next-generation therapies, combined with the need for large-scale, high-quality production, encourages pharmaceutical companies to partner with CDMOs. Additionally, expanding healthcare access and growing patient awareness globally are fueling the adoption of biologic treatments, making the autoimmune disease segment a key area of growth in the biologics CDMO market during the forecast period.

- For Instance, In May 2024, Commit Biologics emerged from stealth mode with €16 million in seed funding to develop antibody therapeutics for cancer and autoimmune diseases using its bispecific complement-engaging (BiCE) technology. (Source: http://commitbio.com/)

Regional Insights

How is North America contributing to the Expansion of the Biologics CDMO Market?

North America led the market in 2024 because of its concentration of biotech startups and established pharma companies that rely heavily on outsourced manufacturing. Advanced technological capabilities, skilled workforce, and access to capital for facility expansion enabled CDMOs to meet high demand efficiently. Additionally, government initiatives supporting biologics development and strong intellectual property protection attracted global collaborations, reinforcing the region’s dominance in revenue generation within the biologics CDMO sector.

The U.S. Biologics CDMO Market Trends

The U.S. market is expanding as more biotech and pharma firms seek flexible, scalable manufacturing solutions for innovative therapies. Growing emphasis on personalized medicine, complex protein therapeutics, and biosimilars is increasing reliance on CDMOs with specialized expertise. Furthermore, strategic partnerships, technological advancements in bioprocessing, and the need to quickly meet rising domestic and global demand are fueling the market’s growth across clinical and commercial biologics production.

The Canadian Biologics CDMO Market Trends

The Canada market is expanding due to increasing investment in biotechnology and biopharmaceutical R&D, coupled with supportive government initiatives and funding programs. Rising demand for monoclonal antibodies, vaccines, and protein therapeutics is driving outsourcing to specialized CDMOs. Additionally, the establishment of advanced manufacturing facilities, growing collaborations with global pharma companies, and the focus on clinical and commercial-scale biologics production are fueling market growth in Canada.

How is Asia-Pacific Accelerating the Biologics CDMO Market?

The Asia-Pacific market is projected to grow rapidly because of the region’s emerging biotech hubs and increasing focus on domestic biologics manufacturing. Rising prevalence of chronic and rare diseases, coupled with expanding regulatory support and government-backed initiatives, encourages companies to outsource production locally. Additionally, the availability of cost-effective facilities, growing contract manufacturing expertise, and strategic collaborations with international pharma firms position the region for the fastest CAGR during the forecast period.

Biologics CDMO Market By Regional, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

9.43 |

10.65 |

12.03 |

13.58 |

15.33 |

17.28 |

19.48 |

21.94 |

24.69 |

27.77 |

31.22 |

| Asia Pacific |

5.84 |

7.05 |

8.50 |

10.23 |

12.29 |

14.75 |

17.67 |

21.14 |

25.26 |

30.15 |

35.95 |

| Europe |

5.39 |

6.14 |

7.00 |

7.98 |

9.10 |

10.37 |

11.81 |

13.46 |

15.33 |

17.45 |

19.87 |

| Latin America |

1.12 |

1.31 |

1.53 |

1.78 |

2.08 |

2.42 |

2.82 |

3.29 |

3.83 |

4.47 |

5.20 |

| Middle East & Africa |

0.67 |

0.76 |

0.87 |

0.99 |

1.12 |

1.27 |

1.44 |

1.63 |

1.84 |

2.09 |

2.37 |

Top Companies in the Biologics CDMO Market

Recent Developments in the Biologics CDMO Market

- In December 2024, Lonza announced a restructuring to strengthen its CDMO operations by unifying three business platforms Integrated Biologics, Advanced Synthesis, and Specialized Modalities, aimed at improving operational efficiency and manufacturing execution. (Source: https://www.lonza.com/)

- In September 2024, Eurofins CDMO Alphora, Inc. announced plans to build a new GMP biologics facility in Ontario for producing monoclonal antibodies and protein therapies for clinical and commercial use, with completion expected by April 2026. The project is supported by funding from the Canadian Federal Government and the Strategic Initiative Funding (SIF) program. (Source: https://www.businesswire.com/)

Segments Covered in the Report

By Type

By Molecule Type

- Monoclonal Antibodies

- Recombinant Proteins

- Vaccines

- Hormones

- Others

By Product Type

By Indication

- Oncology

- Auto-Immune Diseases

- Infectious Diseases

- Neurology

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

List of Tables

-

Table 1: U.S. Biologics CDMO Market, by Type

-

Table 2: U.S. Biologics CDMO Market, by Molecule Type

-

Table 3: U.S. Biologics CDMO Market, by Product Type

-

Table 4: U.S. Biologics CDMO Market, by Indication

-

Table 5: Canada Biologics CDMO Market, by Type

-

Table 6: Canada Biologics CDMO Market, by Molecule Type

-

Table 7: Canada Biologics CDMO Market, by Product Type

-

Table 8: Canada Biologics CDMO Market, by Indication

-

Table 9: Mexico Biologics CDMO Market, by Type

-

Table 10: Mexico Biologics CDMO Market, by Molecule Type

-

Table 11: Mexico Biologics CDMO Market, by Product Type

-

Table 12: Mexico Biologics CDMO Market, by Indication

-

Table 13: Germany Biologics CDMO Market, by Type

-

Table 14: Germany Biologics CDMO Market, by Molecule Type

-

Table 15: Germany Biologics CDMO Market, by Product Type

-

Table 16: Germany Biologics CDMO Market, by Indication

-

Table 17: France Biologics CDMO Market, by Type

-

Table 18: France Biologics CDMO Market, by Molecule Type

-

Table 19: France Biologics CDMO Market, by Product Type

-

Table 20: France Biologics CDMO Market, by Indication

-

Table 21: UK Biologics CDMO Market, by Type

-

Table 22: UK Biologics CDMO Market, by Molecule Type

-

Table 23: UK Biologics CDMO Market, by Product Type

-

Table 24: UK Biologics CDMO Market, by Indication

-

Table 25: Italy Biologics CDMO Market, by Type

-

Table 26: Italy Biologics CDMO Market, by Molecule Type

-

Table 27: Italy Biologics CDMO Market, by Product Type

-

Table 28: Italy Biologics CDMO Market, by Indication

-

Table 29: Rest of Europe Biologics CDMO Market, by Segments

-

Table 30: China Biologics CDMO Market, by Type

-

Table 31: China Biologics CDMO Market, by Molecule Type

-

Table 32: China Biologics CDMO Market, by Product Type

-

Table 33: China Biologics CDMO Market, by Indication

-

Table 34: Japan Biologics CDMO Market, by Type

-

Table 35: Japan Biologics CDMO Market, by Molecule Type

-

Table 36: Japan Biologics CDMO Market, by Product Type

-

Table 37: Japan Biologics CDMO Market, by Indication

-

Table 38: South Korea Biologics CDMO Market, by Type

-

Table 39: South Korea Biologics CDMO Market, by Molecule Type

-

Table 40: South Korea Biologics CDMO Market, by Product Type

-

Table 41: South Korea Biologics CDMO Market, by Indication

-

Table 42: India Biologics CDMO Market, by Type

-

Table 43: India Biologics CDMO Market, by Molecule Type

-

Table 44: India Biologics CDMO Market, by Product Type

-

Table 45: India Biologics CDMO Market, by Indication

-

Table 46: Southeast Asia Biologics CDMO Market, by Segments

-

Table 47: Rest of Asia Pacific Biologics CDMO Market, by Segments

-

Table 48: Brazil Biologics CDMO Market, by Type

-

Table 49: Brazil Biologics CDMO Market, by Molecule Type

-

Table 50: Brazil Biologics CDMO Market, by Product Type

-

Table 51: Brazil Biologics CDMO Market, by Indication

-

Table 52: Rest of Latin America Biologics CDMO Market, by Segments

-

Table 53: GCC Countries Biologics CDMO Market, by Type

-

Table 54: GCC Countries Biologics CDMO Market, by Molecule Type

-

Table 55: GCC Countries Biologics CDMO Market, by Product Type

-

Table 56: GCC Countries Biologics CDMO Market, by Indication

-

Table 57: Turkey Biologics CDMO Market, by Segments

-

Table 58: Africa Biologics CDMO Market, by Segments

-

Table 59: Rest of MEA Biologics CDMO Market, by Segments

-

Figure 1: U.S. Biologics CDMO Market Share, by Type

-

Figure 2: U.S. Biologics CDMO Market Share, by Molecule Type

-

Figure 3: U.S. Biologics CDMO Market Share, by Product Type

-

Figure 4: U.S. Biologics CDMO Market Share, by Indication

-

Figure 5: Canada Biologics CDMO Market Share, by Segments

-

Figure 6: Mexico Biologics CDMO Market Share, by Segments

-

Figure 7: Germany Biologics CDMO Market Share, by Type

-

Figure 8: France Biologics CDMO Market Share, by Segments

-

Figure 9: UK Biologics CDMO Market Share, by Segments

-

Figure 10: Italy Biologics CDMO Market Share, by Segments

-

Figure 11: China Biologics CDMO Market Share, by Type

-

Figure 12: Japan Biologics CDMO Market Share, by Segments

-

Figure 13: South Korea Biologics CDMO Market Share, by Segments

-

Figure 14: India Biologics CDMO Market Share, by Segments

-

Figure 15: Brazil Biologics CDMO Market Share, by Segments

-

Figure 16: GCC Countries Biologics CDMO Market Share, by Segments

-

Figure 17: Turkey Biologics CDMO Market Share, by Segments

-

Figure 18: Africa Biologics CDMO Market Share, by Segments