Biologics Market Size and Growth 2026 to 2035

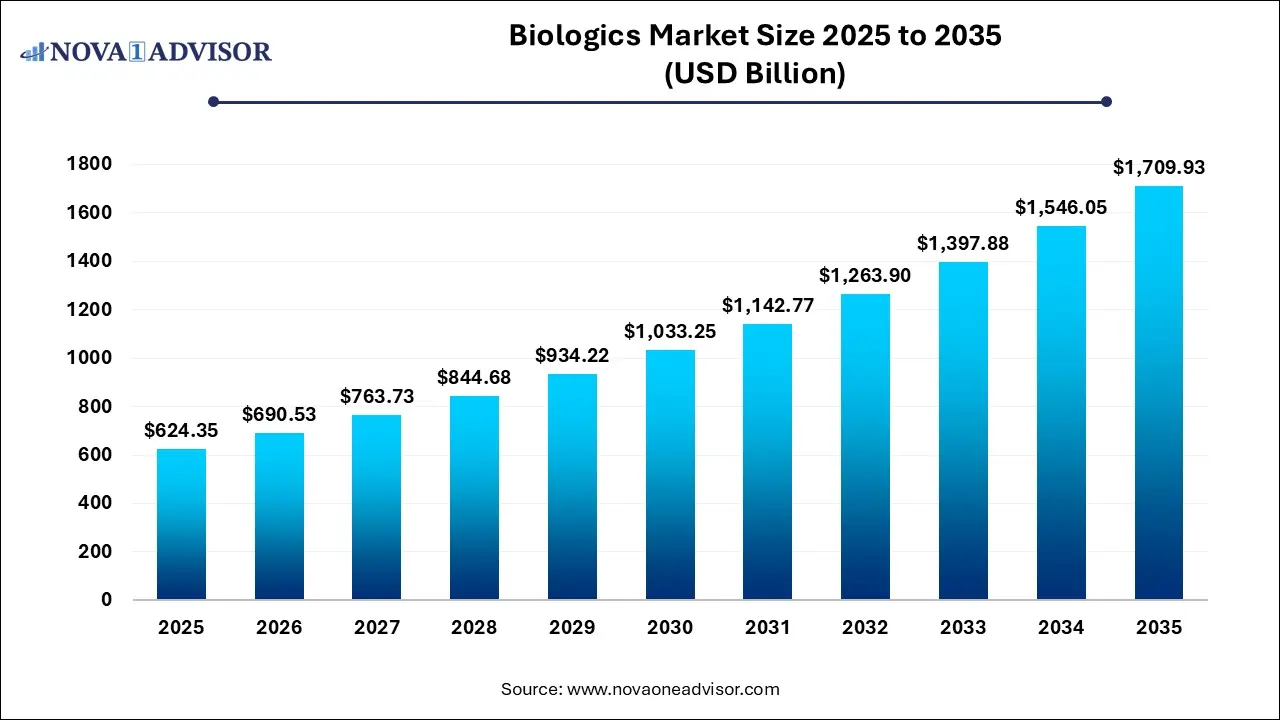

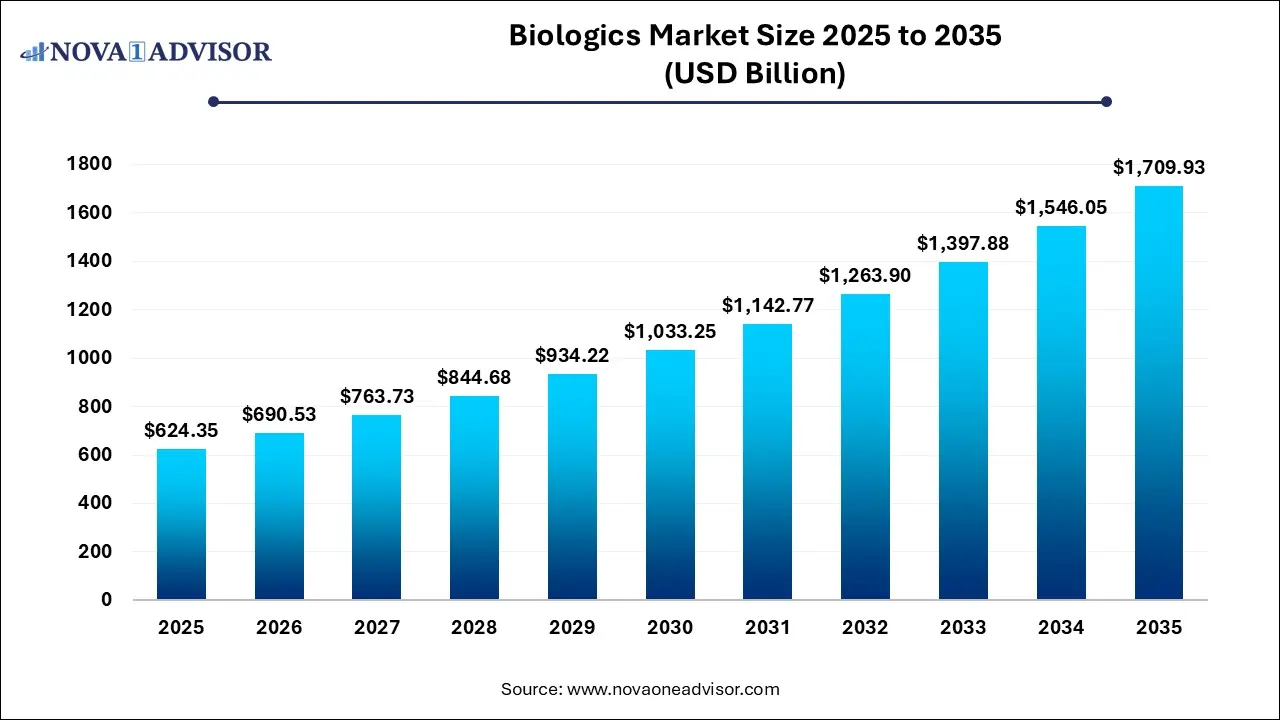

The global biologics market size was estimated at USD 624.35 billion in 2025 and is projected to hit around USD 1,709.93 billion by 2035, growing at a CAGR of 10.6% during the forecast period from 2026 to 2035.

Key Takeaways:

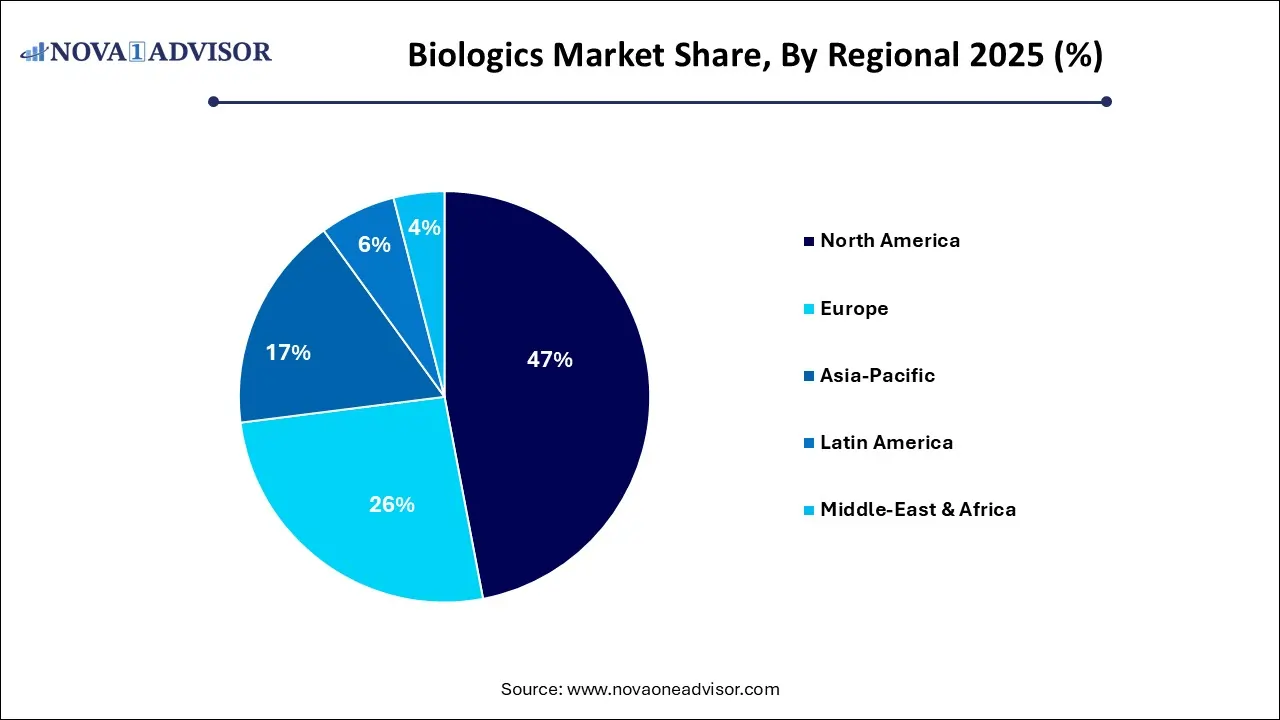

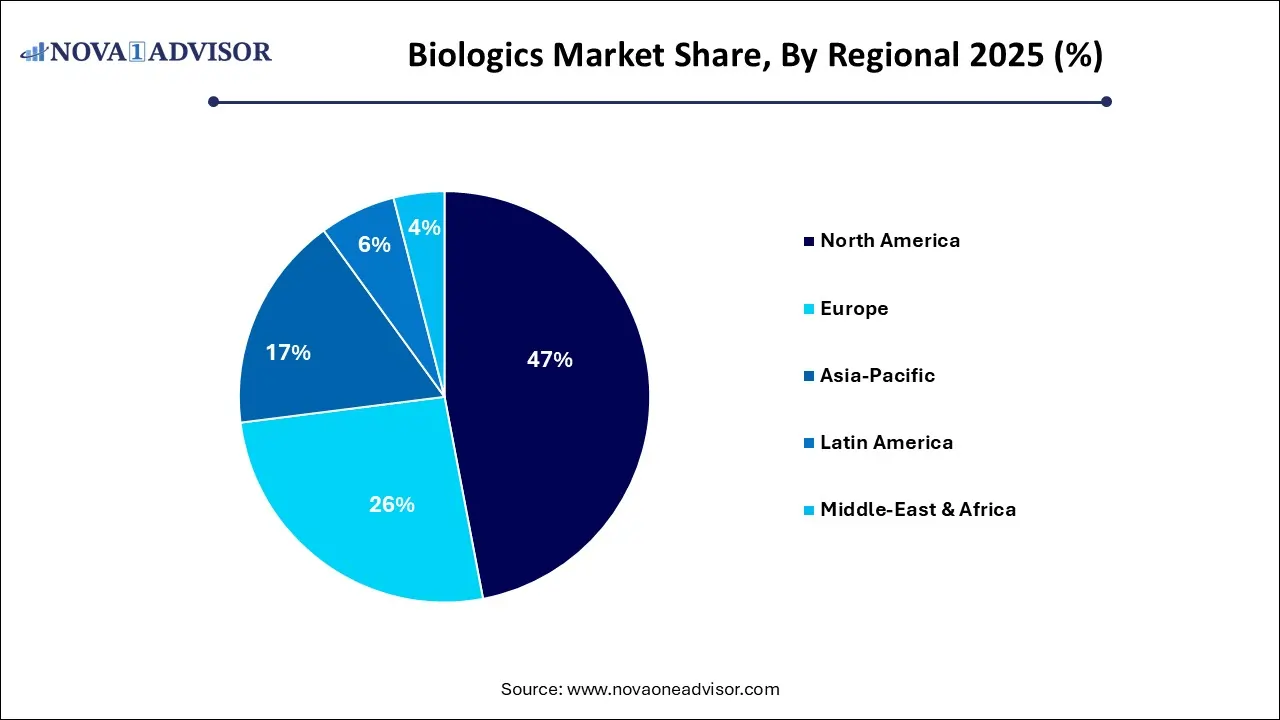

- North America held the largest revenue share of 47.0% in 2025.

- Asia Pacific region is projected to expand at the CAGR of 11.2% during the forecast period.

- Based on the disease category, the oncology segment dominated the biologics industry with a share of 29.40% in 2025.

- The hematological disorder segment is expected to expand at the fastest CAGR of 11.8% during the forecast period.

- Based on source, the microbial segment dominated the biologics industry with a share of 59.23% in 2025.

- The mammalian expression systems segment is expected to expand at a significant CAGR during the forecast period.

- Based on manufacturing, the in-house segment dominated the market with 85.87% share in 2025.

- The outsourcing segment is projected to expand at a CAGR of 10.8% during the forecast period.

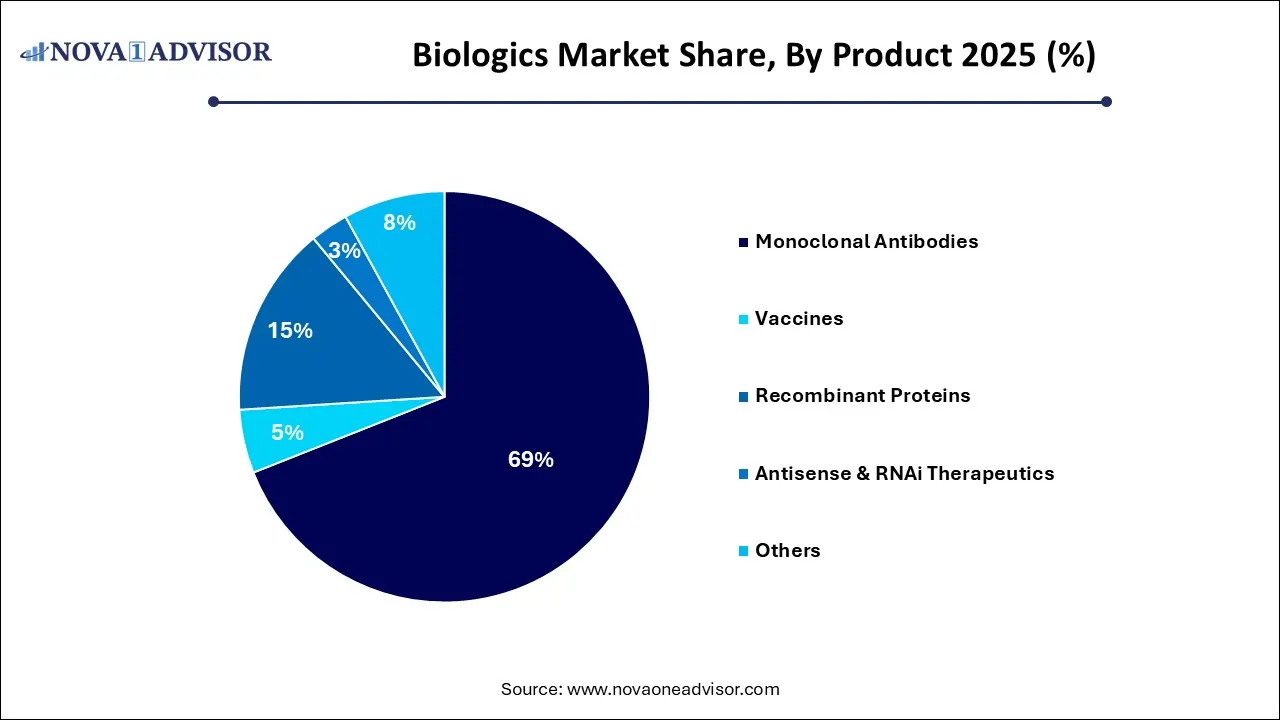

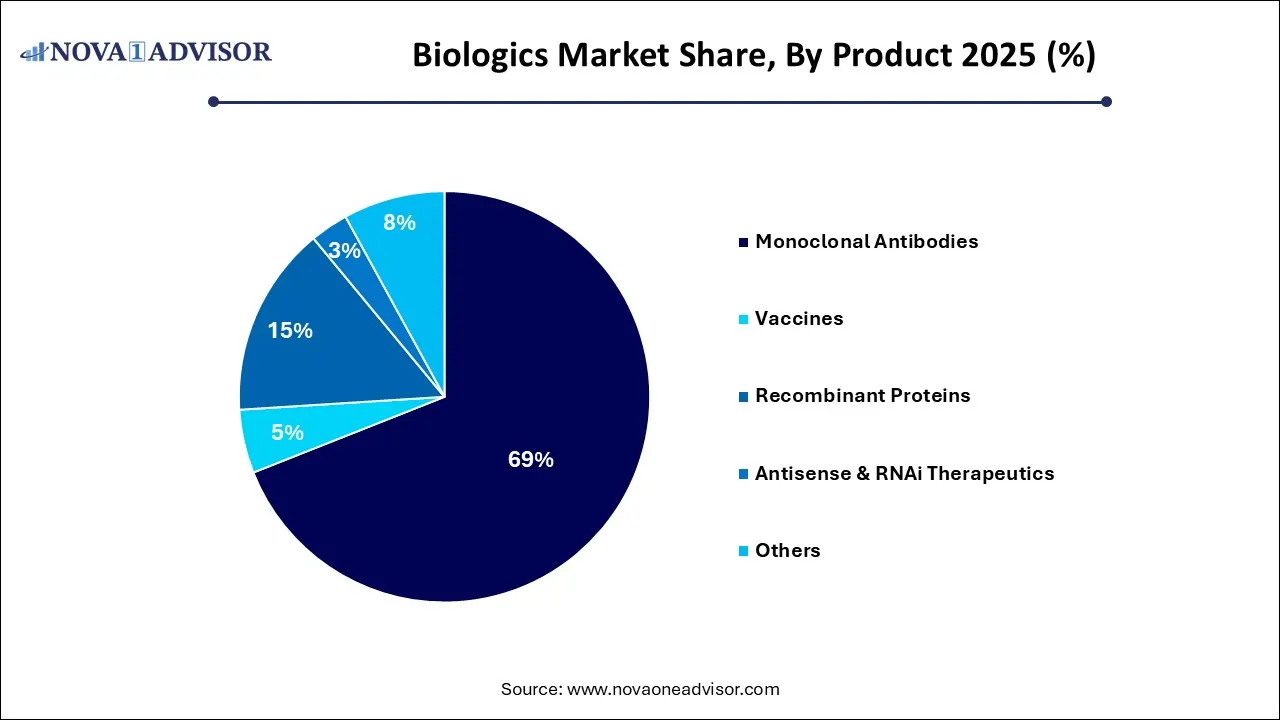

- Based on product, the monoclonal antibodies segment accounted for a share of 69.0% in 2025.

- The antisense and RNAi therapeutics segment is anticipated to expand at a CAGR of 20.7% during the forecast period.

Market Overview

The Biologics Market stands at the confluence of biotechnology, pharmaceutical innovation, and advanced therapeutic strategies. As the world increasingly pivots towards precision medicine and personalized healthcare, biologics have emerged as cornerstone solutions for some of the most complex and chronic diseases known to mankind. Biologics therapies derived from living organisms include monoclonal antibodies, vaccines, recombinant proteins, gene therapies, and RNA-based treatments. Unlike conventional small molecule drugs, biologics offer targeted and often more effective therapeutic outcomes, particularly in areas like oncology, immunology, and infectious diseases.

Market growth is driven by a confluence of rising disease burden, continuous innovation, and evolving regulatory frameworks that increasingly favor expedited approvals for breakthrough biologics. The recent COVID-19 pandemic underscored the transformative potential of biologics, with mRNA vaccines such as those developed by Moderna and Pfizer-BioNTech showcasing not only speed-to-market but also efficacy. As biologic pipelines mature and diversify, pharmaceutical and biotech companies are doubling down on their investments in research, development, and manufacturing capabilities. Moreover, with patent cliffs for several blockbuster biologics approaching, the biosimilars market is also gaining momentum, further expanding the landscape.

Major Trends in the Market

-

Surge in Monoclonal Antibody Therapies: MABs continue to dominate biologics, especially in oncology and immunology, with new entrants leveraging advanced engineering techniques for enhanced efficacy.

-

Rise of mRNA and RNA-based Therapeutics: The success of mRNA vaccines has propelled investments into RNAi and antisense therapies targeting genetic and rare diseases.

-

Hybrid Manufacturing Models: Companies are increasingly adopting a mix of in-house and outsourced biologics manufacturing to optimize speed and scalability.

-

Expansion of Biosimilars: As major biologics face patent expiries, biosimilar development is accelerating, particularly in Europe and emerging markets.

-

Automation and AI in Biologic Manufacturing: Advanced manufacturing facilities are implementing AI and robotics for process optimization and quality assurance.

-

Cold Chain Innovations: As biologics often require stringent temperature control, innovations in logistics and storage are gaining attention.

-

Patient-centric Drug Delivery: Subcutaneous and self-administered biologic formulations are being developed for chronic diseases to enhance patient compliance.

Biologics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 690.53 Billion |

| Market Size by 2035 |

USD 1,709.93 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 10.6% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Source, Product, Disease Category, Manufacturing, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Samsung Biologics; Amgen Inc.; Novo Nordisk A/S; AbbVie Inc.; Sanofi; Johnson & Johnson Services, Inc.; Celltrion Healthcare Co., Ltd.; Bristol-Myers Squibb Company; Eli Lilly and Company; F. Hoffmann La-Roche Ltd. |

Driver: Increasing Prevalence of Chronic and Complex Diseases

One of the most significant drivers for the biologics market is the rising global burden of chronic and complex diseases, particularly cancers, autoimmune disorders, and rare genetic conditions. Traditional therapies often fall short in these areas due to limited efficacy and broader side effect profiles. Biologics, however, offer targeted mechanisms of action, increasing their therapeutic potential. For example, monoclonal antibodies like pembrolizumab (Keytruda) have become standard-of-care treatments in multiple cancers, significantly improving survival outcomes. With aging populations and growing lifestyle-related health issues, demand for biologics is projected to soar, fueling innovation and market expansion.

Restraint: High Cost and Complex Manufacturing

Despite their clinical benefits, the high cost of biologic therapies poses a significant restraint. Biologics often require intricate, living systems-based manufacturing, necessitating advanced bioreactors, specialized personnel, and stringent regulatory compliance. This complexity results in high production costs, which are often passed on to patients or healthcare systems. Moreover, cold chain logistics and short shelf life further inflate expenses. In markets lacking universal healthcare or robust insurance systems, access to biologics remains limited. This disparity threatens equitable healthcare outcomes and dampens market penetration in cost-sensitive regions like parts of Asia, Africa, and Latin America.

Opportunity: Technological Advancements in Biomanufacturing

An emerging opportunity in the biologics market lies in technological innovation within biomanufacturing. With the advent of single-use technologies, continuous processing systems, and AI-enabled production monitoring, the landscape of biologics production is rapidly evolving. These advances promise to enhance scalability, reduce batch failure rates, and lower overall production costs. Moreover, companies are exploring decentralized and modular manufacturing units that can be swiftly deployed in response to pandemics or regional demands. For instance, Cytiva’s FlexFactory platform enables fast-track biomanufacturing setups, a game-changer in expanding biologics access to remote or underserved areas.

Segments Insights:

By Disease Category Insights

Oncology dominates the disease category in biologics application, driven by the high incidence of cancer worldwide and the need for targeted therapies. MABs like rituximab for lymphomas and checkpoint inhibitors like nivolumab have become standard therapeutic tools in cancer treatment. Biologics are also critical in immuno-oncology, where they modulate immune response against tumor cells. With ongoing clinical trials in areas like CAR-T cell therapy and bispecific antibodies, oncology remains the most lucrative and innovation-heavy segment.

Infectious diseases are the fastest-growing disease application, propelled by the COVID-19 pandemic and continued focus on vaccines and antivirals. The success of biologic vaccines like mRNA-based COVID-19 vaccines has prompted a surge in development activity for other viral threats like RSV and influenza. The global response to pandemics has also created a robust pipeline of biologic countermeasures supported by governmental and non-governmental funding.

By Source Insights

Mammalian cells dominate the biologics market by source, accounting for the majority of production platforms used in therapeutic protein and antibody development. Their ability to produce complex, human-like proteins with appropriate glycosylation makes them ideal for producing therapeutic-grade biologics. CHO (Chinese Hamster Ovary) cells are especially prominent and are employed by major biologics manufacturers including Genentech and Amgen. These cells are suitable for large-scale commercial production and have a proven track record of regulatory approval.

Microbial systems are the fastest-growing source category, particularly for vaccines and recombinant proteins. E. coli and yeast-based systems offer high-yield, cost-effective production with simplified culture requirements. These platforms are increasingly used for producing biosimilars and non-glycosylated proteins like insulin. Innovations in strain engineering and fermentation optimization are making microbial expression systems more versatile and scalable, particularly for emerging economies.

By Manufacturing Insights

In-house manufacturing dominates the biologics production approach, especially among large biopharma firms with established infrastructure and expertise. Controlling the production process allows for quality assurance, IP protection, and seamless regulatory compliance. Firms like Roche and Eli Lilly continue to invest in expanding their in-house capacities through state-of-the-art biomanufacturing campuses.

Outsourced manufacturing is rapidly gaining traction, particularly among emerging biotech companies and during clinical trial phases. CDMOs (Contract Development and Manufacturing Organizations) like Samsung Biologics and Lonza offer turnkey solutions that include R&D, production, and even regulatory support. Outsourcing also helps companies scale quickly and respond to regional demands, especially during pandemic outbreaks or drug shortages.

By Product Insights

Monoclonal antibodies (MABs) dominate the product landscape, with extensive use in oncology, autoimmune diseases, and hematological disorders. Their targeted mechanism allows for precise interaction with disease-specific antigens. Within MABs, humanized and fully human types are seeing higher uptake due to lower immunogenicity. Products like Humira (adalimumab) and Herceptin (trastuzumab) have demonstrated multi-billion-dollar market potential, spurring further research into new indications and combination therapies.

Antisense and RNAi therapeutics are the fastest-growing segment, bolstered by increasing approvals and breakthroughs in treating genetic diseases. These products, such as Onpattro (patisiran) for hereditary ATTR amyloidosis, represent the cutting edge of gene-silencing technology. With numerous clinical trials underway and growing interest from both pharma giants and startups, RNAi therapeutics are expected to revolutionize treatment paradigms over the next decade.

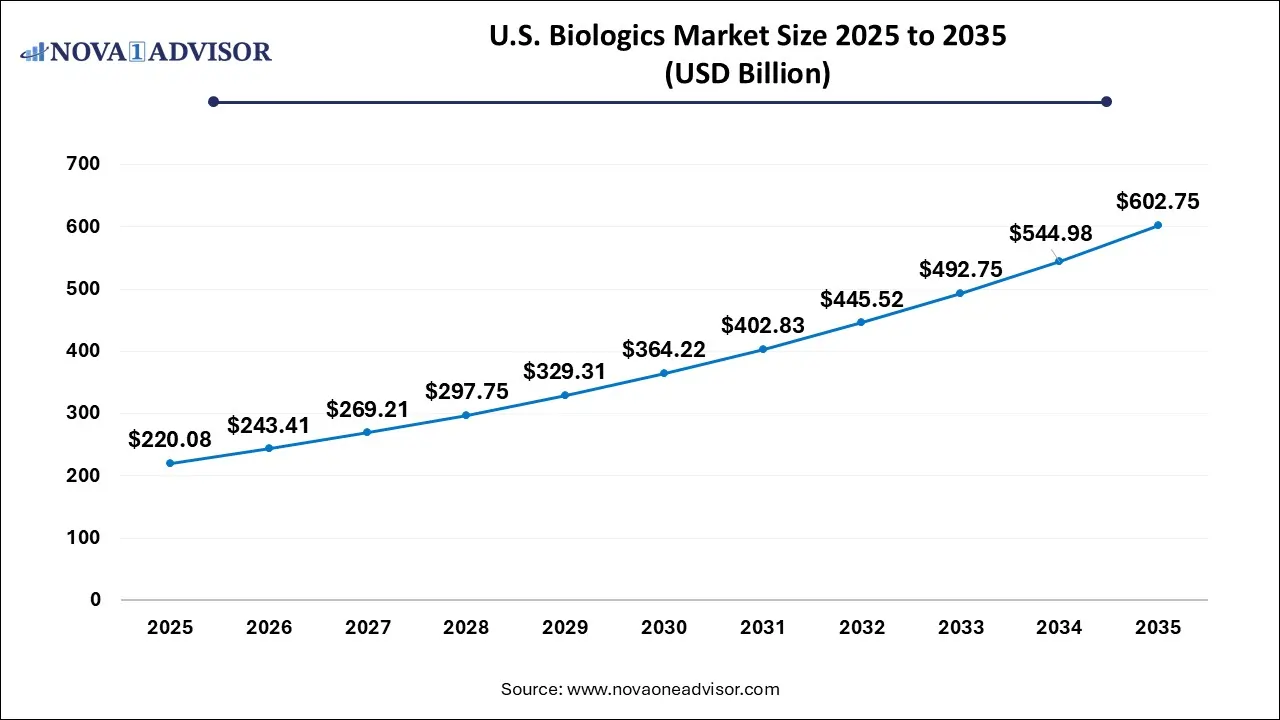

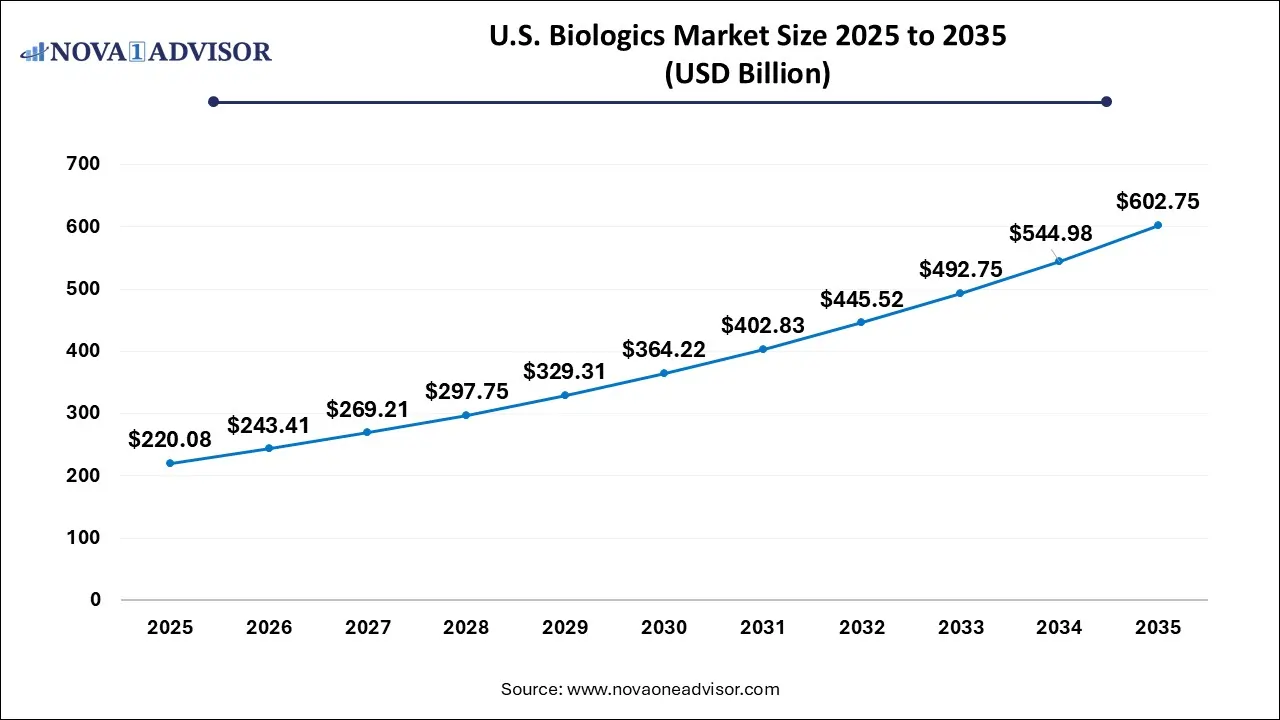

U.S. Biologics Market Size and Growth 2026 to 2035

The U.S. biologics contract development market size is calculated at USD 220.08 billion in 2025 and is expected to reach nearly USD 602.75 billion in 2035, accelerating at a strong CAGR of 9.59% between 2026 and 2035.

By Regional Insights

North America is the undisputed leader in the biologics market, thanks to its well-established biotech ecosystem, robust regulatory framework, and significant R&D funding. The United States alone accounts for over 40% of the global biologics consumption. Companies like Amgen, Pfizer, and Genentech are headquartered here and drive innovation across every therapeutic category. The FDA’s expedited approval programs like Fast Track and Breakthrough Therapy designation also facilitate rapid commercialization of biologics, especially in oncology and rare diseases. Additionally, high adoption of biosimilars and favorable reimbursement policies contribute to the region’s leadership.

Asia-Pacific is the fastest-growing biologics market, fueled by rising healthcare expenditure, improving infrastructure, and strategic government support. Countries like China, India, South Korea, and Japan are investing heavily in biotechnology R&D and manufacturing capacity. China’s “Made in China 2025” policy includes biologics as a strategic industry, while India’s Biopharma Mission aims to create an end-to-end ecosystem for biopharmaceutical innovation. Local companies like WuXi Biologics and Dr. Reddy’s are gaining international recognition, and Western firms are partnering with APAC manufacturers to tap into cost advantages and rapid scalability.

Key Companies & Market Share Insights

- Samsung Biologics

- Amgen Inc.

- Novo Nordisk A/S

- AbbVie Inc.

- Sanofi

- Johnson & Johnson Services, Inc.

- Celltrion Healthcare Co., Ltd.

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann La-Roche Ltd.

Recent Developments

-

Pfizer (January 2025): Pfizer announced the opening of a new $1.4 billion biologics manufacturing facility in North Carolina to support its mRNA and monoclonal antibody pipeline.

-

Samsung Biologics (March 2025): The South Korean CDMO expanded its partnership with Moderna to include large-scale production of new mRNA vaccines targeting RSV and Zika viruses.

-

Amgen (February 2025): Amgen’s biosimilar of Soliris (eculizumab) entered Phase III trials, positioning the company to capture a share of the high-value complement-inhibition therapy market.

-

Biocon Biologics (December 2024): Biocon completed the acquisition of Viatris’ biosimilars business, enhancing its global commercial footprint and expanding its MABs portfolio.

-

Moderna (October 2024): Moderna launched its first non-COVID mRNA therapeutic for cytomegalovirus in Phase II clinical trials, marking its expansion beyond infectious diseases.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Biologics market.

By Source

- Microbial

- Mammalian

- Others

By Product

- Monoclonal Antibodies

- MABs by Application

- Diagnostic

- Biochemical Analysis

- Diagnostic Imaging

- Therapeutic

- Direct MAB Agents

- Targeting MAB Agents

- Protein Purification

- Others

- MABs by Type

- Murine

- Chimeric

- Humanized

- Human

- Others

- Vaccines

- Recombinant Proteins

- Antisense & RNAi Therapeutics

- Others

By Disease Category

- Oncology

- By Product

- MABs

- Vaccines

- Recombinant Proteins

- Antisense & RNAi Therapeutics

- Others (Certain products under trials related to blood products etc)

- Infectious Diseases

- By Product

- Vaccines

- MABs

- Antisense & RNAi Therapeutics

- Recombinant Proteins

- Others

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

By Manufacturing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)