Biomedical Refrigerators And Freezers Market Size and Growth

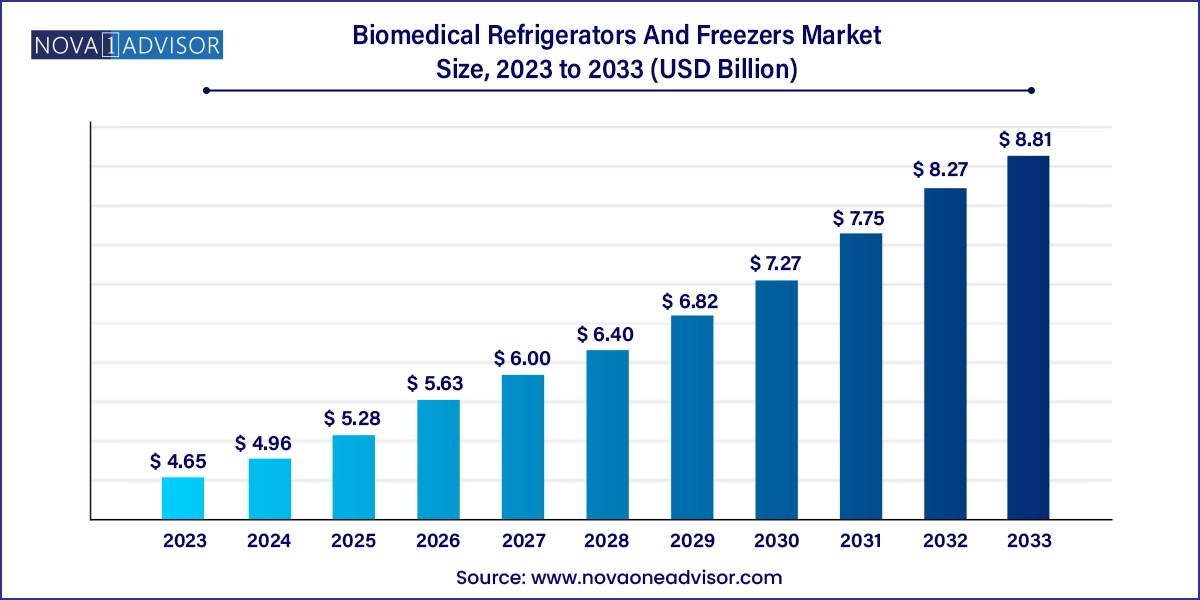

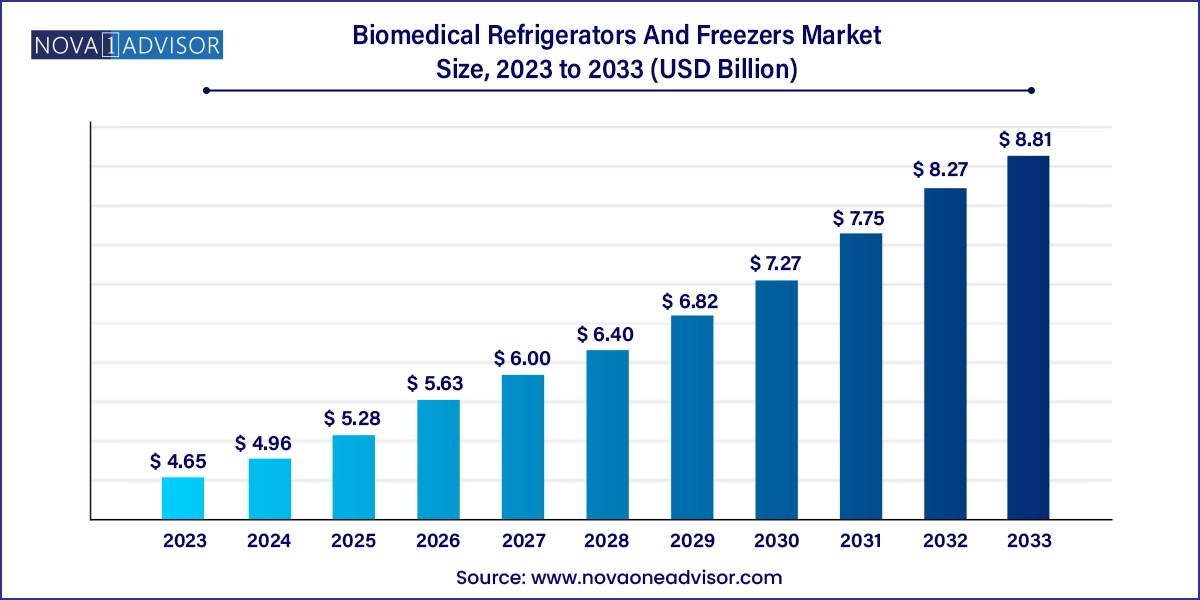

The biomedical refrigerators and freezers market size was exhibited at USD 4.65 billion in 2023 and is projected to hit around USD 8.81 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2024 to 2033.

Biomedical Refrigerators And Freezers Market Key Takeaways:

- Plasma freezers dominated the market and accounted for a market share of 28.2% in 2023.

- The laboratory /pharmacy/medical refrigerators segment is expected to grow at the fastest CAGR over the forecast period.

- Blood banks accounted for the largest market revenue share of 38.2% in 2023.

- Pharmacies segment is expected to grow at a significant rate of 6.6% CAGR during the forecast period.

- North America biomedical refrigerator and freezers market dominated the market in 2023.

Market Overview

The global Biomedical Refrigerators and Freezers Market plays a pivotal role in safeguarding the integrity of temperature-sensitive biological samples, pharmaceuticals, vaccines, blood products, and reagents. These specialized refrigeration systems are crucial to maintaining the cold chain in healthcare, research, pharmaceutical, and diagnostic settings. With growing demand for biopharmaceuticals, a rise in blood donations and transfusions, expanding clinical research activities, and the global push for improved vaccine distribution, the market is poised for substantial growth.

Unlike conventional refrigeration systems, biomedical refrigerators and freezers offer precise temperature control, uniform cooling, alarms for system failure, and superior insulation—essential for preserving the viability and efficacy of stored materials. As regulatory requirements for cold storage become stricter and healthcare infrastructure expands, especially in developing economies, the market's significance is increasing.

The COVID-19 pandemic further highlighted the need for robust biomedical cold storage, particularly for mRNA-based vaccines that required ultra-low temperature (ULT) freezers. This surge in demand prompted many healthcare facilities to upgrade or install advanced refrigeration systems. Going forward, ongoing developments in gene therapies, biologics, and regenerative medicine will further fuel the need for high-performance biomedical refrigeration solutions.

Major Trends in the Market

-

Increased Adoption of Ultra-Low Temperature Freezers: Fueled by demand for mRNA vaccines and genomic material storage.

-

Energy-Efficient and Green Refrigeration Systems: Rising focus on environmentally sustainable cooling technologies.

-

Digital Monitoring and IoT Integration: Smart refrigeration units with remote temperature monitoring and data logging.

-

Expansion of Biobanks and Research Facilities: Supporting long-term sample preservation and genetic research.

-

Customization and Modularity: Tailored configurations to meet diverse laboratory and clinical requirements.

-

Stringent Regulatory Standards: Compliance with guidelines from WHO, CDC, and FDA for cold chain management.

-

Growth in Point-of-Care Diagnostics: Spurring demand for compact, transportable biomedical refrigerators.

-

Increasing Use in Oncology and Immunology: For storage of cell lines, monoclonal antibodies, and immunotherapies.

Report Scope of Biomedical Refrigerators And Freezers Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.96 Billion |

| Market Size by 2033 |

USD 8.81 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End Use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, KSA, UAE, South Africa and Kuwait. |

| Key Companies Profiled |

Panasonic Healthcare Corporation, Haier Biomedical, Eppendorf AG, Power Scientific, Inc., Aegis Scientific, Inc., Haier Biomedical, Follett LLC, Helmer Scientific, Thermo Fisher Scientific, Azbil Corporation |

Driver: Growing Demand for Biopharmaceuticals and Vaccines

The primary driver of the Biomedical Refrigerators and Freezers Market is the global surge in demand for biologics, cell and gene therapies, and vaccines. These temperature-sensitive products require highly controlled storage environments from production to administration.

Pharmaceutical companies and healthcare institutions are investing heavily in refrigeration infrastructure to ensure the viability and regulatory compliance of these therapies. The success of mRNA vaccines during the COVID-19 crisis has further accelerated the development and global distribution of advanced biologics, driving long-term demand for biomedical refrigeration systems across public health and commercial sectors.

Restraint: High Cost and Energy Consumption

A key restraint in this market is the high cost associated with acquiring and maintaining biomedical refrigeration systems. Advanced models, particularly ultra-low temperature freezers, are expensive to install and operate.

Energy consumption is another concern, as these units must run continuously to maintain temperature stability. This poses challenges for facilities with limited budgets or those in regions with unreliable power supply. Additionally, managing refrigerant compliance and regular calibration of equipment require technical expertise and ongoing investment.

Opportunity: Technological Integration with IoT and AI

A promising opportunity lies in the integration of biomedical refrigerators and freezers with Internet of Things (IoT) and artificial intelligence (AI) technologies. These smart systems enable real-time temperature monitoring, predictive maintenance, and remote alerts.

With centralized data logging and compliance reporting capabilities, smart refrigerators improve operational efficiency, ensure regulatory compliance, and reduce the risk of product loss. AI-powered analytics can even forecast system failures or optimize energy usage. Manufacturers focusing on connected, smart refrigeration systems are expected to gain a competitive edge as healthcare and research facilities modernize their infrastructure.

Biomedical Refrigerators And Freezers Market By Product Insights

Laboratory/Pharmacy/Medical Refrigerators dominated the market in 2023. These units are widely used in hospitals, research institutions, and pharmaceutical companies for storing vaccines, reagents, and medications requiring temperature ranges between 2°C and 8°C. Their popularity stems from their essential role in routine clinical and pharmaceutical workflows, making them the most demanded product category.

However, Ultra Low Temperature (ULT) Freezers are projected to be the fastest-growing segment. With a surge in the storage of genetic materials, biologics, and COVID-19 vaccines, demand for freezers operating at -80°C and below has grown rapidly. Ongoing advancements in gene therapy and molecular diagnostics are expected to sustain high demand for ULT freezers in the coming years.

Biomedical Refrigerators And Freezers Market By End Use Insights

Hospitals accounted for the largest share of the end-use segment in 2023. These facilities require a broad range of biomedical refrigeration systems for blood storage, vaccine management, medication preservation, and surgical materials. The growing number of hospitals globally and rising patient admissions continue to drive this segment's growth.

Research Laboratories are the fastest-growing end-user segment. With significant investments in academic research, pharmaceutical R&D, and genomics, laboratories demand precise cold storage solutions for sample integrity. Expansion of public-private research collaborations and the proliferation of clinical trials contribute to this segment’s rapid expansion.

Biomedical Refrigerators And Freezers Market By Regional Insights

North America led the Biomedical Refrigerators and Freezers Market in 2024, primarily driven by the strong presence of biotechnology firms, pharmaceutical giants, and a well-established healthcare infrastructure. The United States alone accounts for a substantial share, with robust investments in drug discovery, diagnostics, and vaccine development.

The region’s adherence to strict regulatory standards and high adoption of advanced cold chain technologies further bolster market demand. In addition, growing awareness of biobanking and the presence of numerous academic and research institutions strengthen North America’s leading position.

Asia Pacific Registers the Fastest Growth

Asia Pacific is poised to experience the fastest growth over the next decade. Factors contributing to this expansion include increasing healthcare expenditure, rising population, expanding pharmaceutical manufacturing capacity, and government-led immunization programs in countries like China and India.

Additionally, the region is witnessing significant growth in biotechnology research and international clinical trials. As healthcare infrastructure modernizes and local production of vaccines and biologics expands, demand for biomedical refrigeration solutions will continue to grow rapidly in Asia Pacific.

Biomedical Refrigerators And Freezers Market Recent Developments

-

March 2025: PHCbi (Panasonic Healthcare) launched a new series of energy-efficient ultra-low temperature freezers with natural refrigerants and cloud connectivity features.

-

January 2025: Thermo Fisher Scientific introduced its TSX Universal Series, integrating AI-powered predictive analytics and enhanced data logging for research-grade biomedical refrigeration.

-

November 2024: Haier Biomedical opened a new manufacturing facility in India to meet rising demand in the Asia-Pacific region and to localize its production capabilities.

-

October 2024: Helmer Scientific unveiled the GX Solution Refrigerators for blood and plasma storage, equipped with advanced thermal uniformity and environmental monitoring.

-

August 2024: Eppendorf AG expanded its CryoCube F740 series of freezers with a focus on ergonomic design and low energy consumption.

Some of the prominent players in the biomedical refrigerators and freezers market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the biomedical refrigerators and freezers market

Product

- Blood Bank Refrigerators

- Shock Freezers

- Plasma Freezers

- Ultra Low Temperature Freezers

- Laboratory /Pharmacy/Medical Refrigerators

- Laboratory /Pharmacy/Medical Freezers

End Use

- Hospitals

- Research Laboratories

- Pharmacies

- Diagnostic Centers

- Blood Banks

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- MEA