U.S. Biopharmaceutical Third-party Logistics Market Size and Trends

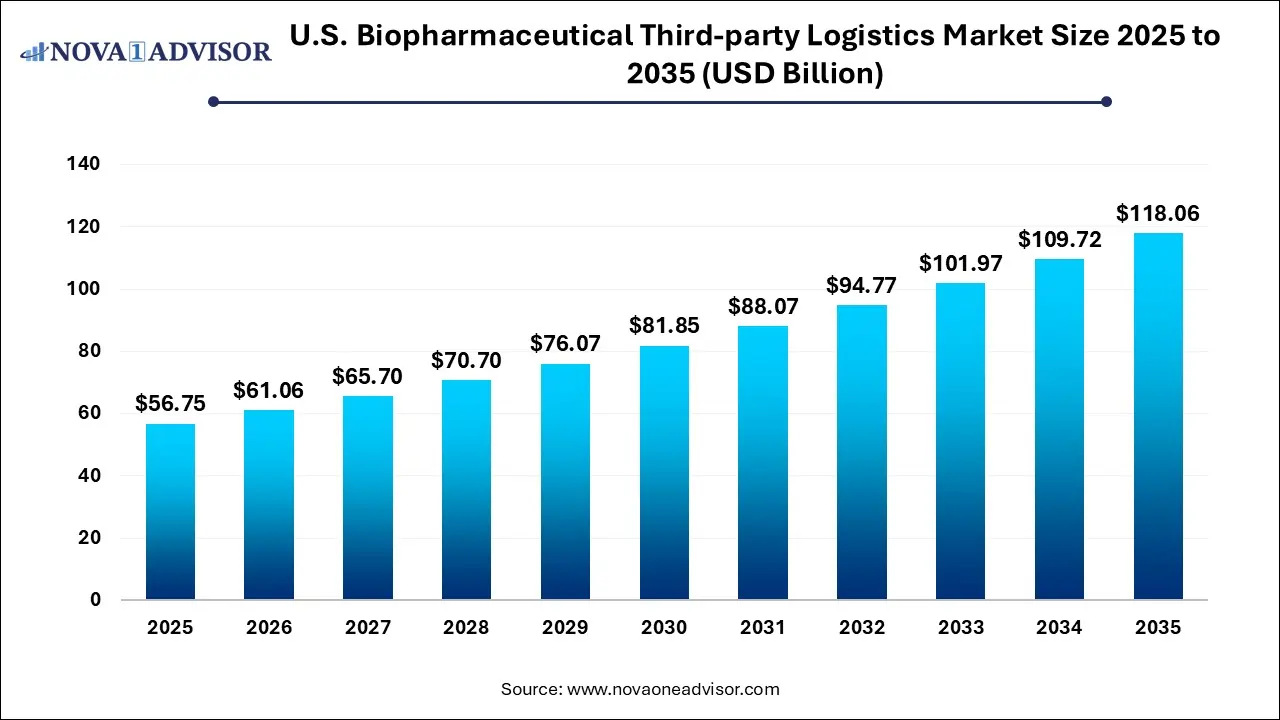

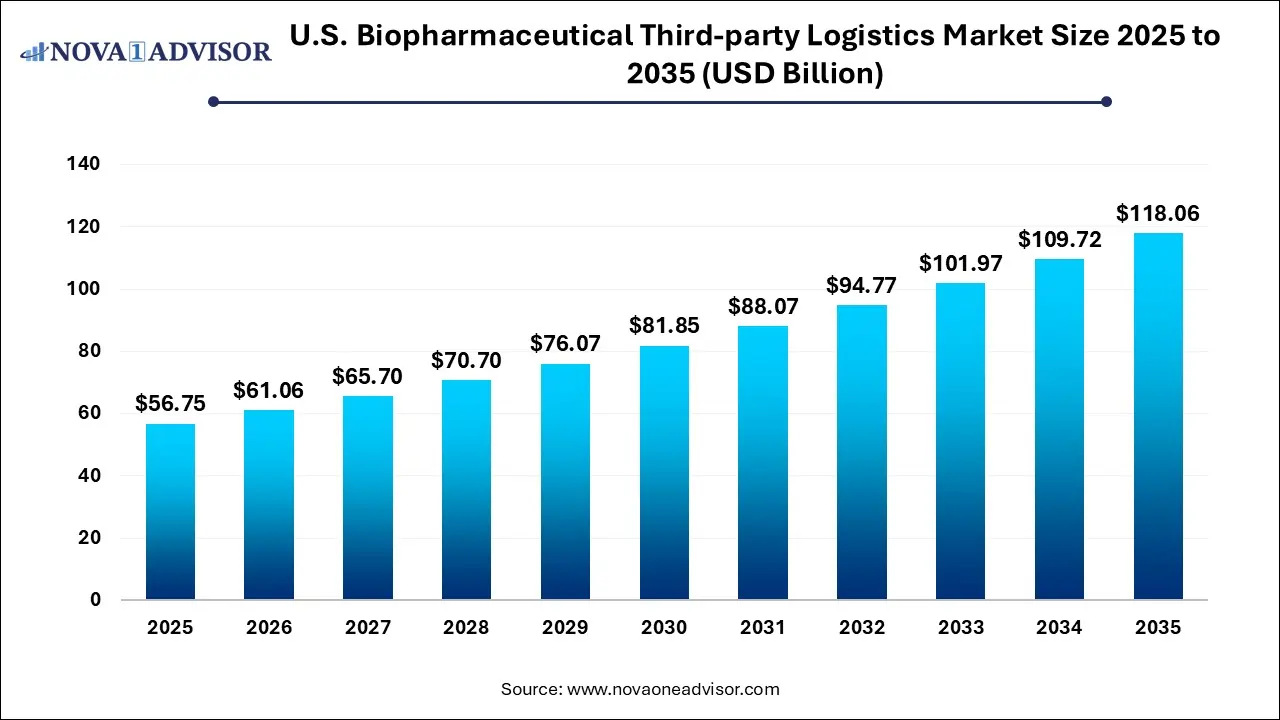

The U.S. biopharmaceutical third-party logistics market size was exhibited at USD 56.75 billion in 2025 and is projected to hit around USD 118.06 billion by 2035, growing at a CAGR of 7.6% during the forecast period 2026 to 2035.

Key Takeaways:

- Non-cold chain logistics led the U.S. Biopharmaceutical Third-party Logistics (3PL) market with the largest revenue share of 80.2% in 2025.

- Cold chain logistics is projected to witness a lucrative growth rate of 10.1% over the forecast period.

- The warehousing & storage segment led in terms of both revenue and volume share in 2025 and accounted for 43.4% of the market.

- These are anticipated to witness lucrative growth over the forecast period.

- Specialty drug products alone contributed to 42% of the industry in 2025.

- The segment is also anticipated to witness the fastest growth rate of 7.7% over the forecast period.

Market Overview

The U.S. biopharmaceutical third-party logistics (3PL) market represents a vital infrastructure component in the pharmaceutical supply chain, especially for high-value and sensitive biopharma products. As the industry increasingly relies on complex biological therapies including vaccines, monoclonal antibodies, and plasma-derived products specialized logistics capabilities have become indispensable. These include temperature-controlled storage, real-time tracking, compliance with FDA and DEA regulations, and timely delivery to hospitals, pharmacies, and research institutions.

The market has grown significantly with the rise in biologics, biosimilars, and specialty drugs. Furthermore, the demand for cold chain solutions has surged in the post-COVID era, emphasizing the need for robust logistics services tailored to fragile biopharmaceutical formulations. Outsourcing logistics to experienced 3PL providers has become a strategic choice for biopharma firms aiming to reduce operational complexity, ensure compliance, and focus on core R&D functions.

From just-in-time delivery systems to end-to-end supply chain visibility, third-party logistics providers are leveraging digital tools, AI, and automation to enhance service quality and reduce risk. This market continues to evolve with strong investment flows, innovation in temperature monitoring, and integration with manufacturing and distribution ecosystems.

Market Outlook

- Market Growth Overview: The U.S. biopharmaceutical third-party logistics market is expected to grow significantly between 2025 and 2034, driven by the rise of biologics & specialty drugs, expansion in cold chain, and e-commerce growth.

- Sustainability Trends: Sustainability trends involve green transportation, route & load optimization, and carbon footprint tracking.

- Major Investors: Major investors in the market include DHL, UPS Healthcare, FedEx, Kuehne+Nagel, DB Schenker, AmerisourceBergen, Cardinal Health, and Thermo Fisher Scientific.

- Startup Economy: The startup economy is focused on the rise of biologics and specialty drugs, increased outsourcing, and technological advancement.

Impact of AI on the U.S. Biopharmaceutical Third-party Logistics Market?

AI is fundamentally transforming the U.S. biopharmaceutical third-party logistics industry by driving significant operational efficiencies, enhancing regulatory compliance, and enabling data-driven decision-making. Through advanced predictive analytics, AI algorithms enable 3PL providers to forecast demand, optimize inventory levels, and plan the most efficient transportation routes in real-time, which minimizes waste and reduces costs. Furthermore, AI and integrated IoT sensors facilitate precise, continuous monitoring of temperature-sensitive biologics and vaccines throughout the cold chain, ensuring product integrity and safety to meet stringent regulatory standards.

Major Trends in the Market

-

Rising Demand for Cold Chain Logistics: The increase in temperature-sensitive drugs is driving innovations in packaging, tracking, and temperature assurance systems.

-

Digital Transformation and Real-Time Monitoring: IoT-enabled tracking systems are gaining prominence for ensuring shipment integrity.

-

Outsourcing of Supply Chain Functions: Biopharma companies are increasingly outsourcing logistics to reduce capital investment and ensure compliance.

-

Customized Distribution Models for Specialty Drugs: Specialty pharmacies and direct-to-patient models are reshaping last-mile delivery strategies.

-

Expansion of Warehousing Infrastructure: Investment in GDP-compliant warehouses, particularly near urban hubs and ports, is increasing.

-

Focus on Sustainability: Green logistics and sustainable packaging solutions are being integrated into biopharma supply chains.

Report Scope of The U.S. Biopharmaceutical Third-party Logistics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 61.06 Billion |

| Market Size by 2036 |

USD 118.06 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.6% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Supply Chain, Service Type, Product Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

FedEx; DHL International GmbH; SF Express; United Parcel Service of America, Inc.; AmerisourceBergen Corporation; DB Schenker; KUEHNE + NAGEL; Kerry Logistics Network Ltd.; Agility |

U.S. Biopharmaceutical Third-party Logistics Market By Supply Chain Insights

Cold chain logistics dominated the supply chain segment in the U.S. biopharmaceutical 3PL market, primarily due to the surge in temperature-sensitive drug categories like vaccines, biosimilars, and monoclonal antibodies. These biologics require storage and transportation in refrigerated or frozen conditions, making cold chain capabilities essential. Sophisticated cold chain management systems with temperature mapping, validated containers, and real-time monitoring are increasingly demanded by pharmaceutical manufacturers.

Non-cold chain logistics, while significant, is witnessing moderate growth as traditional small-molecule drugs continue to be a part of biopharma supply chains. However, the shift in drug development toward more complex biologics is reshaping demand dynamics. Even generics and some oral drugs that don't require refrigeration are being bundled with cold chain services for consolidated delivery.

U.S. Biopharmaceutical Third-party Logistics Market By Service Type Insights

Transportation services held the largest share in the service type segment, driven by the urgent need for secure and timely delivery of biopharma products across state lines and regions. Within transportation, air freight emerged as the leading mode, offering rapid transit times for life-saving drugs and temperature-sensitive products. For example, air cargo was pivotal in distributing COVID-19 vaccines with stringent cold chain requirements.

Warehousing and storage services are the fastest-growing, supported by increased demand for regional storage hubs and temperature-controlled distribution centers. These facilities provide buffer storage for demand fluctuations and offer value-added services like packaging, inventory control, and label compliance. The rise in specialty drug launches is creating a need for more decentralized and strategically located warehouses.

U.S. Biopharmaceutical Third-party Logistics Market By Product Type Insights

Specialty drugs dominated the product type segment, reflecting their increasing share in total pharmaceutical sales. These therapies often require unique handling conditions, customized delivery models, and tighter inventory controls. The 3PL partners for specialty drugs must meet specific regulatory and patient-centric service expectations. Given their complexity and high cost, logistics precision is paramount to prevent waste or delays.

Plasma-derived products are the fastest-growing product category, driven by increasing therapeutic applications in immunology, hematology, and neurology. These products are exceptionally sensitive to environmental conditions and require constant cold chain integrity. The growing prevalence of chronic and rare diseases is fueling demand for these therapies, thereby increasing pressure on logistics firms to meet high service standards.

Country-Level Analysis

The U.S. stands as the world’s largest market for biopharmaceuticals, and correspondingly, its logistics infrastructure is among the most advanced. Stringent FDA regulations, combined with a culture of innovation, have pushed logistics providers to offer high-precision, tech-enabled services. Urban centers like New Jersey, California, and Texas are hubs for pharmaceutical warehousing, while air cargo networks facilitate intercontinental and intra-national biopharma movement.

The growth of patient-centric models such as direct-to-patient delivery, coupled with value-based healthcare, is reshaping expectations from logistics providers. U.S. policies promoting domestic manufacturing of critical pharmaceuticals and expanding vaccine supply chains are further intensifying the need for reliable 3PL partners. Strategic collaborations, tech integration, and infrastructure upgrades are driving continued transformation of the U.S. 3PL market.

U.S. Biopharmaceutical Third-party Logistics Market Companies

- FedEx: Offers specialized pharma logistics with temperature-controlled shipping (like FedEx Cold Chain), advanced tracking, and global reach, ensuring integrity for biologics and vaccines in the U.S. market.

- DHL International GmbH: Provides end-to-end pharma logistics, including custom packaging, monitoring (SenseAware), and customs brokerage, vital for complex U.S. distribution of healthcare products.

- SF Express: While strong in Asia, it extends its capabilities for pharma, focusing on rapid, secure delivery, crucial for timely access in the U.S. with specialized pharma lanes.

- United Parcel Service (UPS): Offers UPS Healthcare with temperature-sensitive solutions, clinical trial logistics, and a vast U.S. network for reliable last-mile delivery of biopharma.

- AmerisourceBergen Corporation: A major distributor, it provides comprehensive supply chain services, including warehousing, distribution, and specialized handling for pharmaceutical products in the U.S.

- DB Schenker: Focuses on complex pharma supply chains with global air/ocean freight, temperature-controlled transport, and robust IT for visibility across the U.S. biopharma sector.

- KUEHNE+NAGEL: A leader in healthcare logistics, offering specialized pharma solutions, including active/passive cold chain, air freight, and regulatory expertise for U.S. market access.

- Kerry Logistics Network Ltd.: Offers integrated supply chain solutions, warehousing, and distribution, with growing capabilities in handling sensitive U.S. biopharma shipments.

- Agility: Provides robust logistics for life sciences, including specialized pharma warehousing, air freight, and project logistics, supporting U.S. distribution and supply chain resilience.

Recent Developments:

- In January 2025, FedEx Healthcare launched the BioTrack analytics dashboard for end-to-end visibility of sensitive shipments and has developed specialized reverse logistics solutions for pharmacies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. biopharmaceutical third-party logistics market

Supply Chain

- Cold chain

- Non-cold chain

Service Type

-

- Air freight

- Sea Freight

- Overland transportation

- Warehousing and storage

- Others

Product Type

- Specialty Drugs

- Generics

- Plasma Derived Products

- Others