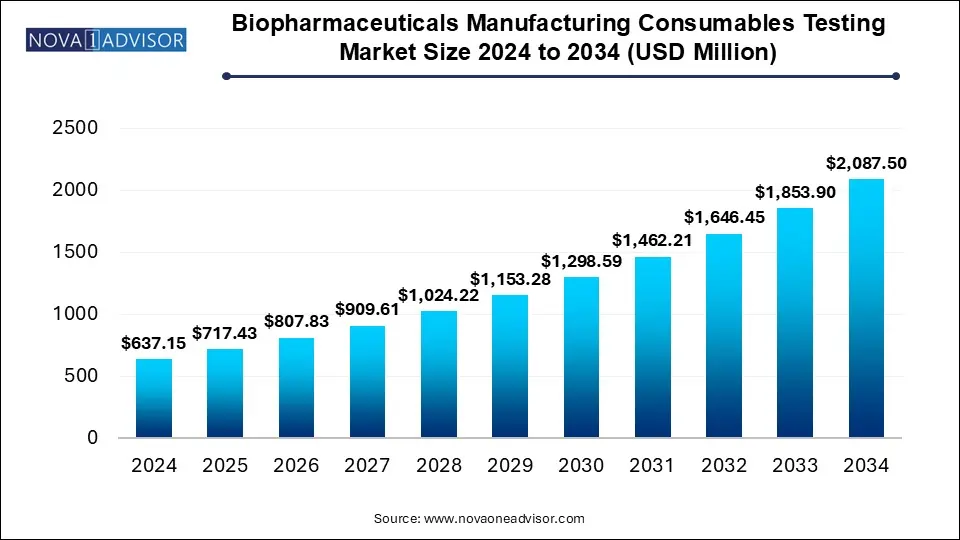

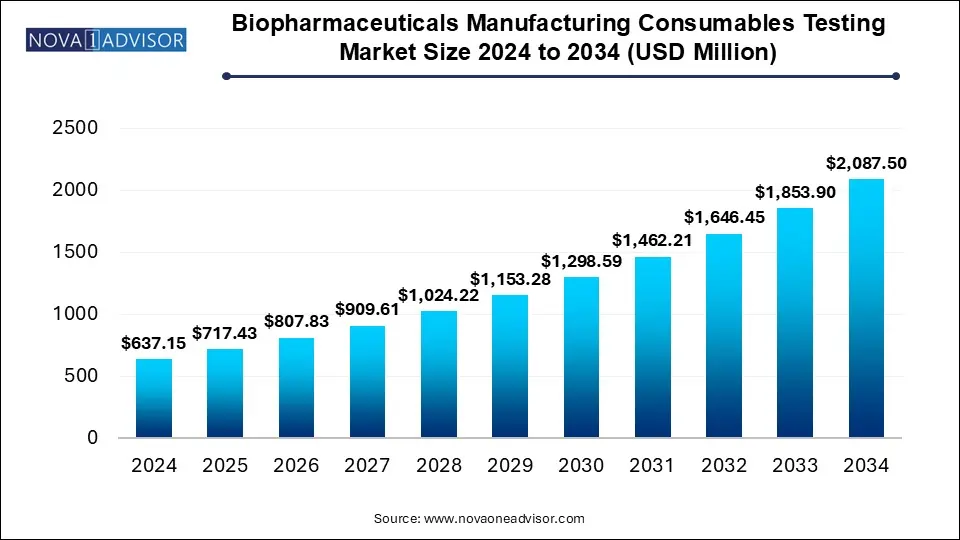

Biopharmaceuticals Manufacturing Consumables Testing Market Size and Growth

The biopharmaceutical manufacturing consumables testing market accounted for USD 637.15 million in 2024 and is expected to reach around USD 2,087.50 million by 2034, growing with a CAGR of 12.6% from 2025 to 2034. This market is growing due to increasing demand for high quality, regulatory-compliant consumables in biopharmaceutical manufacturing processes.

Biopharmaceuticals Manufacturing Consumables Testing Market Key Takeaways

- North America dominated the market with the largest market share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By service, the compendial & multi compendial laboratory testing segment dominated the market with the highest market share in 2024.

- By service, the custom testing/ customer proprietary testing segment is expected to witness significant growth in its market share during the predicted timeframe.

- By raw material, the active pharmaceutical ingredients segment dominated the biopharmaceuticals manufacturing consumables testing market with the largest share in 2024.

- By raw material, the Compendial methods (USP / EP / JP) based vendor qualification program support segment dominated the market with the largest market share.

Biopharmaceuticals Manufacturing Consumables Testing Market Overview

The global biopharmaceutical manufacturing consumables testing market is experiencing significant growth. The growing complexity of biology, stricter regulations, and the widespread use of single-use technologies are the main causes. The increased need for biopharmaceuticals, improvements in analytical testing techniques, and a greater emphasis on product safety and regulatory compliance are the main drivers of this growth. Furthermore, to guarantee the efficacy and safety of biopharmaceutical products the move toward personalized medicine and the rise in biosimilar production call for thorough testing of manufacturing consumables.

Report Scope of Biopharmaceuticals Manufacturing Consumables Testing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 717.43 Million |

| Market Size by 2034 |

USD 2,087.50 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 12.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Service, Raw Material, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Alcami Corporation; Merck KGaA; Eurofins Scientific; Agilent Technologies, Inc.; Charles River Laboratories.; Catalent, Inc; Element Materials Technology (Avomeen Analytical Services); Pace Analytical Services, LLC; Nelson Laboratories, LLC (Gibraltar Laboratories) |

Market Drivers

Rising Demand for Biopharmaceuticals

Biopharmaceuticals are becoming increasingly popular as the prevalence of chronic diseases like diabetes cancer and autoimmune disorders rises worldwide because of their more focused action and fewer adverse effects. Due to the increased demand production must be done on a large scale which calls for dependable consumables and testing procedures. Additionally, biopharmaceuticals are essential to advanced treatments like gene and cell therapies. The need for trustworthy manufacturing techniques is fueled by the ongoing flow of novel biological medications. Consumable testing is an essential component of the supply chain because it guarantees uniformity, safety, and effectiveness across batches.

Stringent Regulatory Requirements

Strict regulations are enforced by regulatory agencies like the FDA EMA and WHO to preserve the quality safety and purity of biopharmaceuticals. These groups require thorough testing of every material that encounters the medication while it is being manufactured. Costly recall penalties and loss of market authorization may follow noncompliance. Businesses are under pressure to meet strict standards as regulations continue to change in tandem with scientific discoveries. To improve patient safety and lower the risk of contamination consumables such as filter tubing and containers must pass stringent quality control tests before use.

Growth Factor

Growing Biopharma Manufacturing Facilities

Increases in biopharmaceutical manufacturing capacity around the world, particularly in emerging and Asia Pacific markets, are helping the consumables testing sector. Advanced modular manufacturing technologies including single-use systems are being installed in new facilities. Every consumable in these setups needs to undergo regular testing and stringent material validation. Furthermore, to satisfy worldwide demand contract manufacturing organizations (CMOs) and CDMOs are growing their capacities which is driving up testing requirements even more. Consumable validation is also necessary for standardized quality assurance in light of the rise in outsourced production.

Market factors

Supply Chain Complexity and Globalization

The supply chain is now more complex due to the globalization of biopharmaceutical production. The frequent international sourcing of consumables and raw materials necessitates consistent testing and quality standards across regions. Supply chain interruptions or irregularities may have an impact on product safety and testing schedules. Standardized international validation procedures are now more important than ever, and this has an impact on vendor selection and procurement choices. Investment in reliable and traceable testing systems is increasing due to this complexity.

Technological Advancements in Manufacturing

The industry is changing due to advanced manufacturing technologies like modular biomanufacturing continuous processing and smart factories. Consumables for these innovations must meet exacting requirements and have constant quality adapting consumables to new systems and technologies requires extensive testing. Testing procedures must change as manufacturers incorporate automation and AI-driven quality control. Advanced consumables testing solutions are in high demand due to the convergence of innovation and precision in production processes.

Market Opportunities

Rising Demand for Personalized and Precision Medicine

The global trend toward precision medicine and personalized therapies creates a specialized but quickly expanding opportunity. Smaller batch production and highly specialized consumables are needed for these treatments and their performance and safety must be thoroughly examined. Adaptable and validated consumables are becoming more and more necessary as biotech therapies. Testing companies can provide tools and services specifically designed for this industry. It is anticipated that this trend will support sustained demand in the consumables testing market.

Demand for Specialized Testing for Single Use Systems (SUS)

With the industry moving strongly toward single-use bioprocessing there is a rising need for extractables and leachable testing. These materials must be carefully validated to avoid product contamination. Companies that specialize in testing single-use components like tubing, bags, and filters can establish a strong market presence. Offering rapid and cost-effective testing tailored to SUS will give firms a competitive advantage. The opportunity is especially strong as SUS becomes the norm in both small-scale and commercial production.

Market Challenge

Evolving and Varied Regulatory Requirements

Global compliance is complicated by the differing regulatory expectations of various nations and areas. Manufacturers have to follow several rules and make sure that every consumable satisfies regional specifications. Operations may be slowed down by the frequent need to update testing procedures employee training and documentation due to these shifting standards. Uncertainty in regulations or a lack of standardization can raise risk and postpone product launches. A constant challenge is maintaining consistent quality while adhering to international regulations.

Segmental Insights

Biopharmaceuticals Manufacturing Consumables Testing Market By Service

The Compendial & multi compendial laboratory testing segment held the largest share in 2024 driven by its crucial function in guaranteeing regulatory compliance and fulfilling pharmacopeial standards. Standardized test procedures that are required at every stage of the production of biopharmaceuticals are included. Its dominance is further reinforced by the fact that these tests are widely used for a variety of consumables including filters containers and tubing. As a result of regulatory bodies' strong emphasis on compendial conformance quality control programs rely heavily on this service.

The Customer testing/ customer proprietary testing segment is expected to grow at the fastest rate because of the growing need for customized solutions that meet the quality and safety standards unique to each product. As the complexity of biology increases producers look for specialized testing for special raw materials and consumables. Particularly important in the case of novel therapies and specialized formulations custom protocols provide flexibility in validation. The growth of this market is being driven by the move toward precise testing and risk assessment tailored to individual products.

Biopharmaceuticals Manufacturing Consumables Testing Market By Raw Material

The active pharmaceutical ingredients segment held the largest share in 2024 driven because they are essential to patient safety and medication efficacy. Consumables that encounter APIs must be tested to prevent contamination and guarantee integrity throughout the manufacturing process. It takes a lot of testing to qualify container filters and process components that communicate with APIs because of their high value and sensitivity. As a result, there is a high need for thorough consumables testing connected to APIs.

Compendial methods (USP / EP / JP) based vendor qualification program support segment is expected to grow at the fastest rate. To assess and qualify their suppliers of consumables manufacturers are increasingly depending on comparative methods. As supply chains and outsourcing become more complex it is now crucial to qualify vendors to guarantee uniformity and compliance. Providing pharmacopeia-aligned standardized testing as a component of vendor audits lowers risks and expedites quality control procedures. The growth of this market is being driven by the need for trustworthy third-party validation using established techniques.

Biopharmaceuticals Manufacturing Consumables Testing Market By Regional Insights

North America will dominate the biopharmaceuticals manufacturing consumables testing market in 2024, because of its sophisticated technological adoption, well-established biopharma industry, and stringent regulatory compliance requirements. Global manufacturers and testing service providers are well-represented in the area. Its dominance is further supported by significant investments in the production of biologics and quality control procedures. Additionally maintaining market leadership is facilitated by the early adoption of automated testing platforms and single-use systems.

Asia Pacific is experiencing rapid growth in the biopharmaceuticals manufacturing consumables testing market driven by rising expenditures on quality control and biomanufacturing infrastructure. With a greater focus on compliance and export readiness, the pharmaceutical industry in the region is modernizing quickly. Consumables testing has benefited greatly from the increase in demand for biologics and the move toward local production. The adoption of advanced testing solutions is being accelerated by the growth of contract manufacturing and increased consumer awareness of product safety.

Some of The Prominent Players in The Biopharmaceuticals Manufacturing Consumables Testing Market Include:

- Alcami Corporation

- Merck KGaA

- Eurofins Scientific

- Agilent Technologies, Inc.

- Charles River Laboratories.

- Catalent, Inc

- Element Materials Technology (Avomeen Analytical Services)

- Pace Analytical Services, LLC

- Nelson Laboratories, LLC (Gibraltar Laboratories)

Biopharmaceuticals Manufacturing Consumables Testing Market Recent Development

- On 12 March 2024, Sartorius AG announced the expansion of its consumables testing facility in Gottingen, Germany, aimed at improving turnaround time for single-use systems validation and enhancing global testing capacity. The new facility features high-efficiency cleanrooms and upgrades extractable and leachable testing labs. It is designed to support the growing demand from contract manufacturers and biologics developers. This move strengthens Sartorius's position as a comprehensive solution provider in consumables testing and bioprocess quality control.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Biopharmaceuticals Manufacturing Consumables Testing Market

By Service

- Laboratory Testing

- Custom Testing / Customer Proprietary Testing

- Compendial & Multi Compendial Laboratory Testing

By Raw Material

- Formulation Excipients

- Active Pharmaceutical Ingredients (API)

- Compendial Methods (USP / EP / JP) Based Vendor Qualification Program Support

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)