Biosimilars Market Size and Trends

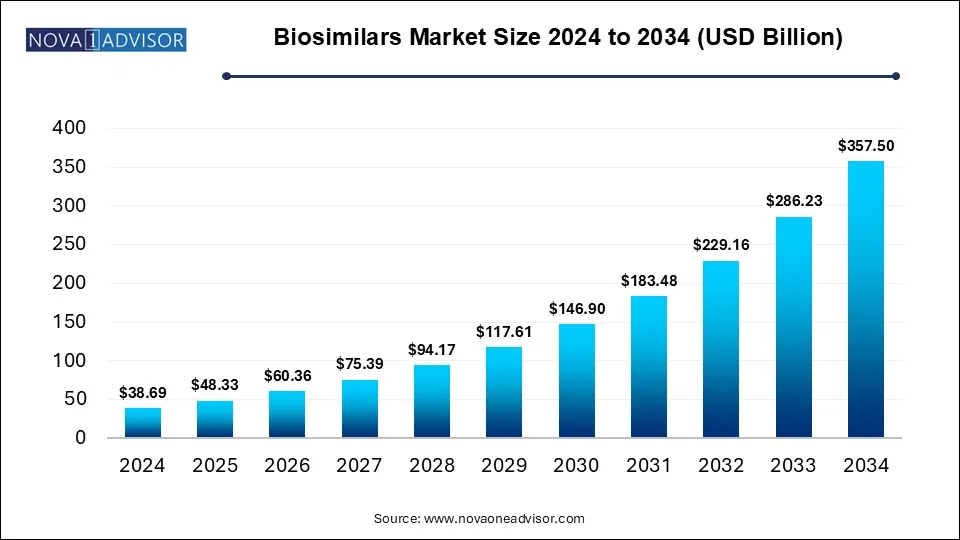

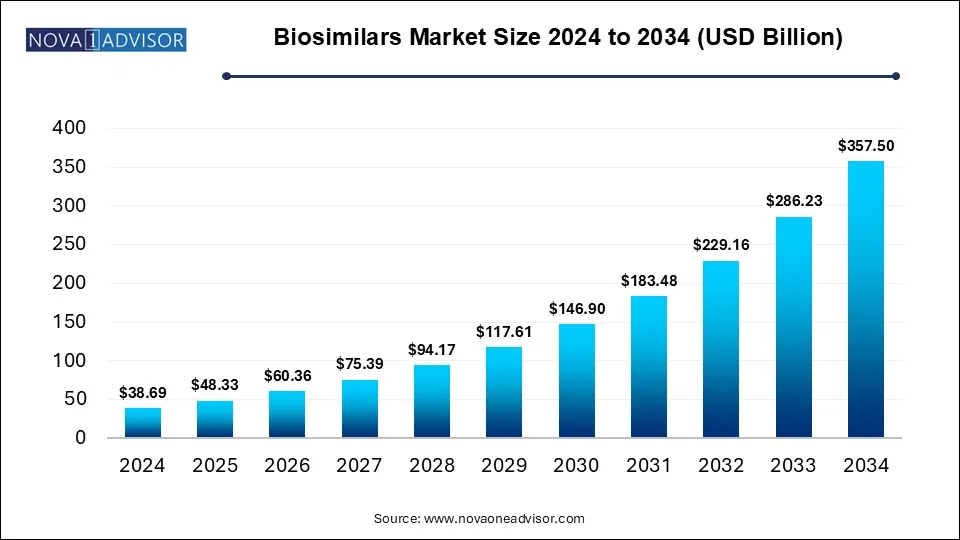

The global biosimilars market size is calculated at USD 38.69 billion in 2024, grows to USD 48.33 billion in 2025, and is projected to reach around USD 357.50 billion by 2034, growing at a CAGR of 24.9% from 2025 to 2034. The biosimilars market expansion is driven by the rising demand for affordable treatments, increasing global disease burden and continuous advancements in biomanufacturing capacities. Rising biologics patent expiration is driving the launch of new biosimilars by various emerging and dominant players in the market.

Biosimilars Market Key Takeaways

- Europe dominated the global biosimilars market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market over the forecast period.

- By application, the oncology diseases segment held the major market share in 2024.

- By application, the chronic & autoimmune diseases segment is expected to grow at the fastest CAGR in between 2025 and 2034.

- By type, the monoclonal antibodies segment accounted for the largest market share in 2024.

- By type, the insulin segment is expected to show the fastest CAGR in the market during the forecast period.

What Factors Are Fuelling the Growth of the Biosimilars Market?

Biosimilars refer to a highly similar biologic with no meaningful clinical differences from an existing approved biological medication which is called as a reference product. Rise in number of patent cliffs for blockbuster biologics is opening doors for various pharmaceutical companies to enter the biosimilars market. High costs of original biologics, pressure on healthcare budget and increasing prevalence of chronic diseases is creating a huge demand for affordable biosimilars. Increasing number of biosimilars approvals with interchangeable designations in some regions, focus on real-world evidence for evaluating safety and efficacy, educational initiatives, and rising investments in improving R&D capabilities as well as for expanding biosimilar pipelines by various pharmaceutical companies are the factors fuelling the market growth.

What are the Key Trends in the Biosimilars Market in 2025?

- In June 2025, Sandoz announced the launch of WYOST (denosumab-bbdz) and Jubbonti (denosumab-bbdz) which are the first and only interchangeable FDA-approved denosumab biosimilars available to patients in U.S.

- In May 2025, Alvotech and Advanz Pharma expanded their existing strategic alliance for including three additional biosimilar candidates, namely Ilaris (canakinumab), Kesimpta (ofatumumab), and an undisclosed early-stage candidate for enhancing their biosimilar portfolio in the European market.

Can AI Revolutionize Biosimilar Development and Adoption?

The use of artificial intelligence in the biosimilars market is driving efficiency, minimizing costs and enhancing workflows in the development process of biosimilars. AI helps in reducing administrative burdens and improving management of data by streamlining the development process of new biosimilars leading to accelerated market reach. AI models can analyze large complex datasets for predicting the biological and clinical outcomes of biosimilars to ensure their safety and efficacy. Identification of potential drug candidates and optimizing molecular designs in drug discovery process can be achieved with the integration of AI algorithms. Efficient and effective clinical trial designs for clinical trials by leveraging AI can accelerate the development process.

Report Scope of Biosimilars Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 48.33 Billion |

| Market Size by 2034 |

USD 357.50 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 24.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Application, By Type, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Amgen Inc., AbbVie Inc., Biocon Ltd. , Celltrion Healthcare Co.,Ltd., Dr. Reddy’s Laboratories Ltd., Eli Lilly and Company, F Hoffman-La Roche Ltd., Kashiv Bio Sciences, Merck & Co. Inc., Pfizer Inc., Reliance Life Sciences, Sandoz International GmbH, Teva Pharmaceutical Industries Ltd., Samsung Biopis, Viatris Inc. |

Market Dynamics

Drivers

How is the Expiration of Blockbuster Biologic Patents Driving the Biosimilars Market Growth?

Expiration of blockbuster biologic relieves it from the legal monopoly held by the originator company, thus removing patent protection. This allows other pharmaceutical companies to develop and manufacture biosimilars of the reference biologics without any setbacks. Biosimilar development and launch facilitates the access to affordable and effective treatments for patients in comparison in expensive biologics. Furthermore, expiring of a single biologic patent drives the entry of multiple biosimilar versions leading to increased market competition and pricing pressure for manufacturers. Governments and healthcare payers promoting the use of biosimilars as well as supportive regulatory frameworks is driving the market growth.

Restraints

Complex Manufacturing Processes and Regulations

Production of biosimilars involves complex manufacturing processes which use proprietary cell lines and procedures requiring significant investments in infrastructure, technical competence and following quality control measures, leading to high development costs. Large-scale manufacturing facilities required for production can potentially restrain the entry of new players in the market due to the overall financial burden. Moreover, stringent evaluation processes for ensuring the efficacy, safety and quality of biosimilars imposed by regulatory agencies can potentially delay market entry and increase compliance costs for manufacturers.

Opportunities

Rising Demand for Affordable Treatments

High costs of original and branded biologic drugs which are highly effective for treating wide range of chronic conditions are straining the healthcare systems, insurance providers and budgets of individual patients. Availability of biosimilars in the market is offering a viable and cost-effective solution for patients and healthcare providers seeking affordable and efficient treatments. Low prices of biosimilars are increasing patient access to safe and effective therapies, further improving health outcomes. Need for addressing unmet medical needs, development of sustainable solutions to increase healthcare system savings, regulatory support and favourable policies implemented by various governments are creating lucrative growth opportunities for players in the market.

Segmental Insights

Why Oncology Diseases Segment Dominated the Biosimilars Market?

By application, the oncology diseases segment dominated the market with the largest share in 2024. Rising patent expirations of blockbuster biologics is driving the development of more affordable versions of cancer drugs for biosimilar manufacturers leading to increased market competition for originator products.

Growing awareness and adoption of oncology biosimilars such as bevacizumab (Avastin), trastuzumab (Herceptin) and rituximab (Rituxan) with approvals from regulatory bodies like FDA and EMA through clear and robust approval pathways is fueling the market growth. Additionally, increasing prevalence of cancer across the globe, continuous advancements in biosimilar manufacturing and development, strategic collaborations and rising investments in R&D activities are the factors driving the market dominance of this segment.

By application, the chronic & autoimmune diseases segment is expected to show the fastest growth over the forecast period. The globally increasing incidences of chronic conditions such as ankylosing spondylitis, diabetes, inflammatory bowel disease, multiple sclerosis, psoriasis, rheumatoid arthritis is creating the demand for cost-effective treatments to address the issue of high cost biologics. Expansion of treatment options and affordability of biosimilars is gaining traction with the launch of new biosimilars in the market. Increased approvals of biosimilars by regulatory agencies like the U.S. FDA is driving their acceptance and adoption among healthcare providers and consumers.

How Monoclonal Antibodies Segment Dominated the Market in 2024?

By type, the monoclonal antibodies segment accounted for the largest market share in 2024. Monoclonal antibodies (mAbs) refer to biological drugs targeting specific proteins or cells in the body which help in fighting diseases for the immune system with high specificity and less off-target effects. With expiring patent protection for high-value mAbs like Humira and Remicade is paving the way for biosimilar manufacturers to enter the market offering cost-effective life-saving therapies to patients. Furthermore, rising applications of mAbs for treating a wide range of chronic conditions, increased adoption and access to affordable biosimilars, supportive regulatory frameworks, technological advancements in biomanufacturing processes and strategic collaborations among pharmaceutical companies are the factors fuelling the market expansion.

By type, the insulin segment is expected to grow at the fastest rate during the forecast period. Development of interchangeable

insulin biosimilars such as Eli Lilly’s Rezvoglar (insulin glargine-aglr) is improving patient access and affordability to insulin treatments. Advancements in manufacturing technologies enabling production of high-quality insulin biosimilars, rising investments in R&D activities focused on developing long-acting insulins, increased regulatory approvals and expansion of insulin glargine pipeline into new markets are the factors fuelling the growth of this segment in the market.

For instance, in February 2025, the U.S. Food and Drug Administration (FDA) approved the first rapid-acting insulin biosimilar product Merilog (insulin-aspart-szjj) as a biosimilar to Novolog (insulin aspart) for improving glycemic control in pediatric and adult patients suffering from diabetes mellitus.

Regional Insights

Why is Europe Dominating the Biosimilars Market?

Europe dominated the global biosimilars market in 2024. The European Medicines Agency (EMA) is the world’s first regulatory agency globally for establishing a comprehensive and clear pathway for approval of biosimilars through its well-defined and robust regulatory framework. Since 2006, 86 biosimilar medicines have been approved in the European Union with focus on cancer, diabetes and rheumatoid arthritis as the major therapeutic areas.

The region’s market growth is driven by the patent expiration of blockbuster biologics, implementation of sustainable practices in national healthcare systems, widespread adoption of biosimilars and increased emphasis on value-based healthcare models. Many countries in Europe are deploying procurement strategies by using tendering processes for driving down prices and increasing the share of biosimilars market. Educational initiatives for and favourable reimbursement policies are incentivizing the use of biosimilars in the European market.

- For instance, in April 2025, the EMA issued a new draft reflection paper discussing about decreasing the amount of clinical data required for development and regulatory approval of biosimilars.

How is Asia Pacific Approaching the Biosimilars Market?

Asia Pacific is expected to grow at the fastest rate in the biosimilars market during the predicted timeframe. The large population with rising middle class, increased investments in advancing healthcare and research infrastructure, demand for affordable treatments and favourable regulatory environments are the factors fuelling the region’s market growth. Increasing number of outsourcing service providers in countries like China and India offering low labor and laboratory costs for biosimilar manufacturing with a skilled workforce is attracting global biosimilar manufacturers, further driving the market expansion.

Some of the Prominent Players in the Biosimilars Market

- Amgen Inc.

- AbbVie Inc.

- Biocon Ltd.

- Celltrion Healthcare Co.,Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- F Hoffman-La Roche Ltd.

- Kashiv Bio Sciences

- Merck & Co. Inc.

- Pfizer Inc.

- Reliance Life Sciences

- Sandoz International GmbH

- Teva Pharmaceutical Industries Ltd.

- Samsung Biopis

- Viatris Inc.

Recent Developments in the Biosimilars Market

- In May 2025, Sandoz, a globally leading producer of generic and biosimilar medicines, commercially launched Pyzchiva (ustekinumab) autoinjector for ustekinumab biosimilars in Europe.

- In May 2025, Starjemza (ustekinumab-hmny) received the U.S. FDA’s approval as a biosimilar to Stelara (ustekinumab) for treating several rheumatic and gastrointestinal conditions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Application

- Blood disorders

- Oncology diseases

- Chronic and autoimmune diseases

- Others

By Type

- Human growth hormone

- Erythropoietin

- Monoclonal antibodies

- Insulin

- Granulocyte-Colony Stimulating Factor

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)