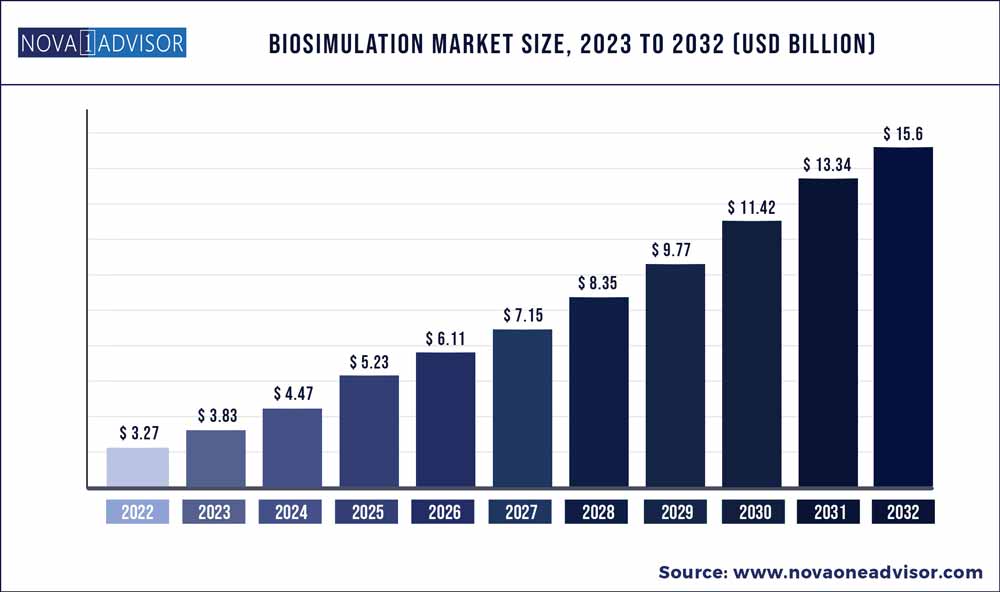

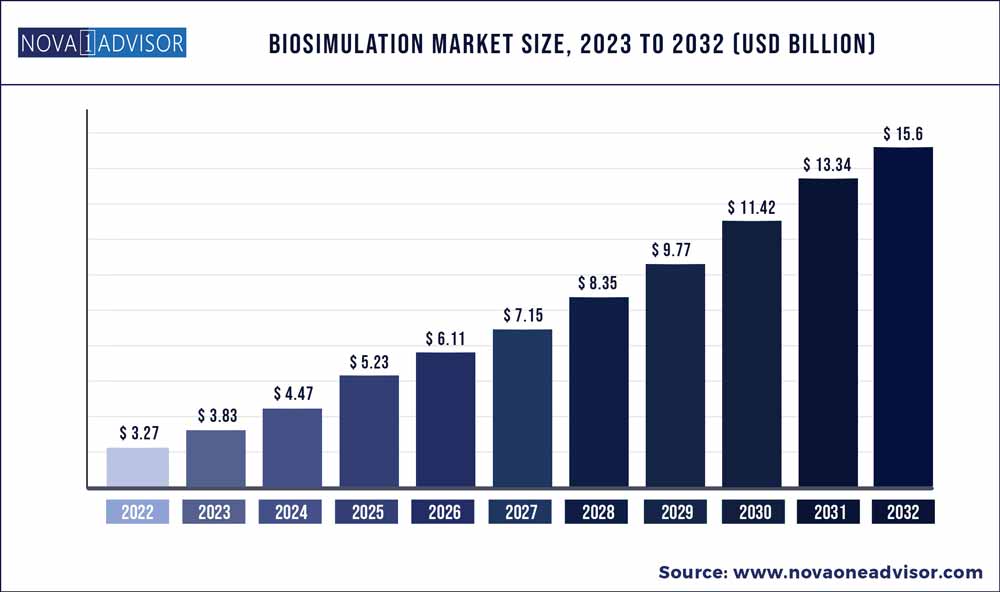

The Biosimulation market size was exhibited at USD 3.27 billion in 2022 and is projected to hit around USD 15.6 billion by 2032, growing at a CAGR of 16.9% during the forecast period 2023 to 2032.

Key Pointers:

- The software segment dominated the market in 2022 with a revenue share of over 63.0%.

- Drug development held the largest revenue share of over 56.9% in 2022.

- Pharmaceutical and biotechnology companies accounted for a revenue share of more than 52.0% in 2022.

- North America held the dominant revenue share of over 50.7% in 2022.

- Asia Pacific is likely to witness exponential growth during the forecast period.

Report Scope of the Biosimulation Market

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 3.83 Billion

|

|

Market Size by 2032

|

USD 15.6 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 16.9%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Product & service, application, delivery model, end user

|

|

Key companies profiled

|

Certara (US), Simulations Plus (US), Dassault Systèmes (France), Schrödinger (US), ACD/Labs (Canada), Chemical Computing Group (Canada), Physiomics (UK), Evidera (US), In silico biosciences (US), INOSIM Software (Germany), Insilico Biotechnology (Germany), LeadInvent Technologies (India), Rosa (US), Nuventra Pharma (US), and Genedata (Switzerland)

|

Biosimulation Market Dynamics

Drivers: Growth in the biologics and biosimilar market

Growth in the global biosimilars market is mainly driven by factors such as the growing pressure to curtail healthcare expenditures, growing demand for biosimilars due to their cost-effectiveness, rising incidence of various diseases, increasing number of off-patented drugs, positive outcomes in ongoing clinical trials, and rising demand for biosimilars in different therapeutic applications such as rheumatoid arthritis and blood disorders. As there is very little success in the R&D of new chemical entities, pharmaceutical companies are trying to find new applications for their existing drugs. As toxicity and other vital parameters of drug safety are already tested, biosimulation technologies are used to confirm the hypothesis of using the drugs for a new indication or disease.

Restraints: Lack of standardization

Biosimulation uses a variety of models, tools, and languages for capturing and processing different aspects of biological processes. The current modeling methods do not capture the underlying semantics of biosimulation models to support building, reusing, composing, and merging of varied, complex biosimulation models. The governing bodies are yet to standardize the use of in silico or biosimulation technologies in the drug discovery or development process. Recent technological advancements have increased the computational power of biomedical researchers for building and managing complex biosimulation systems. However, as their models and simulations grow in complexity, researchers find it more difficult to share, manage, and edit their models. The problem of sharing complex biomedical models becomes severe with the lack of scalable standards for model representation and reuse. As a consequence, many model developers are unable to share and build new models upon previously coded models. This shortcoming of biosimulation can only be solved by the provision of a principled, standards-based representation model, which is able to represent biosimulation data unambiguously in both a human and a machine-interpretable way. The biosimulation community, therefore, has a growing need for tools that will help them to efficiently build, manage, and reuse their models.

Opportunities: Emerging applications

The emerging applications of biosimulation in defense, industrial bioprocessing, nutraceuticals, and agri-food production present significant opportunities for the growth of the global biosimulation market. Various biosimulation companies are adopting inorganic and organic growth strategies to expand the applications of their biosimulation software and services. In May 2017, the Institute of Life Science at Swansea University delivered an in silico drug discovery software platform for the UK Ministry of Defense for the development of antimicrobials to meet the needs of defense and security in the country. Likewise, in April 2017, Certara formed a partnership with the Australian Department of Defense. Certara’s d3 medicine company was selected to conduct a national audit to check the research and development capabilities and capacity of Australia’s medical countermeasures (MCM) product.

Challenges: Shortage of biosimulation and modeling experts

Biosimulation uses mathematical equations to represent real-life processes that take place inside of the human body. Because it can replicate human biological elements and their relationships to drugs when they are introduced into the system, researchers are able to simulate a wide variety of scenarios and study the behavior of a human system in different situations.

However, skilled expertise is required for running, planning, and monitoring biosimulation software. In research laboratories and companies, there is a high demand for researchers well-versed in biosimulation methods, such as molecular modeling and simulation and PK/PD modeling and simulation. Furthermore, the applications of biosimulation for various drug discovery and development purposes require various modified forms of molecular modeling and simulation and PK/PD modeling and simulation. These processes are highly technical and involve the use of various complex laboratory documentation systems; this necessitates training for the personnel carrying out biosimulation. It is important to provide adequate training and support to researchers in order to overcome this challenge. All these factors make biosimulation development a tedious process and thus limit its uptake among researchers.

North America to account for the largest market size during the forecast period

North America held the dominant revenue share of over 46.0% in 2022. This growth is attributed to the presence of key players, increasing digitization in healthcare, and the rising prevalence of chronic health issues. Moreover, the adoption of in-silico models during the enforcement of regulatory policies to ensure high patient safety and treatment standards is further contributing to the regional market growth.

Asia Pacific is likely to witness exponential growth during the forecast period owing to rising initiatives by the public and private sector and consistent up-gradation in healthcare infrastructure. In addition, burgeoning R&D activities in emerging economies are poised to present the region with significant growth opportunities. In November 2020, Certara opened a new office in Shanghai, China. This enabled the company to strengthen its tie-up with customers in the rapidly growing Chinese biopharmaceutical market.

Some of the prominent players in the Biosimulation Market include:

- Certara (US)

- Simulations Plus (US)

- Dassault Systèmes (France)

- Schrödinger (US)

- ACD/Labs (Canada)

- Chemical Computing Group (Canada)

- Physiomics (UK)

- Evidera (US)

- In silico biosciences (US)

- INOSIM Software (Germany)

- Insilico Biotechnology (Germany)

- LeadInvent Technologies (India)

- Rosa (US)

- Nuventra Pharma (US)

- Genedata (Switzerland).

Segments Covered in the Report

This report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor has segmented the Biosimulation market.

By Product & Service

- Software

- Molecular Modeling and Simulation Software

- PBPK Modeling and Simulation Software

- PK/PD Modeling and Simulation Software

- Trial Design Software

- Toxicity Prediction Software

- Other Biosimulation Software

- Services

- In-house Services

- Contract Services

By Application

- Drug Development

- Preclinical Testing

- PK/PD

- ADME/TOX

- Clinical Trials

- Drug Discovery

- Target Identification and Validation

- Lead Identification and Optimization

- Other Applications

By Delivery Model

- Subscription Models

- Ownership Models

By End User

- Pharmaceutical and Biotechnology Companies

- Research Institutes

- Contract Research Organizations

- Regulatory Authorities

- Other End Users

By Region

- North America

- Europe

- Asia

- Rest of the World (RoW)