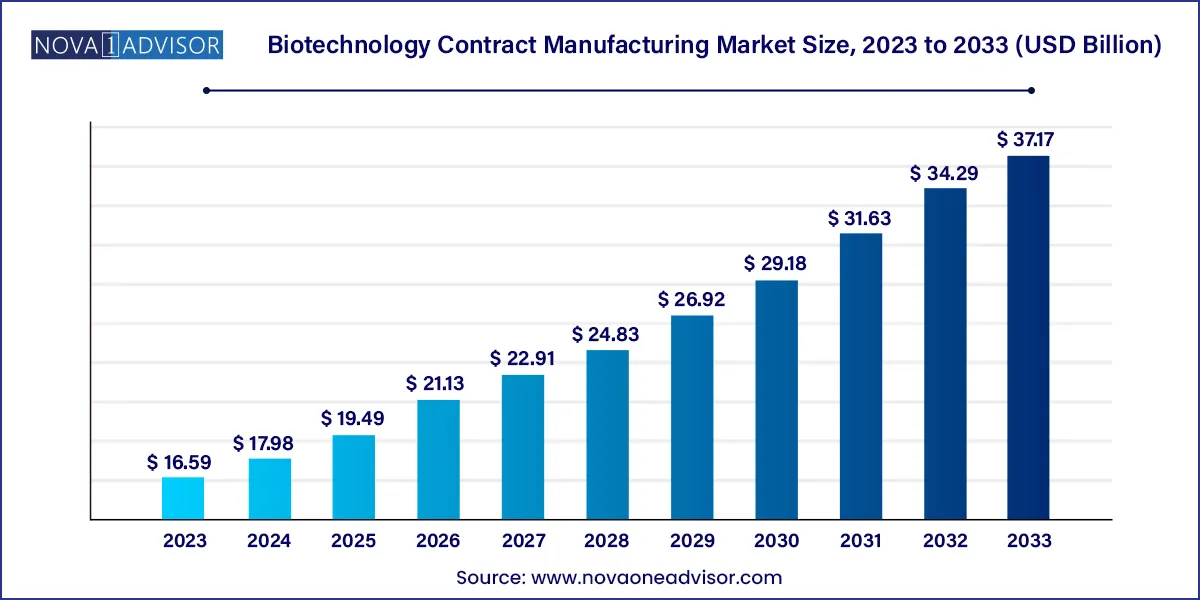

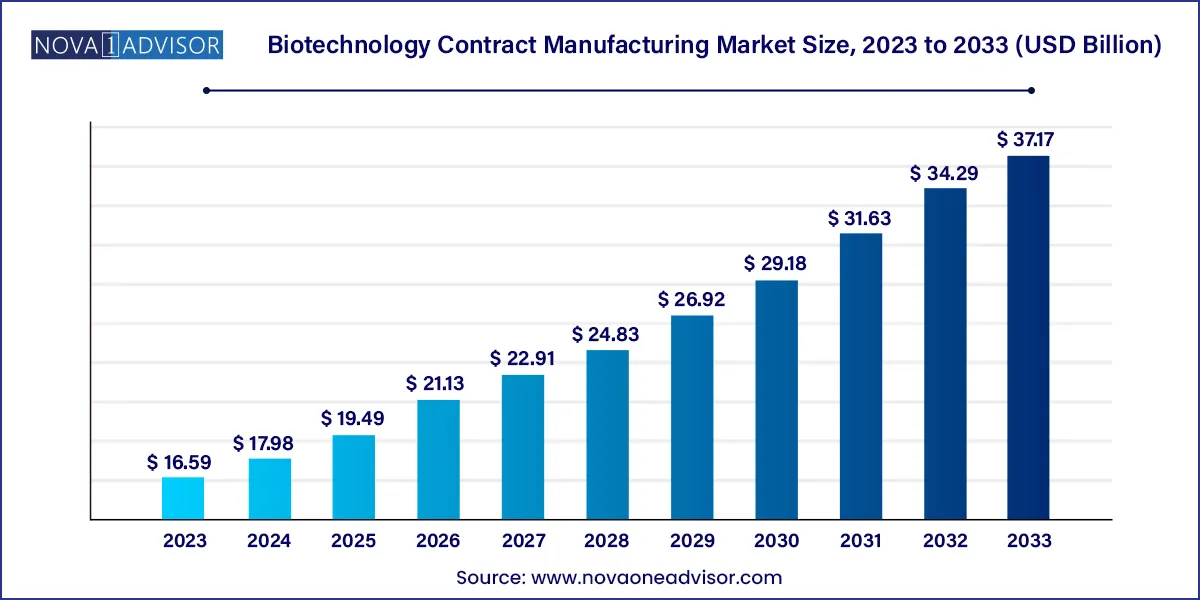

The global biotechnology contract manufacturing market size was estimated at USD 16.59 billion in 2023 and is projected to hit around USD 37.17 billion by 2033, growing at a CAGR of 8.4% during the forecast period from 2024 to 2033.

Key Takeaways:

- The manufacturing segment held the largest share of the global biotechnology contract manufacturing market in 2023.

- The biologic drug substance manufacturing segment held the largest share of the global biopharmaceutical contract manufacturing market in 2023.

- Asia Pacific offers lucrative growth potential for the biotechnology contract manufacturing market.

Market Overview

The Biotechnology Contract Manufacturing Market has emerged as a crucial component of the biopharmaceutical ecosystem, acting as a strategic enabler for companies seeking agility, scalability, and regulatory compliance in the development of advanced biologic therapies. Biotechnology Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) provide comprehensive solutions that include drug substance manufacturing, formulation, fill-finish, packaging, and analytical support for biologic drug developers.

With the increasing complexity of biologics—ranging from monoclonal antibodies and vaccines to cell and gene therapies—biotech companies are finding it increasingly challenging to maintain in-house manufacturing capabilities that are capital-intensive and highly regulated. This is especially relevant for small and mid-sized biotech firms that prioritize research and clinical development over capital infrastructure investments. Even large pharmaceutical companies are leveraging CDMO partnerships to optimize their capacity, reduce time to market, and focus on commercialization.

The market’s relevance was amplified during the COVID-19 pandemic, where contract manufacturers played a key role in supporting rapid vaccine and therapeutic production at scale. Today, the momentum continues as demand for biologics increases across therapeutic areas such as oncology, autoimmune disorders, and rare diseases. CDMOs with high-end capabilities in mammalian and microbial expression systems, sterile fill-finish, and GMP compliance are witnessing strong demand from biopharma innovators.

The biotechnology contract manufacturing market is also undergoing consolidation, capacity expansions, and regional diversification to meet rising global demand. Strategic collaborations between biotech developers and CDMOs are driving innovations in process optimization, cell-line development, and scale-up technologies—accelerating the next generation of biologic therapies into the market.

Major Trends in the Market

-

Shift Toward Biologics over Small Molecules: Increasing preference for monoclonal antibodies, ADCs, and gene therapies is creating specialized manufacturing demands.

-

Outsourcing Across the Drug Lifecycle: Biopharma companies are outsourcing beyond manufacturing, including R&D support, analytical testing, and regulatory documentation.

-

Rise of Flexible, Modular Manufacturing Platforms: CDMOs are investing in single-use bioreactors and modular cleanrooms to enable faster product transitions and scale-up.

-

Growing Importance of Fill-Finish Services: As sterile manufacturing becomes more critical, fill-finish capabilities are in high demand for injectables, particularly in cell and gene therapy.

-

Digitalization of Manufacturing Operations: The use of AI, real-time batch monitoring, and data analytics is improving batch consistency and regulatory traceability.

-

Increased Investments in Advanced Modalities: CDMOs are expanding capacity for novel modalities such as mRNA, lipid nanoparticles (LNPs), and engineered cell therapies.

-

Strategic Partnerships and Long-Term Contracts: Major players are forming multi-year partnerships to ensure uninterrupted capacity and shared innovation pipelines.

Biotechnology Contract Manufacturing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 17.98 Billion |

| Market Size by 2033 |

USD 37.17 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.4% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Service, Type, Scale of Operation, Source, Molecule, Therapeutic Area, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Lonza (Switzerland), Thermo Fisher Scientific, Inc. (US), Catalent, Inc. (US), Samsung Biologics (South Korea), WuXi Biologics (China), Boehringer Ingelheim International GmbH (Germany), FUJIFILM Holding Corporation (Japan), AbbVie, Inc. (US), Eurofins Scientific (Luxembourg), GenScript Biotech Corporation (US), AGC, Inc. (Japan), Merck KgaA (Germany), JSR Corporation (Japan), among others. |

Key Market Driver: Rapid Growth in Biologics and Advanced Therapies

A pivotal driver in the biotechnology contract manufacturing market is the rising demand for biologics and advanced therapies. Unlike traditional small molecules, biologics require highly specialized infrastructure, tight process control, and high-quality standards. The global pipeline of monoclonal antibodies, bispecific antibodies, vaccines, and gene-modified cell therapies is expanding rapidly, driven by their success in targeting complex and previously untreatable conditions such as cancer, autoimmune diseases, and rare genetic disorders.

For instance, over 70 monoclonal antibodies are FDA-approved for clinical use, and hundreds more are in the pipeline. Similarly, the approval of mRNA vaccines during the COVID-19 pandemic opened doors for mRNA-based therapeutics for infectious diseases and oncology. Given the complexity of producing these therapies especially in sterile and GMP-compliant environments biotech companies increasingly rely on contract manufacturers to manage scale-up, regulatory compliance, and timely delivery.

Key Market Restraint: High Entry Barriers and Capacity Constraints

A key restraint limiting market growth is the high cost and technical complexity of biologics manufacturing, which results in significant entry barriers and capacity bottlenecks. Establishing a GMP-compliant manufacturing facility for biologics requires substantial capital investment ranging from tens to hundreds of millions of dollars along with a highly skilled workforce and validated production systems.

Even within existing facilities, scaling production from clinical to commercial batches is often hampered by the limited availability of single-use bioreactors, cleanroom space, and fill-finish lines. In 2023 and 2024, several CDMOs faced backlogs and delays due to overloaded capacities, especially during pandemic-driven demand peaks. Smaller biotech firms are especially vulnerable to these constraints, often competing with large pharma companies for limited slots.

Additionally, regulatory complexity across FDA, EMA, and regional health authorities requires consistent validation, documentation, and compliance practices, adding to the operational burden.

Key Market Opportunity: Rising Demand for End-to-End Integrated Services

A transformative opportunity in the biotechnology contract manufacturing market is the growing demand for fully integrated, end-to-end service offerings. Biotech companies are increasingly seeking partners who can support the entire product lifecycle—from cell line development and upstream/downstream processing to formulation, sterile fill-finish, labeling, packaging, and even regulatory filing support.

This trend is particularly strong among emerging biotechs and virtual companies that operate lean R&D pipelines without internal manufacturing capabilities. CDMOs that offer a “one-stop-shop” model reduce the complexity of managing multiple vendors, ensuring better tech transfer continuity, process scalability, and time-to-market advantages.

Leading CDMOs are responding by expanding infrastructure, acquiring specialized firms, and launching integrated biologics platforms that support multiple modalities, including antibodies, vaccines, mRNA, and cell therapies. Companies that offer tailored support for both early-stage and commercial-stage clients are particularly well-positioned for long-term partnerships.

Segmental Analysis

By Service

Manufacturing services dominate the biotechnology contract manufacturing market. These services cover upstream and downstream processes, fermentation, purification, and bulk drug substance production. Given the surge in biologics and biosimilars, demand for cGMP manufacturing—especially for monoclonal antibodies and recombinant proteins—has grown exponentially. CDMOs with capacity for mammalian and microbial expression systems, single-use systems, and modular cleanrooms are in high demand.

Formulation and Fill-Finish services are the fastest-growing segment. As more therapies enter clinical and commercial stages, sterile injectable production and packaging require sophisticated fill-finish technologies. Fill-finish is particularly critical in cell and gene therapy products, where sterility and temperature sensitivity are paramount. CDMOs are rapidly expanding aseptic fill-finish capabilities with robotic lines, isolators, and real-time quality monitoring systems.

By Type

Biologic Drug Substance Manufacturing leads the market. This includes cell culture, harvesting, and purification of biologic drug material. The complexity of these tasks, particularly for monoclonal antibodies and therapeutic proteins, drives sustained outsourcing demand. CDMOs often provide custom cell line development, process optimization, and high-throughput fermentation.

Biologic Drug Product Manufacturing is the fastest-growing type, reflecting the maturation of early-phase pipelines. This includes final product formulation, stability studies, and packaging. Innovations in freeze-drying, LNP formulation for mRNA, and cryogenic storage are expanding the CDMO role beyond production into late-stage logistics and commercial packaging.

By Scale of Operation

Clinical operations currently dominate, particularly with thousands of biologic candidates in preclinical and clinical development. CDMOs are essential for scaling processes to GMP standards while maintaining flexibility for diverse product types and trial batch sizes.

Commercial operations are the fastest-growing, driven by an increasing number of approved biologics and biosimilars. CDMOs are securing long-term contracts for commercial supply, building dedicated lines and investing in quality management systems suitable for global regulatory compliance.

By Source

Mammalian expression systems are the dominant source, as they offer superior protein folding, post-translational modifications, and glycosylation essential for complex biologics like antibodies. CHO cells (Chinese Hamster Ovary) remain the industry standard for monoclonal antibody production.

Non-mammalian systems, including microbial expression platforms (e.g., E. coli, yeast), are the fastest-growing, especially for simpler proteins, enzymes, and vaccines. These systems offer high yield, lower cost, and faster process development—key advantages in pandemic and outbreak scenarios.

By Molecule

Monoclonal antibodies dominate the molecule type segment. They account for a major share of CDMO manufacturing contracts due to their proven efficacy, regulatory acceptance, and widespread application in oncology, immunology, and chronic diseases. CDMOs are heavily investing in upstream processing and large-scale capacity to accommodate this demand.

Cell & Gene Therapy is the fastest-growing molecule category. As approvals for cell therapies (e.g., CAR-T) and gene therapies (e.g., AAV vectors) increase, demand for specialized, small-batch GMP production is rising. CDMOs are responding with viral vector suites, cryopreservation capabilities, and automated cell processing platforms.

By Therapeutic Area

Oncology remains the dominant therapeutic area. The proliferation of biologics in cancer treatment—including checkpoint inhibitors, antibody-drug conjugates, and immune cell therapies—continues to drive outsourcing in clinical and commercial manufacturing.

Infectious diseases and neurology are among the fastest-growing therapeutic areas. The success of mRNA vaccines in COVID-19 has triggered increased investment in mRNA and protein-based vaccines for influenza, RSV, and HIV. Neurology is seeing growth in gene therapies targeting inherited disorders and neurodegeneration, with CDMOs playing a central role in production.

Regional Analysis

North America dominates the global market

North America, especially the United States, holds the largest share in the biotechnology contract manufacturing market. The region boasts a dense cluster of biotech startups, global pharmaceutical headquarters, and world-class academic research institutions. Regulatory clarity from the FDA, combined with government-backed innovation grants and infrastructure incentives, provides a strong foundation for CDMO expansion.

Leading North American CDMOs like Catalent, Thermo Fisher, and Lonza (U.S. facilities) offer a full spectrum of services including biologic drug substance, fill-finish, packaging, and logistics. Long-term public-private partnerships, such as those formed during Operation Warp Speed, have cemented the region’s leadership in emergency biomanufacturing response.

Asia-Pacific is the fastest-growing region

Asia-Pacific is witnessing rapid growth due to increasing biologics demand, local biopharma investments, and government support for biosimilar and vaccine production. Countries such as China, India, South Korea, and Singapore are investing in biomanufacturing infrastructure, offering cost advantages and streamlined regulations for CDMOs.

Global CDMOs are partnering with local firms or building regional hubs to serve both domestic and global clients. The rise of regional players like Samsung Biologics (South Korea), WuXi Biologics (China), and Syngene (India) is transforming Asia-Pacific into a global biomanufacturing destination. With strong pipelines in oncology, infectious disease, and biosimilars, the region is poised for exponential growth.

Some of the prominent players in the Biotechnology Contract Manufacturing Market include:

- Lonza (Switzerland)

- Thermo Fisher Scientific, Inc. (US)

- Catalent, Inc. (US)

- Samsung Biologics (South Korea)

- WuXi Biologics (China)

- Boehringer Ingelheim International GmbH (Germany)

- FUJIFILM Holding Corporation (Japan)

- AbbVie, Inc. (US)

- Eurofins Scientific (Luxembourg)

- GenScript Biotech Corporation (US)

- AGC, Inc. (Japan)

- Merck KgaA (Germany)

- JSR Corporation (Japan)

Recent Developments

-

March 2025: Catalent announced a $350 million investment to expand its biologics development and drug product manufacturing site in Indiana, adding 5,000L bioreactor capacity.

-

February 2025: Samsung Biologics signed a $1.2 billion manufacturing contract with a U.S.-based biotech firm to produce antibody-drug conjugates and mRNA therapeutics at its new Bio Campus.

-

January 2025: Thermo Fisher Scientific completed its acquisition of a Swiss CDMO specializing in sterile fill-finish services for biologics, expanding its European footprint.

-

December 2024: Lonza and Moderna extended their strategic collaboration to expand mRNA vaccine production capabilities in North America and Europe, including formulation and LNP development.

-

November 2024: WuXi Biologics inaugurated its new GMP biologics manufacturing site in Singapore with state-of-the-art mammalian cell culture and aseptic processing facilities.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Biotechnology Contract Manufacturing market.

By Service

- Manufacturing

- Formulation and Fill-Finish

- Packaging and Labeling

- Other services

By Type

- Biologic Drug Substance Manufacturing

- Biologic Drug Product Manufacturing

- By Scale of Operation

- Commercial Operations

- Clinical Operations

By Source

- Mammalian Expression Systems

- Non-Mammalian Expression Systems

By Molecule

- Monoclonal Antibodies

- Cell Therapy & Gene Therapy

- Antibody-Drug Conjugates (ADCs)

- Vaccines

- Therapeutic Peptides & Proteins

- Other Molecule Types

By Therapeutic Area

- Oncology

- Autoimmune Diseases

- Cardiovascular Diseases

- Metabolic Diseases

- Infectious Diseases

- Neurology

- Other Therapeutic Areas

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)