Biotechnology Market Size, Share, Growth, Report 2026 to 2035

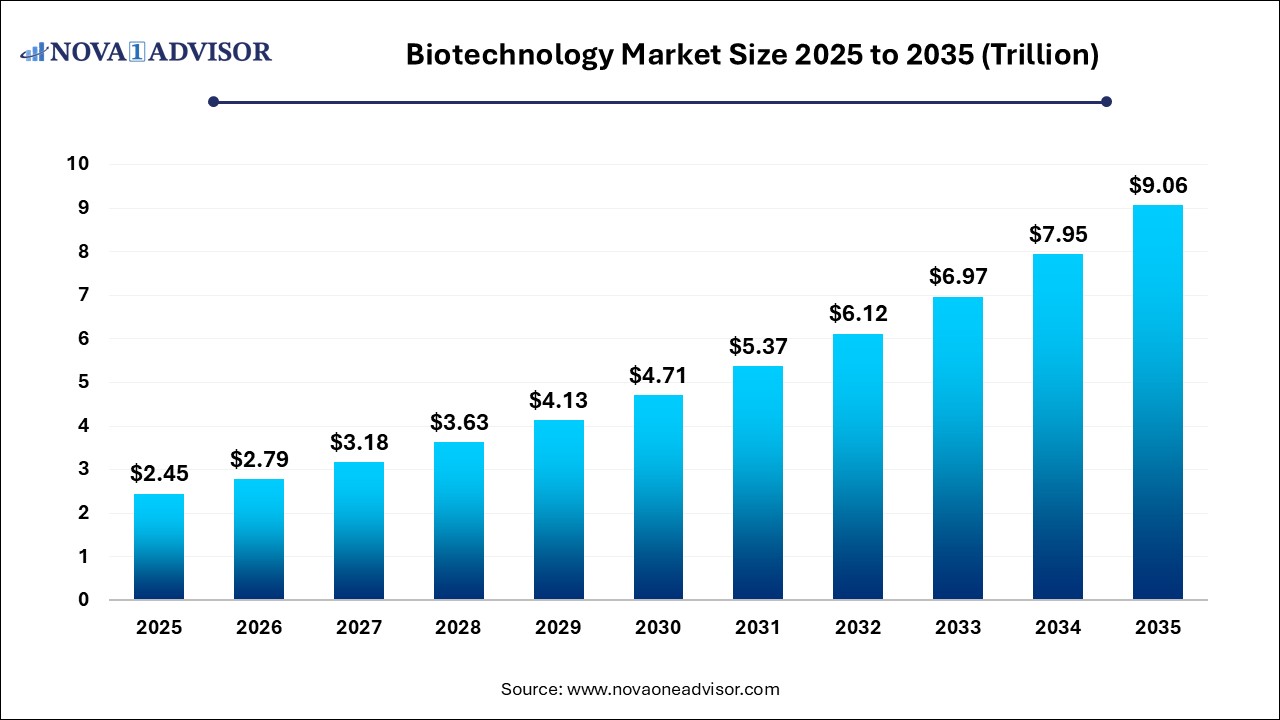

The global biotechnology market size was estimated at USD 2.45 trillion in 2025 and is projected to hit around USD 9.06 trillion by 2035, growing at a CAGR of 13.97% during the forecast period from 2026 to 2035.

Key Takeaways:

- North America accounted for the largest share of 41% in 2025.

- Asia Pacific is expected to expand at the fastest growth rate from 2026 to 2035.

- DNA sequencing held a significant market share of 17.53% in 2025

- Nanobiotechnology is expected to grow at a significant growth rate from 2026 to 2035

- The health application segment accounted for the largest share 51% in 2025.

- The growing demand for biosimilars and rising applications of precision medicine are expected to boost segment growth during the forecast period.

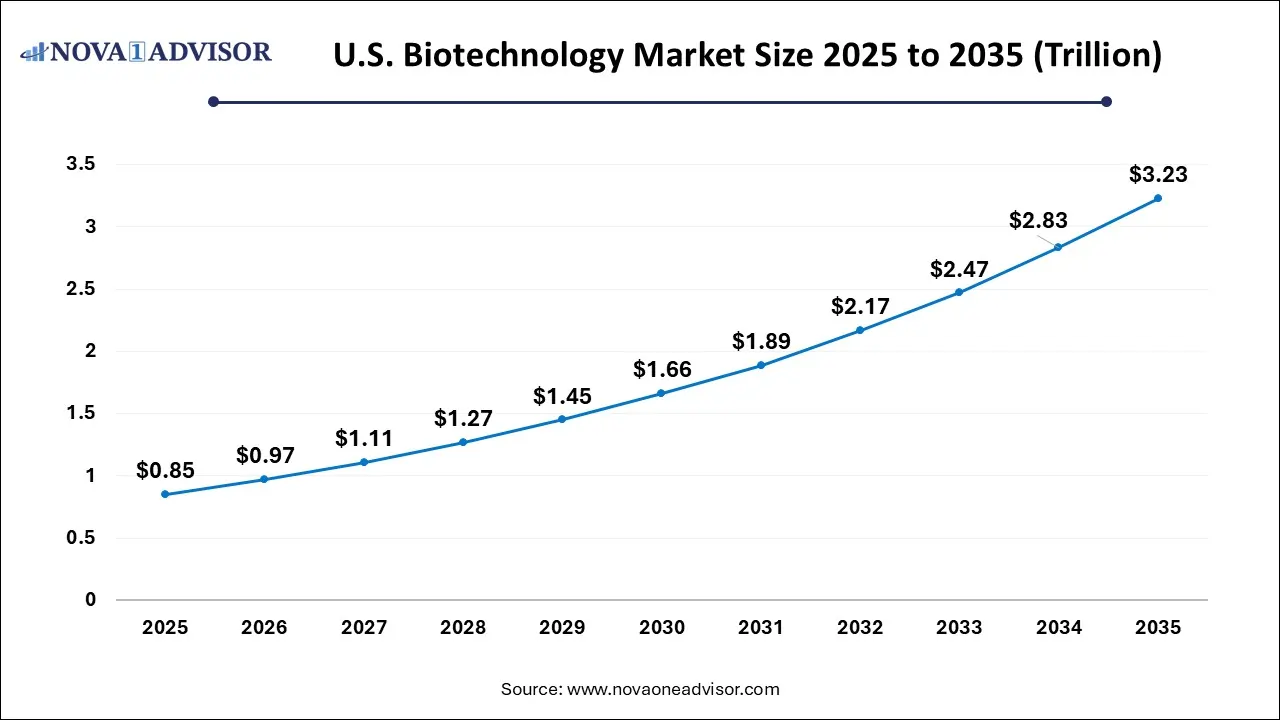

Biotechnology Market in the U.S. 2026 to 2035

The U.S. biotechnology market size was valued at USD 0.85 trillion in 2025 and is anticipated to reach around USD 3.23 trillion by 2035, growing at a CAGR of 14.28% from 2026 to 2035.

North America, particularly the United States, dominates the global biotechnology market due to its robust R&D infrastructure, high healthcare expenditure, and well-established regulatory environment. The U.S. is home to biotech giants like Amgen, Gilead, and Biogen, as well as thousands of startups funded by a vibrant venture capital ecosystem. Federal initiatives like the NIH, BARDA, and the National Cancer Institute fund significant biotech research. The region also benefits from top-tier academic institutions and biotech clusters in Boston, San Francisco, and San Diego. Regulatory support from the FDA’s Breakthrough Therapy Designation and Accelerated Approval pathways has fueled innovation and market access.

Asia-Pacific is the fastest-growing region, led by countries like China, India, Japan, and South Korea. China’s strategic investments in genomics, gene therapy, and biopharmaceuticals under the “Made in China 2025” policy are yielding rapid growth. India is emerging as a major hub for vaccine manufacturing, diagnostics, and generic biologics due to its cost advantages and skilled workforce. Japan’s aging population is increasing demand for regenerative medicine and personalized care. Regional governments are offering tax incentives, establishing biotech parks, and simplifying regulatory pathways. As domestic consumption and innovation capacities rise, Asia-Pacific is poised to reshape the global biotech landscape.

U.S. biotechnology market trends

The rising demand for high-quality genetic therapies to treat a wide range of cancers along with rapid investment by biotech companies for opening up new research and development centers has boosted the market expansion. Moreover, rise in number of biotech startups coupled with technological advancements in the biopharma sector is playing a vital role in shaping the industry in a positive manner.

China biotechnology market analysis

The increasing sales of hybrid fruits and hybrid vegetables coupled with rapid investment by market players for opening up biotech research centers has driven the market growth. Also, numerous government initiatives aimed at developing the healthcare sector is contributing to the industry in a positive direction.

Why Europe is a significant contributor of the biotechnology market?

Europe is a significant contributor of the biotechnology industry. The rapid expansion of the nanobiotechnology sector in several countries including Germany, Italy, France, UK, Denmark and some others has driven the market growth. Additionally, numerous government initiatives aimed at developing the developing the biotechnology sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Roche, Novartis, Biontech and some others is expected to propel the growth of the biotechnology market in this region.

UK biotechnology market analysis

The growing demand for DNA-based therapeutics to treat chronic diseases coupled with rapid investment by the healthcare companies for developing a wide range of cell therapies has boosted the market expansion. Moreover, rapid investment by government for developing the genetic engineering sector is playing a prominent role in shaping the industrial landscape.

What is the role of Latin America in the biotechnology market?

Latin America has played a prominent role in the biotechnology market. The growing demand for cell-based assays from the food and beverage sector in numerous nations such as Brazil, Argentina, Venezuela and some others has boosted the market expansion. Also, rapid investment by government for enhancing the bioinformatics sector is contributing to the industry in a positive manner. Moreover, the presence of numerous market players such as Biocure, Biofábrica Siglo, Bionovis and some others is expected to drive the growth of the biotechnology market in this region.

Brazil biotechnology market trends

The rapid expansion of the tissue engineering sector coupled with technological advancements in the pharma industry has driven the market growth. Additionally, the growing demand for cell-based assays from the food and agriculture sector is contributing to the industry in a positive direction.

Why Middle East and Africa held a notable share of the biotechnology market?

Middle East and Africa held a notable share of the industry. The rising demand for RNA therapeutics for treating cancer in numerous countries including UAE, Saudi Arabia, Qatar, South Africa and some others has driven the market growth. Also, technological advancements in the genetic engineering sector coupled with increasing adoption of hybrid vegetables in developed nations is playing a prominent role in shaping the industrial landscape. Moreover, the presence of several biotechnology companies including G42 Healthcare, NewBridge Pharmaceuticals, Julphar and some others is expected to boost the growth of the biotechnology market in this region.

UAE biotechnology market analysis

The growing demand for high-quality hybrid vegetables coupled with technological advancements in the biotechnology sector has fostered the industrial expansion. Moreover, rapid investment by government for strengthening the pharmaceutical industry is playing a prominent role in shaping the industrial landscape.

Strategic Overview of the Global Biotechnology Industry

The biotechnology market represents one of the most transformative and rapidly evolving sectors of the global economy, bridging life sciences, engineering, and information technology to drive innovations in healthcare, agriculture, energy, and environmental sciences. Rooted in the manipulation of biological systems and organisms for commercial use, biotechnology has expanded from traditional applications like fermentation and crop breeding to cutting-edge areas such as gene editing, nanobiotechnology, regenerative medicine, and synthetic biology.

At its core, biotechnology harnesses cellular and biomolecular processes to develop products that improve human life and the planet. In healthcare, biotechnology has enabled the creation of life-saving biologics, mRNA vaccines, targeted therapies, and diagnostics. In agriculture, it enhances crop yield, pest resistance, and soil quality. Environmental biotechnology is pivotal for waste treatment, bioremediation, and biofuel production. With global challenges like pandemics, food insecurity, climate change, and antibiotic resistance, biotechnology offers novel tools to create scalable, sustainable solutions.

The market's growth is being propelled by increased R&D investments, favorable regulatory frameworks, breakthroughs in omics technologies, and the integration of artificial intelligence in biological data analysis. From startups leveraging CRISPR for rare disease therapies to global pharma giants investing in advanced biologics manufacturing, the industry is seeing diversified expansion across applications and geographies.

Biotechnology’s convergence with digital health, precision agriculture, and green industrial processes ensures its relevance across multiple verticals. As the demand for personalized healthcare, clean energy, and climate-resilient farming intensifies, biotechnology is set to play an even more central role in shaping global economies and societies.

Impact of AI on the Biotechnology Market?

Artificial Intelligence: The Next Growth Catalyst in Biotechnology

AI is profoundly impacting the biotechnology industry by speeding up innovation, driving efficiency, and enabling personalized solutions across the industry. This transformation is primarily driven by AI’s ability to process and derive insights from the vast amount of complex data that human analysis methods traditionally struggle with. In practical terms, AI dramatically shortens the time and reduces the costs associated with R&D, for example, by identifying potential drug candidates in months instead of years through predictive modeling and generative design. Furthermore, AI and machine learning are enabling the rise of personalized medicine by tailoring treatments to individual genetic profiles and optimizing the design and efficiency of clinical trials.

Biotechnology market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to numerous government initiatives aimed at developing the biotechnology sector coupled with rising demand for DNA-based therapeutics to treat chronic diseases.

- Major Investors: Numerous market players are actively entering this market, drawn by partnerships, R&D and business expansions. Several biotechnology companies such as Pfizer, Merck & Co. Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd, and some others have started investing rapidly for developing a wide range of hybrid products to cater the needs of the end-user industries.

- Startup Ecosystem: Various startup brands are engaged in developing advanced biotechnology solutions across the globe. The prominent startup companies dealing in biotechnology comprises of Sea6 Energy String Bio, Molbio Diagnostics and some others.

Major Trends in the Market

-

Explosive Growth of mRNA and Gene Therapies: Post-COVID-19, mRNA platforms and gene-editing tools like CRISPR are reshaping therapeutics and vaccines.

-

Rise of Synthetic Biology: Companies are designing custom organisms for material science, fuel, and food innovations.

-

Increased Investment in Agricultural Biotech: Drought-resistant, nitrogen-efficient, and genetically engineered crops are expanding.

-

Miniaturization Through Nanobiotechnology: Targeted drug delivery, biosensors, and diagnostic nanodevices are in rapid development.

-

Regenerative Medicine and 3D Bioprinting Surge: Tissue engineering is gaining traction for organ repair, wound healing, and musculoskeletal regeneration.

-

Bioinformatics Integration with AI and Cloud: Huge genomic datasets are being processed with machine learning to accelerate drug discovery.

-

Focus on Sustainability and Bio-based Manufacturing: Industrial biotech is replacing petroleum-based processes with enzyme-driven fermentation.

-

Increased Public-Private Collaborations: Government grants, academic partnerships, and biotech accelerators are fostering innovation pipelines.

Biotechnology Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 2.79 Trillion |

| Market Size by 2035 |

USD 9.06 Trillion |

| Growth Rate From 2026 to 2035 |

CAGR of 13.97% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

AstraZeneca, Gilead Sciences, Inc., Bristol-Myers Squibb, Biogen, Abbott Laboratories, Amgen Inc., Novo Nordisk A/S, Merck KGaA., Johnson & Johnson Services, Inc., Novartis AG, Sanofi, F. Hoffmann-La Roche Ltd., Pfizer, Inc., Lonza |

Market Driver: Rising Demand for Personalized and Targeted Therapies

A key driver of the biotechnology market is the increasing demand for personalized and precision medicine, which uses an individual’s genetic, environmental, and lifestyle information to tailor treatments. This paradigm shift is possible due to advancements in genomic sequencing, proteomics, and biomarker discovery—core areas within biotechnology.

For example, oncology treatments now use companion diagnostics to identify specific mutations in tumor DNA, ensuring patients receive targeted therapies with higher efficacy and lower toxicity. CAR-T cell therapy for blood cancers is a prime illustration of personalized medicine made possible by genetic engineering and cell therapy tools. Furthermore, conditions like cystic fibrosis and spinal muscular atrophy are being managed using gene therapies that address the root cause at the molecular level.

As public health systems and insurers emphasize value-based care, biotechnology solutions that offer individualized treatment and better outcomes are gaining traction. The ability to design therapies around a patient’s genetic blueprint is redefining drug development and regulatory models, significantly boosting the sector’s growth.

Market Restraint: High Development Costs and Regulatory Complexity

Despite its immense potential, the biotechnology market is restrained by high R&D costs, lengthy product development timelines, and complex regulatory pathways. Developing a single biotech drug can cost between $1 billion to $2 billion and take over a decade from discovery to market approval. Biologics, gene therapies, and regenerative treatments require specialized facilities, stringent clinical trials, and long safety evaluations.

Additionally, regulatory agencies like the FDA, EMA, and PMDA impose rigorous data standards, especially for novel biologics, cell-based products, or genetically modified organisms (GMOs). Navigating these frameworks requires significant expertise and resources, often limiting market entry for smaller companies. IP protection, pricing debates, and ethical concerns especially around gene editing and cloning add further layers of complexity.

These challenges can delay commercialization, increase investment risk, and limit patient access. Overcoming them requires collaborative engagement between regulators, academia, and industry stakeholders to create agile yet safe innovation environments.

Market Opportunity: Expansion of Biotechnology in Environmental and Industrial Applications

An exciting opportunity lies in the rapid expansion of biotechnology into industrial and environmental sectors, particularly in the context of sustainability. With global attention on climate change, pollution, and resource scarcity, biotech solutions offer greener alternatives to traditional processes.

Industrial biotechnology uses microorganisms and enzymes in fermentation to produce chemicals, materials, and fuels. Companies are developing bio-based plastics, biodegradable packaging, and enzyme-catalyzed synthesis routes that reduce the environmental footprint of manufacturing. For instance, startups are using algae and bacteria to produce biopolymers that replace petroleum-based plastics.

Similarly, environmental biotechnology is vital for waste management, water purification, and soil remediation. Bioengineered microbes can clean oil spills, remove heavy metals, and degrade toxic chemicals. Biofuel production using lignocellulosic biomass and algae also represents a major opportunity, especially with government incentives for clean energy.

As ESG (Environmental, Social, and Governance) metrics become central to corporate strategies, industries are turning to biotechnology for innovation that aligns with sustainability goals—unlocking new revenue streams beyond healthcare.

Biotechnology Market By Technology Insights

DNA sequencing is the dominant technology in the biotechnology market, driven by its foundational role in genomics, diagnostics, and drug discovery. Next-generation sequencing (NGS) has revolutionized biology by enabling rapid, affordable genome mapping. It’s used in everything from cancer diagnostics and rare disease identification to agricultural genomics and microbiome analysis. Companies like Illumina, Thermo Fisher Scientific, and Pacific Biosciences have transformed sequencing into a clinical and research staple. Sequencing enables gene editing, personalized medicine, and population health research, making it a critical pillar of biotechnology advancement.

Conversely, nanobiotechnology is the fastest-growing technology segment, offering transformative potential across healthcare, diagnostics, and environmental monitoring. This field integrates nanotechnology with biological systems to create nanoscale drug delivery systems, biosensors, diagnostic tools, and imaging agents. For instance, nanoparticles are being engineered to deliver chemotherapy drugs directly to tumors, minimizing systemic toxicity. In diagnostics, nanobiosensors can detect diseases at earlier stages by identifying biomarkers in real time. Nanobiotech is also emerging in agriculture and water purification, making it one of the most versatile and promising subfields in biotech innovation.

Biotechnology Market By Application Insights

Health biotechnology remains the largest application segment, encompassing pharmaceuticals, diagnostics, vaccines, and gene/cell therapies. The COVID-19 pandemic accelerated innovation and adoption of health biotech tools such as mRNA vaccines (Pfizer-BioNTech, Moderna) and antibody-based treatments. Chronic diseases like cancer, diabetes, and neurodegenerative disorders continue to drive demand for biopharmaceutical innovation. Technologies like CRISPR, AI-driven drug discovery, and regenerative medicine are fueling a new era in clinical care. Companies are using 3D printing for tissue scaffolds, synthetic biology for vaccine development, and cell therapy for immune modulation, solidifying health biotech’s dominance.

Industrial processing is the fastest-growing application, as biotech expands into green manufacturing, energy, and chemical production. Microbial fermentation, enzyme catalysts, and metabolic engineering are enabling cost-efficient, sustainable alternatives to petrochemical processes. Bioethanol, bioplastics, biosurfactants, and other renewable compounds are gaining commercial traction. Biotech companies are collaborating with manufacturing firms to replace energy-intensive methods with bio-based processes that reduce carbon footprints and waste. As global industries face mounting sustainability pressures, biotechnology offers an economically viable and environmentally friendly alternative.

Value Chain Analysis of the Biotechnology Market

Biotechnology Market Companies

- Pfizer, Inc. (USA): A global leader in biopharmaceuticals, Pfizer is focusing on expanding breakthrough obesity therapies and personalized medicine.

- AstraZeneca (UK/Sweden): Specializing in oncology, cardiovascular, and respiratory diseases, its blockbuster drugs like Farxiga and Tagrisso drove significant revenue growth.

- Novo Nordisk A/S (Denmark): Currently a dominant player in metabolic health, its GLP-1 therapies (Ozempic and Wegovy) are projected to be among the world's top-selling drugs.

- Sanofi (France): A leading diversified healthcare company, Sanofi is focused on rare disease biologics and immunology, with a significant operational presence in Germany.

- Gilead Sciences, Inc. (USA): Renowned for its HIV and hepatitis treatments, Gilead expanded its oncology portfolio in 2024–2025 through acquisitions like CymaBay Therapeutics.

- Bristol Myers Squibb (USA): A leader in biopharma, BMS is launching innovative cardiovascular and oncology biologics in 2025, including the novel schizophrenia treatment Cobenfy.

- Amgen Inc. (USA): A biotechnology pioneer, Amgen remains a key player in the German "red biotechnology" (medical) market with a focus on inflammation and oncology.

- Biogen (USA): A specialist in neuroscience, Biogen focuses on therapies for neurological and neurodegenerative diseases like multiple sclerosis and Alzheimer's.

- Abbott Laboratories (USA): A diversified healthcare company providing medical devices, diagnostics, and branded generic medicines; its biopharmaceutical business was famously spun off into AbbVie.

Biotechnology Market Recent Developments

- In October 2025, Countable Labs launched Countable 10. Countable 10 is a ten-Color PCR platform designed to accelerate commercialization of countable labs’ products.

- In October 2025, REPROCELL Europe Ltd. launched Alvetex Advanced. Alvetex Advanced is an innovative plasticware platform developed for expanding the capabilities of 3D cell culture.

- In April 2025, Aplex Bio launched Hyperplex PCR Kits. Hyperplex PCR Kits are integrated with Nanopixel technology that finds numerous applications in the biotech sector.

Biotechnology Market Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the biotechnology market.

By Technology

- Nanobiotechnology

- Tissue Engineering and Regeneration

- DNA Sequencing

- Cell-based Assays

- Fermentation

- PCR Technology

- Chromatography

- Others

By Application

- Health

- Food & Agriculture

- Natural Resources & Environment

- Industrial Processing

- Bioinformatics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)