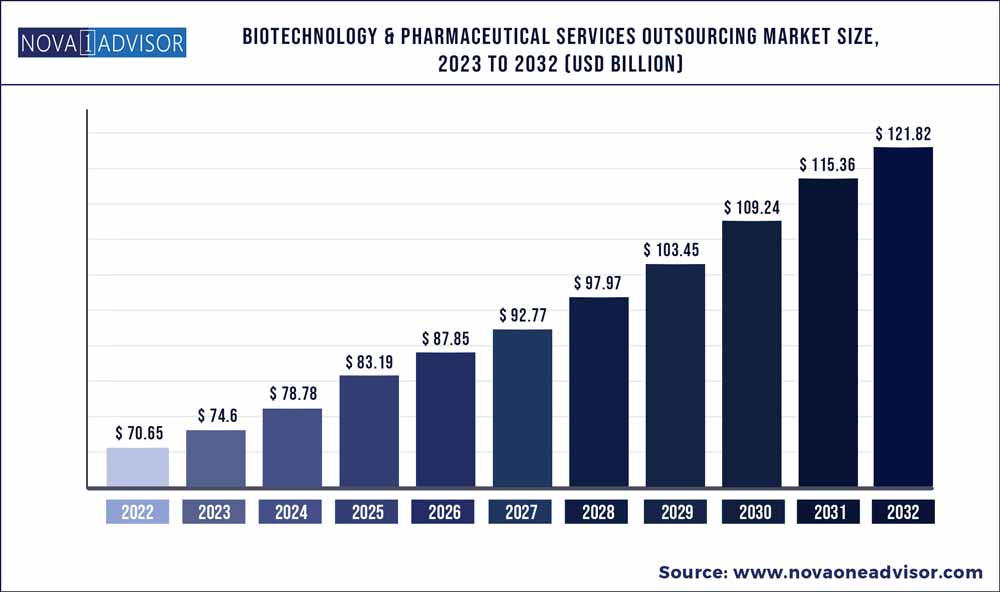

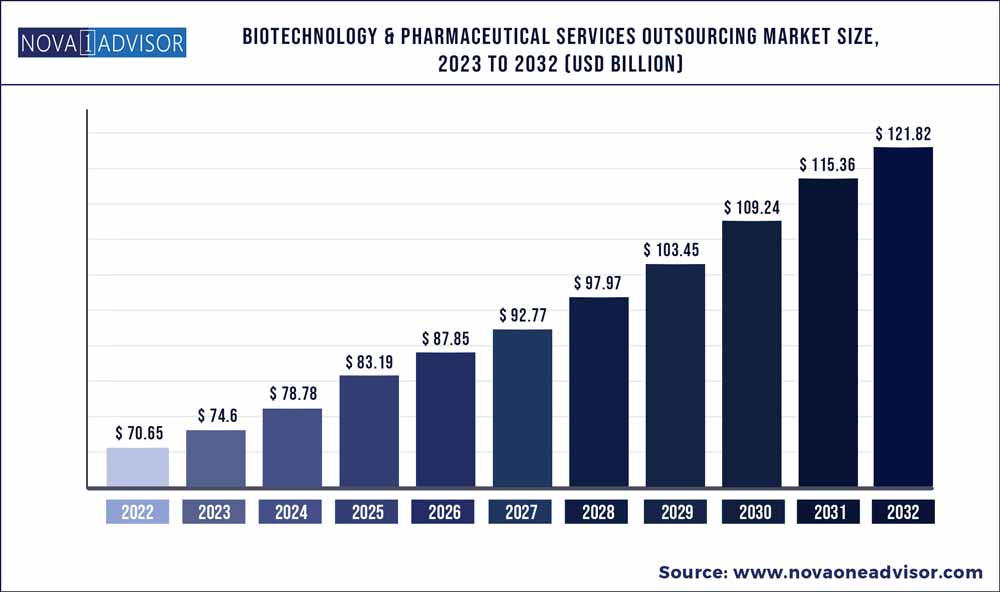

The global Biotechnology & Pharmaceutical Services Outsourcing market size was exhibited at USD 70.65 billion in 2022 and is projected to hit around USD 121.82 billion by 2032, growing at a CAGR of 5.6% during the forecast period 2023 to 2032.

Key Pointers:

- The consulting services segment dominated the market and accounted for the largest revenue share of 20.9% in 2022.

- The pharma segment dominated the market and accounted for the largest revenue share of 56.9% in 2022.

- North America dominated the market and accounted for the largest revenue share of 54.11% in 2022.

- Asia Pacific biotechnology and pharmaceutical services outsourcing market is expected to witness a CAGR of 6.2%

Biotechnology & Pharmaceutical Services Outsourcing Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 74.6 Billion

|

|

Market Size by 2032

|

USD 121.82 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 5.6%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Service, end-use

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

The Quantic Group; IQVIA; Parexel International Corporation; Lachman Consultant Services, Inc.; GMP Pharmaceuticals Pty Ltd.; Concept Heidelberg GmbH; Covance, Inc.; Charles River Laboratories; PRA Health Sciences; ICON plc

|

The COVID-19 pandemic has significantly impacted Biotechnology and Pharmaceutical third-party service providers as well as clinical trials, resulting in trial delay, suspensions, and terminations. The global crisis has stressed the need for virtual trials and leveraging technology and software solutions. The recovery from the pandemic has led to increasing adoption of machine learning-based platforms, artificial intelligence, automation in drug manufacturing, and innovative trial designs are projected to transform the CRO and CMO landscape in the coming years.

Biopharmaceutical and pharmaceutical investments in novel and innovative therapies, for instance, regenerative medicine, are driving the R&D activity together with drug development services. The high demand for biologics along with small molecules has led to the expansion of service portfolios of Contract Manufacturing Organizations (CMOs)/Contract Research Organizations (CROs) for biotechnology and pharmaceutical production. Small pharma/ biotech companies are facing challenges while performing in-house development, manufacturing, regulatory affairs, product maintenance, product design and development, product testing and validation, and training and education such as lack of substantial expertise and expensive capability. This in turn has created lucrative opportunities for the growth of CMOs and CROs. Contract services are growing and becoming strategic, targeted, and planned. These factors are expected to play a pivotal role in enhancing the share of CMOs/CROs in the overall market.

Growing pricing pressure, regulatory challenges, and patent expiration have led to shrinking margins in the biotech and pharmaceutical industry. Contract services are considered a “strategic competitive weapon” among the companies, as these services help overcome these issues. These services offer cost saving to their clients as choosing sustainable suppliers could lead to reduced costs in the long run. They also help save time utilized in the operations and management of a production and research facility. Contract research and manufacturing allows low-cost product development and manufacturing cost of a product. Furthermore, outsourcing services assist in overcoming trade barriers and facilitate the entry of firms into the foreign market. Owing to these advantages, several firms choose to outsource services rather than investing capital in production equipment and hiring skilled labor.

The biologics industry has grown substantially in recent years to include novel product types including nanobodies, rDNA, synthetic vaccines, fusion proteins, soluble receptors, immunoconjugates, and immunotherapeutics. Owing to the revolutionization of disease therapy through biologics, this sector has also provided many opportunities to explore hybrid structures that combine biologics with well-defined chemical entities. The significant growth of biologics is expected to drive the demand for outsourcing of biologics development and manufacturing.

Service Insights

The consulting services segment dominated the market and accounted for the largest revenue share of 20.9% in 2022. The segment is expected to maintain its position over the forecast period. This can be attributed to the increasing M&A activities and constantly changing regulatory protocols. However, pharma and biotech market have witnessed the continuous entry of new players such as Signa Medical Writing, bioSyntagma, and Fieve Clinical Research, Inc. These players need to be compliant with set standards and norms, for which consulting is essential as these new entrant’s lack in such capabilities.

However, the other services segment was valued at USD 10,649.8 million in 2022 and is expected to witness a higher CAGR of 6.5% over the forecast period owing to rising outsourcing of generics and biosimilar manufacturing as CMOs are offering services at lower cost. Other segment is inclusive of contract manufacturing, product upgrade and IT consulting. Biostatistics outsourcing is increasing owing to growing concerns about biotechnology and pharmaceutical companies with regard to competition in product commercialization, clinical trial complexity, and the quality of clinical trials that have boosted the importance of biostatistics.

End-use Insights

The pharma segment dominated the market and accounted for the largest revenue share of 56.9% in 2022. The segment is expected to register a CAGR of 5.7% over the forecast period. An increase in R&D spending by pharmaceutical companies for the development of potential novel products and a rise in investments by CROs for the development of core capabilities are expected to drive the market in the region in the coming years. Contract service providers are recognized as an effective strategic decision to curb the issues of drug shortfall and high production costs, as well as meet the growing demand.

Lack of resources has prompted many pharmaceutical companies to outsource drug development and manufacturing of their products to CROs and CMOs. The CROs and CMOs offer highly sophisticated development and manufacturing services, such as preclinical development, clinical development, commercial manufacturing, clinical manufacturing, precision injection molding, high-speed automation, assembly, fill/finish, and others for a range of pharma products.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 54.11% in 2022. This growth is owing to the presence of several established CROs and CMOs such as Covance Inc., IQVIA, Catalent, and Samsung Biologics, and growing R&D investments by life sciences and pharmaceutical companies in the region. The presence of stringent regulatory policies and increase in R&D expenditure are among the factors likely to boost the demand for outsourcing of services by pharmaceutical and biotechnology companies in the region. In addition, the expansion of foreign CMOs and CROs into the country is expected to propel market growth. For instance, in September 2019, Bora Pharmaceuticals received FDA approval for its CMO services and in October 2019, it opened a sales office in Delaware to expand its presence outside Asia and strengthen its market position.

Asia Pacific biotechnology and pharmaceutical services outsourcing market is expected to witness a CAGR of 6.2% over the forecast period owing to an increase in investments by developed countries and various regulatory reforms in clinical trial evaluation to align with standards of various countries investing in the region. Low cost of drug development and manufacturing, and availability of skilled workforce are likely to foster contract development and manufacturing in this region. Moreover, economic policy reforms in countries such as China are anticipated to create an open and balanced economy, which presents ample opportunity for market players to invest in this region. In July 2017, Novotech expanded its site management services in Korea with the launch of Novotech SMO Korea Co. Limited.

Some of the prominent players in the Biotechnology & Pharmaceutical Services Outsourcing Market include:

- Parexel International Corporation

- The Quantic Group

- IQVIA

- Lachman Consultant Services, Inc.

- GMP Pharmaceuticals Pty Ltd.

- Concept Heidelberg GmbH

- Covance Inc.

- Charles River Laboratories

- PRA Health Sciences

- ICON plc

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Biotechnology & Pharmaceutical Services Outsourcing market.

By Service

- Consulting

- Regulatory compliance

- Remediation

- Quality management systems consulting

- Others

- Auditing and assessment

- Regulatory affairs

- Clinical trial applications & product registration

- Regulatory writing & publishing

- Legal representation

- Others

- Product maintenance

- Product design & development

- Product testing & validation

- Training & education

- Others

By End-use

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)