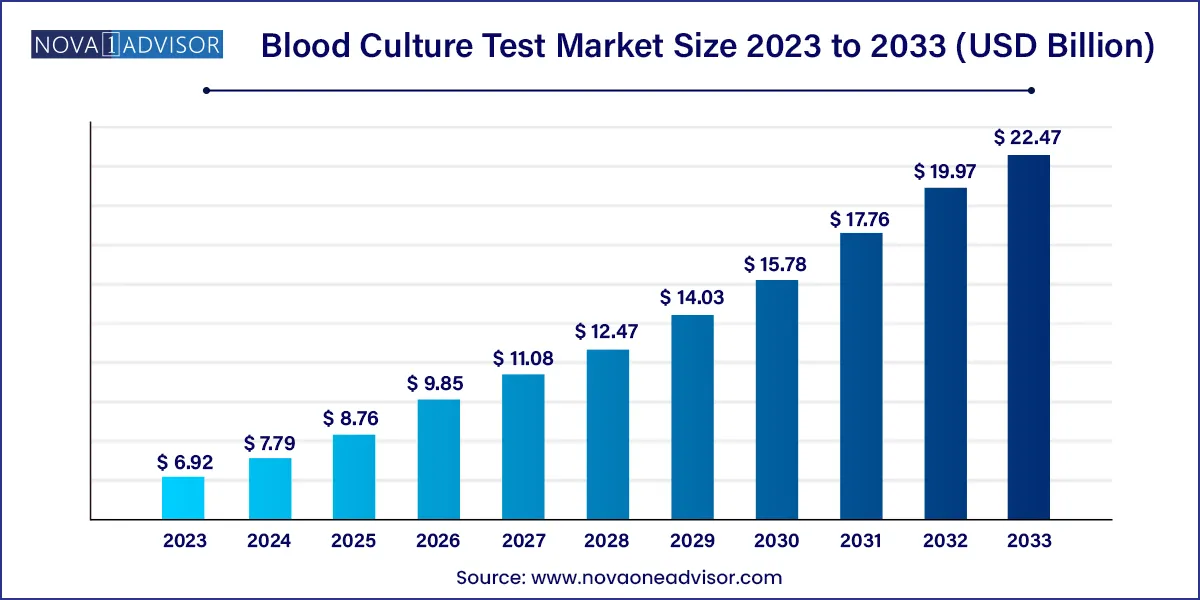

The global blood culture test market size was exhibited at USD 6.92 billion in 2023 and is projected to hit around USD 22.47 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2024 to 2033.

Key Takeaways:

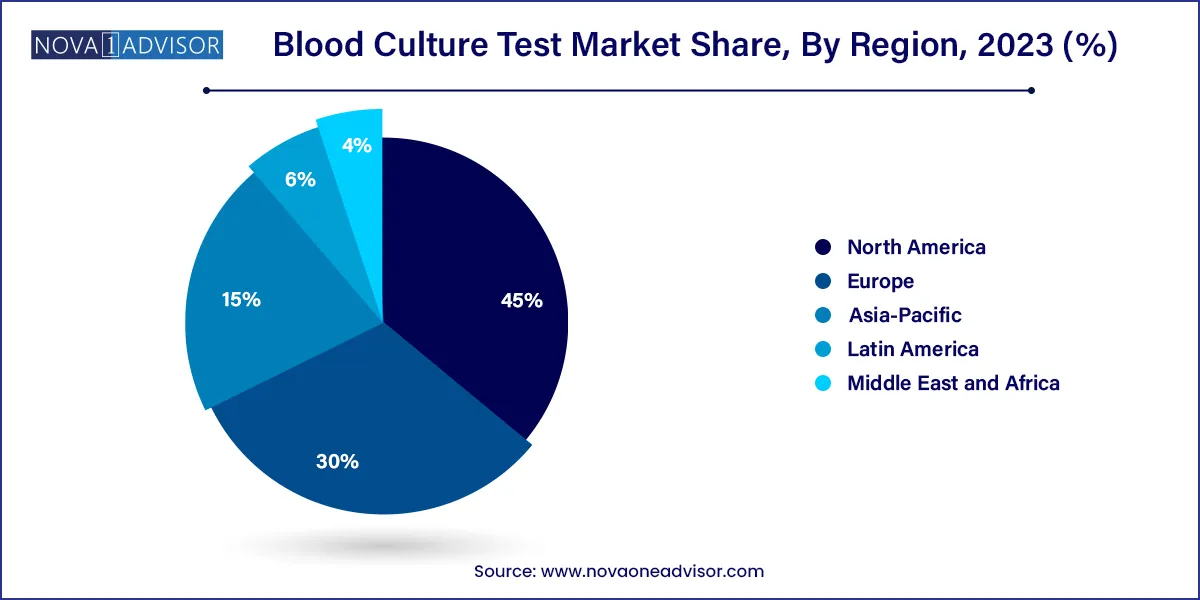

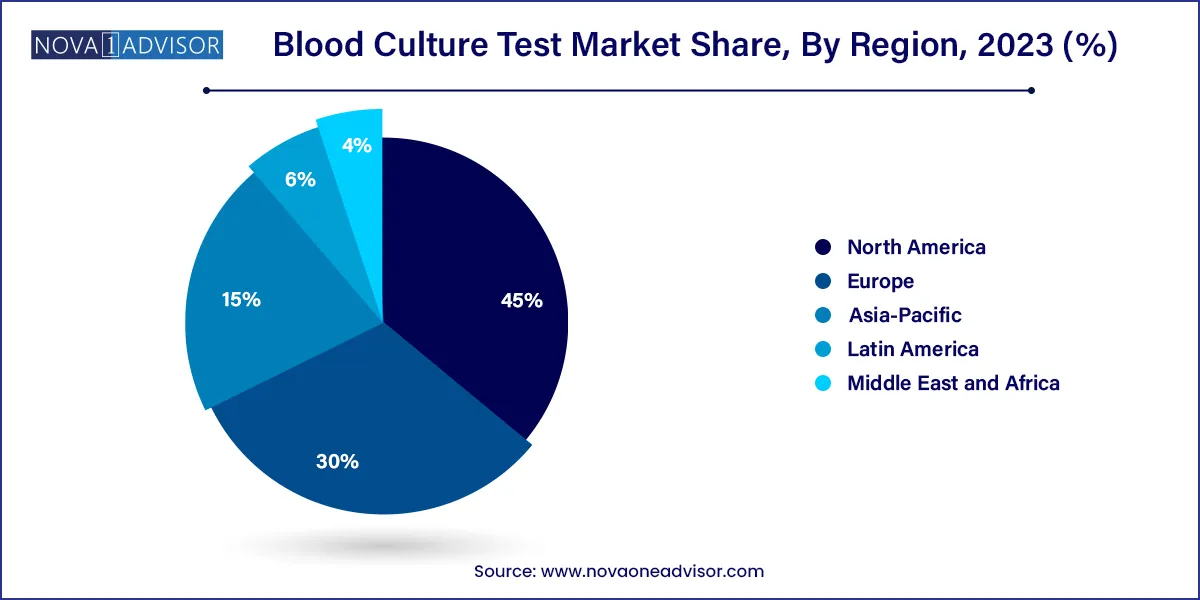

- North America held the largest revenue share of 45.0% in 2023

- The consumables segment held thelargest share of 59.99% of the blood culture tests market in 2023.

- The conventional blood culture technique segment held the largest share of 64.78% in 2023.

- The culture-based technology segment dominated the market with a share of 67.27% in 2023.

- The bacterial infections application segment held the largest share of 71.18% in 2023.

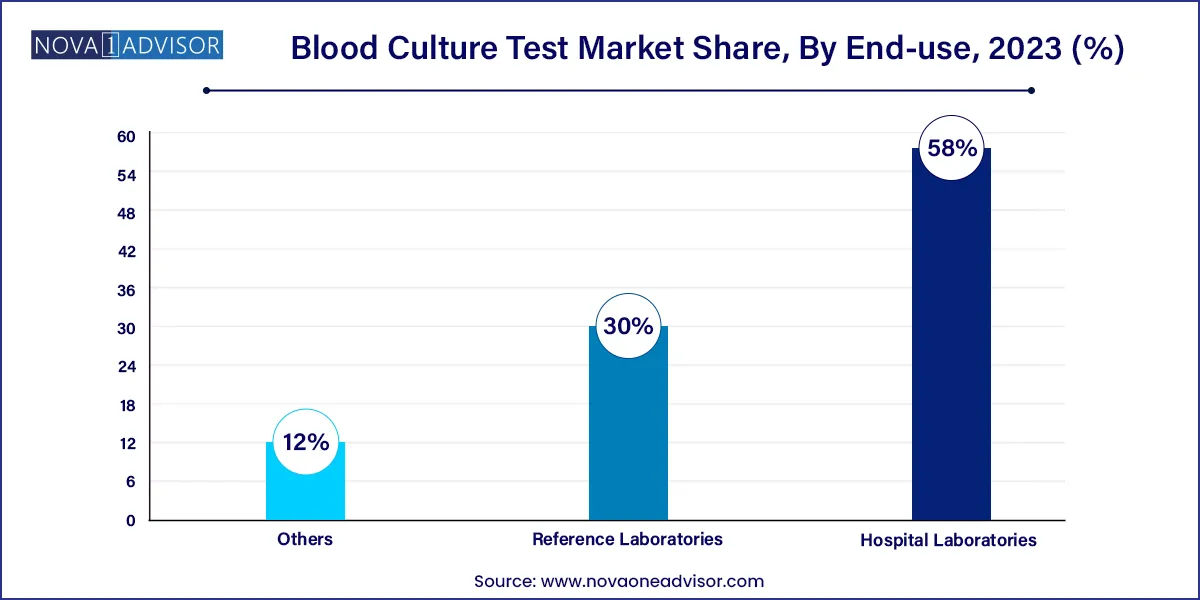

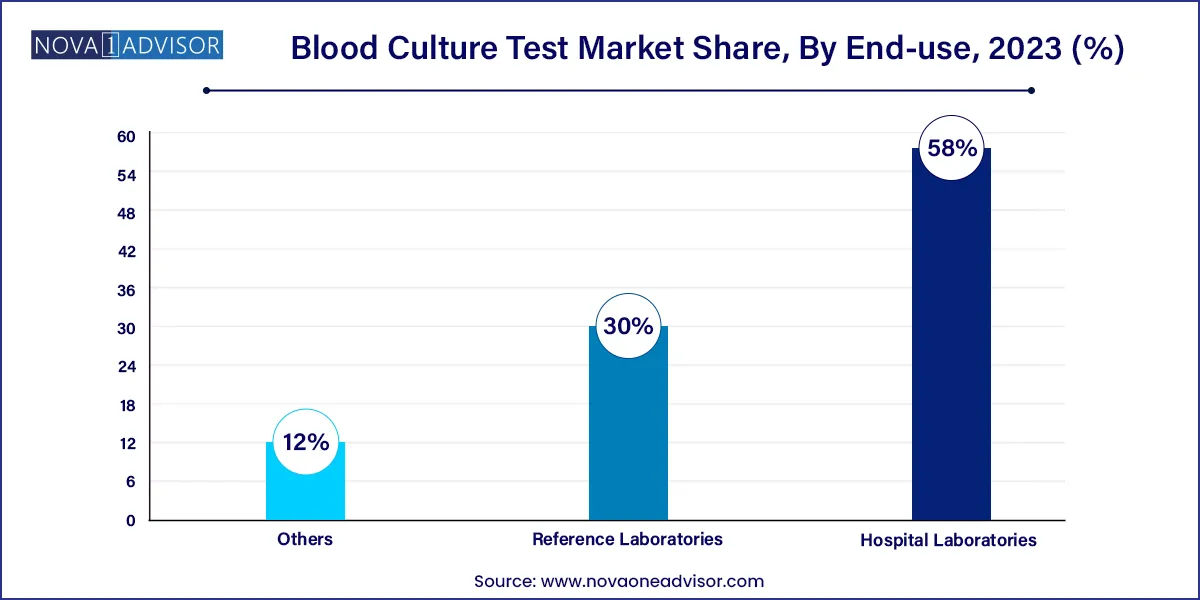

- The hospital laboratories segment accounted for the largest share of 58.0% of the blood culture tests market in 2023.

Market Overview

The blood culture test market plays a pivotal role in the diagnostics ecosystem by identifying bloodstream infections (BSIs), particularly those caused by bacteria, fungi, and mycobacteria. These infections, when undiagnosed or mismanaged, can escalate into life-threatening conditions such as sepsis. As the global healthcare system focuses more on precision diagnostics and infection control, the demand for reliable blood culture testing has grown significantly. The advent of hospital-acquired infections (HAIs), an aging population, and antimicrobial resistance have further underlined the need for rapid, accurate blood culture diagnostics.

Blood culture tests involve incubating blood samples in nutrient-rich media to promote microbial growth and identifying the causative pathogen through various techniques including gram staining, molecular analysis, or automated systems. Hospitals and reference labs rely heavily on these tests to tailor antimicrobial treatments, reduce unnecessary prescriptions, and manage patient care efficiently.

Recent global events, such as the COVID-19 pandemic, brought infectious disease control to the forefront. Although COVID itself is viral, the high incidence of co-infections and secondary bloodstream infections highlighted the importance of blood culture diagnostics. Healthcare facilities worldwide invested in automated blood culture systems to enhance throughput and reduce the burden on laboratory staff. This has catalyzed not only adoption but also innovation in the segment, especially for rapid diagnostics and software-based data integration.

Major Trends in the Market

-

Rising Preference for Automated Blood Culture Systems: Automation is reducing manual labor, human error, and diagnostic turnaround time.

-

Integration of Molecular Diagnostic Techniques: PCR, microarrays, and proteomics are being integrated with blood culture testing for faster pathogen identification.

-

Adoption of Antimicrobial Stewardship Programs: Hospitals are increasingly using blood culture results to guide targeted antibiotic therapy.

-

Expansion in Emerging Markets: Improved healthcare infrastructure and rising awareness are boosting test adoption in Asia-Pacific and Latin America.

-

Prevalence of Fungal Infections in Immunocompromised Patients: Opportunistic infections are driving fungal diagnostics within the culture market.

-

Development of Point-of-Care (POC) Systems: Companies are working on miniaturized culture devices for rapid bedside testing.

-

Artificial Intelligence in Interpretation: AI and software tools are being used to interpret complex blood culture results, especially in automated systems.

-

Increased Hospitalization and ICU Admissions: More patients undergoing invasive procedures means more demand for preemptive blood culture tests.

Blood Culture Test Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 7.79 Billion |

| Market Size by 2033 |

USD 22.47 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technique, Product, Technology, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BD; Terumo Corp.; bioMerieux; Bruker Corp.; T2 Biosystems Inc.; Abbott Laboratories; Luminex Corp.; Siemens Healthineers AG; F. Hoffmann-La Roche AG; Danaher Corp. |

Key Market Driver: Rising Incidence of Sepsis and Bloodstream Infections

One of the strongest market drivers is the global increase in sepsis cases. Sepsis affects nearly 49 million people worldwide annually, causing approximately 11 million deaths. Early detection is critical, as each hour of delayed antibiotic treatment increases mortality rates. Blood culture tests are the gold standard for diagnosing sepsis-causing infections and guiding appropriate antimicrobial therapy.

The use of these tests allows clinicians to detect bacteria or fungi in the bloodstream and tailor antibiotic regimens, avoiding broad-spectrum drugs that contribute to resistance. Major hospital systems, particularly in North America and Europe, have integrated blood culture tests as part of routine screening for suspected sepsis, fueling steady demand for automated systems and advanced consumables.

Key Market Restraint: High False Negative Rates and Sample Contamination

A significant limitation in blood culture diagnostics is the possibility of false negatives or contamination due to improper sample collection or suboptimal media. Low bacterial load in the blood or the presence of fastidious organisms can result in missed diagnoses. Additionally, skin flora may contaminate the sample during collection, leading to false positives, unnecessary treatment, and extended hospital stays.

Such errors have serious clinical implications, often resulting in increased healthcare costs and patient dissatisfaction. These limitations deter smaller clinics or outpatient facilities from relying solely on blood culture diagnostics. As a result, there is a growing need for improved training and quality control, along with the development of more sensitive culture media and detection technologies.

Key Market Opportunity: Advancements in Molecular-Based Rapid Diagnostics

The convergence of traditional culture methods with molecular technologies presents a lucrative growth opportunity. Techniques like PCR, PNA-FISH, and proteomics are being integrated into automated systems to speed up identification and drug-resistance profiling. These advancements offer higher sensitivity and specificity, sometimes delivering results within hours rather than days.

Emerging players are also developing hybrid platforms that begin with culture incubation and switch to molecular identification upon detection of microbial growth. For example, platforms using MALDI-TOF mass spectrometry are shortening the pathogen identification timeline drastically. As the need for timely diagnostics becomes more critical in hospital workflows, such innovations promise to reshape the market landscape and provide manufacturers with a competitive edge.

Segments Insights:

Product Insights

Consumables dominate the blood culture test market, driven by their recurrent usage and essential role in every testing procedure. Blood culture media, assay kits, reagents, and accessories like collection bottles and disinfectants are indispensable in routine diagnostics. Among consumables, blood culture media—specifically aerobic and anaerobic formulations—represent the largest share. They are critical for cultivating a broad spectrum of bacteria and fungi, offering the first step in diagnosis. Fungal-specific media and additives like resins or charcoal to neutralize antibiotics are also gaining traction.

Instruments represent the fastest-growing segment, as healthcare providers upgrade their labs with automated systems to reduce manual errors and improve efficiency. Devices such as incubators, colony counters, and automated gram stainers are streamlining diagnostics in high-volume laboratories. Automated blood culture systems are particularly gaining momentum for their ability to detect microbial growth, notify laboratory personnel instantly, and integrate results into digital health records.

Technique Insights

Automated techniques dominate the market, given their ability to deliver faster results, reduce manual errors, and integrate seamlessly with laboratory information systems. Systems like BACTEC (BD) and BacT/ALERT (bioMérieux) are commonly used in large hospitals and reference labs due to their real-time monitoring and low maintenance needs.

Conventional techniques, while still used in smaller or resource-limited settings, are rapidly losing ground. Manual incubations and subcultures are time-consuming and prone to contamination. The global shift toward laboratory automation is rendering these methods obsolete, especially in urban hospitals and specialized clinics.

Technology Insights

Culture-based technology remains the cornerstone of the blood culture diagnostics market. It is considered the gold standard for detecting live organisms and evaluating their antimicrobial susceptibility. These tests are essential for confirming clinical infections and are recognized in all medical guidelines.

Molecular technology is the fastest-growing sub-segment, revolutionizing pathogen identification. PCR-based systems can detect microbial DNA in hours, even from blood samples that yield no culture growth. PNA-FISH and microarray technologies enable detection of hard-to-culture pathogens, and proteomics (e.g., MALDI-TOF) adds a new layer of speed and accuracy to identification, particularly in high-risk ICU environments.

Application Insights

Bacterial infections form the largest application area, as bacteria are the most common cause of bloodstream infections. Tests focus on gram-positive organisms like Staphylococcus aureus and Streptococcus pneumoniae, and gram-negative pathogens such as Escherichia coli. Hospitals often test patients with fevers, immunosuppression, or those undergoing surgery to prevent complications.

Fungal infections, however, represent the fastest-growing application. Invasive candidiasis, aspergillosis, and other mycoses are on the rise due to increasing use of immunosuppressants, chemotherapy, and organ transplants. These infections are harder to detect with traditional methods, necessitating specialized culture media and longer incubation periods, thereby expanding demand for targeted fungal diagnostic tools.

End-use Insights

Hospital laboratories dominate end-use due to their integration into acute care and emergency settings. Most blood culture tests are initiated during hospital admissions, ICU monitoring, or pre/post-surgical evaluations. Hospitals require fast turnaround and real-time communication of results, favoring investment in automated systems and rapid identification technologies.

Reference laboratories are the fastest-growing end users, particularly for rural and smaller facilities that outsource complex tests. Reference labs like Labcorp and Quest Diagnostics are expanding their blood culture offerings and investing in centralized automation. This trend is also observed in emerging economies where public health systems depend on national or regional diagnostic centers for pathogen surveillance.

Regional Insights

North America dominates the blood culture test market, attributed to its advanced healthcare infrastructure, high awareness of sepsis protocols, and widespread adoption of automated diagnostics. The U.S. Centers for Medicare and Medicaid Services (CMS) mandates sepsis screening as part of hospital quality measures, which includes blood culture testing. Major players such as BD, Thermo Fisher, and bioMérieux have a strong presence in the region, and hospitals regularly upgrade to state-of-the-art diagnostic systems.

Canada also has a structured healthcare system that emphasizes early infection detection and antimicrobial stewardship. Clinical laboratories are highly regulated and follow stringent quality control practices, fostering a conducive environment for premium diagnostic product adoption.

Asia-Pacific is the fastest-growing market, driven by improving healthcare access, rising awareness of infectious diseases, and growing investments in medical infrastructure. Countries like China and India are witnessing increased hospital admissions, ICU expansions, and government-funded infectious disease programs, all of which drive demand for blood culture testing.

Additionally, the burden of multidrug-resistant infections is high in this region, prompting both public and private healthcare providers to strengthen diagnostic capabilities. Rapid urbanization and the expansion of private laboratory chains like SRL Diagnostics and PathKind in India are also boosting the market. Furthermore, medical tourism in Southeast Asia is accelerating the need for world-class diagnostic accuracy, encouraging adoption of automated systems.

Some of the prominent players in the Blood culture test market include:

- BD

- Terumo Corporation

- Bruker Corporation

- bioMerieux

- T2 Biosystems Inc.

- Luminex Corporation

- Abbott Laboratories

- Siemens Healthineers AG

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global blood culture test market.

Product

-

-

- Bacterial Infections

- Fungal Infections

- Mycobacterial Infections

-

-

-

- Aerobic

- Anaerobic

- Fungi/Yeast

- Others

-

-

- Assay, Kits, and Reagents

- Blood Culture Accessories

-

-

- Bacterial Infections

- Fungal Infections

- Mycobacterial Infections

-

-

-

- Incubators

- Colony Counters

- Microscopes

- Gram Stainers

-

-

- Automated Blood Culture Systems

-

- Bacterial Infections

- Fungal Infections

- Mycobacterial Infections

Technique

Technology

- Culture-based Technology

- Molecular Technology

Application

- Bacterial Infections

- Fungal Infections

- Mycobacterial Infections

End-use

- Hospital Laboratories

- Reference Laboratories

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)