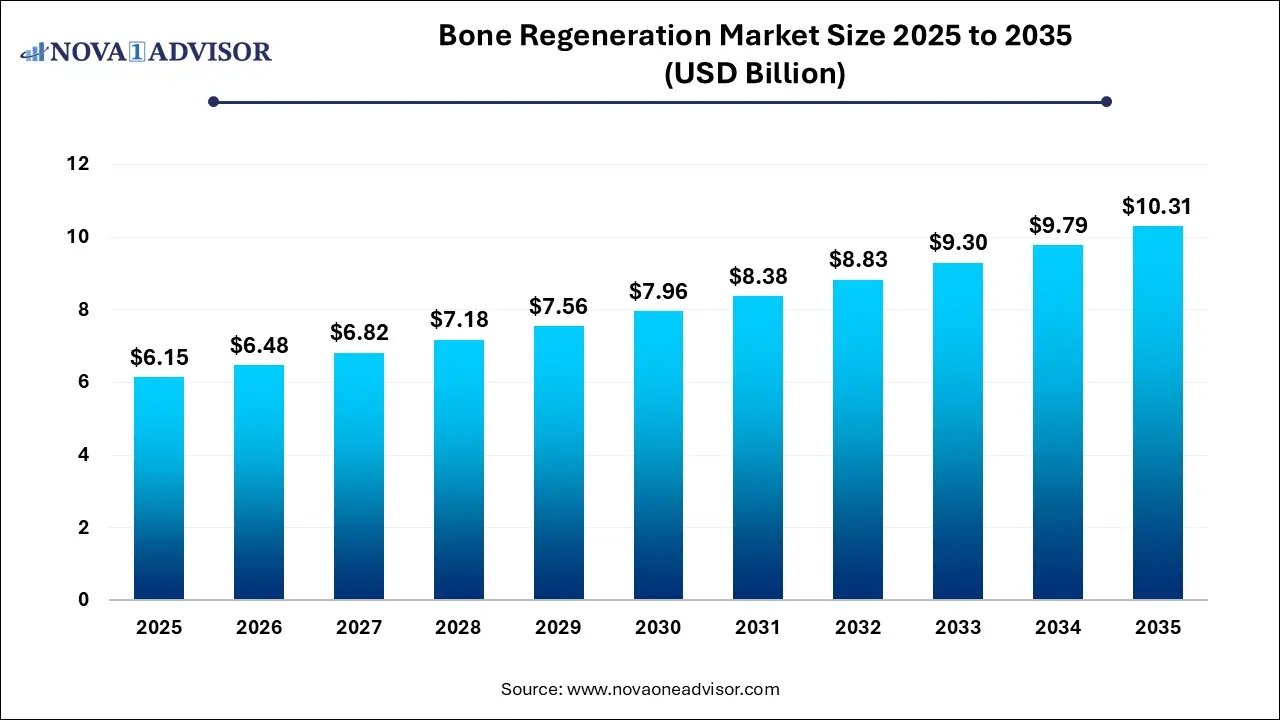

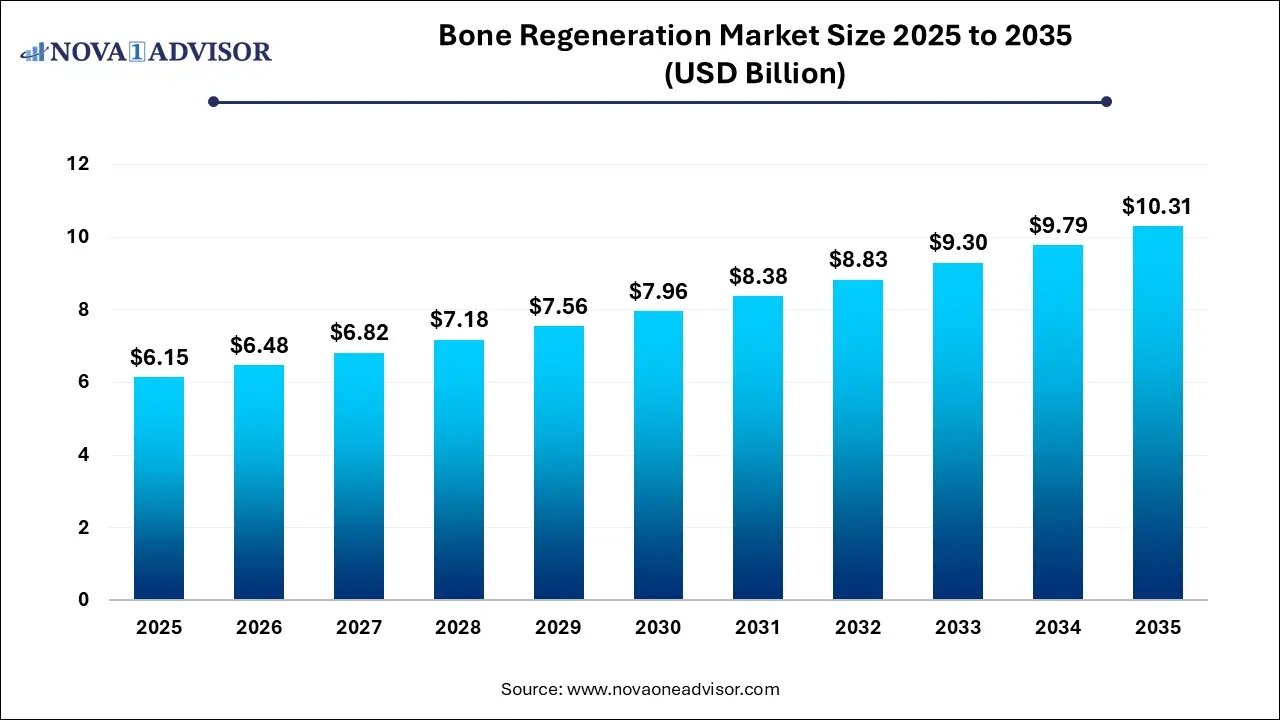

Bone Regeneration Market Size and Growth

The global bone regeneration market size is calculated at USD 6.15 billion in 2025, grows to USD 6.48 billion in 2026, and is projected to reach around USD 10.31 billion by 2035. growing at a CAGR of 5.3% from 2026 to 2035 The market is growing due to increasing cases of bone-related disorders and injuries, especially among the aging population. Advances in generative medicine and biomaterials are enhancing treatment effectiveness. Additionally, rising demand for minimally invasive procedures is driving adoption.

Key Takeaways

- North America dominated the bone regeneration market in 2025.

- Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By product type, the bone grafts and substitutes segment held a dominant presence in the market in 2025.

- By product type, the bone growth stimulators segment is anticipated to grow at the fastest CAGR in the market during the studied years.

- By application, the spinal fusion surgeries segment accounted largest shares in the market in 2025.

- By application, the oral maxillofacial surgeries segment is expected to grow at the fastest rate in the market during the forecast period.

- By end-user, the hospitals segment was dominant in the market in 2025.

- By end-user, the specialty clinics segment is predicted to grow at the fastest CAGR in the bone regeneration market.

How is the Bone Regeneration Market Evolving?

Bone regeneration is the natural or medically assisted process of rebuilding or repairing bone tissue that has been lost or damaged due to injury, disease, or surgery. The market is evolving with innovations in biomaterials, stem cell therapy, and tissue engineering. Demand is rising due to increased cases of fractures, bone defects, and surgical interventions. Medical professionals are increasingly adopting regenerative techniques for faster recovery and better outcomes. These advancements are transforming treatments in orthopedic, dental surgery trauma care worldwide.

- For Instance, In December 2024, according to an article by the National Center for Biotechnology and Information (NCBI), osteoporosis impacts around 10% of the global population, with about 30% of postmenopausal women affected. This growing incidence of bone-related conditions is significantly boosting the need for bone regeneration solutions and treatments.

What are the Key Trends in the Bone Regeneration Market in 2025?

- In October 2023, Orthofix Medical Inc. received 510(k) clearance and officially launched OsteoCove, a next-generation bioactive synthetic graft. Offered in both putty and strip forms, OsteoCove is designed to enhance bone growth while offering excellent handling properties, making it suitable for various spinal and orthopedic procedures.

- In December 2023, ZimVie Inc. revealed that it had signed a definitive agreement to divest its spine division to H.I.G. Capital, a prominent global firm specializing in alternative investments.

How Can AI Revolutionize the Bone Regeneration Market?

AI can transform the bone regeneration market by enhancing diagnostics, predicting treatment outcomes, and personalizing therapy plans. Through advanced imaging analysis and data-driven decision-making, AI helps identify bone loss earlier and improves surgical precision. It also accelerates research in biomaterials and regenerative techniques, leading to more effective and targeted bone healing solutions.

Report Scope of Bone Regeneration Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 6.48 Billion |

| Market Size by 2035 |

USD 10.31 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.3% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Product, By Application, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Baxter International Inc., Bioventus Inc., Johnson & Johnson, Medtronic plc, Zimmer Biomet Holdings, Inc., Enovis Corporation, Institut Straumann AG, Stryker Corporation, Orthofix Medical Inc., Henry Schein, Inc. |

Market Dynamics

Driver

Rise in Bone Related Disorders

The rise in bone-related disorders, such as osteoporosis fractures and bone defects, significantly drives the bone regeneration market. As the global population ages, the number of patients requiring effective bone repair and healing increases. These conditions often lead to weakened or damaged bones that need advanced regenerative treatments, boosting demand for innovative biomaterial grafts and therapies designed to restore bone function and improve patient outcomes.

- For Instance, In 2024, according to the article by Science Direct, there are 771 recognized rare bone and mineral metabolism disorders, which together make up about 5% of all rare diseases. These conditions are estimated to affect around 1.5 million people worldwide, translating to roughly 1 in every 200 individuals.

Restraint

High-cost Treatment

High-cost treatment hinders the bone regeneration market by limiting patient access, especially in developing regions with lower healthcare budgets. Advanced biomaterials, surgical procedures, and specialized equipment are expensive, making therapies unaffordable for many. This financial barrier restrains widespread adoption, slows market expansion, and creates disparities in treatment availability across different socioeconomic groups.

Opportunity

Integration of 3D Printing in Bone Grafting

The integration of 3D printing in bone grafting presents a significant opportunity for the bone regeneration market due to its ability to produce highly customized, patient-specific implants. This technology allows precise replication of bone defects, improving fit and compatibility, which enhances healing and reduces recovery times. Additionally, 3D printing enables the use of advanced biomaterials and complex structures that traditional methods cannot achieve. As a result, it opens new possibilities for treating complex bone injuries and defects, driving innovation and expanding applications in orthopedics, dentistry, and reconstructive surgery.

- For Instance, In March 2025, A research team at the University of Queensland, Brisbane, made a breakthrough by using 3D printing to create scaffolds for repairing damaged alveolar ridges. These scaffolds support bone regeneration, enabling better dental implants. This innovative approach highlights the potential of additive manufacturing to revolutionize dental treatments and bring advanced technology into everyday clinical use.

Segmental Insights

The Bone Grafts and Substitutes Segment Dominated

By product type, the bone grafts and substitutes segment held a dominant presence in the market in 2025. These substitutes include allografts, synthetic materials, and demineralized bone matrix (DBM), which offer advantages such as reduced risk of disease transmission, availability, and cost-effectiveness compared to autografts. Their widespread use in spinal fusion, joint reconstruction, and dental procedures has driven the market share. Additionally, advancement in synthetic substitutes, like calcium phosphate and hydroxyapatite-based materials, have further bolstered their adoption.

The Bone Growth Stimulators Segment Fastest CAGR

By product type, the bone growth stimulators segment is anticipated to grow at the fastest CAGR in the market during the studied years due to its non-invasive nature and effectiveness in enhancing bone healing. These devices, including electrical and ultrasound, accelerate recovery in fracture, spinal fusion, and delayed healing cases. Their increasing adoption is driven by a growing elderly population, rising cases of osteoporosis, and preference for alternatives to surgical interventions. This trend positions strong growth in the bone regeneration market.

The Spinal Fusion Surgeries Segment Largest Shares

By application, the spinal fusion surgeries segment accounted largest shares in the market in 2025 due to the rising incidence of spinal disorders such as disc degeneration and spinal stenosis. The procedure often requires bone grafts or substitutes to promote vertebral fusion and restore spinal stability. Increasing demand for minimally invasive surgeries and the availability of advanced graft materials like DBM and BMPs have further boosted the adoption of the bone regeneration market.

The Oral Maxillofacial Surgeries Segment: Fastest Growing

By application, the oral maxillofacial surgeries segment is expected to grow at the fastest rate in the market during the forecast period. The increasing prevalence of dental conditions such as edentulism, periodontal diseases, and jawbone atrophy necessitates procedures like ridge augmentation, sinus lifts, and implant placements, all of which require bone regeneration techniques. Advancements in regenerative technologies have enhanced the success rate of these procedures, further driving their adoption. Additionally, the growing demand for aesthetic dental restoration and the rise in dental tourism, especially in developing countries offering cost-effective treatments, contribute to the bone regeneration market.

The Hospitals Segment Dominated

By end-user, the hospitals segment was dominant in the market in 2025, due to access to advanced medical infrastructure, skilled professionals, and comprehensive patient care. Hospitals are primary centers for procedures like spinal fusion and maxillofacial surgeries that require bone grafts. Their ability to handle high patient volumes and perform specialized surgeries contributed significantly to their leading role in adopting and utilizing bone regeneration technologies and products.

The Specialty Clinics Segment: Fastest CAGR

By end-user, the specialty clinics segment is predicted to grow at the fastest CAGR in the bone regeneration market due to their focus on minimally invasive, patient-centric care. These clinics offer cost-effective outpatient procedures, attracting patients seeking quicker recovery and personalized treatment. The rise in dental tourism and demand for advanced orthopedic services further propels the market expansion, as specialty clinics increasingly adopt innovative bone graft materials and regenerative technologies to enhance outcomes.

Regional Insights

Well-established Healthcare Infrastructure Propels North America

In 2025, North America dominated the bone regeneration market due to its well-established healthcare infrastructure, high healthcare spending, and strong presence of key market players. The region saw increased demand for advanced bone grafts and regenerative therapies, driven by a growing elderly population and rising cases of orthopedic and dental conditions. The U.S. contributed the largest share, benefiting from frequent spinal and dental surgeries, advanced technology adoption, and supportive regulatory frameworks. Additionally, significant investment in research and development further supported innovation, positioning North America as a global leader in the bone regeneration market.

For Instance, In October 2025, Researchers from the University of Belgrade, including Dr. Maja Miletić and Dr. Slavko Mojsilović, made a notable breakthrough in bone regeneration. Their study, published in Applied Sciences, shows that using periodontal ligament stem cells (PDLSCs) with cold atmospheric plasma (CAP)-treated beta-tricalcium phosphate (β-TCP) significantly boosts bone-healing potential and reduces inflammation. This innovative method, combining stem cell therapy with advanced material treatment, offers promising new possibilities for treating complex bone injuries more effectively.

Increasing Prevalence of Orthopedic Conditions Drives Asia-Pacific

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The region's aging population and increasing prevalence of orthopedic conditions like osteoporosis and osteoarthritis are driving demand for bone regeneration therapies. Countries such as China, India, and Japan are investing heavily in healthcare infrastructure and research, leading to advancements in regenerative medicine. Additionally, the rise in road accidents and sports injuries contributes to the growing need for effective bone repair solutions. Government initiatives and increased awareness further support market expansion in this region.

Some of The Prominent Players in The Bone Regeneration Market Include:

Recent Developments in the Bone Regeneration Market

- In May 2025, Medtronic, a leading medical technology company, announced that its Infuse bone graft, when used with an intervertebral fusion device and standard metallic screw and rod systems, received Breakthrough Device designation from the U.S. FDA. This recognition highlights the innovation and potential impact of the product in spinal fusion procedures.

- In January 2024, Orthofix Medical Inc. and SeaSpine Holdings Corporation finalized their merger as equal partners on January 5. The announcement also shared unaudited preliminary net sales figures for both companies as independent entities for the fourth quarter and full year of 2022. As part of the agreement, SeaSpine now operates as a fully owned subsidiary of Orthofix.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product type

-

- Allografts

- Autografts, Synthetic Bone Grafts

- Synthetic Bpne Grafts

- Other

By Application

- Oral and Maxillofacial Surgeries

- Spinal Fusion Surgeries

- Others

By End user

- Hospitals

- Specialty Clinics

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)