Bone Regeneration Material Market Size and Trends

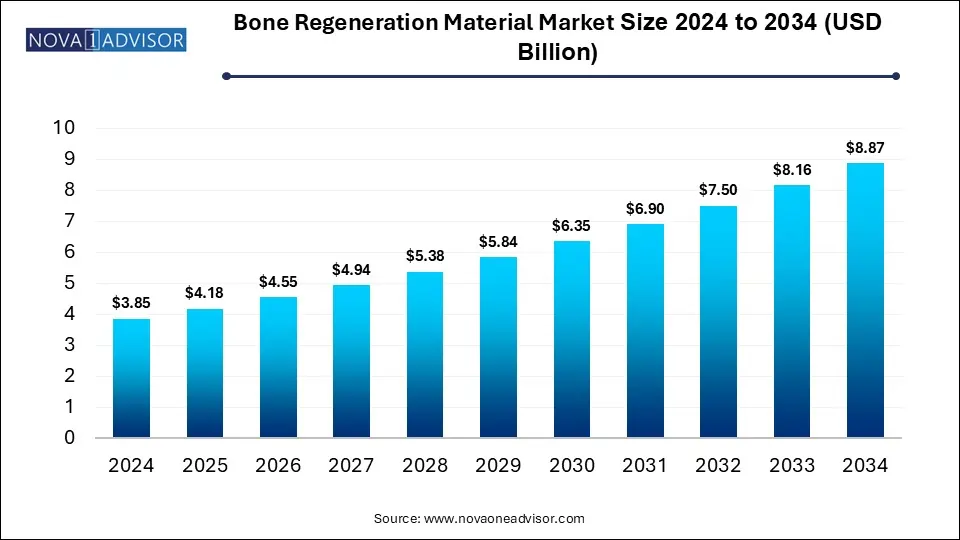

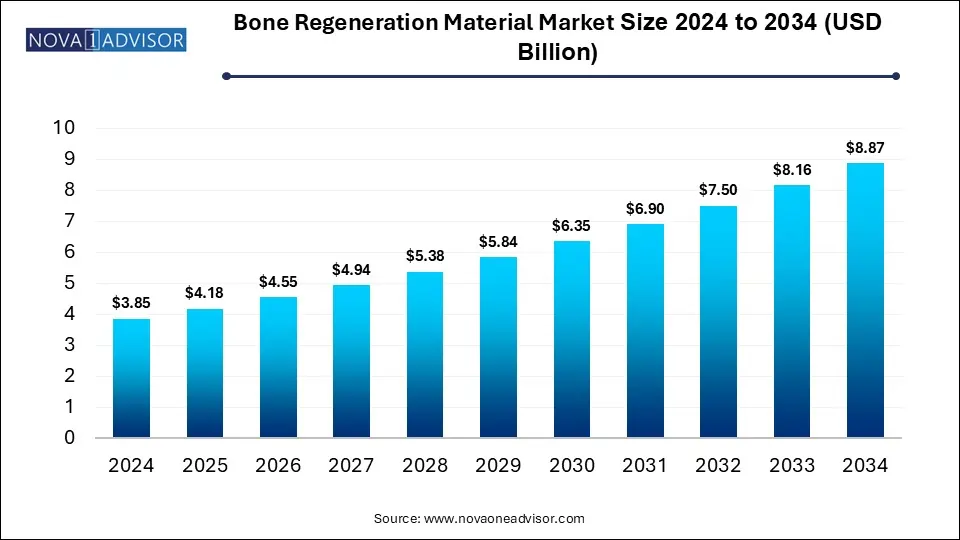

The global bone regeneration material market size is calculated at USD 3.85 billion in 2024, grows to USD 4.18 billion in 2025, and is projected to reach around USD 8.87 billion by 2034, exhibiting a CAGR of 8.7% from 2025 to 2034. The growth of the bone regeneration material market is driven by rising regulatory approvals, focus on patient-centric care and increased research activities on regenerative materials.

Bone Regeneration Material Market Key Takeaways

- North America dominated the global bone regeneration material market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By material type, the bioceramics segment dominated the market with the largest share in 2024.

- By material type, the biodegradable polymers segment is expected to show the fastest growth over the forecast period.

- By application, the orthopaedic applications segment accounted for the highest market share in 2024.

- By application, the dental applications segment is expected to expand rapidly during the predicted timeframe.

- By end-user, hospitals segment held the largest market share in 2024.

- By end-user, orthopaedic clinics segment is expected to register fastest growth during the forecast period.

- By formulation, injectable forms segment captured the largest market share in 2024.

- By formulation, implants segment is expected to show the fastest growth during the forecast period.

- By technology, 3D printing segment generated the highest market revenue in 2024.

- By technology, electrospinning segment is expected register the fastest CAGR over the forecast period.

What Factors Are Driving the Bone Regeneration Material Market?

Bone regeneration materials refer to biomaterials used for stimulating bone cell differentiation and promoting bone healing and regeneration. Rising cases of bone disorders and injuries, continuous innovation in biomaterials, increased healthcare expenditure, supportive government initiatives and demand for minimally invasive procedures is fuelling the growth of the bine regeneration material market. Growing awareness among healthcare providers and patients regarding the benefits of advanced bone regeneration therapies is driving their adoption.

What are the Key Trends in the Bone Regeneration Material Market?

- In April 2025, CGBIO, a leading bio-regenerative medicine company in Korea, received the U.S. FDA’s Investigational Device Exemption (IDE) approval for its innovative bone graft substitute, NOVOSIS PUTTY.

- In December 2024, Atreon Orthopedics achieved a major milestone with the successful use of its orthopaedic care solution, ROTIUM Bioresorbable Wick in more than 10,000 rotator cuff repair surgeries.

AI algorithms can be applied for analyzing large datasets and streamline selection of biomaterials for bone regeneration. AI can assist in optimizing structures of 3D-printed scaffolds and also enable creation of customized scaffolds designed specifically to individual patient needs. Machine learning algorithms can be deployed for predicting performance of new biomaterials by training them on datasets of material properties and their effects. Deep learning methodologies can be used for analyzing medical images such as MRIs and X-rays for assessment of bone damage, predicting treatment outcomes and monitoring progress of bone regeneration.

Report Scope of Bone Regeneration Material Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.18 Billion |

| Market Size by 2034 |

USD 8.87 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Material Type, By Application, By End-User, By Formulation, By Technology, By Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

B&B Dental, BioComp, Citagenix, Ethoss Regeneration Ltd.,J Morita USA, Kerr Restoratives , LASAK s.r.o.,NovaBone, OSSIF, Septodont, Sigma Graft, Stryker Corporation , Sunstar Americas, Inc., Surgical Esthetics, Zimmer Biomet Holdings, Inc. |

Market Dynamics

Drivers

Rising Number of Bone-Related Disorders and Injuries

According to data presented by the International Osteoporosis Foundation, approximately 37 million fragility fractures take place in individuals aged over 55 across the globe. Moreover, 1 in 5 men and 1 in 3 women age over 50 will experience osteoporosis fractures worldwide. Conditions such as arthritis, bone fractures from sport injuries and trauma, bone tumors and dental issues such as periodontitis and tooth loss are rising, further creating the need for effective bone regeneration solutions.

Restraints

High Costs and Stringent Regulations

Bone grafting and regeneration procedures can be overpriced for many patients, especially procedures using advanced biomaterials, stem cells, growth factors or 3D printing. High costs of these procedures make them inaccessible to large patient pool, particularly in low and middle-income countries, further impacting the market growth.

Additionally, strict regulations imposed by regulatory agencies for new bone regeneration therapies and products can be time-consuming and increase costs for manufacturers, leading to delayed commercialization.

Opportunities

Increased Focus on Advancing Treatment Modalities

Growing emphasis on developing novel biomaterials such as allografts, synthetic bone grafts and xenografts with enhanced features such as improved biocompatibility, bioactivity, osteoconductivity and osteoinductivity. Adoption of 3D printing technologies, utilization of cell-based therapies, improvements in bone growth stimulators and biologics such as Bone Morphogenetic Proteins (BMPs) and Platelet-Rich Plasma (PRP) as well as integration of nanotechnology for bone regeneration and addressing unmet medical needs. These factors are creating opportunities for market growth.

Segmental Insights

What Made Bioceramics the Dominant Segment in 2024?

By material type, the bioceramics segment captured the largest market share in 2024. Bioceramics offer excellent biocompatibility and bioactivity which makes them highly suitable for regenerative solutions. Rising incidences of bone-related disorders, aging population, increased emphasis on regenerative medicine and tissue engineering and supportive healthcare infrastructure are the factors driving the market dominance of this segment. Advancements in bioceramics which include bioactive coatings such as hydroxyapatite (HA) coatings and OCP (Octacalcium phosphate) coatings, composite materials like OCP-Hya composite and OCP-collagen composite, porous scaffolds as well as advanced fabrication techniques like sol-gel processes, low-temperature sintering and 3D printing are being applied for promoting bone growth, enhancing integration of implants and tailoring treatments for patients.

By material type, the biodegradable polymers segment is expected to register the fastest CAGR over the forecast period. Biodegradable polymers degrade overtime and are safely absorbed in the body, further eliminating the need for second surgery for implant removal and leading to faster recovery, reduced patient burden and healthcare costs. Rising demand for minimally invasive procedures, continuous research and advancements in biomaterial science and polymer chemistry, convenience of customization and fabrication, controlled degradation rates, ability to imitate natural bone structure and an environmentally responsible solution are the factors driving the adoption of biodegradable polymers, further fuelling the market growth.

How Orthopedic Applications Segment Dominated the Market in 2024?

By application, the orthopaedic applications segment dominated the market with the largest share in 2024. Increased prevalence of degenerative bone conditions and fractures, especially in the older population as well as rising incidents of road traffic accidents, trauma injuries and increased participation in sports activities is driving the market growth of this segment. Spinal disorders such as scoliosis, spinal instability and degenerative disc disease are creating the demand for spinal fusion surgeries. Growing awareness and acceptance of bone regeneration therapies, high unmet needs for effectively managing bone repair in severe cases and need for improving surgical outcomes are the factors boosting the market growth.

By application, the dental applications segment is expected to show the fastest growth during the forecast period. According to WHO, oral diseases affect nearly 3.7 billion people across the globe. Dental caries, edentulism, periodontal disease, oral cancer, oro-dental trauma, genetics and aging population are leading causes of oral diseases for which dental implants and restorative dental treatments are the most effective and preferred choice. Rising trend of cosmetic dentistry offering superior aesthetics, proven success rates of dental implant procedures and expansion of dental clinics providing cost-effective high-quality dental care are the factors anticipated to fuel the growth of this segment in the upcoming years.

Why Did the Hospitals Segment Dominated the Market in 2024?

By end-user, hospitals segment accounted for the largest market share in 2024. Hospitals are equipped with cutting edge diagnostic and imaging facilities, specialized operating rooms and highly skilled medical professionals which makes them the primary centers for major orthopaedic procedures such as joint replacements, spinal fusions and for treating complex bone fractures which require bone regeneration materials. Availability of broad range of bone regeneration products, rise in number of patient admissions for bone grafting procedures, favorable reimbursement policies, and necessary critical care and emergency support provided by hospitals are improving patient recovery rates, leading to long-term functional outcomes.

By end-user, orthopaedic clinics segment is anticipated to witness the fastest growth during the predicted timeframe. Convenient and cost-effective procedures offered by orthopaedic clinics such as ambulatory surgical centers (ASCs) and specialized orthopaedic and spine centers is driving patient shift towards these outpatient settings. Increasing number of patients, specialized expertise offered by orthopaedic clinics, adoption of advanced technologies for personalizing solutions and streamlined processes for patient-friendly care are the factors driving the market growth of this segment.

What Drives the Dominance of Injectable Forms Segment in 2024?

By formulation, injectable forms segment generated the highest market revenue in 2024. Injectable bone regeneration materials can be delivered directly at the target site and eliminate the need for making large incisions, leading to less complications, reduced surgical trauma and post-operative pain, and accelerated recovery times which drives the widespread adoption of these forms. Availability of injectable forms in ready-to-use or easily mixed formulations is enhancing their versatility for various applications such as in dental, spinal fusion, craniomaxillofacial and foot & ankle surgeries.

By formulation, implants segment is expected to expand rapidly over the forecast period. Increased healthcare expenditure and rising investments in R&D activities is driving the adoption and expanding applications of implants in orthopaedic procedures and dentistry. Digital implantology solutions such as pilot guided and fully guided surgeries are enhancing the outcomes of implant treatments.

How is 3D Printing Segment Dominating in 2024?

By technology, 3D printing segment held the largest market share in 2024. 3D printing facilitates the creation of implants and scaffolds matching the individual patient needs, leading to improved integration with existing bone and biomechanical stability, further accelerating patient recovery and enhancing surgical outcomes. Improved bioactivity and drug delivery with the integration of bioactive agents, reduced manufacturing time and costs, material versatility, development of bioinks and streamlined supply chain for custom implants are the benefits offered by 3D printing, which ultimately drive the market growth.

By technology, electrospinning segment is expected to show the fastest CAGR during the forecast period. Electrospinning techniques can be used for producing fibers ranging from nanometers to micrometers in diameter and mimic the natural bone extracellular matrix (ECM), making them highly suitable for cell adhesion, migration, proliferation and differentiation into osteoblasts. Tunable mechanical properties, precise control over fiber characteristics, cost-effective and convenient fabrication as well as ability to integrate with other technologies such 3D printing are the factors driving the growth of the electrospinning segment.

Regional Insights

How is North America Dominating the Bone Regeneration Material Market?

North America dominated the global bone regeneration material market with the largest share in 2024. The market growth is driven by rising incidents of trauma and accidents, prevalence of chronic bone diseases and growing geriatric population creating the demand for safe and effective bone regenerative materials. Additionally, well-developed healthcare infrastructure, demand for minimally invasive procedures, robust research infrastructure, increased regulatory approvals, supportive reimbursement policies and presence of major market players is bolstering the market growth.

How Significant is the Asia Pacific Bone Regeneration Material Market?

Asia Pacific is anticipated to witness fastest growth in the market over the forecast period. Increased incidences of bone disorders and injuries in the large and rapidly aging population in major countries like India, China and Japan is creating the need for advanced bone regenerative materials. Rising disposable incomes, increased healthcare expenditure in emerging economies, adoption of advanced bone regeneration technologies, growing preference for minimally invasive surgeries, surge in dental implant procedures and supportive government policies are driving the market growth.

Some of The Prominent Players in The Bone Regeneration Material Market Include:

- B&B Dental

- BioComp

- Citagenix

- Ethoss Regeneration Ltd.

- J Morita USA

- Kerr Restoratives

- LASAK s.r.o.

- NovaBone

- OSSIF

- Septodont

- Sigma Graft

- Stryker Corporation

- Sunstar Americas, Inc.

- Surgical Esthetics

- Zimmer Biomet Holdings, Inc.

Recent Developments in the Bone Regeneration Material Market

- In October 2024, Amphix Bio received the U.S. Food and Drug Administration’s (FDA’s) Breakthrough Device designation for its drug-device combination product intended for bone regeneration. The therapeutic device will be applied for treating degenerative disc disease along with transforaminal lumbar interbody fusion (TLIF) procedures.

- In October 2024, Regenity Biosciences, a globally leading regenerative medicine and Linden Capital Partners portfolio company, received the 510(k) clearance from the FDA for marketing its minimally invasive collagen-based meniscal implant, RejuvaKnee which is indicated for applying in the reinforcement and repair of the soft tissue injuries of the meniscus.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Bone Regeneration Material Market.

By Material Type

- Bio ceramics

- Biodegradable Polymers

- Composite Materials

- Hydrogels

- Metallic Materials

By Application

- Craniomaxillofacial Applications

- Dental Applications

- Orthopedic Applications

- Spinal Applications

- Others

By End-User

- Hospitals

- Dental Clinics

- Orthopedic Clinics

- Research Institutions

- Others

By Formulation

- Injectable Forms

- Implants

- Films

- Pastes

- Powdered Forms

By Technology

- 3D Printing

- Bioprinting

- Electrospinning

- Sol-Gel Technology

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)