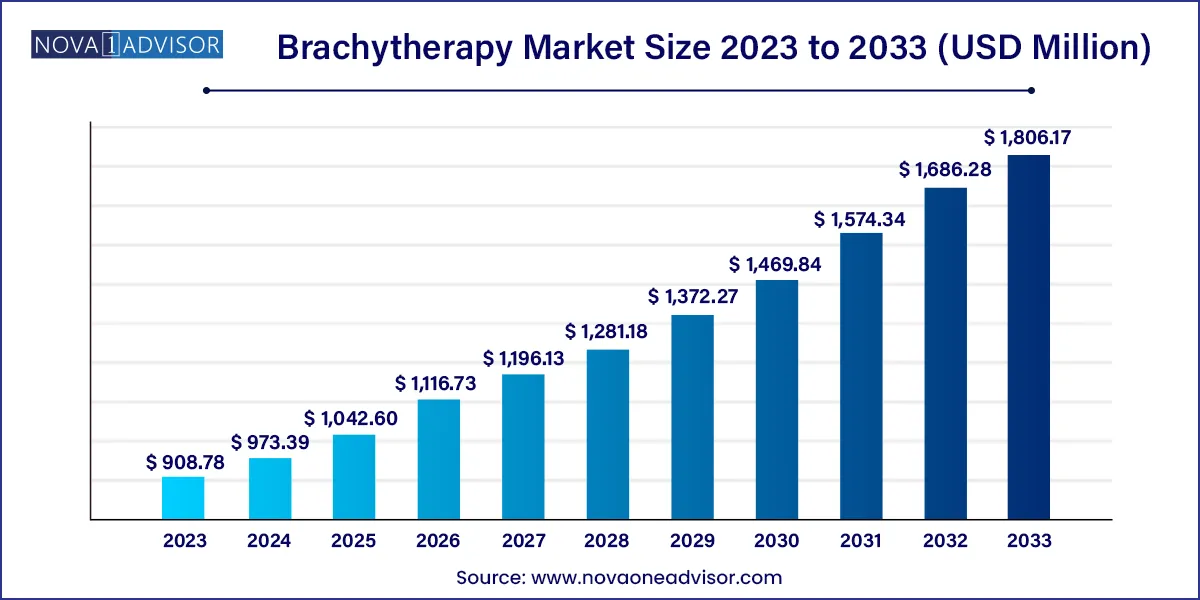

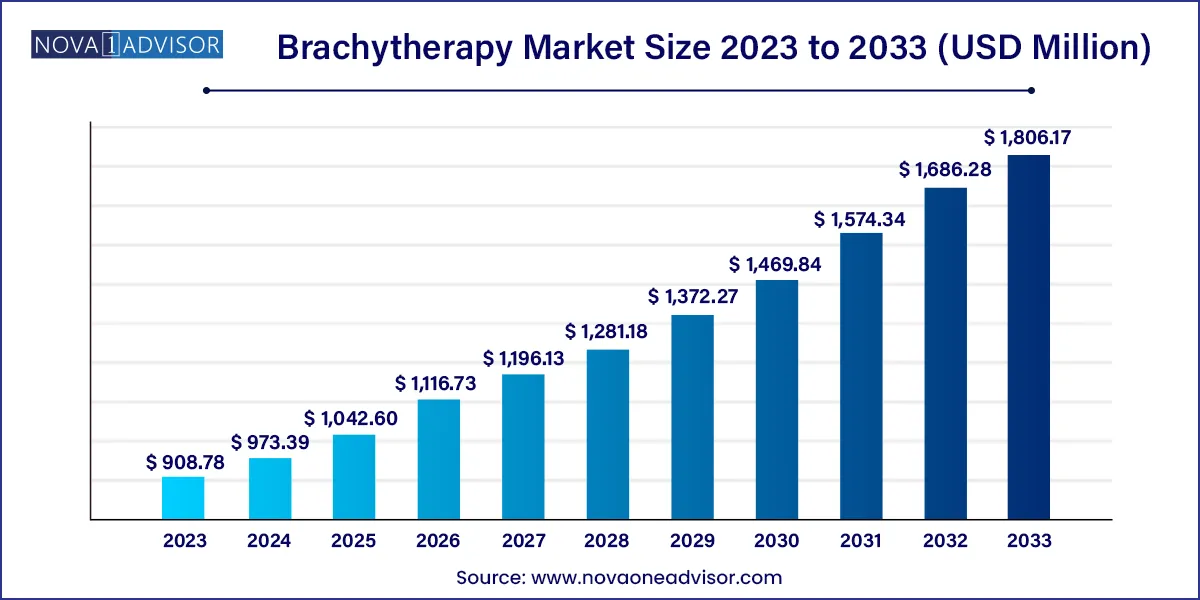

The global brachytherapy market size was exhibited at USD 908.78 million in 2023 and is projected to hit around USD 1,806.17 million by 2033, growing at a CAGR of 7.11% during the forecast period of 2024 to 2033.

Key Takeaways:

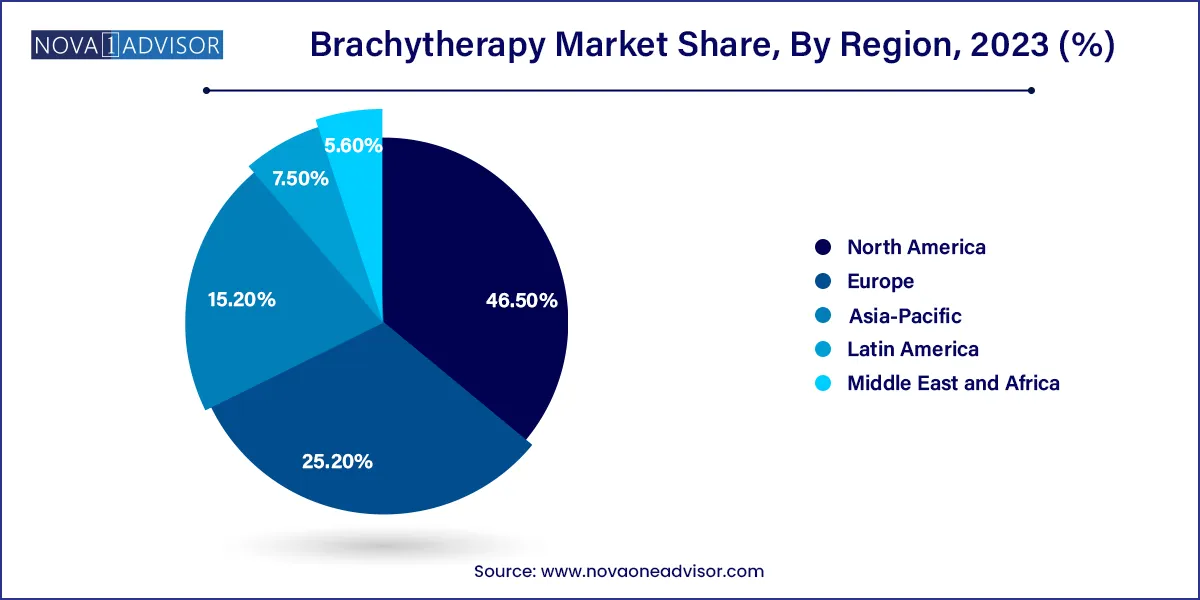

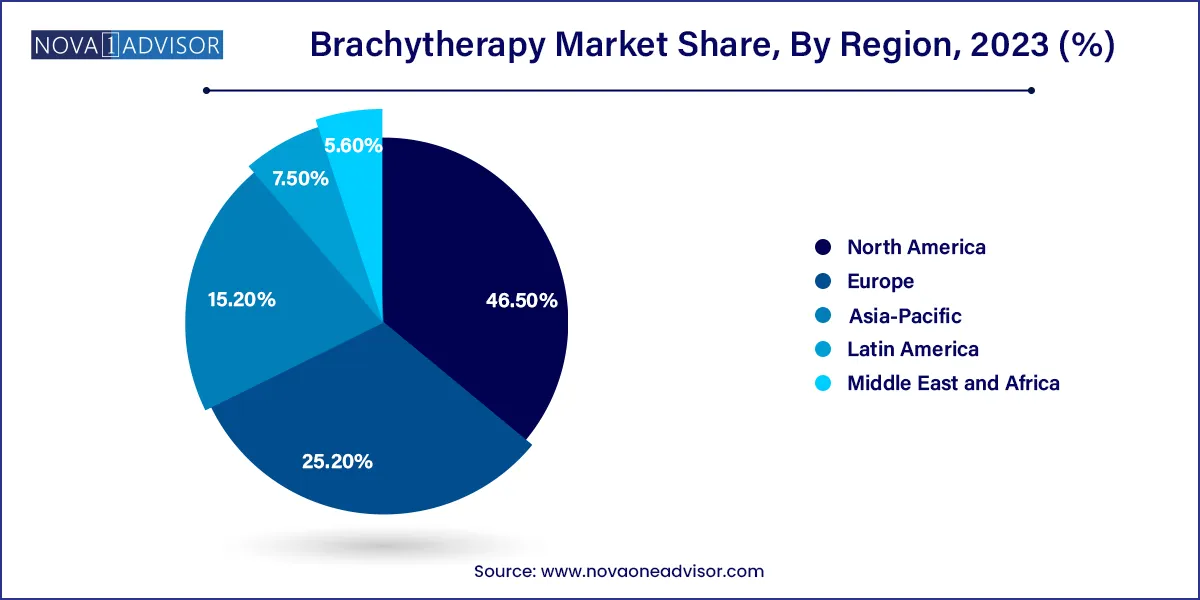

- North America led the market for brachytherapy and accounted for the largest revenue share of 46.5% in 2023.

- The applicators & afterloaders segment dominated the market for brachytherapy and accounted for the largest revenue share of 44.5% in 2023..

- The electronic brachytherapy segment is expected to grow at a significant CAGR over the forecast period.

- The prostate cancer segment accounted for the largest revenue share of 32.91% of the market for brachytherapy in 2023.

- The breast cancer segment is expected to grow at the fastest CAGR during the forecast period.

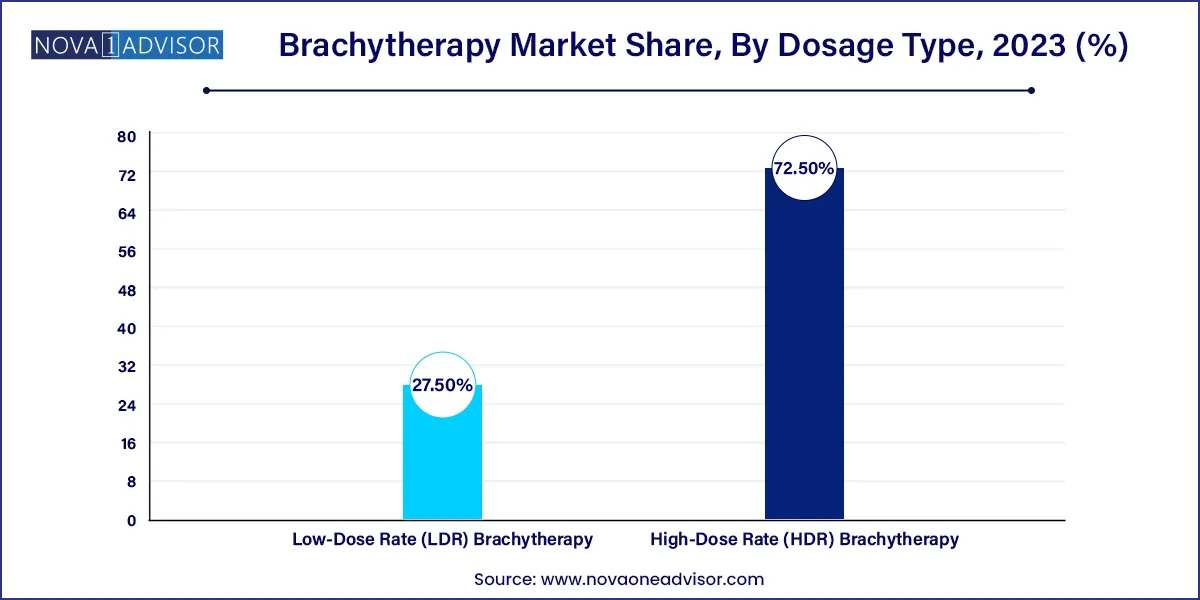

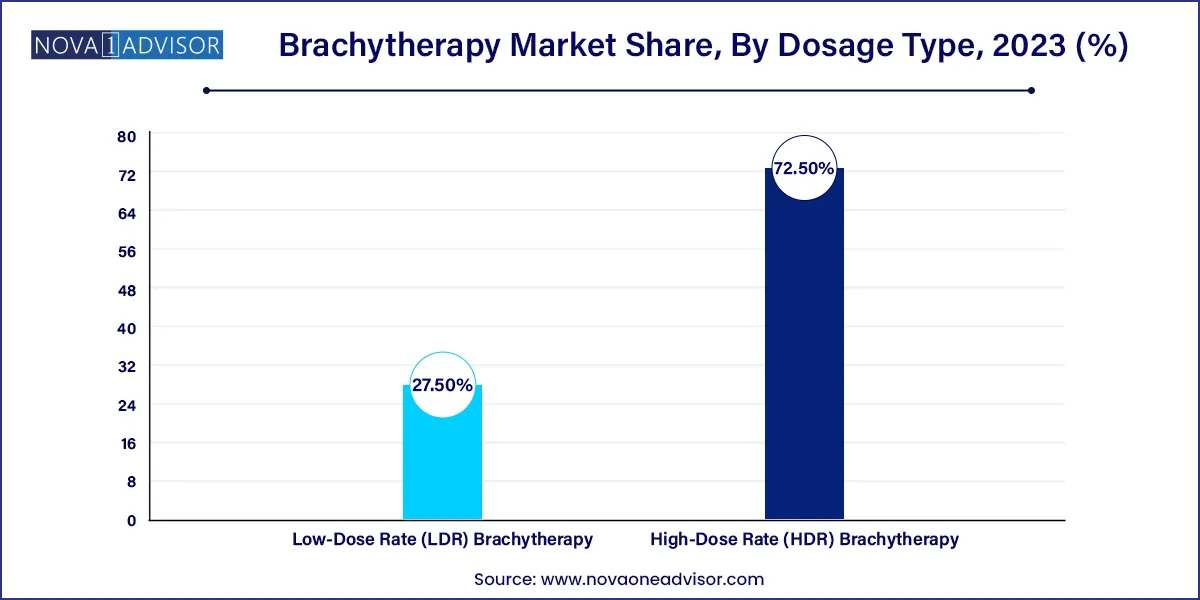

- The high-dose Rate (HDR) brachytherapy segment dominated the market and accounted for the largest revenue share of 72.5% in 2023.

Market Overview

The global Brachytherapy Market is witnessing steady growth as healthcare providers increasingly adopt this targeted form of internal radiation therapy to treat various cancers. Unlike external beam radiation, brachytherapy involves placing radioactive material directly inside or near the tumor site, offering high precision and sparing surrounding healthy tissues. This minimally invasive approach has proven effective across several oncological applications, including prostate, gynecological, breast, and skin cancers.

Technological innovations such as advanced afterloaders, image-guided systems, and electronic brachytherapy units are enhancing treatment accuracy and safety. The increasing incidence of cancer globally, growing awareness of brachytherapy's clinical advantages, and its favorable cost-benefit ratio are fueling market expansion. In both developed and emerging economies, efforts to improve cancer care infrastructure are driving adoption in hospitals, cancer centers, and radiotherapy clinics.

Furthermore, brachytherapy is emerging as a critical component of multimodal cancer treatment plans. It is frequently used in conjunction with surgery, chemotherapy, and external beam radiation, particularly in organ-sparing protocols. As more oncologists and radiologists become proficient in brachytherapy procedures, the market is expected to continue its upward trajectory.

Major Trends in the Market

-

Shift Toward High-Dose Rate (HDR) Brachytherapy: Offering shorter treatment durations and improved precision.

-

Technological Integration in Applicators and Afterloaders: Enhanced real-time imaging and digital dosimetry.

-

Growth in Prostate and Gynecologic Oncology: High demand for LDR and HDR brachytherapy in these segments.

-

Adoption of Electronic Brachytherapy: Eliminating the need for radioactive isotopes and specialized shielding.

-

Expanding Access in Emerging Markets: Government investment in cancer care and increased patient access.

-

Use in Skin and Breast Cancer for Early Stage Patients: Offering localized treatment with minimal side effects.

-

Combination Therapy Approaches: Brachytherapy used with surgery or external beam radiation.

-

Rise in Outpatient Procedures: Supported by minimally invasive techniques and same-day discharge models.

Brachytherapy Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 973.39 Million |

| Market Size by 2033 |

USD 1,806.17 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 7.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Dosage Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Varian Medical Systems, Inc.; Becton, Dickinson & Company; Elekta AB; Isoray Medical, Inc.; Eckert & Ziegler BEBIG; iCAD, Inc.; CIVCO Medical Solutions; Theragenics Corporation |

Product Insights

Applicators & Afterloaders accounted for the largest share of the product segment. These devices are essential for ensuring accurate, safe delivery of radioactive sources. Continuous innovation in modular designs, real-time imaging compatibility, and radiation shielding enhances their clinical utility.

Electronic Brachytherapy is projected to be the fastest-growing product segment. It eliminates the need for radioactive sources and controlled environments, offering greater flexibility, safety, and ease of use. This technology is gaining momentum in dermatology and breast cancer applications, particularly in outpatient and ambulatory settings.

Application Insights

Prostate Cancer held the largest share of the application segment in 2023. Brachytherapy is a widely accepted treatment for localized prostate cancer due to its ability to deliver concentrated radiation directly to the tumor, minimizing damage to nearby organs. Both LDR seed implants and HDR catheters are commonly used in clinical settings.

Breast Cancer is anticipated to be the fastest-growing segment. Accelerated partial breast irradiation using brachytherapy provides an effective alternative to whole breast external radiation, reducing treatment time and improving cosmetic outcomes. As breast-conserving surgeries become more common, demand for targeted radiation methods like brachytherapy is increasing.

Dosage Type Insights

High-Dose Rate (HDR) Brachytherapy dominated the market in 2023 HDR allows for higher radiation doses over shorter treatment sessions, which is highly attractive in busy oncology centers. It is particularly effective in treating gynecological, breast, and skin cancers. The growing preference for outpatient procedures and advancements in image-guided catheter placement contribute to HDR’s widespread adoption.

Low-Dose Rate (LDR) Brachytherapy is expected to witness steady growth, especially in prostate cancer treatment. Permanent seed implants used in LDR offer excellent long-term outcomes with minimal invasiveness. As awareness grows and new isotopes are introduced, LDR remains a vital option, particularly for early-stage localized cancers.

Regional Insights

North America led the brachytherapy market in 2023, owing to its advanced healthcare infrastructure, high cancer awareness, and extensive adoption of cutting-edge treatment modalities. The United States has widespread integration of HDR and LDR brachytherapy, especially in prostate and gynecological oncology. Reimbursement policies and continuous R&D investments by market leaders support innovation and access.

Prominent academic institutions and cancer centers in the U.S. and Canada conduct large-scale clinical trials and actively adopt new technologies, making North America the hub for brachytherapy advancement.

Asia-Pacific is expected to register the fastest growth during the forecast period. Rapid healthcare infrastructure development, growing cancer incidence, and government-led oncology initiatives are major drivers in countries like China, India, and Japan. Rising healthcare expenditure and increased awareness among oncologists are promoting the use of brachytherapy.

Furthermore, the entry of global players and collaborations with regional hospitals are making advanced brachytherapy equipment more accessible. Investments in radiation oncology training and favorable regulatory support are helping bridge gaps in skilled workforce and technology access.

Some of the prominent players in the Brachytherapy market include:

- Varian Medical Systems, Inc.

- Becton

- Dickinson & Company

- Elekta AB

- Isoray Medical, Inc.

- Eckert & Ziegler BEBIG

- iCAD, Inc.

- CIVCO Medical Solutions

- Theragenics Corporation

Recent Developments

-

February 2025: Elekta launched a new version of its Flexitron HDR brachytherapy platform with improved user interface and real-time planning capabilities.

-

January 2025: Isoray Inc. announced a strategic partnership to enhance production capacity for its Cesium-131 isotope used in LDR prostate brachytherapy.

-

November 2024: Varian, a Siemens Healthineers company, expanded its brachytherapy solutions by integrating artificial intelligence into its BrachyVision planning software.

-

September 2024: C4 Imaging received FDA clearance for its MRI-visible positive-signal beacon used in prostate brachytherapy seed placement.

-

August 2024: Eckert & Ziegler entered a partnership with an Indian hospital network to expand access to HDR afterloader systems across South Asia.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global brachytherapy market.

Dosage Type

- High-Dose Rate (HDR) Brachytherapy

- Low-Dose Rate (LDR) Brachytherapy

Product

- Seeds

- Applicators & Afterloaders

- Electronic Brachytherapy

Application

- Prostate Cancer

- Gynaecological Cancer

- Breast Cancer

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)