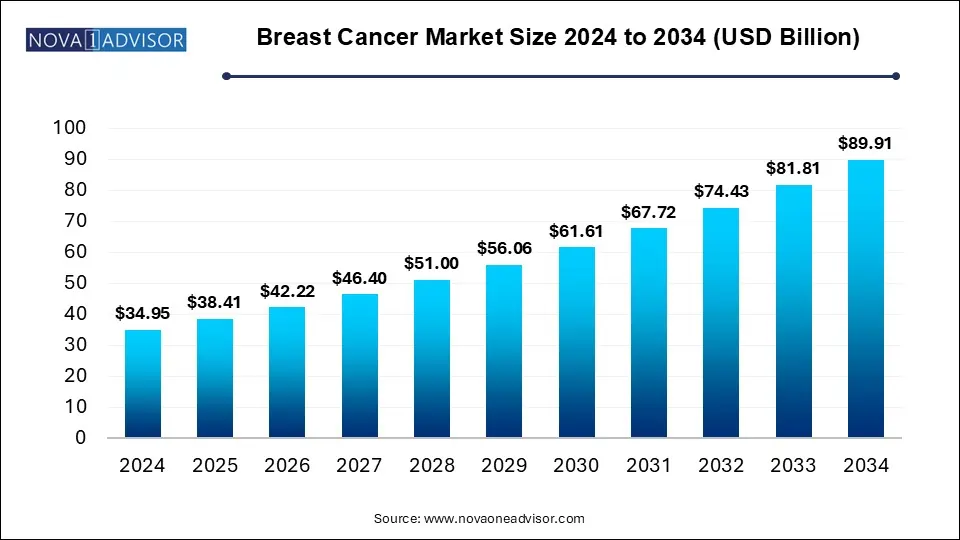

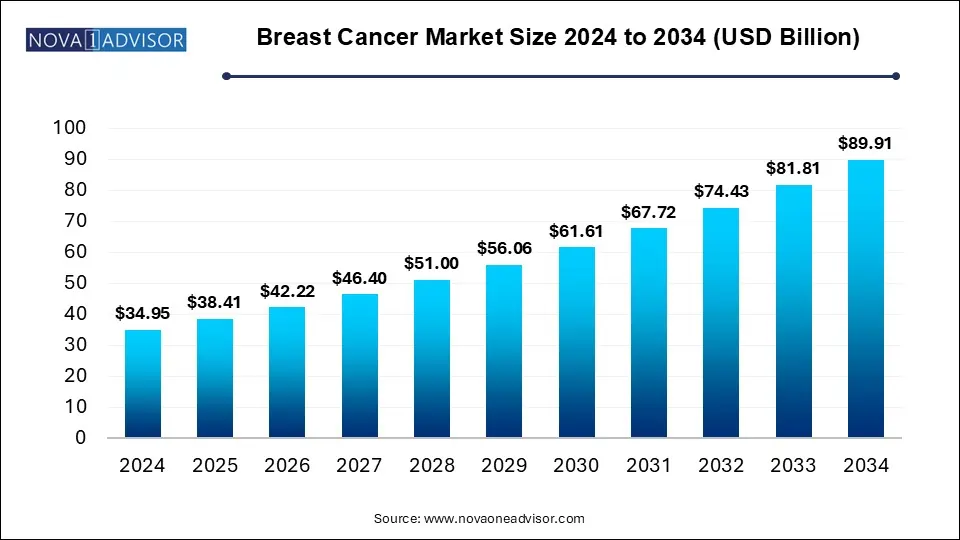

Breast Cancer Market Size and Growth

The global breast cancer market was valued at USD 38.41 billion in 2025 and is projected to reach USD 89.91 billion by 2034, registering a CAGR of 9.91% from 2025 to 2034. The global market growth is attributed to the increasing consumption of animal-derived products.

Breast Cancer Market Key Takeaways

- By region, North America dominated the breast cancer market in 2024.

- By region, Asia Pacific is expected to grow fastest during the forecast period.

- By therapy insights, the targeted therapy segment dominated the market share in 2024.

- By therapy insights, the hormonal therapy is expected to grow fastest during the forecast period.

- By cancer type insights, the hormone receptor segment dominated the breast cancer market in 2024.

- By cancer type insights, the HER2 segment is expected to grow fastest during the forecast period.

- By distribution channel insights, the hospital pharmacies segment dominated the market share in 2024.

- By distribution channel insights, the online pharmacies segment is expected to grow the fastest during the forecast period.

Breast Cancer Market Overview

The breast cancer market deals with disease among the population majorly seen in females with increasing disease. Symptoms of breast cancer are red patches on the skin, size, and shape differences of the breast, formation of lumps in the breast, and others. It is a disorder that spreads the disease with rising symptoms such as breathing problems, pain in the bones swelling of lymph nodes, and many more. The increasing number of medications and improved methods for diagnosis of breast cancer with cutting-edge technologies are contributing to propel the market growth.

The breast cancer market is witnessing rapid growth due to factors such as increasing developed technologies in breast cancer with increased reliability, efficacy, accuracy, efficiency, and speed, increasing support from the government for the integration of new medication and treatments, and increased research and development activities. In addition, increasing demand from the medical industry for treating patients with technologies and novel medicines and an increasing number of breast cancer patients are further expected to drive the market growth.

Key Trends Contributing to Breast Cancer Market Growth

- Personalized medicine: The increasing preference towards personalized medicine for breast cancer treatments tailored with therapies according to molecular and genetic markers is expected to drive the market growth.

- Early detection and screening: The increasing early cancer detection outcomes and rates and advances in mammography and other screening methods have contributed substantial improvements, which may further drive the growth of the breast cancer market.

- Increased support from the government: The increasing government initiatives in developing treatments with advanced technologies to enhance the patient’s health are further expected to drive the market growth.

- Enhanced advanced technologies: The rising developments of medications with new product launches by major players with improved performance are anticipated to enhance the market growth during the forecast period.

Report Scope of Breast Cancer Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 38.41 Billion |

| Market Size by 2034 |

USD 89.91 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.91% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Therapy, By Cancer Type, By Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Merck & Co, Bristol Myers Squiib, Kyowa Kirin, Eisai Co.Ltd, Sanofi, Pfizer Inc, AstraZeneca, Novartis AG, Eli Lilly and Company, Genentech, Mylan Laboratories, Celltrion, Fresenius Kabi, Baxter Healthcare Corporation, Halozyme Inc, GlaxoSmithKline. |

Enhanced development and research may present market opportunities

The increasing research and development is focused on improving detection methods and screening. Mammography is a widely used screening tool, especially in women with dense breast problems. Research is ongoing to develop more sensitive and accurate screening methods, such as 3D mammography and breast MRI. In addition, researchers are exploring the use of biomarkers to detect breast cancer, such as proteins and genetic markers. Furthermore, another area of research and development is focusing on enhancing the efficiency of breast cancer diagnosis. There is room for reducing the need for invasive procedures and improvement in terms of accuracy while biopsy and mammography are currently used to diagnose breast cancer, which may further create significant growth opportunities in the breast cancer market.

Side effects of treatment for breast cancer hamper market growth

The negative impact of treatments includes things such as gastrointestinal issues, high blood pressure, skin conditions, mouth ulcers, diarrhea, nausea, and many more. These factors could make it challenging for the market to growth in size, which may present diverse effects, which could also make cancer people feel weaker. In addition, due to increased adverse events associated with targeted chemotherapy and immunotherapy, the market size may also change and further restrain the growth of the breast cancer market.

Segment Insights

Breast Cancer Market By Therapy Insights

The targeted therapy segment dominated the breast cancer market in 2024. The segment growth in the market is attributed to the enhanced performance and increased output with new launches included in the medications and increasing utilization of breast cancer therapy. Whereas the hormonal therapy segment is expected to grow fastest during the forecast period. Hormonal therapy is used to shrink a cancer before surgery to reduce the risk that the cancer might return.

Breast Cancer Market By Cancer Type Insights

The hormone receptor segment dominated the breast cancer market in 2024. The segment growth in the market is driven by rising technological advancements and an increasing number of cases of breast cancer. In addition, the HER2 segment is expected to grow fastest during the forecast period. HER2 breast cancer is a treatable disease, and outcomes have dramatically improved for these patients with the development of HER2-targeted agents.

Breast Cancer Market By Distribution Channel Insights

The hospital pharmacies segment dominated the breast cancer market in 2024. The segment growth in the market is attributed to the increasing demands from patients for various medications and increased dependence of the patients on the medications. Furthermore, the online pharmacies segment is expected to grow fastest during the forecast period due to the increased connectivity help, increased online pharmacies, increased online prescriptions in the hospital, and increased software development in the hospital.

Breast Cancer Market By Regional Insights

North America dominated the breast cancer market in 2024. The market growth in the region is attributed to the increasing efficacy of the medications, increasing government initiatives in developing new drugs, increasing the number of cancer patients, and increased market share in breast cancer. The U.S. and Canada are dominating countries driving the market growth. Breast cancer is the most common cancer diagnosed among women in the U.S.

For instance, approximately 316,950 women will be diagnosed with invasive breast cancer, with 59,080 new cases of ductal carcinoma in situ (DCIS), which is non-invasive in the U.S., in 2025. About 42,170 women will die from breast cancer in 2025.

Asia Pacific Breast Cancer Market Trends

Asia Pacific is expected to grow fastest during the forecast period. The market growth in the region is driven by increasing demand for breast cancer treatments and medication and an increasing number of breast cancer patients. China, India, Japan, and South Korea are the fastest growing countries in the region. Breast cancer accounts for a substantial proportion of all cancer cases and deaths in India with a cumulative risk of 2.81. With a mortality rate of 12.7 per 100,000 women and an age-adjusted rate as high as 25.8 per 100,000 women, breast cancer is the most common cancer among Indian females. As a result, the increasing prevalence of breast cancer in Indian women necessitates a comprehensive approach focusing on lifestyle changes, early detection, and awareness, which may further be expected to drive the growth of the breast cancer market in India.

Some of The Prominent Players in The Breast Cancer Market Include:

- Merck & Co

- Bristol Myers Squiib

- Kyowa Kirin

- Eisai Co.Ltd

- Sanofi

- Pfizer Inc

- AstraZeneca

- Novartis AG

- Eli Lilly and Company

- Genentech

- Mylan Laboratories

- Celltrion

- Fresenius Kabi

- Baxter Healthcare Corporation

- Halozyme Inc

- GlaxoSmithKline

Breast Cancer Market Recent Developments

- In March 2025, The UK's National Health Service (NHS) launched the world's largest prospective trial of using artificial intelligence (AI) to assess routine mammogram screenings. From April 2025, nearly 700,000 women who have booked routine screenings in the UK will be invited to participate.

- In February 2025, IIT Madras launched the Bharat Cancer Genome Atlas (BCGA) with data on 960 whole exome sequencing. It has been completed so far from tissue samples collected from 480 breast cancer patients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Breast Cancer Market

By Therapy

-

- Abemaciclib

- Adotrastuzumab Emtansine

- Everolimus

- Trastuzumab

- Ribociclib

- Palbocicib

- Pertuzumab

- Olaparib

- Others

-

- Selective Estrogen Receptor Modulators

- Aromatase Inhibitors

- Estrogen Receptor Downregulators

- Chemotherapy ( Epothiones, Taxanes, Alkylating agents, Anthracyclines, Anti-metabolites)

- Immunotherapy

- Surgery and radiation therapy

- Biologic therapy

By Cancer Type

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)