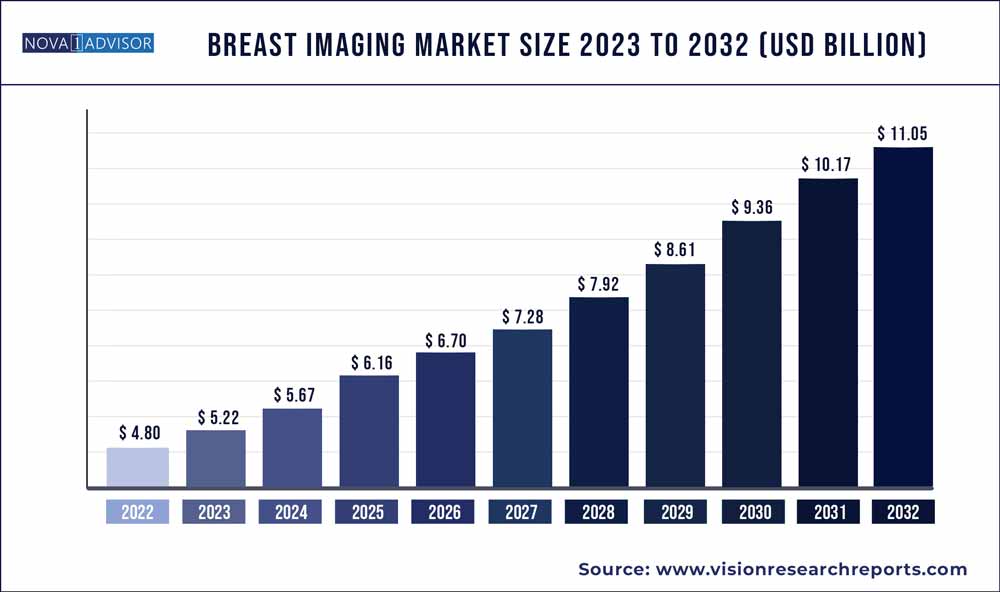

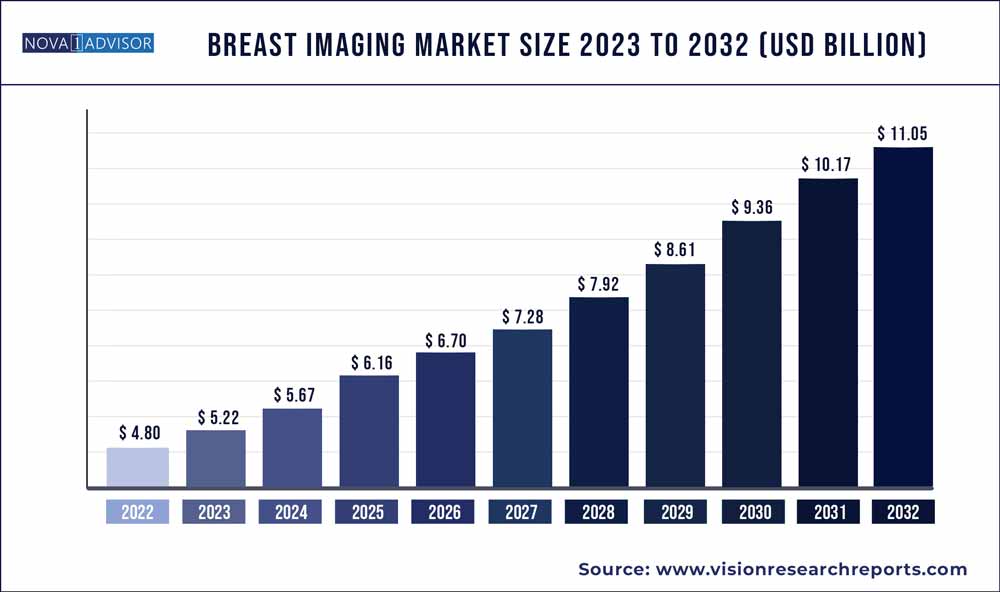

The global breast imaging market size was exhibited at USD 4.80 billion in 2022 and is projected to hit around USD 11.05 billion by 2032, growing at a CAGR of 8.7% during the forecast period 2023 to 2032.

Key Takeaways:

- The Ionizing technology segment held the largest market share of around 63.2% in 2022 and is anticipated to witness the fastest growth over the forecast period.

- Hospitals dominated the end-use segment in 2022 with a share of around 42.2% in terms of revenue.

- North America dominated the breast imaging market in 2022 with a share of around 37.8% in terms of revenue and is expected to exhibit a considerable growth rate during the forecast period.

Market Overview

The breast imaging market is a crucial component of the broader diagnostic imaging industry, focusing specifically on technologies and services used to detect, diagnose, and monitor breast-related abnormalities. This includes breast cancer, cysts, tumors, and other breast tissue anomalies. Given the rising global incidence of breast cancer, particularly among women over the age of 40, the demand for breast imaging has grown substantially. Early and accurate detection significantly improves treatment outcomes, fueling investment and innovation in this domain.

Breast imaging services rely on a spectrum of ionizing and non-ionizing imaging technologies, each offering different diagnostic strengths. From routine screening mammography to advanced modalities like 3D tomosynthesis and MRI, the industry is characterized by technological diversification and continuous upgrades. Government-backed awareness campaigns, growing insurance coverage, and improvements in healthcare infrastructure have also contributed to higher screening rates.

Simultaneously, the integration of artificial intelligence, telemedicine, and digital health platforms is enhancing the accuracy and efficiency of breast imaging diagnostics. In both developed and emerging markets, private and public sector investments are boosting the accessibility of breast screening services, thus shaping a market poised for continuous expansion.

Major Trends in the Market

-

Widespread adoption of 3D breast tomosynthesis for improved screening accuracy

-

Integration of artificial intelligence (AI) for automated image interpretation

-

Rising utilization of contrast-enhanced mammography and digital breast tomosynthesis

-

Development of portable and low-cost ultrasound systems for rural screening

-

Increasing application of MRI in high-risk population screening

-

Growth in point-of-care breast imaging diagnostics and telemammography

-

Expansion of breast density screening protocols and volumetric analysis tools

-

Regulatory shifts encouraging routine mammography for women aged 40 and above

Breast Imaging Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 4.80 Billion |

| Market Size by 2032 |

USD 11.05 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 8.7% |

| Base Year |

2022 |

| Forecast Period |

2023-2032 |

| Segments Covered |

Technology, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

GE Healthcare; Hologic, Inc.; Philips Healthcare; Gamma Medica, Inc.; Siemens Healthcare; Fujifilm Holdings Corp., SonoCine, Inc.; Toshiba Corporation; Dilon Technologies, Inc.; Aurora Imaging Technology, Inc. |

Market Driver: Rising Incidence of Breast Cancer and Screening Awareness

A major driver of the breast imaging market is the increasing prevalence of breast cancer globally. According to the World Health Organization, breast cancer is now the most commonly diagnosed cancer in women worldwide. In the United States alone, approximately 1 in 8 women will develop invasive breast cancer in their lifetime, highlighting the critical need for early and regular screening.

Government-led initiatives, such as the Breast Cancer Screening Program in the U.S. and Europe, have raised awareness and pushed for early diagnosis through organized mammography screenings. These programs are often accompanied by insurance coverage mandates, removing financial barriers to access. With growing awareness and technological advancement, the number of women opting for annual or biennial breast screening has significantly increased, sustaining market demand.

Market Restraint: High Equipment Costs and Uneven Access in Emerging Markets

Despite its critical importance, breast imaging faces a key restraint in the form of high capital and operational costs. Advanced technologies like digital mammography, 3D tomosynthesis, and breast MRI require substantial investments in infrastructure, trained personnel, and ongoing maintenance. For many smaller hospitals, clinics, and healthcare providers especially in low-income or rural areas these expenses can be prohibitive.

Moreover, in many developing regions, limited access to diagnostic imaging services continues to delay diagnosis and treatment. Infrastructural limitations, a shortage of trained radiologists, and inconsistent reimbursement mechanisms further hinder adoption. As a result, while developed countries maintain high screening rates, emerging economies continue to struggle with underdiagnosis and late-stage breast cancer presentations.

Market Opportunity: AI-Driven Diagnostics and Personalized Screening

Artificial intelligence is opening new frontiers in the breast imaging market, offering enhanced diagnostic accuracy and workflow efficiency. AI algorithms are now capable of detecting microcalcifications, architectural distortions, and masses with high precision—often flagging anomalies that may be missed by human interpretation. These tools can significantly reduce reading time and inter-reader variability, especially in high-volume screening environments.

Moreover, personalized screening strategies—driven by risk assessment tools that incorporate genetic, lifestyle, and breast density data—are becoming increasingly viable. AI-enabled decision support systems can recommend screening intervals and modalities tailored to each individual, thus improving both efficacy and resource allocation. As these technologies mature and receive regulatory backing, they represent a transformative opportunity for market growth.

By Technology Insights

Ionizing breast imaging technologies dominate the market, with full-field digital mammography (FFDM) and 3D breast tomosynthesis leading the way. FFDM remains the standard for routine screening due to its widespread availability, cost-effectiveness, and clinical validation. However, 3D tomosynthesis is rapidly gaining ground for its superior image clarity and lower recall rates. These technologies are particularly favored in organized screening programs and urban hospital networks.

Non-ionizing imaging modalities are the fastest-growing segment, especially breast MRI and automated whole-breast ultrasound (AWBU). MRI is invaluable for high-risk patients, dense breast evaluation, and pre-surgical planning, while AWBU offers a comfortable and radiation-free alternative for supplemental screening. Thermography and optical imaging, although niche, are being explored for their portability and use in populations with contraindications to radiation.

By End-use Insights

Hospitals represent the largest end-user segment, benefitting from multidisciplinary teams, high patient volumes, and access to advanced imaging infrastructure. Most large hospitals offer comprehensive breast imaging services, including mammography, MRI, and ultrasound under one roof. Their ability to support diagnostic, interventional, and surgical follow-up gives them a structural advantage in the market.

Breast care centers and diagnostic imaging centers are the fastest-growing end-users, driven by the outpatient care trend and emphasis on specialized diagnostics. These centers offer personalized services, shorter wait times, and state-of-the-art technologies, often in collaboration with oncology specialists. Many such centers are expanding their footprint through mobile screening units and partnerships with employer wellness programs, enhancing accessibility.

By Regional Insights

North America dominates the global breast imaging market, due to early technology adoption, high awareness levels, and robust reimbursement structures. The United States has a well-established screening infrastructure supported by federal recommendations and private payer incentives. Additionally, strong R&D ecosystems in companies like Hologic, GE HealthCare, and Siemens Healthineers ensure continuous innovation in breast imaging technologies.

Asia-Pacific is the fastest-growing region, fueled by growing awareness, increasing disposable incomes, and rising breast cancer incidence. Countries like China, India, and Japan are investing in diagnostic infrastructure, training radiologists, and launching national screening programs. Moreover, mobile mammography units and AI-based imaging tools are improving access in remote and underserved areas, driving rapid market expansion across the region.

Recent Developments

-

In April 2025, Hologic received FDA clearance for its next-generation 3D breast tomosynthesis system with AI-enhanced lesion detection.

-

In February 2025, iCAD Inc. launched ProFound AI Risk 2.0, a tool that integrates clinical and imaging data to assess short-term breast cancer risk.

-

In January 2025, GE HealthCare introduced a mobile mammography platform targeting rural women’s health initiatives across North America.

-

In December 2024, ScreenPoint Medical partnered with a European hospital network to implement AI-powered mammography readings.

-

In October 2024, Siemens Healthineers unveiled an upgrade to its MAMMOMAT Revelation platform, improving breast density measurement and workflow integration.

Some of the prominent players in the Breast imaging Market include:

- GE Healthcare,

- Hologic, Inc.,

- Philips Healthcare

- Gamma Medica, Inc.

- Siemens Healthcare

- Fujifilm Holdings Corp.

- SonoCine, Inc.,

- Toshiba Corporation,

- Dilon Technologies, Inc.,

- Aurora Imaging Technology, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Breast imaging market.

Technology

-

- Full-field Digital Mammography

- Analog Mammography

- Positron Emission Mammography

- Electric Impedance Tomography

- Cone-Beam Computed Tomography

- Positron Emission Tomography & Computed Tomography

- 3D Breast Tomosynthesis

- MBI/BSGI

-

- MRI

- Thermography

- Ultrasound

- Optical Imaging

- Automated Whole-breast Ultrasound

End-use

- Hospitals

- Breast Care Centers

- Diagnostic Imaging Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)