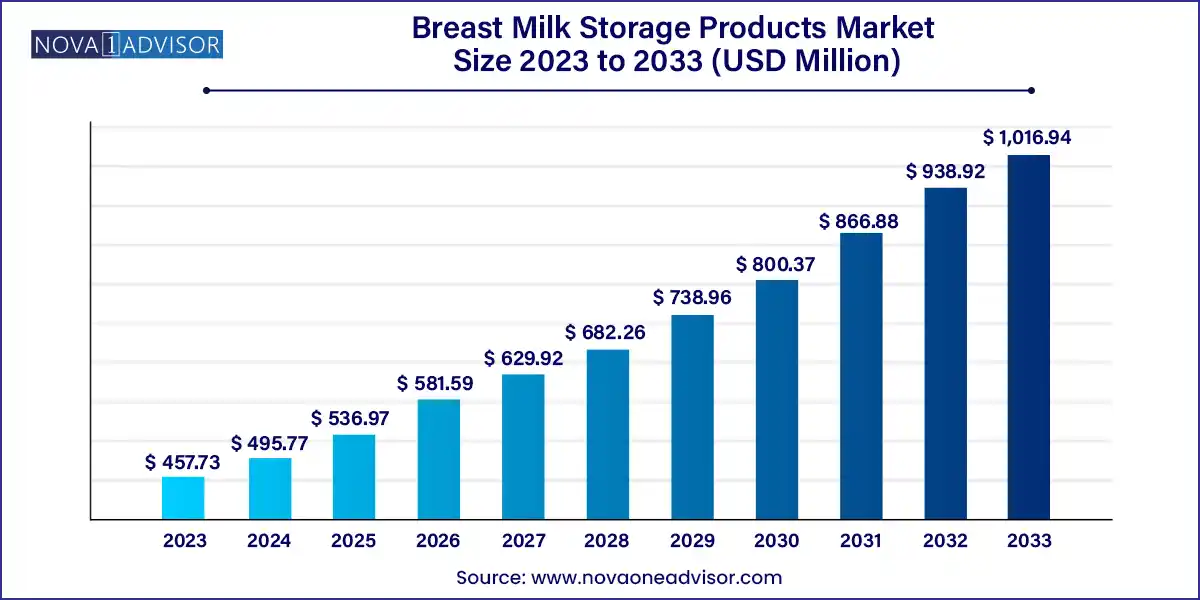

The global breast milk storage products market size was exhibited at USD 457.73 million in 2023 and is projected to hit around USD 1,016.94 million by 2033, growing at a CAGR of 8.31% during the forecast period 2024 to 2033.

Key Takeaways:

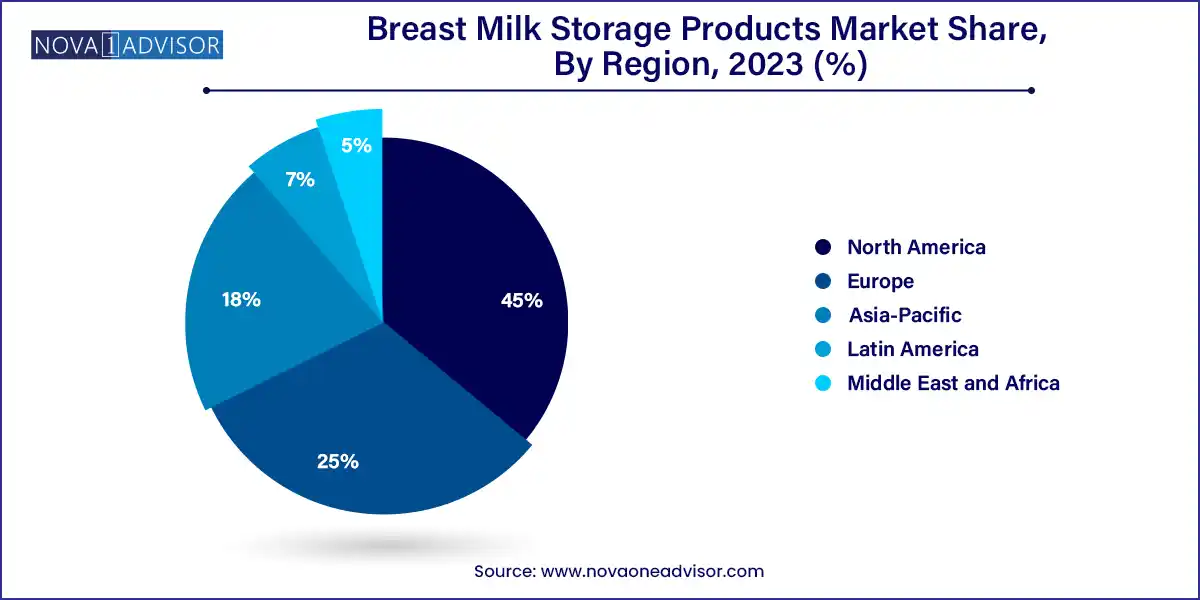

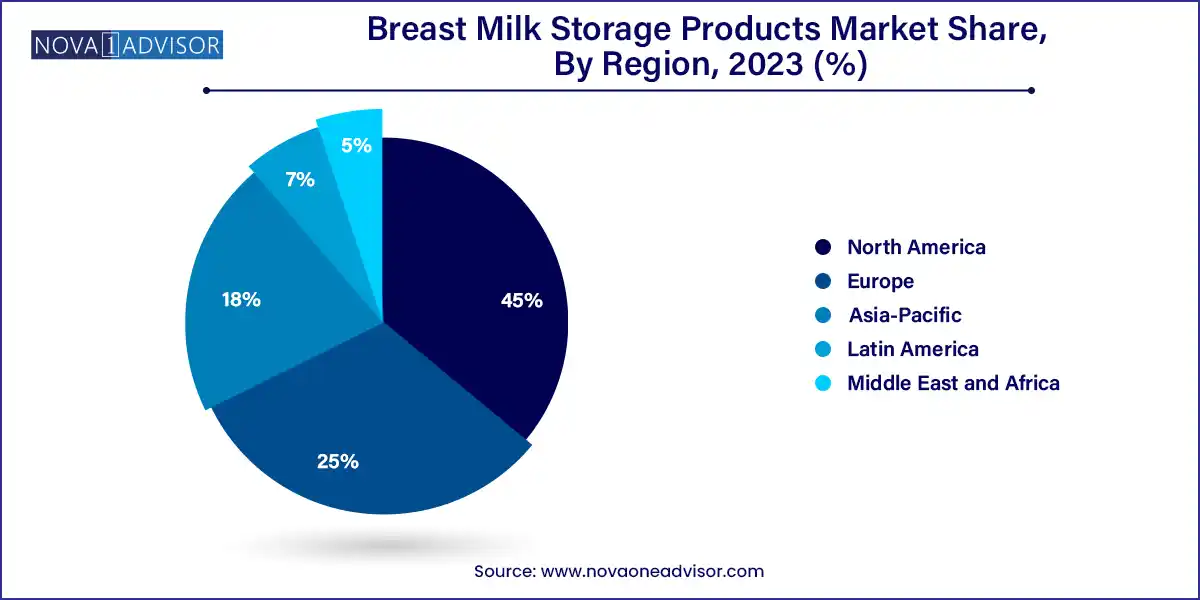

- Asia Pacific dominated the market with a revenue share of over 45.0% in 2023.

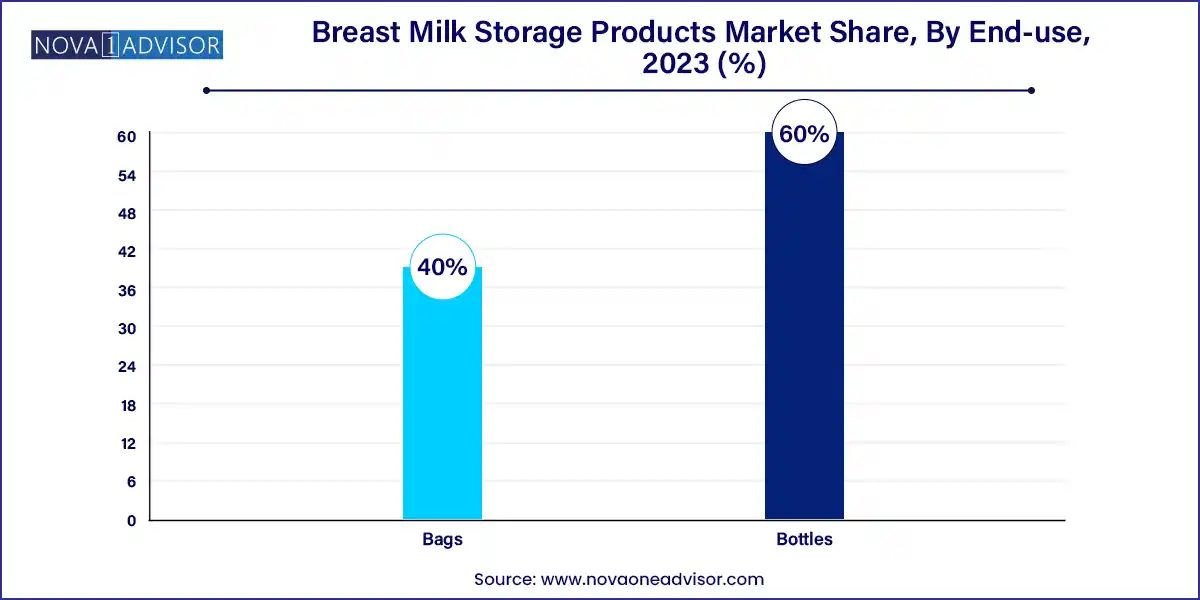

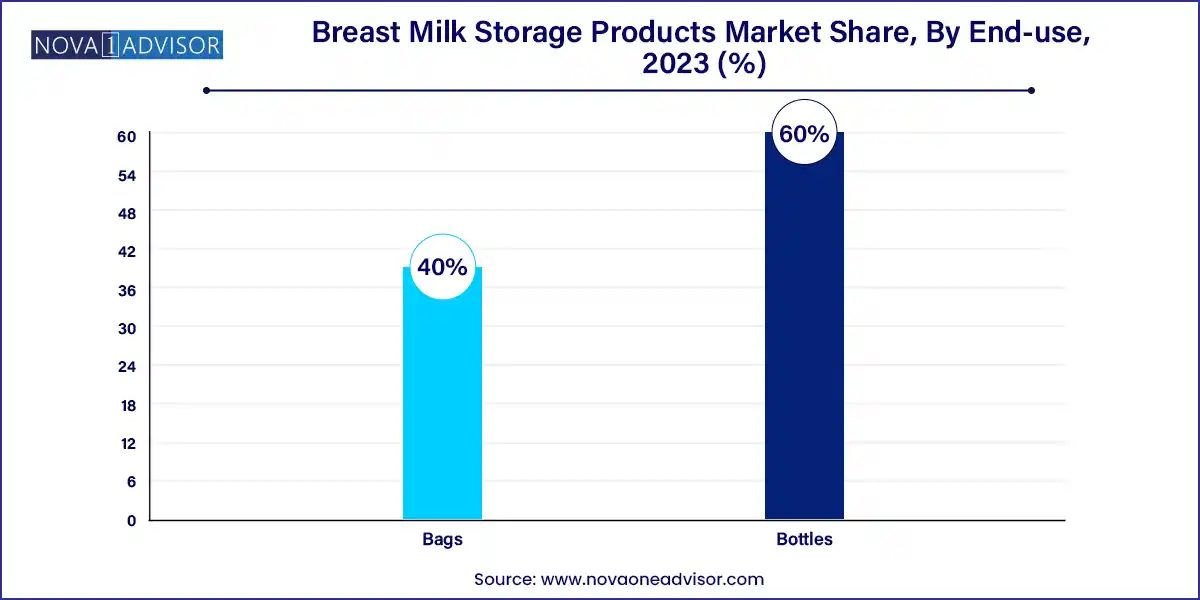

- The bottles segment held the largest share of over 60.0% in 2023 and is expected to grow at the fastest rate over the forecast period.

- The hospital pharmacy segment held the largest share of over 35.0% in 2023.

Market Overview

The Breast Milk Storage Products Market is witnessing robust expansion, driven by increasing awareness of breastfeeding benefits, the rise of working mothers, and advancements in infant care solutions. Breast milk is globally recognized as the most nutritious and immunologically protective food for infants. As the focus on neonatal health, maternal support, and infant nutrition intensifies, breast milk storage products such as storage bottles and bags have become essential tools for lactating mothers, caregivers, and healthcare providers.

Breast milk storage products are specially designed containers that allow safe storage, refrigeration, and even freezing of expressed breast milk without compromising its nutritional quality. With the surge in breastfeeding support programs, rising adoption of breast pumps, and the need for flexibility in infant feeding schedules, demand for these products is on a steady upward trajectory.

Societal shifts such as urbanization, dual-income households, delayed parenthood, and increased maternal employment are contributing to the growing popularity of breast milk expression and storage. Hospitals and maternity clinics now routinely recommend and offer breast milk storage options to new mothers. Simultaneously, innovations in materials (e.g., BPA-free plastics, eco-friendly polymers), enhanced product designs (double-zip lock, leak-proof caps), and consumer-friendly packaging are expanding product appeal.

Additionally, e-commerce channels and maternal blogs have accelerated product discovery and consumer education, creating a thriving global market. From metro cities to remote regions, the accessibility and awareness of breast milk storage products are spreading, positioning this market at the intersection of healthcare, parenting, and convenience.

Major Trends in the Market

-

Rising Number of Working Mothers: Increasing female workforce participation, especially in urban regions, is fueling demand for efficient breast milk storage solutions.

-

Hospital Adoption and Breastfeeding Support Initiatives: Hospitals and maternity clinics are promoting breast milk pumping and storage, often supplying starter kits post-delivery.

-

Eco-friendly and Reusable Options: Sustainable alternatives like silicone bottles and reusable pouches are gaining traction among environmentally conscious consumers.

-

Growth of Direct-to-Consumer (D2C) and E-commerce Channels: Online platforms are becoming dominant sales avenues, offering convenience, variety, and discreet delivery.

-

Improved Sterilization and Storage Technologies: Some products now feature sterilizable components, temperature indicators, and antimicrobial materials for safer storage.

-

Influencer and Parenting Blog Endorsements: Social media influencers and mom bloggers play a critical role in product visibility and trust among new parents.

-

Expansion into Emerging Markets: Awareness campaigns, NGO initiatives, and improved healthcare infrastructure are opening new markets in Africa, Southeast Asia, and Latin America.

Breast Milk Storage Products Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 495.77 Million |

| Market Size by 2033 |

USD 1,016.94 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 8.31% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Sales Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Medela; Magneto, Inc. (Ameda); Ardo medical AG; Koninklijke Philips N.V.; Pigeon Corporation; Spectra Baby USA; LaVie Mom; Motif Medical; Mayborn Group Limited; Chicco |

A major market driver is the growing global emphasis on breastfeeding advocacy, backed by initiatives from governments, health organizations, and non-profits. The World Health Organization (WHO) and UNICEF recommend exclusive breastfeeding for the first six months, followed by continued breastfeeding with complementary foods for two years or more. As a result, many countries are launching awareness campaigns, offering breastfeeding counseling, and improving maternity leave policies.

Breast milk storage products enable mothers to breastfeed indirectly by storing expressed milk safely. This becomes particularly critical when returning to work, during medical treatments, or when dealing with latch issues. National programs in countries like the U.S. (e.g., WIC), India (POSHAN Abhiyaan), and Brazil (Rede Brasileira de Bancos de Leite Humano) include breast milk promotion and support tools, directly boosting demand for storage solutions. In this context, breast milk storage products are no longer niche they are an integral component of maternal and child health infrastructure.

Market Restraint: Safety Concerns and Lack of Awareness in Low-Income Regions

Despite market growth, the breast milk storage market faces constraints in the form of safety concerns and limited consumer education, particularly in developing and underserved regions. The safety of plastic materials used in bottles and bags remains a persistent concern among parents, especially due to past controversies involving BPA and phthalates. Although most products are now labeled BPA-free, skepticism still exists, creating a need for transparent certifications and third-party testing.

Additionally, in many rural areas and low-income countries, awareness of breast milk storage hygiene and protocols is limited. Mothers may lack access to refrigeration or sterilization, making safe storage difficult even if products are available. Cultural stigmas, misinformation, or preference for traditional feeding methods further limit market penetration. Manufacturers must invest in localized education campaigns, affordable product variants, and partnerships with NGOs to overcome these barriers.

Market Opportunity: Innovation in Smart Storage Products and Connected Ecosystems

An emerging opportunity in the breast milk storage products market lies in the development of smart, connected storage solutions. As parenting integrates with digital lifestyles, tech-enabled baby products are gaining appeal among younger, tech-savvy parents. This includes storage containers that track volume, monitor temperature, and connect with mobile apps to log feeding times, expiry status, and alerts.

Startups and established brands are beginning to introduce IoT-integrated milk storage solutions that provide real-time data, sync with wearable breast pumps, and even suggest optimal feeding times based on baby’s routines. Additionally, modular kits that include sterilizers, warmers, storage bags, and mobile refrigeration units are becoming attractive to traveling mothers and working professionals. These innovations not only enhance convenience but also provide peace of mind, opening new revenue streams in premium product categories.

Segments Insights:

By Product Insights

Bottles dominate the product segment, owing to their durability, reusability, and compatibility with breast pumps and feeding systems. Breast milk storage bottles are often preferred by mothers who want to both store and feed from the same container, minimizing transfer loss and reducing contamination risk. Brands like Philips Avent, Medela, and Dr. Brown’s have established robust product ecosystems centered around bottles that integrate with sterilizers and warmers. Hospitals also favor bottles due to their standardization and ease of labeling.

However, bags are the fastest-growing product segment, particularly among mothers seeking space-saving, travel-friendly, and disposable storage options. Storage bags are cost-effective, easier to freeze and stack, and designed for single use, which reduces sterilization requirements. Modern storage bags come with double-zip locks, spouts for easy pouring, and volume markings, enhancing usability. The rise in exclusive pumping, working mothers, and mobile lifestyles is driving the popularity of storage bags as an on-the-go solution.

By Sales Channel

Retail stores continue to dominate the sales channel segment, particularly in mature markets like North America and Europe. Pharmacies, supermarkets, baby stores, and maternity boutiques offer a tactile shopping experience, where consumers can compare product features, packaging, and price. Retail channels also benefit from cross-selling with pumps, feeding bottles, and maternity accessories. In-store consultations, discounts, and bundling with other infant care products encourage in-person purchases, especially for first-time parents.

Meanwhile, e-commerce is the fastest-growing sales channel, driven by convenience, wider product availability, and rapid doorstep delivery. Online platforms like Amazon, Walmart, and specialty D2C brands offer detailed reviews, demo videos, and subscription discounts, attracting digitally inclined parents. The discreet nature of online shopping also appeals to consumers in regions where discussing breastfeeding is culturally sensitive. During the COVID-19 pandemic, e-commerce became the primary shopping method for breast milk storage products, a trend that continues to accelerate in 2025.

By Regional Insights

North America dominates the global breast milk storage products market, owing to high awareness, favorable maternity policies, and a strong ecosystem of hospitals, lactation consultants, and breastfeeding advocacy groups. In the United States, rising maternal employment, insurance coverage for breast pumps (under the Affordable Care Act), and the growth of e-commerce have made breast milk storage mainstream. Companies like Medela, Lansinoh, and Kiinde have established strong retail and D2C networks. Additionally, support from organizations like La Leche League and the U.S. Breastfeeding Committee ensures continued education and demand for storage solutions.

In contrast, Asia-Pacific is the fastest-growing region, driven by rising birth rates, increasing female workforce participation, and improved healthcare infrastructure. Countries such as China, India, Indonesia, and Vietnam are witnessing a surge in urban nuclear families, where convenience-focused parenting tools are highly valued. Government programs like India’s POSHAN Abhiyaan and China’s Healthy Baby initiatives are promoting breastfeeding, leading to greater adoption of storage products. Moreover, local brands are emerging in these markets offering cost-effective storage bags and bottles tailored to regional needs. As mobile and online commerce proliferates, Asia-Pacific is poised to become a major revenue center for global and regional players alike.

Some of the prominent players in the Breast milk storage products market include:

- Medela

- Magneto, Inc. (Ameda)

- Ardo medical AG

- KoninklijkePhilips N.V.

- Pigeon Corporation

- Spectra Baby USA

- LaVie Mom

- Motif Medical

- Mayborn Group Limited

- Chicco

Recent Developments

-

March 2025 – Medela AG announced the launch of its next-generation breast milk storage bottles made from medical-grade Tritan™ plastic, offering enhanced clarity, odor resistance, and sterilization durability.

-

January 2025 – Lansinoh Laboratories Inc. introduced an upgraded line of breast milk storage bags with built-in thermal sensors that change color to indicate safe temperature ranges for refrigeration and thawing.

-

November 2024 – Haakaa expanded its global distribution by partnering with Babyshop Group in the Middle East and North Africa (MENA), targeting growing demand in emerging markets.

-

September 2024 – Philips Avent unveiled a connected ecosystem featuring app-enabled pumps and storage systems that allow mothers to track milk expression, storage dates, and feeding routines from their smartphones.

-

July 2024 – Spectra Baby USA launched a new travel-friendly breast milk cooler kit, bundled with reusable storage bottles and an insulated carry bag for working and traveling mothers.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global breast milk storage products market.

Product

Sales Channel

- Hospital Pharmacy (Inpatient)

- Retail Store

- E-commerce

- Wholesaler/Distributors

- Direct Purchase

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)