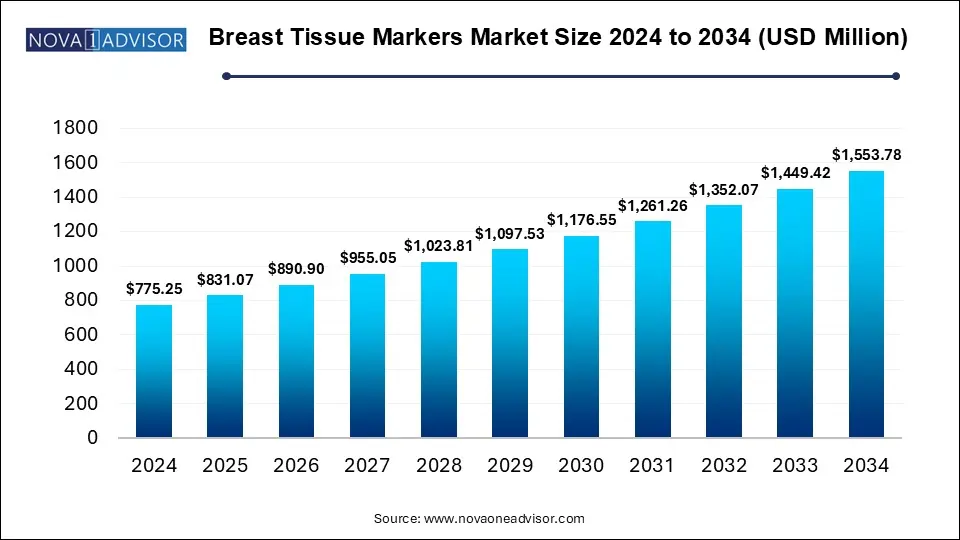

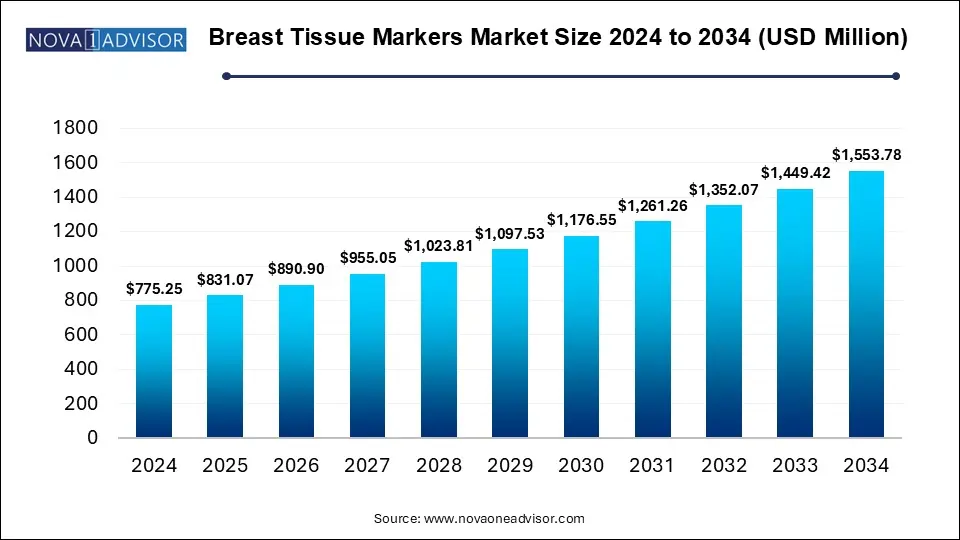

Breast Tissue Markers Market Size and Growth

The Breast Tissue Markers Market size was exhibited at USD 775.25 million in 2024 and is projected to hit around USD 1553.78 million by 2034, growing at a CAGR of 7.2% during the forecast period 2025 to 2034.

Key Takeaways:

- The biopsy segment held the largest share in 2024

- The coil segment held the largest market share in terms of revenue in 2024

- The non-absorbable segment held the largest market in 2024

- The hospitals segment held the largest share in 2024

- North America accounted for the highest market revenue share in 2024.

Market Overview

The breast tissue markers market is an integral component of the diagnostic and therapeutic landscape in breast cancer management. These markers, also known as biopsy markers or clips, are small devices implanted in breast tissue during biopsy procedures to aid in accurately identifying the location of abnormal tissue during subsequent imaging or surgical procedures. Their importance is underscored in the era of precision medicine, where targeted therapy and accurate surgical intervention are pivotal in enhancing patient outcomes.

Driven by rising breast cancer prevalence, the increasing adoption of minimally invasive diagnostic procedures, and technological innovations in imaging and material sciences, the market has witnessed consistent growth. The American Cancer Society estimated over 297,000 new cases of invasive breast cancer in U.S. women in 2023 alone, highlighting the increasing demand for accurate diagnostics. Additionally, the global shift towards breast-conserving surgeries and the widespread usage of image-guided biopsies contribute to the robust demand for these markers.

Breast tissue markers are not only used to ensure precision in biopsy procedures but also play a crucial role during surgical planning and radiation therapy. They facilitate the localization of previously biopsied lesions, especially when they are small, non-palpable, or have completely resolved post-chemotherapy. As healthcare providers focus on improving patient comfort and surgical accuracy, the breast tissue markers market is poised for significant advancements.

Major Trends in the Market

-

Increased adoption of bio-absorbable materials: Markers made from bio-compatible materials that degrade naturally in the body are gaining popularity due to reduced foreign body retention risks.

-

Integration of 3D imaging technologies: Enhanced imaging techniques improve the visibility of markers, especially during MRI and ultrasound-guided biopsies.

-

Rising preference for minimally invasive procedures: Surgeons and radiologists increasingly use markers to avoid repeated invasive procedures and improve localization accuracy.

-

Technological advancements in marker shapes and coatings: Innovation in design—such as heart, venus, or U-shaped markers—improves visibility and placement accuracy.

-

Growth in outpatient breast biopsy centers: As diagnostic procedures shift toward ambulatory surgical settings, demand for compact and reliable marker systems grows.

-

Personalized patient care protocols: The rise in patient-specific treatment strategies increases the use of markers in tailored radiation and surgical planning.

-

Expansion of breast screening programs in emerging markets: With greater awareness and government initiatives, developing countries are adopting advanced diagnostic protocols, including marker placement.

Report Scope of Breast Tissue Markers Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 831.07 Million |

| Market Size by 2034 |

USD 1553.78 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 7.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Material, Usage Type, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

BD; Hologic; INRAD, Inc.; Carbon Medical Technologies, Inc.; Vigeo srl; MOLLI Surgical (Stryker); Mammotome; Mermaid Medical |

Market Driver: Rising Incidence of Breast Cancer

One of the most influential drivers of the breast tissue markers market is the surging global incidence of breast cancer. With over 2.3 million women diagnosed globally in 2023, breast cancer remains the most commonly diagnosed cancer among women. This alarming rise has led to increased screening efforts and the subsequent demand for precise diagnostic tools.

Breast tissue markers play a critical role in improving localization during follow-up procedures. The transition from generalized to personalized cancer care has further highlighted the necessity for these markers in guiding surgery or radiation, especially in cases involving neoadjuvant chemotherapy. Furthermore, early-stage diagnosis through mammography or MRI increases the demand for tissue marking due to the smaller, often impalpable nature of detected tumors. This creates a sustained need for reliable, accurate, and minimally invasive marking tools.

Market Restraint: High Cost of Advanced Imaging and Diagnostic Procedures

While the clinical value of breast tissue markers is undisputed, the high cost associated with advanced imaging and biopsy procedures remains a significant restraint, particularly in low- and middle-income countries. The total expense, including imaging equipment, consumables, markers, and professional fees, can make these procedures inaccessible for uninsured or underinsured populations.

Moreover, the cost of technologically sophisticated markers—especially those with enhanced imaging visibility or bio-absorbable properties can be a deterrent for small diagnostic clinics. These financial constraints hinder the widespread adoption of breast tissue markers, thereby impacting market penetration in cost-sensitive regions.

Market Opportunity: Expansion of Breast Cancer Screening Programs in Emerging Markets

The expansion of government-backed breast cancer screening initiatives across emerging markets offers a considerable growth opportunity. Countries such as India, Brazil, and China are increasingly focusing on early cancer detection, especially in rural and semi-urban regions. As awareness increases, so does the number of image-guided biopsies and related procedures requiring tissue markers.

In India, for instance, the government’s National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) supports early screening initiatives that could boost demand for these devices. Similarly, public-private partnerships in Latin America have helped improve access to diagnostic tools, enabling market players to introduce cost-effective, localized solutions. This trend indicates untapped potential for manufacturers to penetrate underserved areas with scalable, affordable marker solutions.

Segmental Analysis

By Product

Coil-shaped markers dominated the market in 2024, attributed to their proven reliability, ease of placement, and widespread use across various biopsy methods. Radiologists prefer coil designs due to their superior visibility under X-ray, ultrasound, and MRI modalities. Their flexible structure adapts well within soft breast tissue, reducing migration risk. Additionally, coil markers are widely supported across legacy and modern biopsy devices, making them a staple in standard diagnostic protocols.

On the other hand, heart-shaped markers are the fastest-growing segment, driven by innovations in patient-friendly designs and enhanced imaging contrast. These newer shapes are designed to address both clinical and psychological patient needs. The symbolic heart shape is also perceived more positively by patients, contributing to compliance during follow-up procedures. Furthermore, manufacturers are combining aesthetic designs with functional enhancements such as hydrogel coatings or bio-compatible cores, which improve long-term tissue visibility and integration.

By Material

Non-absorbable markers currently dominate the breast tissue markers market, owing to their durability, stability, and historical precedence in clinical use. These markers often made of titanium or stainless steel offer long-term visibility and are preferred in cases where extended follow-up is anticipated. Their inert nature and compatibility with multiple imaging modalities make them the default choice for most radiologists and surgeons, particularly in regions with mature healthcare systems.

Conversely, bio-absorbable markers are gaining rapid traction, especially in patient-centric treatment models. These markers degrade naturally over time, eliminating the need for surgical retrieval and reducing the long-term presence of foreign materials in the body. Hospitals promoting minimally invasive and sustainable solutions are increasingly opting for biodegradable markers, particularly for younger patients or those undergoing breast-conserving treatments. The segment is expected to grow significantly as bioengineering advances enable cost-effective, safe, and visible absorbable materials.

By Usage Type

Biopsy procedures dominate usage-type segmentation, particularly stereotactic and ultrasound-guided types. These methods are the most frequently employed techniques in breast tissue diagnosis, and markers placed during these procedures aid in future localization. With the rise in non-palpable tumor detection through mammography, biopsy usage has skyrocketed, placing tissue marking at the center of early diagnosis strategies.

Meanwhile, MRI-guided biopsies are the fastest-growing segment, owing to their superior detection ability for lesions not visible under other imaging modalities. As MRI equipment becomes more widely available, especially in tertiary care centers and cancer institutes, the demand for markers that are MRI-compatible and easily detectable within high-resolution scans is rising. New marker compositions and coatings are now tailored specifically for MRI procedures, further accelerating growth.

By End Use

Hospitals are the leading end-users of breast tissue markers, benefiting from their comprehensive infrastructure and the availability of multidisciplinary teams. Most breast biopsies, especially complex or MRI-guided ones, are performed in hospitals where imaging equipment, oncology surgeons, and interventional radiologists collaborate. Hospitals also cater to the bulk of government-funded or insured patient cases, ensuring steady marker procurement.

Ambulatory Surgical Centers (ASCs) represent the fastest-growing end-use segment, driven by the shift toward outpatient procedures. ASCs offer cost-effective, time-efficient alternatives for routine biopsies, and their popularity is growing in both developed and developing countries. Equipped with modern imaging tools and minimally invasive surgical setups, these centers are increasingly purchasing marker kits optimized for fast workflows and reduced patient downtime.

Regional Analysis

North America Dominates the Market

North America accounted for the largest share of the breast tissue markers market in 2024, due to high breast cancer screening rates, advanced healthcare infrastructure, and substantial investments in oncology diagnostics. The U.S., in particular, leads global screening programs, with high patient awareness, strong reimbursement support, and access to cutting-edge diagnostic tools. Moreover, the presence of major market players like BD (Becton, Dickinson and Company), Hologic, and Merit Medical enables continuous innovation and early adoption of new marker technologies.

North America's dominance is also backed by widespread participation in clinical trials and active integration of emerging marker designs into practice. The region benefits from a strong network of specialized breast imaging centers that routinely use tissue markers for precision diagnostics and treatment planning.

Asia Pacific is the Fastest Growing Region

Asia Pacific is experiencing the fastest growth in the breast tissue markers market, attributed to rising breast cancer cases, improved healthcare access, and increasing government initiatives for early cancer detection. Countries such as China and India are investing heavily in healthcare infrastructure, including cancer screening and diagnostic programs.

With a rising middle-class population and growing health awareness, the demand for minimally invasive diagnostic tools has surged. Public and private hospitals are upgrading to image-guided biopsy systems, creating a strong pull for tissue marker products. Additionally, international companies are entering partnerships or launching affordable variants to cater to this region's vast, untapped potential.

Some of The Prominent Players in The Breast Tissue Markers Market Include:

- BD

- Hologic

- INRAD, Inc.

- Carbon Medical Technologies, Inc.

- Vigeo srl

- MOLLI Surgical (Stryker)

- Mammotome

- Mermaid Medical

Recent Developments

-

February 2025: Hologic Inc. announced the launch of the Serena Bright® biopsy marker compatible with contrast-enhanced mammography, allowing better localization in advanced diagnostic environments.

-

October 2024: Merit Medical Systems introduced a next-generation SCOUT Radar Localization System upgrade, offering better surgical precision and marker tracking in wireless configurations.

-

August 2024: BD expanded its breast health product portfolio in collaboration with cancer treatment centers in Europe to include new bio-absorbable marker lines.

-

May 2024: Somatex Medical Technologies launched a heart-shaped marker line with hydrogel coating in select European markets to address both aesthetic and clinical visibility needs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Coil

- Ribbon

- Wing

- U Shaped

- Conic

- Ring

- Heart

- Venus

- Others

By Material

- Bio-absorbable

- Non-absorbable

By Usage Type

-

- Stereotactic

- Ultrasound

- MRI-guided

By End Use

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Specialty Clinics

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)