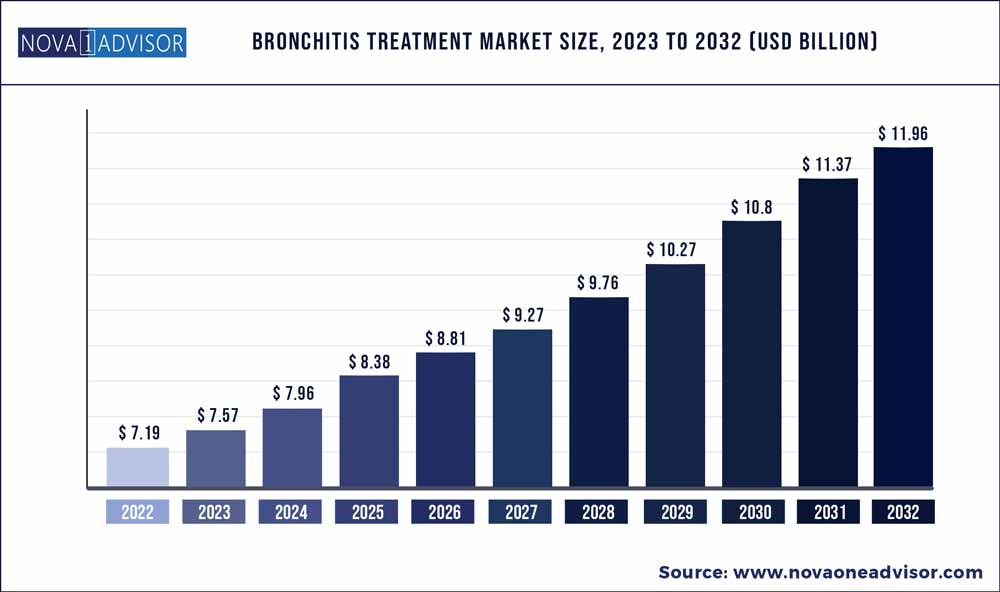

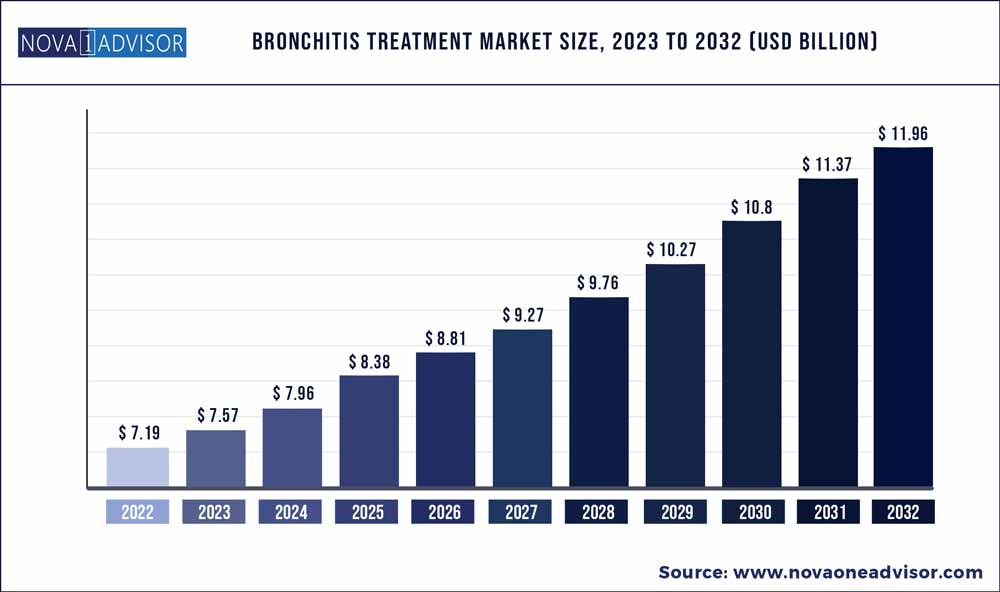

The global bronchitis treatment market size was exhibited at USD 7.19 billion in 2022 and is projected to hit around USD 11.96 billion by 2032, growing at a CAGR of 5.22% during the forecast period 2023 to 2032.

Key Pointers:

- By type, the chronic bronchitis segment has emerged as the largest market.

- By drug class, the antibiotic segment has emerged as the major market.

- By distribution channel, the hospital pharmacies segment has emerged as the largest market.

- By geography, the North America region has emerged as the largest global market.

- By geography, the Europe region held the second-largest market.

Bronchitis Treatment Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 7.57 Billion |

| Market Size by 2032 |

USD 11.96 Billion |

| Growth Rate from 2023 to 2032 |

CAGR of 5.22% |

| Base year |

2022 |

| Forecast period |

2023 to 2032 |

| Segments covered |

By Type, By Treatment, By Drug Class, and By Distribution Channel |

| Regional scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key companies profiled |

AstraZeneca, Novartis AG, GlaxoSmithKline plc, Dr. Reddy's Laboratories Ltd., Melinta Therapeutics, Sanofi Aventis, Boehringer Ingelheim International GmbH and others. |

Companies investing in bronchitis treatment market are interested in studying the etiology of bronchitis. Key viruses are Influenza type A and B, while key bacterial agents are Streptococcus, Mycoplasma pneumonia, and Staphylococcus. There are several risk factors when population has high disposition to develop chronic bronchitis, particularly in regions where they are exposed to high environmental pollutants. The prevalence of bronchitis is high the general population. In chronic obstructive pulmonary disease (COPD) patients, the prevalence estimates can be as high as 54%. The high burden has been highlighted as a key driver for the evolution of the bronchitis treatment market.

Other key risk factors comprise tobacco smoking, increasing age, socioeconomic status, and occupational exposure. Both pharmacological and non-pharmacological interventions have gathered considerable attention among players in the bronchitis treatment market.

Among the two types, chronic bronchitis holds the leading share of the global market throughout the forecast period. The rise in the opportunities in this segment is the high morbidity and mortality rate. However, rate of developments in prognosis still seems tepid. Coordinated efforts made by all healthcare teams to improve the outcomes of pharmacological treatment for chronic is a key trend driving prospects in the bronchitis treatment market. Further, clinicians recommend making changes in lifestyle in reducing the morbidity of chronic bronchitis.

On the other hand, acute bronchitis is also garnering attention among drug makers and medical device manufacturers. The segment is expected to keep contributing significant revenues in coming years. In developed countries, given the high incidence, an array of studies have been done to understand the risk factors. These studies shed light on expected avenues in the bronchitis treatment market.

Over the years, nonpharmacological interventions have risen in popularity. The various drugs classes are antibiotics, bronchodilators, mucolytics, and, anti-inflammatory drugs. Of these, bronchodilators have been frequently recommended for the treatment of symptomatic COPD.

Advent of novel LAMA/LABA fixed dose combination inhalers has helped in preventing the exacerbations in COPD patients. Thus, long-acting bronchodilators have attracted research targeted toward improving the mechanism. Growing number of clinical trials has helped develop long-acting bronchodilators. The findings of these studies have paved way to guidelines for reducing COPD exacerbations, thus unlocking new prospects for players in the bronchitis treatment market. Introduction of new drug regimens in COPD treatment options has expanded the horizon for stakeholders in the market. This has also led to the approval of novel LAMA/LABA fixed combinations, opening new doors to opportunities for market players.

Bronchitis Treatment Market Segmentation

| By Type |

By Treatment |

By Drug Class |

By Distribution Channel |

- Acute Bronchitis

- Chronic Bronchitis

|

|

- Anti-Inflammatory Drugs

- Antibiotics

- Bronchodilators

- Mucolytic

|

- Online Pharmaceutical Store

- Retail Pharmacies

- Hospital Pharmacies

|