Cancer Vaccine Market Size and Research

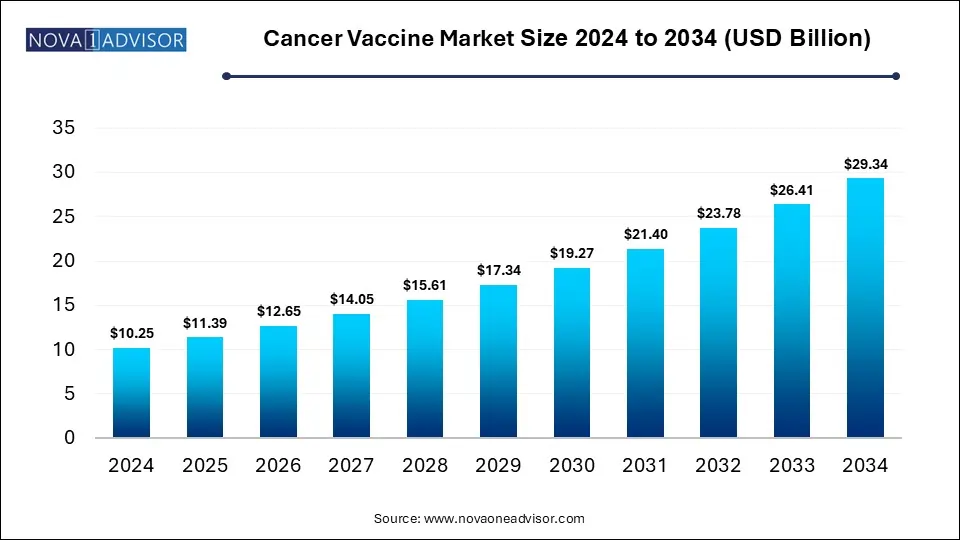

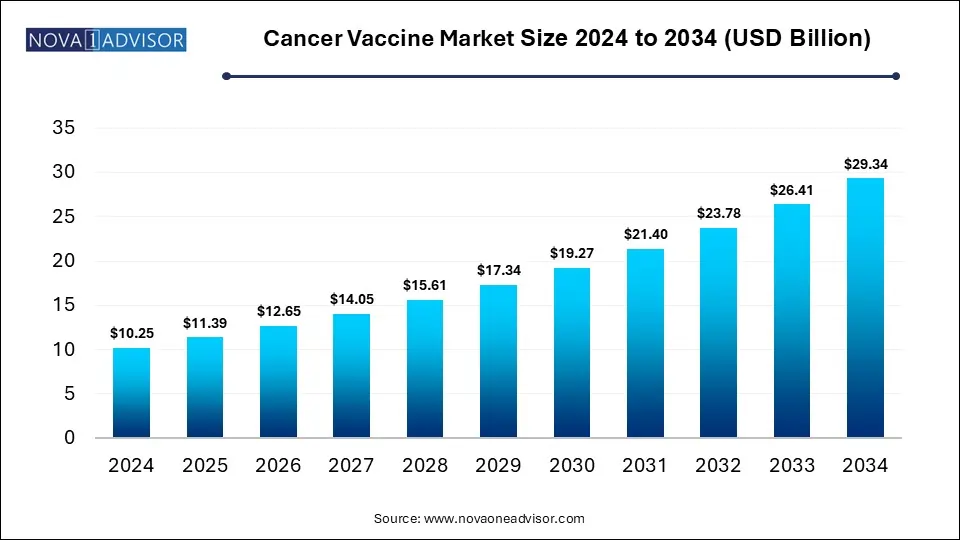

The global cancer vaccines market size is calculated at USD 10.25 billion in 2024, grow to USD 11.39 billion in 2025, and is projected to reach around USD 29.34 billion by 2034, growing at a CAGR of 11.09% from 2025 to 2034. The market is growing due to rising cancer prevalence and increasing investments in immunotherapy research. Technological advancements in personalized medicine also support market expansion.

Cancer Vaccine Market Key Takeaways

- North America dominated the cancer vaccines market revenue shares in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By vaccine type, the preventive cancer vaccines segment dominated the market with a revenue share.

- By vaccine type, the therapeutic cancer vaccines is expected to grow at the fastest CAGR in the market during the studied years.

- By indication type, the cervical cancer segment held the largest market share.

- By indication type, the bladder cancer segment is expected to grow significantly in the market during the studied years.

- By technology type, the recombinant vaccine segment led the market in 2024.

- By technology type, the viral vector and DNA cancer vaccines segment is expected to grow at the fastest CAGR in the market during the studied years.

Market Size & Forecast

- 2024 Market Size: USD 10.25 Billion

- 2034 Projected Market Size: USD 29.34 Billion

- CAGR (2025-2034): 11.09%

- North America: Largest market in 2024

How Cancer Vaccines Market Evolving?

Cancer vaccines are immunotherapies designed to stimulate the body’s immune system to prevent or treat cancer by targeting tumor-specific antigens. The cancer vaccines market is evolving through innovations in mRNA technology, personalized immunotherapy, and targeted antigen discovery. Therapeutic vaccines are gaining momentum, especially for cancers like melanoma, lung, and prostate, offering new treatment possibilities beyond prevention. Advances in biotechnology and growing success in clinical trials are enhancing vaccines efficacy. Additionally, increased collaboration between biotech firms and research institutions, along with supportive regulatory pathways, is accelerating development and adoption, positioning cancer vaccines as a transformative approach in oncology.

- For Instance, As per the American Cancer Society’s Cancer Facts & Figures Report released in January 2023, around 1.96 million new cancer cases were expected in the U.S., potentially causing about 610,000 deaths. This marks a 2.2% rise in new cancer diagnoses compared to the previous year.

What are the Key Trends in the Cancer Vaccines Market in 2024?

- In March 2024, BostonGene, NEC, and Transgene strengthened their partnership to advance the Phase I/II clinical trial of the neoantigen-based cancer vaccine TG4050.

- In February 2024, Moderna began a cancer vaccine trial in the U.K., with the first patients receiving an experimental mRNA-based vaccine at Imperial College Healthcare NHS Trust.

How Can AI Affect the Cancer Vaccines Market?

AI is significantly impacting the cancer vaccine market by accelerating the discovery of tumor-specific antigens and personalizing vaccine development. It enables rapid analysis of genomic data to identify targets unique to each patient’s cancer, improving vaccine precision and effectiveness. AI also streamlines clinical trial design, predicts patient responses, and enhances manufacturing efficiency. These capabilities reduce development time and costs, fostering innovation and expanding the potential of cancer vaccines in both preventive and therapeutic applications.

Report Scope of Cancer Vaccine Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 11.39 Billion |

| Market Size by 2034 |

USD 29.34 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.09% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Vaccine Type, Indication Type, Technology Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Merck & Co., Inc., GSK plc, Dendreon Pharmaceuticals LLC., Dynavax Technologies., Ferring B.V., Amgen, Inc., Moderna, Inc., Sanofi, AstraZeneca, Bristol-Myers Squibb Company |

Market Dynamics

Driver

Advances in Immunotherapy

Advancements in immunotherapy are a driver in the cancer vaccines market by enabling more precise and effective immune responses against cancer cells. Innovations like checkpoint inhibitors and T-cell therapies have demonstrated the potential of the immune system in combating tumors, paving the way for vaccine-based approaches. These developments enhance the design of therapeutic cancer vaccines, improve research. As immunotherapy gains clinical success, it reinforces the demand for personalized and targeted cancer vaccines.

Restraint

High Development Costs

High development costs are a major restraint in the cancer vaccines market because creating effective vaccines involves extensive research, preclinical studies, and multi-phase clinical trials, all of which require substantial financial resources. These costs are even higher for personalized vaccines due to their complexity. Smaller biotech firms often struggle to secure necessary funding, slowing innovation. Additionally, the long development timelines and uncertain regulatory approvals increase financial risk, making investment cautious and limiting market expansion.

Opportunity

Advancement of Personalized Neoantigen Vaccines

Advancement in personalized neoantigen vaccines presents a promising future opportunity in the cancer vaccines market due to their ability to target tumor-specific mutations unique to each patient. These vaccines enhance immune precision, reducing the risk of off-target effects and improving treatment outcomes. With progress in genomic sequencing, bioinformatics, and AI, identifying patient-specific neoantigens has become more efficient, paving the way for highly individualized therapies. This approach holds strong potential for treating aggressive and therapy-resistant cancers.

Cancer Vaccine Market By Segmental Insights

How will the Preventive Cancer Vaccines Segment Dominate the Cancer Vaccines Market in 2024?

The preventive cancer vaccine segment leads the market mainly due to success in controlling virus-induced cancers through early immunization strategies. Widespread use of vaccines like HPV and hepatitis in national immunization schedules has significantly lowered infection rates linked to cancer of administration, and long-term benefits in reducing cancer burden have further strengthened the adoption of preventive vaccines, making them a dominant choice in the overall cancer vaccine landscape.

For Instance, In December 2023, the Family Planning Association of India (FPAI) launched the “Race to Erase Cervical Cancer” campaign to raise awareness and promote prevention. The initiative includes public education on cervical cancer and the distribution of the HPV vaccine developed by the Serum Institute of India.

The therapeutic cancer vaccines segment is expected to witness the highest CAGR due to the growing demand for targeted and personalized cancer treatment. These vaccines work by stimulating the immune system to recognize and destroy cancer cells, making them suitable for treating advanced or recurring cancers. Continued progress in immunotherapy, along with increasing clinical trial success and regulatory support, is encouraging their adoption. This evolving approach offers new hope for patients with limited treatment options, driving rapid market growth.

- For Instance, In May 2024, China-based biotech company WestGene marked a breakthrough with FDA approval of its mRNA-based cancer vaccine, WGc-043. This is the world’s first mRNA therapeutic cancer vaccine targeting Epstein-Barr virus (EBV)-related tumors. The approval represents a significant step forward in cancer treatment, offering new hope to patients battling advanced EBV-associated cancers.

Why Did the Cervical Cancer Segment Dominate the Market in 2024?

In 2024, the cervical cancer segment led the cancer vaccines market, primarily due to the widespread adoption of HPV vaccines like Gardasil and Cervarix. These vaccines effectively prevent infections from high-risk HPV types, notably 16 and 18, which are responsible for approximately 70% of cervical cancer cases. Global health initiatives, including school-based immunization programs and government-backed campaigns, have significantly increased vaccine coverage, especially in low-and middle-income countries, solidifying cervical cancer's dominant position in the market.

The bladder cancer segment is expected to grow significantly in the cancer vaccines market due to rising global cases and increased demand for targeted therapies. Innovation in immunotherapy, including mRNA-based and BCG-combined vaccines, has shown promising results in treating non-muscle invasive bladder cancer. Additionally, regulatory approvals and ongoing clinical trials are accelerating the development of effective vaccines. These factors, along with growing investments in personalized medicine, are driving substantial progress in this market.

How Does the Recombinant Vaccine Segment Dominate the Cancer Vaccines Market?

The recombinant vaccines segment dominated the cancer vaccines market due to its versatility and ability to generate strong immune responses using engineered proteins. This technology enables the development of highly targeted vaccines with improved safety profiles and fewer adverse reactions. Its success in producing effective vaccines like those for HPV has supported widespread clinical use. Moreover, the ease of large-scale production and adaptability to various cancer types have further strengthened its position in the market.

The viral vector and DNA cancer vaccine segment is projected to grow at the fastest rate due to its ability to elicit strong, targeted immune responses, especially T-cell activation, which is crucial for combating tumors. These platforms offer flexibility in design and rapid development, making them suitable for personalized therapies. Advancements in gene delivery systems and increased investment in immuno-oncology research are further propelling this segment's expansion in the cancer vaccines market.

- For Instance, In January 2023, Ferring B.V. announced that ADSTILADRIN (nadofaragene firadenovec-vncg) was now fully available across the U.S. for prescription. This therapy is designed for adults with high-risk, BCG-unresponsive non-muscle invasive bladder cancer (NMIBC), specifically those with carcinoma in situ, with or without papillary tumors. Thanks to major investments in manufacturing, the company was able to ensure complete product availability earlier than expected.

By Regional Insights

How is North America Contributing to the Expansion of the Cancer Vaccines Market?

North America is significantly contributing to the expansion of the cancer vaccines market through robust R&D investments, advanced healthcare infrastructure, and strong regulatory frameworks. The region accounts for a substantial share of global mRNA cancer vaccine research, with the U.S. hosting over 60% of such programs. High cancer incidence rates, particularly in the U.S. and Canada, drive demand for innovative treatments. Government initiatives and funding further bolster vaccine development and adoption, positioning North America as a leader in this sector.

- For Instance, In April 2023, research from the American Association for Cancer Research revealed that combining mRNA-4157/V940 with pembrolizumab improved treatment outcomes in patients with high tumor mutational burden, showing enhanced clinical benefits.

How is Asia-Pacific approaching the Cancer Vaccines Market in 2024?

The Asia-Pacific region is projected to experience the fastest CAGR in the cancer vaccines market due to several key factors. These include a rising cancer burden, with Asia accounting for 60% of global cases, and government-backed HPV immunization programs in countries like India and China. Additionally, advancements in personalized mRNA and neoantigen vaccine platforms, along with increased investments in biotech clusters and manufacturing capacity, are accelerating vaccine development and accessibility across the region.

- For Instance, In June 2023, Crowell & Moring International partnered with TogetHER for Health, Roche, and CAPED to launch the Asia-Pacific Women's Cancer Coalition. This initiative aims to raise awareness about the growing incidence of cervical and breast cancer in the region.

Top Companies in the Cancer Vaccines Market

- Merck & Co., Inc.

- GSK plc

- Dendreon Pharmaceuticals LLC.

- Dynavax Technologies.

- Ferring B.V.

- Amgen, Inc.

- Moderna, Inc.

- Sanofi

- AstraZeneca

- Bristol-Myers Squibb Company

Recent Developments in the Cancer Vaccines Market

- In April 2025, PharmaJet, known for its needle-free injection technology, is set to share findings from various partner trials involving DNA cancer vaccines at the World Vaccine event. These studies utilize PharmaJet’s Precision Delivery Systems to enhance the effectiveness and delivery of injectable treatments.

- In January 2025, the development of mRNA cancer vaccines is progressing quickly, with more than 60 candidates in clinical trials. This cutting-edge approach uses messenger RNA to activate the immune system to fight cancer cells. With ongoing research into different formulations and cancer types, this field is rapidly evolving, offering promising new treatment options for patients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cancer vaccine market.

By Vaccine Type

- Preventive Cancer Vaccines

- Therapeutic Cancer Vaccines

- Others

By Indication Type

- Prostate Cancer

- Bladder Cancer

- Melanoma

- Cervical Cancer

- Other

By Technology Type

- Recombinant Cancer Vaccines

- Whole-cell Cancer Vaccines

- Viral Vector and DNA Cancer Vaccines

- Other Technologies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)