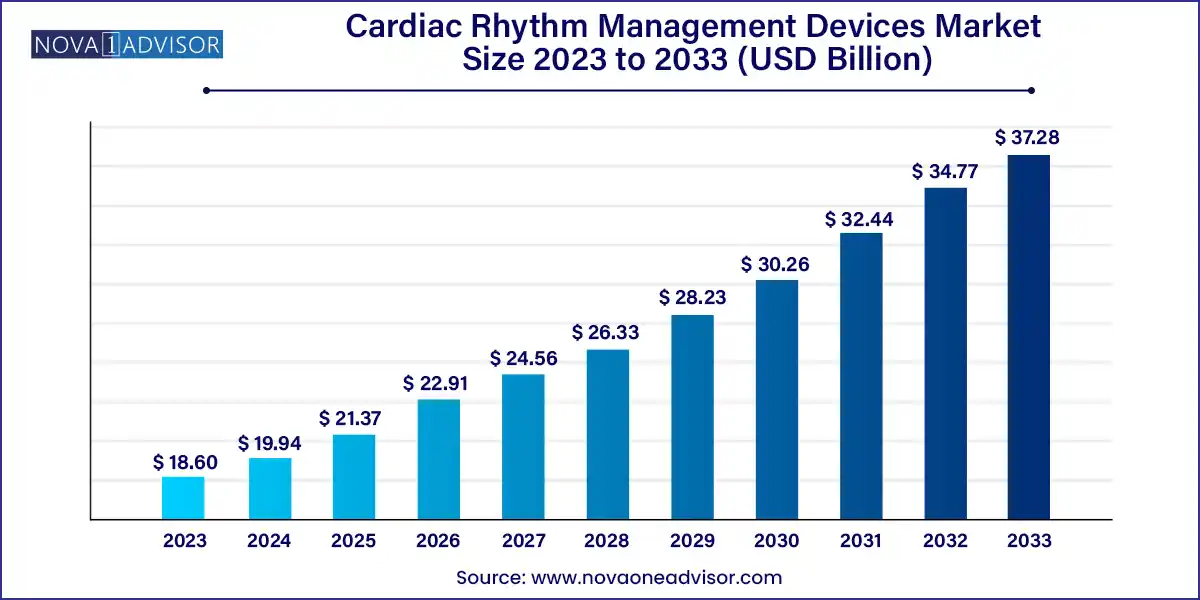

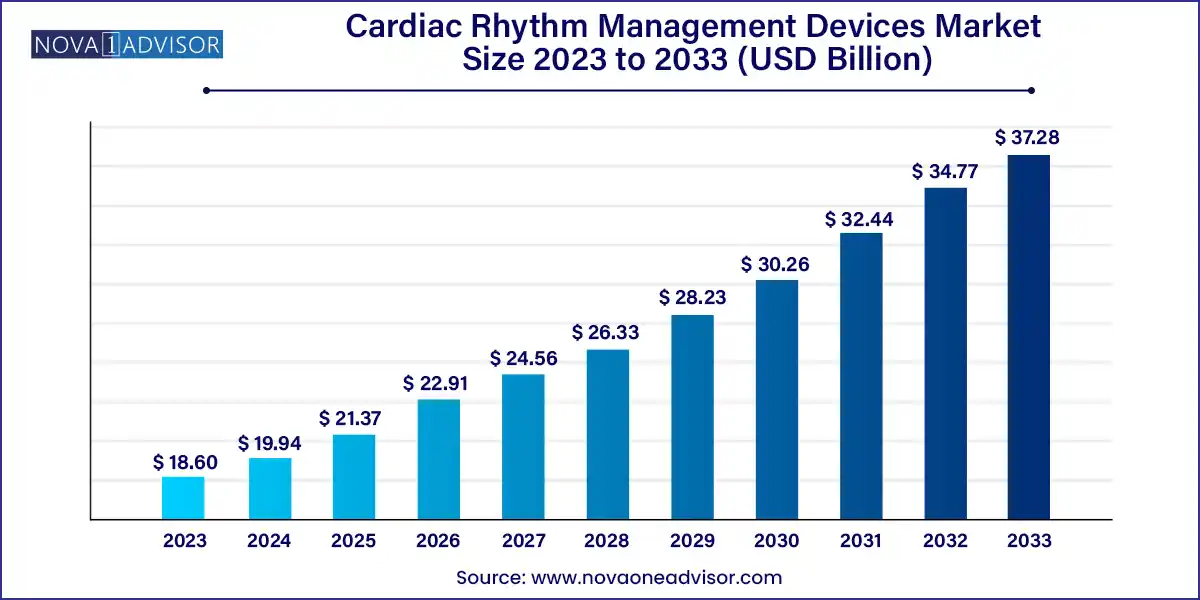

The global cardiac rhythm management devices market size was exhibited at USD 18.60 billion in 2023 and is projected to hit around USD 37.28 billion by 2033, growing at a CAGR of 7.2% during the forecast period 2024 to 2033.

Key Takeaways:

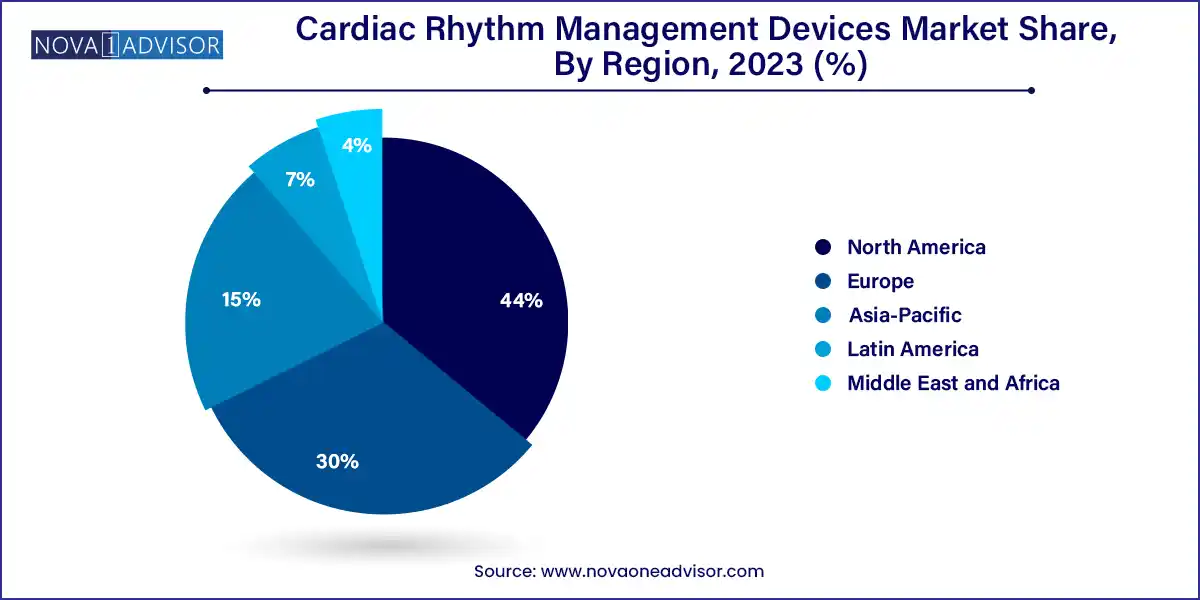

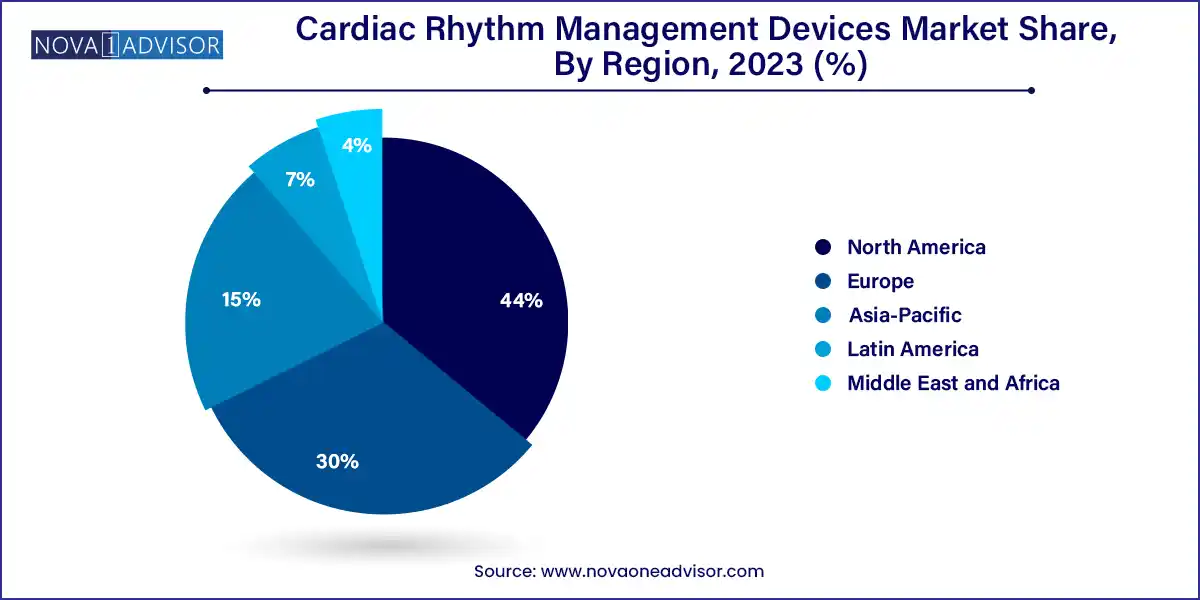

- North America dominated the overall market with a share of 44.0% in 2023.

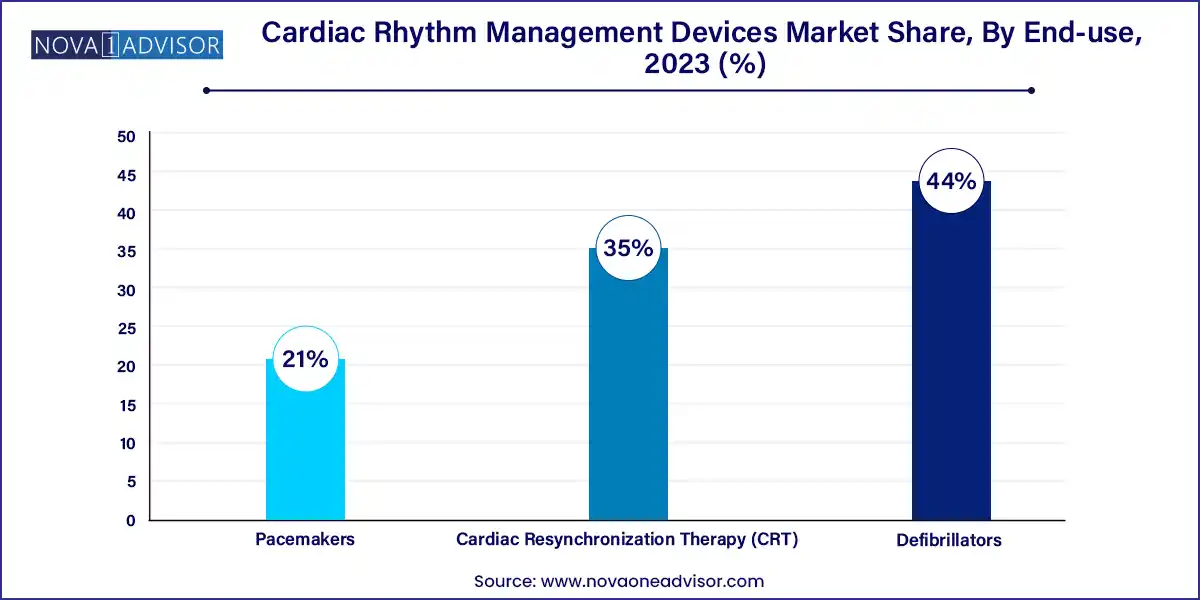

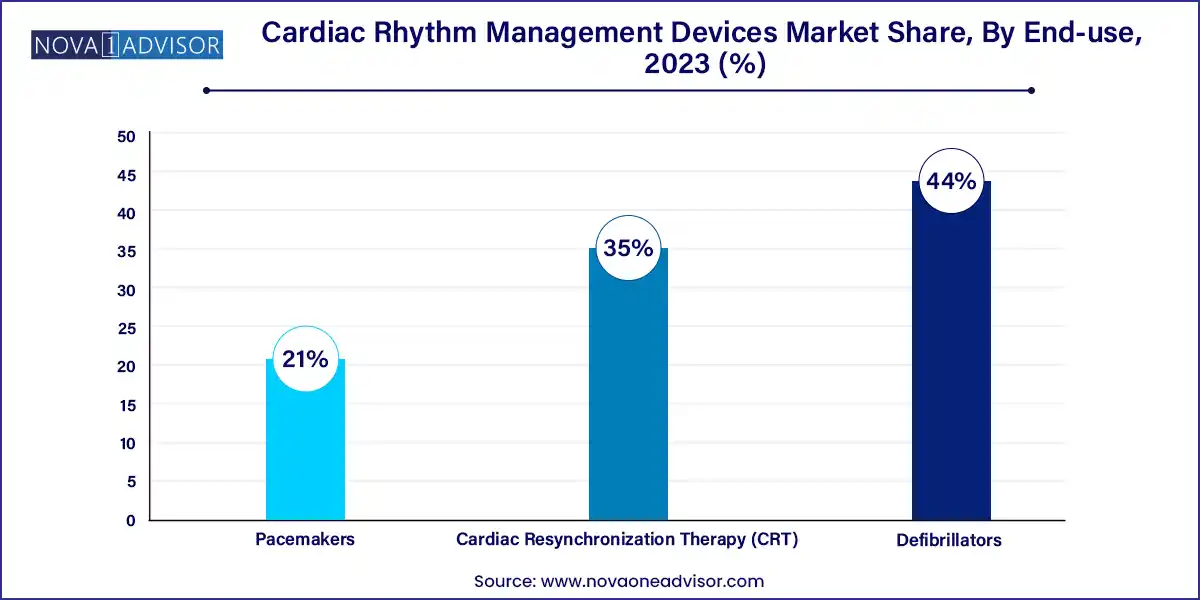

- The defibrillators segment held the largest share of over 44.0% in 2023.

Market Overview

The Cardiac Rhythm Management (CRM) Devices Market plays a pivotal role in the global medical device industry, addressing the urgent clinical need for managing and correcting abnormal heart rhythms. These devices encompass pacemakers, defibrillators, and cardiac resynchronization therapy (CRT) systems, each tailored to restore and maintain adequate cardiac function in patients experiencing arrhythmias, bradycardia, heart block, or heart failure.

As cardiovascular disease remains the leading cause of death worldwide claiming approximately 18 million lives annually according to the WHO the role of CRM devices in improving survival and quality of life has become increasingly critical. These devices not only reduce mortality associated with sudden cardiac arrest (SCA) but also help prevent disease progression in heart failure patients.

CRM technology has evolved significantly, moving from bulky, hospital-dependent solutions to miniaturized, intelligent, connected implants that offer real-time data transmission, AI-guided therapy adjustments, and remote patient monitoring. With aging populations, increasing arrhythmia incidence, and heightened awareness of early intervention benefits, CRM devices are becoming essential across inpatient, outpatient, and emergency care settings.

Moreover, rising adoption in emerging economies, supportive reimbursement policies in developed markets, and technological breakthroughs are expanding the global CRM device landscape. As healthcare systems increasingly shift toward preventive care and outpatient models, CRM devices are at the forefront of enabling predictive, personalized, and remote cardiology solutions.

Major Trends in the Market

-

Rise of Leadless and Wireless Technologies: Leadless pacemakers and wireless ICDs are reducing infection risks, improving patient comfort, and simplifying surgical procedures.

-

Growing Demand for MRI-Conditional Devices: With an increasing number of patients requiring MRIs, manufacturers are developing CRM devices compatible with MRI scans.

-

Integration with Remote Monitoring and Digital Health Platforms: CRM devices are now paired with mobile apps and cloud-based platforms for real-time rhythm monitoring and data sharing with healthcare providers.

-

Emergence of AI and Predictive Analytics: Algorithms are being used to predict arrhythmia episodes and recommend adjustments to pacing or defibrillation settings.

-

Miniaturization and Battery Innovations: Extended battery life and smaller form factors are making implants less invasive and reducing the need for replacement surgeries.

-

Hybrid Devices with Dual Functions: CRT-defibrillator combos and wearable cardioverter-defibrillators are emerging as solutions for multi-condition patients.

-

Increased Use in Out-of-Hospital Cardiac Arrest (OHCA): Public availability of AEDs and wearable defibrillators is expanding life-saving coverage beyond hospitals.

Cardiac Rhythm Management Devices Market Report Scope

Market Driver: Global Rise in Cardiovascular Disease and Arrhythmia Cases

A primary driver of the cardiac rhythm management devices market is the surging global burden of cardiovascular diseases, particularly arrhythmias, heart block, and sudden cardiac arrest (SCA). The rising prevalence of risk factors such as hypertension, obesity, diabetes, and sedentary lifestyles has led to an increased incidence of heart rhythm disorders globally.

Conditions like atrial fibrillation (AFib), which affects over 33 million people worldwide, significantly raise the risk of stroke and heart failure. Additionally, sudden cardiac arrest is responsible for hundreds of thousands of deaths annually, many of which are preventable through timely defibrillation or pacing. CRM devices such as implantable pacemakers, ICDs, and CRTs have demonstrated clear clinical benefits in extending survival and improving quality of life in such patients.

This growing disease burden, coupled with improved diagnostic techniques and awareness campaigns, is driving early detection and treatment ultimately accelerating the demand for CRM solutions across all healthcare levels.

Market Restraint: High Cost of Devices and Limited Reimbursement in Some Regions

One of the major constraints in the CRM devices market is the high cost of implants and associated surgical procedures, particularly in resource-constrained regions. CRM devices especially ICDs and CRTs can cost between $10,000 and $40,000, excluding procedural, follow-up, and device maintenance expenses.

While developed markets like the U.S. and Western Europe benefit from established reimbursement policies through Medicare and private insurers, many developing economies lack comprehensive coverage, making access to advanced CRM therapies financially prohibitive. Additionally, in some regions, regulatory approval delays and insufficient infrastructure for cardiac surgeries further restrict adoption.

This cost-related restraint hampers CRM device penetration, particularly in rural and underdeveloped healthcare ecosystems, creating a stark disparity between need and access.

Market Opportunity: Expansion of Wearable and Public Access Defibrillators

A transformative opportunity within the CRM market is the increasing adoption of wearable defibrillators and publicly accessible automated external defibrillators (AEDs). These technologies address the crucial gap in care during out-of-hospital cardiac arrests (OHCA), which are often fatal due to delayed intervention.

Wearable cardioverter defibrillators (WCDs) provide non-invasive SCA protection for patients at temporary risk—such as those awaiting implantable ICDs or recovering from a recent cardiac event. These wearable devices are gaining traction in outpatient and transitional care settings.

Simultaneously, governments and institutions are investing in widespread AED installations in airports, schools, malls, and sports arenas, driven by awareness campaigns and lifesaving potential. For instance, initiatives like the “Heart Safe City” program in the U.S. and Japan’s AED expansion strategy are fostering public access and adoption. This trend opens new consumer-facing and institutional CRM submarkets.

Segments Insights:

By Product Insights

Pacemakers dominated the product category, owing to their extensive clinical usage in managing bradycardia and atrioventricular block. Implantable pacemakers are the standard of care for patients with slow heart rates, offering long-term rhythm correction with high efficacy. These devices are widely used in elderly patients, a group rapidly expanding due to global aging trends. Technological advancements such as dual-chamber pacing, MRI-compatibility, and rate-responsive modes have further enhanced clinical outcomes, solidifying pacemakers as a foundational CRM solution.

However, implantable cardioverter defibrillators (ICDs) are the fastest-growing product segment, particularly among patients at high risk of sudden cardiac arrest (SCA) and ventricular tachyarrhythmias. The S-ICD (subcutaneous) subtype, which does not require leads in the heart, is gaining popularity due to its reduced infection risk and ease of implantation. Additionally, wearable defibrillators are becoming increasingly relevant in short-term SCA prevention, offering a bridge-to-ICD solution for post-MI and heart failure patients. The expansion of ICD eligibility criteria and increasing clinical evidence supporting their effectiveness is fueling rapid adoption worldwide.

By Regional Insights

North America dominates the global CRM devices market, attributed to its high disease burden, advanced healthcare infrastructure, and strong regulatory and reimbursement frameworks. The U.S. alone accounts for a significant proportion of pacemaker, ICD, and CRT implantations globally. The presence of leading manufacturers such as Medtronic, Boston Scientific, and Abbott Laboratories alongside numerous cardiac centers and high adoption of digital health platforms, drives market leadership. Additionally, robust funding for cardiac research and population screening programs further boosts CRM usage.

Conversely, Asia-Pacific is the fastest-growing region, fueled by a rising prevalence of cardiovascular disease, growing middle-class populations, and rapid healthcare modernization. Countries such as China, India, Japan, and South Korea are witnessing increased CRM device usage due to expanding diagnostic services, government-backed cardiac care initiatives, and foreign investments. For instance, India’s Ayushman Bharat health scheme is increasing access to tertiary care, while China’s "Healthy China 2030" initiative includes heart disease prevention strategies. Rising medical tourism in the region also contributes to growth, as CRM implantation procedures are often more affordable than in the West.

Recent Developments

-

March 2025 – Boston Scientific announced FDA approval for its Emblem S-ICD Gen 3, featuring extended battery life, real-time data analytics, and a reduced implant footprint.

-

February 2025 – Medtronic launched its LINQ III Insertable Cardiac Monitor with artificial intelligence-powered arrhythmia detection and seamless EHR integration.

-

January 2025 – Abbott Laboratories began global distribution of its Aveir DR Leadless Pacemaker System, the world’s first dual-chamber leadless pacemaker system with communication between atrial and ventricular modules.

-

October 2024 – Biotronik partnered with AliveCor to develop a combined wearable and implantable monitoring platform for continuous patient rhythm assessment.

-

August 2024 – Nihon Kohden launched a new AED unit optimized for rural clinics in Asia and Latin America, featuring voice prompts in multiple languages and remote diagnostics.

Some of the prominent players in the Cardiac rhythm management devices market include:

- Physio-Control, Inc. (Stryker)

- BIOTRONIK

- Schiller

- Medtronic

- Abbott

- Koninklijke Philips N.V.

- Zoll Medical Corporation

- Schiller

- Boston Scientific Corporation

- Progetti Srl

- LivaNova Plc

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cardiac rhythm management devices market.

Product

-

- Implantable Cardioverter Defibrillators (ICD)

-

-

- Manual External Defibrillator

- Automatic External Defibrillator

- Wearable Cardioverter Defibrillator

- Cardiac Resynchronization Therapy (CRT)

-

- CRT-Defibrillator

- CRT-Pacemakers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)