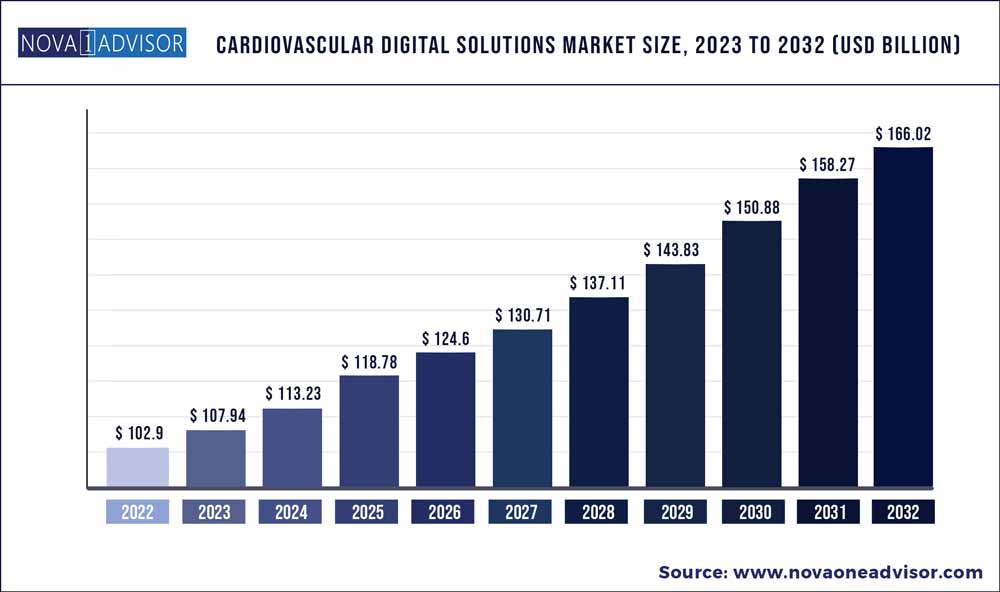

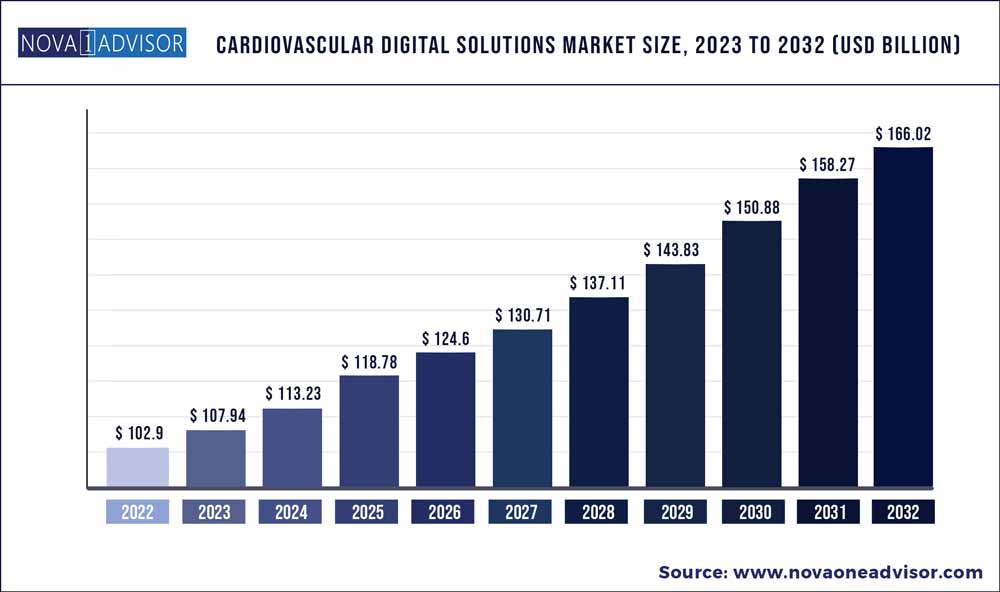

The global cardiovascular digital solutions market size was exhibited at USD 102.9 billion in 2022 and is projected to hit around USD 166.02 billion by 2032, growing at a CAGR of 4.9% during the forecast period 2023 to 2032.

Key Pointers:

- The unobtrusive testing segment accounted for the largest revenue share of 39.9% in 2022.

- The devices segment accounted for the largest revenue share of 74.14% in 2022 and is expected to continue its dominance with the fastest growth rate of 4.11% in the forecast period.

- The cloud-based segment accounted for the largest revenue share of 67.19% in 2022 and is expected to continue its dominance with the fastest growth rate of 5.2% over the forecast period.

- The hospitals & clinics segment accounted for the largest revenue share of 50.26% in 2022 and is expected to continue its dominance with the fastest growth rate of over 5.1% from 2023-2030.

- The ambulatory care centers are expected to witness a CAGR of 4.9% during the forecast period.

- North America dominated the market and accounted for the largest revenue share of 40.3% in 2022.

- The Asia Pacific cardiovascular digital solutions market is anticipated to witness rapid growth in the forecast period with a CAGR of 5.4%.

Cardiovascular Digital Solutions Market Report Scope

Cardiovascular diseases are the most common cause of mortality and morbidity and require a detailed multi-parameter evaluation beyond the ECG. Digital solutions are important for monitoring patients, early detection, and intervention of cardiac conditions to make cardiac care more tailored and efficient. The increase in the prevalence of cardiovascular diseases globally and the rapid advancement in healthcare technology worldwide are some of the major factors driving the growth of the cardiovascular digital solutions market.

The COVID-19 pandemic caused a mild decline in the cardiovascular digital solutions market. The COVID-19 pandemic brought a global crisis for the major world economies, specifically the healthcare industry. Key players in the market continued to alter their plans in response to the constantly shifting circumstances. However, different countries and key players in the market had undertaken critical healthcare modifications until the emergency takes a back seat.

North America dominated the market and accounted for the largest revenue share of 40.3% in 2022. This is owing to the rapid technological advancements in the medical sector and the highly developed health infrastructure of the region. In addition, the rise in the prevalence of cardiovascular conditions is further increasing the growth of the market. As per the article published by Future Science Group on “As per the article published by Future Science Group, an estimated 3.6 million heart failure hospitalizations and 7.6 million diagnosed prevalent chronic heart failure (CHF) cases were witnessed in North America in 2020.

The Asia Pacific cardiovascular digital solutions market is anticipated to witness rapid growth in the forecast period with a CAGR of 5.4%. The increase in the geriatric population and the development of cardiac health management technology in Asian countries are driving the growth of the regional market. As per the article published by JACC journals on "Epidemiological Features of Cardiovascular Disease in Asia" cardiovascular disease (CVD) continues to be the leading cause of death and premature death worldwide. Around 58% of the 18.6 million CVD fatalities that occurred globally in 2019 were in Asia. As the nation with the highest population density and the widest diversity of cultures, ethnicities, socioeconomic status, and health care systems, Asia Pacific faces numerous challenges in cardiovascular disease prevention and treatment.

Cardiovascular Digital Solutions Market Segmentation