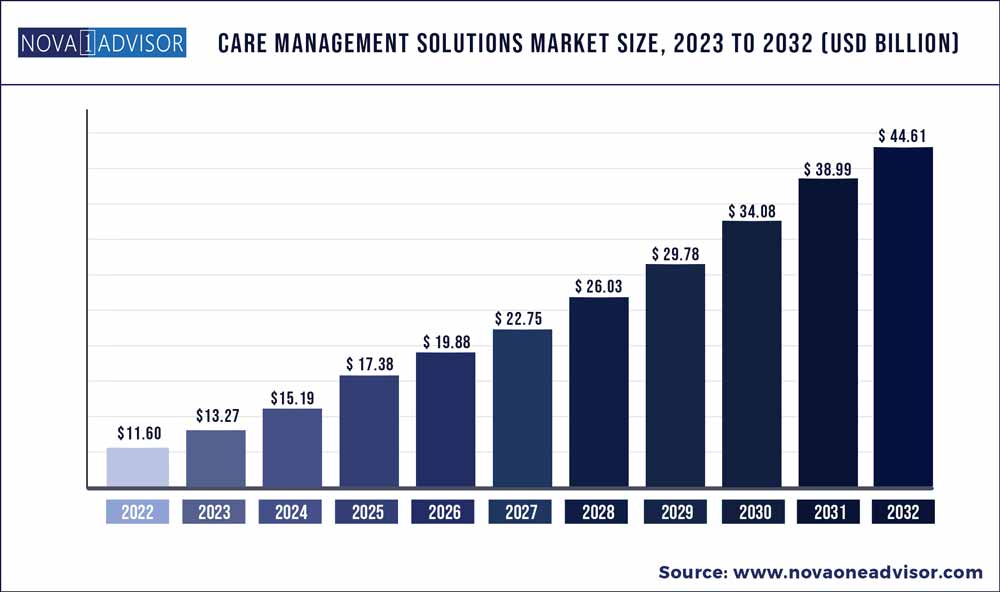

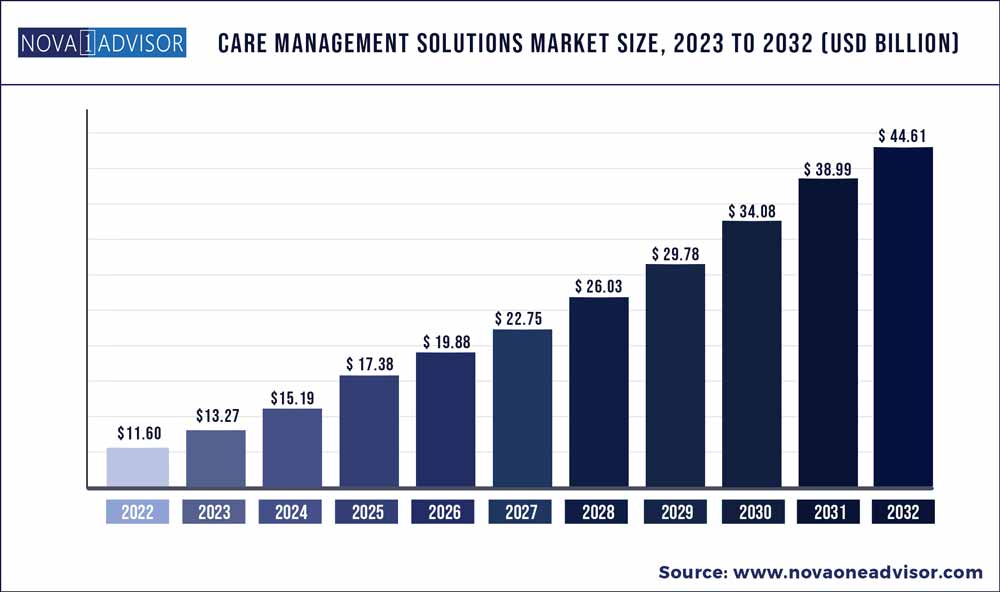

The global care management solutions market size was exhibited at USD 11.60 billion in 2022 and is projected to hit around USD 41.61 billion by 2032, growing at a CAGR of 14.42% during the forecast period 2023 to 2032. Increasing focus on patient-centric care and the growing burden of healthcare expenditure is boosting the need for integrated health solutions. As a result, they are being used more frequently by healthcare payers, governments, and employer groups. Furthermore, the increasing adoption of technological software and services in the healthcare system is favoring industry growth.As the prevalence of various chronic diseases increases, the need for effective disease management solutions rises.

Key Takeaways:

- The software segment led the industry in 2022 with a share of more than 57.50% and is estimated to remain dominant throughout the forecast period.

- The healthcare providers segment accounted for the major share of more than 54.20% of the global revenue in 2022.

- The web-based segment dominated the industry with a share of 39.2% in 2022.

- North America led the overall industry in 2022 with a revenue share of 51.3%.

Care management solutions Market Report Scope

According to the Centers for Disease Control and Prevention, 90% of USD 4.1 trillion in health expenditure is spent on people with chronic physical and mental health disorders. This rising cost of healthcare possess a huge challenge to the healthcare system. Rising healthcare expenditures have created a strong need to reduce costs while also improving the quality of care. Disease management software can be used to perform risk stratification to access patient care. This helps providers in reducing the overall healthcare cost. Supportive government initiatives boosting the adoption of HCIT solutions to improve patient experience and reduce cost are expected to favor industry growth. Governments insist on value-based care.

The fee-for-services is slowly moving towards value-based care, which is increasing the demand for health management interventions to improve patient engagement and outcomes and deliver results across a wide spectrum of the patient population. Apart from cost reduction and improved efficiency, health management software offers potential advantages in data aggregation. They can aggregate large pools of data, which can be used for predictive analysis. Furthermore, they also help in communication between patients and providers, enabling them to manage multiple patients at one time.

Patients included in care management programs have reduced hospitalizations and ER visits and improved health status and quality of life, as demonstrated by the Alliance of Community Health Plans. The growing adoption of integrated health management services and other digital systems has boosted the launch of new software. For instance, in July 2020, Health Catalyst, Inc., the provider of services and data analytics to healthcare organizations, launched a Care Management Suite, an analytical and patient-centric data-driven method. In April 2022, CareCloud, Inc., introduced a new service for chronic care management. The new services for chronic disease management are part of its rising range of digital health solutions that helps providers in improving patient treatment and revenue streams.

Component Insights

Based on components, the industry has been further bifurcated into services and software. The software segment led the industry in 2022 with a share of more than 57.50% and is estimated to remain dominant throughout the forecast period. The segment is also projected to witness the fastest growth over the forecast period. This can be attributed to the ease of use and affordability of software. Software solutions provide coordinated and efficient care. They enable providers to effectively diagnose patients, monitor a patient’s vitals and medications, minimize errors during surgery, and generate digital records for clinical research.

Increasing spending on IT solutions by healthcare facilities, rising demand for patient-centric software, and increasing focus of key players on enhancing their existing software are propelling segment growth. For instance, in July 2022, VirtualHealth released a modernized utilization management module within HELIOS, a cloud-based care management software. Increasing numbers of service providers as well as providers outsourcing care managers are boosting the growth of the service segment. Furthermore, incentive programs by the governments to ensure coordinated healthcare for patients are expected to boost segment growth. For instance, the Centers for Medicare and Medicaid Services (CMS) allows providers to use chronic care management codes and participate in incentive programs.

End-use Insights

In terms of end-uses, the industry has been segmented into healthcare payers, healthcare providers, and others, such as employers and governments. The healthcare providers segment accounted for the major share of more than 54.20% of the global revenue in 2022. Increasing demand for patient-centric care, improved quality of healthcare, growing patient base, and rising need for faster services are factors responsible for the dominant share of the segment. The presence of well-developed hospitals and increased strategic initiatives by key players are set to drive segment growth.

For instance, in February 2022, MyHealthcare, a supplier of a digital healthcare ecosystem, released the MyHealthcare Enterprise Application (MHEA) for hospitals and other healthcare facilities. This MHEA ecosystem is constructed on a configurable workflow engine that lets hospital teams and clinicians manage hospital operations and patient care. Health insurance companies highly depend on statistical models and clinical models. Big data analysis helps them identify members with certain chronic conditions and formulate the most relevant disease management programs for patients. It also helps them increase the efficiency of healthcare management programs.

Mode of Delivery Insights

Based on the mode of delivery, the industry is divided into web-based, cloud-based, and on-premise. The web-based segment dominated the industry with a share of 39.2% in 2022. However, the cloud-based segment is expected to register the fastest CAGR during the forecast period. Cloud-based software provides higher flexibility, is easy to scale up depending on the patient base, and is comparatively more affordable than other modes of delivery. These factors are responsible for the higher growth of the segment. The rising adoption of cloud-based EHR by healthcare providers to improve accessibility, security, and storage capabilities is driving industry growth.

Moreover, the need for cloud-based care management solutions is also anticipated to increase as the healthcare industry uses cloud computing in the coming years. The disease management solutions offer an exclusive combination of real-time integrated data and best practices. In addition, on-premises software support healthcare providers in enhancing patient health management programs. They are usually preferred by large health systems as they have a high patient load, complex workflow, and high budget.

Regional Insights

North America led the overall industry in 2022 with a revenue share of 51.3%. The growth of the industry is attributed to the growing adoption of patient care solutions that assist in succeeding healthcare goals of lower costs and improved quality by healthcare providers. In addition, increasing adoption of cloud-based software and technological advancements are booting the industry growth in the region. In addition, strong government support is propelling the growth. For instance, Principal Care Management (PCM) services were introduced by The American Medical Association in 2020 to provide chronic care management for individuals with a single chronic ailment or with numerous chronic conditions.

Such initiatives from the government will fuel the demand in the coming years. Asia Pacific, on the other hand, is expected to register the fastest CAGR over the forecast period. Improvement of healthcare facilities due to rapid economic development witnessed in emerging countries, such as China, Japan, South Korea, and India, is one of the high-impact rendering drivers. Rising interest and investments by prominent industry players and ongoing collaborative efforts are also responsible for regional growth. For instance, in May 2018, SingHealth, a Singapore-based healthcare group, collaborated with Allscripts to implement the iPro Anesthesia platform across SingHealth’s institutions. The software keeps track of patients’ vital signs and medications during surgery as well as generates digital records for clinical research.

Some of the prominent players in the Care management solutions Market include:

- Allscripts Healthcare, LLC

- Epic Systems Corp.

- Cognizant

- ExlService Holdings, Inc.

- Koninklijke Philips N.V.

- Cerner Corp. (Oracle)

- ZeOmega

- Medecision

- IBM

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Care management solutions market.

Component Outlook

Mode of Delivery Outlook

- Web-based

- Cloud-based

- On-premise

End-use Outlook

- Healthcare Providers

- Healthcare Payers

- Others

Regional Outlook

-

- U.K.

- Germany

- France

- Italy

- Spain

-

- China

- Japan

- India

- Australia

- South Korea

-

- South Africa

- Saudi Arabia