Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market Size and Trends

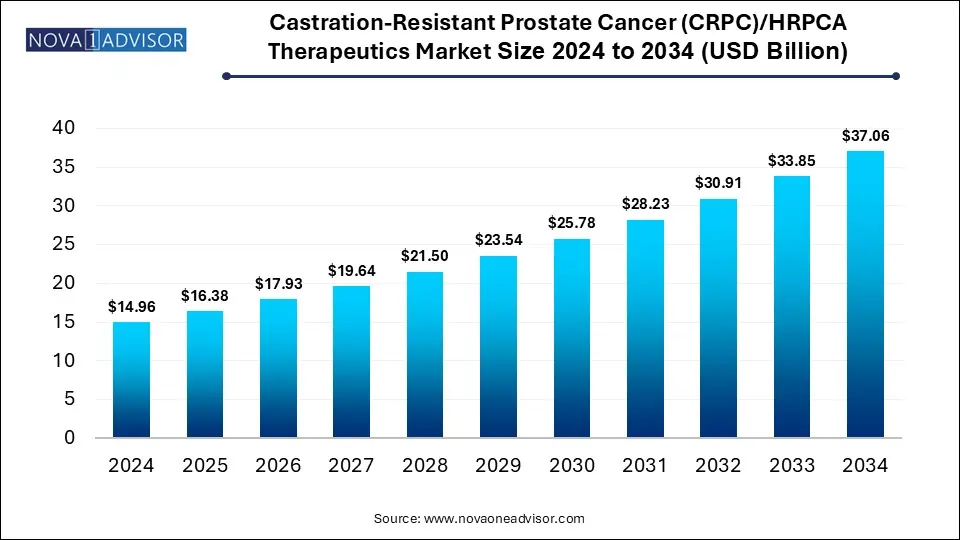

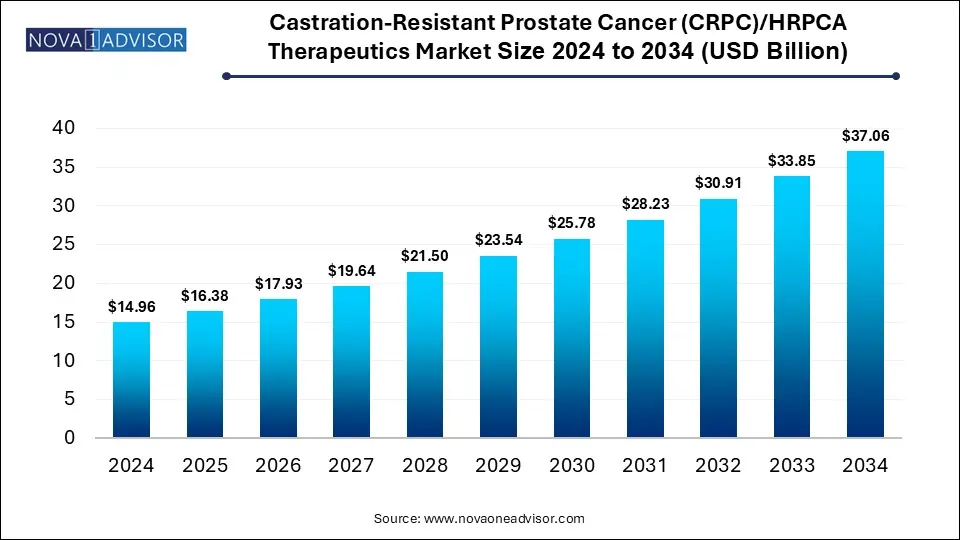

The global castration-resistant prostate cancer (CRPC)/HRPCA therapeutics market size is calculated at USD 14.96 billion in 2024, grow to USD 16.38 billion in 2025, and is projected to reach around USD 37.06 billion by 2034, growing at a CAGR of 9.5% from 2025 to 2034. The market is growing due to the rising incidence of advanced prostate cancer and the increasing adoption of next-generation hormonal therapies. Additionally, improved diagnostics methods are enhancing earlier and more targeted treatment.

Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market Key Takeaways

- North America dominated the castration-resistant prostate cancer (CRPC)/HRPCA therapeutics market in 2024.

- Asia-Pacific is expected to grow at the highest CAGR in the market during the forecast period.

- By therapy type, the hormonal therapy segment dominated the market in 2024.

- By therapy type, the radiation therapy segment is expected to grow at the fastest CAGR in the market during the studied years.

- By drug delivery method, the oral therapy segment held the largest market share.

- By drug delivery method, the injectable segment is expected to grow at the fastest CAGR in the market during the studied years.

How Innovation is Impacting Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market

Castration-resistant prostate cancer (CRPC)/HRPCA therapeutics refer to treatment developed for prostate cancer that continues to grow despite low testosterone levels, including advanced hormonal therapies, chemotherapy, immunotherapy, and targeted drugs. Innovation is driving the castration-resistant prostate cancer (CRPC)/HRPCA therapeutics market through the development of advanced treatments like PARP inhibitors, radioligand therapy, and next-generation hormonal drugs. These innovations offer better targeting of cancer cells, improved patient outcomes, and longer survival rates. Additionally, precision medicine and biomarker-based approaches are enabling more personalized therapies, while ongoing clinical trials continue to expand treatment options for patients with advanced, treatment prostate cancer.

- For Instance, According to the American Cancer Society, Prostate cancer mainly affects older men, with most cases diagnosed at age 65 or above and rarely before 40. The average age at diagnosis is 67. In 2025, the U.S. is expected to report around 313,780 new cases and 35,770 deaths, according to the American Cancer Society.

What are the Key Trends in the Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market in 2025?

- In October 2023, Novartis shared results from its Phase III PSMAfore trial at the ESMO Congress. Presented during the Presidential Symposium, the data showed that Pluvicto (lutetium-177 vipivotide tetraxetan) significantly improved radiographic progression-free survival (rPFS) in patients with PSMA-positive metastatic castration-resistant prostate cancer (mCRPC) who had already been treated with androgen receptor pathway inhibitors (ARPIs), outperforming ARPI therapy alone.

- In August 2023, the U.S. FDA approved Akeega a fixed-dose combination of niraparib and abiraterone acetate with prednisone for adult patients with castration-resistant prostate cancer (mCRPC) who have confirmed or likely harmful BRCA mutations, as identified by an FDA-approved test.

How Can AI Affect the Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market?

AI is positively impacting the CRPC/HRPCA therapeutic market by enabling faster drug discovery, improving patient stratification, and enhancing diagnostic accuracy through imaging and biomarker analysis. It supports personalized treatment plans by analyzing large datasets to predict treatment responses. AI also accelerates clinical trials by identifying suitable candidates and optimizing trial design. Overall, AI contributes to more efficient, targeted, and cost-effective approaches to managing advanced prostate cancer.

Report Scope of Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 16.38 Billion |

| Market Size by 2034 |

USD 37.06 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Therapy Type, By Drug Delivery Method, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Astellas, Abbott Laboratories, Active Biotech AB, Astellas Pharma Inc., Bayer AG., Dendreon Corporation, GlaxoSmithKline PLC, Johnson & Johnson |

Market Dynamics

Driver

Increasing Prevalence of Advanced Prostate Cancer

The rising prevalence of advanced prostate cancer drives the Castration-resistant prostate cancer (CRPC)/HRPCA therapeutics market as more patients progress to treatment-resistant stages, creating greater demand for effective therapies. With aging populations and improved diagnostics, more cases are identified earlier, but many still advance to castration resistance. This fuels the need for innovative treatment, including targeted therapies and next-generation hormonal agents, pushing research, development, and adoption of advanced (CRPC)/HRPCA therapeutics globally.

- For Instance, According to the World Health Organization, prostate cancer cases are expected to rise to 1.7 million per year by 2030. This growing number highlights the urgent need for advanced and effective treatment options to manage the increasing patient load.

Restraint

High Treatment costs

High treatment costs can limit in Castration-resistant prostate cancer (CRPC)/HRPCA therapeutics market because advanced therapies such as PARP inhibitors, immunotherapies, and radioligand treatments are often expensive and not affordable for all patients. Limited insurance coverage, especially in low and middle-income regions, further restricts access. This financial burden can lead to delayed or discontinued treatment, reducing overall market penetration and hindering optimal patient outcomes.

- For Instance, A report by the Centers for Medicare & Medicaid Services (CMS) highlights that treating castration-resistant prostate cancer (CRPC) can cost over $100,000 per year. This high expense places a heavy financial strain on both patients and healthcare providers, making access to advanced therapies more challenging.

Opportunity

Combination Therapies and Personalized Medicine

Combination therapies and personalized medicine represent a major future opportunity in the Castration-resistant prostate cancer (CRPC)/HRPCA therapeutics market because, they offer more effective, tailored treatment strategies. By targeting multiple cancer pathways simultaneously, combination therapies can improve outcomes and overcome resistance to single-agent treatments. Personalized medicine, guided by genetic and biomarker profiling, ensures that patient receives therapies most suited to their cancer type. This approach enhances efficacy, reduces side effects, and supports the growing demand for precision oncology solutions.

Segmental Insights

How Hormonal Therapy Segment Dominate the Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market in 2024?

In 2024, the hormonal therapy segment led the market due to its established efficacy in slowing cancer progression by targeting androgen signaling, which fuels prostate cancer growth. Widely used drugs like enzalutamide and abiraterone acetate remain standard treatment, especially in early and advanced stages. Their proven clinical benefits, broad availability, and ability to extend survival make hormonal therapies the preferred choice among physician, driving their dominance in the market.

The radiation therapy segment is projected to grow at the fastest rate in the Castration-resistant prostate cancer (CRPC)/HRPCA therapeutics market due to rising adoption of advanced techniques like radioligand therapy, particularly with agents such as Lutetium-177-PSMA. These therapies offer targeted treatment with fewer side effects and improved outcomes for metastatic cases. Growing clinical evidence, regulatory approvals, and increasing availability are driving demand, positioning radiation therapy as an emerging option in the evolving prostate cancer treatment landscape.

Why Did the Oral Therapy Segment Dominate the Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market in 2024?

In 2024, the oral therapy segment held major shares of in market due to its convenience, patient compliance, and widespread use of effective oral drugs like enzalutamide, abiraterone, and the newly approved Akeega. Oral treatments reduce the need for hospital visits and invasive procedures, making them more accessible and manageable for long-term care. Their ease of administration and strong clinical outcomes contribute to their growing preference among both patients and healthcare providers.

The injectable segment is witnessing rapid growth in the Castration-resistant prostate cancer (CRPC)/HRPCA therapeutics market as newer treatment options such as radiopharmaceuticals and monoclonal antibodies require intravenous or subcutaneous administration. These therapies are gaining traction for their precision in targeting metastatic tumors and improving patient outcomes. Moreover, healthcare providers increasingly prefer injectables for delivering consistent dosing in clinical settings, especially for patients with advanced disease who may not respond well to oral medications.

Regional Insights

How is North America Contributing to the Expansion of the Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market?

North America dominated the market in 2024 due to its well-established healthcare infrastructure, high prevalence of prostate cancer, and strong presence of key pharmaceutical companies. The region also benefits from the early adoption of advanced therapies, extensive R&D activities, and favorable reimbursement policies. Additionally, increasing awareness, regular screening programs, and access to cutting-edge treatments like radioligand and targeted therapies have further contributed to North America’s leading position in the market.

- For Instance, In March 2025, the FDA approved lutetium Lu 177 for use in chemotherapy-naïve metastatic castration-resistant prostate cancer (mCRPC), following strong results from the Phase 3 PSMAfore trial. The therapy reduced the risk of radiographic progression or death by 59% and more than doubled median progression-free survival to 11.6 months. One patient, previously ineligible and reluctant to begin chemotherapy, was treated within six days of approval, becoming the first commercial recipient—highlighting the real-world impact of this milestone.

How is Asia-Pacific approaching the Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market in 2025?

Asia-Pacific is witnessing rapid growth in the market due to increasing healthcare investments, rising adoption of precision medicine, and greater availability of advanced therapies in emerging economies. Pharmaceutical companies are also expanding clinical trials and drug launches in the region, driven by a large patient pool and favorable regulatory changes. These developments, along with improved diagnostic capabilities and growing awareness, are accelerating market expansion across Asia-Pacific.

Some of The Prominent Players in The Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market Include:

Recent Developments in the Castration-Resistant Prostate Cancer (CRPC)/HRPCA Therapeutics Market

- In September 2024, Ipsen reported results from the Phase III CONTACT-02 trial evaluating Cabometyx® with atezolizumab in metastatic CRPC. While the combination did not show a statistically significant improvement in overall survival, it successfully achieved its progression-free survival (PFS) goal, marking a step forward in treatment options for mCRPC patients.

- In September 2024, Oncternal Therapeutics decided to halt the clinical development of ONCT-534, its dual-action androgen receptor inhibitor, which was being tested for treating metastatic castration-resistant prostate cancer (mCRPC).

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Pulmonary Embolism Market

By Therapy Type

- Hormonal therapy

- Chemotherapy

- Immunotherapy

- Radiotherapy

By Drug Delivery Method

- Oral Route

- Injectable Route

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)