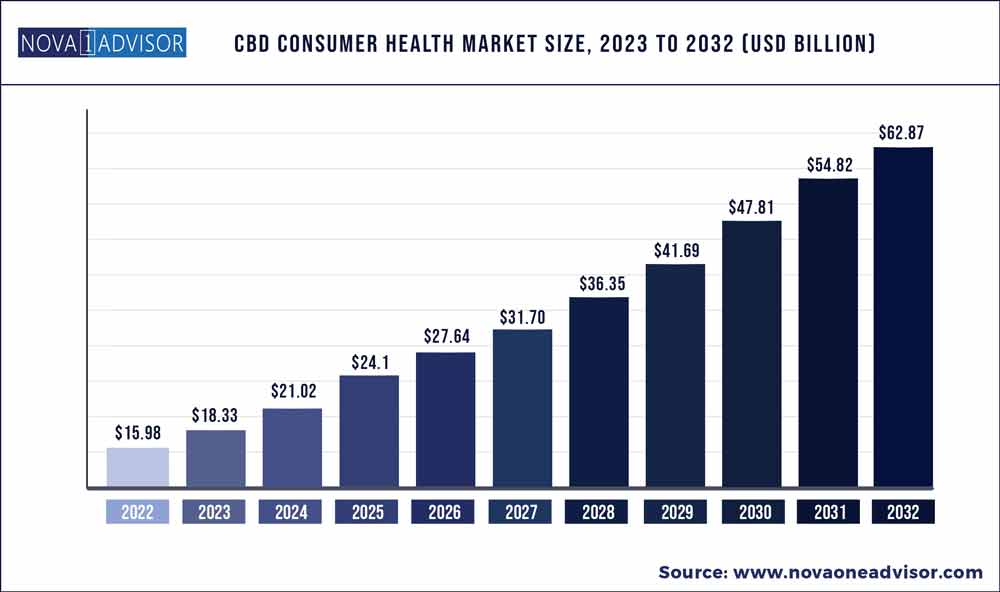

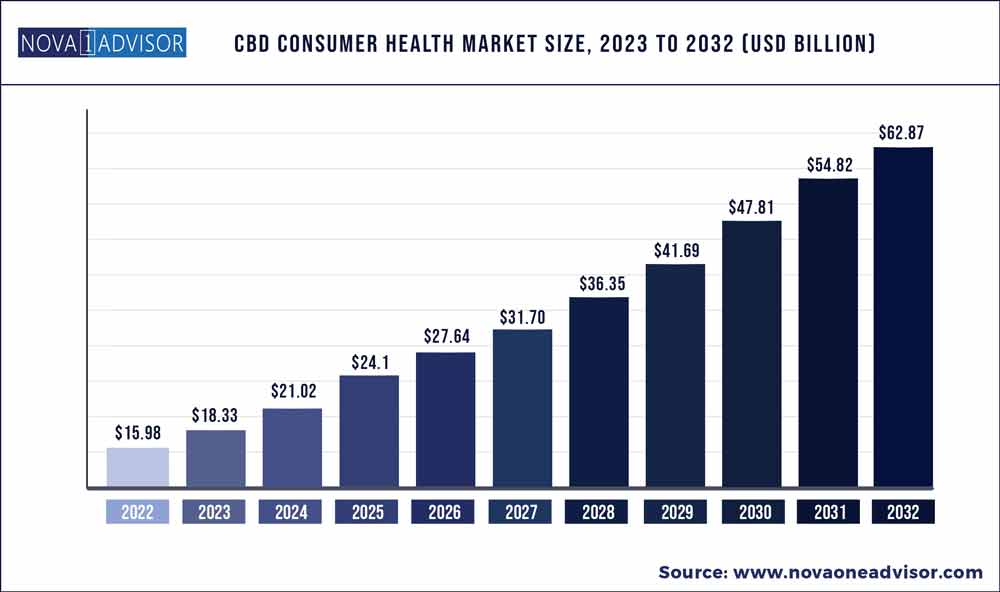

The global CBD consumer health market size was exhibited at USD 15.98 billion in 2022 and is projected to hit around USD 62.87 billion by 2032, growing at a CAGR of 14.68% during the forecast period 2023 to 2032.

Key Pointers:

- North America captured of over 61.9% of revenue share in 2022.

- Europe is the second largest region for the global market.

- Asia Pacific is predicted to record noticeable growth between 2032 and 2032.

- By product, the nutraceuticals segment contributed more than 64.8% of revenue share in 2022.

- By product, the medical over the counter (OTC) products segment is projected to hold a significant share of the market.

- By distribution channel, the retail pharmacy segment generated more than 41.2% of the revenue share in 2022.

- By distribution channel, the online store segment is projected to register a noticeable rate between 2032 and 2032.

CBD Consumer Health Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 18.33 Billion

|

|

Market Size by 2032

|

USD 62.87 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 14.68%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

By Product and By Distribution Channel

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

ENDOCA, Lord Jones, CV Sciences Inc, Joy Organics, Isodiol International Inc, Medical Marijuana Inc, NuLeaf Naturals LLC and Others.

|

The leading factor attributed to the growth is the positive government reforms for the legalization of cannabidiol (CBD) in various regions. CBD consumer products are gaining significant acceptance owing to rising awareness regarding their health benefits. Furthermore, the demand for hemp-derived CBD products is increasing globally due to the legalization of hemp in various countries.

Cannabidiol has become increasingly popular in dietary supplements due to its health benefits and non-narcotic properties. Unlike Tetrahydrocannabinol (THC), it helps users obtain the health benefits of cannabis without intoxication. People believe that CBD supplements offer more natural alternatives when compared to prescription or over-the-counter drugs, for relieving stiffness, pain, anxiety, stress, and other medical conditions. Hemp-derived CBD is a preferred source by manufacturers, owing to the low concentration of THC. The presence of favorable regulations about hemp cultivation in various countries, such as the U.S., Canada, China, India, the U.K., and several European countries has supported the demand for hemp-derived CBD products and help these countries boost the exports.

Cannabidiol has become the latest consumer trend. Increasing number of benefits of cannabidiol in various health applications, and marketing and advertising efforts taken by the market participants are some of the major factors driving the product demand. Subsequently, the increase in the product options for consumers such as topicals, analgesics, edibles, oils, tinctures, and many other products are also driving the CBD consumer in health market.

In addition, increasing awareness about the health benefits of CBD-infused products has led to an increase in the number of people willing to buy these products, irrespective of the cost. The mainstream retailers earlier engaged in the sale of non-CBD products are focusing on selling CBD-based products due to the higher profit margin and growing demand. For instance, in March 2019, CVS Pharmacy started selling hemp-derived CBD topicals across 800 retail stores in eight states in the U.S. In addition, after a short span, another company, Walgreens Boots Alliance, announced its decision of stocking their CBD topicals in 1,500 stores across the U.S.

Some players such as Green Roads, Elixinol LLC, and Isodiol International, are expanding their presence in various geographies and are creating visibility of their brand to the consumers. For instance, in January 2019, Aphria acquired a German pharmaceutical distributor company named CC Pharma GmbH. This company serves more than 13,000 pharmacies across Germany and other EU member states. This is expected to strengthen Aphria's global presence in Germany as well as other European countries. Many such strategic initiatives, by major players, are expected to influence the growth of the CBD in consumer health market over the forecast period.

Some of the prominent players in the CBD Consumer Health Market include:

- ENDOCA

- Lord Jones

- CV Sciences Inc

- Joy Organics

- Isodiol International Inc

- Medical Marijuana Inc

- NuLeaf Naturals LLC

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global CBD Consumer Health market.

By Product

- Nutraceuticals

- CBD Vitamins and Dietary Supplements

- CBD Sports Nutrition

- CBD Weight Management and Wellbeing

- Medical OTC Products

- CBD Dermatology Products

- CBD Sleeping Aids Products

- CBD Analgesic Products

- CBD Mental Health Products

- Other OTC Products

By Distribution Channel

- Online Stores

- Retail Stores

- Retail Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)