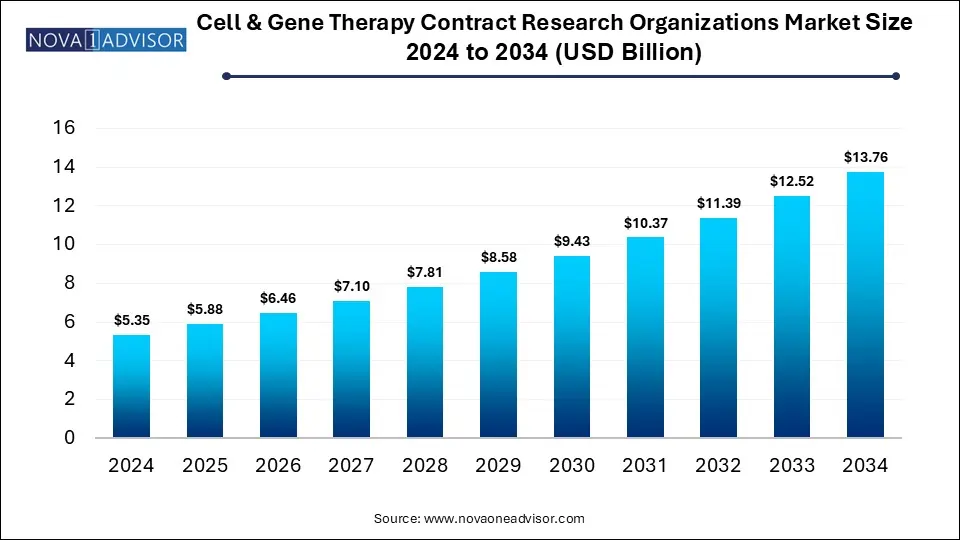

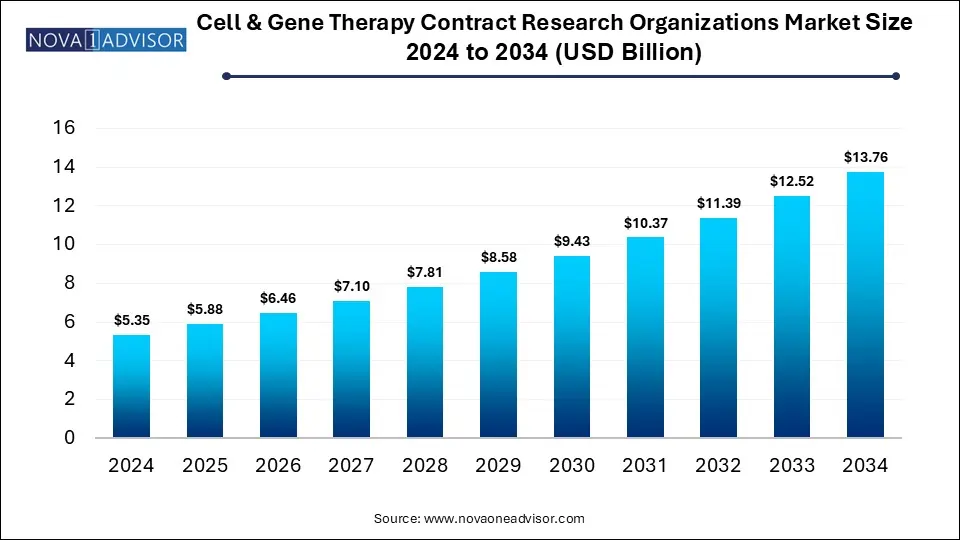

Cell & Gene Therapy Contract Research Organizations Market Size and Growth 2025 to 2034

The global cell & gene therapy contract research organizations market size is calculated at USD 5.35 billion in 2024, grows to USD 5.88 billion in 2025, and is projected to reach around USD 13.76 billion by 2034, growing at a CAGR of 9.91% from 2025 to 2034. The growth of the cell & gene therapy CROs market is driven by rising number of clinical trials, increasing demand for outsourcing services, regulatory complexity and focus on advanced therapy medicinal products (ATMPs).

Cell & Gene Therapy Contract Research Organizations Market Key Takeaways

- North America dominated the global bone regeneration material market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By type, the clinical segment dominated the market with the largest share in 2024.

- By type, the preclinical segment is expected to show the fastest growth over the forecast period.

- By service, the clinical monitoring segment accounted for the highest market share in 2024.

- By service, the regulatory strategy segment is expected to expand rapidly during the predicted timeframe.

- By indication, the oncology segment held the largest market share in 2024.

- By indication, the CNS disorders segment is expected to register fastest growth during the forecast period.

- By modality, the cell-based therapies segment captured the largest market share in 2024.

- By modality, the gene therapies segment is expected to show the fastest growth during the forecast period.

How is the Cell & Gene Therapy Contract Research Organizations Market Expanding?

Cell and gene therapy contract research organizations (CROs) are dedicated businesses offering research services, specifically for the development and clinical trials of cell and gene therapies. These services are provided on a contractual basis by these organizations to pharmaceutical, biotechnology and medical device companies with specialized expertise in areas such aa clinical trial management, data management and biostatistics, regulatory affairs and manufacturing support.

The cell and gene therapy CROs market is experiencing significant growth driven by factors such as rising trend of outsourcing R&D operations, access to technical expertise and specialized services, evolving regulatory landscapes, demand for personalized approaches and rising number of rare and complex conditions. Adoption of advanced technologies such as organ-on-a-chip platforms, AI-based toxicology modelling and in vivo imaging enhancing the efficacy and predictability of these therapies, further expanding the market potential.

What Are the Key Trends in the Cell & Gene Therapy Contract Research Organizations Market in 2025?

- In June 2025, Medable Inc., launched its new Partner Program, focused on empowering contract research organizations (CROs) and other partners with generative AI-driven, self-service electronic clinical outcome assessment (eCOA) build capabilities for digitally enabled clinical trials. The program accelerates clinical trial startup times by at least 50% and includes a digital-first Long-Term Follow-Up (LTFU) model developed for supporting the FDA-mandated 15-year follow-up period for certain cell and gene therapies.

- In March 2025, Oribiotech Ltd., launched its Preferred Partner Network (PPN) for connecting top academic medical centers (AMCs) and contract development and manufacturing organizations (CDMOs) to provide world-class solutions for accelerating the development and commercialization of cell and gene therapies.

How is AI Impacting the Cell & Gene Therapy Contract Research Organizations Market?

Contract research organizations (CROs) are integrating advanced technologies such as artificial intelligence (AI) and machine learning models for accelerating various stages of development in cell and gene therapy research. In preclinical research and development, AI algorithms are being applied for data analysis and target identification, in predictive modeling and for optimizing therapy designs. Simulation of clinical trials with AI-powered platforms and digital twins is enabling optimization of trial design, identification of potential challenges and improvements in patient recruitment strategies. Additionally, automated generation of regulatory documents with integration of AI can potentially accelerate the regulatory submission process.

Report Scope of Cell & Gene Therapy Contract Research Organizations Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.88 Billion |

| Market Size by 2034 |

USD 13.76 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.91% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Service, Indication, Modality, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Altasciences, Allucent, ICON plc, Labcorp, Linical, Medpace, Thermo Fisher Scientific Inc., Precision Medicine Group, LLC., QPS Holdings, Syneos Health |

Market Dynamics

Drivers

Expansion of Clinical Pipelines of Cell and Gene Therapies

There is a significant rise in the number of innovative cell and gene therapy products in the pipeline, particularly from small to mid-sized biotech companies and emerging startups. Development of cell and gene therapies is a complex process which requires specialized expertise in areas such as drug discovery, clinical evaluation, quality control and regulatory compliance. Lack of in-house infrastructure and capital for managing these complex is driving outsourcing to specialized CROs, offering end-to-end services for CGT development such as planning, regulatory strategy and patient pathway development (PPD).

Restraints

High Costs and Complex Regulations

Cell and gene therapies are extremely expensive as they involve intricate development processes, intensive clinical testing and often require specialized manufacturing facilities and equipment, leading to high capital expenditure. Limited patient populations for these therapies targeting rare diseases and unfavourable reimbursement policies can potentially restrain market adoption of these advanced treatments. Furthermore, complex and evolving regulatory frameworks for these therapies requiring rigorous scrutiny can be challenging for companies and CROs, leading to delays in approvals processes and increased costs for regulatory submissions.

Opportunities

Focus on Expanding Geographic Reach

Contract research organizations (CROs) specializing in cell and gene therapies are expanding their geographical base, which is creating significant opportunities for market growth. Geographical expansion allows CROs to access a large and diverse patient population for cell and gene therapies targeting rare diseases and specific genetic conditions, further accelerating the patient recruitment process for clinical trials and the generation of robust universal data.

CROs with a global presence can assist their clients in navigating through the complex regulatory landscapes across various countries to ensure compliance with local regulations and expedite the approval process. The establishment of local teams and strategic partnerships by CROs facilitates the seamless execution of CGT clinical research and studies across different geographical locations. Furthermore, CROs are targeting high-growth regions to develop specialized facilities and expertise to contribute to the global development of these innovative therapies.

Segmental Insights

What Drives the Dominance of Clinical Segment in the Market in 2024?

By type, the clinical segment accounted for the largest market share in 2024. The number of clinical trials for cell and gene therapies pipeline is expanding rapidly for evaluating their safety and efficacy across various stages of development. Specialized trial designs, regulatory knowledge and intensive patient monitoring is required in clinical studies for cell and gene therapies which drives the demand for CROs. Biopharmaceutical companies are outsourcing R&D activities like clinical trials due to factors such as need for specialized expertise and high capital expenditure for developing in-house infrastructure. Moreover, CROs offer logistical support such as cell preservation, shipping and temperature controlled storage for cell and gene therapy clinical trials to maintain product safety and stability.

By type, the preclinical segment is expected to register the fastest growth during the forecast period. Increased awareness regarding potential of cell and gene therapies for treating rare diseases and addressing unmet medical needs is driving the demand for preclinical research of cell and gene therapies to evaluate their safety and efficacy for before clinical trials. CROs are expanding their capabilities by leveraging advanced technologies such as in silico modelling and simulation, automated platforms for high-throughput screening, sophisticated nucleic acid formats, viral biosynthesis methods, microfluidics, non-chromatographic separations, new optical methods for nanoscale imaging, among others to meet the growing demand for preclinical development services in cell and gene therapy.

Furthermore, rising complexity and cost of developing innovative therapies, expansion of biotechnology sector, increased collaborations and supportive regulatory frameworks are fuelling the market growth.

Cell & Gene Therapy Contract Research Organizations Market Size By Type, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Drug Discovery |

0.80 |

0.88 |

0.97 |

1.04 |

1.14 |

1.25 |

1.36 |

1.47 |

1.60 |

1.77 |

1.95 |

| Preclinical |

1.61 |

1.76 |

1.93 |

2.12 |

2.34 |

2.54 |

2.82 |

3.10 |

3.42 |

3.70 |

4.10 |

| Clinical |

2.94 |

3.23 |

3.56 |

3.94 |

4.33 |

4.79 |

5.25 |

5.79 |

6.38 |

7.05 |

7.71 |

How Did the Clinical Monitoring Segment Dominate the Market in 2024?

By service, the clinical monitoring segment dominated the market with the highest share in 2024. Clinical monitoring is essential for accurate and reliable data collection to ensure data quality and consistency across multiple cell and gene therapy trial sites. The rising complexity of cell and gene therapy clinical trials involving intricate protocols, use of advanced technologies and specialized procedures is creating demand for CROs offering real-time oversight and quality assurance in clinical monitoring. Innovative technologies such as real-time data acquisition tools and advanced analytics are enhancing the potential of clinical monitoring services.

By service, the regulatory strategy segment is expected to show the fastest CAGR over the forecast period. The rising complexity of cell and gene therapies usually including novel mechanisms such as autologous cell modification or genome editing necessitates customized regulatory strategies to navigate through the evolving standards of regulatory bodies like the EMA, FDA and PMDA. Genetically modified organisms (GMOs) require adherence to stringent standards and biosafety protocols for ensuring patient safety. To address these unique regulatory challenges, biopharmaceutical companies are increasingly outsourcing R&D operations through CROs to navigate through complex regulatory pathways and gaining competitive advantage, leading to faster market access. Regulatory affairs management and strategies for CGT offered by CROs assists companies in overseeing the development, submission and compliance of regulatory documentation as well as in identifying and mitigating potential risks, further ensuring the long-ter

Cell & Gene Therapy Contract Research Organizations Market Size By Service, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Project & Clinical Trial Management |

0.96 |

1.06 |

1.17 |

1.28 |

1.43 |

1.57 |

1.75 |

1.91 |

2.10 |

2.32 |

2.54 |

| Regulatory Strategy |

0.54 |

0.60 |

0.66 |

0.72 |

0.80 |

0.85 |

0.94 |

1.06 |

1.16 |

1.29 |

1.42 |

| Data Management & Medical Writing |

0.52 |

0.59 |

0.64 |

0.73 |

0.79 |

0.89 |

0.94 |

1.07 |

1.12 |

1.29 |

1.41 |

| Clinical Monitoring |

0.85 |

0.93 |

1.05 |

1.14 |

1.26 |

1.39 |

1.56 |

1.69 |

1.89 |

2.02 |

2.28 |

| Quality Management / GMP Compliance |

0.65 |

0.70 |

0.76 |

0.87 |

0.95 |

1.04 |

1.18 |

1.31 |

1.42 |

1.58 |

1.78 |

| Biostatistics & Safety Monitoring |

0.53 |

0.59 |

0.66 |

0.72 |

0.78 |

0.85 |

0.96 |

1.05 |

1.16 |

1.27 |

1.39 |

| Patient & Site Recruitment |

0.54 |

0.59 |

0.64 |

0.72 |

0.76 |

0.88 |

0.95 |

1.03 |

1.16 |

1.30 |

1.41 |

| Technology Transfer |

0.44 |

0.47 |

0.54 |

0.57 |

0.67 |

0.74 |

0.81 |

0.89 |

0.98 |

1.09 |

1.20 |

| Others |

0.32 |

0.34 |

0.33 |

0.36 |

0.37 |

0.37 |

0.34 |

0.35 |

0.40 |

0.36 |

0.34 |

Why the Oncology Segment Dominated the Market in 2024?

By indication, the oncology segment captured the largest market share in 2024. The rising prevalence of various types of cancer is driving investments in R&D efforts for cell and gene therapy treatments across the globe. Proven success of CAR-T (Chimeric Antigen Receptor T-cell) therapies in treating hematological malignancies as well as emergence of promising alternative such as CAR-NK (Chimeric Antigen Receptor Natural Killer cell) therapy is encouraging further development and clinical trials for targeting solid tumors. CROs are offering specialized expertise for navigating the complexities in oncology-based cell and gene therapy clinical research and trials, including trial design, patient recruitment, manufacturing and logistics expertise as well as regulatory guidance.

By indication, the CNS disorders segment is expected to show the fastest growth during the predicted timeframe. According to the World Health Organization, over 1 in 3 people is affected by neurological conditions and more than 3 billion people worldwide were living with a neurological disorder in 2021. The rising incidences of CNS disorders such as Amyotrophic Lateral Sclerosis (ALS), Alzheimer’s and Parkinson’s due to factors like lifestyle changes and aging populations is creating a need for advanced and regenerative treatments like cell and gene therapies. CROs are assisting biopharmaceutical companies in addressing the complexities of cell and gene therapies being developed for CNS-based disorders such as need for precise targeting, conquering biological barriers and managing possible immune responses.

Cell & Gene Therapy Contract Research Organizations Market Size By Indication, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Oncology |

2.38 |

2.66 |

2.91 |

3.19 |

3.56 |

3.86 |

4.28 |

4.76 |

5.21 |

5.75 |

6.21 |

| CNS Disorders |

0.44 |

0.48 |

0.53 |

0.57 |

0.62 |

0.71 |

0.78 |

0.83 |

0.93 |

0.98 |

1.13 |

| Infectious Diseases |

0.53 |

0.59 |

0.65 |

0.73 |

0.79 |

0.87 |

0.96 |

1.04 |

1.15 |

1.29 |

1.40 |

| Immunological Disorders |

0.53 |

0.57 |

0.63 |

0.72 |

0.78 |

0.88 |

0.97 |

1.08 |

1.17 |

1.29 |

1.42 |

| Cardiovascular Diseases |

0.33 |

0.36 |

0.39 |

0.42 |

0.45 |

0.50 |

0.56 |

0.60 |

0.68 |

0.77 |

0.86 |

| Respiratory Diseases |

0.27 |

0.28 |

0.32 |

0.36 |

0.40 |

0.45 |

0.47 |

0.53 |

0.57 |

0.65 |

0.73 |

| Diabetes |

0.16 |

0.16 |

0.19 |

0.22 |

0.23 |

0.27 |

0.27 |

0.31 |

0.33 |

0.32 |

0.42 |

| Ophthalmology |

0.22 |

0.24 |

0.28 |

0.27 |

0.32 |

0.35 |

0.37 |

0.42 |

0.47 |

0.53 |

0.59 |

| Pain Management |

0.22 |

0.25 |

0.27 |

0.28 |

0.31 |

0.33 |

0.39 |

0.39 |

0.46 |

0.51 |

0.57 |

| Others |

0.27 |

0.29 |

0.29 |

0.32 |

0.34 |

0.37 |

0.37 |

0.41 |

0.42 |

0.43 |

0.44 |

What Made Cell-Based Therapies the Dominant Segment in the Market in 2024?

By modality, the cell-based therapies segment dominated the market with the biggest revenue share in 2024. The rising number of cell-based therapy clinical trials, especially in Phase I and Phase II stage focused on safety and efficacy assessments, adherence to stringent regulations, tailoring trial designs and rigorous patient monitoring are driving the demand for specialized CRO services. Preclinical services expertise offered by CROs in areas like biodistribution analysis, immunogenicity testing and vector safety profiling for cell therapies are contributing to the market growth.

By modality, the gene therapies segment is anticipated to witness lucrative growth over the forecast period. Advancements in gene editing tools such as CRISPR and delivery systems like lipid nanoparticles and AAV vectors are expanding clinical pipeline in gene therapy trials. Sponsors are seeking outsourcing services from specialized CROs to address sophisticated gene therapy development pathways, particularly the need for complaint and scalable vector production. Furthermore, focus on high unmet medical need for treating rare and genetic disorders, curative potential of gene therapies, strict regulations demand compliance with Good Clinical Practice (GCP) and other guidelines as well as rise of personalized therapies are contributing to the market expansion.

Cell & Gene Therapy Contract Research Organizations Market Size By Modality, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Cell-Based Therapies |

2.68 |

2.95 |

3.23 |

3.53 |

3.87 |

4.25 |

4.64 |

5.07 |

5.58 |

6.10 |

6.72 |

| Gene Therapies |

1.60 |

1.77 |

1.93 |

2.14 |

2.35 |

2.60 |

2.84 |

3.15 |

3.47 |

3.83 |

4.17 |

| Gene-Modified Cell Therapies |

1.07 |

1.16 |

1.30 |

1.43 |

1.59 |

1.74 |

1.95 |

2.15 |

2.34 |

2.60 |

2.87 |

Regional Insights

What Made North America the Dominant Region in Cell & Gene Therapy CROs Market?

North America dominated the global market by accounting for the largest revenue share in 2024. The rising focus of biopharmaceutical companies in North America on expanding cell and gene therapy products pipeline, increased outsourcing of R&D activities to CROs, high chronic disease burden and well-established healthcare infrastructure are contributing to the region’s market dominance. Expansion of service offerings, launch of innovative solutions, rise in M&A acquisition activities, and focus on strengthening market presence by CROs is fuelling the market expansion. Additionally, increased government support such as U.S. FDA’s Center for Biologics Evaluation and Research (CBER) providing guidance and reviewing investigational new drug (IND) applications is expediting the approvals of CGT products.

How is the Asia Pacific Cell & Gene Therapy CROs Market Expanding?

Asia Pacific is anticipated to witness the fastest growth in the market over the forecast period. The market expansion is driven by increasing incidences of chronic and rare diseases, focus on personalized medicine, adoption of advanced technologies, and emergence of new therapies such as stem cell therapies and tissue-engineered products. Rising number of cell and gene therapies in preclinical and clinical development stage is driving outsourcing trend to specialized CROs for enhancing research and development. The cost-effectiveness and efficiency of services offered by CROs in the Asia Pacific compared to Western countries is attracting several companies for outsourcing R&D activities. Well-developed regulatory frameworks in Japan and China as well as access to the region’s large and diverse demographics is streamlining patient recruitment and conduction of clinical trials.

Cell & Gene Therapy Contract Research Organizations Market Size By Regional, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

2.13 |

2.34 |

2.58 |

2.82 |

3.09 |

3.38 |

3.73 |

4.12 |

4.47 |

4.90 |

5.39 |

| Asia Pacific |

1.35 |

1.48 |

1.62 |

1.79 |

1.99 |

2.21 |

2.40 |

2.65 |

2.93 |

3.25 |

3.56 |

| Europe |

1.22 |

1.34 |

1.48 |

1.64 |

1.81 |

1.99 |

2.20 |

2.40 |

2.65 |

2.89 |

3.19 |

| Latin America |

0.33 |

0.37 |

0.39 |

0.42 |

0.47 |

0.49 |

0.56 |

0.60 |

0.65 |

0.74 |

0.78 |

| Middle East and Africa |

0.32 |

0.35 |

0.40 |

0.43 |

0.45 |

0.51 |

0.54 |

0.60 |

0.69 |

0.75 |

0.83 |

Some of the Prominent Players in the Cell & Gene Therapy Contract Research Organizations Market

- Altasciences

- Allucent

- ICON plc

- Labcorp

- Linical

- Medpace

- Thermo Fisher Scientific Inc.

- Precision Medicine Group, LLC.

- QPS Holdings

- Syneos Health

Recent Developments

- In November 2024, Precision for Medicine, expanded its offerings of spatial biology solutions with the integration of Akoya’s PhenoCycler-Fusion 2.0 and the new PhenoCode Discovery IO60 immuno-oncology panel into its service portfolio.

- In February 2024, the Europe-based full-service provider of clinical research services, FGK Clinical Research GmbH, successfully acquired Clinicology Ltd., a CRO based in UK.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Cell & Gene Therapy Contract Research Organizations Market.

By Type

-

- Target Validation

- Lead Identification

- Lead Optimization

-

- Phase I

- Phase II

- Phase III

- Phase IV

By Service

- Project & Clinical Trial Management

- Regulatory Strategy

- Data Management & Medical Writing

- Clinical Monitoring

- Quality Management / GMP Compliance

- Biostatistics & Safety Monitoring

- Patient & Site Recruitment

- Technology Transfer

- Others

By Indication

- Oncology

- CNS Disorders

- Infectious Diseases

- Immunological Disorders

- Cardiovascular Diseases

- Respiratory Diseases

- Diabetes

- Ophthalmology

- Pain Management

- Others

By Modality

- Cell-Based Therapies

- Gene Therapies

- Gene-Modified Cell Therapies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)