Cell And Gene Therapy Manufacturing Market Size and Growth 2026 to 2035

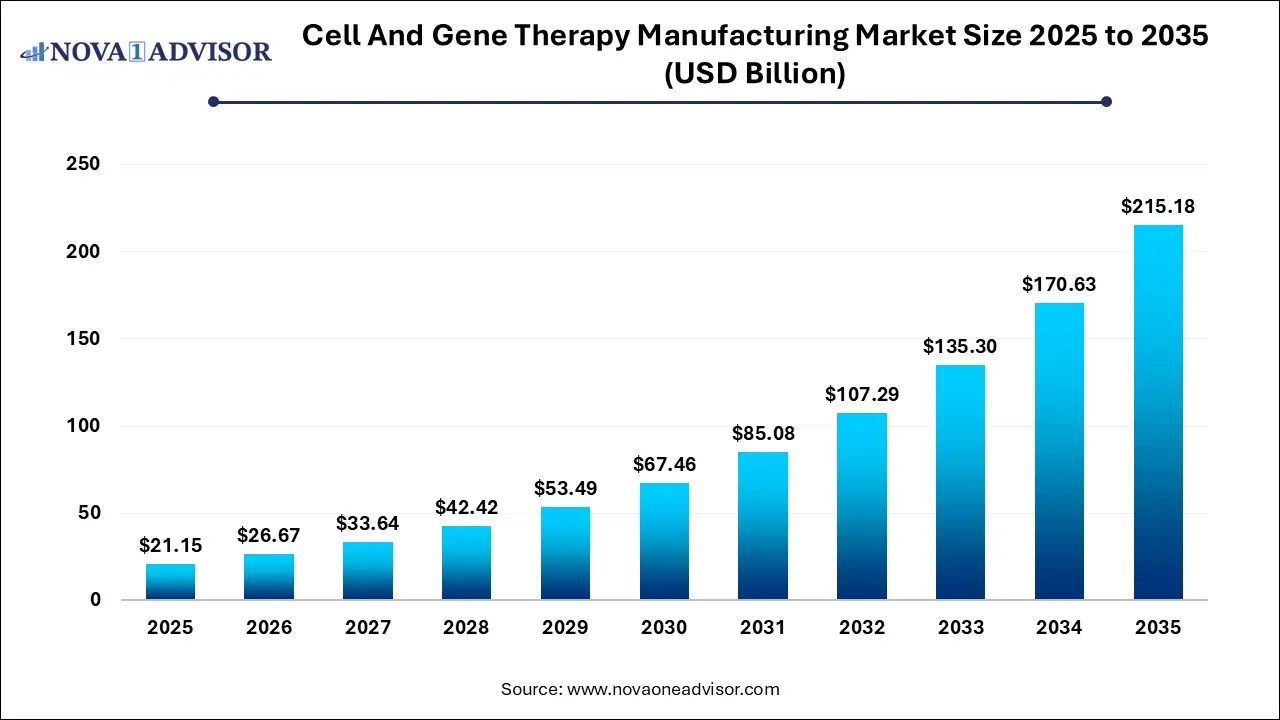

The global cell and gene therapy manufacturing market size was estimated at USD 21.15 billion in 2025 and is projected to hit around USD 215.18 billion by 2035, growing at a CAGR of 26.11% during the forecast period from 2026 to 2035.

Key Takeaways:

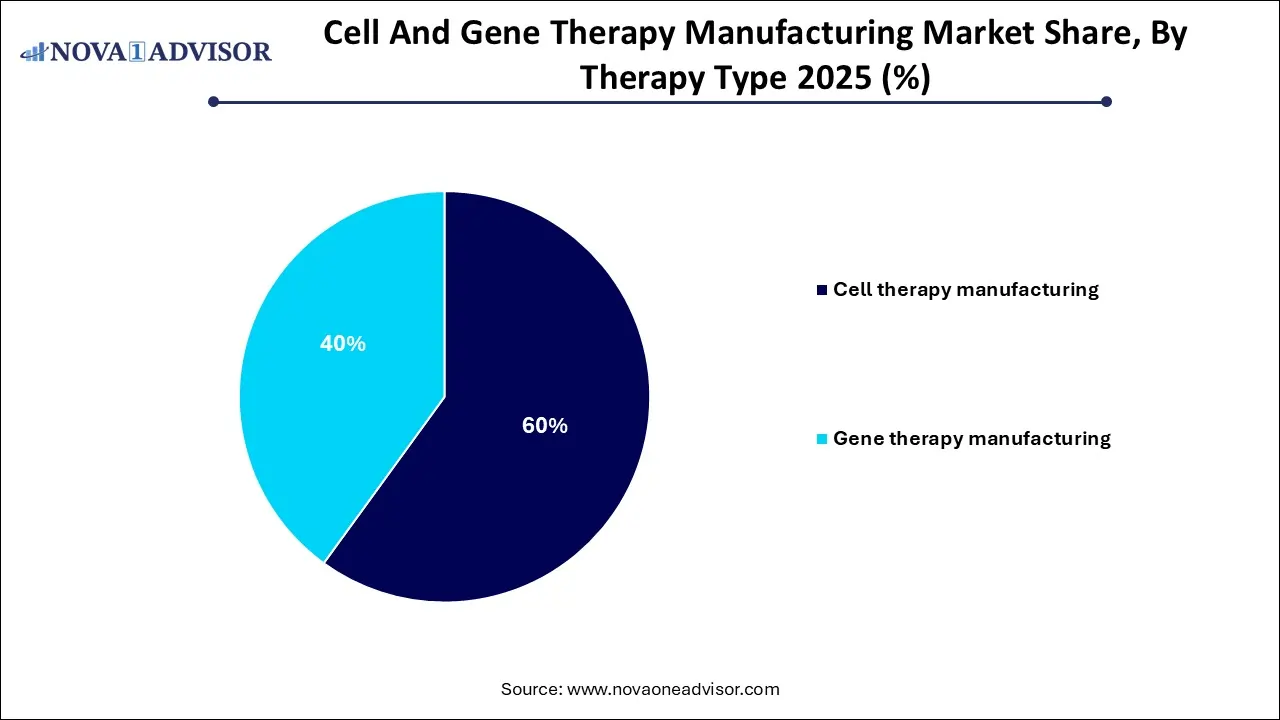

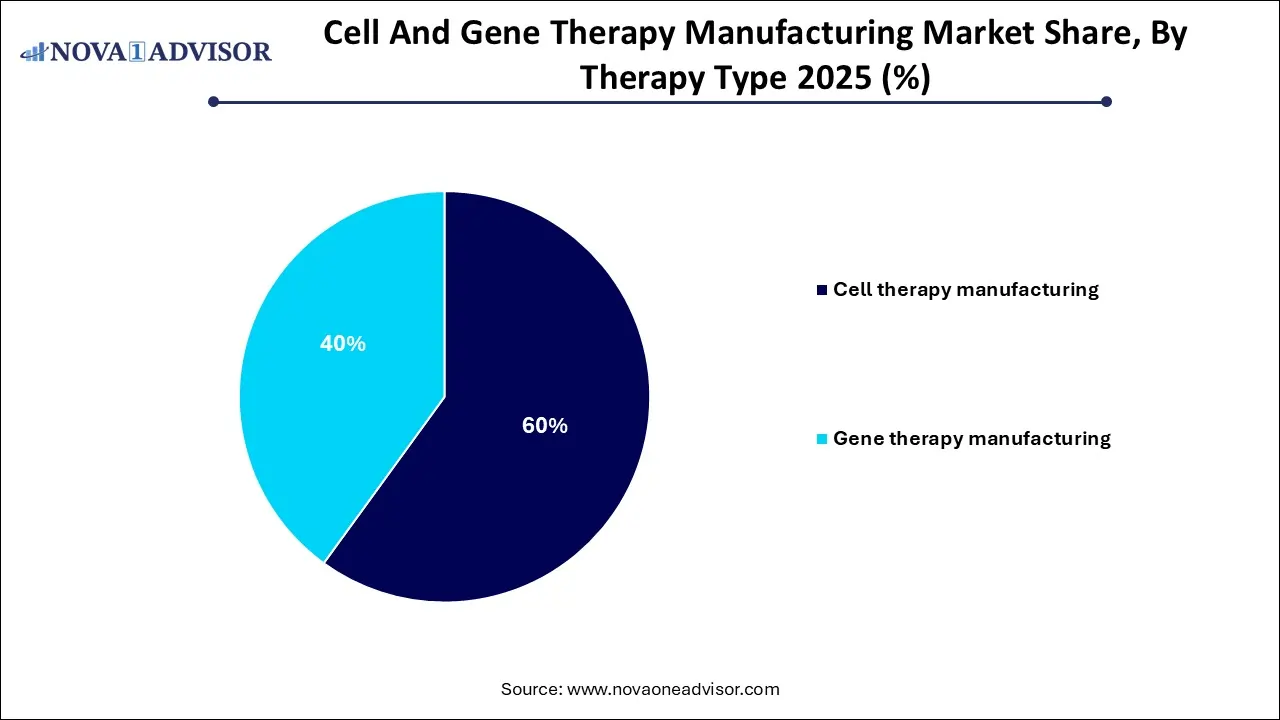

- By therapy type, the cell therapy segment dominated the market in 2025.

- By therapy type, the gene therapy (in vivo) segment is expected to grow at the fastest rate during the forecast period.

- By vector type, the viral vectors segment led the market as of this year.

- By vector type, the non-viral vectors (LNPs) segment is seen to grow at the fastest rate.

- By application, the oncology segment dominated the market as of this year.

- By application, the rare and genetic disorders segment is seen to have the fastest growth rate throughout the forecast years.

- By end user, pharmaceutical & biotechnology companies were the most dominant segment as of this year.

- By end user, the CROs & CDMOs segment is expected to grow at the fastest rate.

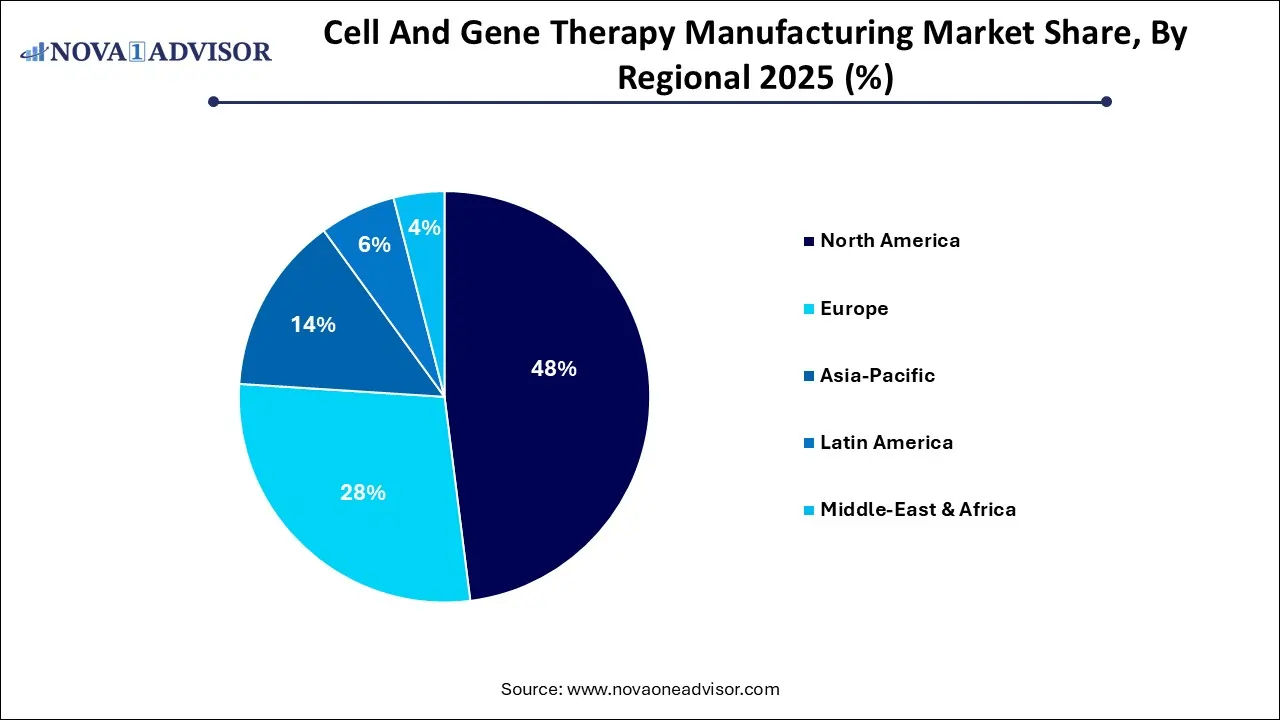

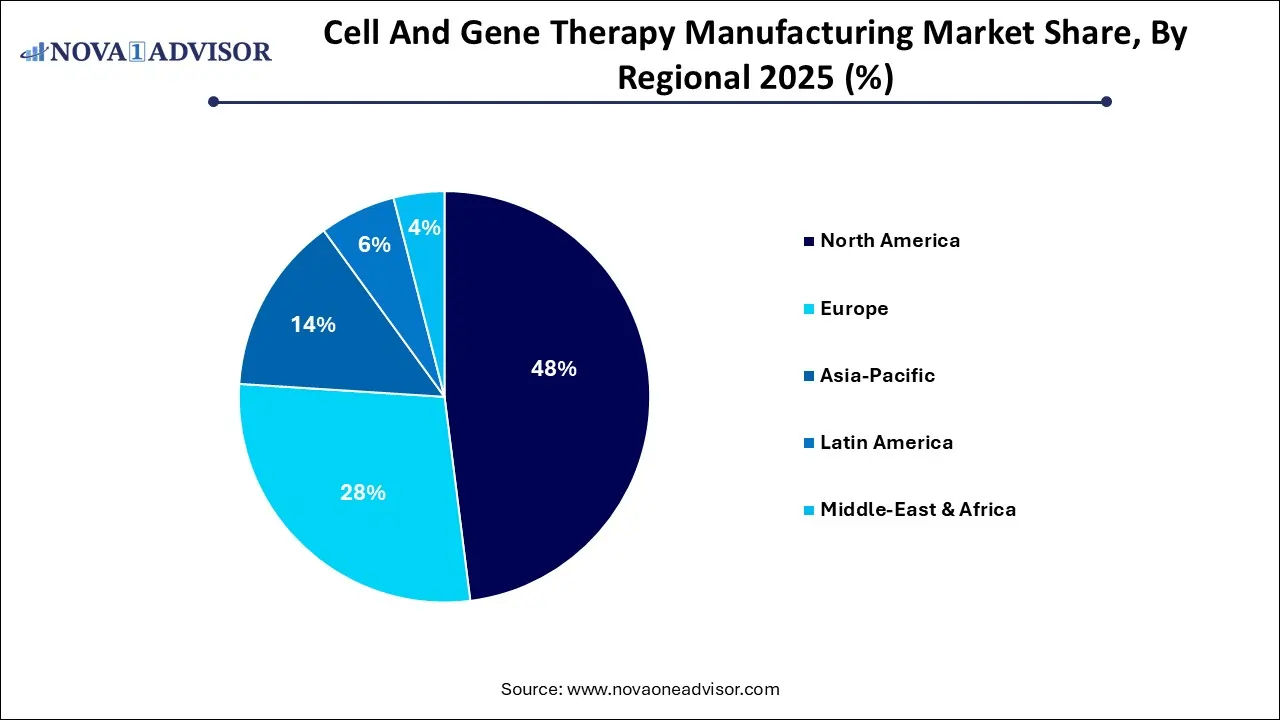

- By region, North America held the largest market share in 2025.

- By region, Asia-Pacific is estimated to be the fastest growing segment all throughout the forecast period.

Market Overview

The U.S. cell and gene therapy manufacturing market has witnessed a dramatic transformation over the last decade, becoming one of the most promising segments in the biotechnology and pharmaceutical industries. With rising incidences of chronic diseases, increasing FDA approvals for novel therapies, and rapid advancements in biotechnology platforms, this market is poised for robust growth. Cell and gene therapies represent a new frontier in personalized medicine, offering curative potential for conditions previously deemed untreatable.

Cell therapy involves the administration of living cells into a patient’s body to repair or replace damaged tissues or cells, while gene therapy entails the insertion or modification of genetic material to treat diseases at the molecular level. Manufacturing these therapies is complex and requires a highly specialized infrastructure, skilled workforce, rigorous quality control, and regulatory compliance.

The U.S. has emerged as a dominant force in this industry, not only due to its concentration of key players and biopharmaceutical innovators but also because of a conducive regulatory environment, government funding, and academic collaborations. The market continues to witness strategic mergers, technological innovations in automation and single-use bioprocessing systems, and a growing emphasis on decentralizing manufacturing capabilities to scale production.

The high cost and complexity of manufacturing pose challenges, but these are being progressively addressed through outsourcing to contract manufacturing organizations (CMOs), automation in cell processing, and standardization of production workflows. The evolution of CRISPR technologies, advancements in viral vector production, and digitization of quality control processes are driving efficiencies that enhance both scalability and affordability.

What is Cell and Gene Therapy?

Cell and gene therapies represent two cutting-edge approaches to treating various diseases, offering significant breakthroughs in modern day medicine. Cell therapy involves modifying or enhancing cells outside the patient’s body before reintroducing them in order to function as living medication. Whereas gene therapy focuses on altering genetic material either within or outside the patient’s cells to deactivate, replace or even add genes that help correct underlying conditions. These innovative treatments aim to stop or significantly slow down disease progression and even reverse the growth of chronic illnesses, including certain cancers and rare genetic disorders.

What are the Key Market Trends?

- With rising number of therapies transitioning from preclinical stages to clinical trials and commercialization, the need for specialized manufacturing services is on the rise in order to facilitate their production, thus boosting market demand.

- Rising investments in research and development activities have had a strong impact on the growth of the cell and gene therapy manufacturing market. These investments are driven by increasing private equity and capital infusion in the life sciences sector.

- The market is also witnessing a rise in strategic partnerships and agreements between pharmaceutical companies and CDMOs, supportive government initiatives and fundings are also on the rise, playing a crucial role in propelling the growth of the market.

- The growth of the market can also be attributed to its versatile applications in treating a wide range of conditions such as cancers, autoimmune diseases, urinary problems, infectious diseases and other applications. Constant research and experimentation boosts innovation, leading to market growth.

What is the impact of AI in this field?

Cell and gene therapies offer hope to patients living with conditions such as cancer, sickle cell disease, and autoimmune conditions. Historically, these therapies have always been associated with high costs and lengthy development timelines. However, AI and ML tools are now starting to revolutionize all this. While applications of AI are still in the early stages, they are already making a significant impact.

Today cell and gene therapy processes are largely personalized, where traditional large-batch manufacturing doesn’t work. Production processes often come directly from work connected to academic discoveries, which results in a limited scalability. As a result, these processes are frequently cumbersome, heavily manual and typically paper-based. This is where AI comes into play. AI tools and systems can analyze large, vast sets of data in less than half the time, making it easy for healthcare personnel and researchers to modify treatments based on the patient’s personal medical history, allowing for much efficient and effective therapies.

AI also enables automatic real-time monitoring and control of glucose and lactate concentrations in cell culture processes. Measurements can be taken as frequently as every two minutes, providing real-time data on culture progression. This capability enhances the monitoring of cell expansion and also helps to ensure process robustness.

Cell And Gene Therapy Manufacturing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 26.67 Billion |

| Market Size by 2035 |

USD 215.18 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 26.11% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Therapy Type, Scale, Mode, Workflow, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Lonza; Bluebird Bio; Catalent Inc.; F. Hoffmann-La Roche Ltd.; Samsung Biologics; Boehringer Ingelheim; Cellular Therapeutics; Hitachi Chemical Co., Ltd.; Bluebird Bio Inc.; Takara Bio Inc.; Miltenyi Biotec; Thermo Fisher Scientific; F. Hoffmann-La Roche Ltd; Novartis AG; Merck KGaA; Wuxi Advanced Therapies |

Key Market Driver: Surge in FDA Approvals for Cell and Gene Therapies

A significant growth driver for the U.S. cell and gene therapy manufacturing market is the surge in FDA approvals of advanced therapies. The U.S. Food and Drug Administration has been actively accelerating the regulatory pathways for innovative cell and gene therapies under programs such as the Regenerative Medicine Advanced Therapy (RMAT) designation. Between 2019 and 2024, the FDA approved several transformative therapies, such as Zolgensma for spinal muscular atrophy and Abecma for multiple myeloma. These approvals have led to a rapid increase in demand for manufacturing capabilities, pushing companies to expand their production infrastructure and streamline processes to meet commercial demand. Furthermore, with more than 1,000 cell and gene therapy clinical trials currently underway in the U.S., this trend is expected to intensify, significantly contributing to the growth of manufacturing capabilities.

Key Market Restraint: High Cost and Complexity of Manufacturing

Despite its high potential, the market is hampered by the high cost and technical complexity associated with cell and gene therapy manufacturing. Unlike traditional pharmaceuticals, these therapies involve highly personalized, time-sensitive, and resource-intensive processes. Manufacturing requires specialized facilities compliant with Good Manufacturing Practices (GMP), skilled personnel, and complex logistics to maintain cell viability. Moreover, the scalability of autologous therapies which are patient-specific is particularly challenging. Each batch must be manufactured under unique parameters, making standardization and cost reduction difficult. For many biotech startups, the capital investment required to establish in-house capabilities is prohibitively high, creating a dependency on contract manufacturers and thereby increasing time-to-market and product pricing.

Key Market Opportunity: Expansion of Contract Manufacturing Services

One of the most promising opportunities lies in the growing reliance on contract manufacturing services. With a surge in clinical pipelines and increasing commercialization of approved therapies, small and mid-sized biotech firms are turning to CMOs to avoid the high upfront costs of setting up GMP-compliant facilities. Leading CMOs in the U.S. have responded by expanding their capabilities, including cell banking, vector production, and fill-finish operations. They are also investing in automation and modular bioprocessing systems that enable flexibility and reduce turnaround times. As demand outpaces supply, CMOs that can offer end-to-end, scalable solutions are positioned to capture a substantial share of the market. The expansion of these services will play a pivotal role in accelerating innovation and democratizing access to life-saving therapies.

Segments Insights:

By Therapy Type Insights

Which therapy dominated the market in 2025?

The cell therapy segment dominated the market in 2025. This dominance is attributed to the increasing number of products entering the marketplace and the high number of ongoing clinical trials. The advantage and popularity of this segment lies in its ability to demonstrate strong results in targeting and treating various cancers, especially blood cancers and solid tumors. Rising investments and technological advancements further push cell based therapy forward.

The gene therapy segment is expected to grow at the fastest rate throughout the forecast period. With a large number of products currently in clinical trials, production process improvement has been on the rise for the gene therapy. Increased investments from key players and clinical success have boosted this segment even more. It is a simplified and less invasive procedure, which makes it popular in today’s market.

By Vector Type Insights

Which vector type led the market as of this year?

The viral vectors segment led the market as of this year. This is because it has high transduction efficiency, a stable gene expression, a safer profile and reduced immunogenicity. The widespread use of approved and late-stage therapies applications across diverse therapeutic areas has led to market expansion. The increased research and development investments and regulatory support, have boosted market growth.

The non-viral vectors (LNPs) segment is experiencing the fastest growth in the during the forecast period. This growth is due to rising demand for safe and scalable gene delivery systems, thus leading to innovation in LNP technology. The development and deployment of LNP-based mRNA vaccines, such as those for Covid-19 have showcased the potential of non-viral carriers.

By Application Insights

Which application was the most dominant as of this year in 2025?

The oncology segment dominated the market as of this year in 2025. This is due to high global cancer prevalence and the clinical success of CAR-T cell therapies for blood cancers. This segment’s dominance is further supported by a robust oncology-focused clinical trial pipeline and significant investments in research and developments. Favorable regulatory pathways have also accelerated the development and approval of new oncology CGT products, while the personalized nature of these treatments leads to constant innovation and growth.

The rare and genetic disorders segment is seen to be the fastest-growing in the market during the forecast period. The limitations of traditional treatments for many rare genetic disorders creates a high demand for the potentially curative capabilities of cell and gene therapies, which target the root genetic causes of these conditions. This rising demand is also met with rapid progress in gene editing, like CRISPR-Cas9 and increasingly efficient delivery systems.

By End Use Insights

Which end user held the largest market share in 2025?

The pharmaceutical and biotechnology segment held the largest market share in 2025 due to their immense financial power, extensive research capabilities and advanced manufacturing infrastructure. This segment helps to drive innovation from clinical development all the way to commercialization. This segment’s position is further cemented by their experience in navigating complex regulatory pathways and utilizing global commercial networks to manage supply chains and secure market access for expensive, intricate therapies.

The CROs and CDMOs segment is expected to be the fastest-growing in the market during the forecast period. They provide specialized expertise and infrastructure, and enable biopharmaceutical companies to navigate regulatory hurdles, manage costs and accelerate development timelines. This vital support allows biotech firms to focus on innovation, thus driving the development of life-changing therapies and helping them to enter market faster and more efficiently.

By Regional Analysis

Why did North America Dominate the Market in 2025?

North America dominated the market in 2025. This dominance is due to its supportive regulatory environment FDA implemented initiatives, such as regenerative medicine advanced therapy and breakthrough therapy designations, to accelerate the development. The region also benefits from high investments in R&D. The region also focuses on targeted therapeutic areas, and is quick to adopt advanced technologies, thus driving the market growth. Through all these factors, we can see how North America has strategically positioned itself as a global leader and competitor.

What are the Advancements in Asia Pacific?

Asia Pacific is expected to witness the fastest growth in the market during the forecast period. This growth is due to significant investments being made in research and development and the ongoing focus on oncology trials, especially for CAR-T cell therapies. Maturating biotech ecosystem and investments, increasing government and private sector funding, are attracting new companies in the region and fostering innovation. Additionally, the increasing prevalence of chronic and genetic diseases has heightened the demand for innovative therapies, further propelling market growth.

Key Companies & Market Share Insights

The key entities in the market are undertaking several strategic initiatives such as licensing, partnership, and mergers and acquisitions to expand their market presence. Over the last few years, the market witnessed various remarkable mergers and acquisitions. For instance, in January 2022, Thermo Fisher acquired PeproTech, a manufacturer of recombinant proteins such as growth factors and cytokines, for USD 1.85 billion:

- Lonza

- Bluebird Bio Inc.

- Catalent Inc.

- F. Hoffmann-La Roche Ltd.

- Samsung Biologics

- Boehringer Ingelheim

- Cellular Therapeutics

- Hitachi Chemical Co., Ltd.

- Bluebird Bio Inc.

- Takara Bio Inc.

- Miltenyi Biotec

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Merck KGaA

- Wuxi Advanced Therapies

Recent Developments

- In February 2025, Bluebird bio, Inc. announced that it has entered into a definitive agreement to be acquired by funds managed by global investment firms Carlyle and SK Capital Partners, in collaboration with a team of highly experienced biotech executives. David Meek, former CEO of Mirati Therapeutics and Ipsen, is expected to become CEO of bluebird upon closing. Carlyle and SK Capital will provide bluebird primary capital to scale bluebird’s commercial delivery of gene therapies for patients with sickle cell disease, β-thalassemia, and cerebral adrenoleukodystrophy.

- In November 2025, India launched its first indigenous CRISPR-based gene therapy for Sickle Cell Disease, a condition that disproportionately affects tribal communities. The therapy, named “BIRSA 101” in honour of tribal freedom fighter Bhagwan Birsa Munda, was unveiled by Union Minister of State for Science and Technology (Independent Charge) Dr. Jitendra Singh. The breakthrough treatment was developed by the CSIR–Institute of Genomics and Integrative Biology (IGIB), showcasing India’s ability to create cutting-edge therapies at a fraction of global prices.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the cell and gene therapy manufacturing market.

By Therapy Type

- Cell therapy manufacturing

- Stem cell therapy

- Non-stem cell therapy

- Gene therapy manufacturing

By Scale

- Pre-commercial/ R&D scale manufacturing

- Commercial scale manufacturing

By Mode

- Contract manufacturing

- In-house manufacturing

By Workflow

- Cell processing

- Cell banking

- Process development

- Fill & finish operations

- Analytical and quality testing

- Raw material testing

- Vector production

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America