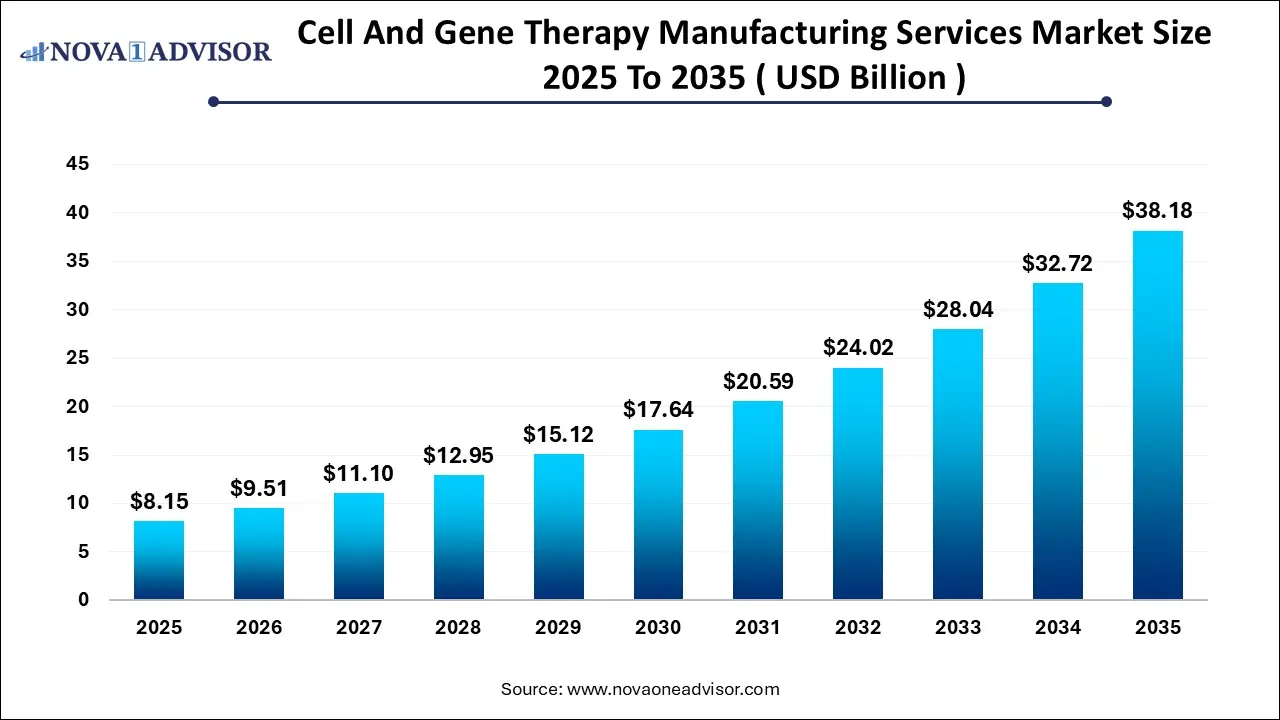

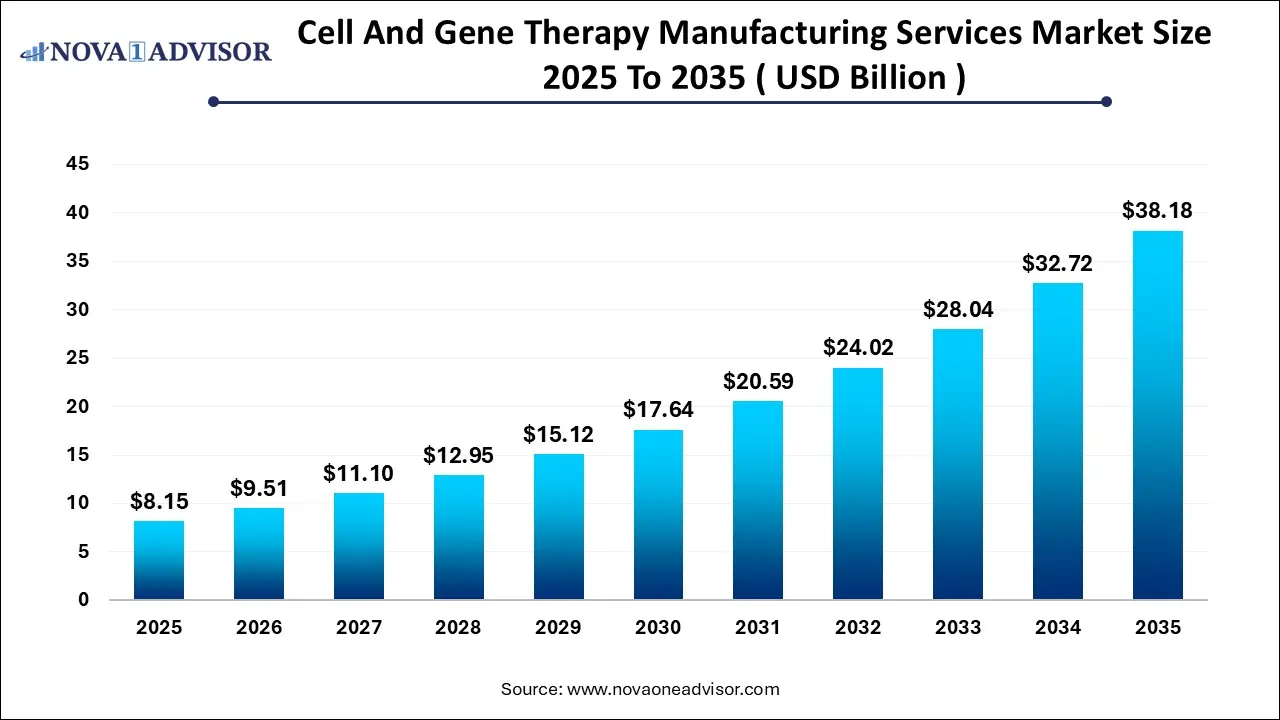

Cell and Gene Therapy Manufacturing Services Market Size and Growth 2025 to 2035

The global cell and gene therapy manufacturing services market size was estimated at USD 8.15 billion in 2025 and is projected to hit around USD 38.18 billion by 2035, growing at a CAGR of 16.7% during the forecast period from 2026 to 2035.

Key Takeaways

- By component, the services segment dominated the market in 2025.

- By component, the software and informatics is the fastest growing segment.

- By therapy type, the cell therapy segment led the market as of this year.

- By therapy type, the gene therapy segment is expected to witness the fastest growth over the forecast period.

- By process stage/workflow, the upstream process QC segment dominated the market as of this year.

- By process stage/workflow, the raw material and incoming QC segment is expected to grow at the fastest rate.

- By end-user, the contract development & manufacturing organizations (CDMOs) were the most dominant segment in 2024.

- By end-user, the academic and research institutes segment is expected to have the fastest growth rate.

- By region, North America held the largest market share in 2025.

- By region, Asia Pacific is expected to grow at the fastest rate in the forecast period.

Market Summary

The cell and gene therapy manufacturing services market consists of technologies, products and services that are involved in modifying, engineering and delivering therapeutic cells and genetic material in order to treat, prevent or even potentially cure diseases. The market’s growth is driven by the rising prevalence of chronic and rare genetic diseases, along with the aging global population, thus increasing demand for therapeutic solutions.

The advancements in delivery systems, including viral vectors and non-viral methods like lipid nanoparticles, is improving the safety and efficacy of transporting genetic material into target cells. Innovations in automation, AI and strategic investments, as well as supportive regulations also lead to market expansion.

What is Cell and Gene Therapy Manufacturing Services ?

Cell and gene therapy manufacturing services is a complex process that includes cell selection, genetic modification, expansion and quality control. The manufacturing process is necessary for the widespread adoption of cell therapies, which are used to treat serious conditions like blood cancers, autoimmune disorders and rare diseases. The process is standardized and scaled in order to ensure the final therapeutic products are safe, effective and reproducible. The FDA and EMA are expected to see an increase in the number of CGT therapies and ATMPs launched, indicating a growing demand for these innovative treatments.

What are the Key Trends in the Market?

- Rise of Allogeneic Therapies: Allogeneic products are propelling the market towards batch-based manufacturing with economies of scale. This reduces per-dose cost and enables commercial viability for large patient populations.

- Automation and Closed-System Processing: Automated systems reduce contamination risk, ensure consistency, and reduce labor dependency. This increases throughput and accelerates regulatory compliance.

- Expansion of Specialized CDMOs: CDMOs are becoming essential partners, especially doe smaller biotech firms who want to avoid the cost of building GMP suites. This has led to an increase in outsourcing for vector production, fill-finish and analytical testing.

- Potency and Analytical Standardization: Advanced assay development is becoming a major competitive advantage in the market as regulators are demanding for robust potency data, comparability analyses and long-term characterization.

- Regulatory Evolution: Agencies worldwide are issuing new guidelines for ATMPs, covering manufacturing changes, CMC expectations, comparability studies and long-term follow-up, which helps to drive greater investment in quality systems and traceability.

What is the Impact of AI in this field?

AI tools and systems are completely revolutionizing the way CGT products are evaluated and analyzed through QC processes by introducing automation. Automated systems can help improve the throughput and consistency of QC labs. They also enhance the efficiency, reproducibility and accuracy of QC processes, thus minimizing human errors. AI and machine learning (ML) algorithms can now analyze vast amounts of data and help in data analysis. Generative AI is a new thing in the market that can improve the handling of unstructured and multimodal data, enhancing data extraction. This integration leads to increased throughput, reduced deviation closure time and decreased costs.

Today cell and gene therapy processes are largely personalized, where traditional large-batch manufacturing can fall short. Production processes often come directly from work connected to academic discoveries, which results in a limited scalability. As a result, these processes are frequently cumbersome, heavily manual and typically paper-based. This is where AI comes into the picture. AI tools and systems are able to analyze large, vast sets of data in lesser time, making it easy for healthcare personnel and researchers to modify treatments based on the patient’s personal medical history, allowing for much efficient and effective therapies.

Report Scope of Cell and Gene Therapy Manufacturing Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 9.51 Billion |

| Market Size by 2034 |

USD 38.18 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 16.7% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Component, By Therapy Type, By Workflow, By End-User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Lonza, Thermo Fisher Scientific, Charles River Laboratories, Catalent, Merck KGaA / MilliporeSigma, Eurofins Scientific, Pace, Pharmaron, BioAgilytix Labs, Avance Biosciences, SGS, IQVIA, Alcami, Solvias |

Market Dynamics

Driver

Rising Prevalence of Disorders Globally

The increasing prevalence of genetic disorders, chronic diseases, and cancer is a key driver that is driving the demand for cell and gene therapies. As healthcare providers and researchers all over the world look for new ways to address and deal with the root causes of diseases, gene therapies offer promising areas for long-term solutions. Genetic disorders such as cystic fibrosis, muscular dystrophy, and hemophilia, along with various types of cancer, have proven difficult to treat with traditional methods.

Sickle cell anaemia, cystic fibrosis, and Tay-Sachs disease are few more common genetic disorders. Regarding chronic diseases, leukemias, brain and nervous system cancers, and lymphomas are the most prevalent malignant diseases, especially in younger subjects. This growing patient pool is seen to accelerate the demand for gene therapies, thus driving the market growth and development.

Restraint

High Costs and Lack of Skilled Personnel

Despite promising growth prospects, the market does have its fair share of challenges. One such challenge is the high cost associated with the treatment process. Gene therapy is among the most expensive drugs available in the market today, with some single-treatment doses costing over millions of dollars. This creates a heavy financial burden for patients and healthcare systems alike. This could be particularly burdensome for smaller payers, such as self-insured employers.

Several companies and research institutions from smaller countries or those situated in rural areas lack skilled professionals to perform complex CGT manufacturing QC processes. Training individuals for particular processes and instruments takes time, reducing productivity. This slows down market growth and development.

Opportunity

Rise of Personalized Medicine

The integration of cell and gene therapies with personalized medicine is a key opportunity that is shaping the global cell and gene therapy manufacturing services market. Personalized medicine is the customization of healthcare treatments based on individual genetic profiles, lifestyle and environmental factors. Gene therapy is linked to this concept as it involves tailoring treatments to address the unique genetic mutations of individual patients. The ability to target specific genetic alterations within a patient’s genome enables for a more effective and individualized therapy, thus reducing the risk of adverse reactions and improving the overall success of treatments. These types of therapies are particularly relevant in the treatment of rare genetic disorders, cancer, and other conditions where traditional treatments may not be as effective.

Additionally, the FDA’s approval of personalized medications, including new molecular entities and cell/gene-based therapies, has highlighted the integration of cell and gene therapies with personalized medicine. These approvals showcase the ever growing trend of tailoring treatments to individual genetic profiles, offering more precise and effective therapeutic options for patients. As personalized medicine continues to gain traction in the market, it is set to boost market growth and innovation.

Segmental Analysis

By Component Insights

Which component segment dominated the market in 2025?

The services segment dominated the market in 2025. This is due to increasing collaborations among key players and the need for faster time to market. Several companies all over the world are seen outsourcing their QC services to well-equipped contract research organizations (CROs) or CDMOs in order to avoid in-house scale-up costs. CROs and CDMOs provide advanced and customized services to resolve complex issues related to manufacturing, and also comply with evolving regulatory policies and deliver quality solutions.

The software and informatics segment is expected to grow at the fastest rate during the forecast period. Advancements in technologies and the development of user-friendly software tools have boosted this segment’s growth. Software and informatics facilitate the analysis and storage of a large amount of data. Researchers can access their data at any time and from anywhere. It also streamlines the QC processes by reducing complexity and improving the scalability of CGT manufacturing.

By Therapy type Insights

Which therapy type was the most dominant as of this year in 2025?

The cell therapy segment led the market as of this year. This dominance is attributed to extensive cellular potency or identity testing. Cell therapy can differentiate into different cell types in the body, promoting tissue regeneration, modulating the immune system and also reducing inflammation. These types of therapies are mainly approved for the treatment of cancer patients in whom a transplant fails or for those who relapse after transplant.

The gene therapy segment is expected to witness the fastest growth in the market over the forecast period. The demand for gene therapy is increasing more and more because it is a one-time treatment, rather than being delivered in doses. Gene therapy can modify the genetic information to cure rare diseases, cancer, autoimmune disorders and neurological disorders. Apart from curing a disease, it can also prevent a disease by administering it at an early stage, thus making it a popular segment.

By Workflow Insights

Which workflow segment led the market as of this year?

The upstream process QC segment was the most dominant in the market as of this year. This is due to the ability of upstream process QC to monitor and control critical parameters during the initial bioprocess stages. This helps manufacturers and researchers to make critical decisions and also carry out the necessary changes before manufacturing. They assess raw materials and also verify the DNA sequence of the reagents used in gene editing labs.

The raw material and incoming QC segment is expected to grow at the fastest rate in the upcoming years. Stringent regulatory processes necessitate manufacturers to conduct QC tests on raw materials in order to avoid contamination. CGT manufacturing does not include true purification steps, has limited clearance steps, and no terminal sterile filtration step, and thus, it requires sterile and high-quality raw materials for further bioprocessing.

By End User Insights

Which end user held the largest market share in 2025?

The contract development and manufacturing organizations (CDMOs) segment held the largest market share in 2025. This dominance is due to the increasing number of pharmaceutical and biotech startups and the need to expand CGT pipelines on a global scale. CDMOs have specialized infrastructure that helps in advanced manufacturing and quality control services. They also have skilled professionals that can provide relevant expertise for complex problems. By collaborating with CDMOs, companies can focus on more product sales and marketing, thus making this segment an ideal choice.

By end-user, the academic & research institutes segment is expected to show the fastest growth over the forecast period. The growing research and development activities and increasing investments by government and private organizations augment the segment’s growth. Academic & research institutes receive funding to adopt advanced technologies for CGT manufacturing QC. They conduct clinical trials to evaluate the safety and efficacy of CGT products, necessitating QC testing.

By Regional Analysis

Why did North America dominate the market in 2025?

North America dominated the market in 2025. This dominance can be attributed to the region’s advanced healthcare infrastructure, their substantial investments in biotechnology and a robust pipeline of cell and gene therapy. The region is also home to major pharmaceutical and biotechnology companies and has supportive regulatory frameworks, which has facilitated rapid advancements in manufacturing capabilities. Collaborations between academic institutions and industry players in the region have gained traction, fostering research and development activities. With ongoing technological advancements and a strong focus on personalized medicine, North America is expected to maintain its leading position in the market.

What are the advancements in Asia-Pacific’s cell and gene therapy manufacturing services market?

Asia-Pacific is expected to grow at the fastest rate during the forecast period. Countries like China, Japan, India, and South Korea benefit from favorable CGT manufacturing infrastructure, encouraging foreign investors to set up their manufacturing facilities in that region. The increasing number of startups and venture capital investments also leads to market growth. The rising CDMO buildup and clinical activity related to CGT products also contributes to market growth. The growing demand for personalized medicines due to rapidly changing demographics also facilitates the development of CGTs, pushing the region forward.

Some of The Prominent Players in The Cell and Gene Therapy Manufacturing Services Market Include:

- Lonza

- Thermo Fisher Scientific

- Charles River Laboratories

- Catalent

- Merck KGaA / MilliporeSigma

- Eurofins Scientific

- Pace

- Pharmaron

- BioAgilytix Labs

- Avance Biosciences

- SGS

- IQVIA

- Alcami

- Solvias

Recent Developments

- In November 2025, Bharat Biotech International Ltd has forayed deeper into advanced biologics with the launch of Nucelion Therapeutics Pvt Ltd, a wholly owned Contract Research, Development and Manufacturing Organisation (CRDMO) dedicated to cell and gene therapy (CGT) development and production.

- In February 2025, Bluebird bio, Inc. announced that it has entered into a definitive agreement to be acquired by funds managed by global investment firms Carlyle and SK Capital Partners, in collaboration with a team of highly experienced biotech executives. David Meek, former CEO of Mirati Therapeutics and Ipsen, is expected to become CEO of bluebird upon closing. Carlyle and SK Capital will provide bluebird primary capital to scale bluebird’s commercial delivery of gene therapies for patients with sickle cell disease, β-thalassemia, and cerebral adrenoleukodystrophy.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the cell and gene therapy manufacturing services market.

By Component

- Services (Testing & outsourced QC)

- Software & Informatics (LIMS, data integration, release automation)

- Equipment/Instruments (Flow cytometers, sequencers, qPCR/dPCR platforms, chromatography systems)

- Consumables & Reagents (assay kits, media, antibodies, columns, kits)

- Validation & Consulting (method development, assay validation)

By Therapy Type

- Cell Therapy (CAR-T, CAR-NK, TCR, MSCs)

- Gene Therapy (viral vectors AAV, lentivirus; non-viral modalities)

By Workflow

- Upstream Process QC (cell expansion, transduction efficiency monitoring)

- Raw Material & Incoming QC (critical raw material testing)

- Downstream Process QC (purification, concentration, vector harvest)

- Fill & Finish/Final Product Release Testing

By End-User

- Contract Development & Manufacturing Organizations (CDMOs)

- Academic & Research Institutes (R&D/pre-clinical QC)

- Pharmaceutical/Biotech Companies

- Clinical Labs & Specialized CROs

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)