Cell-based Assays Market Size and Forecast 2025 to 2034

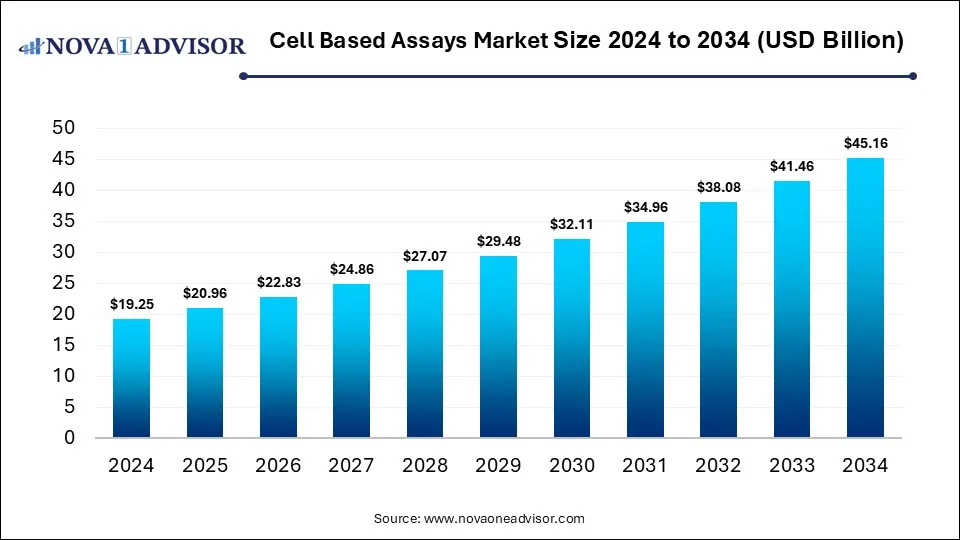

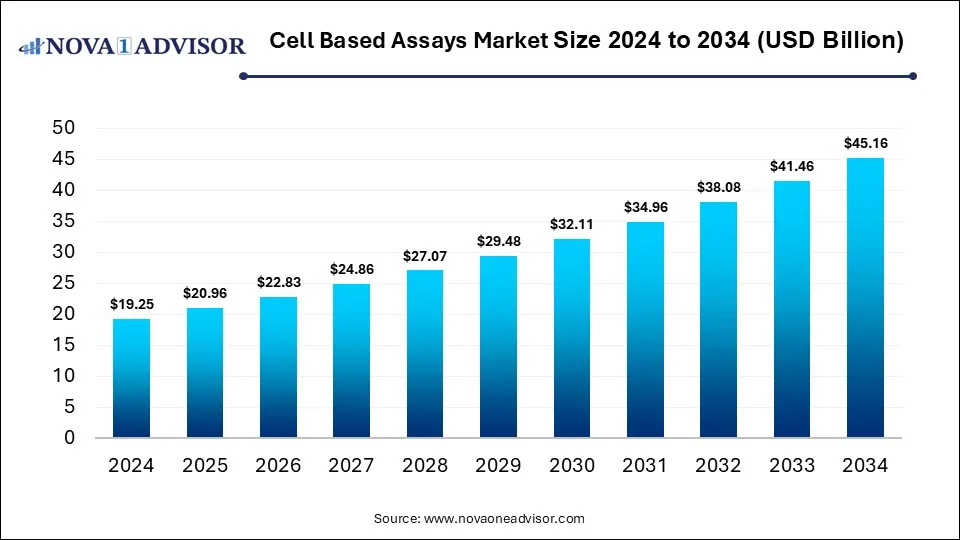

The global cell-based assays market size is calculated at USD 19.25 billion in 2024, grows to USD 20.96 billion in 2025, and is projected to reach around USD 45.16 billion by 2034, growing at a CAGR of 8.9% from 2025 to 2034. The market is growing due to rising demand for drug discovery, toxicity testing, and personalized medicine. Advancements in high-throughput screening and automation further drive adoption across the pharmaceutical and biotech industries.

Cell-based Assays Market Key Takeaways:

- North America dominated the cell-based assays market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product & services, the assay kits segment held the largest market share in 2024.

- By product & services, the reagents segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the drug discovery segment led the market with the largest revenue share in 2024.

- By application, the basic research segment is expected to grow at a significant rate in the market during the forecast period.

- By end user, the pharmaceutical and biotechnology segment held the highest market share in 2024.

- By end user, the academic and research institutes segment is expected to grow at the fastest CAGR in the market during the forecast period.

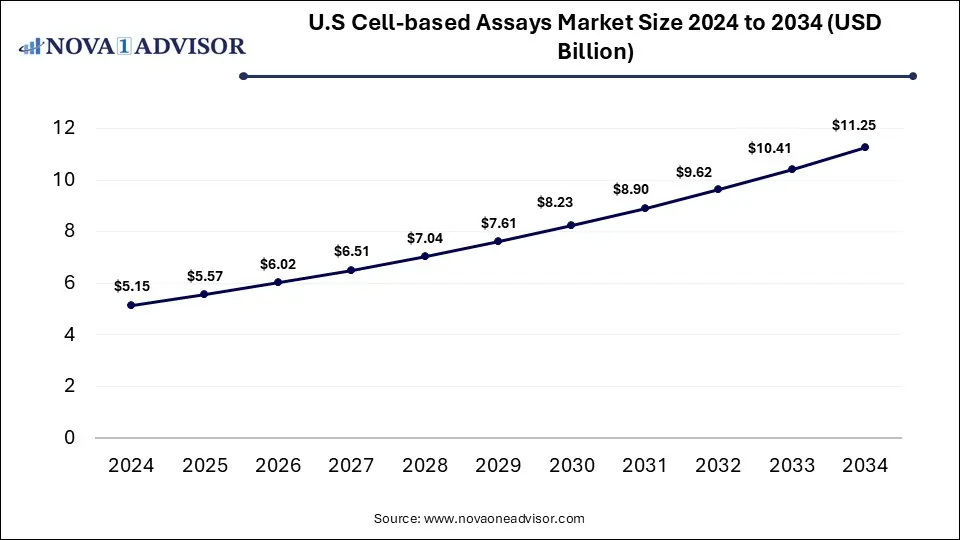

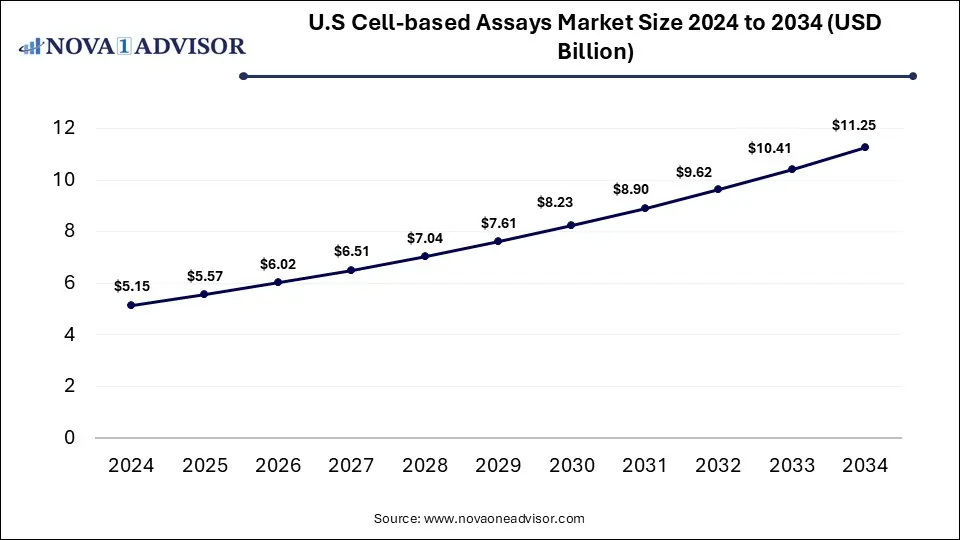

U.S Cell-based Assays Market Size and Growth 2025 to 2034

The U.S. cell-based assays market size is evaluated at USD 5.15 billion in 2024 and is projected to be worth around USD 11.25 billion by 2034, growing at a CAGR of 8.13% from 2025 to 2034.

How is North America contributing to the Expansion of the Cell Based Assays Market?

In 2024, North America led the market because of its robust academic and research ecosystem and widespread collaboration between industry and research institutions. The region’s emphasis on innovative drug development, access to cutting-edge assay technologies, and growing government and private funding for life sciences research fueled market growth. Moreover, rising awareness of alternative testing methods and early adoption of label-free and real-time assay platforms strengthened North America’s position as the largest revenue-generating region in the global market.

How is Asia-Pacific Accelerating the Cell Based Assays Market?

Asia-Pacific is projected to register the fastest growth because of the region’s expanding biotech and pharmaceutical industries, increasing focus on personalized medicine, and rising prevalence of chronic and lifestyle-related diseases. Improving regulatory frameworks, growing funding for research, and adoption of innovative technologies like 3D cultures and organ-on-chip systems further support market expansion. Additionally, lower operational costs and a large, skilled scientific workforce make the region attractive for contract research and high-throughput screening, driving rapid adoption of cell-based assays.

How is the Cell Based Assays Market Evolving?

The cell-based assay is a laboratory technique that uses living cells to study how drugs, chemicals, or biological agents affect cellular function, providing insights into safety, efficacy, and mechanism of action. The cell based assays market is evolving with a strong shift towards advanced models that mimic real human biology, improving accuracy over traditional methods. Growing use in immuno-oncology, stem cell research, and biologics development is expanding its scope. Integration of automation, robotics, and microfluidics is making these assays faster and more reliable. Additionally, rising collaboration between pharma, biotech, and academic institutions is driving innovation, making cell-based assays central to modern biomedical research and therapeutic development.

- For Instance, In September 2024, Ncardia introduced new cell-based assays designed to support screening for neurodegenerative disorders such as Parkinson’s disease, enhancing research in this therapeutic area. (Source: https://www.ncardia.com/)

What are the Key trends in the Cell Based Assays Market in 2024?

- In April 2025, BD Biosciences unveiled the BD FACSDiscover A8 Cell Analyzer, a spectral system with real-time imaging. By combining BD CellView Image Technology and BD SpectralFX Technology, researchers can capture detailed images while conducting spectral flow cytometry at the same time. (Source: https://www.bdbiosciences.com/)

- In February 2025, Intertek set up its regional headquarters in Riyadh, Saudi Arabia, aiming to expand its service offerings and support the nation’s Vision 2030 objectives. (Source: https://www.intertek.com/)

How Can AI Affect the Cell Based Assays Market?

AI is reshaping the market by enabling automated experiment planning, real-time monitoring, and predictive modeling of complex cellular behaviors. It accelerates assay development by optimizing reagent usage and reducing experimental errors. Machine learning algorithms assist in analyzing high-content imaging and multi-parameter data, uncovering insights that were previously difficult to detect. Additionally, AI-driven platforms facilitate more efficient drug screening and biomarker discovery, boosting productivity and supporting the development of novel therapies cost-effectively.

Report Scope of Cell-based Assays Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 20.96 Billion |

| Market Size by 2034 |

USD 45.16 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Products & Services, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled |

Bio-Rad Laboratories, Inc.; Corning Incorporated; Merck KGaA; Lonza Group AG; Charles River Laboratories; Becton, Dickinson and Company (BD); Danaher Corporation; Promega Corporation; Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche Ltd. (Roche Holdings AG); Perkin Elmer Inc. |

Market Dynamics

Driver

Expanding Drug Discovery and Development Efforts

Rising drug discovery and development efforts boost the cell based assay market because research increasingly requires models that reflect real human cellular responses. These assays help identify potential drug targets, study disease mechanisms, and optimize lead compounds before clinical trials. With stricter regulations, companies are adopting cell based approaches to streamline development pipelines, reduce lead-stage failure, and accelerate the translation of laboratory findings into viable treatments.

- For Instance, In April 2025, the FDA launched a pilot program permitting alternatives such as organ-on-chip systems and human cell-based assays to replace animal testing for antibody therapies, aiming to speed up drug development and enhance predictive accuracy. (Source: https://www.fda.gov/)

Restraint

High Cost and Complexities

High costs and technical complexities restrain the cell based assay market because setting up and running these assays often require costly infrastructure, maintenance, and quality control measures. Additionally, variabilities in cell lines and experimental conditions can lead to inconsistent results, necessitating repeated experiments and further increasing expense. Regulatory compliance and validation of novel assays also add time and financial burden, making it challenging for smaller companies or academic labs to adopt these advanced technologies at scale.

Opportunities

Emergence of Label-free Real-time Technologies

The rise of label-free and real-time technologies offers new opportunities in the cell based assay market by enabling more efficient and flexible experimental workflows. These approaches eliminate the need for fluorescent or chemical tags, reducing potential artifacts and simplifying assay design. They also allow continuous, high-resolution monitoring of cellular processes, supporting more accurate prediction of drug efficacy and toxicity. As researchers prioritize faster, cost-effective, and physiologically relevant models, these technologies are poised to expand adoption across the pharmaceutical and biotech sectors.

- For Instance, In March 2025, Nanolive introduced the Smart Mitochondrial Assay LIVE, the first label-free, real-time assay using AI to track mitochondrial dynamics. It measures processes like fission, fusion, and mitophagy in live cells, offering dye-free, accurate analysis for drug testing, toxicology, and disease research, while improving reproducibility and efficiency. (Source: https://www.nanolive.com/)

Cell-based Assays Market By Products & Services Insights

How does Assay Kits Dominate the Cell Based Assays Market in 2024?

In 2024, the assay kit segment dominated the market because these kits provide comprehensive solutions that streamline workflow and minimize technical errors. Their user-friendly design allows researchers with varying expertise to perform complex assays efficiently. Rising adoption in high-throughput screening, personalized medicine, and preclinical research further fueled demand. Moreover, the availability of a diverse list targeting specific cellular pathways, biomarkers, and disease models makes them a versatile tool, driving their preference over standalone reagents or customized assay setups.

The reagents segment is projected to grow rapidly because researchers increasingly rely on customized and high-quality reagents to support complex cell-based assays. Advances in stem cell research, organoids, and precision medicine require regents that can accurately mimic physiological conditions. Additionally, the growing focus on automation and high-throughput platforms increases reagent consumption. With expanding applications in drug development, toxicity testing, and biomarker discovery, demand for diverse and specialized services is driving the segment's accelerated growth in the market.

Cell-based Assays Market By Application Insights

Why Did the Drug Discovery Segment Dominate the Cell Based Assays Market in 2024?

In 2024, the drug discovery segment dominated the market because cell based assays enable detailed analysis of disease mechanisms and target validation, supporting the development of innovative therapies. Increasing focus on complex diseases, such as cancer and neurodegenerative disorders, has driven demand for a reliable in vitro model. Collaborations between pharmaceutical companies and research institutions, along with advanced, high-throughput, and automated screening technologies, have further strengthened the segment’s revenue share by accelerating early-stage development and improving success rates.

The basic research segment is projected to grow rapidly as researchers seek deeper insights into cellular behavior, signaling pathways, and disease modeling. Increasing adoption of innovative assay platforms, such as real-time and label-free technologies, allows detailed observation of live cell dynamics. Furthermore, expanding funding for academic and translational research, coupled with the need for reproducible and scalable in vitro models, is driving the use of cell-based assays in foundational studies, positioning basic research as a key growth area in the market.

Cell-based Assays Market By End-use Insights

What made the pharmaceutical and biotechnology Segment Dominant in the Cell Based Assays Market in 2024?

In 2024, the pharmaceutical and biotechnology segment dominated the market as these companies required efficient tools to accelerate R&D pipelines and reduce late-stage drug failures. Cell-based assays enabled detailed mechanistic studies, biomarker identification, and validation of therapeutic targets. Growing collaboration between pharma, biotech firms, and academic institutions for innovative drug development further boosted demand. The segments focus on cost-effective, high-throughput, and scalable testing solutions, positioning it as the largest end-user of cell based assay technologies during this period.

The academic and research institute segment is projected to grow rapidly as these organizations increasingly adopt cell based assays for innovative studies in drug discovery, toxicological, and disease modeling. The push towards advanced experimental models, including stem cells and organ-on-chip systems, drives demand for flexible and customizable assay platforms. Additionally. Rising global funding for scientific research, combined with the growing emphasis on training and skill development in biotechnology, supports faster adoption, making academic and research institutions a key growth driver in the market.

Some of the prominent players in the Cell-based Assays Market include:

Cell-based Assays Market Recent Developments

- In January 2025, Merck KGaA acquired HUB Organoids Holding B.V., a leader in organoid technology, to boost its expertise in 3D cell cultures and organoid-based assays, supporting more efficient drug discovery and development. (Source: https://www.merckgroup.com/)

- In January 2025, BD partnered with Biosero to integrate robotic arms with BD flow cytometry systems, aiming to streamline processes and accelerate drug discovery and development. (Source: https://news.bd.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cell-based assays market

By Products & Services

-

- Cell Growth Assays

- Reporter Gene Assays

- Cell Death Assays

- Second Messenger Assays

- Microplates

- Probes & Labels

- Instruments & Software

- Cell Lines

-

- Primary Cell Lines

- Stem Cell Lines

- Immortalized Cell Lines

By Application

- Basic Research

- Drug Discovery

- Other Applications

By End-use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

Global Level

- Global Cell-based Assays Market Size (USD Billion), 2024–2034

- Global Cell-based Assays Market Share by Products & Services, 2024 & 2034

- Global Cell-based Assays Market Share by Application, 2024 & 2034

- Global Cell-based Assays Market Share by End-use, 2024 & 2034

Regional & Country Level

North America

- North America Cell-based Assays Market Size, by Country, 2024–2034

- U.S. Cell-based Assays Market Size, by Products & Services, 2024–2034

- Canada Cell-based Assays Market Size, by Products & Services, 2024–2034

- Mexico Cell-based Assays Market Size, by Products & Services, 2024–2034

- North America Cell-based Assays Market Size, by Application, 2024–2034

- North America Cell-based Assays Market Size, by End-use, 2024–2034

Europe

- Europe Cell-based Assays Market Size, by Country, 2024–2034

- Germany Cell-based Assays Market Size, by Products & Services, 2024–2034

- France Cell-based Assays Market Size, by Products & Services, 2024–2034

- U.K. Cell-based Assays Market Size, by Products & Services, 2024–2034

- Italy Cell-based Assays Market Size, by Products & Services, 2024–2034

- Rest of Europe Cell-based Assays Market Size, by Products & Services, 2024–2034

- Europe Cell-based Assays Market Size, by Application, 2024–2034

- Europe Cell-based Assays Market Size, by End-use, 2024–2034

Asia Pacific

- Asia Pacific Cell-based Assays Market Size, by Country, 2024–2034

- China Cell-based Assays Market Size, by Products & Services, 2024–2034

- Japan Cell-based Assays Market Size, by Products & Services, 2024–2034

- South Korea Cell-based Assays Market Size, by Products & Services, 2024–2034

- India Cell-based Assays Market Size, by Products & Services, 2024–2034

- Southeast Asia Cell-based Assays Market Size, by Products & Services, 2024–2034

- Rest of Asia Pacific Cell-based Assays Market Size, by Products & Services, 2024–2034

- Asia Pacific Cell-based Assays Market Size, by Application, 2024–2034

- Asia Pacific Cell-based Assays Market Size, by End-use, 2024–2034

Latin America

- Latin America Cell-based Assays Market Size, by Country, 2024–2034

- Brazil Cell-based Assays Market Size, by Products & Services, 2024–2034

- Rest of Latin America Cell-based Assays Market Size, by Products & Services, 2024–2034

- Latin America Cell-based Assays Market Size, by Application, 2024–2034

- Latin America Cell-based Assays Market Size, by End-use, 2024–2034

Middle East & Africa

- Middle East & Africa Cell-based Assays Market Size, by Country, 2024–2034

- Turkey Cell-based Assays Market Size, by Products & Services, 2024–2034

- GCC Countries Cell-based Assays Market Size, by Products & Services, 2024–2034

- Africa Cell-based Assays Market Size, by Products & Services, 2024–2034

- Rest of Middle East & Africa Cell-based Assays Market Size, by Products & Services, 2024–2034

- Middle East & Africa Cell-based Assays Market Size, by Application, 2024–2034

- Middle East & Africa Cell-based Assays Market Size, by End-use, 2024–2034

- Global Cell-based Assays Market Outlook, 2024–2034 (USD Billion)

- Global Cell-based Assays Market Share, by Products & Services, 2024

- Global Cell-based Assays Market Share, by Application, 2024

- Global Cell-based Assays Market Share, by End-use, 2024

- North America Cell-based Assays Market Share, by Country, 2024

- U.S. Cell-based Assays Market Share, by Products & Services, 2024

- Europe Cell-based Assays Market Share, by Country, 2024

- Germany Cell-based Assays Market Share, by Products & Services, 2024

- Asia Pacific Cell-based Assays Market Share, by Country, 2024

- China Cell-based Assays Market Share, by Products & Services, 2024

- Latin America Cell-based Assays Market Share, by Country, 2024

- Brazil Cell-based Assays Market Share, by Products & Services, 2024

- Middle East & Africa Cell-based Assays Market Share, by Country, 2024

- GCC Countries Cell-based Assays Market Share, by Products & Services, 2024

- Comparative Growth Rate of Cell-based Assays Market across Regions, 2024–2034