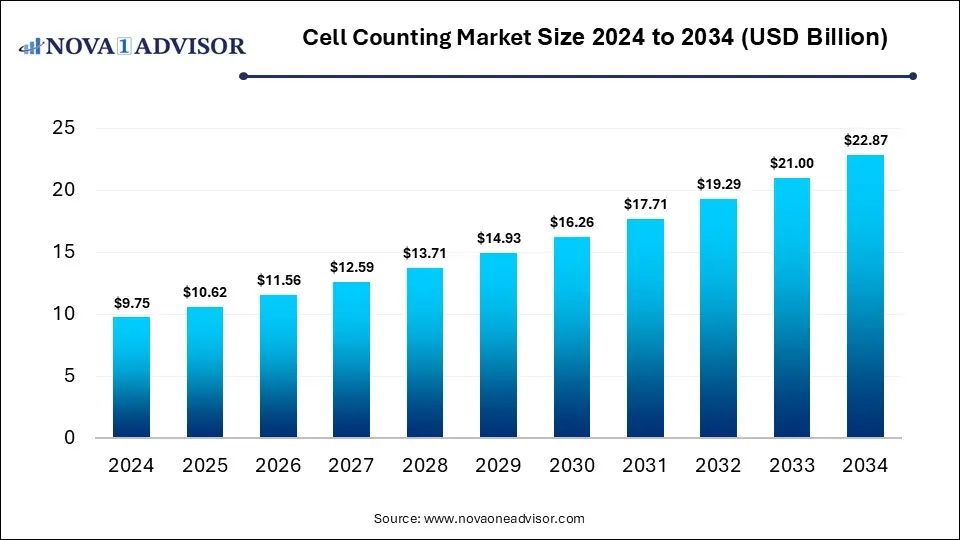

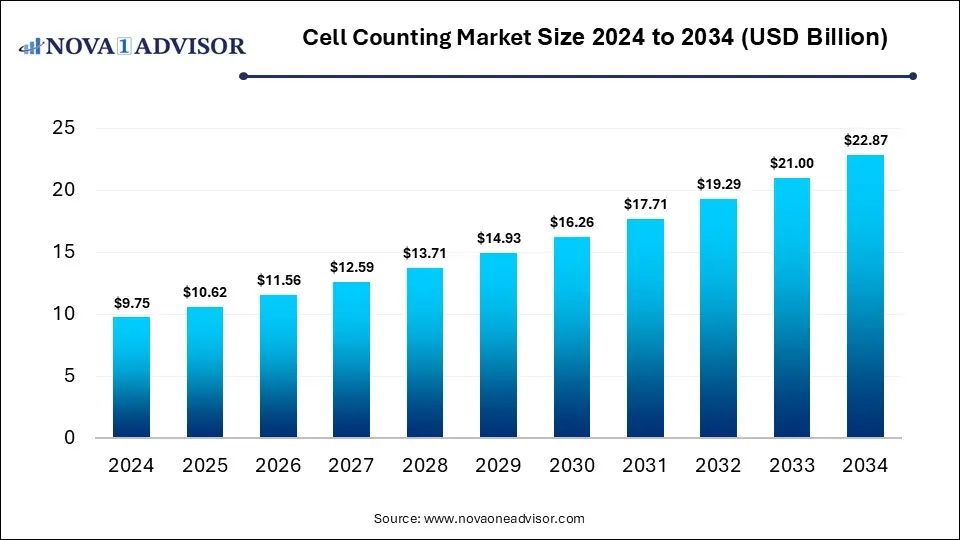

Cell Counting Market Size and Forecast 2025 to 2034

The global cell counting market size is calculated at USD 9.75 billion in 2024, grows to USD 10.62 billion in 2025, and is projected to reach around USD 22.87 billion by 2034, grow at a CAGR of 8.9% from 2025 to 2034. The market is growing due to the rising prevalence of chronic diseases and increasing demand for regenerative medicine and cancer research. Technological advancements in automated and AI-powered cell counters further boost their growth.

Cell Counting Market Key Takeaways

- North America dominated the cell counting market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the consumables & accessories segment held the largest market share in 2024.

- By product, the instruments segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the complete blood count (CBC) segment dominated the market with a major revenue share in 2024.

- By application, the stem cell research segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the research & academic institutes segment led the market in 2024.

- By end user, the pharmaceutical & biotechnology companies segment is expected to grow at the fastest CAGR in the market during the forecast period.

Which Factors are Driving the Growth of the Cell Counting Market?

Cell counting is the process of determining the number of cells in a sample used to assess cell health, growth, and concentration for research, clinical, and biotechnological applications. The cell counting market is growing due to the surge in biologics and vaccine production, where precise cell analysis is essential. Rising applications in stem cell research and personalized medicine are also fueling demand. Furthermore, the increasing focus on quality control in biopharmaceutical manufacturing and growing academic-industry collaborations for advanced research are boosting market adoption. The expanding use of cell counting in environmental testing, microbial, and food safety further diversifies its growth opportunities worldwide.

- For Instance, In January 2024, Thermo Fisher Scientific introduced Gibco CTS Cellmation Software, a validated platform designed to automate cell therapy manufacturing. The solution improves workflow integration, ensures regulatory compliance, and boosts efficiency across the company’s instrument range.

What are the Key trends in the Cell Counting Market in 2024?

- In April 2025, Logos Biosystems’ award-winning LUNATM automated cell counters were highlighted in an exclusive application e-Book by SelectScience®, showcasing the latest advancements, applications, and methods in cell counting technology.

- In June 2024, Bio-Rad introduced the ddSEQ Single-Cell 3’ RNA-Seq Kit along with Omnition v1.1 software, offering researchers streamlined, affordable solutions to advance single-cell gene expression studies across multiple applications.

How Can AI Affect the Cell Counting Market?

AI is transforming the market by improving accuracy, speed, and consistency in analyzing cell samples. Automated AI-driven systems can detect and classify cells more precisely, reducing human error and saving time in research and clinical workflows. AI also enables real-time data analysis, predictive insights, and integration with imaging technologies, supporting advanced applications in drug discovery, cancer diagnostics, and regenerative medicine. These benefits are driving higher adoption of AI-powered cell counting solutions across the healthcare and biotechnology sectors.

Report Scope of Cell Counting Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 10.62 Billion |

| Market Size by 2034 |

USD 22.87 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Application, By End Use, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc., Merck KGaA, Agilent Technologies, Inc., PerkinElmer, BD, Danaher Corporation, Bio-Rad Laboratories, Inc., GE HealthCare, DeNovix |

Market Dynamics

Driver

Rising demand for Advanced Diagnostics

The demand for advanced diagnostics is boosting the cell counting market because modern healthcare requires rapid, high-throughput tools that can handle large sample volumes with efficiency. Cell counting technologies support advanced molecular and genetic diagnostics methods by providing accurate cellular data for downstream analysis. Moreover, the integration of automated counters with digital platforms ensures faster results, reduces workloads in clinical labs, and supports large-scale screening programs, making them vital for the evolving needs of diagnostics applications.

- For Instance, In January 2024, Oculyze introduced an AI-driven yeast cell counting system that automates manual image analysis using cloud-based image recognition. This innovation markedly improves lab productivity and accuracy by integrating seamlessly into existing workflows and reducing reliance on manual counting.

Restraint

High Cost of Advanced Instruments

The high cost of advanced cell counting instruments restrains the market as it reduces affordability for large-scale deployment in routine testing and diagnostics. Many healthcare systems and smaller labs prefer manual or basic semi-automated methods to cut expenses, even if they are less efficient. Additionally, funding constraints in academic and public organizations make it challenging to upgrade to newer technologies, limiting overall accessibility and slowing down the transition towards high-end automated solutions in the global market.

Opportunity

Growing Demand for Personalized Medicine

The rise of personalized medicine opens opportunities in the cell counting market as it requires detailed profiling of patient samples to identify cellular variations linked to specific diseases. Advanced cell counting supports biomarker discovery, stratification of patients for targeted therapies, and monitoring treatment effectiveness at the cellular level. With pharmaceutical companies investing heavily in individualized drug pipelines, demand for precise and flexible cell counting platforms is expected to grow, making them critical tools in advancing personalized healthcare solutions.

- For Instance, In March 2024, the FDA approved Bristol Myers Squibb’s Breyanzi as the first CAR T-cell therapy for CLL and SLL. Since CAR T treatments rely on precise cell counting for manufacturing and dosing, this approval highlights personalized medicine as a major opportunity for advanced cell counting technologies.

Segmental Insights

How did Consumables & Accessories dominate the Cell Counting Market in 2024?

In 2024, the consumables & accessories segment dominated the market as manufacturers increasingly launched specialized kits and reagents tailored for advanced applications like stem cell research, cancer studies, and regenerative medicine. Growing adoption of automated cell counters also fueled higher demand for compatible cartridges, slides, and assay kits. Moreover, the shift towards high-throughput testing in clinical and research laboratories required frequent use of consumables, ensuring their steady growth and reinforcing their leading position in the cell counting market.

The instruments segment is expected to register the fastest CAGR as many labs and hospitals are shifting from manual or semi-automated methods to fully automated platforms to handle larger sample volumes. Growing collaborations between research institutes and instrument manufacturers are also encouraging the adoption of next-generation systems. Furthermore, the introduction of compact, user-friendly, and multi-functional instruments in making advanced cell counting accessible to mid-sized labs, fueling the rapid growth of this segment during the forecast period.

What made the Complete Blood Count (CBC) Segment Dominant in the Cell Counting Market in 2024?

In 2024, the complete blood count (CBC) segment dominated the market as healthcare providers increasingly relied on it for preventive health check-ups and regular monitoring of patient health. The test’s ability to provide a broad overview of overall wellness made it a standard component of routine medical examinations. Rising awareness about early disease detection and the expansion of diagnostic services in both developed and emerging regions further drove the frequent use of CBC tests, ensuring its leading revenue contribution.

The stem cell research segment is projected to grow at the fastest CAGR as scientists are exploring its potential in organ regeneration, neurological disorders treatment, and rare disease therapies. The complexity of stem cells demands advanced analytical tools, making accurate cell counting crucial for ensuring quality and consistency in experiments. Additionally, the emergence of 3D cell culture and tissue engineering has further increased reliance on cell counting systems, fueling rapid adoption of innovative instruments in the research area.

How does the Research & Academic Institutes Segment Dominate the Market?

In 2024, research & academic institutes dominated the market as they primary centers for innovative, continuously experimenting with novel methods in genomics, proteomics, and stem cell studies. Their role in publishing scientific findings and validating new technologies created a strong demand for reliable cell counting tools. Moreover, the push to modernize laboratories with advanced equipment for student training and global research competitiveness further increased adoption, securing this segment's leading position in the market.

- For Instance, In June 2023, OGT, a subsidiary of Sysmex Corporation, partnered with Applied Spectral Imaging (ASI) to secure marketing rights for ASI’s specialized cytogenetic imaging and analysis technologies. The collaboration is designed to strengthen clinical laboratories’ capabilities in conducting detailed genomic structural assessments.

The pharmaceutical & biotechnology companies segment is set to grow at the fastest CAGR as these organizations are expanding into different areas like gene therapy, regenerative medicine, and precision biologics, all of which demand reliable cell evaluation. Increasing partnership between biopharma firms and research institutes is accelerating the adoption of advanced counting platforms. Additionally, strict regulatory standards for cell quality and safety in therapeutic development are pushing companies to invest in modern instruments, driving strong growth during the forecast period.

Regional Insights

How is North America Contributing to the Expansion of the Cell Counting Market?

In 2024, North America led the market as the region saw rapid adoption of advanced laboratory automation and digital platforms in healthcare and research. Expanding clinical trials for novel therapies, including cell and gene treatments, also drove higher demand for precise cell analysis. Moreover, the strong presence of academic collaborations, venture capital investments in biotech startups, and early integration of AI-based technologies positioned North America at the forefront of market growth and revenue generation.

How is Asia-Pacific Accelerating the Market?

Asia-Pacific is expected to record the fastest CAGR as the region is witnessing a strong rise in academic research output and cross-border collaborations with global biotech companies. The growing presence of contract research and manufacturing organizations (CROs and CMOs) is further accelerating the need for precise cell analysis tools. Additionally, the rapid adoption of innovative technologies by emerging biotech startups and the rising demand for affordable yet advanced laboratory solutions are propelling market expansion across the Asia-Pacific.

Top Companies in the Cell Counting Market

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Agilent Technologies, Inc.

- PerkinElmer

- BD

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- GE HealthCare

- DeNovix

Recent Developments in the Cell Counting Market

- In October 2024, ChemoMetec finalized a tender agreement to acquire Belgian firm Ovizio Imaging Systems SA, following due diligence. The deal involved purchasing 100% of Ovizio’s shares, strengthening ChemoMetec’s position in advanced imaging technologies.

- In October 2024, BD introduced its first reagent kits designed for robotic platforms, developed in partnership with Hamilton. These kits aim to advance automation in single-cell research by simplifying workflows and boosting efficiency in genetic sequencing, particularly for oncology and immunology studies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cell counting market.

By Product

-

- Spectrophotometers

- Flow Cytometers

- Hemocytometer

- Automated Cell Counters

- Microscopes

- Others

- Consumables & Accessories

-

- Reagents

- Microplates

- Others

By Application

-

- Automated Cell Counters

- Manual Cell Counters

- Stem Cell Research

- Cell Based Therapeutics

- Bioprocessing

- Toxicology

- Others

By End Use

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

-

Global Cell Counting Market Size (USD Billion), 2024–2034

-

Global Cell Counting Market Share by Product, 2024 & 2034

-

Global Cell Counting Market Share by Application, 2024 & 2034

-

Global Cell Counting Market Share by End Use, 2024 & 2034

-

North America Cell Counting Market Size, by Country, 2024–2034

-

U.S. Cell Counting Market Size, by Product, 2024–2034

-

U.S. Cell Counting Market Size, by Application, 2024–2034

-

U.S. Cell Counting Market Size, by End Use, 2024–2034

-

Canada Cell Counting Market Size, by Product, 2024–2034

-

Mexico Cell Counting Market Size, by Product, 2024–2034

-

North America Cell Counting Market Size, by Application, 2024–2034

-

North America Cell Counting Market Size, by End Use, 2024–2034

-

Europe Cell Counting Market Size, by Country, 2024–2034

-

Germany Cell Counting Market Size, by Product, 2024–2034

-

France Cell Counting Market Size, by Product, 2024–2034

-

U.K. Cell Counting Market Size, by Product, 2024–2034

-

Italy Cell Counting Market Size, by Product, 2024–2034

-

Rest of Europe Cell Counting Market Size, by Product, 2024–2034

-

Europe Cell Counting Market Size, by Application, 2024–2034

-

Europe Cell Counting Market Size, by End Use, 2024–2034

-

Asia Pacific Cell Counting Market Size, by Country, 2024–2034

-

China Cell Counting Market Size, by Product, 2024–2034

-

Japan Cell Counting Market Size, by Product, 2024–2034

-

South Korea Cell Counting Market Size, by Product, 2024–2034

-

India Cell Counting Market Size, by Product, 2024–2034

-

Southeast Asia Cell Counting Market Size, by Product, 2024–2034

-

Rest of Asia Pacific Cell Counting Market Size, by Product, 2024–2034

-

Asia Pacific Cell Counting Market Size, by Application, 2024–2034

-

Asia Pacific Cell Counting Market Size, by End Use, 2024–2034

-

Latin America Cell Counting Market Size, by Country, 2024–2034

-

Brazil Cell Counting Market Size, by Product, 2024–2034

-

Rest of Latin America Cell Counting Market Size, by Product, 2024–2034

-

Latin America Cell Counting Market Size, by Application, 2024–2034

-

Latin America Cell Counting Market Size, by End Use, 2024–2034

-

Middle East & Africa Cell Counting Market Size, by Country, 2024–2034

-

Turkey Cell Counting Market Size, by Product, 2024–2034

-

GCC Countries Cell Counting Market Size, by Product, 2024–2034

-

Africa Cell Counting Market Size, by Product, 2024–2034

-

Rest of Middle East & Africa Cell Counting Market Size, by Product, 2024–2034

-

Middle East & Africa Cell Counting Market Size, by Application, 2024–2034

-

Middle East & Africa Cell Counting Market Size, by End Use, 2024–2034

-

Global Cell Counting Market Outlook, 2024–2034 (USD Billion)

-

Global Cell Counting Market Share, by Product, 2024

-

Global Cell Counting Market Share, by Application, 2024

-

Global Cell Counting Market Share, by End Use, 2024

-

Global Cell Counting Market Share, by Product, 2034

-

Global Cell Counting Market Share, by Application, 2034

-

Global Cell Counting Market Share, by End Use, 2034

-

North America Cell Counting Market Share, by Country, 2024

-

U.S. Cell Counting Market Share, by Product, 2024

-

Europe Cell Counting Market Share, by Country, 2024

-

Germany Cell Counting Market Share, by Product, 2024

-

Asia Pacific Cell Counting Market Share, by Country, 2024

-

China Cell Counting Market Share, by Product, 2024

-

Latin America Cell Counting Market Share, by Country, 2024

-

Brazil Cell Counting Market Share, by Product, 2024

-

Middle East & Africa Cell Counting Market Share, by Country, 2024

-

GCC Countries Cell Counting Market Share, by Product, 2024

-

Comparative Growth Rate of Cell Counting Market across Regions, 2024–2034