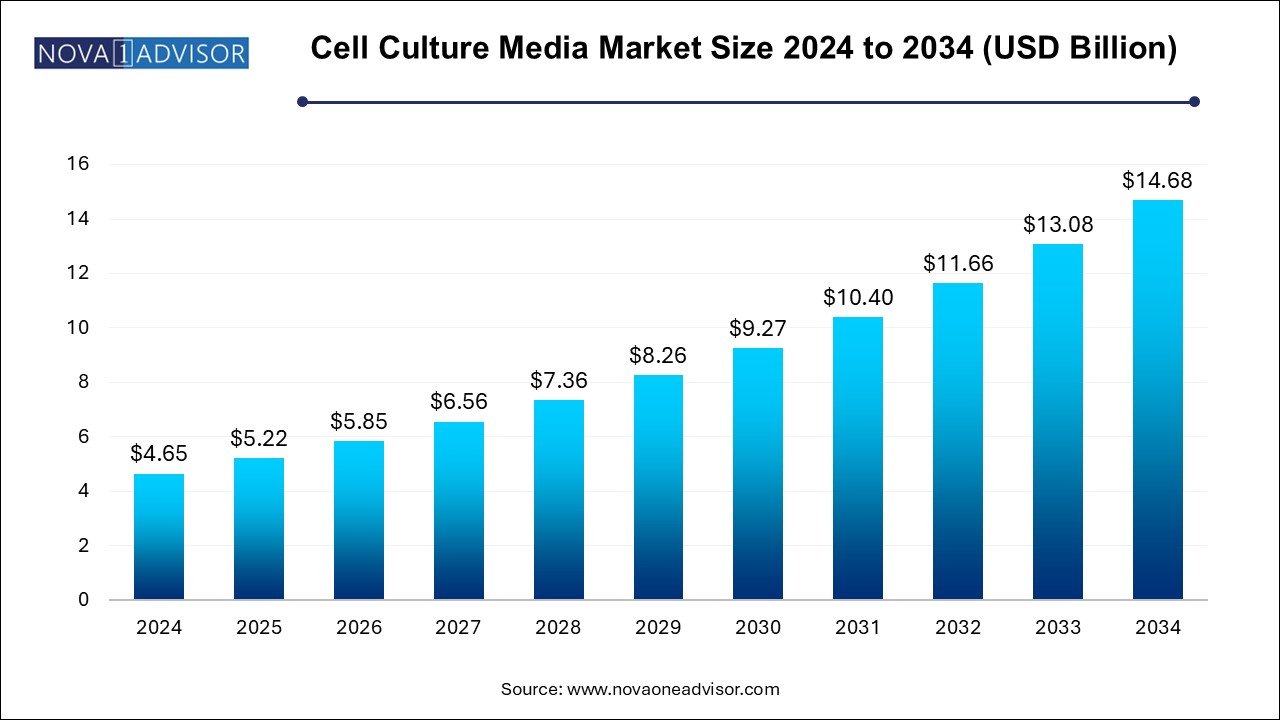

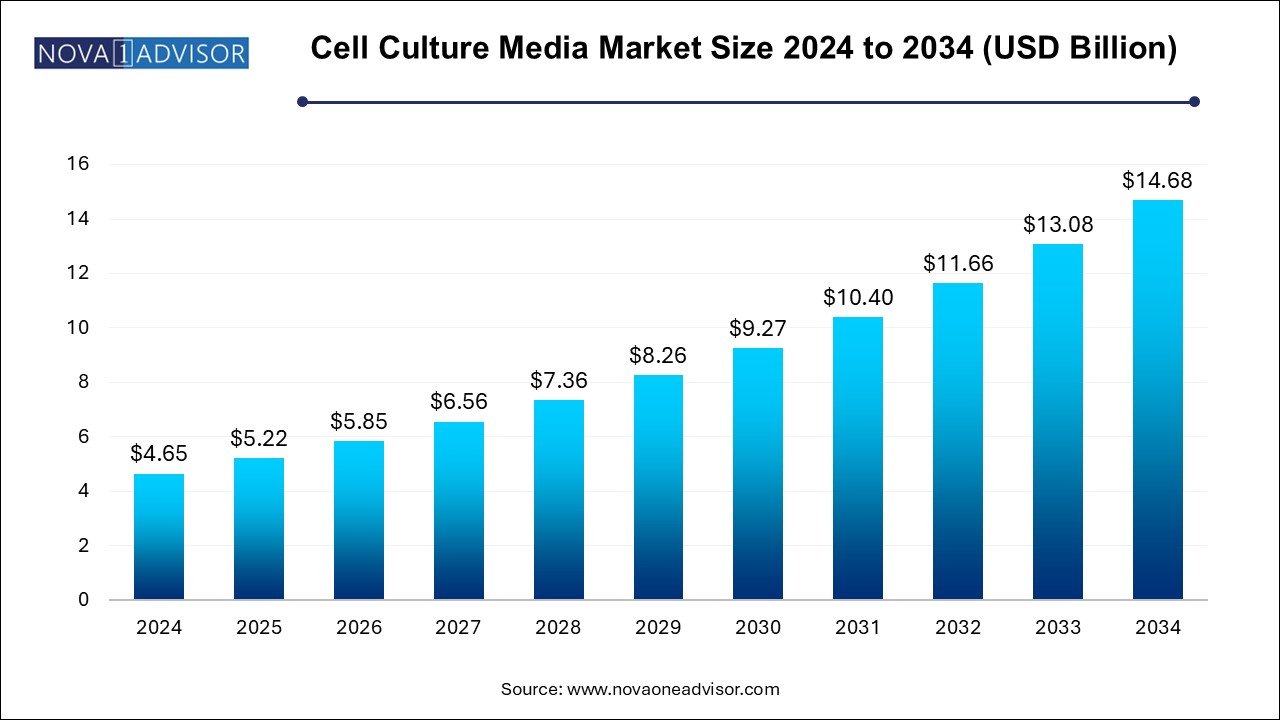

The cell culture media market size was exhibited at USD 4.65 billion in 2024 and is projected to hit around USD 14.68 billion by 2034, growing at a CAGR of 12.18% during the forecast period 2025 to 2034. The market growth is driven by increasing biopharmaceutical production, cell-based research, and personalized medicine.

- North America led the market while holding the largest share in 2024.

- Asia Pacific is expected to experience the fastest growth in the market between 2025 and 2034.

- By type, the liquid media segment held the largest share of the market in 2024.

- By type, the semi-solid & solid media segment is expected to grow at the highest CAGR over the forecast period.

- By product, the serum-free media segment dominated the market in 2024.

- By product, the stem cell culture media segment is expected to expand at the highest CAGR over the projection period.

- By application, the biopharmaceutical production segment led the market in 2024.

- By application, the diagnostics segment is expected to grow at a significant rate in the coming years.

- By end-use, the pharmaceutical & biotechnology companies segment dominated the market in 2024.

- By end-use, the hospitals & diagnostic laboratories segment is expected to expand at a rapid pace during the projection period.

Artificial intelligence (AI) is significantly transforming the cell culture media market by optimizing media formulation, improving predictive modeling, and accelerating research workflows. AI algorithms can analyze vast datasets from cell experiments to identify optimal nutrient compositions tailored to specific cell lines, reducing trial-and-error and development time. In biomanufacturing, AI enhances process automation and real-time monitoring, ensuring consistent media quality and performance. It also plays a key role in personalized medicine by enabling the design of customized media for patient-specific cell cultures. As AI integration grows, it is driving innovation, efficiency, and precision across R&D and production in the cell culture media industry.

- In October 2024, Shimadzu Corporation launched CellTune, AI-powered software that optimizes cell culture conditions by analyzing culture supernatant data via LC-MS and LC/MS/MS methods, recommending ideal media composition and environment.

Market Overview

The cell culture media market refers to the industry focused on the production and development of nutrient-rich solutions used to support the growth, proliferation, and maintenance of cells in vitro. These media are essential in a wide range of applications including biopharmaceutical production, vaccine development, regenerative medicine, diagnostics, and academic research. The primary benefits of cell culture media include controlled environments for cell growth, reproducibility in experiments, and the ability to customize formulations for specific cell types or applications. Market growth is driven by the rising demand for biologics, increasing investments in cell and gene therapy, and advancements in 3D cell culture and stem cell research. Additionally, the shift toward serum-free and chemically defined media is enhancing product quality and regulatory compliance, further propelling the market forward.

Major Market Trends

1. Shift Toward Serum-Free and Chemically Defined Media

There is increasing demand for serum-free and chemically defined media to ensure batch-to-batch consistency, reduce contamination risk, and meet stringent regulatory standards. This shift supports safer and more reproducible outcomes, especially in biopharmaceutical production and clinical research.

2. Integration of AI and Automation

AI and machine learning are being used to optimize media composition and predict cell responses, reducing trial-and-error and speeding up development. Automation in media preparation and monitoring is also improving scalability and efficiency in both R&D and manufacturing settings.

3. Growth of Stem Cell and Regenerative Medicine

The expanding use of stem cells in regenerative therapies and cell-based treatments is driving demand for media specifically designed to support pluripotent and differentiated cell types. This includes media that promote cell viability, self-renewal, and lineage-specific differentiation.

4. Increasing Adoption of 3D Cell Culture and Organoids

3D cell culture models and organoids offer more physiologically relevant environments compared to 2D cultures, requiring advanced media formulations. These models are increasingly used in drug discovery, cancer research, and toxicology studies.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.22 Billion |

| Market Size by 2034 |

USD 14.68 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.18% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Lonza; BD; STEMCELL Technologies; Cell Biologics, Inc.; PromoCell GmbH |

Market Dynamics

Drivers

Growing Demand for Biopharmaceuticals

The growing demand for biopharmaceuticals, including monoclonal antibodies and vaccines, is a major factor driving the growth of the cell culture media market. These biologics rely heavily on cell-based production systems, where high-quality and optimized media are essential to support cell growth, viability, and productivity. As pharmaceutical companies scale up manufacturing to meet global therapeutic needs, the demand for consistent, chemically defined, and scalable media solutions has surged.

Additionally, the rising development of gene therapies is significantly driving the growth of the cell culture media market, as these therapies rely on specialized cell-based platforms for vector production, transfection, and cell modification. Cell culture media play a critical role in maintaining health, proliferation, and transduction efficiency of host cells used in gene therapy manufacturing.

Increasing R&D Investments

Rising investments in research and development (R&D) drives the growth of the market. Increased funding from both public and private sectors supports the development of advanced therapies, such as biologics, stem cell treatments, and gene therapies, all of which require optimized cell culture conditions. These investments accelerate the need for high-quality, customizable media formulations to support diverse cell lines and complex experimental models. Moreover, academic institutions and biotech startups are increasingly relying on sophisticated media to ensure reproducibility and efficiency in preclinical and clinical research. As R&D activities continue to expand globally, the demand for innovative, scalable, and compliant cell culture media will rise in parallel.

Restraint

High Costs and Stringent Regulatory Requirements

The growth of the cell culture media market is restrained by several factors, including the high cost of specialized media formulations, which can be a significant barrier for small-scale labs and emerging biotech firms. Advanced or customized media, especially those that are serum-free or chemically defined, often involve complex manufacturing processes that increase production costs. Contamination risks, such as microbial or cross-contamination, also pose serious threats to experimental integrity and product safety, particularly in large-scale biomanufacturing. Additionally, strict regulatory requirements for media used in clinical and therapeutic applications demand extensive quality control, documentation, and compliance, which can slow down product development and increase operational burdens.

Opportunities

Advancements in Cell Culture Technologies

Ongoing advancements in cell culture technologies create immense opportunities in the cell culture media market. Innovations such as 3D cell culture, organoids, microfluidic systems, and bioreactor-based platforms demand highly specialized media formulations that can support complex cell behaviors and interactions. These cutting-edge methods are increasingly used in drug discovery, toxicity testing, and personalized medicine, driving the need for tailored media solutions. Additionally, improvements in media optimization tools, including AI and automation, are helping researchers develop faster and more reproducible workflows. As the industry shifts toward more sophisticated in vitro models, the demand for next-generation cell culture media is set to expand rapidly.

Rising Demand for Personalized Medicine

The rising demand for personalized medicine and regenerative medicine is generating significant opportunities in the market, as both fields rely heavily on cultivating patient-specific or specialized cell types. Personalized medicine requires media formulations that can support the growth of individual patient-derived cells, enabling customized treatment development and more accurate disease modeling. In regenerative medicine, the use of stem cells and tissue engineering demands highly controlled and nutrient-rich media to promote cell differentiation, expansion, and functionality. This growing focus on precision and repair-oriented therapies has increased the need for specialized, serum-free, and chemically defined media that meet clinical-grade standards.

What Made Serum-Free Media the Dominant Segment in the Market in 2024?

The serum-free media segment dominated the cell culture media market in 2024. This is mainly due to its growing adoption in biopharmaceutical manufacturing and advanced cell-based research. Unlike traditional serum-containing media, serum-free formulations offer greater consistency, reduced risk of contamination, and better regulatory compliance, especially important in therapeutic production. Serum-free media is widely used in the cultivation of CHO, HEK 293, and other recombinant cell lines for monoclonal antibody and vaccine production.

The shift toward animal component-free and chemically defined media has further strengthened this segment, aligning with ethical standards and reproducibility demands in clinical and commercial applications. Additionally, the increasing use of serum-free media in cell and gene therapy research has contributed to its dominant market position.

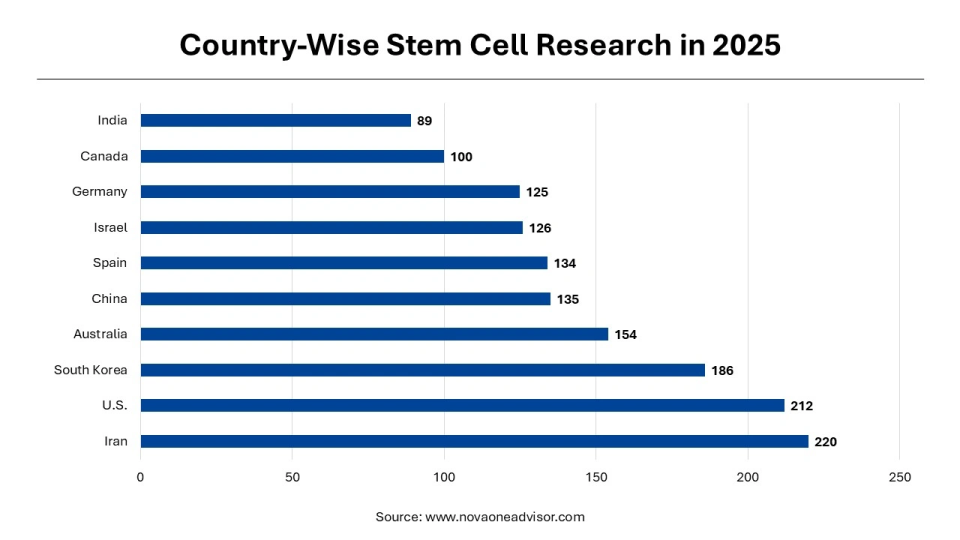

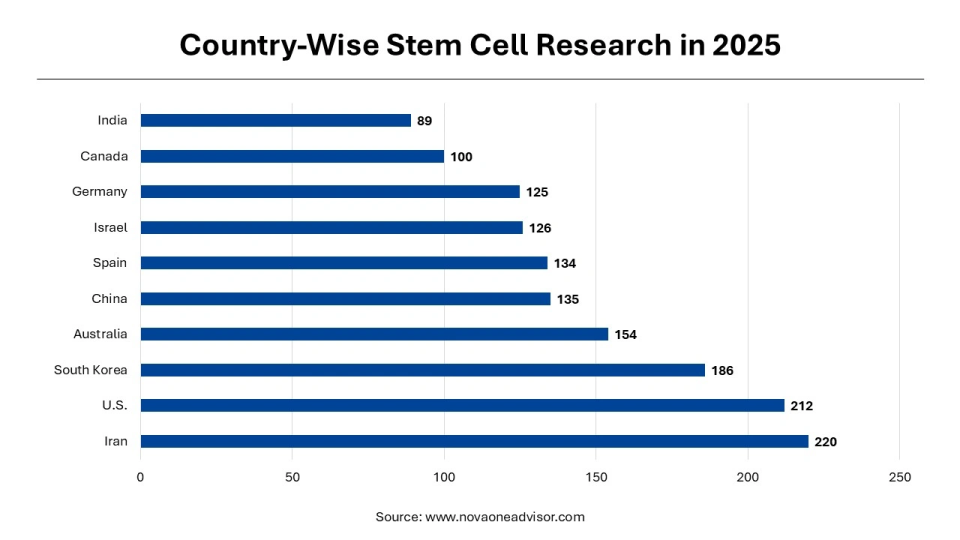

The stem cell culture media segment is expected to grow at the highest CAGR in the upcoming period due to the rapid expansion of regenerative medicine, cell therapy, and tissue engineering applications. As clinical trials and approved therapies involving stem cells increase, there is a rising demand for specialized, high-performance media that support the growth, maintenance, and differentiation of pluripotent and adult stem cells. Additionally, advancements in personalized medicine and 3D cell culture technologies are further driving the need for tailored media formulations. This trend is supported by growing investments from both public and private sectors in stem cell research and manufacturing infrastructure globally.

How Does the Biopharmaceutical Production Segment Lead the Market in 2024?

The biopharmaceutical production segment led the cell culture media market in 2024. This is primarily due to the increased global demand for monoclonal antibodies, vaccines, and recombinant protein therapeutics. Cell culture media are critical components in the large-scale manufacturing of these biologics, ensuring optimal cell growth, productivity, and product quality. The increasing prevalence of chronic diseases and the expansion of biologic pipelines by pharmaceutical companies have further accelerated the use of cell-based production systems.

Additionally, the growth of contract development and manufacturing organizations (CDMOs) and the shift toward serum-free and chemically defined media for regulatory compliance have reinforced this segment’s leadership. Biopharmaceutical production remains the backbone of industrial cell culture applications, making it the largest revenue contributor to the market.

The diagnostics segment is expected to grow at a significant rate in the near future due to the increasing use of cell-based assays in infectious disease detection, cancer diagnostics, and personalized medicine. As diagnostic technologies advance, there's growing demand for specialized media that support rapid, reliable, and high-throughput cell culture testing. The expansion of point-of-care testing, along with heightened global focus on early disease detection and pandemic preparedness, is further accelerating adoption. Additionally, innovations in molecular and cellular diagnostics, such as organoids and 3D cultures, require optimized media solutions for accurate results, contributing to segmental growth.

Why Did the Liquid Media Segment Dominated the Cell Culture Media Market in 2024?

The liquid media segment dominated the market with the largest share in 2024 due to its widespread use across a wide range of applications, including biopharmaceutical production, academic research, and diagnostics. Liquid media offers advantages such as ease of handling, uniform nutrient distribution, and compatibility with automated and high-throughput systems, making it the preferred choice for large-scale cell culture processes. Its critical role in monoclonal antibody production, vaccine development, and recombinant protein expression further solidified its market leadership.

Additionally, advancements in serum-free and chemically defined liquid formulations have enhanced reproducibility and regulatory compliance, particularly in clinical and commercial manufacturing. As demand for scalable and efficient culture systems continues to rise, liquid media remains the foundation of modern cell culture workflows.

The semi-solid & solid media segment is expected to expand at the fastest CAGR during the forecast period, owing to its increasing application in colony isolation, microbial culture, and cancer research. These media types are essential for supporting 3D cell culture models, spheroid formation, and tissue-like structures, which are gaining traction in drug discovery and regenerative medicine. Additionally, rising demand for personalized medicine and stem cell research has fueled interest in platforms that require more physiologically relevant environments, which solid and semi-solid media can provide. The shift toward more complex and functional in vitro models is driving the rapid adoption of these media formats across research and biotech industries.

How Did Pharmaceutical & Biotechnology Companies Segment Contribute the Largest Market Share in 2024?

The pharmaceutical & biotechnology companies segment dominated the cell culture media market while capturing the largest share in 2024. This is mainly due to their extensive use of media in the development and large-scale production of biologics, including monoclonal antibodies, vaccines, and recombinant proteins. These companies require high-quality, scalable, and regulatory-compliant media formulations to ensure product consistency and efficiency in manufacturing. The growing demand for innovative therapies, such as cell and gene therapies, has further driven biopharma firms to invest heavily in optimized cell culture systems.

Additionally, the increasing reliance on chemically defined and serum-free media for clinical-grade production has positioned biopharmaceutical companies as the largest consumers in the market. Their role in both research and commercial production has made them a key driver of market dominance.

The hospitals & diagnostic laboratories segment is expected to expand at a rapid pace during the projection period, owing to the increasing adoption of cell-based diagnostic tests and personalized medicine. Growing awareness about early disease detection and the rise in chronic and infectious diseases are driving demand for advanced diagnostic technologies that rely on high-quality cell culture media. Additionally, the expansion of point-of-care testing and molecular diagnostics in hospital settings requires specialized media to support accurate and rapid results. Technological advancements in 3D cell culture and organoid models for diagnostics are also fueling growth in this segment.

What Made North America the Dominant Region in the Cell Culture Media Market?

North America dominated the cell culture media market while capturing the largest share in 2024. This is mainly due to its strong biotechnology and pharmaceutical infrastructure, along with significant investments in research and development. The region is home to a large number of leading biopharma companies, academic institutions, and research organizations that actively use cell culture media for drug development, vaccine production, and regenerative medicine. Favorable government funding and initiatives, such as support from the NIH and FDA for cell-based therapies, have further accelerated market growth.

In addition, the early adoption of advanced technologies like 3D cell culture, bioreactors, and AI-driven media optimization has enhanced productivity and innovation in the region. A high prevalence of chronic diseases and increasing demand for personalized medicine also drive the need for advanced cell culture systems.

The U.S. is a major contributor to the North American cell culture media market due to its robust biotechnology and pharmaceutical sectors, which extensively utilize cell culture systems for drug discovery, biologics production, and regenerative medicine. The country benefits from strong government funding, advanced research infrastructure, and the presence of leading industry players like Thermo Fisher Scientific, Danaher, and GE HealthCare. Additionally, high demand for personalized medicine and stem cell therapies continues to drive the need for specialized media solutions. The U.S. also leads in clinical trials and regulatory support, further solidifying its dominant position in the regional market.

- For instance, the International Society for Stem Cell Research (ISSCR) released updated guidelines to enhance ethical, scientific, and regulatory standards in stem cell research and clinical translation, ensuring safe therapies and preventing premature commercialization.

What Factors Contribute to the Cell Culture Media Market in Asia Pacific?

Asia Pacific is expected to experience rapid growth due to several key factors, including increasing investments in biotechnology, pharmaceutical R&D, and biomanufacturing across countries like China, India, South Korea, and Japan. Government support for life sciences, along with expanding healthcare infrastructure and growing awareness of cell-based therapies, is fueling demand for advanced culture media. The rise in chronic diseases and aging populations in the region is also driving interest in regenerative medicine and personalized treatments, which rely heavily on high-quality cell culture systems. Additionally, the availability of skilled scientific talent and the expansion of contract research and manufacturing organizations (CROs and CMOs) are supporting large-scale adoption of innovative media products.

China is a major player in the cell culture media market in Asia Pacific, driven by its rapidly expanding biotechnology and pharmaceutical industries. The country has significantly increased investments in life sciences, supported by favorable government policies and funding initiatives like "Made in China 2025" and the National Health Commission’s innovation drive. China is also a growing hub for biomanufacturing, stem cell research, and clinical trials, all of which require large volumes of high-quality cell culture media. Additionally, the presence of domestic and international biotech firms, along with an expanding network of CROs and CMOs, contributes to the rising demand for specialized media.

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Drives |

Key Challenges |

Market Outlook |

| North America |

USD 1.9 Bn |

~6.6% |

Strong biotech & pharma infrastructure, high R&D spending |

Regulatory complexities, high costs |

Mature & steady growth |

| Asia Pacific |

USD 1.4 Bn |

~7.55% |

Rising biotech investments, expanding healthcare access |

Infrastructure gaps, price sensitivity |

Fastest-growing region |

| Europe |

USD 1.1 Bn |

~10.92% |

Advanced healthcare systems, growing demand for personalized medicine |

Slow regulatory approvals, reimbursement caps |

Stable Growth |

| Latin America |

USD 0.4 Bn |

~4.14% |

Expanding healthcare infrastructure, growing CROs |

Political instability, limited funding |

Emerging market with potential |

| MEA |

USD 0.2 Bn |

~4.14% |

Urbanization, government initiatives in biotech |

Infrastructure & skilled workforce shortage |

Emerging & underpenetrated |

1. Raw Material Sourcing

This stage involves the procurement of high-quality components such as amino acids, vitamins, salts, growth factors, and serum or serum alternatives. The purity and consistency of these ingredients are critical for the performance and safety of cell culture media.

- Key players: Thermo Fisher Scientific, Merck KGaA, Sartorius Stedim Biotech, Avantor, FUJIFILM Irvine Scientific.

2. Media Formulation and Development

In this phase, companies develop specialized media formulations tailored to specific cell lines and applications, ranging from monoclonal antibody production to stem cell culture. The formulations may be serum-based, serum-free, or chemically defined, and undergo extensive testing for performance and reproducibility.

- Key players: Corning Inc., Thermo Fisher Scientific, Danaher (Cytiva), Lonza Group, FUJIFILM Irvine Scientific.

3. Production and Quality Control

Manufacturing involves scaling up media production while maintaining strict quality control standards, such as sterility, endotoxin levels, pH balance, and osmolality. Regulatory compliance with GMP (Good Manufacturing Practices) is essential, especially for media used in therapeutic applications.

- Key players: Merck KGaA, Thermo Fisher Scientific, Sartorius, Lonza, GE HealthCare.

4. Packaging and Distribution

Cell culture media must be packaged in sterile, contamination-free conditions, often in bottles, bags, or bulk containers depending on end-use. Efficient cold-chain logistics and distribution networks are necessary to ensure product stability and timely delivery worldwide.

- Key players: Avantor, Thermo Fisher Scientific, Corning, Danaher, Bio-Techne.

5. End-User Application

The final stage includes the use of media by end-users such as pharmaceutical companies, biotech firms, academic research labs, and diagnostic facilities. Cell culture media are vital for cell expansion, biologics manufacturing, vaccine production, toxicity testing, and regenerative medicine.

- Key users: Pfizer, Moderna, Novartis, academic institutions, CDMOs like Lonza and WuXi AppTec.

Competitive Landscape

1. Thermo Fisher Scientific

It is a global leader offering a broad portfolio of high-quality, innovative cell culture media products tailored for various applications like biopharmaceutical manufacturing, stem cell research, and vaccine development. It drives market growth through continuous R&D and extensive distribution networks.

2. Merck KGaA

It provides advanced, chemically defined media and serum-free solutions that support efficient and scalable cell growth, especially for biologics production. Their focus on quality and regulatory compliance strengthens their position in therapeutic applications.

3. Corning Incorporated

Known for its comprehensive media solutions and cell culture consumables, Corning supports diverse research and industrial applications, contributing to advancements in tissue engineering and regenerative medicine.

4. Lonza Group

It offers customized media solutions and contract development and manufacturing services (CDMO), helping biopharmaceutical companies accelerate drug development and commercial production.

5. FUJIFILM Irvine Scientific

The company specializes in media for assisted reproductive technology (ART), stem cell research, and bioproduction, delivering innovative formulations that meet stringent clinical and research standards.

6. Danaher Corporation (Cytiva)

It provides cell culture media alongside bioprocessing technologies, supporting both research and large-scale biomanufacturing through integrated solutions.

7. Avantor, Inc.

The company supplies raw materials and cell culture media products, focusing on high purity and consistency, catering to pharmaceutical and biotech industries globally.

Recent Developments

- In July 2024, Merck has launched its first GMP-compliant cell culture media manufacturing line in Nantong, China, investing nearly €6.6 million ($7.1 million). This facility aims to meet rising local demand for high-quality custom CCM essential for biopharmaceutical, vaccine, and therapeutic production.

- On November 1, 2023, Ajinomoto CELLiST Korea launched CELLiST F7, an innovative cell culture medium featuring cysteine stabilization technology that allows high cysteine concentrations in a single formulation, enhancing culture performance. Utilizing advanced Digital Twin technology, the medium is optimized for amino acids and components to boost antibody productivity. Research showed CELLiST F7 outperforms existing products in antibody production across all CHO cell lines.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cell culture media market.

By Type

- Liquid Media

- Semi-Solid & Solid Media

By Product

-

- CHO Media

- BHK Media

- Vero Media

- HEK 293 Media

- Others

- Classical Media

- Stem Cell Culture Media

- Specialty Media

- Chemically-Defined Media

- Others

By Application

- Biopharmaceutical Production

-

- Monoclonal Antibodies

- Vaccine Production

- Others

- Diagnostics

- Drug Screening & Development

- Tissue Engineering & Regenerative Medicine

-

- Cell and Gene Therapy

- Others

By End-Use

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)