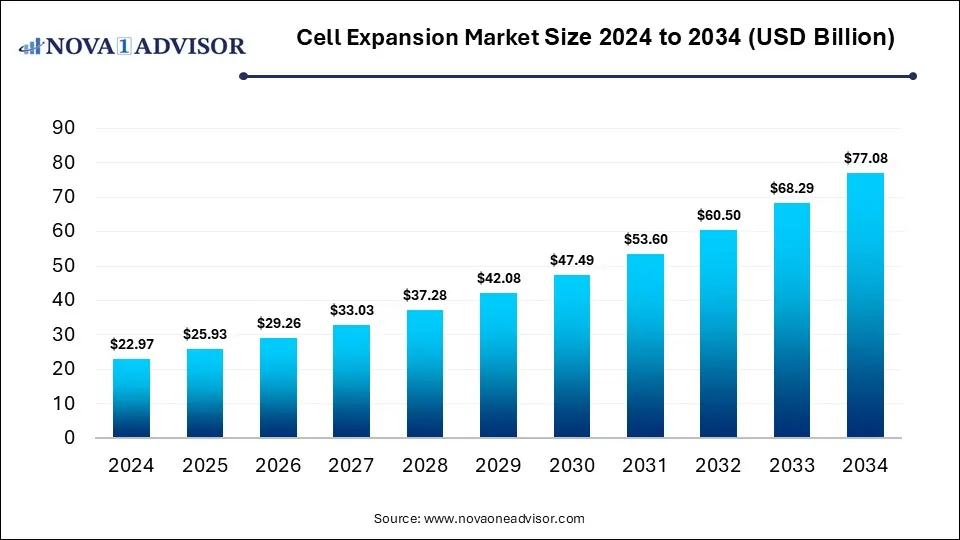

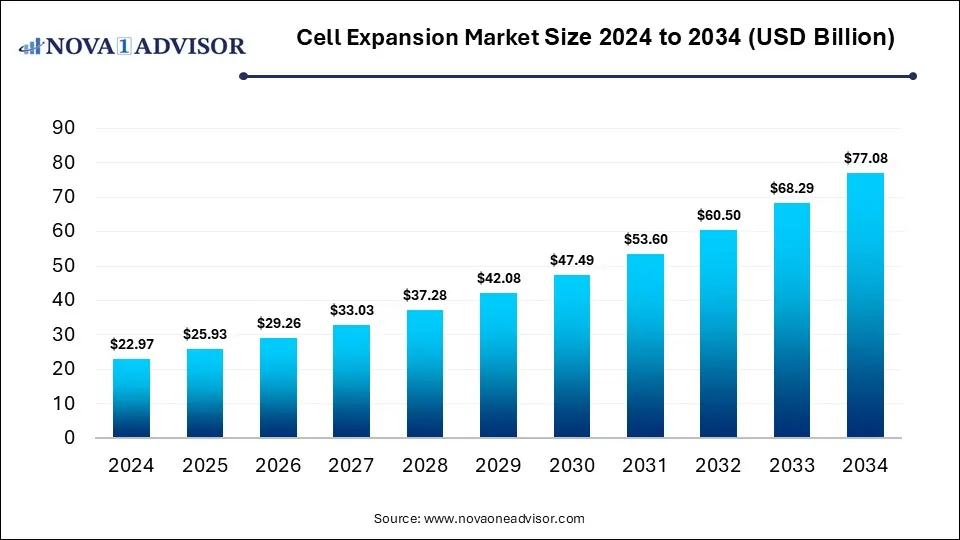

Cell Expansion Market Size and Growth 2025 to 2034

The global cell expansion market size is calculated at USD 22.97 billion in 2024, grows to USD 25.93 billion in 2025, and is projected to reach around USD 77.08 billion by 2034, registering a CAGR of 12.87% over the forecast period of 2025 to 2034. The market is growing due to rising demand for cell therapies and regenerative medicine. Advancements in bioprocessing technologies are also boosting large-scale cell production efficiency.

Cell Expansion Market Key Takeaways

- North America dominated the cell expansion market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the consumables segment held the largest market share in 2024.

- By product, the instruments segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By cell type, the mammalian cells segment dominated the market with a major revenue share in 2024.

- By cell type, the human stem cells segment is expected to grow at a significant rate in the market during the forecast period.

- By end-use, the biotechnology & biopharmaceutical companies segment led the market in 2024.

- By end-use, the research institutes segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the biopharmaceutical segment dominated the market in 2024.

- By application, the vaccine production segment is expected to grow at the fastest CAGR in the market during the forecast period.

How is Innovation Impacting the Cell Expansion Market?

Cell expansion is the controlled process of increasing the number of cells in vitro while maintaining their viability, functionality, and desired characteristics, typically for use in research, therapeutic applications, or biomanufacturing. Technological innovation is accelerating the cell expansion market by enabling more efficient, scalable, and reproducible cell production. Automation, advanced bioreactor design, and optimized culture conditions reduce labor and contamination risks while improving cell quality. Emerging tools for real-time monitoring and data-driven process optimization ensure consistent outcomes. Furthermore, breakthroughs in synthetic media and stem cell engineering are expanding applications in regenerative medicine and cell therapies, fueling market growth and meeting the increasing demand for high-quality, large-scale cell products.

What are the Key trends in the Cell Expansion Market in 2024?

- In February 2024, Multiply Labs strengthened its partnership with Thermo Fisher Scientific to advance automation in cell expansion and separation, aiming to enhance efficiency and scalability in cell therapy manufacturing.

- In May 2023, panCELLa partnered with BioCentriq through a research agreement to explore NK cell expansion from stem cells. The study focuses on assessing panCELLa’s engineered feeder cells designed to improve expansion efficiency, yield, and the generation of functional NK cells.

How Can AI Affect the Cell Expansion Market?

AI is reshaping the market by enabling predictive modeling, automation, and real-time monitoring of cell growth. Machine learning algorithms can analyze large datasets to optimize culture conditions, improve yield, and ensure consistent cell quality. AI-driven automation reduces manual errors, enhances scalability, and speeds up production timelines. Additionally, AI supports advanced quality control and process standardization, which are crucial for clinical-grade cell therapies. These benefits collectively accelerate innovation, reduce costs, and expand applications in regenerative medicine and biopharmaceuticals.

Cell Expansion Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 25.93 Billion |

| Market Size by 2034 |

USD 77.08 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.35% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Cell Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc., Corning Incorporated, Merck KGaA, Miltenyi Biotec, BD (Becton, Dickinson and Company), Terumo BCT, Inc., Sartorius AG, Takara Bio Inc.,TRINOVA BIOCHEM GmbH, upcyte technologies GmbH

|

Market Dynamics

Driver

Growing Demand for Cell-based Therapies and Regenerative Medicine

The surge in demand for cell-based therapies and regenerative medicine is fueling the growth of the cell expansion market because these treatments rely on consistent and large-scale cell production. With rising cases of chronic illness and the push for personalized medicine, healthcare providers require advanced methods to produce viable cells. Cell expansion technologies play a crucial role in meeting this need by improving scalability, safety, and efficiency, making them vital for advancing therapeutic applications worldwide.

- For Instance, In February 2024, the FDA granted accelerated approval to Lifileucel, marketed as Amtagvi, marking the first tumor-infiltrating lymphocyte (TIL) cell therapy for solid tumors specifically, unresectable or metastatic melanoma. This milestone underscores the need for scalable cell expansion processes to produce large quantities of TILs for clinical deployment.

Restraint

Ethical Concerns Related to Cell Biology

Ethical issues in cell biology restrain the cell expansion market as they spark debate around stem cell sourcing, genetic modification, and long-term societal impacts. Concerns over human embryo use and potential misuse of advanced cell technologies often create public resistance and stricter oversight. Such barriers limit research freedom, reduce investment interest, and complicate regulatory approvals. Consequently, these ethical challenges slow down the pace of innovation and hinder the widespread adoption of cell expansion solutions in therapeutic applications.

Opportunity

Advancements in Stem Cell Research

Progress in stem cell research offers significant future opportunities for the cell expansion market by broadening its use in treating chronic and degenerative diseases. Breakthroughs in deriving, culturing, and modifying stem cells are improving their stability, quality, and scalability for clinical applications. These advancements support the development of next-generation therapies, including tissue regeneration and organ repair. As stem cell-based solutions move closer to commercialization, demand for efficient and automated expansion platforms is expected to accelerate, driving market growth.

Segmental Insights

What made the Consumables Segment Dominant in the Cell Expansion Market in 2024?

The consumables segment dominated the cell expansion market in 2024 because of their frequent use in daily laboratory workflows and therapeutic manufacturing. Products such as growth media, supplements, sera, and plasticware are indispensable for maintaining cell cultures and ensuring consistent results. As research in regenerative medicine and cell therapies advanced, reliance on these supplies grew significantly. Their recurring demand, coupled with the need for specialized, high-quality materials, positioned consumables as specialized, high-quality materials, positioned consumables as the leading revenue-generating category within the market.

- For Instance, In May 2023, Lonza launched TheraPEAK T-VIVO Cell Culture Medium, a chemically defined, animal-free formulation designed to support CAR T-cell production. The medium improves consistency, simplifies regulatory compliance, and enhances process efficiency, thereby speeding up the development of cell therapies.

The instruments segment is projected to record the fastest growth in the cell expansion market as laboratories and biopharma companies shift towards high-tech solutions for large-scale cell production. Modern equipment, such as automated bioreactors, advanced filtration systems, and monitoring devices, enables better control over culture conditions and higher cell yields. Growing emphasis on precision, reduced manual intervention, and standardized workflows further boost the demand for innovative instruments, propelling this segment for rapid expansion during the forecast period.

How did the Mammalian Cells Segment Dominate the Cell Expansion Market in 2024?

The mammalian cells segment led the market in 2024, capturing the largest revenue share, because of their critical role in biopharmaceutical production and advanced research. These cells closely resemble human physiology, making them ideal for developing complex therapeutics, testing drug safety, and creating cell-based therapies. Their proven effectiveness in producing high-quality biologics and supporting regenerative medicine applications has driven widespread adoption across research institutes and pharmaceutical companies, solidifying their dominance in global cell expansion.

The human stem cell segment is set to witness strong growth during the forecast period as its versatility supports applications in developing novel treatments for conditions like neurodegenerative disorders, cardiovascular diseases, and diabetes. Expanding research into regenerative medicine and personalized therapies is driving their use, while improvements in culture techniques are enhancing efficiency and scalability. Growing investments from both public and private sectors in stem cell research further strengthen the segment position, fueling its rapid expansion in the coming years.

How did the Biotechnology & Biopharmaceutical Companies Segment Dominate the Cell Expansion Market?

The biotechnology & biopharmaceutical companies segment dominated the market in 2024, owing to their central role in driving innovation in drug discovery, regenerative medicine, and advanced therapies. These companies require large-scale, high-quality cell production to support clinical trials and commercial manufacturing. With a growing focus on cell-based treatments such as CAR-T therapies and monoclonal antibodies, they rely heavily on advanced expansion systems, making them the leading contributors to revenue generation in the global cell expansion market.

- For Instance, In March 2023, TrakCel and Lonza integrated TrakCel’s OCELLOS cell orchestration system with Lonza’s MODA-ES manufacturing platform. This collaboration aimed to enhance data management, streamline manufacturing processes, and strengthen supply chain security in cell and gene therapies, ensuring smoother coordination throughout the patient journey.

The research institutes segment is projected to expand at the fastest CAGR as they serve as hubs for pioneering studies in stem cell biology, immunotherapy, and tissue engineering. Growing emphasis on translational research and preclinical studies is fueling their reliance on advanced cell culture and expansion tools. Increased funding support, academic-industry partnership, and rising participation in clinical trials further strengthen their role, positioning research institutions as key drivers in innovation and growth in the cell expansion market.

Why the Biopharmaceutical Segment Dominated the Market in 2024?

The biopharmaceutical segment held the largest share of the market in 2024 as cell expansion is central to developing innovative biologics and cell-based therapies. With the rising prevalence of chronic and rare diseases, these companies are increasingly focusing on producing advanced treatments like immunotherapies and regenerative medicine. Strong investment in large-scale manufacturing infrastructure and adoption of modern expansion systems allowed biopharmaceutical firms to maintain efficiency and quality, securing their position as the leading revenue-generating segment in the cell expansion market.

The vaccine production segment is projected to expand at the fastest rate as healthcare systems increasingly shift towards cell-based platforms for safer and more scalable vaccine manufacturing. Rising incidence of viral outbreaks and the need for a rapid-response vaccine. Continuous R&D efforts, coupled with supportive funding from the government and global health organizations, are further boosting adoption, making vaccine production a key driver of growth in the cell expansion market during the forecast period.

Regional Insights

How is North America Contributing to the Expansion of the Cell Expansion Market?

North America led the market in 2024, supported by robust R&D activities, a strong pipeline of cell-based therapies, and widespread use of advanced bioprocessing tools. The region benefits from significant government and private sector funding, alongside a well-established regulatory framework that accelerates product approvals. The growing prevalence of chronic diseases and rising demand for personalized medicine also boosted the adoption of expansion technologies, securing North America’s position as the top revenue contributor in the global market.

How is Asia-Pacific Accelerating the Market?

Asia-Pacific is projected to record the fastest CAGR in the cell expansion market owing to rapid advancements in biotechnology, expanding research initiatives, and a growing focus on regenerative medicine. Rising healthcare spending, supportive government policies, and increasing collaborations with global pharma companies are fueling the adoption of advanced expansion technologies. The region’s large patient pool, coupled with cost-effective manufacturing and rising prevalence of chronic diseases, is creating strong demand, positioning Asia-Pacific as the fastest-growing market during the forecast period.

Top Companies in the Cell Expansion Market

- Thermo Fisher Scientific, Inc.

- Corning Incorporated

- Merck KGaA

- Miltenyi Biotec

- BD (Becton, Dickinson and Company)

- Terumo BCT, Inc.

- Sartorius AG

- Takara Bio Inc.

- TRINOVA BIOCHEM GmbH

- upcyte technologies GmbH

Recent Developments in the Cell Expansion Market

- In February 2024, BioCentriq released CAR-T cell expansion results achieved using Terumo Blood and Cell Technologies’ Quantum Flex Cell Expansion System, highlighting its effectiveness in supporting advanced cell therapy development.

- In April 2023, Danaher’s Cytiva introduced its X-platform bioreactors designed to streamline single-use upstream bioprocessing. These scalable and customizable systems support the production of monoclonal antibodies, cell and gene therapies, and viral vectors, aiming to boost efficiency and productivity in development and manufacturing.

Cell Expansion Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Cell Expansion market.

By Product

- Consumables

- Reagents, Media, & Serum

- Other Consumables

- Culture Flasks and Accessories

- Tissue Culture Flasks

- Bioreactor Accessories

- Other Culture Flasks and Accessories

- Instruments

- Automated Cell Expansion Systems

- Cell Counters

- Centrifuges

- Bioreactors

- Other Instruments

By Cell Type

- Mammalian

- Human

- Stem Cells (SCs)

- Adult SCs

- Embryonic SCs

- Induced Pluripotent SCs

- Differentiated Cells

- Animal

- Microbial

- Others

By Application

- Biopharmaceuticals

- Tissue Culture & Engineering

- Vaccine Production

- Drug Development

- Gene Therapy

- Cancer Research

- Stem Cell Research

- Others

By End-use

- Biopharmaceutical & Biotechnology Companies

- Research Institutes

- Cell Banks

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)