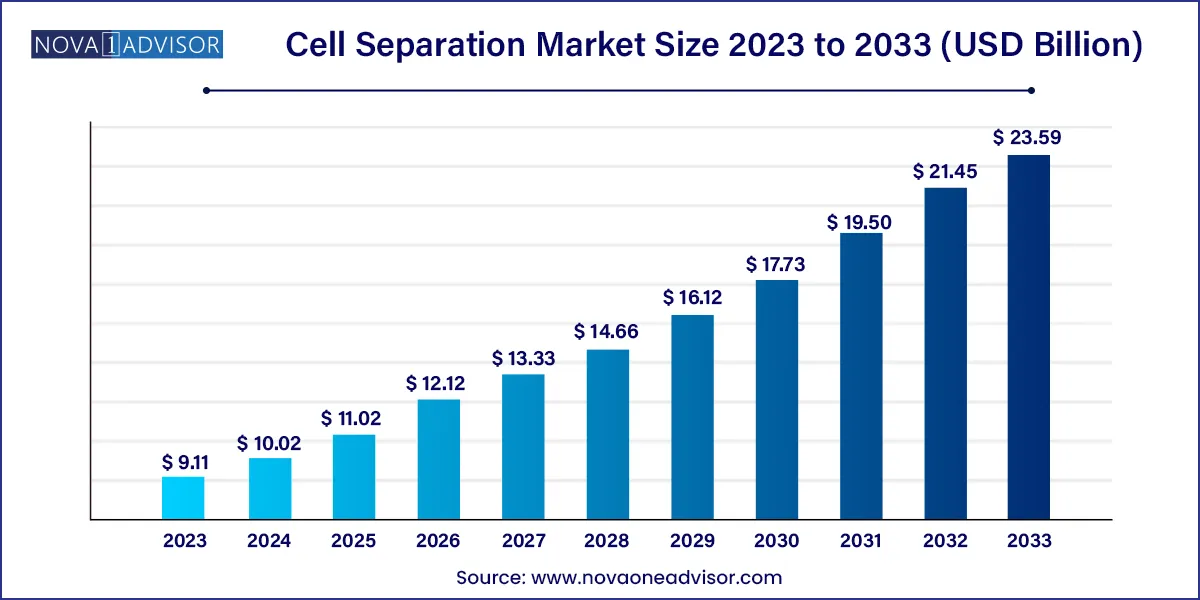

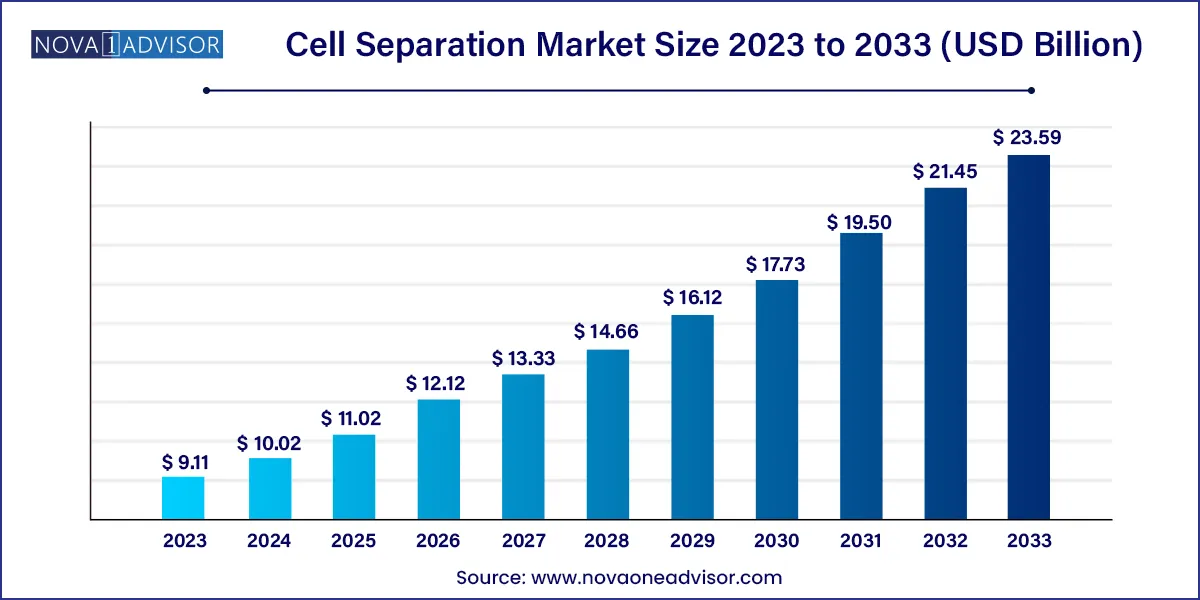

The global cell separation market size was exhibited at USD 9.11 billion in 2023 and is projected to hit around USD 23.59 billion by 2033, growing at a CAGR of 9.98% during the forecast period of 2024 to 2033.

Key Takeaways:

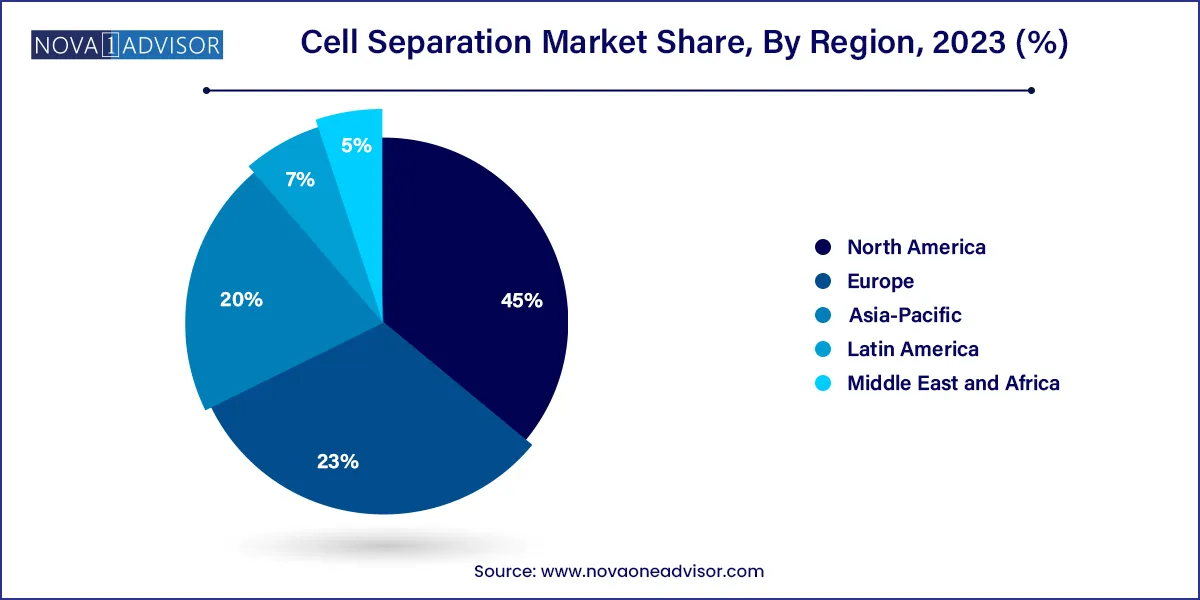

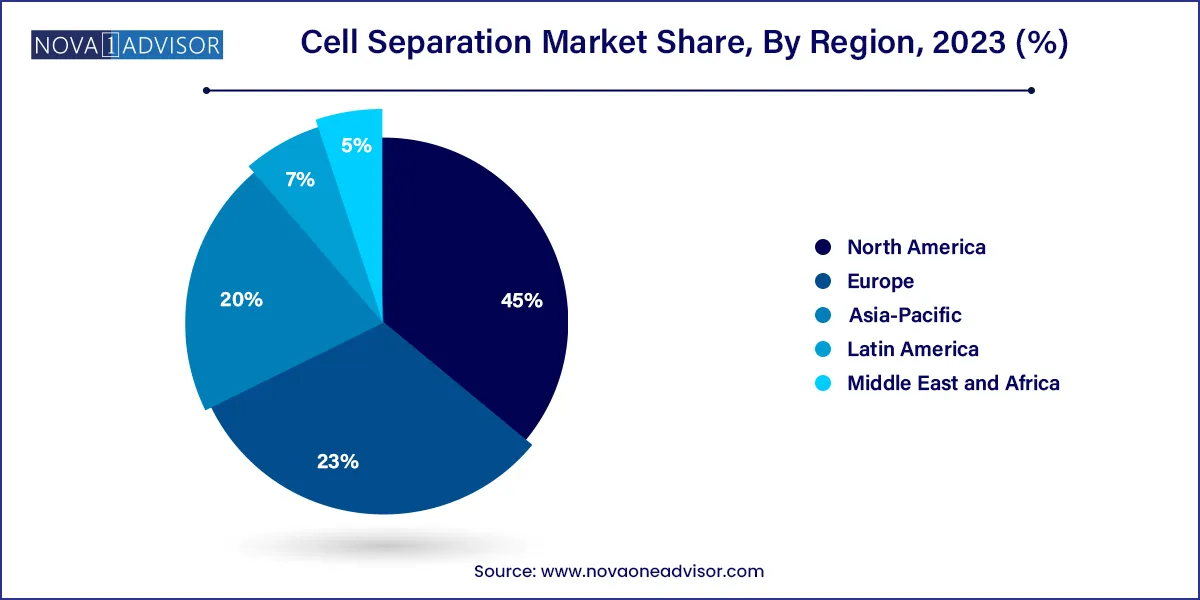

- North America dominated the global market and held the largest revenue share of 45.0% in 2023.

- The biotechnology and biopharmaceutical companies segment held the largest revenue share of 42.9% in 2023 and is expected to hold its position throughout the study period.

- In 2023, the consumables segment dominated the market and accounted for the largest revenue share of 61.94%.

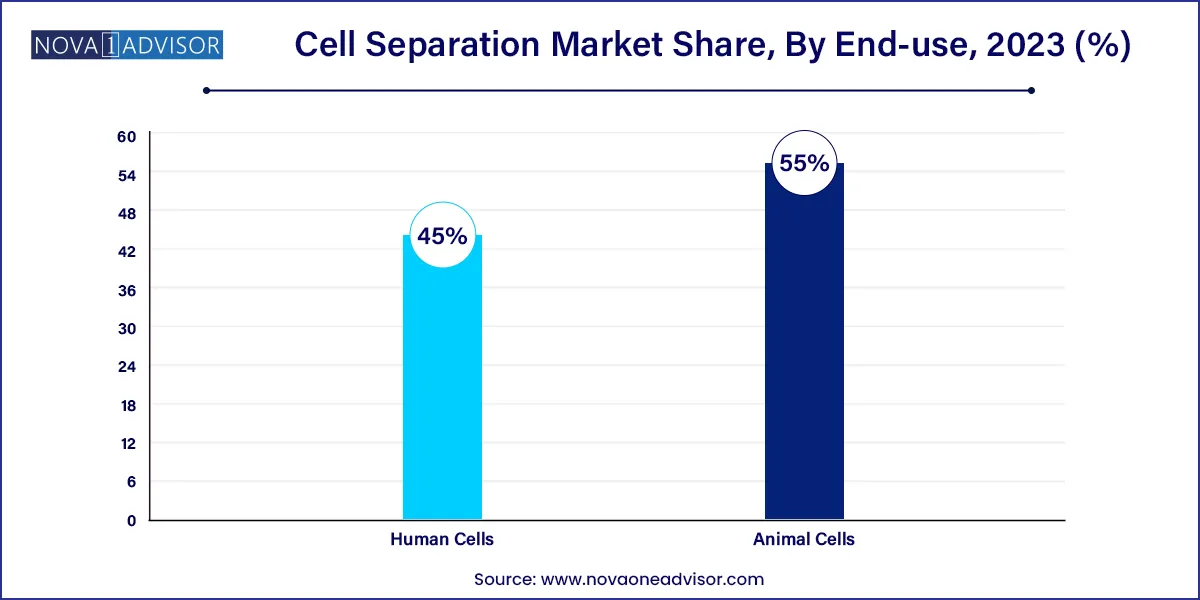

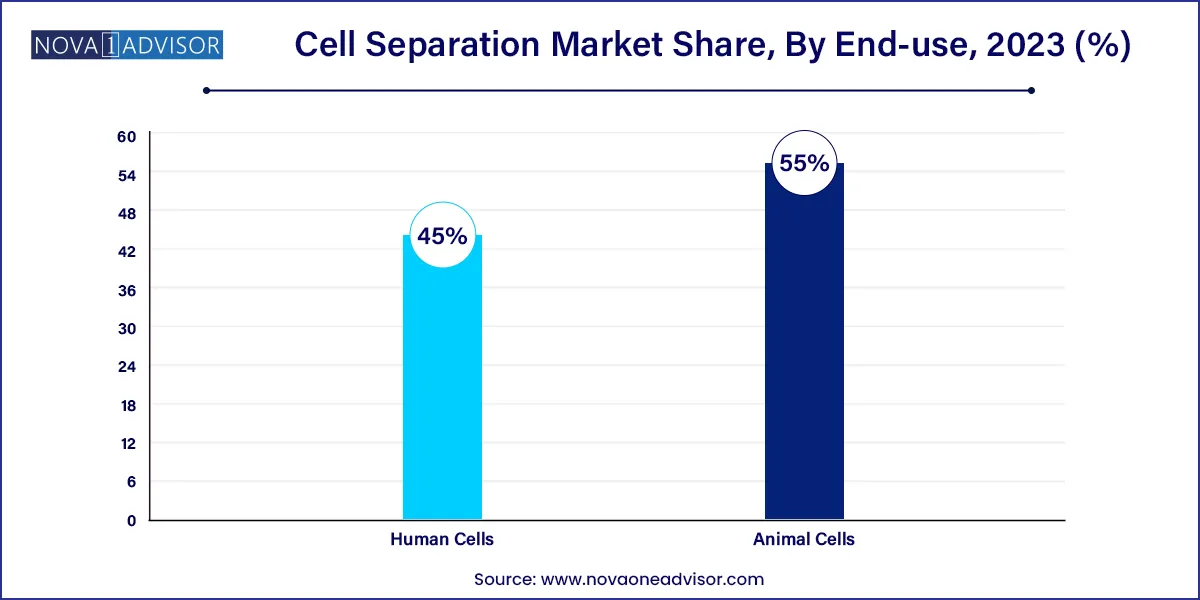

- The animal cells segment held the largest revenue share of 55.0% in 2023.

- The centrifugation segment dominated the market with a revenue share of 42.3% in 2023.

- The biomolecule isolation segment dominated the market with a share of 29.5% in 2023.

Market Overview

The Cell Separation Market, often referred to as cell isolation, is a cornerstone technology in biomedical research and clinical diagnostics. It involves the selective removal of cells from a heterogeneous population based on specific characteristics such as cell type, size, density, surface protein expression, or other physiological properties. Cell separation is essential for applications in stem cell therapy, regenerative medicine, cancer biology, immunology, and advanced drug discovery.

Over the past decade, the cell separation market has witnessed tremendous growth driven by increasing investments in life sciences research, personalized medicine, and the surge of cell-based therapies. The rise in chronic and infectious diseases, such as cancer and autoimmune disorders, has further expanded the demand for precision diagnostics and targeted treatments. Technologies such as magnetic-activated cell sorting (MACS), fluorescence-activated cell sorting (FACS), and microfluidics have become instrumental in isolating rare cells with high specificity and purity.

The COVID-19 pandemic also played a pivotal role in the acceleration of cell-based research, particularly in vaccine development and immune profiling. Researchers required large volumes of purified immune cells to understand virus-host interactions and develop antibody therapies. As a result, demand for consumables and instruments for cell separation surged globally.

With rising global interest in regenerative medicine and stem cell therapies, the future of the cell separation market is poised for robust and sustained growth. However, the complexity of cell biology, high cost of instrumentation, and technical challenges associated with handling live cells present ongoing hurdles for market participants.

Major Trends in the Market

-

Rising focus on single-cell analysis for precision diagnostics and drug discovery, driving demand for high-resolution separation technologies.

-

Increased use of microfluidics and lab-on-a-chip platforms to allow gentle, label-free cell separation with minimal sample loss.

-

Adoption of automated and high-throughput cell sorting systems in large research and biomanufacturing facilities.

-

Growing utilization of magnetic beads and antibody-based separation techniques due to high specificity and scalability.

-

Expansion of clinical applications of cell separation including CAR-T cell therapy, stem cell transplantation, and immunotherapy.

-

Emergence of AI and machine learning in cell characterization, improving downstream analysis after separation.

-

Rising demand for cell separation in liquid biopsy technologies, especially in early cancer detection and monitoring.

-

Collaborations between academia and industry players to improve accessibility and cost-efficiency of cell separation tools

Cell Separation Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 10.02 Billion |

| Market Size by 2033 |

USD 23.59 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.98% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Cell Type, Technique, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; BD; Danaher; Terumo Corp.; STEMCELL Technologies Inc.; Bio-Rad Laboratories, Inc.; Merck KgaA; Agilent Technologies, Inc.; Corning Inc.; Akadeum Life Sciences |

Key Market Driver: Surge in Stem Cell and Regenerative Medicine Research

A major driving force behind the cell separation market is the unprecedented expansion of stem cell research and regenerative medicine. Stem cells have the unique ability to develop into different cell types and thus hold immense promise for treating degenerative diseases, injuries, and genetic disorders. However, isolating stem cells with high purity is essential to ensure safety and efficacy. Technologies like magnetic-activated cell separation and flow cytometry have enabled precise identification and isolation of stem cells from blood, bone marrow, and tissue sources.

Moreover, advancements in induced pluripotent stem cells (iPSCs) and mesenchymal stem cells (MSCs) have significantly widened clinical applications. Countries such as Japan and South Korea have been at the forefront of investing in stem cell-based treatments. For instance, in 2024, researchers in the U.S. initiated a clinical trial using purified cardiac stem cells to treat patients with heart failure. Such developments directly contribute to the rising demand for robust cell separation technologies.

Key Market Restraint: High Instrumentation Cost and Technical Complexity

Despite the exciting growth potential, high capital investment and technical challenges associated with cell separation instruments continue to hinder market penetration, particularly in resource-limited settings. Instruments such as high-speed centrifuges, flow cytometers, and magnetic cell sorters are not only expensive but also require trained personnel for accurate operation and maintenance.

Many small research laboratories and healthcare institutions in emerging economies struggle with budget constraints, limiting their ability to adopt advanced cell separation platforms. Additionally, improper handling or non-optimized protocols can lead to sample contamination or loss of viability, which undermines research outcomes and therapeutic development. The need for standardization and user-friendly systems remains a critical challenge that industry stakeholders must address to ensure widespread adoption.

Key Market Opportunity: Integration with Cell-Based Diagnostics and Personalized Medicine

A compelling opportunity within the cell separation market lies in its integration with personalized medicine and cell-based diagnostics. As healthcare shifts toward individualized treatment strategies, the ability to isolate specific cell subtypes from a patient’s blood or tissue sample becomes vital for tailored therapies. Cell separation plays an indispensable role in detecting circulating tumor cells (CTCs), rare immune cell populations, and disease-specific biomarkers.

Startups and biotech firms are now developing point-of-care and portable separation systems that work in tandem with diagnostic platforms, enabling near-patient testing. The potential to link cell isolation with real-time disease monitoring and therapeutic decision-making is a transformative leap for oncology, infectious diseases, and autoimmune conditions. This intersection of diagnostics and cell biology promises a paradigm shift in how diseases are identified and managed.

By Product

Consumables dominated the product segment, accounting for the largest revenue share. Within this segment, reagents, kits, and magnetic beads are frequently replenished components used across all types of cell separation experiments. These materials are integral to the success of antibody-based and magnetic separation techniques, providing specificity and minimizing contamination. The increasing adoption of single-use consumables in sterile environments, especially in cell therapy manufacturing and diagnostics, has significantly propelled this segment.

On the other hand, instruments are projected to be the fastest-growing product segment, driven by rising demand for automation and high-throughput capabilities. Modern research labs and biopharma companies increasingly invest in centrifuges, FACS machines, and magnetic cell separators. These instruments enable scalable and precise separation of large volumes of cells, essential for downstream applications such as gene therapy, vaccine production, and cell banking. Manufacturers are also introducing modular designs and smart software, further boosting instrument adoption.

By Cell Type

Human cells accounted for the largest market share due to their extensive use in clinical research, therapeutic development, and disease modeling. The isolation of immune cells, tumor cells, and stem cells from human samples is central to translational research and personalized therapy. Human cell separation is also critical in vaccine development, where T-cells and B-cells are studied in depth.

Animal cells are witnessing robust growth, especially in academic and preclinical research. Rodent models remain essential for understanding disease mechanisms and drug efficacy, and the need for cell-specific studies has boosted demand for separation tools tailored to animal cell protocols. Veterinary research, agricultural biotechnology, and comparative biology also contribute to this segment’s expansion.

By Technique

Centrifugation continues to dominate among the cell separation techniques, owing to its long-standing use, versatility, and cost-effectiveness. Most laboratories, regardless of size, rely on centrifugation to separate cells based on density. It remains the preferred method for bulk cell separation, especially when processing blood and bone marrow samples.

However, surface marker-based separation is emerging as the fastest-growing technique, driven by the need for high precision and specificity. Techniques such as immunomagnetic sorting and FACS use antibodies tagged to markers like CD4, CD8, or CD34 to selectively isolate desired cells. These methods are vital in stem cell therapy, immunotherapy, and cancer diagnostics, where purity and phenotype retention are critical.

By Application

Cancer research leads the application segment, supported by the global emphasis on developing targeted therapies and immuno-oncology drugs. Cell separation helps isolate tumor-infiltrating lymphocytes (TILs), CTCs, and tumor-associated macrophages, aiding in biomarker discovery and therapeutic profiling. The demand for personalized cancer vaccines and checkpoint inhibitor testing also propels this segment.

Stem cell research is the fastest-growing application area, bolstered by increasing clinical trials and regenerative medicine projects. The ability to isolate pluripotent stem cells or lineage-specific progenitors has opened doors for treatments of neurological disorders, spinal injuries, and blood cancers. Ongoing investments in iPSC-based therapies and organ regeneration further elevate this segment.

By End-Use

Research laboratories and institutes dominate the end-user landscape, as they are primary hubs for experimentation, biomarker discovery, and proof-of-concept studies. Government-funded programs and academic collaborations across the U.S., Germany, and Japan drive procurement of both consumables and instruments.

Meanwhile, biotechnology and biopharmaceutical companies are the fastest-growing end-users, due to their active involvement in cell-based drug development, clinical trials, and manufacturing of biologics. The need for GMP-compliant, scalable, and reproducible cell separation processes has led to strong demand from this segment, particularly in CAR-T therapy and monoclonal antibody production.

By Regional Insights

North America dominates the global cell separation market, fueled by robust R&D infrastructure, high adoption of advanced technologies, and a thriving biopharmaceutical industry. The U.S. is home to many major players such as Thermo Fisher Scientific, BD Biosciences, and Miltenyi Biotec. Academic institutions like Harvard, Stanford, and the NIH are at the forefront of cell biology research, driving continual demand for separation tools. The region’s well-established regulatory environment and funding mechanisms, including grants from the NIH and DARPA, support market growth.

Asia-Pacific is expected to be the fastest-growing region, primarily due to increasing investments in healthcare infrastructure, research capabilities, and government-backed life sciences programs. Countries like China, India, Japan, and South Korea are rapidly advancing in genomics, cancer research, and regenerative medicine. For example, China’s “Made in China 2025” strategy includes biotechnology as a key sector, and India’s biotech industry is expanding with support from initiatives like "Startup India." The rising number of CROs and CMOs in the region also contributes to the demand for efficient and scalable cell separation platforms.

Some of the prominent players in the Cell separation market include:

- Thermo Fisher Scientific, Inc.

- BD

- Danaher

- Terumo Corp.

- STEMCELL Technologies Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Agilent Technologies, Inc.

- Corning Inc.

- Akadeum Life Sciences

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cell separation market.

Product

-

- Reagents, Kits, Media, and Sera

- Beads

- Disposables

-

- Centrifuges

- Flow Cytometers

- Filtration Systems

- Magnetic-activated Cell Separator Systems

Cell Type

Technique

- Centrifugation

- Surface Marker

- Filtration

Application

- Biomolecule Isolation

- Cancer Research

- Stem Cell Research

- Tissue Regeneration

- In Vitro Diagnostics

- Therapeutics

End-Use

- Research laboratories and institutes

- Biotechnology and biopharmaceutical companies

- Hospitals and diagnostic laboratories

- Cell banks

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)