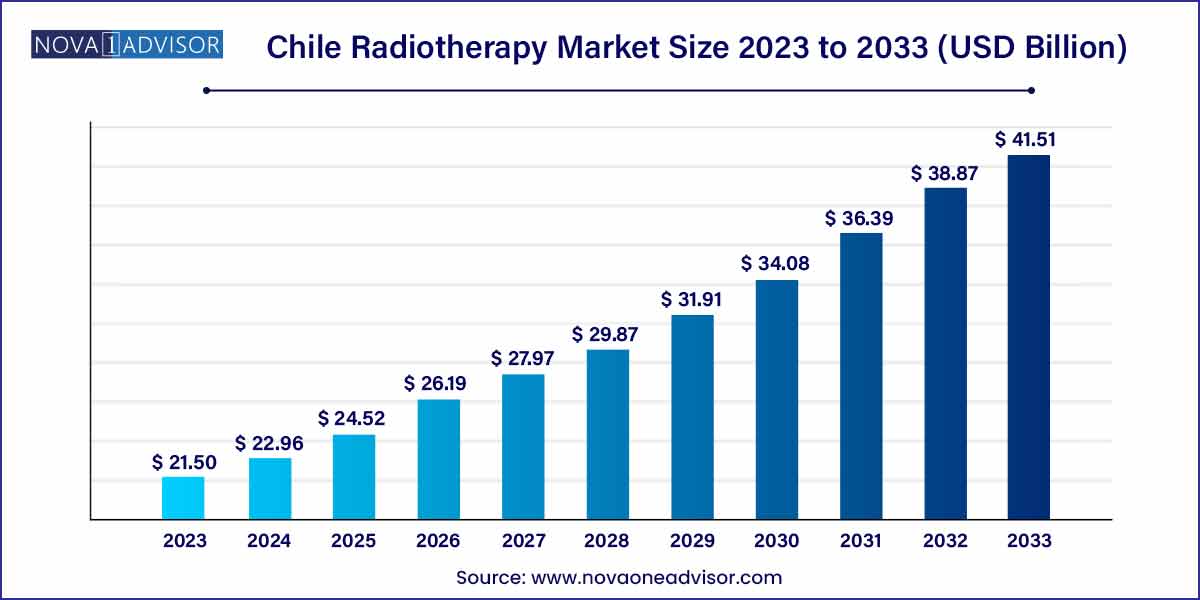

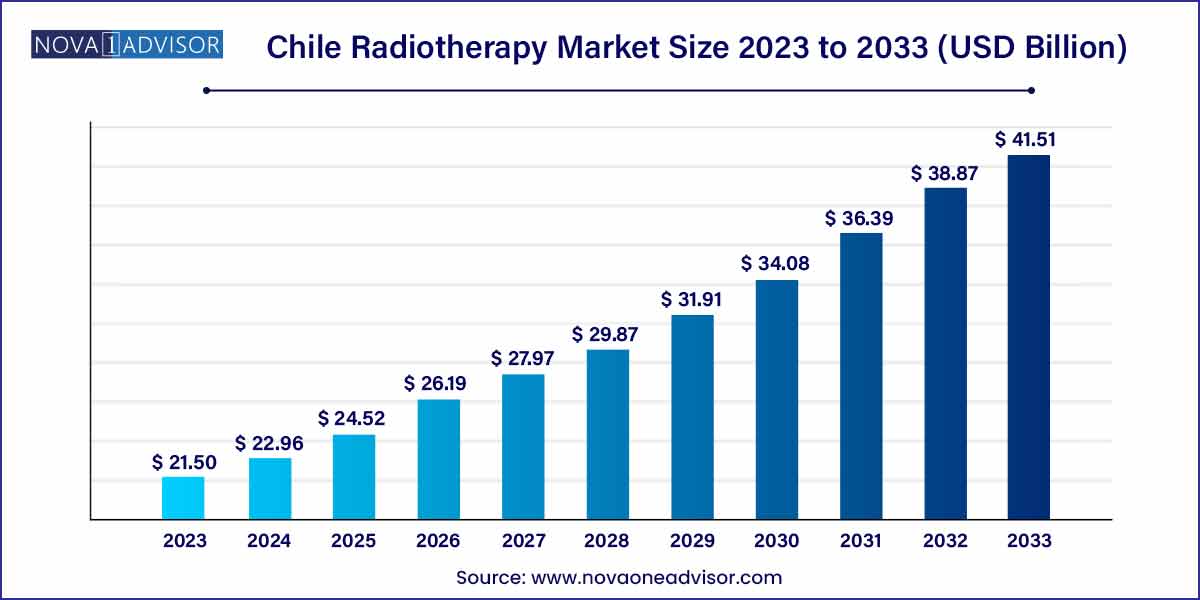

The global Chile radiotherapy market size was exhibited at USD 21.50 billion in 2023 and is projected to hit around USD 41.51 billion by 2033, growing at a CAGR of 6.8% during the forecast period of 2024 to 2033.

Key Takeaways:

- The external beam radiotherapy segment dominated the market and accounted for the largest revenue share of 86.5% in 2023.

- The prostate cancer segment dominated the Chile radiotherapy market and accounted for the largest revenue share of 25.0% in 2023.

Chile Radiotherapy Market: Overview

The Chile Radiotherapy Market is witnessing significant growth as the country ramps up investments in advanced cancer care infrastructure. Radiotherapy, a cornerstone of modern oncology, involves the use of ionizing radiation to control or kill malignant cells. As cancer incidence continues to rise in Chile, demand for precise, effective, and minimally invasive treatment options is surging. Radiotherapy is particularly crucial for treating prevalent cancers such as breast, prostate, lung, head and neck, and colorectal cancers.

Public and private healthcare sectors are actively investing in upgrading equipment, expanding access to radiotherapy services, and incorporating newer modalities like image-guided radiotherapy (IGRT) and intensity-modulated radiotherapy (IMRT). Additionally, government initiatives to improve cancer diagnosis and treatment, coupled with rising awareness about early detection, are key growth drivers.

Chile’s adoption of high-precision external beam radiotherapy (EBRT) systems, internal beam therapy (brachytherapy), and systemic radiotherapy is transforming patient care outcomes. Despite certain infrastructural and affordability challenges, the future of the radiotherapy market in Chile appears promising, supported by technological innovation, public health reforms, and collaborative efforts among key stakeholders.

Chile Radiotherapy Market Growth

The growth of the Chilean radiotherapy market can be attributed to several key factors. Firstly, the rising incidence of cancer within the country has spurred an increased demand for advanced radiotherapy solutions. This has led to a growing emphasis on the development and accessibility of healthcare infrastructure. Furthermore, continuous technological advancements, including innovations in radiotherapy such as intensity-modulated radiation therapy (IMRT) and stereotactic radiosurgery (SRS), have significantly enhanced treatment efficacy. Government initiatives and substantial healthcare investments also play a pivotal role, fostering market growth by supporting the expansion of radiotherapy facilities. The collaborative efforts between healthcare institutions, research organizations, and industry players contribute to a dynamic and innovative landscape. These growth factors collectively position the Chilean radiotherapy market for sustained expansion in the foreseeable future.

Chile Radiotherapy Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 21.50 Billion |

| Market Size by 2033 |

USD 41.51 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Varian Medical Systems, Inc.; Elekta AB; Accuray Incorporated; Becton, Dickinson and Company; NTP Radioisotopes; Isoray Medical. |

Market Dynamics

- Rising Incidence of Cancer:

The Chilean radiotherapy market is dynamically influenced by the increasing prevalence of cancer within the country. The rising number of cancer cases has become a significant driver for the demand for advanced radiotherapy solutions. This surge necessitates the development and enhancement of radiotherapy facilities to accommodate the growing patient population. The correlation between the incidence of cancer and the demand for radiotherapy underscores the vital role this factor plays in shaping the dynamics of the market.

- Technological Advancements:

A pivotal dynamic shaping the Chilean radiotherapy market is the continual evolution of technology within the field. Advanced radiotherapy technologies, including but not limited to intensity-modulated radiation therapy (IMRT) and stereotactic radiosurgery (SRS), have revolutionized cancer treatment. These innovations offer enhanced precision and effectiveness in targeting cancer cells, thereby improving overall treatment outcomes. The market dynamics are further influenced by the ongoing research and development in radiotherapy technologies, positioning Chile as a hub for state-of-the-art cancer treatment modalities.

Market Restraint

- Limited Access to Advanced Radiotherapy Facilities:

A prominent restraint in the Chilean radiotherapy market is the limited access to advanced radiotherapy facilities, particularly in remote or underserved regions. Disparities in healthcare infrastructure contribute to uneven accessibility, hindering patients' ability to avail themselves of cutting-edge radiotherapy treatments. This geographical imbalance poses a significant challenge, limiting the widespread adoption of advanced radiotherapy technologies and hindering the equitable distribution of cancer care services across the country.

- Cost Constraints and Affordability Issues:

Cost constraints and affordability issues pose a substantial restraint to the growth of the Chilean radiotherapy market. Advanced radiotherapy treatments often involve sophisticated technologies and equipment, making them relatively expensive. The financial burden associated with these treatments may restrict access for a considerable portion of the population. Addressing cost barriers and enhancing affordability is crucial for expanding the reach of radiotherapy services and ensuring that patients from diverse socio-economic backgrounds can benefit from the latest advancements in cancer treatment.

Market Opportunity

- Government Initiatives and Healthcare Investments:

A significant opportunity in the Chilean radiotherapy market lies in the proactive role of the government and increasing healthcare investments. Ongoing and future government initiatives aimed at bolstering healthcare infrastructure and accessibility to advanced treatments provide a favorable environment for market growth. Strategic investments in the expansion of radiotherapy facilities, coupled with supportive policies, can create new avenues for technological adoption and innovation, ultimately enhancing the overall quality of cancer care in the country.

- Collaborations for Research and Development:

Collaborations between healthcare institutions, research organizations, and industry players represent a promising opportunity in the Chilean radiotherapy market. Joint efforts in research and development can lead to the discovery and implementation of novel radiotherapy technologies and treatment modalities. These collaborations foster a dynamic ecosystem for knowledge exchange, innovation, and the introduction of cutting-edge solutions. By leveraging collective expertise, the industry has the potential to capitalize on emerging opportunities, positioning Chile as a hub for advanced radiotherapy research and application.

Market Challenges

- Shortage of Skilled Healthcare Professionals:

A significant challenge facing the Chilean radiotherapy market is the shortage of skilled healthcare professionals, including radiation oncologists, medical physicists, and radiologic technologists. The complexity of radiotherapy treatments requires specialized expertise for accurate planning and precise delivery. The shortage of qualified professionals may lead to increased workloads, potential delays in treatment, and compromises in the quality of patient care. Addressing this challenge requires targeted efforts in education, training programs, and incentives to attract and retain skilled professionals in the field of radiotherapy.

- Regulatory Hurdles and Compliance:

Navigating regulatory hurdles and ensuring compliance with evolving healthcare regulations present notable challenges in the Chilean radiotherapy market. Stringent regulatory frameworks may impact the timely approval and adoption of advanced radiotherapy technologies. The need for adherence to safety standards, quality assurance protocols, and ethical considerations adds complexity to the introduction of new treatments. Overcoming these regulatory challenges requires close collaboration between industry stakeholders, regulatory bodies, and policymakers to streamline approval processes while maintaining rigorous standards for patient safety and treatment efficacy.

Segments Insights:

Type Insights

External Beam Radiotherapy (EBRT) dominated the Chile radiotherapy market in 2023, capturing the largest market share. EBRT, including techniques such as IMRT, IGRT, SBRT, and 3D conformal radiotherapy, has become the primary mode of cancer treatment due to its non-invasive nature and ability to target tumors with high precision while sparing surrounding healthy tissues. Major public and private hospitals in Chile have heavily invested in EBRT technologies, recognizing their role in improving clinical outcomes.

On the other hand, Internal Beam Radiotherapy (Brachytherapy) is expected to witness the fastest growth during the forecast period. Brachytherapy is particularly effective for treating prostate, cervical, and breast cancers, offering localized high-dose radiation with minimal systemic exposure. As awareness grows regarding its clinical advantages and as more radiology centers are equipped with brachytherapy facilities, adoption rates are rising steadily.

Application Insights

Breast cancer accounted for the largest share of the Chile radiotherapy market in 2023. With breast cancer being the most frequently diagnosed cancer among Chilean women, radiotherapy plays a critical role in post-surgical treatment, local control of disease, and survival improvement. Government screening programs and advocacy initiatives have boosted early detection, subsequently driving radiotherapy demand.

Meanwhile, lung cancer treatment is projected to grow at the fastest rate. The high mortality associated with lung cancer and the emergence of non-small cell lung cancer (NSCLC) as a leading subtype have underscored the need for high-precision radiotherapy options like SBRT. Increasing tobacco consumption rates and environmental risk factors are contributing to the rising incidence, creating urgent demand for effective radiotherapy interventions.

Regional Analysis

Santiago Metropolitan Region Dominates the Market

The Santiago Metropolitan Region remains the epicenter of the Chile radiotherapy market. As the most populous and economically developed area in the country, Santiago hosts the majority of Chile’s top-tier oncology centers, including the National Cancer Institute and Clínica Alemana. Access to advanced EBRT machines, trained oncologists, and robust healthcare infrastructure has enabled Santiago to dominate radiotherapy services.

The city's hospitals are often the first to adopt cutting-edge technologies such as proton therapy research units and robotic radiosurgery systems. Government support and private healthcare investments continue to enhance Santiago's role as a central hub for cancer treatment and research.

Southern Chile Registers the Fastest Growth

Southern Chile, encompassing regions such as Biobío and Los Lagos, is expected to witness the fastest growth in radiotherapy services. Historically underserved, these areas are now benefitting from targeted health initiatives aimed at expanding oncology services beyond Santiago.

The construction of new cancer treatment centers in cities like Concepción and Temuco, coupled with investments in linear accelerators and brachytherapy units, is improving local access to radiotherapy. Additionally, public-private collaborations and tele-oncology solutions are helping overcome geographic barriers, making advanced cancer care more accessible to patients across southern Chile.

Some of the prominent players in the Chile radiotherapy market include:

- Varian Medical Systems, Inc.

- Elekta AB

- Accuray Incorporated

- Becton, Dickinson and Company

- Isoray Medical

- NTP Radioisotopes SOC Ltd.

Recent Developments

-

March 2025: Varian Medical Systems, a Siemens Healthineers company, announced the installation of TrueBeam® linear accelerators at Santiago's Hospital de La Florida, enhancing the hospital’s capacity for IMRT and SBRT treatments.

-

January 2025: Clinica Las Condes launched a new comprehensive cancer center equipped with advanced radiotherapy technologies, including stereotactic radiosurgery (SRS) platforms.

-

November 2024: Elekta signed an agreement with the Chilean Ministry of Health to provide training and maintenance support for newly installed linear accelerators across public hospitals.

-

October 2024: Accuray Incorporated collaborated with Fundación Arturo López Pérez to introduce the Radixact® System for helical radiotherapy, improving treatment for complex tumors.

-

August 2024: The Chilean Society of Radiotherapy Oncology (SOCHRADI) launched a national initiative to standardize radiotherapy protocols and improve treatment outcome reporting across Chile.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global Chile radiotherapy market.

Type

- External Beam Radiotherapy

- Internal Beam Radiotherapy

- Systemic Radiotherapy

Application

- Breast Cancer

- Prostate Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others