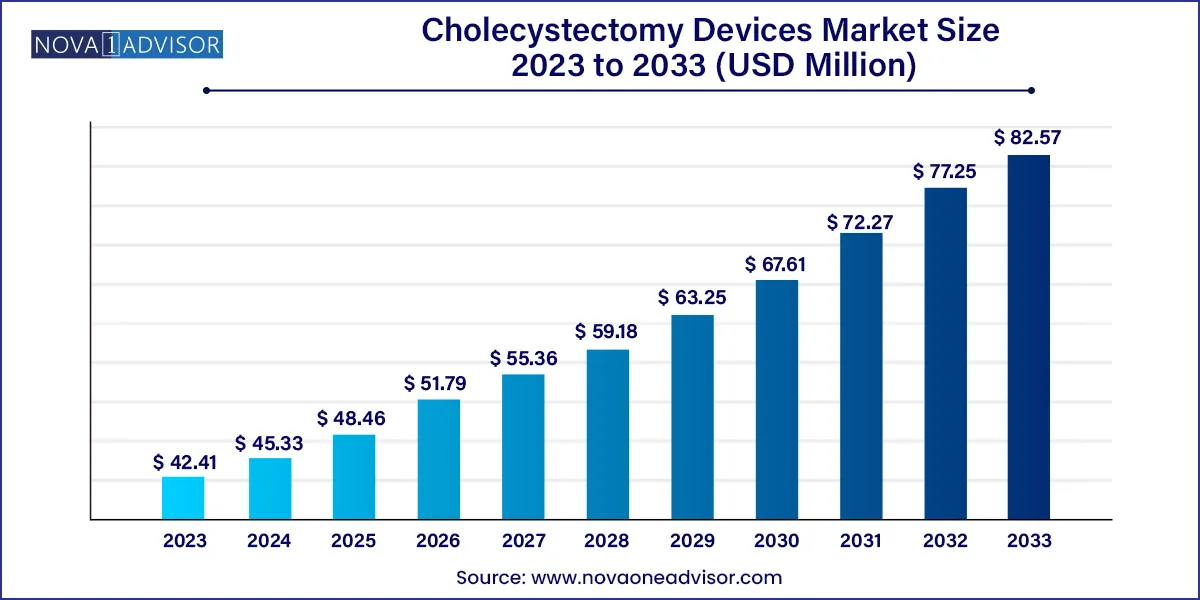

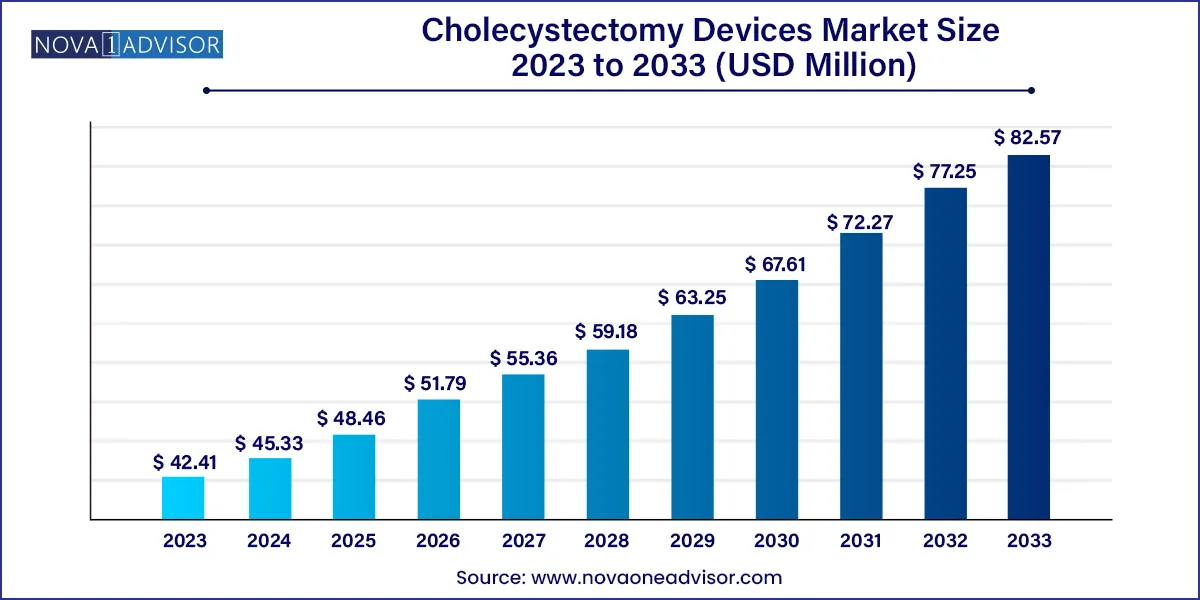

The global cholecystectomy devices market size was exhibited at USD 42.41 million in 2023 and is projected to hit around USD 82.57 million by 2033, growing at a CAGR of 6.89% during the forecast period 2024 to 2033.

Key Takeaways:

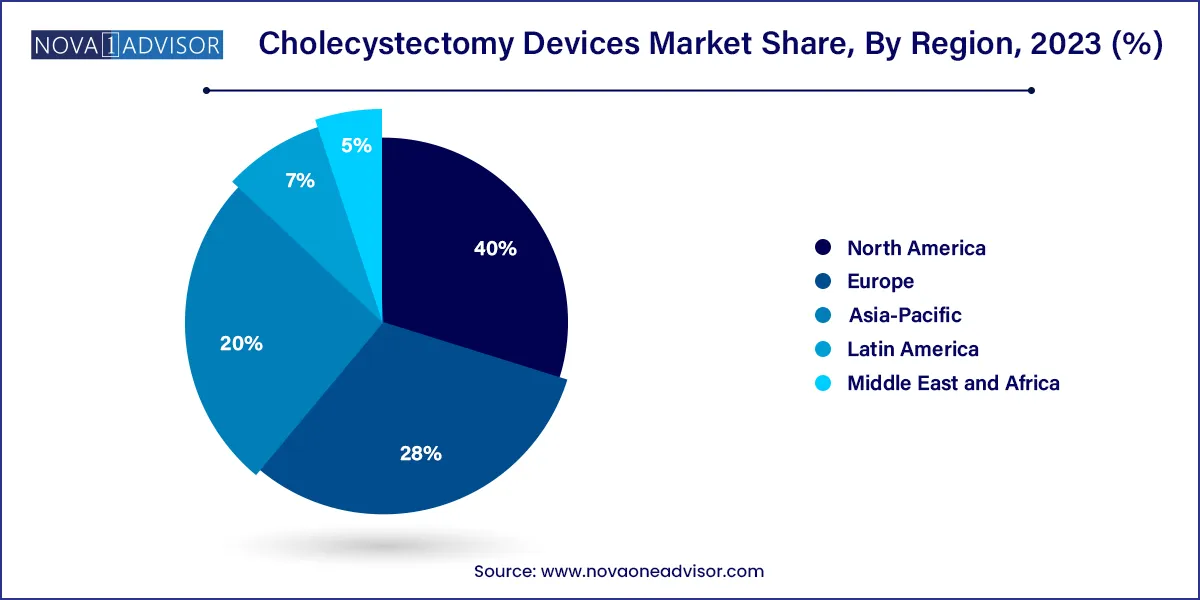

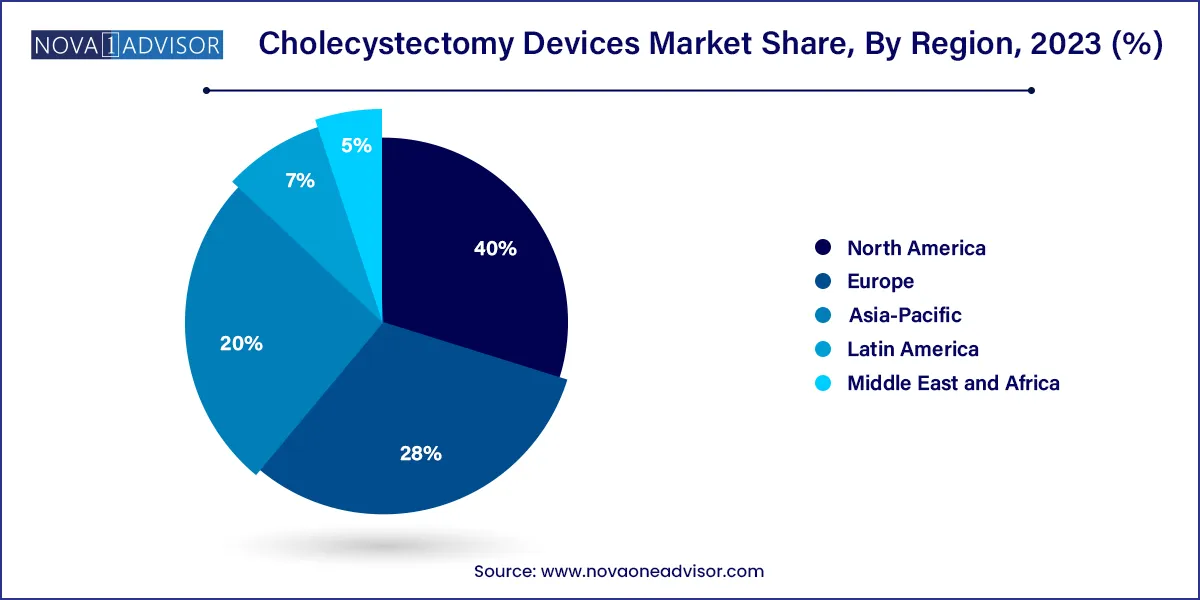

- The industry is dominated by North America, which held a major revenue share of more than 40.0% in 2023.

- On the basis of devices, the industry has been further segmented into conventional and robotic-assisted cholecystectomy surgery devices.

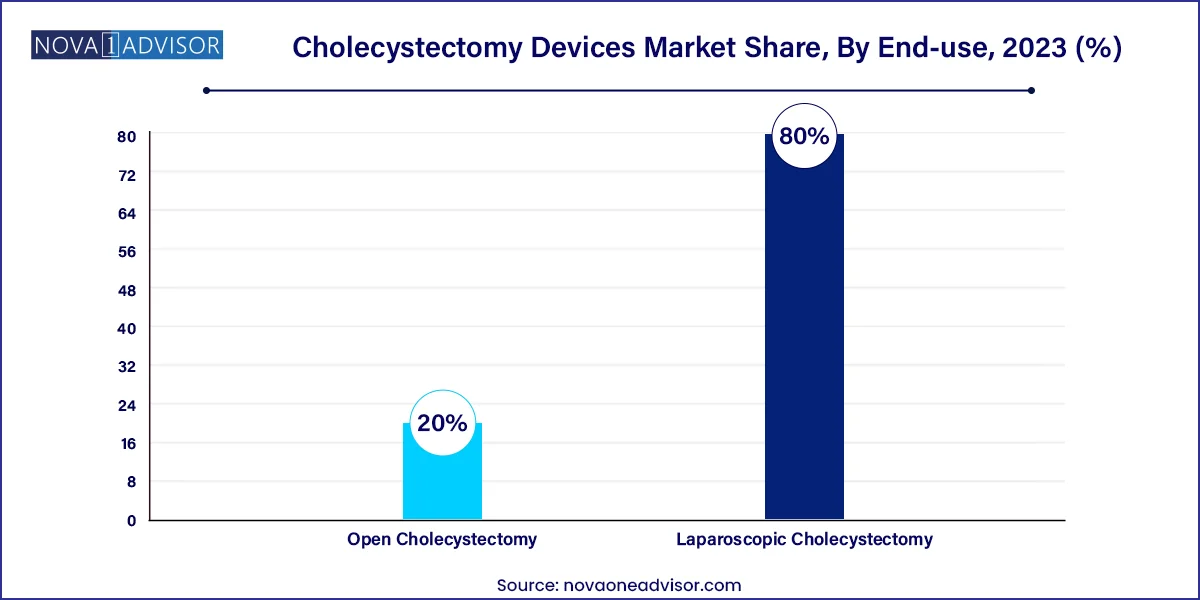

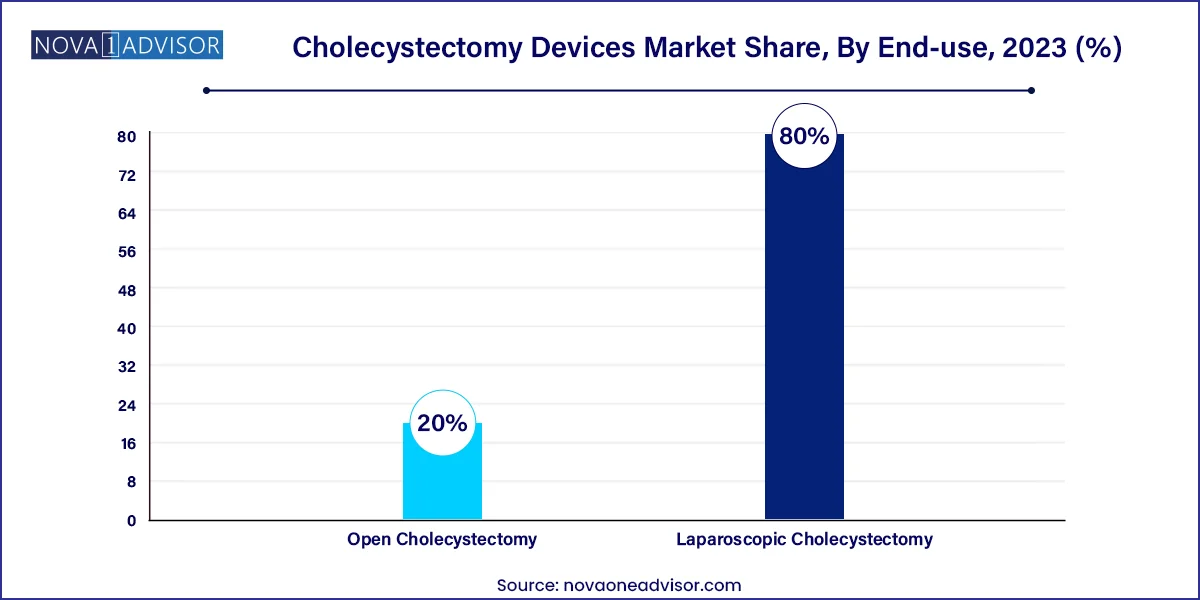

- The laparoscopic cholecystectomy segment dominated the global industry in 2023 and accounted for the maximum share of more than 80.0% of the overall revenue.

- The cholecystitis segment dominated the global industry in 2023 and accounted for the largest share of more than 41.85% of the overall revenue.

- The hospital segment dominated the global industry in 2023 and accounted for the maximum share of more than 56.90% of the overall revenue.

Market Overview

The Cholecystectomy Devices Market is an integral component of the surgical device industry, encompassing a broad range of instruments used in gallbladder removal procedures. Cholecystectomy, the surgical excision of the gallbladder, is one of the most frequently performed abdominal surgeries worldwide. It is primarily indicated in cases of cholelithiasis (gallstones), cholecystitis (inflammation of the gallbladder), choledocholithiasis (stones in the common bile duct), and gallstone-related pancreatitis.

Historically performed through open surgery, cholecystectomy has undergone a paradigm shift with the advent of laparoscopic and robotic-assisted surgical techniques. Minimally invasive approaches offer reduced post-operative pain, shorter hospital stays, faster recovery, and lower infection risk—making them the preferred choice in both developed and developing healthcare systems.

As surgical techniques evolve, the market for cholecystectomy devices is being shaped by technological advancements, rising adoption of robot-assisted surgery, and increased focus on ambulatory care. Devices like energy systems, insufflators, hand access tools, suction/irrigation devices, and trocars are now integral to delivering safe, effective, and efficient gallbladder surgery.

Global trends such as the increasing prevalence of gallstone disease, growing geriatric population, and rising healthcare expenditures are contributing to steady market growth. Simultaneously, manufacturers are innovating to address unmet needs such as improved visibility, ergonomics, and compatibility with digital operating rooms.

Major Trends in the Market

-

Shift Toward Laparoscopic and Minimally Invasive Surgeries: Surgeons and patients increasingly favor less invasive approaches due to better outcomes and reduced hospital time.

-

Adoption of Robotic-assisted Surgery: Technologies like the da Vinci Surgical System are making robotic cholecystectomy a viable alternative for complex procedures.

-

Advancements in Energy Systems: Bipolar and ultrasonic energy devices are gaining popularity for precise dissection and hemostasis during gallbladder surgery.

-

Focus on Ergonomics and Integration: Devices are being designed to enhance surgeon comfort and integrate seamlessly into modern OR suites.

-

Surge in Day-care and Ambulatory Procedures: Ambulatory surgical centers are performing more cholecystectomies due to high turnover and efficiency.

-

Rise in 3D Laparoscopy and Visualization Systems: High-definition imaging supports better surgical outcomes, especially in anatomically challenging patients.

-

Emergence of Disposable Laparoscopic Tools: Single-use devices reduce infection risk and eliminate the need for sterilization in high-volume centers.

Cholecystectomy Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 45.33 Million |

| Market Size by 2033 |

USD 82.57 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.89% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Device, Surgery Type, Indication, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Surgical Holding; B. Braun SE; Surtex Instruments Limited.; Sklar Surgical Instruments; Olympus; Millennium Surgical; Stryker Corp.; Medtronic; Intuitive Surgical; GerMedUSA |

Market Driver: Increasing Prevalence of Gallstone Disease and Associated Complications

A primary driver for the cholecystectomy devices market is the growing global incidence of gallstone-related disorders, particularly in populations with sedentary lifestyles, poor diets, and obesity. Studies show that gallstone disease affects 10-15% of the adult population in developed countries and is a leading cause of hospital admissions for digestive tract disorders.

Risk factors such as aging, female gender, rapid weight loss, diabetes, and metabolic syndrome further contribute to the growing need for gallbladder removal. Moreover, complications like acute cholecystitis, obstructive jaundice, and pancreatitis necessitate surgical intervention, often urgently.

The availability of high-precision instruments and minimally invasive surgical techniques has facilitated earlier intervention, increased surgical safety, and improved patient throughput, creating sustained demand for advanced cholecystectomy tools.

Market Restraint: High Capital Cost of Robotic Systems and Training Requirements

Despite the advantages of robotic-assisted surgery, the high capital cost of robotic platforms, coupled with the steep learning curve and training requirements, remains a major market restraint. Robotic systems such as the da Vinci Surgical System can cost between $1 million to $2.5 million, with additional expenses for maintenance, instruments, and consumables.

This limits adoption in community hospitals, small surgical centers, and resource-constrained regions, where laparoscopic or even open techniques may continue to dominate. Additionally, a lack of skilled personnel trained in robotic systems can lead to underutilization of existing infrastructure.

Although robotic systems offer superior ergonomics and visualization, especially in complex or obese patients, cost-effectiveness analyses are often inconclusive, limiting reimbursement and institutional adoption.

Market Opportunity: Expansion of Outpatient and Ambulatory Surgery Centers

A promising opportunity lies in the growing utilization of ambulatory surgical centers (ASCs) for performing minimally invasive cholecystectomy. ASCs offer significant cost savings, shorter hospital stays, and rapid patient turnover, making them increasingly popular in both urban and semi-urban areas.

As laparoscopic and robotic instruments become more compact and user-friendly, their integration into day-care surgery models is expanding. Manufacturers are developing portable insufflators, disposable laparoscopic sets, and modular energy systems tailored for ASC use.

Furthermore, advancements in anesthesia protocols, pain management, and post-op care are enabling same-day discharge for uncomplicated laparoscopic cholecystectomies. This trend aligns with broader healthcare goals of cost containment and patient-centric care, expanding the addressable market for cholecystectomy devices.

Segments Insights:

By Device

Conventional cholecystectomy devices dominate the market, driven by their widespread use in laparoscopic procedures across hospitals and ambulatory centers. Instruments such as trocars, energy systems, closure devices, insufflators, and laparoscopes are foundational to laparoscopic surgery. The majority of cholecystectomies globally are performed using these devices, which have been refined over decades for safety, durability, and compatibility.

Robotic-assisted cholecystectomy devices are the fastest-growing segment, owing to the increasing preference for precision surgery, especially in obese or high-risk patients. Robotic systems allow enhanced dexterity, 3D visualization, and tremor filtration. Companies are introducing next-gen systems with smaller footprints and lower costs, targeting broader adoption beyond high-end hospitals.

By Surgery Type

Laparoscopic cholecystectomy is the dominant surgery type, representing over 90% of all cholecystectomy procedures globally. It is considered the gold standard for gallbladder removal due to its minimal invasiveness, quick recovery time, and low complication rates. The technique relies heavily on a well-coordinated set of laparoscopic tools and visualization systems, making it a significant revenue driver for device manufacturers.

Open cholecystectomy remains relevant but is gradually declining, reserved for complicated cases involving perforated gallbladders, extensive adhesions, or malignancy. While it plays a minor role in high-resource settings, it is still practiced in developing regions with limited laparoscopic access or in emergency trauma cases.

By Indication

Cholelithiasis (gallstones) dominates the indication segment, as it is the most common cause for cholecystectomy. Gallstones may cause recurrent pain, biliary colic, and obstruction, leading to elective or emergency surgery. The prevalence of gallstones increases with age, female gender, and certain metabolic conditions, ensuring a stable patient base.

Choledocholithiasis and cholecystitis are rapidly growing subsegments, as endoscopic and laparoscopic technologies advance, allowing earlier detection and intervention. Pancreatitis-related gallbladder issues are also rising, driven by lifestyle-related causes such as alcohol consumption and obesity.

By End-use

Hospitals account for the largest market share, owing to their surgical infrastructure, round-the-clock availability, and ability to manage complex or emergent cases. Public and private hospitals across developed and developing countries remain the primary centers for cholecystectomy, both open and laparoscopic.

Ambulatory surgical centers (ASCs) are the fastest-growing segment, thanks to their cost-efficiency, specialized focus, and reduced overheads. ASCs are particularly favored in the U.S., U.K., and increasingly in Asia, where healthcare systems are shifting toward value-based care and short-stay models. Device vendors are targeting ASCs with compact, single-use, and multi-functional instruments.

By Regional Insights

North America dominates the cholecystectomy devices market, attributed to high surgical volumes, advanced healthcare infrastructure, and early adoption of minimally invasive and robotic procedures. The U.S. conducts over 700,000 cholecystectomy procedures annually, with a growing share occurring in ambulatory centers. Strong reimbursement systems, technological innovations, and presence of key players such as Medtronic and Intuitive Surgical support market leadership.

Asia-Pacific is the fastest-growing region, driven by a rising burden of gallstone disease, expanding access to healthcare, and government investments in surgical infrastructure. Countries like India, China, South Korea, and Japan are witnessing a rapid shift toward laparoscopic and robotic surgeries, supported by medical tourism and increased patient awareness. Local manufacturers are also contributing to device accessibility through cost-effective solutions.

Some of the prominent players in the Cholecystectomy devices market include:

- Surgical Holding

- B. Braun SE

- Surtex Instruments Ltd.

- Sklar Surgical Instruments

- Olympus

- Millennium Surgical

- Stryker Corporation

- Medtronic

- Intuitive Surgical

- GerMedUSA

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cholecystectomy devices market.

Device

- Conventional Cholecystectomy Devices

-

- Laparoscopes

- Energy Systems

- Trocars

- Closure Devices

- Suction/ Irrigation Device

- Insufflation Device

- Hand Access Instruments

- Robotic-assisted Cholecystectomy Surgery Devices

Surgery Type

- Laparoscopic Cholecystectomy

- Open Cholecystectomy

Indication

- Cholelithiasis

- Choledocholithiasis

- Cholecystitis

- Pancreatitis

- Others

End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)