Cholera Vaccines Market Size and Research

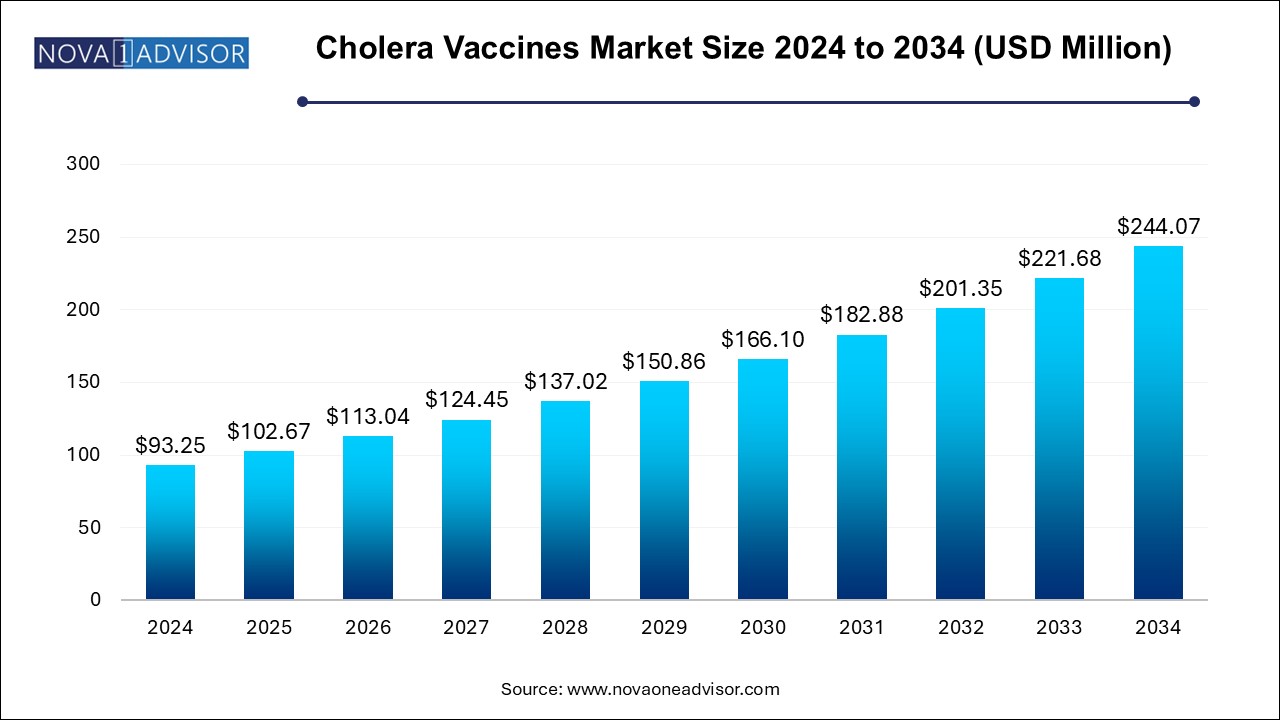

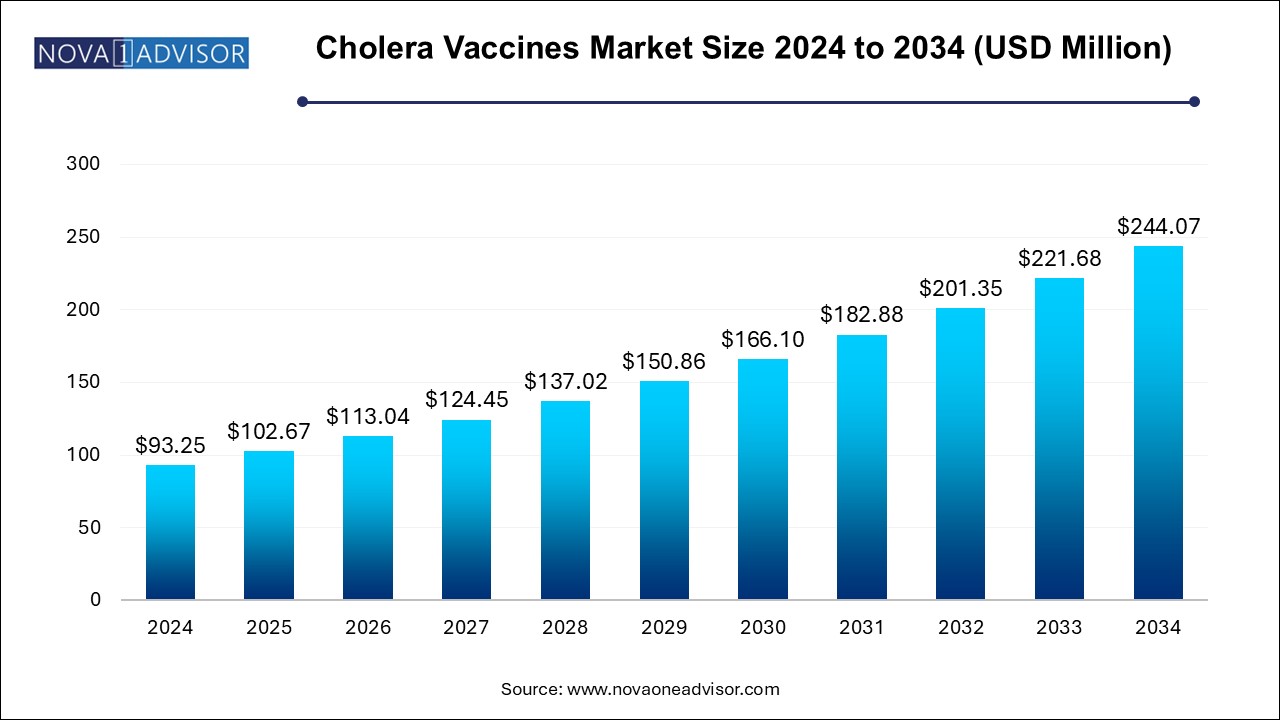

The cholera vaccine market size was exhibited at USD 93.25 million in 2024 and is projected to hit around USD 244.07 million by 2034, growing at a CAGR of 10.1% during the forecast period 2024 to 2034. The growth of the global cholera vaccines market is driven by the rising demand for cholera vaccines due to increased cholera outbreaks in various regions across the globe as well as several initiatives taken by the governments and international health organizations for tackling the disease.

Cholera Vaccine Market Key Takeaways:

- The killed oral o1 and o139 segment dominated the market and accounted for the largest revenue share of 60.0% in 2024 and is expected to grow at the fastest CAGR of 11.5% over the forecast period.

- Dukoral dominated the market and accounted for the largest revenue share of 32.5% in 2024.

- Vaxchora is expected to grow at the fastest rate CAGR of 14.1% over the forecast period.

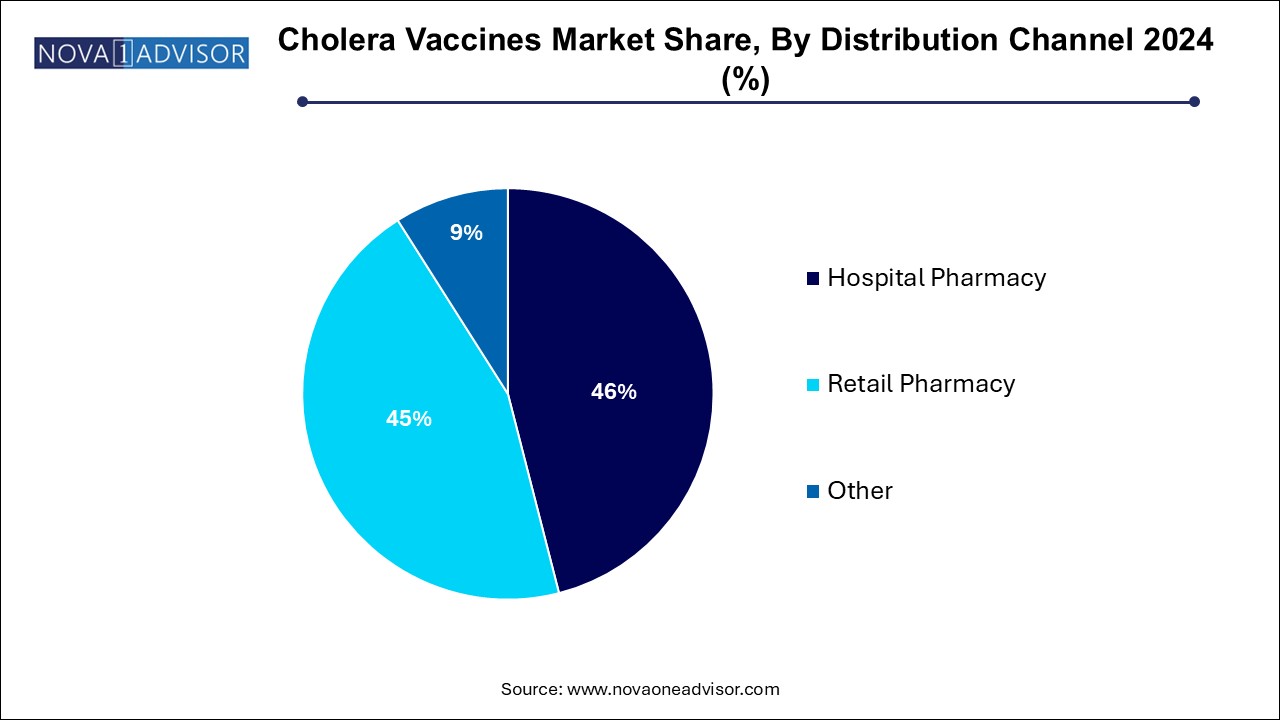

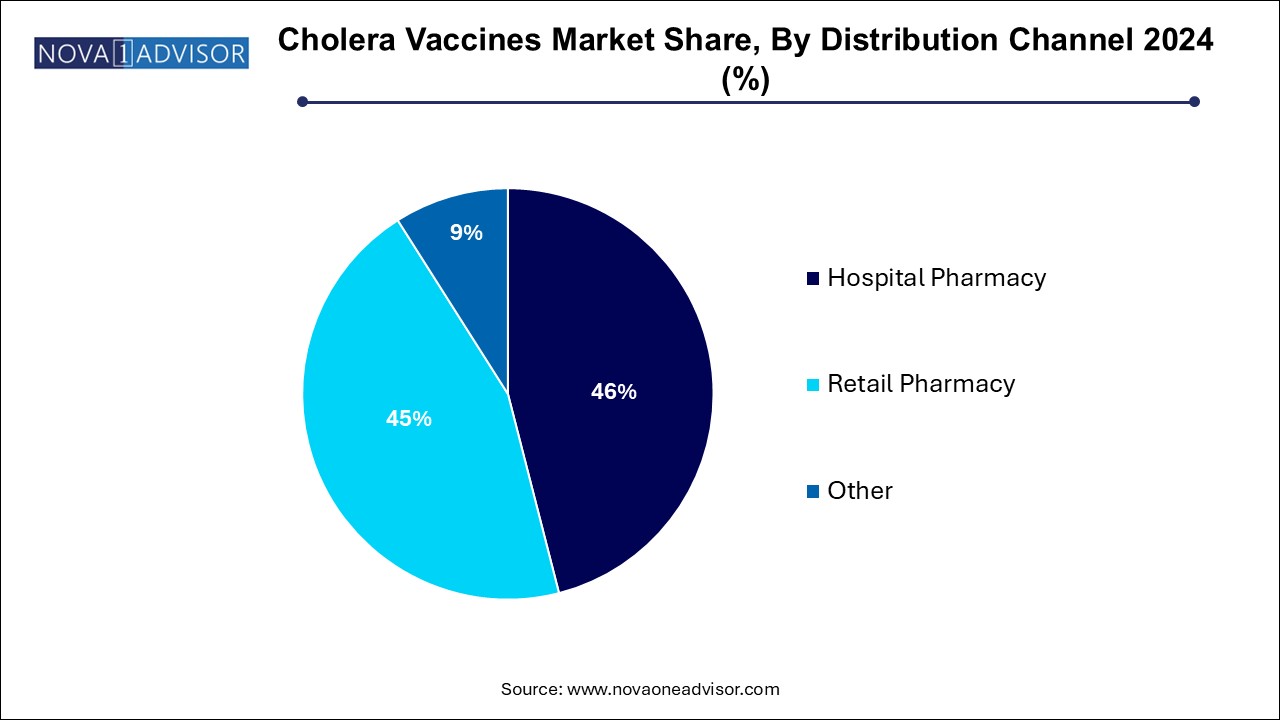

- Hospital pharmacies in the distribution channel segment dominated the market and accounted for the largest revenue share of 46.0% in 2024

- North America cholera vaccines market dominated the global market and accounted for the largest revenue share 37.6% in 2024.

Market Overview

The cholera vaccines market plays a vital role in the global public health landscape, particularly in regions grappling with inadequate sanitation, contaminated water supplies, and recurring outbreaks of cholera—a waterborne bacterial infection caused by Vibrio cholerae. With approximately 1.3 to 4 million cholera cases reported globally each year, and 21,000 to 143,000 related deaths according to the World Health Organization (WHO), the importance of cholera vaccination as a preventive strategy cannot be overstated.

Cholera vaccines serve both proactive and reactive public health strategies. In endemic regions such as parts of Africa, Southeast Asia, and Latin America, oral cholera vaccines (OCVs) are administered routinely to mitigate long-term risks. During humanitarian crises, refugee displacement, and natural disasters, cholera vaccines act as rapid-response tools to curtail the spread of infection. The vaccine types range from inactivated/killed whole-cell preparations to live attenuated vaccines, offering short- to medium-term protection and forming an essential component of outbreak response kits maintained by international agencies.

Governments and non-governmental organizations (NGOs) including Gavi, the Vaccine Alliance, UNICEF, and Médecins Sans Frontières, collaborate with vaccine manufacturers to ensure widespread access to cholera vaccines through subsidized procurement and deployment in high-risk populations. Innovations in cold chain logistics, formulation, and oral dosing convenience have improved vaccine reach, especially in resource-constrained settings. The growing threat of climate change and urban overcrowding continues to amplify the demand for scalable and affordable cholera vaccination strategies.

While cholera is largely preventable, vaccine coverage remains inadequate in several high-burden areas due to supply bottlenecks, funding limitations, and geopolitical instability. However, increased R&D investments, improved manufacturing capacity, and strategic partnerships among global health bodies are expected to boost market performance significantly through 2034.

Major Trends in the Market

-

Rising global stockpile demands coordinated by WHO and Gavi to respond to cholera outbreaks and humanitarian emergencies.

-

Increased funding for vaccine development and local manufacturing capacity in low- and middle-income countries (LMICs).

-

Surge in R&D for thermostable and single-dose formulations, improving vaccine logistics and administration efficiency.

-

Integration of cholera vaccination into national immunization programs in endemic countries.

-

Growing use of public-private partnerships to accelerate vaccine access and market penetration.

-

Development of combination vaccines (e.g., cholera-typhoid) to streamline immunization in endemic regions.

-

Emphasis on oral vaccines for ease of administration and rapid deployment during outbreaks.

-

Adoption of digital tools and GIS mapping to track vaccination coverage and outbreak risk zones.

-

Increased traveler vaccination uptake amid growing global mobility and travel to endemic zones.

Report Scope of Cholera Vaccine Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 102.67 Million |

| Market Size by 2034 |

USD 244.07 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 10.1% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, Product, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Valneva SE; Sanofi S.A.; Astellas Pharma, Inc.; Emergent BioSolutions Inc.; PavVax Inc.; EuBiologics Co., Ltd.; Shantha Biotechnics Limited; Hilleman Laboratories; Astellas Pharma Inc.; Incepta Vaccine Ltd.; Vabiotech |

Market Driver: Increased Cholera Outbreaks and Endemic Spread

A critical driver of the cholera vaccines market is the increasing frequency and geographic spread of cholera outbreaks, especially in low-income countries with limited access to clean water and sanitation infrastructure. The recurrence of cholera epidemics in parts of Africa, the Indian subcontinent, and Haiti underscores the persistent vulnerability of millions of people to this preventable disease.

In 2023 alone, several countries such as Malawi, Mozambique, and Syria reported severe cholera outbreaks, prompting emergency vaccination campaigns funded by WHO and Gavi. These rapid deployment efforts rely heavily on the global cholera vaccine stockpile—a reserve of millions of vaccine doses used during humanitarian crises. As climate change exacerbates flooding and droughts, the risk of water contamination and subsequent disease transmission grows, reinforcing the importance of preemptive and reactive vaccination efforts. The rise in conflict-induced displacement also fuels outbreak potential, particularly in refugee camps where basic hygiene and healthcare infrastructure is lacking. These conditions are contributing to consistent and growing demand for cholera vaccines worldwide.

Market Restraint: Supply Chain Challenges and Limited Manufacturing Capacity

Despite rising demand, a prominent restraint in the cholera vaccines market is supply chain bottlenecks and limited global manufacturing capacity, which restrict timely access during emergencies. Cholera vaccines, primarily produced by a handful of manufacturers, require stringent quality control and cold chain logistics, both of which pose challenges in LMICs.

For example, the global stockpile of cholera vaccines, managed by the International Coordinating Group (ICG), faced critical shortages in 2022 and 2023, leading to temporary shifts from two-dose to single-dose strategies to maximize reach. While efforts are underway to scale up production, delays in facility expansions, regulatory approvals, and raw material sourcing can create supply gaps, particularly during sudden surges in demand. Without a diversified manufacturing base and robust logistics networks, the market remains vulnerable to disruptions, ultimately impacting vaccination coverage and disease control efforts.

Market Opportunity: Development of Next-Generation, Thermostable Oral Cholera Vaccines

One of the most promising opportunities in the cholera vaccines market lies in the development of next-generation oral cholera vaccines (OCVs) with improved thermal stability and single-dose effectiveness. These innovations are critical for deployment in hot, humid, and infrastructure-limited settings where traditional cold chain requirements may be difficult to maintain.

Several research initiatives are focused on formulating freeze-dried or heat-stable OCVs that can be stored and transported without refrigeration, significantly enhancing logistical feasibility. Furthermore, single-dose vaccines could reduce programmatic costs, increase patient compliance, and facilitate faster outbreak control. These features are particularly attractive for emergency response teams operating in remote areas or during natural disasters. Continued investment in R&D, supported by global health agencies and philanthropic foundations, is likely to yield new entrants that address both efficacy and accessibility concerns, unlocking significant market growth potential.

Cholera Vaccine Market By Type Insights

The killed oral o1 and o139 segment dominated the market and accounted for the largest revenue share of 60.0% in 2024 and is expected to grow at the fastest CAGR of 11.5% over the forecast period. driven by their safety profile, ease of oral administration, and cost-effectiveness. These vaccines, such as Shanchol, are prequalified by WHO and widely deployed in both preventive and reactive contexts. Their use is expanding rapidly across Africa and Asia, as governments incorporate them into national immunization strategies. Their dual-serogroup formulation improves coverage against emerging strains, making them increasingly relevant in global cholera control efforts.

Whole cell Vibrio cholerae O1 vaccines with recombinant B-subunit dominate the market, primarily due to their proven efficacy, regulatory approvals, and inclusion in international vaccination programs. These vaccines stimulate robust immune responses and have been widely used in mass campaigns in cholera-endemic regions. They also offer partial cross-protection against other serogroups, enhancing their utility in outbreak containment.

Cholera Vaccine Market By Product Insights

Dukoral dominated the market and accounted for the largest revenue share of 32.5% in 2024 with extensive use in WHO-backed immunization programs across Asia and Africa. Manufactured by Shantha Biotechnics (a Sanofi company), Shanchol is a bivalent, inactivated oral vaccine effective against O1 and O139 strains. Its low cost, WHO prequalification, and suitability for large-scale campaigns have cemented its role as the go-to vaccine for humanitarian and public health agencies.

Vaxchora is expected to grow at the fastest rate CAGR of 14.1% over the forecast period, particularly in North America and Europe, where it is marketed for travelers visiting cholera-endemic regions. Developed by Emergent BioSolutions and approved by the U.S. FDA and European regulators, Vaxchora is a live attenuated single-dose oral vaccine. It offers rapid protection and is convenient for last-minute travelers. As global travel rebounds post-COVID and awareness increases, Vaxchora's adoption is

Cholera Vaccine Market By Distribution Channel Insights

Hospital pharmacies in the distribution channel segment dominated the market and accounted for the largest revenue share of 46.0% in 2024, particularly in cholera-endemic countries and during organized immunization campaigns. Mass vaccination efforts managed by ministries of health, WHO, and NGOs rely heavily on centralized hospital-based systems for storage and distribution. These settings also facilitate medical supervision and patient record tracking, which are essential in high-risk populations.

Retail pharmacies are the fastest growing distribution channel, especially in developed countries where individual travelers and expatriates seek preventive vaccination before visiting high-risk areas. Retail channels, including community pharmacies and online vaccine booking platforms, enhance accessibility and offer convenient immunization options. As travel health becomes a growing niche, retail pharmacies are expected to play a larger role in cholera vaccine distribution in urban and suburban areas globally.

Cholera Vaccine Market By Regional Insights

North America dominated the global cholera vaccines market with the largest share in 2024. The region’s dominance can be linked to the robust healthcare infrastructure, presence of major pharmaceutical companies and supportive government policies encouraging immunization programs in lieu of vaccines administered in the region itself. Pre-travel vaccination and is a rising trend in the region due to increased international travel rates. Increased awareness of waterborne diseases and growing focus on preventive healthcare is encouraging individuals for seeking vaccinations to mitigate potential health risks. Additionally, the huge presence of non-governmental organizations (NGOs) and international organizations involved in humanitarian aid and disaster relief for cholera affected regions are bolstering the market growth.

Asia Pacific is the fastest growing region, attributed to improved surveillance, expanded immunization programs, and increasing production capabilities. Countries like India, Bangladesh, and Nepal have witnessed historical cholera outbreaks but are now making significant progress through vaccination and infrastructure investment.

India, in particular, plays a dual role as a high-burden country and a manufacturing hub for cholera vaccines. The rising domestic adoption of vaccines, growing middle-class health awareness, and participation in global health initiatives contribute to robust regional growth. Additionally, the region's manufacturing capacity and regulatory momentum are drawing attention from international partners looking to diversify supply chains.

The MEA region holds a significant share in the global cholera vaccines market. The market growth is driven by high disease burden, recurring outbreaks, and large-scale humanitarian emergencies. Countries such as Yemen, Sudan, Ethiopia, Somalia, and Nigeria report frequent cholera cases due to poor water infrastructure, lack of hygiene practices, natural disasters and conflicts resulting in disrupted infrastructure and population displacement. These nations are major recipients of cholera vaccine stockpile doses coordinated by WHO and Gavi.

In 2023, over 10 million doses of cholera vaccines were distributed across African countries as part of emergency response and preemptive campaigns. MEA's growth is reinforced by partnerships between national health ministries and global health organizations to improve vaccine access and outbreak response capacity.

- For instance, in June 2024, at the Global Forum for Vaccine Sovereignty and Innovation summit in Paris, a funding of $1.2 billion was announced by world, leaders, health groups and pharmaceutical organizations for production of vaccines in Africa through the African Vaccine Manufacturing Accelerator scheme to address various health crises like the rising cholera outbreaks. Donors included leading countries like Germany, France, UK, U.S., Canada, Japan, Norway and the Gates Foundation among others.

Global Cholera Trends by WHO

According to the World Health Organization’s (WHO’s) Cholera Report 2024 published in November 2024, a total sum of 486,760 cholera and acute watery diarrhoea cases and 4,018 death were reported from January to late October 2024 from 33 countries in five WHO regions. Oral cholera vaccines (OCVs) have had a long-lasting impact in preventing and controlling cholera outbreaks. But severe response challenges in outbreak settings due to limited supply of vaccines and rising cases have increased the death toll by 54% as of October 2024.

Additionally, cross-border dynamics are increasing the complexity of cholera outbreaks. Although record production of OCVs in November was achieved with development of novel formulations and production methods, the OCV emergency stockpile was at subpar 600,000 doses in October 2024 which was far lesser than the target of five million doses required in case of an effective outbreak response at all times.

Key Cholera Vaccines Available in the Market

| Vaccine Name |

Manufacturer |

Recommended Dosage |

Target Age Group |

Vaccine Effectiveness |

Approved by |

| Dukoral |

Valneva Canada Inc. |

2 doses, administered 1-6 weeks apart

(Children aged 2-5 years need 3 doses, given 1-6 weeks apart) |

2 years and older |

2 years |

WHO |

| Euvichol/Euvichol-Plus/ Euvichol-S |

EuBiologics |

2 doses, administered at least 2 weeks apart |

1 year and older |

At least 3 years for 2 doses |

WHO |

| Vaxchora |

Bavarian Nordic |

1 dose |

2-64 years |

At least 3 to 6 months |

FDA |

Some of the prominent players in the cholera vaccine market include:

- Valneva SE

- Sanofi S.A.

- Emergent BioSolutions Inc.

- PaxVax Inc.

- EuBiologics Co., Ltd.

- Shantha Biotechnics Limited

- Hilleman Laboratories

- Astellas Pharma Inc.

- Incepta Vaccine Ltd.

- Vabiotech

Cholera Vaccine Market Recent Developments

-

As of January 2025, the current cholera outbreak in the Republic of South recorded 21,000 cases and 367 deaths in an announcement made by the World Health Organization (WHO). To address this issue, the government launched oral cholera vaccination (OCV) campaigns in four high-risk counties in January 2025. About 4 million vaccine doses were approved with support from Gavi, the Vaccine Alliance and around 910,000 doses were administered successfully.

-

In December 2024, the Ministry of Public Health and Population, Yemen in partnership with the United Nations Children’s Fund (UNICEF) and the World Health Organization (WHO) launched a mass oral cholera vaccination campaign with support from Gavi, the Vaccine Alliance. The campaign aims at administering single dose of OCV to 3.8 million individuals spread across 6 governorates across Yemen for mitigating the ongoing cholera outbreak.

-

In August 2024, Bharat Biotech International Ltd (BBIL), a vaccine maker, launched Hillchol (BBV131), a novel single-strain oral cholera vaccine (OCV) which was developed under license from Hilleman Laboratories, an equal-joint venture between Merck, USA and Wellcome Trust, UK. The vaccine rolled out following a successful Phase 3 study confirming the safety, immunogenicity, non-inferiority to existing OCVs and aims at addressing the global shortage of OCVs demanding more than 100 million doses annually. The large-scale manufacturing facilities of BBIL can produce 200 million doses of Hillchol.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cholera vaccine market

By Type

- Whole Cell v. Cholerae O1 with Recombinant B- subunit

- Killed Oral O1 and O139

By Product

- Vaxchora

- Dukoral

- Shanchol

- Other products

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Other

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)