Chromatography Instruments Market Size and Trends

The chromatography instruments market size was exhibited at USD 10,241.15 million in 2024 and is projected to hit around USD 17,164.55 million by 2034, growing at a CAGR of 5.3% during the forecast period 2025 to 2034.

Chromatography Instruments Market Key Takeaways:

- Based on chromatography systems, the liquid chromatography segment led the market with the largest revenue share of 48.83% in 2024.

- Based on consumable, the columns segment led the market with the largest revenue share of 55.9% in 2024.

- Based on accessories, the column accessories segment led the market with the largest revenue share of 48.33% in 2024.

- Based on application, the pharmaceutical firms segment led the market with the largest revenue share of 55.0% in 2024.

- The chromatography instruments market in North America is anticipated to grow at the fastest CAGR during the forecast period.

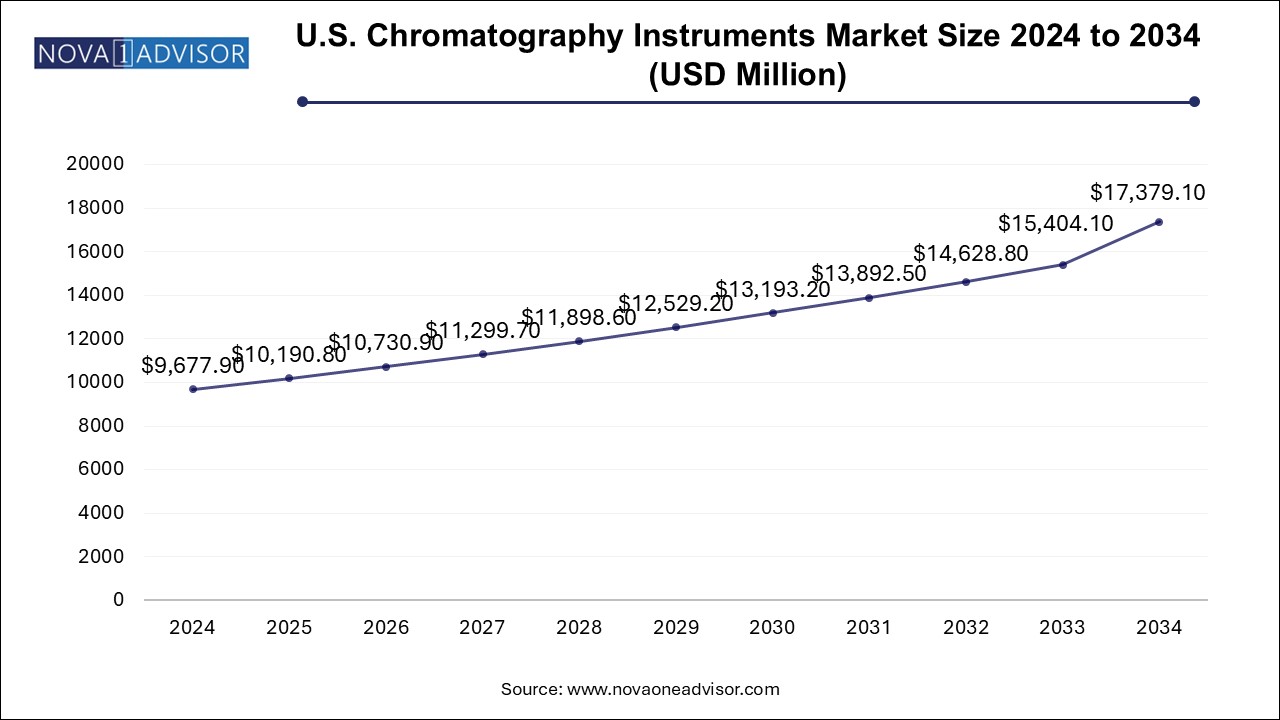

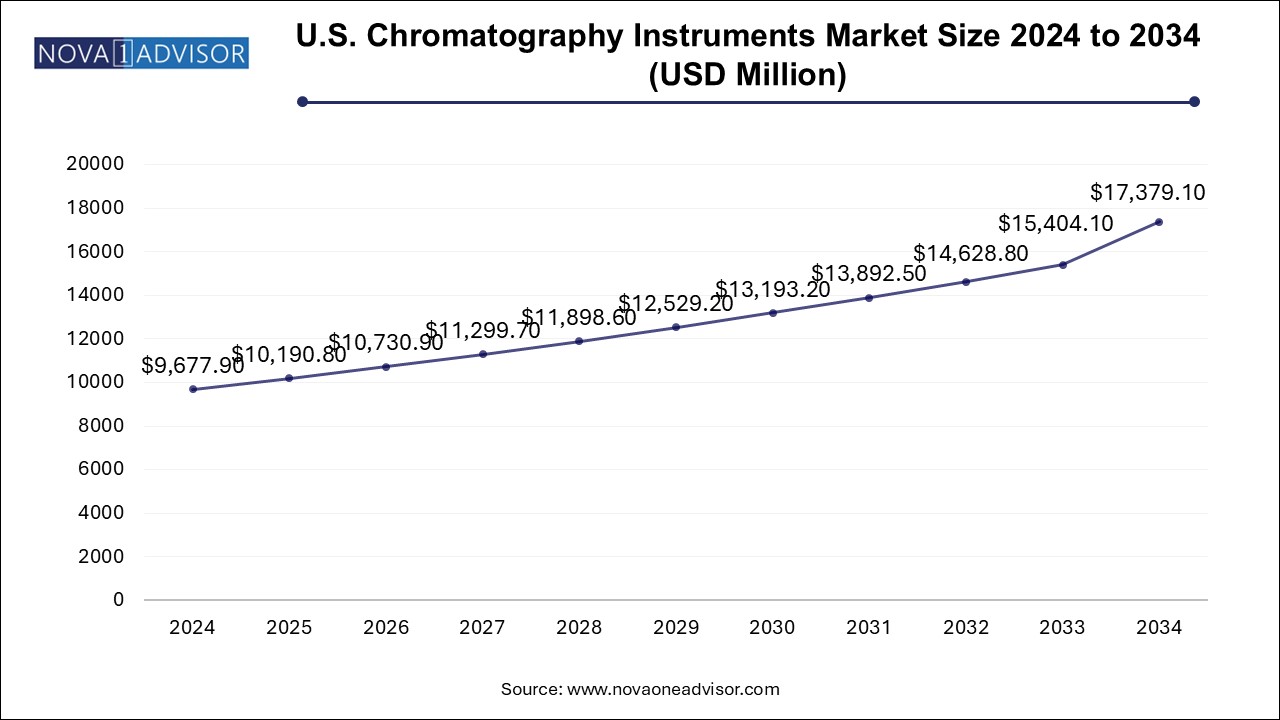

U.S Chromatography Instruments Market Size and Growth 2025 to 2034

The U.S. chromatography instruments market size is evaluated at USD 9677.9 million in 2024 and is projected to be worth around USD 17,379.1 million by 2034, growing at a CAGR of 5.46% from 2025 to 2034.

North America led the chromatography instruments market in 2024, driven by high R&D spending in pharmaceutical and biotechnology sectors, robust environmental regulations, and advanced healthcare infrastructure.

The U.S., in particular, boasts a mature market characterized by early technology adoption, strong regulatory frameworks, and significant investments by top chromatography companies. Collaborative initiatives between industry and academic research institutions also boost market growth.

Asia-Pacific is poised to register the fastest growth during the forecast period. Rapid industrialization, expanding pharmaceutical manufacturing hubs, growing academic research funding, and increased government focus on food safety and environmental monitoring are key factors fueling growth.

China, India, and Japan are major contributors to regional expansion, with rising investments in life sciences research, biopharmaceutical production, and clinical diagnostics creating robust opportunities for chromatography instrument manufacturers.

Market Overview

The global Chromatography Instruments Market has emerged as a cornerstone of modern analytical science, playing a vital role across sectors such as pharmaceuticals, biotechnology, environmental testing, food safety, clinical research, and agriculture. Chromatography is a powerful technique for separating, identifying, and quantifying components in complex mixtures, making it indispensable for quality control, regulatory compliance, research, and development.

The surge in pharmaceutical R&D activities, growing demand for biologics and biosimilars, strict food safety regulations, increasing environmental concerns, and advancements in clinical diagnostics are major factors driving the market's growth. Innovations in chromatography systems such as miniaturized platforms, high-throughput capabilities, and integration with mass spectrometry (MS) are further expanding their applications.

Despite some challenges, such as high equipment costs and the need for skilled operators, the chromatography instruments market is poised for robust expansion. The market's evolution reflects broader trends in precision medicine, personalized therapies, and sustainability, making chromatography more critical than ever in solving complex scientific and industrial challenges.

Major Trends in the Market

-

Rise of Hyphenated Techniques: Integration of chromatography with mass spectrometry (LC-MS, GC-MS) is enhancing sensitivity and specificity.

-

Miniaturization and Portability: Development of compact and portable chromatography systems for field analysis.

-

Automation and High-throughput Screening: Automated sample preparation, injection, and data analysis are improving efficiency.

-

Expansion into Biopharmaceutical Applications: Chromatography is essential for purification and analysis of biologics, vaccines, and gene therapies.

-

Environmental Monitoring Demand: Increasing focus on air, water, and soil testing is boosting adoption of chromatography techniques.

-

Green Chromatography: Development of eco-friendly solvents and energy-efficient systems to reduce environmental impact.

-

Growth of Customized Columns and Consumables: Tailored solutions for specific applications and industries.

-

Artificial Intelligence (AI) and Machine Learning Integration: Smarter chromatographic data analysis and system optimization.

Report Scope of Chromatography Instruments Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 10,783.93 Million |

| Market Size by 2034 |

USD 17,164.55 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 5.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Chromatography Systems, Consumables, Accessories, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled |

Agilent Technologies; Waters Corporation; Shimadzu Corporation; Thermo Fisher Scientific; Perkinelmer, Inc.; Merck KGaA; Sartorius AG; Bio-Rad Laboratories; Restek Corporation; Gilson, Inc.; Phenomenex; Cytiva; SCION Instruments; Hitachi; Waters Corporation; Danaher |

Chromatography Instruments Market By Chromatography Systems Insights

Liquid Chromatography (LC) dominated the chromatography instruments market in 2024. LC systems, including HPLC and UHPLC, are extensively used across pharmaceutical, clinical, environmental, and food industries due to their versatility, sensitivity, and ability to handle thermally labile compounds.

Gas Chromatography (GC), on the other hand, is projected to witness the fastest growth. GC is vital for volatile compound analysis in environmental testing, petrochemical analysis, and food safety. Advances in GC-MS technology, improved column chemistries, and portable GC systems are further fueling its rapid expansion.

Thin-Layer Chromatography (TLC) maintains its niche relevance for quick, low-cost analysis in teaching laboratories and small-scale industries, while Supercritical Fluid Chromatography (SFC) is gaining attention for chiral separations and eco-friendly analytical solutions.

Chromatography Instruments Market By Consumables Insights

Columns held the largest share of the chromatography consumables market in 2024. Columns are critical for achieving high-resolution separations and are frequently replaced, ensuring recurring demand. Innovations such as monolithic columns, core-shell particle technology, and customized stationary phases are enhancing column performance across industries.

Solvents are anticipated to witness the fastest growth. Increasing analytical volumes, demand for high-purity solvents, and green solvent initiatives are driving the solvent segment, particularly in pharmaceutical and environmental laboratories.

Chromatography Instruments Market By Accessories Insights

Pumps dominated the accessories segment in 2024. Reliable and precise fluid delivery is essential for chromatography system performance, making high-pressure, low-pulsation pumps critical components.

Meanwhile, Auto-Sampler Accessories are forecasted to experience the fastest growth. The trend toward high-throughput, automated workflows in pharmaceutical and clinical laboratories is spurring demand for advanced auto-samplers and related accessories that minimize manual errors and boost efficiency.

Chromatography Instruments Market By Application Insights

Pharmaceutical Firms accounted for the largest market share in 2024. Chromatography is indispensable throughout the pharmaceutical value chain, from drug discovery and development to manufacturing and quality control.

However, Environmental Testing is projected to witness the fastest growth. Growing concerns over pollution, climate change, and regulatory standards like EPA's environmental monitoring guidelines are driving extensive deployment of chromatography systems for air, water, and soil analysis.

Some of the prominent players in the chromatography instruments market include:

- Agilent Technologies

- Waters Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific

- Perkinelmer, Inc.

- Merck KGaA

- Sartorius AG

- Bio-Rad Laboratories

- Restek Corporation

- Gilson, Inc.

- Phenomenex

- Cytiva

- SCION Instruments

- Hitachi

- Waters Corporation

- Danaher

Chromatography Instruments Market Recent Developments

-

March 2025: Agilent Technologies launched the "InfinityLab LC/MSD iQ System," a compact, AI-enabled liquid chromatography-mass spectrometry solution designed for routine analysis.

-

January 2025: Shimadzu Corporation introduced the "Nexera XS inert HPLC System," optimized for bioanalytical applications and trace analysis.

-

December 2024: Thermo Fisher Scientific expanded its chromatography consumables portfolio with the launch of "Accucore Vanquish UHPLC Columns" for ultra-fast, high-efficiency separations.

-

November 2024: Waters Corporation announced the "Xevo TQ Absolute," an integrated LC-MS system offering enhanced sensitivity for pharmaceutical and clinical research.

-

September 2024: PerkinElmer Inc. unveiled the "QSight 420 LC/MS/MS System" targeted at food safety and pesticide residue analysis.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the chromatography instruments market

By Chromatography Systems

- Liquid Chromatography

- Gas Chromatography

- Thin-Layer Chromatography

- Supercritical Fluid Chromatography

By Consumables

- Columns

- Solvents

- Syringes

- Others

By Accessories

- Column Accessories

- Auto-Sampler Accessories

- Pumps

- Others

By Application

- Pharmaceutical firms

- Clinical research organizations

- Agriculture

- Environmental Testing

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)